Seche Environnement Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seche Environnement Bundle

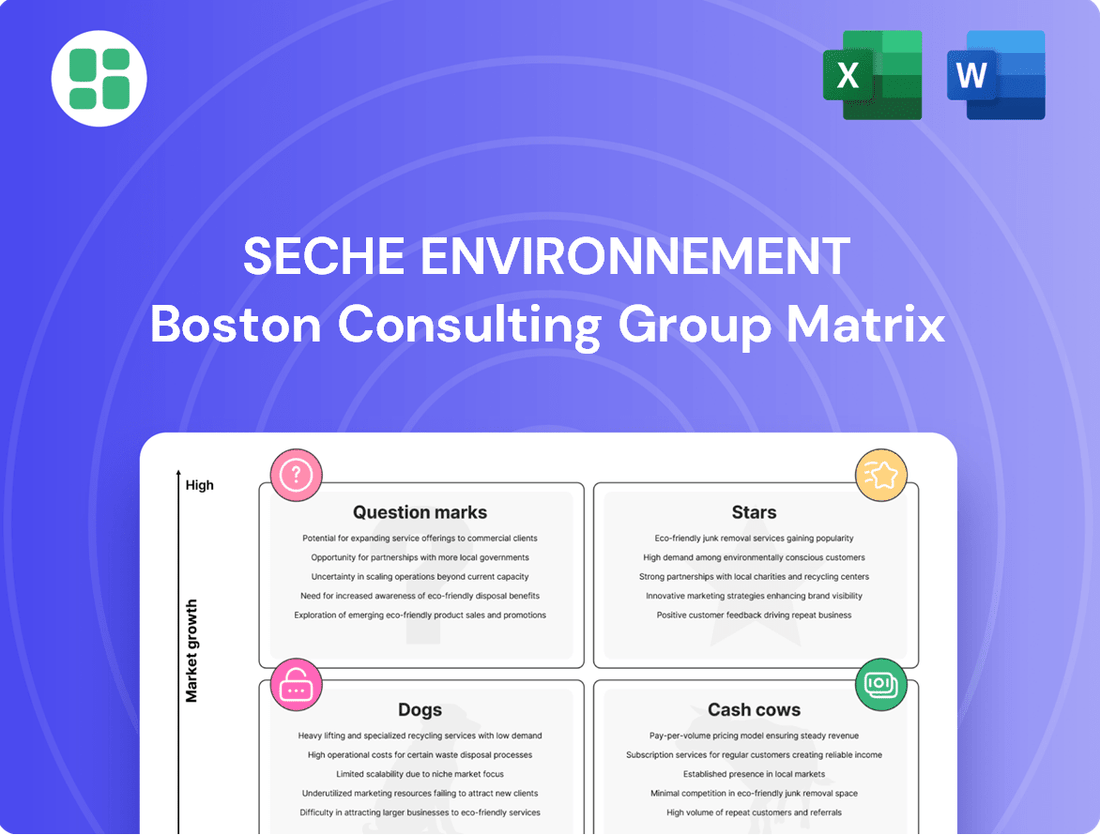

Seche Environnement's BCG Matrix offers a powerful lens to understand its diverse business portfolio. Discover which segments are driving growth, which are stable cash generators, and which require careful consideration for future investment. This preview highlights the strategic positioning of their key offerings.

Unlock the full potential of Seche Environnement's strategic landscape by purchasing the complete BCG Matrix. Gain detailed insights into each quadrant, enabling you to make informed decisions about resource allocation and future growth opportunities. Don't miss out on this essential strategic tool.

Stars

Séché Environnement's strategic expansion into international hazardous waste management, highlighted by the July 2024 acquisition of ECO in Singapore and the June 2025 acquisition of Groupe Flamme in Europe, firmly positions these operations as Stars within its BCG matrix. These acquisitions instantly catapulted Séché into leadership roles within rapidly expanding industrial markets, securing significant market share and immediate substantial presence.

The global hazardous waste management market is experiencing robust growth, with projections indicating a compound annual growth rate of 6.5% from 2023 to 2030, reaching an estimated $200 billion by 2030. This favorable market dynamic directly fuels the star status of Séché's newly integrated international hazardous waste operations, driven by increasing industrialization and stricter environmental regulations worldwide.

