Banco de Sabadell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco de Sabadell Bundle

Discover the critical Political, Economic, Social, Technological, Legal, and Environmental forces shaping Banco de Sabadell's future. Our expert-crafted PESTLE analysis provides the deep insights you need to anticipate market shifts and identify strategic opportunities. Don't get left behind – download the full version now for actionable intelligence.

Political factors

The Spanish government's conditional approval for BBVA's takeover of Banco Sabadell, mandating they remain separate legal entities for three years, underscores potent political oversight. This move, intended to preserve competition and regional financial access, introduces operational hurdles and potentially limits merger benefits.

Further complicating matters, the European Commission has contested these conditions, asserting they contravene EU single market principles. This dispute injects considerable political and legal uncertainty into Spain's banking sector consolidation efforts.

Banco Sabadell's operations are significantly shaped by the European Banking Union's regulatory landscape, with the European Central Bank (ECB) and the European Banking Authority (EBA) acting as key supervisors. This oversight dictates many of the bank's strategic and operational decisions.

The EBA's focus for 2024-2025 includes strengthening the Single Rulebook and embedding new digital finance regulations like DORA and MiCA. These initiatives are critical for ensuring financial stability across the EU and will require substantial compliance efforts from Sabadell.

Adherence to evolving EU directives, such as those concerning restrictive measures effective from December 2025, presents both challenges and opportunities for Banco Sabadell. Navigating these complex regulations is paramount for maintaining market access and operational integrity.

Changes in national banking taxation policies, such as the suspension of Spain's banking tax in 2025, directly impact Banco Sabadell's profitability. The absence of this tax helped the bank's margins and widened operating jaws in Q1 2025, contributing to a net interest income of €1.3 billion in that quarter.

Future fiscal measures by the Spanish government or the EU could introduce new levies or alter existing ones. For instance, any reintroduction of a banking tax or the implementation of new financial transaction taxes would negatively affect Banco Sabadell's financial outlook and necessitate strategic adjustments to maintain profitability.

Political Stability and Geopolitical Tensions

Political stability within Spain and the wider European region is a crucial element for Banco Sabadell. Any significant shifts or instability can directly impact investor sentiment and the overall economic trajectory, which are vital for banking operations. For instance, the Spanish government's focus on economic reforms and fiscal management plays a key role in shaping the domestic investment climate.

Broader geopolitical tensions, such as ongoing conflicts or trade disputes, introduce a layer of global uncertainty. While Spain's economic outlook for 2024 and 2025 projects growth exceeding many European counterparts, these external factors can still trigger supply chain disruptions or affect international financial flows. This necessitates robust risk management frameworks for institutions like Banco Sabadell.

Banco Sabadell's strategic planning and ongoing risk assessments must therefore actively incorporate these external political dynamics. The bank's ability to navigate potential economic headwinds stemming from geopolitical events is paramount to maintaining its financial health and achieving its growth objectives in the coming years.

- Spain's projected GDP growth for 2024 was around 2.3%, with forecasts for 2025 hovering near 2.1%, indicating a relatively stable domestic economic environment compared to some EU neighbors.

- Geopolitical events, such as the ongoing conflict in Ukraine, have continued to influence energy prices and inflation rates across Europe, impacting consumer spending and business investment.

- The European Central Bank's monetary policy decisions, influenced by political stability and inflation targets, directly affect interest rates and credit availability for banks like Banco Sabadell.

International Relations and Trade Policies

International relations and evolving trade policies significantly shape Banco Sabadell's global footprint, particularly given its ownership of the UK-based TSB. Changes in trade agreements or geopolitical alliances can directly affect the bank's cross-border operations and, consequently, its profitability. For instance, TSB's contribution was a notable factor in Banco Sabadell's robust Q1 2025 performance, highlighting the sensitivity of the bank's results to the economic climate in key international markets.

Shifts in trade policies, such as potential tariff adjustments or new regulatory frameworks impacting financial services, could influence Banco Sabadell's international business segments. The bank's strategic decisions regarding expansion or divestment in different regions are often informed by the stability and predictability of these international relationships. The bank reported a net profit of €355 million in Q1 2025, with TSB contributing positively to this result, underscoring the importance of stable UK-Spain relations.

- Impact of Trade Agreements: Changes in trade agreements between the UK and the EU, or other major trading blocs, can affect currency exchange rates and the cost of doing business for TSB and, by extension, Banco Sabadell.

- Geopolitical Stability: Broader geopolitical stability influences investor confidence and capital flows, which are crucial for the bank's international operations and its ability to attract and retain customers across different markets.

- Regulatory Harmonization: The degree of regulatory alignment or divergence between Spain, the UK, and other operational jurisdictions can create both opportunities and challenges for Banco Sabadell's compliance and business development strategies.

The Spanish government's conditional approval for BBVA's takeover of Banco Sabadell, mandating they remain separate legal entities for three years, underscores potent political oversight. This move, intended to preserve competition and regional financial access, introduces operational hurdles and potentially limits merger benefits.

