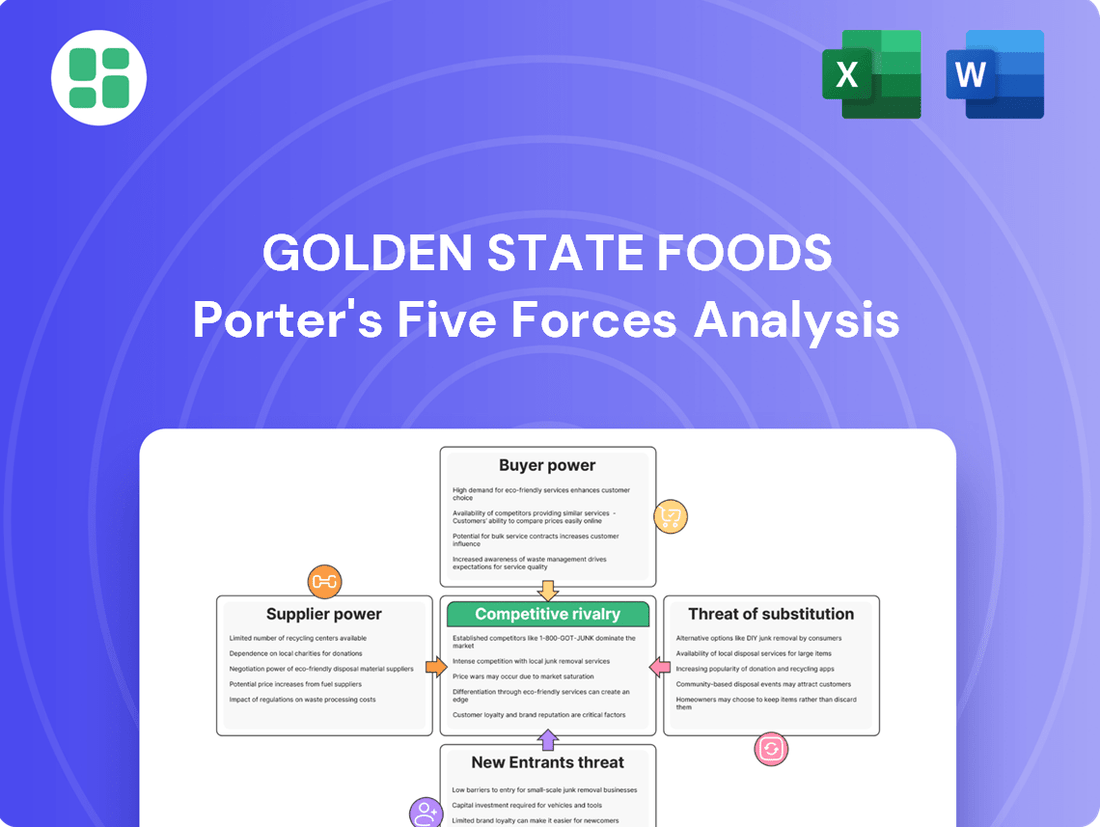

Golden State Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden State Foods Bundle

Golden State Foods operates in a dynamic industry where supplier power significantly impacts its cost structure, and the threat of new entrants is moderate due to capital requirements. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Golden State Foods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Golden State Foods relies on a diverse global supplier base for everything from liquids and dairy to produce and protein. When a specific ingredient, like a unique flavor or a specialty agricultural product from a limited growing region, is sourced from only a handful of specialized providers, those suppliers gain significant leverage. For instance, if a particular type of vanilla bean, crucial for a popular beverage, is cultivated in only one or two countries and processed using proprietary methods, the few suppliers controlling this supply chain can dictate terms more forcefully.

Golden State Foods (GSF) faces significant supplier bargaining power due to the intricate nature of its integrated manufacturing and distribution network. The complexity involved in sourcing critical components and ingredients means that shifting to new suppliers would incur substantial costs and operational disruptions. For instance, the need for re-tooling production lines, re-certifying new ingredients to meet stringent food safety standards, and renegotiating complex supply agreements all contribute to high switching costs for GSF.

