Banco de Sabadell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco de Sabadell Bundle

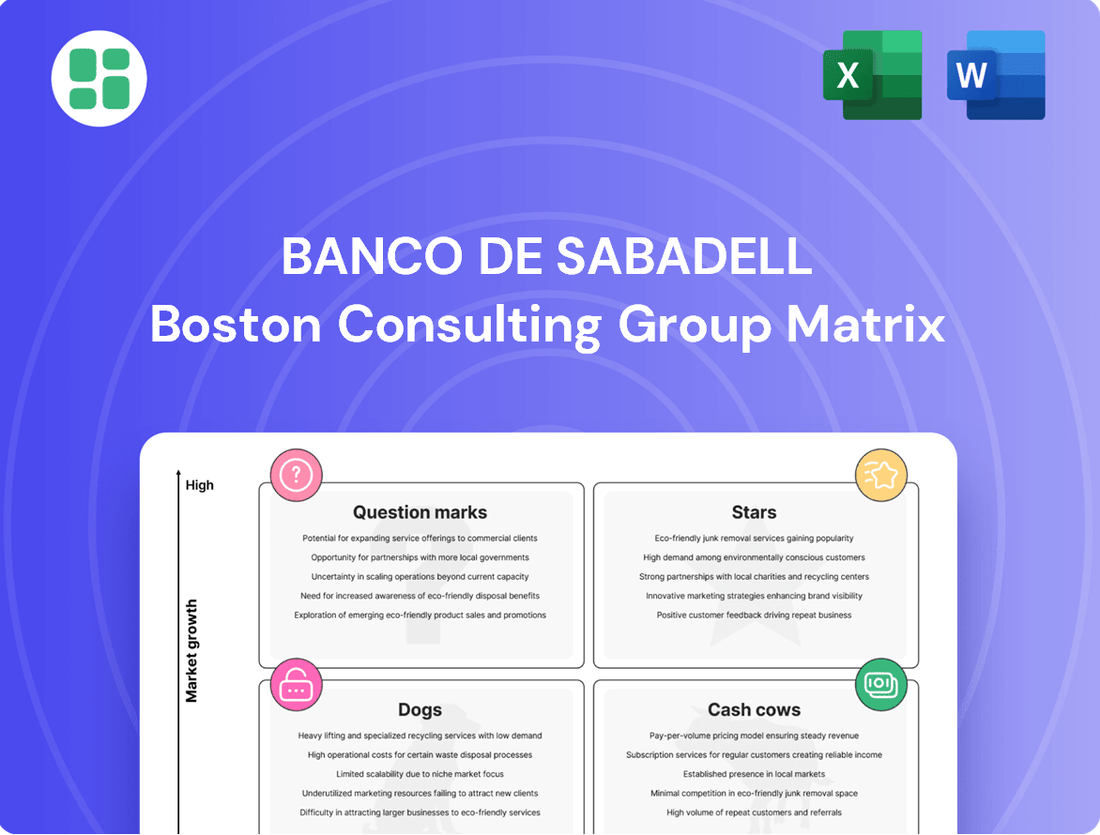

Uncover the strategic positioning of Banco de Sabadell's diverse portfolio with our comprehensive BCG Matrix analysis. See which of their offerings are poised for growth as Stars, which are generating consistent returns as Cash Cows, and which may require a closer look as Dogs or Question Marks.

This preview offers a glimpse into the powerful insights available. Purchase the full BCG Matrix report for a detailed quadrant breakdown, data-driven recommendations, and a clear roadmap to optimizing Banco de Sabadell's product strategy and capital allocation.

Stars

Banco de Sabadell is heavily invested in the Spanish business lending market, targeting over 4% annual growth in corporate and SME lending, outpacing the broader sector. This focus is a cornerstone of their strategy for profitability and capital generation, bolstered by a dedicated customer service approach.

The bank's Spanish loan portfolio, particularly in corporate finance, demonstrated robust performance. In the first quarter of 2025, these loans saw a healthy 5% increase compared to the same period in the previous year, reflecting strong market engagement.

Consumer loans represent a significant growth engine for Banco de Sabadell. In the first quarter of 2025, this segment saw an impressive year-on-year increase of 20.6%.