Further complicating matters, the European Commission has contested these conditions, asserting they contravene EU single market principles. This dispute injects considerable political and legal uncertainty into Spain's banking sector consolidation efforts.

Banco Sabadell's operations are significantly shaped by the European Banking Union's regulatory landscape, with the European Central Bank (ECB) and the European Banking Authority (EBA) acting as key supervisors. This oversight dictates many of the bank's strategic and operational decisions.

The EBA's focus for 2024-2025 includes strengthening the Single Rulebook and embedding new digital finance regulations like DORA and MiCA. These initiatives are critical for ensuring financial stability across the EU and will require substantial compliance efforts from Sabadell.

Adherence to evolving EU directives, such as those concerning restrictive measures effective from December 2025, presents both challenges and opportunities for Banco Sabadell. Navigating these complex regulations is paramount for maintaining market access and operational integrity.

Changes in national banking taxation policies, such as the suspension of Spain's banking tax in 2025, directly impact Banco Sabadell's profitability. The absence of this tax helped the bank's margins and widened operating jaws in Q1 2025, contributing to a net interest income of €1.3 billion in that quarter.

Future fiscal measures by the Spanish government or the EU could introduce new levies or alter existing ones. For instance, any reintroduction of a banking tax or the implementation of new financial transaction taxes would negatively affect Banco Sabadell's financial outlook and necessitate strategic adjustments to maintain profitability.

Political stability within Spain and the wider European region is a crucial element for Banco Sabadell. Any significant shifts or instability can directly impact investor sentiment and the overall economic trajectory, which are vital for banking operations. For instance, the Spanish government's focus on economic reforms and fiscal management plays a key role in shaping the domestic investment climate.

Broader geopolitical tensions, such as ongoing conflicts or trade disputes, introduce a layer of global uncertainty. While Spain's economic outlook for 2024 and 2025 projects growth exceeding many European counterparts, these external factors can still trigger supply chain disruptions or affect international financial flows. This necessitates robust risk management frameworks for institutions like Banco Sabadell.

Banco Sabadell's strategic planning and ongoing risk assessments must therefore actively incorporate these external political dynamics. The bank's ability to navigate potential economic headwinds stemming from geopolitical events is paramount to maintaining its financial health and achieving its growth objectives in the coming years.

- Spain's projected GDP growth for 2024 was around 2.3%, with forecasts for 2025 hovering near 2.1%, indicating a relatively stable domestic economic environment compared to some EU neighbors.

- Geopolitical events, such as the ongoing conflict in Ukraine, have continued to influence energy prices and inflation rates across Europe, impacting consumer spending and business investment.

- The European Central Bank's monetary policy decisions, influenced by political stability and inflation targets, directly affect interest rates and credit availability for banks like Banco Sabadell.

International relations and evolving trade policies significantly shape Banco Sabadell's global footprint, particularly given its ownership of the UK-based TSB. Changes in trade agreements or geopolitical alliances can directly affect the bank's cross-border operations and, consequently, its profitability. For instance, TSB's contribution was a notable factor in Banco Sabadell's robust Q1 2025 performance, highlighting the sensitivity of the bank's results to the economic climate in key international markets.

Shifts in trade policies, such as potential tariff adjustments or new regulatory frameworks impacting financial services, could influence Banco Sabadell's international business segments. The bank's strategic decisions regarding expansion or divestment in different regions are often informed by the stability and predictability of these international relationships. The bank reported a net profit of €355 million in Q1 2025, with TSB contributing positively to this result, underscoring the importance of stable UK-Spain relations.

- Impact of Trade Agreements: Changes in trade agreements between the UK and the EU, or other major trading blocs, can affect currency exchange rates and the cost of doing business for TSB and, by extension, Banco Sabadell.

- Geopolitical Stability: Broader geopolitical stability influences investor confidence and capital flows, which are crucial for the bank's international operations and its ability to attract and retain customers across different markets.

- Regulatory Harmonization: The degree of regulatory alignment or divergence between Spain, the UK, and other operational jurisdictions can create both opportunities and challenges for Banco Sabadell's compliance and business development strategies.

| Political Factor | Impact on Banco Sabadell | 2024/2025 Data/Forecast |

|---|---|---|

| Regulatory Approval Conditions (BBVA/Sabadell) | Operational hurdles, potential limit on merger benefits | Conditional approval by Spanish government; EU Commission contestation ongoing. |

| EU Banking Regulation (DORA, MiCA) | Requires substantial compliance efforts, impacts digital finance strategy | EBA focus for 2024-2025; implementation crucial for financial stability. |

| National Banking Taxation | Direct impact on profitability; absence of tax improved margins | Suspension of Spanish banking tax in 2025; Q1 2025 Net Interest Income: €1.3 billion. |

| Geopolitical Stability & Trade Policies | Influences investor sentiment, international operations, and cross-border business | Spain GDP growth forecast: 2.3% (2024), 2.1% (2025); TSB contributed positively to Q1 2025 net profit of €355 million. |