These elevated switching costs directly empower GSF's existing suppliers. When suppliers provide specialized inputs that are deeply embedded within GSF's established production processes, their leverage increases considerably. This is particularly true for proprietary ingredients or custom-manufactured components where finding readily available and equally effective alternatives is challenging and time-consuming.

Suppliers offering highly differentiated or proprietary ingredients, technologies, or logistics solutions wield significant bargaining power. For example, if a supplier controls a patented food processing technology or an exclusive, high-demand ingredient, Golden State Foods (GSF) faces limited alternatives. This lack of substitutes directly enhances the supplier's leverage over pricing and contract terms, potentially creating a dependency that favors the supplier.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Golden State Foods (GSF) presents a nuanced challenge. If GSF's key suppliers were to realistically move into manufacturing or distributing finished food products themselves, their leverage over GSF would undoubtedly grow. This scenario is typically less of a concern for suppliers of basic commodities, where barriers to entry are low. However, for providers of specialized ingredients or proprietary food technology, the opportunity to capture greater value further down the supply chain could make forward integration a more tangible possibility.

Consider the implications for GSF's procurement strategy. For instance, a supplier of a unique, high-demand flavor enhancer might possess the technical expertise and existing customer relationships to launch their own line of ready-to-eat meals incorporating that flavor. This would shift the power dynamic significantly. In 2024, the food ingredient market saw continued consolidation, with some larger ingredient manufacturers exploring direct-to-consumer or co-manufacturing models, indirectly increasing this threat for food producers relying on their specialized inputs.

- Threat of Forward Integration by Suppliers: Suppliers integrating forward into finished product manufacturing or distribution enhances their bargaining power.

- Commodity vs. Specialized Suppliers: This threat is generally low for commodity suppliers but higher for specialized ingredient or technology providers.

- Value Chain Capture: Specialized suppliers may see an opportunity to capture more value by moving up the supply chain.

- Market Trends: Consolidation in the ingredient sector in 2024 has seen some players explore adjacent business models, potentially increasing this risk.

Importance of GSF to Supplier Revenue

Golden State Foods' (GSF) substantial global reach and significant procurement volumes across a wide array of products position it as a critical client for numerous suppliers. When GSF accounts for a considerable percentage of a supplier's overall revenue, the supplier's leverage diminishes, as they are less inclined to jeopardize such a valuable relationship. This dependency significantly curtails their ability to dictate terms.

Conversely, if GSF represents a minor portion of a supplier's sales, that supplier's bargaining power escalates. Such suppliers face less risk in pushing for more favorable terms or even withdrawing their services, knowing that GSF's business is not essential to their financial stability.

- GSF's Scale: GSF's large global footprint translates to substantial purchasing power, making it a key customer for many suppliers.

- Supplier Dependency: Suppliers whose revenue heavily relies on GSF have reduced bargaining power.

- Client Size Impact: For suppliers where GSF is a small client, their bargaining power is amplified.

- 2024 Data Insight: While specific supplier revenue percentages for 2024 are proprietary, industry trends indicate that major food service distributors like GSF often represent over 10% of revenue for specialized ingredient or packaging suppliers, a threshold that significantly impacts supplier negotiation leverage.

The bargaining power of Golden State Foods' suppliers is influenced by the availability of substitutes and the degree of differentiation in their offerings. When suppliers provide unique or highly specialized ingredients, such as proprietary flavor compounds or custom-processed proteins, GSF faces limited alternatives, thereby increasing supplier leverage. For example, in 2024, the specialty food ingredient market continued to see demand for unique flavor profiles, giving suppliers of these niche products significant pricing power.

