Seche Environnement Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seche Environnement Bundle

Seche Environnement operates in a dynamic waste management sector, facing moderate competitive rivalry and significant bargaining power from large industrial clients. The threat of substitutes is relatively low due to the specialized nature of waste treatment, but the potential for new entrants is a growing concern.

The complete report reveals the real forces shaping Seche Environnement’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers offering highly specialized waste treatment technologies, like AI-driven sorting or advanced thermal processing, can be substantial for companies such as Séché Environnement. These cutting-edge solutions are vital for maintaining innovative and sustainable operations, creating a dependency on a select group of specialized providers.

Suppliers of suitable land for landfill operations, particularly for hazardous waste, wield significant influence. This power stems from the limited availability of such sites and the rigorous environmental regulations that dictate their creation and ongoing management.

Landfills continue to be a critical element in waste management, especially for waste that cannot be recycled or recovered. In 2024, the demand for compliant landfill space remains high, directly affecting Seche Environnement's operational capacity and future growth potential.

The cost and availability of energy are significant factors for Séché Environnement, impacting both operational needs and energy recovery initiatives. Volatile energy markets can amplify the bargaining power of energy suppliers, directly affecting the company's cost structure. For instance, Séché Environnement's 2024 performance highlighted a return to more stable energy selling prices following prior increases, underscoring the sensitivity of their business to these fluctuations.

Furthermore, suppliers of critical chemicals and other raw materials essential for waste treatment processes can wield considerable influence. This power is amplified when these suppliers offer unique or highly specialized products that are difficult for Séché Environnement to substitute, potentially leading to increased input costs or supply chain disruptions.

Specialized Labor and Expertise

The bargaining power of suppliers for Seche Environnement is significantly influenced by the availability of specialized labor and expertise. A scarcity of skilled professionals in waste management, environmental engineering, and regulatory compliance can empower these individuals or consulting firms, driving up labor costs.

The demand for niche skills, particularly in hazardous waste handling and the burgeoning circular economy, continues to rise. For instance, the global environmental consulting market was valued at approximately $39.1 billion in 2023 and is projected to grow, indicating a strong demand for specialized knowledge that Seche Environnement relies upon.

- Skilled Workforce Demand: High demand for environmental engineers and hazardous waste specialists.

- Consulting Firm Influence: Specialized consulting firms can command higher fees due to unique expertise.

- Circular Economy Growth: Increasing need for talent in sustainable waste management practices.

- Talent Shortage Impact: A limited supply of qualified personnel directly increases supplier bargaining power.

Regulatory and Permitting Agencies

Regulatory bodies and permitting agencies function as powerful suppliers for Seche Environnement, granting essential licenses and approvals in the heavily regulated waste management sector. Their control over these crucial authorizations significantly influences operational continuity and market entry, effectively acting as gatekeepers.

The complexity and duration of securing permits for waste handling, treatment, and disposal create substantial barriers to entry. This process is critical for Seche Environnement's ability to operate and expand its services across its various waste management segments.

France's environmental regulations are particularly stringent, impacting Seche Environnement's operations. For instance, new Extended Producer Responsibility (EPR) regulations for packaging are set to be implemented from 2025, and mandatory bio-waste sorting commenced in 2024, requiring significant adaptation and investment from companies like Seche Environnement.

- Regulatory Gatekeepers: Agencies control licenses and permits, vital for waste management operations.

- High Barriers to Entry: Complex permitting processes limit new competitors.

- Operational Continuity: Maintaining compliance with evolving regulations is crucial for Seche Environnement.

- French Regulatory Impact: New EPR packaging rules (2025) and bio-waste sorting (2024) necessitate strategic adjustments.

Suppliers of specialized waste treatment technologies, such as AI-driven sorting or advanced thermal processing, hold considerable sway over Séché Environnement. The limited availability of these cutting-edge solutions, crucial for innovation and compliance, creates a dependency that can lead to higher costs or restricted access to essential services.

