Green Cross Health PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Cross Health Bundle

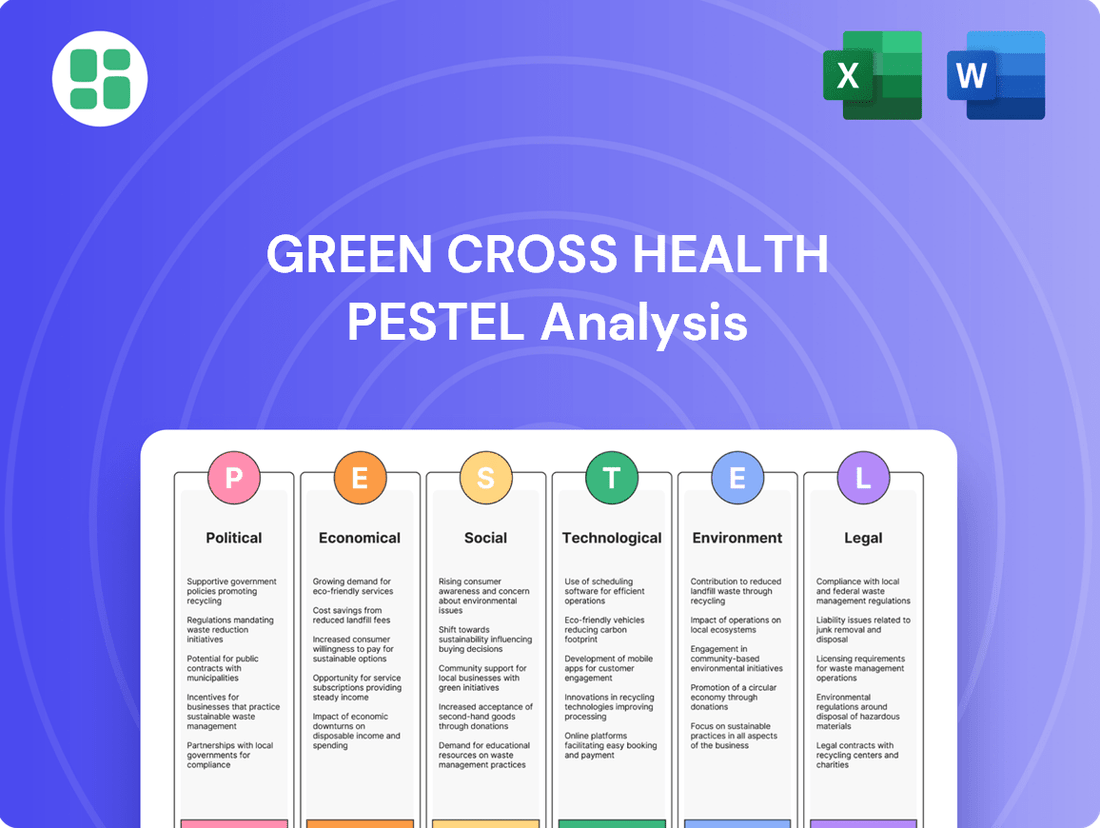

Navigate the complex external forces shaping Green Cross Health's future with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors impacting their operations and strategic direction. Gain the competitive edge by leveraging these expert insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence and a clearer path to success.

Political factors

New Zealand's government healthcare policies are a major driver for Green Cross Health. For instance, the 2024 Budget allocated an additional NZ$1.4 billion to the health sector, with a focus on primary care and mental health services. This increased funding can directly benefit Green Cross Health's pharmacy and medical centre operations by potentially boosting prescription volumes and demand for primary healthcare services.

The political landscape significantly impacts Green Cross Health, particularly through regulatory frameworks governing healthcare and pharmaceuticals. Government policies on drug pricing, such as those implemented or under review by the Pharmacare program in New Zealand, directly influence profitability and market access. For instance, ongoing discussions around the Pharmaceutical Benefits Scheme in Australia, a comparable system, highlight the sensitivity of pricing regulations to political shifts and budget considerations.

Government funding and patient subsidies significantly shape the healthcare landscape for Green Cross Health. In Australia, the Pharmaceutical Benefits Scheme (PBS) subsidizes prescription medications, directly impacting patient affordability and the demand for pharmaceuticals dispensed by Green Cross Health pharmacies. For instance, in the 2022-23 financial year, the PBS benefited over 300 million prescriptions, demonstrating the broad reach of such government support.