Séché Environnement's Environmental Services & Remediation division is a significant growth driver, showcasing robust organic expansion, especially in international arenas. This segment benefits from increasing global demand for pollution control and remediation solutions.

In 2024, the company solidified its presence with substantial new contracts in Latin America, including Peru and Chile, alongside a key agreement in South Africa. These ventures are now in their operational phases, directly fueling revenue streams and demonstrating the company's successful international strategy.

The strong performance in this sector highlights a dynamic market where Séché is effectively capturing market share. Its comprehensive service portfolio, covering everything from emergency response to intricate site remediation, positions it as a key player in addressing environmental challenges worldwide.

Séché Environnement is actively developing advanced circular economy solutions, notably through its Speichim subsidiary which is expanding its chemical purification capabilities. This strategic move targets high-value niches within the burgeoning ecological transition sector.

A prime example is Séché Environnement's unique bromine regeneration process, a specialized offering that addresses specific industrial needs. Such focused investments are key to capturing growth in specialized environmental services.

The company's commitment to decarbonization and material regeneration underpins the high growth potential for these advanced solutions. By 2024, the circular economy market is projected to see significant expansion, with companies like Séché positioned to benefit from this trend.

Sustainable Mining Waste Management

Séché Environnement's sustainable mining waste management operations are a key component of its strategic positioning. The company has secured substantial, multi-year contracts with major mining entities in Peru, alongside significant clean-up initiatives in Chile. These engagements underscore their growing proficiency in a specialized and expanding market.

This focus on sustainable solutions for challenging mining waste is enabling Séché Environnement to effectively increase its market share within this vital industrial domain. For instance, their involvement in large-scale environmental remediation projects demonstrates a commitment to addressing the complex needs of the mining sector.

- Secured multi-year contracts with leading mining companies in Peru.

- Undertaking large-scale clean-up operations in Chile.

- Demonstrates expertise in a specialized, high-growth market segment.

- Capturing market share through comprehensive and sustainable waste management solutions for the mining industry.

Industrial Water Treatment Services

Following its 2022 acquisition of Veolia's French industrial water treatment operations, Séché Environnement is now a significant player in outsourced water cycle management for industrial clients. This strategic move enhances their ability to address the increasing demand for industries to minimize environmental impact and effectively manage wastewater. The company is actively expanding its service offerings in this area, recognizing its potential for substantial growth and market share capture.

The industrial water treatment services segment is experiencing robust expansion, driven by stricter environmental regulations and corporate sustainability goals. Séché Environnement's investment in this sector, particularly after the 2022 acquisition, positions them to capitalize on this trend. For instance, the global industrial water treatment market was valued at approximately USD 75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% through 2030, indicating a fertile ground for Séché's development.

Séché Environnement's industrial water treatment services are likely to be categorized as a Star in the BCG Matrix. This is due to the high growth potential of the market, fueled by environmental concerns and regulatory pressures, and the company's strengthened position following the 2022 acquisition. Their comprehensive approach to water cycle management offers value-added solutions that cater to evolving industrial needs.

- Market Growth: The industrial water treatment sector is a high-growth area, with projections indicating continued expansion.

- Acquisition Synergies: The 2022 acquisition of Veolia's French business significantly bolstered Séché Environnement's capabilities and market presence.

- Value Proposition: Séché offers comprehensive outsourced water cycle management, addressing critical industrial needs for environmental compliance and efficiency.

- Strategic Positioning: This segment represents a strategic investment for Séché, aligning with global trends towards sustainability and resource management.

Séché Environnement's international hazardous waste management operations, bolstered by significant 2024 and 2025 acquisitions in Asia and Europe, are firmly positioned as Stars. These ventures tap into a global market projected to reach $200 billion by 2030, growing at a 6.5% CAGR. This rapid expansion, driven by increasing industrialization and stringent environmental rules, allows Séché to capture substantial market share in high-demand regions.

What is included in the product

The Seche Environnement BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investment, divestment, or harvesting for each unit.

The Seche Environnement BCG Matrix provides a clear visual of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Séché Environnement's waste-to-energy operations in France, exemplified by the Nantes-Alcea incinerator's 20-year public service delegation renewal, represent a classic Cash Cow. This long-term contract secures consistent revenue from a dominant market position.