The availability of suitable land for landfill operations, especially for hazardous waste, is a significant factor. With strict environmental regulations and limited suitable sites, suppliers of these locations can exert substantial bargaining power, impacting Séché Environnement's capacity and expansion plans.

Energy suppliers also possess considerable influence, given the energy-intensive nature of waste treatment and recovery processes. Fluctuations in energy prices directly affect operational costs and profitability, as seen in Séché Environnement's 2024 performance where stable energy selling prices were noted after prior increases.

| Supplier Type | Bargaining Power Factors | Impact on Séché Environnement |

|---|---|---|

| Specialized Technology Providers | Uniqueness of solutions, R&D investment | Potential for higher costs, reliance on innovation |

| Landfill Site Owners | Scarcity of compliant sites, regulatory hurdles | Increased land acquisition/leasing costs, operational constraints |

| Energy Suppliers | Market volatility, geopolitical factors | Direct impact on operational expenses and energy recovery margins |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Seche Environnement's waste management sector.

Instantly identify and mitigate competitive threats with a dynamic Seche Environnement Porter's Five Forces analysis that adapts to real-time market shifts.

Customers Bargaining Power

Séché Environnement's diverse customer base, encompassing industries, local authorities, and healthcare facilities, inherently limits the bargaining power of any single customer group. This fragmentation means that while some industrial clients may be significant, the sheer variety of customer types prevents an over-reliance on any one segment, thereby diffusing concentrated power.

The company's strategic approach has focused on solidifying commercial relationships across both industrial and public sectors, both within France and internationally. This broad market penetration further strengthens Séché Environnement's position by reducing the impact of any individual customer's demands.

Long-term contracts significantly reduce customer bargaining power in the integrated waste management sector, particularly for hazardous waste. These agreements lock in clients, making it costly and complex for them to switch providers, thereby bolstering Séché Environnement's position. A prime example is Séché Environnement's 20-year contract renewal for its public service operations in Nantes, demonstrating the long-term commitment and reduced short-term leverage of its customers.

Increasing regulatory pressure on customers, especially industries and local authorities, to handle waste responsibly and embrace circular economy principles limits their focus solely on cost. This trend heightens demand for integrated, compliant waste management solutions, thereby bolstering Séché Environnement's market standing.

France's Anti-Waste Law for a Circular Economy, coupled with the mandatory bio-waste sorting requirement effective from 2024, exemplifies these regulatory shifts. Such mandates compel customers to seek out specialized services, making price a less dominant factor in their decision-making process.

Customer Price Sensitivity and Service Differentiation

While large clients can indeed push for lower prices, Séché Environnement's specialization in treating hazardous and complex waste streams creates a unique value proposition. This focus on niche services, coupled with their commitment to innovative and sustainable treatment methods, helps to mitigate direct price comparisons with less specialized competitors. For instance, in 2024, the company continued to invest in advanced thermal treatment technologies, a key differentiator for clients requiring high-compliance disposal solutions.

The assurance of regulatory compliance and the overall quality of service are paramount for Séché Environnement's clientele, often outweighing minor price differences. Clients are willing to pay a premium for reliable, safe, and environmentally sound waste management. Séché Environnement actively highlights its robust quality management systems and its proactive approach to anticipating evolving environmental regulations, which are critical selling points in the sector.

- Specialized Waste Treatment: Séché Environnement's expertise in hazardous and complex waste management reduces direct price competition.

- Innovation and Sustainability: Investments in advanced, eco-friendly treatment technologies enhance service differentiation.

- Quality and Compliance: Clients prioritize reliable service and strict adherence to environmental regulations, justifying premium pricing.

- Anticipatory Strategy: Séché Environnement's forward-looking approach to regulatory changes further solidifies its value proposition.

Customer Focus on Circular Economy and ESG

Customers, particularly major corporations and public bodies, are placing a greater emphasis on sustainability, circular economy principles, and Environmental, Social, and Governance (ESG) factors when selecting waste management partners. This growing demand for eco-conscious solutions directly benefits Séché Environnement, as its business model is inherently aligned with these values, potentially enhancing its service appeal beyond mere cost-effectiveness.