Banco de Sabadell anticipates outperforming the broader market in consumer banking, where overall growth is projected at 6% annually. This suggests a strategic advantage and an expanding market share within a flourishing sector.

The robust performance in consumer lending positions it as a critical driver of the bank's future expansion. This segment is a clear star within the BCG matrix due to its high growth and strong market potential.

Banco de Sabadell is heavily investing in its digital banking and mobile app services, aiming to simplify processes like customer onboarding and enhance user experience. This strategic focus positions the bank to capitalize on the burgeoning Spanish digital banking market.

The Spanish digital banking sector is set for substantial expansion, with forecasts indicating a compound annual growth rate of 11.189% from 2025 to 2035. This growth is fueled by increasing smartphone penetration and supportive government initiatives promoting digitization across the nation.

Sabadell's commitment to digital innovation is evident in features like real-time card payment geolocation, directly addressing the market's demand for seamless and modern banking tools. These advancements are crucial for competing effectively in a rapidly evolving digital landscape.

Asset Management with Amundi Partnership (ESG Focus)

Banco de Sabadell's strategic alliance with Amundi has significantly bolstered its asset management capabilities, particularly with an emphasis on Environmental, Social, and Governance (ESG) principles. This partnership, established in June 2020, has driven a remarkable 53% surge in assets under management, now exceeding €21.9 billion.

The growth is heavily weighted towards ESG investments, with over 85% of the managed assets aligned with these sustainable criteria. This strategic positioning taps into a burgeoning market segment with substantial investor demand. Furthermore, the introduction of Sabadell Portfolios in April 2024, a discretionary portfolio management offering, has accelerated this growth, contributing to a 59% increase in managed assets.

- Partnership with Amundi: Since June 2020, assets under management have grown by 53%, reaching over €21.9 billion.

- ESG Focus: More than 85% of managed assets are invested in ESG-aligned products, capitalizing on market demand.

- Sabadell Portfolios Launch: Introduced in April 2024, this service has further driven managed asset growth by 59%.

TSB (UK Subsidiary)

TSB, Banco de Sabadell's UK subsidiary, is demonstrating robust growth, making it a significant contributor to the group's overall financial health. In the first quarter of 2025, TSB's standalone net profit surged by an impressive 96.1% compared to the previous year, highlighting its strong operational performance.

The UK housing market also shows resilience, reflected in TSB's mortgage lending, which increased by 12% year-on-year in Q1 2025. This growth indicates continued demand for housing and TSB's ability to capture market share.

Despite plans for its eventual sale, TSB's current financial strength and market position in the UK firmly place it as a Star in the BCG matrix for Banco de Sabadell. Its high profitability and growth trajectory are key drivers of this classification in the short to medium term.

- TSB's Q1 2025 standalone net profit increased by 96.1% year-on-year.

- Mortgage lending at TSB grew by 12% year-on-year in Q1 2025.

- TSB's strong performance positions it as a Star in Banco de Sabadell's BCG matrix.

Banco de Sabadell's consumer lending and digital banking initiatives are clear Stars. Consumer loans saw a 20.6% year-on-year increase in Q1 2025, significantly outpacing the projected 6% market growth. The digital banking sector, expected to grow at over 11% annually, is also a key area of focus, with Sabadell investing heavily in enhancing user experience and digital services.

The bank's asset management arm, particularly its ESG-focused investments, also shines. Through its partnership with Amundi, assets under management have grown by 53% since June 2020, exceeding €21.9 billion, with over 85% allocated to ESG. The launch of Sabadell Portfolios in April 2024 further boosted managed assets by 59%.

TSB, Banco de Sabadell's UK subsidiary, is also performing exceptionally well, despite plans for its eventual sale. TSB's Q1 2025 net profit surged by 96.1% year-on-year, and its mortgage lending grew by 12% in the same period, demonstrating strong market presence and profitability.

| Business Segment | Growth Metric | Performance (Q1 2025) | BCG Classification |

|---|---|---|---|

| Consumer Lending | Year-on-Year Growth | +20.6% | Star |

| Digital Banking | Market CAGR (2025-2035) | 11.189% | Star |

| Asset Management (ESG) | AUM Growth (since Jun 2020) | +53% (to €21.9B) | Star |

| TSB (UK Subsidiary) | Net Profit Growth | +96.1% | Star |

What is included in the product

Analysis of Banco de Sabadell's business units across the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

Banco de Sabadell's BCG Matrix offers a clear, one-page overview, relieving the pain of strategic confusion by placing each business unit in its optimal quadrant.