While the infrastructure is robust, the segment's 2024 performance saw a dampening effect from the normalization of energy selling prices for steam and electricity. This suggests a mature market where growth is primarily tied to energy price volatility rather than significant volume expansion.

Séché Environnement's traditional non-hazardous waste treatment and disposal operations in France represent a core, mature business. This segment benefits from established infrastructure and long-standing customer relationships, ensuring a steady stream of revenue.

In 2024, this mature market saw stable, albeit modest, growth, with some analysts projecting a slight contraction on a like-for-like basis into early 2025, reflecting the segment's maturity and the ongoing shift towards circular economy principles that aim to reduce overall waste generation.

Seche Environnement's established landfill operations, primarily for non-hazardous waste, are a classic Cash Cow. These sites boast significant existing capacity and a solid market position, ensuring consistent revenue streams. In 2023, Seche Environnement reported a substantial portion of its revenue derived from waste management services, including landfilling, highlighting the stable cash generation from these mature assets.

Basic Waste Collection and Sorting Services

Séché Environnement's basic waste collection and sorting services in its mature French markets are the bedrock of its operations. These services cater to both industrial clients and public authorities, representing a stable, high-volume business. In 2023, Séché Environnement reported that its Waste Management division, which encompasses these core services, generated a significant portion of its revenue, demonstrating their foundational role.

These activities are crucial for generating consistent revenue and cash flow, acting as the company's cash cows. While they are essential for environmental management and compliance, their growth potential is typically limited compared to newer, more specialized waste treatment technologies or international expansion efforts. The company's focus here is on operational efficiency and maintaining market share in established territories.

- Stable Revenue Generation: These services provide predictable income streams due to their essential nature and high customer retention in mature markets.

- High Volume, Low Growth: Characterized by consistent demand from a broad customer base, but with limited opportunities for significant expansion.

- Operational Efficiency Focus: Success hinges on optimizing collection routes and sorting processes to maintain profitability.

- Foundation for Investment: The cash generated supports investment in the company's Stars and Question Marks segments.

Long-Term Public Service Delegation Contracts

Long-term public service delegation contracts, like Seche Environnement's 20-year renewal for the Nantes Waste Treatment and Recovery Center, are classic Cash Cows. These agreements guarantee stable, predictable revenue for extended periods, offering a solid foundation for financial planning. The predictability stems from the long-term nature of the commitments.

These contracts secure a substantial market share in defined geographical areas, minimizing competitive threats and ensuring consistent demand. This regional dominance is a key characteristic of a Cash Cow, providing a secure revenue stream. The Nantes contract, for instance, solidifies Seche's position in that region for two decades.

- Predictable Revenue: Long-term contracts ensure consistent cash flow.

- Market Dominance: Secures significant regional market share.

- Limited Growth: Growth is typically tied to contractual escalations, not rapid expansion.

- Financial Stability: Provides a reliable source of cash generation.

Séché Environnement's established waste management operations, particularly in non-hazardous waste treatment and disposal within France, function as its primary Cash Cows. These segments benefit from long-standing infrastructure, deep customer relationships, and a stable market position, ensuring consistent revenue generation. While these operations are vital for steady cash flow, their growth potential is inherently limited due to market maturity and the increasing adoption of circular economy principles.

In 2023, Séché Environnement's Waste Management division, encompassing these core activities, contributed significantly to the company's overall revenue, underscoring their foundational role. Projections for 2024 indicated stable, albeit modest, growth in this segment, with some analysts anticipating a slight like-for-like contraction into early 2025, reflecting the segment's mature status.

| Segment | Characteristics | 2023 Revenue Contribution (Illustrative) | 2024 Outlook |

|---|---|---|---|

| Non-Hazardous Waste Treatment & Disposal (France) | Mature, stable, high volume, low growth | Significant portion of total revenue | Stable to slight contraction |

| Landfill Operations (France) | Established capacity, solid market position, consistent cash flow | Substantial revenue driver | Continued stable cash generation |

| Waste Collection & Sorting (France) | Essential services, high customer retention, bedrock operations | Foundational revenue stream | Steady demand |

What You See Is What You Get

Seche Environnement BCG Matrix

The Seche Environnement BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase. This comprehensive document, designed for strategic clarity, will be instantly downloadable, allowing immediate application in your business planning and analysis. You can trust that this preview accurately represents the professional-grade, ready-to-use BCG Matrix that will be yours without any watermarks or demo content.