The implementation of the Corporate Sustainability Reporting Directive (CSRD) in 2024 mandates that companies disclose their environmental performance, thereby amplifying the need for waste management providers capable of facilitating compliance. For instance, in 2023, a significant portion of major European companies began preparing for CSRD reporting, indicating a strong market pull for services that support these new disclosure requirements.

- Increased Customer Demand for Sustainable Waste Solutions: Large clients are actively seeking waste management partners that demonstrate strong ESG credentials.

- Alignment with Séché Environnement's Core Business: The company's focus on circular economy and waste valorization naturally appeals to environmentally conscious customers.

- Impact of CSRD (2024): This regulation is a key driver, compelling businesses to engage with waste management services that ensure regulatory compliance and transparent environmental reporting.

- Competitive Advantage: Séché Environnement's established expertise in sustainable waste management positions it favorably to capture market share from competitors less equipped to meet these evolving customer expectations.

Séché Environnement's diverse client base, spanning industries, local authorities, and healthcare, naturally dilutes the bargaining power of any single customer. Long-term contracts, like the 20-year renewal in Nantes, lock in clients, making switching providers costly and complex, thus limiting their leverage.

Increasing regulatory demands for responsible waste management and circular economy principles shift customer focus from pure cost to compliance and specialized solutions. This trend, exemplified by France's 2024 bio-waste sorting mandate, compels customers to seek expert services, reducing price sensitivity.

Séché Environnement's specialization in hazardous waste treatment, coupled with investments in advanced technologies like thermal treatment in 2024, creates a unique value proposition. Clients prioritize regulatory compliance and service quality, often accepting premium pricing for these critical assurances.

The growing emphasis on ESG factors and sustainability by major clients, amplified by the 2024 CSRD reporting requirements, further strengthens Séché Environnement's market position. Their business model, aligned with circular economy principles, appeals to these environmentally conscious customers.