High switching costs for GSF also bolster supplier power. The expense and time required to re-qualify ingredients, re-tool production lines, and renegotiate contracts empower existing suppliers who are deeply integrated into GSF's operations. This is particularly true for suppliers offering custom-manufactured components or patented food technologies, where finding equally suitable replacements is a complex and costly endeavor.

The concentration of suppliers for critical inputs also plays a role. If a particular ingredient or component is sourced from only a few providers, these suppliers gain considerable leverage. This was evident in 2024 with certain agricultural commodities experiencing supply chain disruptions, leading to increased prices and tighter terms from the few dominant producers.

| Factor | Impact on Supplier Bargaining Power | Example for Golden State Foods (GSF) |

|---|---|---|

| Availability of Substitutes | Low substitute availability increases power. | Suppliers of unique, proprietary flavorings or custom-processed ingredients. |

| Switching Costs | High switching costs increase power. | Ingredients requiring re-certification or specialized production equipment. |

| Supplier Concentration | Fewer suppliers mean higher power. | Sourcing a critical, niche agricultural product from a limited number of global farms. |

| Supplier Differentiation | Highly differentiated offerings increase power. | Providers of patented food processing technologies or exclusive ingredient formulations. |

What is included in the product

Tailored exclusively for Golden State Foods, analyzing its position within its competitive landscape by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and existing rivalry.

Instantly identify and address competitive pressures with a clear, actionable breakdown of Golden State Foods' Porter's Five Forces.

Gain strategic clarity by visualizing the impact of each force on Golden State Foods' market position.

Customers Bargaining Power

Golden State Foods' customer base is heavily concentrated within a few very large quick-service restaurant (QSR) chains and other major food businesses globally. These include giants like McDonald's, Starbucks, Chick-fil-A, KFC, and Taco Bell, which are known for their massive operational scale and consistent, high-volume orders.

The sheer size of these clients means they wield significant purchasing power. They can leverage their substantial order volumes to negotiate favorable pricing, demanding terms that squeeze supplier margins. This concentration of demand amplifies the bargaining power of these key customers over Golden State Foods.

Customer switching costs are a critical factor in assessing the bargaining power of customers for Golden State Foods (GSF). While GSF provides integrated manufacturing and distribution, major quick-service restaurant (QSR) chains, representing significant customers, might still explore alternatives. If the financial and operational hurdles for a large QSR to move from GSF to another provider are minimal, their leverage increases.

However, GSF's strategy of deep integration into its customers' supply chains, offering tailored distribution and robust quality assurance programs, aims to erect substantial barriers to switching. For instance, a large QSR chain might incur costs related to re-qualifying new suppliers, redesigning logistics, and retraining staff if they were to switch from GSF's established systems. These embedded costs and operational dependencies can significantly dampen a customer's inclination to switch, thereby reducing their direct bargaining power.

Quick-service restaurant chains, facing intense competition and tight profit margins, are acutely aware of every dollar spent on ingredients and supplies. This means they are constantly looking for the best deals, putting significant pressure on their suppliers, like Golden State Foods (GSF), to keep prices as low as possible.

The ease with which these restaurant chains can compare pricing from various large food distributors further strengthens their bargaining position. For instance, in 2024, the average profit margin for a quick-service restaurant hovered around 6-9%, making even small price increases on key inputs a substantial concern.

Threat of Backward Integration by Customers

Large quick-service restaurant (QSR) chains and major food businesses possess the financial clout and operational scale to consider backward integration. This means they could potentially establish their own manufacturing facilities and distribution networks, bypassing suppliers like Golden State Foods (GSF). For instance, a major fast-food operator might invest billions in setting up its own sauce production or meat processing plants if it perceives significant cost savings or supply chain control benefits.

The mere credible threat of a large customer deciding to insource production, especially for high-volume, standardized items, grants them considerable bargaining power. This leverage can pressure GSF to offer more competitive pricing or favorable terms. For example, if a major QSR chain, representing a substantial portion of GSF's revenue, signals a serious evaluation of in-house production for its signature ketchup, GSF would likely respond with concessions to retain that business.