What is included in the product

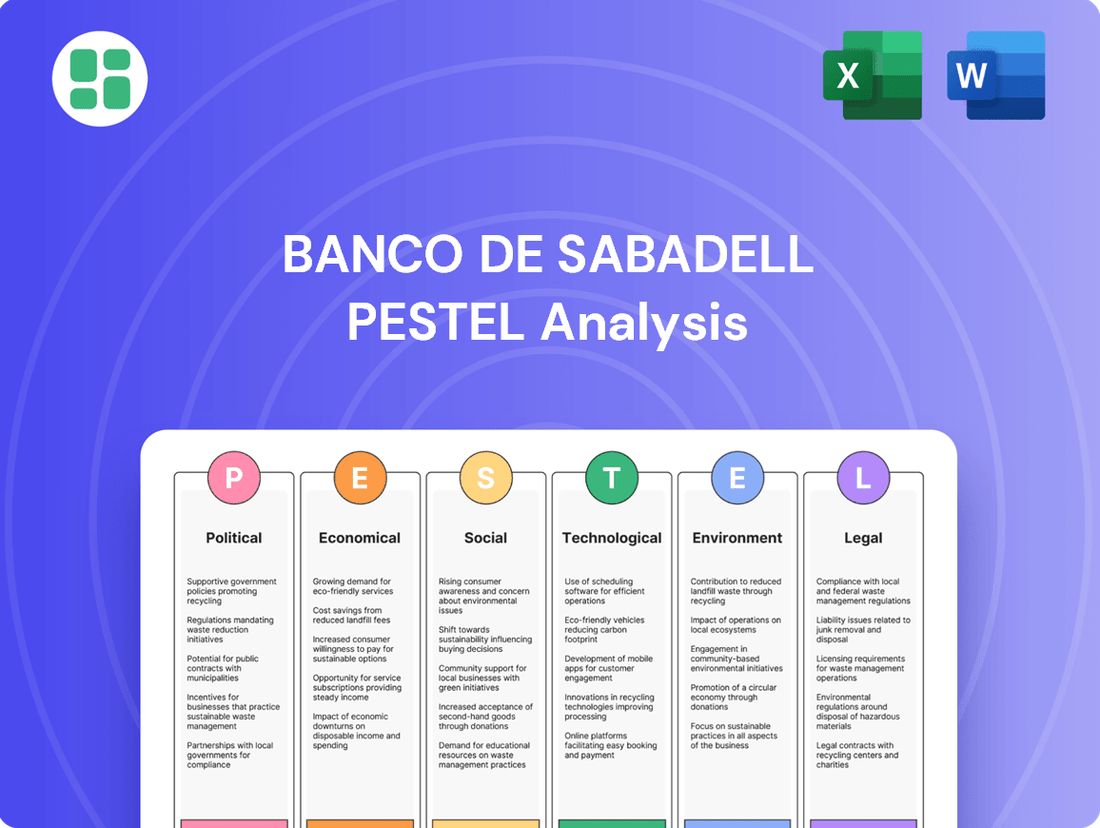

This PESTLE analysis for Banco de Sabadell examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides actionable insights into how these macro-environmental forces create both challenges and strategic advantages for the bank.

A PESTLE analysis for Banco de Sabadell provides a clear, summarized view of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

The European Central Bank's (ECB) interest rate decisions are a critical factor for Banco Sabadell. A slight dip in the bank's net interest income (NII) in the first quarter of 2025 was attributed to lower interest rate levels.

Current forecasts indicate ECB interest rates are likely to remain around 2% through the end of 2027. This sustained period of moderate rates will continue to shape lending margins and the profitability of customer deposits for Banco Sabadell.

Inflation trends and overall economic growth within Spain and the broader Eurozone significantly influence Banco de Sabadell's operational landscape, impacting everything from the demand for loans to the quality of its existing assets and the spending habits of consumers.

Spain's economic trajectory is currently showing positive signs, with forecasts suggesting continued growth, which in turn bolsters opportunities for domestic lending, especially within the crucial mortgage and consumer credit sectors.

Looking ahead, inflation is anticipated to continue its downward trend, a development that could prompt monetary easing from central banks, potentially providing a much-needed stimulus to overall economic activity and, by extension, banking sector performance.

The health of the credit market is a crucial economic indicator, directly impacting financial institutions like Banco de Sabadell. Loan growth and the quality of those loans are paramount.

Banco de Sabadell has demonstrated robust performance in its loan book, experiencing strong growth. Crucially, the bank has achieved a significant improvement in its asset quality, with its non-performing loan (NPL) ratio hitting a near-decade low in the first quarter of 2025.

This positive trend in asset quality signals effective credit underwriting practices and a resilient loan portfolio. Consequently, Banco de Sabadell has seen a reduction in the need for loan loss provisions, which directly contributes to enhanced profitability and a stronger financial footing.