What You See Is What You Get

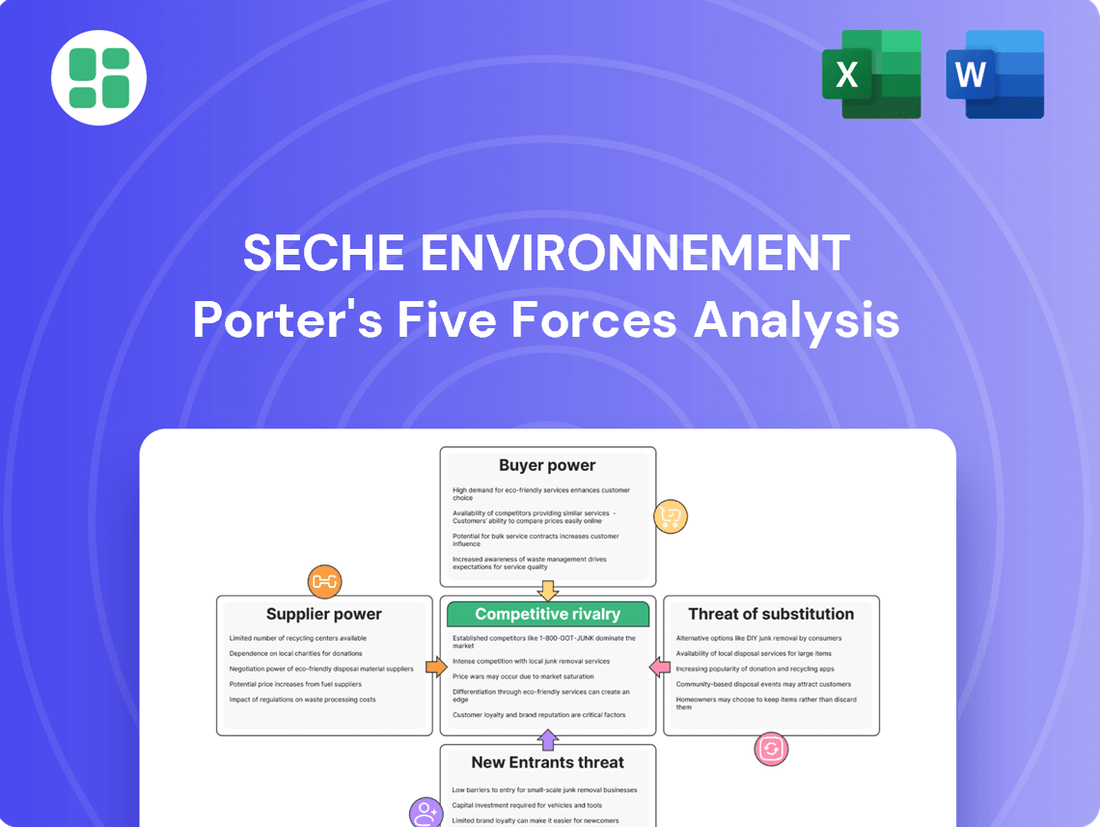

Seche Environnement Porter's Five Forces Analysis

This preview showcases the complete Seche Environnement Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You'll gain immediate access to this professionally formatted analysis, ready for your strategic planning needs.

Rivalry Among Competitors

The waste management sector, especially in France and across Europe, is a battleground for major global and regional players. Companies like Veolia and Suez are giants in this space, offering comprehensive waste management solutions that directly challenge Séché Environnement.

These established behemoths have extensive networks and a wide array of services, from collection and treatment to recycling and recovery. Their broad offerings mean they often compete head-to-head with Séché Environnement for contracts and market share across numerous waste management segments. For instance, Veolia reported revenues of €42.8 billion in 2023, highlighting its significant scale and market presence.

The waste management industry, particularly for hazardous waste treatment, demands substantial upfront investment in specialized infrastructure like treatment plants, incinerators, and secure landfills. These high capital requirements translate into significant fixed costs for companies. For instance, Séché Environnement, a key player, consistently makes large investments in its industrial assets to maintain and expand its treatment capabilities.

This inherent capital intensity pressures companies to operate at high utilization rates to spread these fixed costs over a larger volume of waste. Consequently, there's an intensified drive to secure long-term contracts and capture market share, leading to fierce competition among established players.

Séché Environnement's deep specialization in hazardous and complex waste management provides a significant competitive edge. This niche demands specialized expertise, advanced technologies, and rigorous adherence to regulations, setting them apart from general waste management providers.

The French hazardous waste management market is characterized by its stringent regulatory framework and a growing demand for highly specialized handling and disposal services. This environment favors companies like Séché Environnement that possess the necessary capabilities and compliance infrastructure.

Market Growth and Consolidation

The waste management sector, particularly hazardous waste, is seeing robust growth. This expansion, fueled by circular economy principles, attracts new entrants but also encourages consolidation as companies like Séché Environnement seek to scale. For instance, Séché Environnement's acquisition of ECO in Singapore, a key player in hazardous waste, demonstrates this trend of strategic expansion into high-growth regions.

The global waste management market is on an upward trajectory, with projections indicating continued expansion. The hazardous waste segment, in particular, is a significant driver of this growth, offering substantial opportunities for companies capable of navigating its complexities and regulatory demands. This market dynamism creates both opportunities for new competition and a strong impetus for strategic mergers and acquisitions.

- Market Growth Drivers: Circular economy initiatives and increasing volumes of hazardous waste are key growth catalysts.

- Competitive Landscape: Growth attracts new competitors, but also fuels consolidation through strategic acquisitions.

- Séché Environnement's Strategy: The acquisition of ECO in Singapore exemplifies expansion into dynamic hazardous waste markets.

- Global Market Outlook: The overall waste management market is expected to grow, with hazardous waste segments showing particularly strong performance.

Regulatory Landscape and Innovation

The regulatory environment is a significant force shaping competition in the waste management sector. Increasing governmental mandates across Europe, particularly in 2024, are pushing for higher recycling rates and greater adoption of circular economy principles. This regulatory push directly fuels innovation, as companies are incentivized to develop and implement more advanced waste treatment and resource recovery technologies to meet these evolving standards.