Cash Cows

Traditional retail deposits are a bedrock for Banco de Sabadell, offering a steady and cost-effective source of funding. This segment, while mature, is vital for the bank's liquidity and fuels its lending operations.

In 2024, retail deposits remained a significant portion of Banco de Sabadell's funding structure, underscoring their importance. The bank's commitment to its Spanish customer base helps ensure these funds remain stable and readily available for its core business.

Banco de Sabadell’s established mortgage portfolio in Spain acts as a strong Cash Cow. This segment experienced a 5.7% year-on-year growth in the first half of 2025, demonstrating its continued vitality.

Despite potentially moderate overall market expansion, Sabadell’s substantial market share and consistent loan origination contribute to a reliable income stream. The portfolio benefits from improving asset quality and a low non-performing loan ratio, solidifying its position as a stable profit generator for the bank.

Banco de Sabadell's corporate banking, built on established relationships, acts as a significant cash cow. These long-standing ties with major corporations generate a steady stream of fee income and lending business, providing a reliable financial foundation.

While this segment experiences slower growth compared to newer ventures, its high market share ensures consistent cash flow. This stability stems from the long-term nature of corporate financing agreements and treasury services, making it a dependable income generator for the bank.

In 2024, Banco de Sabadell's corporate banking division continued to demonstrate its resilience. For instance, the bank reported robust net interest income from its corporate clients, underscoring the value of these enduring partnerships. The efficiency and profitability within this established segment remain a key strength.

Payment Methods and Point-of-Sale (POS) Turnover

Banco de Sabadell's Payment Methods and Point-of-Sale (POS) turnover is a significant Cash Cow. The bank commands a substantial 17% market share in Spain's POS turnover, demonstrating a robust position in payment processing services.

This segment consistently contributes fee income derived from transaction volumes, offering a predictable and stable revenue stream within a well-established market. The growth in card turnover, which saw a 6% increase in the first quarter of 2025, further reinforces its status as a dependable source of cash generation for the bank.

- Market Share: 17% in Spanish POS turnover.

- Revenue Stream: Consistent fee income from transactions.

- Growth Indicator: 6% increase in card turnover in Q1 2025.

- Strategic Position: Reliable cash generator in a mature market.

Basic Insurance Products

Basic insurance products within Banco de Sabadell's portfolio likely represent Cash Cows. While specific growth rates aren't publicly detailed for these offerings, they are integral to the bank's extensive financial services. These products, often bundled with core banking relationships like mortgages or current accounts, benefit from high existing customer penetration.

These insurance offerings, such as basic home or life policies, typically exhibit low market growth. However, their established presence within the bank's client base ensures consistent, recurring revenue. This stability allows for minimal additional investment, characteristic of a Cash Cow strategy.

- Low Growth, High Market Share: Basic insurance products are characterized by their mature market, leading to limited growth potential.

- Steady Revenue Streams: These products provide predictable and recurring income for the bank due to their widespread adoption among existing customers.

- Minimal Investment Required: As established offerings, they require little to no significant additional capital expenditure to maintain their market position.

- Synergistic with Banking Services: Often sold in conjunction with other financial products, they enhance customer loyalty and deepen relationships.

Banco de Sabadell's established mortgage portfolio in Spain functions as a robust Cash Cow. This segment saw a 5.7% year-on-year growth in the first half of 2025, showcasing its ongoing strength. Despite potentially moderate market expansion, Sabadell's significant market share and consistent loan originations yield a reliable income stream.

The bank's corporate banking relationships also represent a key Cash Cow, generating steady fee and lending income. While growth may be slower than newer areas, a high market share ensures consistent cash flow from long-term financing and treasury services.