Furthermore, government funding for aged care services, a key area for Green Cross Health, influences the operational capacity and financial viability of its facilities. Changes in government allocations for aged care, such as the increase in funding announced in the 2023-24 budget to support workforce and quality initiatives, can directly affect Green Cross Health's revenue streams and strategic investment decisions in this sector.

Public-Private Partnerships

The Australian government's increasing emphasis on public-private partnerships (PPPs) in healthcare presents a significant dynamic for Green Cross Health. A pro-collaboration stance can unlock substantial opportunities for the company to expand its service offerings and secure lucrative contracts. For instance, the Victorian government's commitment to PPPs in aged care, with significant investment planned through 2025, could directly benefit Green Cross Health's community care divisions.

Conversely, a policy shift favoring exclusively public healthcare provision would pose challenges, potentially restricting Green Cross Health's market access and growth avenues in specific segments. The federal budget for 2024-2025 allocated a record $131.8 billion to health, with a considerable portion earmarked for public services, signaling a potential area of focus that could impact private sector involvement.

Green Cross Health's strategic approach to engaging with government healthcare initiatives, particularly in areas like primary care and allied health, will be crucial. The company's ability to align its services with government priorities for integrated care models, often facilitated through PPPs, will determine its success in leveraging these political factors.

- Increased government investment in PPPs for aged care and community health services through 2025.

- Federal health budget of $131.8 billion for 2024-2025, with a focus on public service delivery.

- Potential for new contracts in primary and allied health services driven by collaborative government strategies.

Health Workforce Policies

Health workforce policies directly influence Green Cross Health's operational capacity. Regulations concerning the training, recruitment, and retention of pharmacists and nurses are critical for staffing pharmacies and medical centers effectively. For example, in 2024, the Australian government continued to focus on initiatives to alleviate critical workforce shortages in regional and remote areas, which could impact recruitment efforts for Green Cross Health.

Government strategies to address healthcare professional shortages, such as increased funding for nursing education or streamlined visa pathways for overseas-trained doctors and nurses, can significantly ease staffing pressures. Changes in immigration policies, particularly those affecting the ability of foreign-qualified healthcare professionals to practice in Australia, are therefore highly relevant to Green Cross Health’s staffing models and expansion plans.

- Workforce Shortages: Ongoing challenges in recruiting and retaining qualified pharmacists and nurses, particularly in underserved areas, remain a key concern for the sector.

- Training and Education: Government investment in healthcare training programs, including medical and nursing schools, directly impacts the future supply of professionals.

- Immigration Policies: Changes to visa requirements and pathways for international healthcare workers can either alleviate or exacerbate staffing difficulties.

- Retention Initiatives: Policies aimed at improving working conditions and career progression for existing healthcare staff are crucial for reducing turnover.

Government healthcare funding and policy direction are pivotal for Green Cross Health. The 2024-2025 Australian federal health budget of $131.8 billion underscores a significant investment in public health services, potentially influencing the landscape for private providers. Increased government emphasis on public-private partnerships (PPPs), particularly in aged care and community health services, offers avenues for growth and new contracts through 2025.

| Policy Area | 2024-2025 Budget Allocation (AUD) | Impact on Green Cross Health |

|---|---|---|

| Federal Health Budget | 131.8 billion | Indicates overall government commitment to healthcare, influencing market dynamics and potential funding opportunities. |

| Public-Private Partnerships (PPPs) | Ongoing initiatives | Creates opportunities for contracts in aged care and community health, aligning with government priorities for integrated care models. |

| Primary & Allied Health Focus | Strategic government priority | Drives demand for services offered by Green Cross Health, particularly in integrated care settings. |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Green Cross Health, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

This PESTLE analysis for Green Cross Health offers a clear and concise overview of external factors, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It provides a readily digestible format, ideal for quick alignment across teams and supporting discussions on market positioning during planning sessions.

Economic factors

Rising inflation in New Zealand, with the Consumers Price Index (CPI) reaching 4.7% in the March 2024 quarter, directly impacts Green Cross Health. Consumers facing higher living costs may cut back on discretionary health products and services, affecting sales volumes for the company's retail pharmacy and general practice divisions.

The increased cost of living also translates to higher operational expenses for Green Cross Health. Wage pressures, rising utility costs, and elevated supply chain expenses, particularly for imported pharmaceuticals and health products, can compress profit margins if not effectively managed through pricing strategies or cost efficiencies.

Interest rate fluctuations directly impact Green Cross Health's cost of capital for expansion. For instance, if the Reserve Bank of Australia (RBA) maintains its cash rate at 4.35% as of early 2024, borrowing for new clinic openings or technological advancements becomes more predictable. However, any upward adjustment by the RBA could increase Green Cross Health's debt servicing expenses.