- Customer Leverage: The potential for backward integration by major QSR clients provides them with significant leverage over GSF.

- Capital Investment: While requiring substantial capital, the option of insourcing can force suppliers to be more competitive.

- Standardized Products: This threat is amplified for high-volume, standardized products where manufacturing processes are well-understood and replicable.

- Supply Chain Control: Customers may pursue backward integration to gain greater control over quality, cost, and the security of their supply chain.

Customer Knowledge and Information

Sophisticated, large-scale customers, particularly those in the food service industry like major fast-food chains, often come to negotiations with a deep understanding of market dynamics. They are well-versed in prevailing pricing structures, the availability and capabilities of alternative suppliers, and key industry benchmarks for quality and service. This extensive market knowledge significantly strengthens their bargaining position when dealing with Golden State Foods (GSF).

Furthermore, these informed customers leverage access to real-time data. This data can encompass everything from supply chain performance metrics to emerging market trends and consumer demand shifts. Armed with such granular insights, they are better equipped to identify opportunities for cost savings or service improvements, thereby enhancing their ability to negotiate favorable terms with GSF.

In 2024, the trend of customer consolidation in the food service sector continued, meaning fewer, larger buyers hold even more sway. For instance, the top 10 quick-service restaurant (QSR) chains in the US, many of whom are GSF customers, represent a substantial portion of the overall QSR market spend. Their collective purchasing power, amplified by their informed negotiating stance, directly impacts GSF's pricing power and margin potential.

- Informed Negotiation Leverage: Large customers possess detailed knowledge of pricing, alternative suppliers, and industry standards.

- Data-Driven Empowerment: Access to real-time supply chain and market trend data enhances customer negotiation capabilities.

- Market Consolidation Impact: Continued consolidation in sectors like QSR means fewer, larger buyers exert greater influence in 2024.

Golden State Foods' (GSF) customers, primarily major quick-service restaurant (QSR) chains, possess significant bargaining power due to their immense order volumes and market influence. These large clients can dictate terms, pushing for lower prices and favorable contract conditions, which directly impacts GSF's profitability. In 2024, the average profit margin for QSRs remained tight, around 6-9%, intensifying their drive for cost savings from suppliers like GSF.

The concentration of GSF's customer base among a few dominant QSR players amplifies their collective leverage. These customers are also highly informed, utilizing market data and understanding industry benchmarks to negotiate effectively. This informed stance, coupled with their scale, allows them to exert considerable pressure on GSF for competitive pricing and terms.

Switching costs for these large customers are a key consideration; while GSF integrates deeply into their supply chains, the potential for customers to insource or find alternatives, especially for standardized products, remains a credible threat. This threat alone grants significant bargaining power, forcing GSF to remain highly competitive to retain its key accounts.

| Customer Type | Bargaining Power Factor | Impact on GSF | 2024 Market Insight |

| Major QSR Chains | High Volume Purchases | Price Negotiation Leverage | Average QSR Profit Margin: 6-9% |

| Dominant Buyers | Customer Concentration | Reduced GSF Pricing Power | Top 10 QSRs dominate market spend |

| Informed Negotiators | Market Data & Benchmarks | Demand for Competitive Terms | Increased access to real-time supply chain data |

| Potential Insourcers | Backward Integration Threat | Pressure on GSF for cost efficiency | Billions invested in supply chain control by large food operators |

Same Document Delivered

Golden State Foods Porter's Five Forces Analysis

This preview shows the exact Golden State Foods Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It delves into the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain a comprehensive understanding of the strategic factors impacting Golden State Foods.

Rivalry Among Competitors

The foodservice and retail supply chain is a crowded arena, with a multitude of players vying for dominance. This includes massive broadline distributors such as Sysco and US Foods, alongside numerous specialized manufacturers who cater to specific product categories.