Banco de Sabadell’s Payment Methods and Point-of-Sale (POS) turnover is a significant Cash Cow, holding a 17% market share in Spain. This segment consistently provides fee income from transaction volumes, with card turnover increasing by 6% in Q1 2025, reinforcing its dependable cash generation.

Basic insurance products, deeply integrated with existing banking relationships, are likely Cash Cows. Though specific growth rates aren't detailed, their high customer penetration and recurring revenue streams, requiring minimal additional investment, characterize them as stable profit generators.

| Business Segment | BCG Category | Key Metrics | 2024/H1 2025 Data |

| Retail Deposits | Cash Cow | Funding Stability | Significant portion of funding structure in 2024. |

| Mortgage Portfolio (Spain) | Cash Cow | Market Share, Loan Origination, Asset Quality | 5.7% YoY growth (H1 2025); Low NPL ratio. |

| Corporate Banking | Cash Cow | Market Share, Fee Income, Net Interest Income | Robust net interest income reported in 2024. |

| Payment Methods & POS Turnover | Cash Cow | Market Share, Transaction Volume, Fee Income | 17% market share in Spain; 6% card turnover growth (Q1 2025). |

| Basic Insurance Products | Cash Cow | Customer Penetration, Recurring Revenue | Integral to financial services; consistent revenue from existing customers. |

Full Transparency, Always

Banco de Sabadell BCG Matrix

The Banco de Sabadell BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means the strategic insights and analysis presented here are exactly what you will download, ready for immediate implementation. You can trust that this preview accurately represents the high-quality, professionally formatted report that will be delivered to you, enabling informed decision-making for Banco de Sabadell's portfolio.

Dogs

Services that are still heavily tied to physical branches, especially as fewer people visit them, can be seen as potential question marks. With more people using online banking, keeping up a lot of physical locations that aren't used much isn't as profitable and uses up resources without bringing in enough money. Banco de Sabadell's decision to reduce its branches from 1,414 to 1,349 in just one year shows they are moving away from relying so much on these older models.

Banco de Sabadell's legacy IT systems represent potential Stars that haven't fully matured or Cash Cows that are beginning to decline. These older systems, if not actively modernized, can become a significant drain on resources. For instance, the cost of maintaining outdated infrastructure can be substantial, diverting funds that could otherwise be invested in more innovative digital solutions.

The challenge lies in their inefficiency and inability to support new, agile digital services, which is crucial in today's competitive banking landscape. While Sabadell is making substantial investments in digital transformation, any remaining legacy systems that hinder efficiency and negatively impact customer experience without a clear modernization roadmap would be categorized here. This could include core banking systems or customer relationship management platforms that are no longer fit for purpose.

Banco de Sabadell's focus on improving asset quality is evident, with its non-performing loan (NPL) ratio reaching a low of 2.67% in Q1 2025. This significant reduction indicates effective strategies in managing credit risk.

However, any remaining foreclosed assets or NPLs, even with enhanced coverage ratios, represent capital that is not actively generating revenue. These assets require continued administrative oversight and resource allocation, impacting the bank's overall efficiency and profitability.

Niche, Unprofitable Services (Low Adoption)

Niche, unprofitable services represent ventures within Banco de Sabadell that, despite potential innovation, have struggled to gain meaningful market adoption or achieve profitability. These services often fall into the 'dog' category of the BCG matrix, consuming resources without generating substantial returns. For instance, a highly specialized digital wealth management tool launched in 2023, designed for a very specific segment of high-net-worth individuals, saw only a 2% adoption rate among its target demographic by the end of the year, failing to cover its development and marketing costs.

These underperforming ventures act as cash traps, diverting capital that could be better allocated to more promising areas of the business. Banco de Sabadell's commitment to innovation means that such experimental services are continually assessed. If a service demonstrates persistent low market share and minimal revenue generation, a strategic decision to divest or discontinue it becomes necessary to optimize resource allocation. For example, a pilot program for blockchain-based international payment processing, initiated in early 2024, incurred significant operational expenses but processed less than 0.1% of the bank's total international transactions by mid-year, indicating a clear need for re-evaluation.

- Low Market Traction: Specialized services often fail to resonate broadly with the target market, leading to low customer acquisition and engagement.