Consumer Spending and Household Debt

Consumer spending and household debt are critical drivers for retail banking. In Spain, for instance, the first quarter of 2025 saw a significant uptick in mortgage originations, with a reported 15% year-on-year increase, signaling strong household demand for property. Similarly, consumer loans experienced a robust expansion, growing by approximately 10% over the same period, indicating a healthy appetite for credit among Spanish consumers.

However, the economic landscape presents potential headwinds. The depletion of pandemic-era excess savings, estimated to be down by nearly 30% by mid-2025, coupled with persistently tight monetary conditions, could dampen future consumer spending. This trend necessitates careful monitoring by financial institutions like Banco de Sabadell.

- Mortgage Growth: Spanish mortgage originations rose by 15% year-on-year in Q1 2025.

- Consumer Loans: Consumer credit expanded by approximately 10% in the same quarter.

- Savings Depletion: Excess household savings have decreased by an estimated 30% by mid-2025.

- Monetary Conditions: Tight monetary policy continues to influence borrowing costs and spending power.

Capital Markets and Investor Confidence

The health of capital markets and the prevailing investor sentiment directly impact Banco Sabadell's ability to secure funding, generate capital, and influence its stock valuation. In 2024, European equity markets, including Spain's IBEX 35, have shown resilience, with investor confidence buoyed by moderating inflation and expectations of interest rate cuts. This positive environment generally translates to lower funding costs for banks.

Banco Sabadell has actively reinforced its financial standing. For instance, the bank has consistently maintained a robust Common Equity Tier 1 (CET1) ratio, exceeding regulatory requirements. In its 2024 performance updates, Sabadell highlighted its commitment to shareholder returns through significant share buyback programs and a progressive dividend policy, signaling a strong belief in its underlying financial strength and strategic trajectory.

- Capital Markets Performance: The STOXX Europe 600 Banks index experienced a notable uptick in early 2024, reflecting improved investor sentiment towards the financial sector.

- Investor Confidence Indicators: Surveys of European fund managers in Q1 2024 indicated a cautious but growing optimism regarding economic prospects, which often correlates with increased investment in banking stocks.

- Sabadell's Capital Position: Banco Sabadell reported a CET1 ratio of approximately 12.5% as of the end of 2023, well above the European Banking Authority's minimum requirements.

- Shareholder Returns: The bank's 2024 dividend guidance and ongoing share repurchase authorizations underscore its strategy to enhance shareholder value, a key driver of investor confidence.

Economic factors significantly shape Banco Sabadell's performance, with interest rate environments and inflation trends being paramount. Spain's economic growth is a key driver for lending, particularly in mortgages and consumer credit.

The bank's asset quality has improved, with a near-decade low in its non-performing loan ratio in Q1 2025, which reduces the need for loan loss provisions.

Consumer spending remains a vital component, though the depletion of excess savings and tight monetary conditions could pose challenges.

| Economic Factor | Data Point (Q1 2025 / Mid-2025) | Impact on Banco Sabadell |

|---|---|---|

| ECB Interest Rates | Forecasted around 2% through end of 2027 | Shapes lending margins and deposit profitability |

| Spanish Economic Growth | Positive trajectory, supporting lending opportunities | Boosts demand in mortgage and consumer credit sectors |

| Non-Performing Loan (NPL) Ratio | Near decade low in Q1 2025 | Reduces loan loss provisions, enhances profitability |

| Consumer Spending | Potential dampening due to savings depletion (-30% by mid-2025) | Requires careful monitoring of credit demand and risk |

Preview the Actual Deliverable

Banco de Sabadell PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Banco de Sabadell. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic planning.

Sociological factors

Consumers are increasingly embracing digital banking, a key sociological shift. Banco Sabadell recognizes this, investing heavily in its digital transformation to boost customer acquisition, particularly via online channels. This trend demands ongoing innovation in mobile apps, online platforms, and tailored digital experiences to satisfy evolving customer demands.

Spain's demographic landscape is notably shaped by an aging population, with the proportion of individuals aged 65 and over projected to reach approximately 30% by 2050, up from around 20% in 2023. This significant shift directly impacts Banco Sabadell's product development, driving increased demand for wealth management, retirement planning services, and tailored mortgage solutions for seniors. The bank must strategically adjust its outreach and service models to effectively serve the evolving financial requirements of these distinct age cohorts.

The financial literacy of a nation's population directly influences their engagement with financial products and services. In Spain, initiatives to boost financial education are ongoing, aiming to equip citizens with the knowledge to manage their finances effectively. For instance, the Spanish National Financial Education Plan (ENEF) continues its efforts to improve understanding of financial concepts.

Banco Sabadell actively contributes to financial inclusion by developing accessible banking solutions and participating in programs that extend financial services to less-served segments of the population. This commitment is crucial for fostering economic participation and ensuring that a wider range of individuals and businesses can benefit from the formal financial system, a key aspect of societal well-being.