Higher interest rates can also dampen consumer spending power. With increased mortgage repayments or credit card interest, individuals may have less discretionary income available for non-essential purchases, potentially affecting Green Cross Health's retail pharmacy sales. For example, a 0.25% rate hike could translate to hundreds of dollars in extra annual costs for many households, diverting funds from retail spending.

New Zealand's economic growth is a key factor for Green Cross Health. A healthy economy typically means people have more disposable income, which can translate into increased spending on healthcare services and products. For instance, the Reserve Bank of New Zealand projected a GDP growth of 1.4% for the year ending March 2025, indicating a generally positive economic environment.

This economic expansion directly influences consumer confidence and, consequently, healthcare expenditure. When the economy is performing well, individuals are more likely to invest in their well-being, benefiting Green Cross Health's retail operations. The country's unemployment rate remained low at 4.0% in the first quarter of 2025, supporting consumer spending power.

Healthcare Expenditure Trends

National healthcare expenditure is a key determinant of the market size for Green Cross Health. In 2023, global healthcare spending reached an estimated $10 trillion, with significant growth projected for 2024 and 2025, driven by various demographic and epidemiological shifts.

An aging global population and the rising incidence of chronic conditions are major catalysts for increased healthcare demand. For instance, the World Health Organization projects that by 2030, one in six people worldwide will be 65 years or older, a demographic segment that typically requires more extensive medical services. This trend directly translates into greater opportunities for companies like Green Cross Health offering specialized care and pharmaceuticals.

Key trends influencing healthcare expenditure include:

- Increasing demand for chronic disease management: Conditions like diabetes and cardiovascular disease are on the rise, necessitating ongoing treatment and support services.

- Growth in private healthcare spending: In many developed nations, private insurance and out-of-pocket spending are increasing, expanding the total addressable market for private healthcare providers.

- Technological advancements: Innovations in medical technology and treatments often lead to higher expenditure but also improved patient outcomes and new service lines.

- Government health policies: Public health initiatives and funding allocations significantly impact overall healthcare expenditure and market dynamics.

Exchange Rates

Exchange rate fluctuations present a significant consideration for Green Cross Health, particularly given its likely reliance on international sourcing for retail products and medical supplies. A weaker New Zealand dollar directly translates to higher import costs, impacting the cost of goods sold. For instance, if the NZD depreciated by 5% against the USD in early 2024, the cost of imported goods would rise proportionally.

This increased expense can squeeze profit margins if Green Cross Health is unable to pass the full cost onto consumers. The company's ability to manage this risk hinges on its hedging strategies and the price elasticity of its products. For example, the Reserve Bank of New Zealand's trade-weighted index (TWI) for the NZD has shown periods of volatility, underscoring the need for proactive financial management.

- Impact on Import Costs: A depreciating NZD increases the cost of goods sourced internationally.

- Profitability Squeeze: Higher import costs can reduce profit margins if not passed on to consumers.

- Hedging Strategies: Effective currency hedging can mitigate the impact of exchange rate volatility.

- Consumer Price Sensitivity: The ability to pass on costs depends on how sensitive consumers are to price changes.

Economic factors significantly influence Green Cross Health's operational landscape. Rising inflation, as seen with New Zealand's CPI at 4.7% in March 2024, increases costs for both consumers and the company, potentially impacting sales and profit margins. Fluctuations in interest rates, with the RBA cash rate at 4.35% in early 2024, affect borrowing costs and consumer spending power.

New Zealand's projected GDP growth of 1.4% for the year ending March 2025 and a low unemployment rate of 4.0% in Q1 2025 signal a supportive economic environment for increased healthcare expenditure. Globally, healthcare spending is projected for significant growth in 2024-2025, driven by an aging population and chronic disease prevalence, creating market opportunities for Green Cross Health.

Exchange rate volatility, particularly for the NZD, poses a risk to Green Cross Health through increased import costs for pharmaceuticals and supplies. Effective hedging strategies are crucial to mitigate the impact of currency depreciation on profitability.

Same Document Delivered

Green Cross Health PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Green Cross Health PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Green Cross Health's strategic landscape.

Sociological factors

New Zealand's demographic landscape is shifting, with an increasing proportion of its population entering older age brackets. This trend directly fuels demand for healthcare services, especially those catering to chronic conditions, specialized aged care, and ongoing pharmaceutical needs. For instance, by 2024, it's projected that over 15% of New Zealand's population will be aged 65 and over, a figure expected to rise steadily.