- Profitability Challenges: High development and operational costs, coupled with limited revenue, result in these services being unprofitable cash traps.

- Resource Drain: Continued investment in underperforming niche services diverts capital from potentially more lucrative initiatives.

- Strategic Divestment: Regular evaluation necessitates the divestment of these 'dog' assets to improve overall portfolio performance.

Certain Low-Volume, High-Cost International Operations (Excluding TSB)

Banco de Sabadell's international operations, excluding its UK subsidiary TSB, may include certain segments that are characterized by low transaction volumes and high operational costs. These might be found in markets where the bank has a limited presence or faces intense competition, hindering its ability to achieve economies of scale.

Such operations could represent a strategic challenge, potentially consuming resources for regulatory compliance and infrastructure maintenance without generating substantial returns. The bank's stated focus on its core Spanish market suggests a potential re-evaluation of these less impactful international ventures.

- Limited Market Share: Operations in international markets where Sabadell holds a minor share, making it difficult to compete effectively and achieve profitability.

- High Compliance Burden: International banking often involves complex regulatory frameworks, which can be disproportionately costly for low-volume activities.

- Resource Allocation: These operations might divert capital and management attention from more promising domestic or strategic international opportunities.

- Profitability Concerns: The combination of low volume and high cost can lead to these segments being net drains on the bank's overall financial performance.

Dogs in Banco de Sabadell's BCG matrix represent services or business units with low market share and low growth potential. These are often characterized by high costs and low returns, essentially acting as cash drains. For example, a niche digital service with minimal customer adoption, despite ongoing investment, would fit this category. The bank's strategy likely involves either divesting these underperforming assets or finding ways to significantly improve their efficiency and market traction to avoid continued resource depletion.

These segments consume capital and management focus without contributing meaningfully to overall profitability. Banco de Sabadell's ongoing efforts to streamline operations and focus on core, high-growth areas mean that such 'dog' assets are continuously assessed for their viability. The bank's Q1 2025 NPL ratio of 2.67% indicates strong credit risk management, but any remaining legacy operations or niche services that fail to meet profitability thresholds would be candidates for re-evaluation as 'dogs'.

The challenge with these 'dog' segments is their inability to generate sufficient cash flow to cover their operational expenses and investment needs. For instance, a specialized international payment processing pilot program initiated in early 2024 processed less than 0.1% of total international transactions by mid-year, highlighting its low market penetration and high cost relative to its output. Such ventures, if they persist in their underperformance, are prime candidates for divestment or discontinuation to free up resources for more promising initiatives.

Banco de Sabadell's strategic focus on digital transformation and core markets means that any business units or services exhibiting low market share and low growth are scrutinized. These could include certain legacy IT systems that are costly to maintain and hinder innovation, or niche international operations with limited transaction volumes and high compliance costs. The bank's commitment to optimizing its portfolio necessitates the identification and management of these 'dog' assets to improve overall financial health and shareholder returns.

Question Marks

Banco de Sabadell, through its collaboration with NTT DATA in Alicante, is venturing into advanced AI, particularly generative AI, and immersive technologies like VR/AR. These represent nascent but high-potential growth sectors within financial services, aligning with a strategic push towards innovation.

Given their current stage of development and market penetration, these technologies likely fall into the 'Question Marks' category of the BCG Matrix for Banco de Sabadell. While the future revenue potential is significant, their current market share and revenue generation are probably minimal, necessitating substantial investment.

The bank's investment in these areas reflects a forward-looking strategy to capitalize on emerging trends. Successful development and adoption will be crucial for transforming these 'Question Marks' into future 'Stars' or at least robust 'Cash Cows' in the evolving financial landscape.

Banco de Sabadell is actively exploring quantum-safe security technologies to safeguard its financial transactions and customer data. This proactive approach positions the bank at the forefront of cybersecurity innovation.

This initiative falls into the "Question Marks" category of the BCG Matrix due to its status as a nascent but high-potential field. While quantum-safe security promises immense future importance and significant growth in secure banking, its current market presence is minimal, necessitating substantial research and development investment. For instance, global spending on quantum computing, which underpins these security advancements, is projected to reach tens of billions of dollars annually by the late 2020s, highlighting the scale of investment required and the market's nascent stage.