Dogs

Certain international construction site activities, notably in Latin America and South Africa, faced significant delays and underperformance during the first half of 2024. For instance, Seche Environnement reported that some of its projects in these regions experienced revenue shortfalls of up to 15% compared to initial projections in H1 2024.

While recovery has been observed in some segments, persistently underperforming or highly volatile individual projects within these areas, where Seche Environnement's market share is not dominant, could be classified as Dogs. These activities consume valuable capital and management attention without consistently delivering substantial profits, impacting overall resource allocation efficiency.

While Séché Environnement’s broader circular economy initiatives are strategically vital, certain niche materials recovery operations have faced headwinds. For instance, Interwaste in South Africa experienced a downturn in Q3 2024. This specific segment, if facing persistent market contraction or if Séché possesses a limited market share within it, could be categorized as a Dog in the BCG Matrix.

Some of Séché Environnement's older waste treatment facilities may be less efficient, impacting overall profitability. These sites could have lower market share in advanced treatment or struggle to meet current operational standards, potentially becoming resource drains. Significant capital expenditure for minor upgrades to these older assets is often deemed uneconomical.

Small, Non-Strategic Legacy Contracts

Séché Environnement might possess several small, legacy contracts that no longer fit its strategic direction or commitment to the circular economy. These contracts, while contributing some revenue, likely operate in niche markets with limited growth prospects and low profit margins.

These "Dogs" in the BCG matrix represent opportunities for optimization. For instance, if a legacy contract represents less than 1% of Séché Environnement's total revenue, which was €1.3 billion in 2023, it might be a candidate for divestment. Such a move could unlock resources for more promising initiatives.

- Low Growth Potential: These contracts typically operate in mature or declining niche markets with minimal opportunity for expansion.

- Limited Profitability: Due to their legacy nature and potentially outdated operational models, these contracts often yield low profit margins.

- Resource Drain: They can consume valuable management time and capital that could be better allocated to strategic growth areas.

- Divestment Opportunity: Selling or discontinuing these contracts can free up resources for investment in higher-return ventures aligned with the company's future vision.

Highly Volatile 'Spot' Environmental Emergency Activities (if not consistently capitalized on)

Highly Volatile 'Spot' Environmental Emergency Activities, when not consistently capitalized upon, can indeed represent a challenging segment within the BCG matrix for companies like Seche Environnement. While the demand for environmental emergency response is generally robust, the unpredictable, 'spot' nature of certain incidents means revenue streams can fluctuate significantly. This unpredictability can hinder the development of a consistent market share, even if the overall market is growing. For instance, a major spill response might provide a substantial revenue boost in one quarter, but without a strategy to leverage that expertise into ongoing service contracts or preventative measures, the next quarter could see a sharp decline in that specific activity.

If these reactive environmental emergency segments don't evolve into repeatable business or establish a sustained market presence, they risk being categorized as Question Marks. This is due to their inherent volatility and the potential for inconsistent returns. For example, if a company excels at rapid containment of a specific type of industrial accident but fails to secure long-term maintenance or remediation contracts related to that industry, the revenue generated from such events will remain episodic. This contrasts with more predictable service offerings like routine hazardous waste management, which can build a more stable market share.

- Market Growth vs. Market Share Volatility: Environmental emergency services generally exhibit strong market growth, but the 'spot' or reactive nature of some activities can lead to highly unpredictable revenue contributions.

- Inconsistent Revenue Streams: Without strategies to convert one-off emergency responses into ongoing service agreements or preventative contracts, these activities can result in low and inconsistent market share.

- Risk of Becoming a Question Mark: If reactive segments fail to translate into repeatable business or sustained market presence, their inherent volatility and potential for inconsistent returns can place them in the Question Mark category of the BCG matrix.

- Strategic Imperative for Repeat Business: Companies must focus on leveraging emergency response expertise to build long-term relationships and secure recurring revenue, thereby mitigating the volatility associated with 'spot' activities.

Dogs in the BCG matrix represent business units or activities with low market share in low-growth industries. For Seche Environnement, these could be legacy contracts or niche operations facing market contraction. For example, some older waste treatment facilities might require significant capital for minor upgrades, offering little return. Divesting such low-margin, low-growth segments, which might represent less than 1% of total revenue, can free up resources for more strategic initiatives.