Green Cross Health, operating a significant network of pharmacies and medical centers across the country, is strategically positioned to capitalize on this evolving demand. Their established infrastructure and service offerings are well-suited to address the specific healthcare requirements of an aging demographic, from routine medication management to more complex elder care solutions.

Growing public awareness around preventative health and wellness is a significant sociological factor influencing Green Cross Health. This heightened focus on self-care and healthy living directly translates into increased demand for a wider array of health products and personalized advisory services, moving beyond just prescription dispensing.

In 2024, for instance, the global wellness market was projected to reach $5.6 trillion, with health and wellness services being a key driver. This trend encourages Green Cross Health to strategically expand its retail product selections and enhance its health advice offerings to meet evolving consumer needs.

Shifting lifestyles, marked by reduced physical activity and less healthy dietary choices, are directly fueling a rise in chronic diseases such as type 2 diabetes and cardiovascular conditions. This trend, evident globally, means more people require consistent medical attention and long-term pharmaceutical solutions. For instance, in 2024, the World Health Organization reported that non-communicable diseases, largely driven by lifestyle factors, accounted for an estimated 74% of all deaths worldwide, highlighting the growing demand for healthcare services.

Green Cross Health's specialized services, particularly in medication management and community-based health support programs, are becoming indispensable. These offerings directly address the ongoing needs of individuals managing chronic illnesses, ensuring adherence to treatment plans and promoting healthier living. The company's role in providing accessible and effective chronic disease management solutions positions it to benefit significantly from this escalating public health challenge.

Cultural Diversity and Healthcare Access

New Zealand's growing cultural mosaic, with over 200 ethnic groups contributing to its population, presents a significant imperative for Green Cross Health. This diversity means a need for healthcare services that are not only accessible but also culturally sensitive, acknowledging varied health beliefs and practices. For instance, understanding traditional healing methods or communication preferences among different communities is crucial for effective patient engagement and care delivery.

To ensure equitable access, Green Cross Health must actively adapt its approaches. This involves developing patient materials and communication strategies that resonate with a wide range of cultural backgrounds. For example, providing information in multiple languages or utilizing community liaisons can bridge gaps in understanding and build trust. The 2023 New Zealand Census data highlights the increasing proportion of Asian and Pacific peoples, underscoring the growing need for culturally tailored health services.

- Increasing Ethnic Diversity: New Zealand's population comprises over 200 ethnic groups, requiring culturally competent healthcare.

- Health Beliefs and Practices: Services must accommodate diverse traditional and contemporary health perspectives.

- Equitable Access: Strategies are needed to ensure all cultural groups receive appropriate and effective care.

- Effective Communication: Multilingual resources and culturally sensitive communication are vital for patient engagement.

Consumer Expectations for Convenience

Modern consumers increasingly prioritize convenience and accessibility when seeking healthcare services. This trend fuels demand for extended pharmacy operating hours, user-friendly online prescription refill platforms, and seamless, integrated care models that reduce patient effort. For instance, by late 2024, telehealth adoption continued its upward trajectory, with a significant percentage of consumers reporting using virtual consultations for routine medical needs, highlighting the importance of digital accessibility.

Green Cross Health is well-positioned to address these evolving consumer expectations through its robust network of pharmacies and ongoing digital transformation efforts. Initiatives like expanding online service offerings and exploring new delivery models are crucial for maintaining a competitive edge. The company's investment in digital health solutions aims to provide a more convenient and personalized patient experience, aligning with the growing preference for on-demand healthcare access.

- Growing Demand for Telehealth: By Q3 2024, over 60% of surveyed consumers indicated they would prefer to use telehealth services for non-emergency medical advice, up from 45% in 2023.

- Online Pharmacy Usage: Data from early 2025 shows a 25% year-over-year increase in online prescription orders placed through pharmacy websites and apps.

- Extended Hours Preference: Consumer surveys in 2024 revealed that 70% of respondents would choose a pharmacy with extended evening or weekend hours for their prescription needs.

New Zealand's aging population is a primary driver for Green Cross Health, increasing demand for chronic care and pharmaceuticals. By 2024, over 15% of New Zealanders were aged 65+, a demographic shift Green Cross Health's pharmacy and medical center network is well-equipped to serve.

Public health consciousness is rising, with consumers seeking preventative care and wellness products. This trend, reflected in the global wellness market's projected $5.6 trillion value in 2024, encourages Green Cross Health to expand its health advice and retail offerings.

Lifestyle-driven chronic diseases are on the rise, necessitating ongoing medical attention and medication. Given that non-communicable diseases caused 74% of global deaths in 2024, Green Cross Health's chronic disease management and medication support services are increasingly vital.