Companies that proactively invest in cutting-edge solutions are better positioned to thrive. For instance, the integration of AI in waste sorting can dramatically improve efficiency and the quality of recovered materials. Waste-to-energy technologies also offer a pathway to resource recovery, aligning with sustainability goals. Séché Environnement's strategic focus on anticipation and innovation, as demonstrated by its investments in advanced sorting facilities and waste-to-energy plants, allows it to adapt and gain a competitive advantage in this dynamic landscape.

- Regulatory Push: European Union targets for 2025, such as increasing the recycling rate of municipal waste to at least 55%, are driving significant investment in innovative waste management solutions.

- Technological Advancement: AI-powered sorting systems can achieve recovery rates exceeding 90% for certain materials, offering a distinct competitive advantage.

- Circular Economy Focus: Waste-to-energy plants, like those operated by Séché Environnement, contribute to resource recovery and energy production, aligning with circular economy objectives and attracting investment.

- Séché Environnement's Strategy: The company's commitment to R&D and early adoption of new technologies positions it favorably against competitors who may lag in adapting to regulatory changes.

The competitive rivalry within the waste management sector, particularly for Séché Environnement, is intense due to the presence of large, established players like Veolia and Suez. These competitors possess extensive networks and a broad service portfolio, directly challenging Séché's market share across various waste management segments.

The industry's high capital intensity, requiring significant investment in specialized infrastructure, creates a barrier to entry but also intensifies competition among existing firms. Companies like Séché Environnement must maintain high operational efficiency and secure long-term contracts to manage these substantial fixed costs effectively.

Séché Environnement's specialization in hazardous waste management offers a distinct advantage, as this niche demands advanced technologies and regulatory expertise. However, the growing market for hazardous waste, driven by circular economy principles, attracts new entrants and consolidates existing players, as seen in Séché's acquisition of ECO in Singapore.

Regulatory changes, such as the EU's push for higher recycling rates by 2030, are a significant competitive factor, incentivizing innovation in waste treatment and resource recovery technologies. Companies that invest in advanced solutions, like AI-powered sorting or waste-to-energy plants, gain a competitive edge. For example, Séché Environnement's investments in advanced sorting facilities position it favorably.

SSubstitutes Threaten

The threat of substitutes for waste management services, particularly for Seche Environnement, is significant. Customers actively seeking to reduce waste at its origin through process optimization, eco-friendly product development, and shifts in consumer behavior directly diminish the need for external waste handling. For instance, in 2024, many manufacturing sectors are investing heavily in closed-loop systems, aiming to cut waste by up to 20% by 2026.

The growing adoption of circular economy principles further amplifies this threat. By prioritizing reduce, reuse, recycling, and recovery, businesses and individuals are increasingly keeping materials within the economic loop, thereby bypassing traditional waste disposal pathways. This strategic shift is evident in the European Union's ambitious targets, aiming for a 65% recycling rate for municipal waste by 2035, up from approximately 47% in 2020.

Large industrial clients, particularly those dealing with significant volumes of non-hazardous waste, may opt for in-house management if they possess the required infrastructure and technical know-how. This internal approach can bypass external waste management providers, potentially reducing costs and increasing control over the process. For example, a large manufacturing plant might invest in on-site recycling equipment for common materials like cardboard or plastics, or even implement composting for organic byproducts.

Innovations in materials science are a significant threat to Seche Environnement. The increasing adoption of biodegradable and compostable materials, for instance, directly reduces the volume of traditional waste requiring treatment and disposal. This trend shifts the industry focus from waste management to waste prevention and the circular economy, potentially diminishing demand for Seche's core services.

Shift Towards Circular Economy Models

The growing momentum behind circular economy models represents a significant threat of substitution for traditional waste management services like those offered by Seche Environnement. This shift, driven by both societal demand and increasingly stringent regulations, reframes waste not as an endpoint but as a valuable resource. By emphasizing recycling, reuse, and energy recovery, these models offer alternatives to landfilling and conventional incineration, directly impacting the volume of waste requiring disposal through established channels.