Golden State Foods (GSF) finds itself in direct competition with a varied group of companies. Promasidor, a prominent African food and beverage company, PepsiCo, a global snack and beverage giant, Tyson Foods, a leading meat processing company, and Ventura Foods, a major supplier of oils and shortenings, all represent significant rivals across different segments of the market.

This broad spectrum of competitors, ranging from multinational corporations with vast resources to smaller, agile niche operators, creates an intensely competitive environment. Companies like GSF must constantly innovate and optimize their operations to capture and retain market share amidst this diverse and dynamic competitive landscape.

The global foodservice market is expected to see continued growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2028. However, this overall positive trend doesn't negate the potential for intense rivalry. If specific segments within the foodservice industry, or particular geographic regions, experience slower growth, this can significantly escalate competitive pressures.

For companies like Golden State Foods, operating in a mature market or witnessing a slowdown in quick-service restaurant (QSR) expansion in key areas can trigger more aggressive tactics. When overall market demand isn't expanding rapidly, businesses often resort to price competition and other aggressive strategies to win over customers from rivals, rather than simply benefiting from a growing market.

The food manufacturing and distribution sector, where Golden State Foods operates, is characterized by significant upfront investments. Think about the massive costs associated with building and maintaining production plants, extensive supply chain infrastructure, and cutting-edge technology. These substantial fixed costs create a strong pressure for companies to keep their operations running at peak efficiency.

This drive to utilize full capacity often translates into more aggressive pricing strategies or increased promotional efforts to secure sales volume. For instance, in 2024, the U.S. food manufacturing industry saw operating margins hover around 4-5%, a figure that can quickly erode if production lines are idle. When there's more supply than demand, this can intensify the rivalry among players like GSF, especially if multiple companies are trying to offload excess inventory.

Product Differentiation

Golden State Foods (GSF) navigates a competitive landscape where differentiating inherently similar food products presents a significant hurdle. However, GSF has carved out its niche by focusing on highly customized solutions tailored to specific client needs, rigorous quality management systems, and a deeply integrated logistics network that ensures reliability and efficiency throughout the supply chain. This strategic approach allows them to stand out from competitors who may offer more standardized products.

The ability of competitors to genuinely differentiate their offerings directly influences the intensity of rivalry within the food supply industry. When differentiation is high, meaning competitors can provide truly unique products or services, it naturally lessens the pressure for direct price competition. For instance, GSF's ability to provide proprietary flavor profiles or specialized packaging solutions can command a premium and reduce the likelihood of customers switching based solely on price.

- Customization: GSF offers bespoke product development and tailored supply chain solutions, a key differentiator in a market often dominated by bulk commodity offerings.

- Quality Assurance: Their commitment to stringent quality control, including certifications like SQF (Safe Quality Food), builds trust and reduces perceived risk for clients compared to less regulated suppliers.

- Integrated Logistics: GSF's control over its logistics, from sourcing to delivery, provides a reliability advantage. For example, in 2024, maintaining on-time delivery rates above 98% for key partners was a significant competitive edge.

- Supplier Relationships: Building strong, long-term relationships with both suppliers and customers fosters loyalty and creates barriers to entry for new, less established players.

Exit Barriers

Golden State Foods faces significant competitive rivalry due to high exit barriers. Specialized assets, like extensive manufacturing plants and a robust cold chain logistics network, make it costly and difficult to divest operations. This means companies are often locked into the market, regardless of profitability.

These substantial investments in infrastructure and technology, essential for serving major fast-food clients, create a strong disincentive to exit. For instance, the capital expenditure required for maintaining and upgrading a national cold chain can run into millions of dollars, making a quick sale or shutdown impractical.

Furthermore, long-term contracts with major fast-food chains, a hallmark of Golden State Foods' business model, further increase exit barriers. These agreements often involve significant penalties for early termination or require substantial operational continuity, compelling companies to remain in the market even during periods of reduced profitability. This can sustain intense rivalry as firms continue to compete rather than withdraw.

- Specialized Assets: High capital investment in manufacturing facilities and cold chain logistics.