Trust and Reputation in Banking

Public trust is the bedrock of any financial institution, and for Banco Sabadell, this is particularly true in the wake of economic volatility. A strong reputation, built on ethical conduct and superior customer service, directly translates to customer loyalty and a stable client base. For instance, in early 2024, surveys indicated that while overall trust in Spanish banks was recovering, specific institutions demonstrating robust governance and clear communication saw higher customer retention rates.

Banco Sabadell's standing is intrinsically linked to its perceived stability and adherence to ethical principles. In 2024, the bank continued to emphasize its commitment to corporate social responsibility, with initiatives focused on financial education and sustainable banking practices, aiming to bolster its image. This focus is critical, as a bank's reputation can significantly impact its ability to attract and retain both retail and corporate clients.

Maintaining high standards of corporate governance and transparency is paramount for Banco Sabadell to cultivate and preserve customer loyalty. The bank's 2024 annual report highlighted increased investment in cybersecurity and data protection, responding to growing customer concerns about financial data security, a key factor in building trust.

- Public Trust: Essential for financial institutions, especially after economic downturns.

- Reputation Drivers: Ethical practices, customer service quality, and perceived stability are key for Banco Sabadell.

- Customer Loyalty: Directly influenced by a bank's reputation and its commitment to transparency.

- Governance & Transparency: Vital for building and retaining trust, with increased focus on data security in 2024.

Workforce Dynamics and Talent Attraction

Banco Sabadell, like many financial institutions, faces evolving workforce dynamics. The availability of skilled talent, particularly in cutting-edge fields such as artificial intelligence, cybersecurity, and data analytics, is paramount as the banking sector embraces digital transformation. Attracting and retaining these professionals is crucial for maintaining a competitive edge.

The demand for digital skills in banking is intensifying. For instance, a 2024 report indicated a 25% year-over-year increase in job postings requiring AI and machine learning expertise within the European financial services sector. This trend directly impacts Banco Sabadell's ability to recruit individuals who can drive innovation and manage increasingly complex technological landscapes.

- Talent Scarcity: Shortage of professionals with specialized skills in AI, cybersecurity, and data analytics.

- Digital Transformation Needs: Banking sector's shift requires new skill sets for competitiveness.

- Retention Challenges: High demand for tech talent leads to increased competition for skilled employees.

- Upskilling Initiatives: Banco Sabadell may need to invest in training existing staff to bridge skill gaps.

Consumer preferences are shifting towards digital-first banking experiences, necessitating robust online platforms and mobile applications from Banco Sabadell. This trend, evident in the increasing adoption of digital channels for transactions and customer service, requires continuous investment in user-friendly interfaces and personalized digital offerings to meet evolving expectations.

Spain's demographic profile is characterized by a growing elderly population, with those aged 65 and over expected to constitute nearly 30% of the population by 2050, a significant increase from approximately 20% in 2023. This demographic shift directly influences Banco Sabadell's product strategy, creating a greater demand for specialized financial services such as wealth management, retirement planning, and tailored mortgage solutions for older clients.

Financial literacy remains a key societal factor influencing engagement with financial products. Ongoing efforts, like Spain's National Financial Education Plan (ENEF), aim to improve citizens' understanding of financial concepts, which in turn can lead to more informed banking decisions and increased utilization of financial services offered by institutions like Banco Sabadell.

Banco Sabadell's commitment to financial inclusion is vital for societal well-being, extending banking services to underserved communities and promoting economic participation. By developing accessible products and engaging in outreach programs, the bank helps ensure a broader segment of the population benefits from the formal financial system.

Public trust is fundamental for financial institutions, especially in periods of economic uncertainty. Banco Sabadell's reputation, built on ethical conduct and service quality, directly impacts customer loyalty. Surveys from early 2024 indicated that banks demonstrating strong governance and clear communication experienced higher customer retention rates amidst a general recovery in trust levels across the Spanish banking sector.

The bank's perceived stability and ethical standing are crucial for client retention. In 2024, Banco Sabadell reinforced its commitment to corporate social responsibility through initiatives in financial education and sustainable banking. This focus is essential for maintaining a positive image and attracting both individual and corporate clients.

Maintaining high standards of corporate governance and transparency is paramount for fostering customer loyalty. Banco Sabadell's 2024 annual report highlighted increased investments in cybersecurity and data protection, addressing growing customer concerns about the security of their financial information.

The banking sector's digital transformation is creating a demand for specialized talent in areas like AI, cybersecurity, and data analytics. Banco Sabadell faces the challenge of attracting and retaining these skilled professionals to maintain its competitive edge, as evidenced by a 2024 report showing a 25% year-over-year increase in job postings for AI/ML expertise in European finance.