By 2025, the circular economy is a dominant trend in waste management. For instance, the European Union's Circular Economy Action Plan aims to double resource productivity by 2030, signaling a clear direction away from linear waste disposal. This focus incentivizes businesses and municipalities to invest in advanced sorting, reprocessing, and remanufacturing technologies, creating new service providers and diminishing reliance on traditional waste management firms.

- Circular Economy Growth: Projections indicate a substantial increase in the value of the global circular economy, potentially reaching trillions of dollars by the mid-2030s, diverting waste streams.

- Regulatory Push: Policies such as extended producer responsibility (EPR) schemes are compelling manufacturers to manage their products' end-of-life, often through take-back programs that bypass traditional waste handlers.

- Technological Advancements: Innovations in material science and recycling technologies are making it more economically viable to recover and reuse materials previously destined for disposal.

- Consumer Behavior: A growing consumer preference for sustainable products and services is indirectly pressuring businesses to adopt circular practices, reducing their waste output.

Decentralized Waste Processing and Local Solutions

The rise of decentralized waste processing presents a significant threat. These localized solutions, often smaller and community-driven, manage waste closer to where it's generated. This approach can lessen the need for Seche Environnement's large-scale, centralized facilities by reducing transportation costs and emissions. For instance, a 2024 report highlighted a 15% increase in municipal investment in local composting and anaerobic digestion projects across Europe, indicating a growing preference for distributed waste management.

This trend directly challenges traditional models by offering more agile and potentially cost-effective alternatives for waste treatment. By focusing on resource recovery at a local level, these initiatives can divert waste streams that would otherwise go to larger plants. The environmental benefits, such as reduced carbon footprint from shorter hauls, also make these decentralized options increasingly attractive to municipalities and businesses.

- Reduced Demand for Centralized Facilities: Local processing minimizes the volume of waste requiring transport to large-scale plants.

- Environmental Advantages: Shorter transport distances lead to lower emissions, a key driver for decentralized solutions.

- Resource Recovery Focus: Community-based initiatives often prioritize recycling and upcycling, diverting materials from traditional treatment.

- Growing Investment: Municipalities are increasingly funding smaller, local waste management projects, as seen in a 15% rise in European investment in such initiatives in 2024.

The threat of substitutes for Seche Environnement's services is amplified by the increasing adoption of circular economy principles, which prioritize waste reduction and resource reuse. Innovations in biodegradable materials also divert waste streams from traditional disposal. By 2025, the EU's Circular Economy Action Plan targets doubling resource productivity by 2030, encouraging advanced sorting and reprocessing technologies.

| Factor | Impact on Seche Environnement | Illustrative Data/Trend |

|---|---|---|

| Circular Economy Adoption | Reduces demand for traditional waste disposal and treatment services. | EU aims to double resource productivity by 2030. |

| Material Science Innovations | Biodegradable and compostable materials decrease reliance on waste management. | Growing market share for eco-friendly packaging materials. |

| In-house Waste Management | Large clients may manage waste internally, bypassing external providers. | Companies investing in on-site recycling for cost control. |

| Decentralized Processing | Local waste solutions reduce the need for large, centralized facilities. | 15% rise in European municipal investment in local composting in 2024. |

Entrants Threaten

Entering the waste management sector, especially for advanced services like hazardous waste treatment, demands significant upfront capital. Think about the cost of specialized treatment plants, advanced machinery, and suitable land. For instance, building a new hazardous waste incineration facility can easily run into hundreds of millions of euros, a substantial hurdle for newcomers.

The waste management industry, particularly for hazardous materials and environmental protection, operates under a very strict regulatory umbrella. This means that any company looking to enter this space must navigate a complex web of rules and obtain a multitude of permits.

France, for instance, has been actively strengthening its environmental regulations. For example, new legislation mandates the sorting of bio-waste and introduces Extended Producer Responsibility (EPR) schemes for packaging. These stringent standards and lengthy approval processes act as a substantial barrier for potential new competitors looking to enter the market.