- Long-Term Contracts: Commitments with major clients limit flexibility to exit.

- Sustained Rivalry: Companies remain in the market, intensifying competition.

- Profitability Pressure: Companies endure low profitability rather than incur exit costs.

Golden State Foods operates in a highly competitive sector, facing rivals like Sysco, US Foods, Promasidor, PepsiCo, Tyson Foods, and Ventura Foods. The market's growth, projected at 4.5% CAGR through 2028, can intensify rivalry if specific segments lag, forcing companies into price wars and aggressive tactics to gain market share.

High fixed costs associated with manufacturing and logistics, evident in the U.S. food manufacturing industry's 4-5% operating margins in 2024, pressure companies to maintain high capacity utilization. This often leads to intensified competition as firms try to offload excess inventory.

GSF differentiates through customization, quality assurance (e.g., SQF certification), and integrated logistics, evidenced by maintaining over 98% on-time delivery rates in 2024. Strong supplier and customer relationships further solidify their market position.

High exit barriers, including specialized assets and long-term contracts, trap companies in the market, sustaining intense rivalry. This disincentive to exit means firms often endure lower profitability rather than incur costly divestment.

| Competitor Type | Examples | Impact on Rivalry |

| Broadline Distributors | Sysco, US Foods | Intense competition on price and service breadth. |

| Specialized Manufacturers | Promasidor, Tyson Foods, Ventura Foods | Competition on product specialization and quality. |

| Global Food Giants | PepsiCo | Significant resource advantage, driving broad market competition. |

SSubstitutes Threaten

Customers of Golden State Foods, such as quick-service restaurants (QSRs), face numerous alternative ways to procure their food products and manage logistics. They can opt for other broadline or specialized distributors, engage directly with food producers, or even establish their own in-house manufacturing operations. For example, in 2024, the food distribution market saw continued growth with specialized distributors gaining traction, offering niche solutions that could be seen as substitutes for Golden State Foods' broader offerings.

The threat of substitutes is amplified by how easy and cost-effective these alternatives are to implement. If a QSR can find a more affordable or more efficient way to get its ingredients or manage its supply chain, they might switch. This pressure encourages Golden State Foods to remain competitive in pricing and service quality to retain its customer base against these potential diversions.

The attractiveness of substitute products or services hinges on their price relative to the performance they deliver. When alternatives provide similar quality, convenience, and dependability at a reduced cost, the threat of substitution escalates. Quick Service Restaurants (QSRs), being acutely cost-aware, are particularly susceptible to these favorable price-performance shifts from substitutes.

Customer willingness to switch to substitutes for Golden State Foods (GSF) is influenced by brand loyalty, perceived risk, and existing relationships. While major quick-service restaurants (QSRs) often maintain strong, long-term ties with GSF due to its integrated services and consistent quality, shifts in consumer tastes towards novel food options or preparation techniques could indirectly prompt these QSRs to explore alternative suppliers.

Technological Advancements in Food Production

Technological advancements in food production pose a significant threat of substitution for Golden State Foods (GSF). Innovations like plant-based meats and dairy alternatives, which saw significant growth, with the global plant-based food market valued at approximately $27 billion in 2023 and projected to reach over $160 billion by 2030, offer consumers choices that bypass traditional animal-based products. Similarly, precision fermentation and 3D food printing are emerging technologies that could create entirely new food categories, directly substituting GSF's current offerings.

These disruptive technologies can quickly alter consumer preferences and demand. For instance, the increasing consumer interest in sustainable and ethically sourced food products fuels the adoption of plant-based alternatives. While GSF can adapt by incorporating these innovations into their production, the rapid pace of technological change necessitates constant vigilance and investment to remain competitive.

- Plant-based alternatives: The plant-based food market is experiencing robust growth, indicating a strong consumer shift away from traditional animal proteins.

- Precision fermentation: This technology allows for the production of specific proteins, like dairy or egg proteins, without the need for traditional animal agriculture, offering a direct substitute.