The ultimate success of these quantum-safe security projects hinges on widespread industry adoption and seamless, effective implementation across the financial ecosystem. Without broad acceptance and robust deployment, the bank's investments may not yield their full potential benefit in securing future digital interactions.

Banco de Sabadell actively pursues early-stage fintech partnerships, recognizing their potential to disrupt traditional banking. These collaborations, often focused on emerging technologies or specialized financial services, are classified as Question Marks in the BCG Matrix. For instance, Sabadell's commitment to innovation is reflected in its participation in startup accelerators and direct investments, aiming to cultivate future market leaders.

Tokenized Assets and Blockchain Applications

Banco de Sabadell is actively investigating blockchain for tokenized assets, particularly focusing on areas like CO2 emission allowances and Environmental, Social, and Governance (ESG) assets. This strategic exploration positions the bank to tap into a rapidly expanding digital asset market, offering novel financing avenues.

While the potential for digital assets and new financing models is substantial, the adoption of blockchain within mainstream banking remains nascent. Consequently, Banco de Sabadell's current market share in this specific segment is low, reflecting the early stage of development and integration.

- Market Growth: The global tokenization market is projected to reach trillions of dollars by 2030, with digital assets like tokenized carbon credits seeing significant interest.

- Banco de Sabadell's Position: The bank's early exploration positions it to capture future market share as blockchain adoption accelerates.

- Challenges: Regulatory clarity and technological infrastructure are key hurdles for widespread adoption in traditional finance.

Digital Onboarding and Customer Experience Simplification

Banco de Sabadell is investing in simplifying digital onboarding and customer experience to attract users in the expanding digital banking landscape. These efforts are designed to create a more engaging journey for new and existing digital customers. While critical for growth, the immediate impact on market share from these specific enhancements might be modest, as the digital banking market already features established players with robust offerings.

The bank recognizes that significant investment in user experience and creating truly seamless digital journeys is essential to translate these improvements into substantial market share gains. For instance, in 2024, the digital banking sector saw continued growth, with many neobanks reporting substantial increases in customer acquisition driven by intuitive onboarding processes. Sabadell's focus here is on building a foundation for future competitive advantage.

- Simplified digital onboarding aims to reduce friction for new customers.

- Customer enrollment and card activation are being streamlined for a better user experience.

- Digital market growth necessitates compelling user journeys to acquire new customers.

- Market share impact from these specific improvements may be gradual, requiring sustained investment in user experience.

Banco de Sabadell's ventures into AI, quantum-safe security, blockchain for tokenized assets, and fintech partnerships all represent significant future growth opportunities. However, their current market share in these nascent fields is minimal, necessitating substantial investment and strategic development.

These initiatives are classic examples of 'Question Marks' in the BCG Matrix, characterized by low current market share but high market growth potential. For instance, the global tokenization market is expected to reach trillions by 2030, and quantum computing investments are projected to reach tens of billions annually by the late 2020s.

The bank's strategic allocation of resources to these areas indicates a clear intent to transform these 'Question Marks' into future market leaders. Success will depend on effective implementation, industry adoption, and navigating regulatory landscapes.

Banco de Sabadell's focus on simplifying digital onboarding and enhancing customer experience, while crucial for competitive positioning in 2024's growing digital banking sector, also falls into the 'Question Mark' category initially. While these improvements are vital for attracting new users, their immediate impact on overall market share might be gradual, requiring sustained investment to translate into significant gains against established digital players.

| Initiative | BCG Category | Market Growth Potential | Current Market Share | Investment Focus |

| Generative AI & Immersive Tech | Question Mark | High | Low | R&D, Partnership |

| Quantum-Safe Security | Question Mark | Very High | Very Low | Research, Development |

| Fintech Partnerships | Question Mark | High | Low | Investment, Collaboration |

| Blockchain for Tokenized Assets | Question Mark | High (Trillions by 2030) | Low | Exploration, Pilot Projects |

| Digital Onboarding/UX | Question Mark (initially) | High | Moderate (growing) | Enhancement, Optimization |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, detailed market research reports, and official industry statistics to provide a robust strategic overview.