| Sociological Factor | Description | Impact on Banco Sabadell | Relevant Data/Trend |

|---|---|---|---|

| Digital Adoption | Increasing consumer preference for digital banking channels. | Requires investment in online and mobile platforms; influences customer acquisition strategies. | Growing number of transactions conducted via digital channels. |

| Demographics | Aging population in Spain. | Drives demand for wealth management, retirement planning, and senior-focused financial products. | Projected 30% of population aged 65+ by 2050 (vs. ~20% in 2023). |

| Financial Literacy | Level of understanding of financial concepts among the population. | Influences engagement with financial products; supported by national education initiatives. | Ongoing efforts via ENEF to improve financial knowledge. |

| Financial Inclusion | Access to financial services for all segments of society. | Necessitates development of accessible banking solutions and participation in outreach programs. | Key for fostering economic participation and societal well-being. |

| Public Trust & Reputation | Customer confidence in the bank's stability, ethics, and service. | Crucial for customer loyalty and client base stability; influenced by governance and transparency. | Early 2024 surveys show higher retention for banks with strong governance and communication. |

| Workforce Skills | Availability of talent with digital and specialized skills. | Critical for innovation and competitiveness in a transforming sector; poses recruitment challenges. | 25% YoY increase in AI/ML job postings in European finance (2024). |

Technological factors

Banco Sabadell is aggressively pursuing digital transformation, aiming to seamlessly blend its online and mobile offerings with its physical branch network. This omnichannel approach focuses on enhancing customer experience by streamlining processes and leveraging technology across all interaction points.

In 2024, the bank continued to invest heavily in its digital infrastructure, with a significant portion of its IT budget allocated to these initiatives. For instance, Sabadell reported that digital channels accounted for over 70% of its retail customer transactions by the end of 2024, a clear indicator of shifting customer preferences and the success of its digital strategy.

The burgeoning FinTech sector is a significant technological factor, compelling established institutions like Banco de Sabadell to accelerate their own innovation. This competitive pressure is driving a wave of new digital services and customer-centric approaches across the banking industry.

Banco de Sabadell is proactively addressing this by partnering with NTT DATA to launch a financial innovation lab. This initiative is specifically targeting advancements in generative AI and immersive technologies, aiming to create groundbreaking financial solutions and enhance customer interactions.

Artificial intelligence and advanced data analytics are increasingly vital for banks like Banco Sabadell, impacting everything from customer interactions and fraud prevention to managing risks and streamlining operations. Sabadell is actively investigating generative AI and other AI tools to improve both customer and employee experiences, while also extracting more valuable insights from its extensive data. For instance, in 2023, many banks reported significant investments in AI for fraud detection, with some seeing a reduction in false positives by up to 20%.

Cybersecurity and Data Protection

The increasing reliance on digital platforms for banking services amplifies cybersecurity risks for Banco Sabadell. Protecting sensitive customer data from evolving cyber threats is a constant challenge, necessitating significant and ongoing investment in advanced security infrastructure and protocols. Failure to do so can lead to data breaches, reputational damage, and substantial financial penalties.

Adherence to stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), is crucial for Banco Sabadell. These regulations mandate robust data protection measures and impose heavy fines for non-compliance. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial imperative of strong data governance.

Maintaining operational resilience against cyberattacks is paramount for financial institutions like Banco Sabadell. A successful cyberattack can disrupt critical banking operations, impacting customer access to services and the bank's ability to conduct transactions. In 2023, the financial sector globally experienced a significant rise in sophisticated cyberattacks, with ransomware attacks alone costing businesses billions, highlighting the critical need for proactive defense strategies.

- Cybersecurity Investment: Banco Sabadell must allocate substantial resources to cutting-edge security technologies, including AI-driven threat detection and continuous monitoring systems.

- Regulatory Compliance: Strict adherence to data privacy laws like GDPR is non-negotiable, requiring comprehensive data protection policies and regular audits.

- Operational Continuity: Implementing robust business continuity and disaster recovery plans is essential to mitigate the impact of potential cyber incidents and ensure uninterrupted service delivery.

- Customer Trust: Demonstrating a strong commitment to cybersecurity and data protection is vital for maintaining customer confidence and loyalty in an increasingly digital banking environment.

Cloud Computing and Infrastructure Modernization

Banco de Sabadell is actively embracing cloud computing to modernize its IT infrastructure, aiming for greater scalability and cost-effectiveness. This strategic shift is crucial for enhancing agility in service delivery and data handling, aligning with the bank's broader digital transformation goals.

By migrating core banking systems to the cloud, Sabadell can accelerate the launch of new financial products and services, improve data analytics capabilities, and bolster its operational resilience. For instance, in 2024, the bank continued its investment in cloud-native architectures, with a significant portion of its IT budget allocated to these modernization efforts.

- Scalability: Cloud adoption allows Sabadell to dynamically adjust IT resources based on demand, a key advantage in fluctuating market conditions.

- Cost Efficiency: Moving to the cloud can reduce capital expenditure on physical hardware and optimize operational IT costs.

- Innovation: Modernized, cloud-based systems facilitate faster development and deployment of innovative digital banking solutions.

- Resilience: Cloud infrastructure often provides enhanced disaster recovery and business continuity capabilities, ensuring service availability.