The need for specialized expertise and advanced technology presents a substantial barrier to new entrants in the waste management sector. Effective handling of hazardous and complex waste streams requires deep technical knowledge and significant investment in sophisticated treatment facilities. For instance, Séché Environnement's proficiency in areas like sustainable mining waste and challenging industrial waste demonstrates the high level of specialized skill required, which is not easily replicated by newcomers.

Economies of Scale and Established Infrastructure

Incumbent players like Séché Environnement leverage significant economies of scale derived from their vast network of collection, treatment, and disposal facilities. For instance, in 2023, Séché Environnement reported revenues of €1.4 billion, underscoring the scale of its operations. New entrants face a substantial hurdle in matching these cost efficiencies, as achieving comparable scale requires immense capital investment.

Building out the necessary infrastructure, from specialized treatment plants to logistics networks, represents a formidable barrier. This capital intensity means that new competitors would struggle to achieve price competitiveness against established players who have already amortized these significant upfront costs over decades of operation. The sheer financial commitment required to replicate Séché Environnement's operational footprint is a deterrent.

- Economies of Scale: Séché Environnement's extensive network allows for lower per-unit operating costs in waste collection, treatment, and disposal.

- Infrastructure Investment: The high cost of building and maintaining specialized waste management facilities deters new market entrants.

- Capital Intensity: The waste management sector demands substantial upfront capital, creating a significant barrier to entry for smaller or less-funded competitors.

- Network Effects: Established players benefit from a more efficient and cost-effective logistics network, further disadvantaging new entrants.

Long-Term Contracts and Customer Relationships

The threat of new entrants is significantly mitigated by Seche Environnement's established long-term contracts with key clients. These agreements, often spanning decades, create substantial barriers to entry by locking in revenue and market access, making it exceedingly challenging for newcomers to secure a foothold. For instance, Seche Environnement recently renewed a critical 20-year public service contract, demonstrating the sticky nature of these relationships.

Furthermore, the company's success in securing multi-year international contracts highlights its ability to build and maintain strong client loyalty. This focus on long-term partnerships not only ensures predictable cash flow but also makes it difficult for new players to compete on price or service without significant upfront investment and proven track records.

- Long-Term Contracts: Seche Environnement benefits from extended agreements, often 10-20 years, with industrial and municipal clients.

- Customer Loyalty: The company's ability to renew and secure multi-year international contracts underscores strong client relationships.

- Barriers to Entry: These long-term commitments create a high hurdle for new companies seeking to enter the waste management and environmental services market.

The threat of new entrants into the waste management sector, particularly for specialized services, is considerably low due to immense capital requirements. Building modern treatment facilities and acquiring advanced technology demands hundreds of millions of euros, a significant barrier for any new player. For example, the construction of a new hazardous waste incineration plant can easily exceed €200 million.

Stringent regulations and the need for specialized expertise further deter new companies. Navigating complex environmental laws and obtaining numerous permits is a lengthy and costly process. Séché Environnement's deep technical knowledge in handling challenging waste streams, like those from mining operations, is a testament to the high skill level required, which is difficult for newcomers to replicate.

Established players like Séché Environnement benefit from significant economies of scale, with 2023 revenues reaching €1.4 billion, allowing for lower per-unit operating costs. New entrants struggle to match this cost efficiency without massive upfront investment to build a comparable network of collection, treatment, and disposal facilities.

| Barrier Type | Description | Example Impact |

|---|---|---|

| Capital Intensity | High upfront investment for infrastructure and technology. | Building a new hazardous waste facility can cost over €200 million. |

| Regulatory Complexity | Navigating strict environmental laws and permit acquisition. | Lengthy approval processes for new treatment plants. |

| Specialized Expertise | Requirement for deep technical knowledge in waste handling. | Séché Environnement's proficiency in complex industrial waste. |

| Economies of Scale | Lower operating costs for established, large-scale players. | Séché Environnement's 2023 revenue of €1.4 billion. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Seche Environnement is built upon a foundation of comprehensive data, including company annual reports, industry-specific market research from firms like IBISWorld, and regulatory filings from relevant environmental agencies.