Question Marks

Séché Environnement's R&D is exploring pyrogasification and biological methanation for waste-to-gas, alongside advanced soil stabilization techniques. These initiatives address significant environmental needs, aiming to capture future market opportunities.

Currently, these innovative projects are in their nascent stages, likely representing a low market share for Séché Environnement. However, their focus on high-growth environmental sectors positions them as potential future stars within the company's portfolio.

Through its recent ECO acquisition, Séché Environnement has entered the emerging niche of lithium recycling, specifically targeting semiconductor clients. This specialized area, though new to Séché, presents substantial growth prospects.

While this lithium recycling operation is part of Séché’s broader hazardous waste management services, it currently constitutes a small fraction of the company’s total market share. The sector is experiencing rapid expansion, driven by increasing demand for electric vehicles and portable electronics.

In 2024, the global lithium-ion battery recycling market was valued at approximately $3.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, underscoring the significant potential for Séché’s nascent venture.

The market for advanced PFAS treatment technologies is experiencing significant growth, driven by heightened regulatory scrutiny and public demand for cleaner water. Séché Environnement, through its subsidiary SYPRED, is strategically positioning itself in this high-potential sector by focusing on industrial water treatment for PFAS contamination. While the precise market share for these emerging solutions is still developing as the technologies mature and scale, the overall market is projected to reach billions of dollars globally by the end of the decade, with specialized treatment solutions being a key driver.

Early-Stage Organic Expansion into Untapped Geographies

Séché Environnement is actively pursuing organic growth by entering new, emerging international markets. These ventures represent a strategic move to capture future growth in regions where the company is still developing its presence and customer base.

While these nascent geographies hold substantial long-term potential, Séché Environnement's current market share in these specific new territories is understandably low. The focus here is on building foundational operations and securing initial clients.

- Untapped Geographies: Focus on markets with low existing penetration for Séché Environnement.

- Organic Expansion Strategy: Growth achieved through internal development and market building, not acquisitions.

- Low Current Market Share: Reflects the early stage of operations and client acquisition in these new regions.

- High Future Growth Potential: These markets are identified for their long-term expansion prospects.

Developing Solutions for Specific Complex Industrial Effluents

Séché Environnement's research and development, bolstered by operational expertise, actively crafts tailored solutions for challenging industrial waste streams, exemplified by advancements in mercury capture for emissions control. These specialized, high-margin solutions address critical environmental compliance needs, anticipating substantial market expansion driven by increasingly stringent regulations and ongoing industrial requirements.

While currently holding a modest market share, these highly technical, bespoke treatments represent a significant growth opportunity for Séché Environnement as they move towards wider commercial availability and acceptance.

- Focus on Niche Markets: Séché Environnement targets complex industrial effluents, such as those requiring advanced mercury capture in flue gas treatment.

- Regulatory Tailwinds: Tightening environmental regulations globally are a key driver for demand in these specialized solutions.

- High Value Proposition: These bespoke, technical solutions command higher margins due to their complexity and effectiveness.

- Growth Potential: Despite a current low market share, the segment is poised for significant expansion as commercialization efforts mature.

Question Marks represent Séché Environnement's emerging ventures with uncertain futures but high growth potential. These are typically new technologies or market entries where market share is minimal, but the long-term outlook is promising, aligning with the BCG matrix's definition of Question Marks.

These initiatives, such as lithium recycling and advanced PFAS treatment, are in their early stages, reflecting low current market penetration. However, they are strategically positioned to capitalize on rapidly expanding global markets driven by environmental regulations and technological advancements.

The company's investment in pyrogasification and biological methanation for waste-to-gas, alongside its expansion into new international markets, also falls under the Question Mark category. These efforts, while currently contributing little to overall market share, are designed to build future revenue streams in high-demand sectors.

The success of these Question Marks hinges on continued R&D, effective market penetration strategies, and favorable regulatory environments, particularly as demonstrated by the projected growth in the lithium-ion battery recycling market, which was valued at approximately $3.5 billion in 2024.

BCG Matrix Data Sources

Our Seche Environnement BCG Matrix leverages comprehensive data, including financial reports, waste management industry statistics, and regulatory filings, to accurately assess market share and growth potential.