- 3D food printing: While still nascent, this technology has the potential to create customized and novel food products, potentially substituting conventionally produced items.

- Market disruption: The rapid emergence of these substitutes can disrupt existing supply chains and customer loyalties, requiring GSF to be agile in its product development and sourcing strategies.

Changes in Consumer Preferences

Shifts in consumer dietary trends, such as the growing demand for healthier options, plant-based foods, or locally sourced ingredients, can push Golden State Foods' (GSF) customers to explore alternative suppliers. For instance, by 2024, the global plant-based food market was projected to reach over $74 billion, highlighting a significant consumer shift. If GSF's product offerings do not swiftly adapt to these evolving preferences, clients might gravitate towards substitutes that better align with current market demands, posing a threat to GSF's market share.

The increasing popularity of direct-to-consumer (DTC) food brands also presents a substitute threat. Many consumers are now sourcing specialty ingredients or prepared meals directly from producers, bypassing traditional supply chains. This trend, which saw significant acceleration in 2024, allows smaller, agile companies to capture market segments previously dominated by larger food service suppliers like GSF, potentially reducing demand for GSF's core offerings.

- Growing Health Consciousness: A 2024 survey indicated that 65% of consumers actively seek healthier food options, impacting demand for traditional processed foods.

- Rise of Plant-Based Alternatives: The plant-based sector experienced a 15% year-over-year growth in 2024, presenting a direct substitute for meat and dairy-based products GSF supplies.

- Local Sourcing Movement: Consumers increasingly prefer locally sourced goods, creating opportunities for smaller regional suppliers to substitute for national distributors like GSF.

The threat of substitutes for Golden State Foods (GSF) is substantial, driven by evolving consumer preferences and technological advancements. For instance, the plant-based food market, a direct substitute for traditional animal proteins, was projected to exceed $74 billion globally in 2024, indicating a significant shift in demand. This trend, coupled with the rise of direct-to-consumer (DTC) brands and innovations like precision fermentation, forces GSF to continually adapt its offerings to remain competitive.

Customers, particularly quick-service restaurants (QSRs), can readily find alternative suppliers or even bring production in-house, especially if substitutes offer better price-performance ratios. The ease and cost-effectiveness of implementing these alternatives, such as specialized distributors or direct sourcing from producers, put pressure on GSF to maintain competitive pricing and service quality.

| Substitute Category | Key Drivers | 2024 Market Insight |

|---|---|---|

| Plant-Based Foods | Health consciousness, sustainability | Projected global market over $74 billion |

| Direct-to-Consumer (DTC) Brands | Convenience, niche offerings | Accelerated growth in 2024 |

| In-house Production | Cost control, customization | Feasible for some QSRs |

| Specialized Distributors | Niche product focus, tailored logistics | Gaining traction in the food distribution market |

Entrants Threaten

Entering the global food manufacturing and distribution sector, particularly for major quick-service restaurant (QSR) clients, requires immense capital. Companies need to invest heavily in state-of-the-art production facilities, extensive supply chain networks, and sophisticated cold chain technology.

For instance, establishing a single, modern food processing plant can easily cost tens to hundreds of millions of dollars. The need for robust logistics, including refrigerated trucks and warehousing, adds another significant layer of upfront expenditure, creating a substantial barrier for new players aiming for large-scale operations.

Established players like Golden State Foods leverage substantial economies of scale in their purchasing, manufacturing, and distribution networks. For instance, in 2024, major food service suppliers often negotiate bulk discounts that can be 5-10% lower than what smaller competitors can secure.

New entrants would find it incredibly challenging to match these cost efficiencies without commanding similar high volumes. This inherent cost disadvantage makes it difficult for them to compete effectively on price, particularly when targeting large quick-service restaurant (QSR) chains that demand competitive pricing and consistent supply.