Technological advancements are reshaping Banco Sabadell's operations, driving significant investment in digital transformation and cloud computing. The bank's commitment to an omnichannel experience is evident, with digital channels handling over 70% of retail transactions in 2024. This digital push is further fueled by the competitive FinTech landscape, prompting Sabadell to explore generative AI and immersive technologies through partnerships like the one with NTT DATA. These investments are crucial for enhancing customer engagement, operational efficiency, and maintaining a competitive edge in the evolving financial services sector.

Legal factors

Banco Sabadell navigates a stringent regulatory landscape, including the Capital Requirements Directive (CRD) and Capital Requirements Regulation (CRR), under the watchful eyes of the European Central Bank and the Bank of Spain. Its commitment to compliance is evident, with a capital ratio notably surpassing regulatory minimums in the first quarter of 2025, underscoring its financial resilience.

The bank must remain agile in response to evolving directives from the European Banking Authority (EBA), particularly concerning restrictive measures and prudential supervision. These continuous adjustments are crucial for maintaining operational integrity and market confidence.

Banco Sabadell, like all global financial institutions, must adhere to rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These regulations are paramount to maintaining financial system integrity. In 2023, Spanish banks collectively reported over 100,000 suspicious transactions, highlighting the scale of compliance efforts.

The bank's global policy is built on robust customer due diligence, stringent internal controls, and the proactive reporting of suspicious activities to relevant authorities. This framework is essential for preventing illicit financial flows and meeting international standards.

The upcoming implementation of new EU AML/CFT frameworks and the establishment of new EU authorities in 2025 will demand continuous adaptation and heightened vigilance from Banco Sabadell to ensure ongoing compliance and effective risk management.

Data privacy regulations like the GDPR significantly impact banks like Banco Sabadell. These laws mandate strict protocols for handling customer data, from collection to storage, directly affecting operational procedures and IT infrastructure investments. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Banco Sabadell's commitment to robust data privacy not only ensures legal compliance but also fosters crucial customer trust. By demonstrating a strong adherence to regulations such as GDPR, the bank can differentiate itself in a competitive market. This focus on privacy is increasingly important as digital banking services grow, making data protection a key element of customer loyalty and brand reputation.

Competition Law and Merger Control

Competition laws are crucial, especially for significant mergers like the potential BBVA acquisition of Banco Sabadell. These regulations aim to prevent market dominance and ensure fair competition for consumers and businesses.

The Spanish government's actions regarding this proposed merger have drawn scrutiny from the EU Commission. The Commission views these interventions as potentially conflicting with EU banking regulations and the principles of the single market, underscoring the intricate legal landscape surrounding banking consolidation.

- Regulatory Scrutiny: Mergers of this scale are subject to rigorous review by competition authorities in Spain and potentially the EU to assess their impact on market competition.

- Government Influence: The Spanish government's stance on the BBVA-Sabadell deal highlights how national political considerations can intersect with competition law and EU market rules.

- EU Commission Oversight: The EU Commission's involvement signals the potential for cross-border regulatory challenges and the enforcement of single market principles in banking sector consolidation.

Consumer Lending and Mortgage Regulations

Consumer lending and mortgage regulations are critical for Banco Sabadell. For instance, the EU's Mortgage Credit Directive (MCD) sets stringent rules on pre-contractual information, responsible lending, and mortgage intermediary conduct, directly influencing how Sabadell structures and markets its mortgage products. In Spain, the Mortgage Market Law (Ley 5/2019) further enhances consumer protection by introducing new transparency obligations and mechanisms for dealing with mortgage defaults, impacting loan origination and servicing processes.

These legal frameworks, including potential interest rate caps or specific disclosure requirements, directly shape Banco Sabadell's retail banking strategies. Compliance is paramount to avoid penalties and maintain customer trust. For example, in 2023, Spanish banks were subject to heightened scrutiny regarding variable-rate mortgage adjustments, pushing institutions like Sabadell to offer more transparent and potentially fixed-rate alternatives to mitigate consumer risk and regulatory exposure.

- Mortgage Credit Directive (MCD): Mandates standardized pre-contractual information across the EU, impacting Sabadell's mortgage product disclosures.

- Spanish Mortgage Market Law (Ley 5/2019): Strengthens consumer protection through enhanced transparency and default management, affecting Sabadell's lending practices.

- Consumer Credit Directive: Governs all forms of consumer credit, setting rules on information, fairness, and credit protection, influencing Sabadell's personal loan offerings.

- Regulatory Scrutiny (2023-2024): Increased focus on variable-rate mortgage adjustments and potential for interest rate caps directly impacts Sabadell's risk management and product development in this segment.

Banco Sabadell operates within a complex web of EU and national legislation, requiring constant adaptation to maintain compliance. The ongoing evolution of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, including new EU frameworks expected in 2025, necessitates robust due diligence and reporting mechanisms. Furthermore, data privacy laws like GDPR impose strict data handling protocols, with non-compliance carrying significant financial penalties, underscoring the importance of secure data management for customer trust and operational integrity.

Environmental factors

Banco Sabadell is actively addressing climate change, acknowledging its responsibility in adaptation and mitigation efforts. The bank is committed to decarbonizing its financial operations and has set a goal to mobilize €65 billion in sustainable finance solutions by 2025, demonstrating a clear strategic direction towards environmental responsibility.

This commitment translates into tangible actions, including offering financial products that support energy efficiency improvements, the development of renewable energy projects, and the promotion of circular economy principles. These initiatives aim to drive positive environmental impact while aligning with evolving market demands for sustainable investments.

Banco Sabadell is actively integrating Environmental, Social, and Governance (ESG) factors into its core strategy, business operations, and internal systems. This commitment is central to its environmental responsibilities, aiming to embed sustainability across all decision-making processes.

The bank's ESG action framework is specifically designed to align with the United Nations Sustainable Development Goals. This alignment ensures that sustainability risks are systematically incorporated into investment decisions and even influences the bank's remuneration policies, directly linking financial performance with sustainable practices.

A concrete example of this integration is Banco Sabadell's establishment of decarbonization targets for sectors with significant emissions. For instance, by the end of 2024, the bank aims to reduce financed emissions from its corporate loan portfolio in sectors like energy and real estate, with specific percentage reduction goals set for 2030.

Banks like Banco de Sabadell face growing regulatory demands to integrate environmental considerations into their operations. For instance, the European Banking Authority (EBA) is increasingly focusing on climate-related financial risks, pushing institutions to disclose their environmental, social, and governance (ESG) performance and align with frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD). This regulatory push is becoming a significant factor in how banks manage their portfolios and strategic planning.

Operational Carbon Footprint Reduction

Banco Sabadell is actively working to lower its own environmental impact, going beyond just financing green initiatives. A key part of this effort is reducing its operational carbon footprint.

The bank has been committed to using 100% renewable electricity sources since 2005, demonstrating a long-term dedication to cleaner energy. This commitment has translated into tangible results, with significant reductions in its total carbon footprint within Spain, even surpassing its initial reduction goals.

To further offset its emissions, Banco Sabadell also engages in reforestation projects. These actions directly contribute to carbon sequestration and biodiversity enhancement.

- 100% Renewable Electricity: Utilized since 2005.

- Carbon Footprint Reduction: Exceeded original targets in Spain.

- Reforestation Initiatives: Actively promotes these to offset emissions.

Reputational Risk and Greenwashing Concerns

Increased public and investor focus on environmental impact creates significant reputational risks for banks, particularly concerning accusations of greenwashing. Banco Sabadell's commitment to transparently communicating its sustainability efforts, as evidenced by its annual SDG and Climate Reports, is vital for building and maintaining trust in its environmental initiatives. For instance, the bank's 2023 Climate Report detailed a 22% reduction in financed emissions intensity for its corporate loan portfolio compared to 2022. This demonstrates a tangible effort to back its green claims.

Failure to demonstrate genuine progress can lead to a loss of investor confidence and damage brand image. Banco Sabadell's proactive approach involves detailed disclosures on its progress towards its sustainability targets, aiming to mitigate these risks. The bank reported that 40% of its new financing in 2023 was aligned with sustainability criteria, showcasing a strategic shift in its lending practices.

- Reputational Risk: Growing scrutiny over environmental performance can lead to accusations of greenwashing, impacting public and investor trust.

- Greenwashing Concerns: Banks must provide verifiable data to support their environmental claims and avoid misleading marketing.

- Transparency as Mitigation: Banco Sabadell's annual SDG and Climate Reports, like the 2023 report showing a 22% reduction in financed emissions intensity, are key to building credibility.

- Investor Confidence: Demonstrating genuine progress in sustainability, such as 40% of new financing in 2023 aligned with sustainability criteria, is crucial for maintaining investor confidence.

Environmental factors significantly shape Banco Sabadell's strategy, driven by climate change concerns and regulatory shifts. The bank has committed to mobilizing €65 billion in sustainable finance by 2025, underscoring its dedication to green initiatives and decarbonization targets for key sectors. These efforts are crucial for managing reputational risks and maintaining investor confidence amidst increasing scrutiny of environmental performance.

| Environmental Factor | Banco Sabadell's Action/Target | Data/Metric |

|---|---|---|

| Climate Change Mitigation | Mobilize sustainable finance | €65 billion by 2025 |

| Decarbonization of Operations | Reduce financed emissions intensity in corporate loans | Targeted reduction for energy and real estate sectors by 2030 (specific percentages detailed in internal reports) |

| Operational Footprint | Utilize renewable electricity | 100% since 2005 |

| Reputational Risk Management | Transparent reporting on sustainability | 2023 Climate Report showed 22% reduction in financed emissions intensity; 40% of new financing aligned with sustainability criteria in 2023 |

PESTLE Analysis Data Sources

Our Banco de Sabadell PESTLE Analysis is built on a foundation of robust data, drawing from official reports by the Bank of Spain, the European Central Bank, and international financial institutions like the IMF and World Bank. We also incorporate insights from reputable market research firms and leading financial news outlets.