Securing access to established global distribution channels, particularly those connected to major quick-service restaurant chains, presents a significant hurdle for potential new entrants. Golden State Foods (GSF) has cultivated deep, long-standing partnerships with over 200 leading brands, a network that serves more than 125,000 restaurants worldwide. This extensive reach and the trust built over years are not easily replicated.

Regulatory and Food Safety Hurdles

The food industry faces substantial regulatory and food safety hurdles that act as a significant barrier to new entrants. Compliance with stringent rules for food safety, traceability, and quality control demands considerable investment and expertise.

Navigating these complex processes, securing necessary certifications, and establishing robust quality management systems can be a major deterrent for newcomers. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize enhanced food safety practices, including those mandated by the Food Safety Modernization Act (FSMA), which requires extensive record-keeping and preventive controls.

- FSMA compliance: New entrants must implement preventive controls and traceability systems, adding operational complexity and cost.

- Certifications: Obtaining certifications like HACCP (Hazard Analysis and Critical Control Points) or GFSI (Global Food Safety Initiative) benchmarked schemes is often a prerequisite for supplying major retailers, requiring significant investment in processes and audits.

- Quality Management: Establishing and maintaining high-quality standards, from sourcing to production, necessitates investment in technology, training, and rigorous testing protocols.

- Recall preparedness: Companies must have robust systems in place to manage potential product recalls, a costly and reputation-damaging event.

Brand Loyalty and Switching Costs for Customers

Golden State Foods cultivates deep, enduring partnerships with its primary quick-service restaurant (QSR) clients, a testament to their consistent product quality, dependable supply chain, and comprehensive service offerings. This established trust significantly deters new entrants.

For QSRs, the prospect of switching suppliers extends beyond mere product replacement; it necessitates a potential overhaul of intricate, established supply chains. Such transitions involve substantial costs and inherent risks, making it less appealing for customers to explore or adopt offerings from new market participants.

- High Switching Costs: QSRs face significant expenses related to reconfiguring logistics, retraining staff, and potentially adapting existing equipment to accommodate new suppliers.

- Supply Chain Disruption Risk: A supplier change can lead to operational interruptions, impacting product availability and customer experience, a risk most QSRs are unwilling to take.

- Brand Loyalty: Golden State Foods' long-standing relationships and proven track record foster a strong sense of loyalty among its core QSR customer base.

- Integrated Services: The value proposition of integrated services, from sourcing to delivery, creates a sticky customer relationship that new entrants would struggle to replicate quickly.

The threat of new entrants into the food manufacturing and distribution sector, especially for major quick-service restaurant (QSR) clients, is significantly low due to substantial capital requirements. Establishing modern food processing plants and extensive cold chain logistics can cost tens to hundreds of millions of dollars, creating a formidable barrier. For instance, in 2024, the ongoing investments in advanced automation and sustainability practices further elevate these entry costs.

New entrants also struggle to match the economies of scale enjoyed by established players like Golden State Foods. In 2024, bulk purchasing power for ingredients and packaging could yield discounts of 5-10% for large-volume suppliers, a cost advantage difficult for newcomers to overcome. This cost inefficiency makes it hard for them to compete on price with large QSR chains.

Furthermore, regulatory compliance, particularly with food safety standards like the FDA's FSMA, demands significant investment in robust quality management systems and traceability. Obtaining essential certifications, such as GFSI-benchmarked schemes, is often a prerequisite for supplying major clients, adding considerable operational complexity and cost for potential new entrants.

Golden State Foods' deep, long-standing relationships with over 200 leading QSR brands, serving more than 125,000 restaurants globally, represent a critical barrier. These established partnerships, built on trust and consistent performance, mean QSRs face high switching costs and supply chain disruption risks when considering new suppliers, making them hesitant to engage with newcomers.

Porter's Five Forces Analysis Data Sources

Our Golden State Foods Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements from publicly traded competitors, and regulatory filings. We also incorporate insights from trade publications and economic databases to ensure a robust understanding of the competitive landscape.