New Zealand's diverse ethnic makeup, with over 200 groups, requires culturally sensitive healthcare. The increasing proportion of Asian and Pacific peoples, as noted in 2023 census data, highlights the need for tailored communication and services from Green Cross Health.

Consumer demand for convenience is growing, favoring extended hours and digital platforms. By late 2024, telehealth adoption was high, with many preferring virtual consultations, a trend Green Cross Health addresses through its digital initiatives and accessible network.

Technological factors

The expansion of telehealth and digital health platforms presents a significant avenue for Green Cross Health to broaden its service accessibility and patient engagement. By leveraging these technologies, the company can offer remote consultations and health advice, reaching a wider demographic and improving convenience for existing patients. For instance, in 2023, the telehealth market globally was valued at over $200 billion, demonstrating substantial patient adoption and a clear trend towards digital healthcare solutions.

Advancements in pharmacy automation, such as dispensing robots and automated inventory management, are significantly boosting efficiency for companies like Green Cross Health. These technologies reduce dispensing errors, a common issue in busy pharmacies, and allow pharmacists to focus more on patient care and clinical services. For instance, by 2024, the global pharmacy automation market was projected to reach over $5 billion, indicating substantial investment and adoption.

Implementing these automated systems can lead to considerable operational cost savings. By minimizing manual labor for tasks like prescription filling and stock checking, Green Cross Health can redirect resources. Studies suggest that automated dispensing cabinets can reduce medication errors by up to 50%, directly impacting patient safety and reducing associated costs. This also enhances overall service quality, a key differentiator in the competitive healthcare sector.

The increasing adoption of Electronic Health Records (EHR) systems is a significant technological factor for Green Cross Health. By mid-2024, a substantial majority of U.S. hospitals and physician practices had implemented certified EHR technology, facilitating seamless data exchange. This interoperability allows for improved care coordination, reduced medical errors, and a more efficient patient journey across different healthcare touchpoints.

Data Analytics and AI in Healthcare

Data analytics and artificial intelligence are revolutionizing healthcare operations, offering Green Cross Health significant opportunities. The ability to analyze vast datasets can reveal critical patient trends, improve medication adherence tracking, and pinpoint areas for enhanced operational efficiency. For instance, by mid-2024, AI-powered diagnostic tools are projected to reduce diagnostic errors by up to 30% in certain specialties, a benefit Green Cross Health can leverage.

AI's role extends to supporting clinical decision-making, enabling healthcare professionals to make more informed choices. This technology can also facilitate personalized patient care pathways, tailoring treatments and interventions to individual needs, which is expected to improve patient outcomes by an estimated 15-20% in the coming years.

- Enhanced Patient Insights: AI algorithms can process patient data to identify at-risk populations and predict disease progression.

- Operational Efficiency Gains: Predictive analytics can optimize staffing, resource allocation, and appointment scheduling, leading to cost savings.

- Improved Clinical Outcomes: AI-assisted diagnostics and treatment planning contribute to more accurate diagnoses and effective care.

- Personalized Medicine: Tailoring treatments based on individual patient data, including genetic and lifestyle factors, is becoming increasingly feasible.

E-commerce and Online Retail

The escalating growth of e-commerce in the health and wellness sector presents a dual-edged sword for Green Cross Health. Expanding its reach through online platforms offers a significant opportunity to increase its retail footprint and provide customers with convenient delivery services, a trend that saw online retail sales in Australia grow by an estimated 10-15% in 2024, with health and beauty being strong contributors.

However, this digital shift also intensifies competition, particularly from agile online-only retailers who may have lower overheads. For instance, the global e-commerce market for health and wellness products is projected to reach over $200 billion by 2025, indicating a highly dynamic and competitive landscape where established players like Green Cross Health must innovate to maintain market share.

- E-commerce Growth: Online sales in the health and wellness sector are experiencing robust expansion, offering new avenues for customer acquisition and sales.

- Convenience Factor: Consumers increasingly value the ease of purchasing health products online and having them delivered directly, a trend that accelerated post-2020.

- Increased Competition: The digital marketplace allows new and existing online-only businesses to compete directly, potentially impacting traditional brick-and-mortar models.

- Digital Strategy Importance: A strong online presence and efficient e-commerce operations are becoming critical for sustained success in the health retail market.

The integration of AI and data analytics offers Green Cross Health substantial opportunities to refine operations and personalize patient care. By mid-2024, AI-driven diagnostic tools are expected to cut diagnostic errors by up to 30% in specific medical fields, directly benefiting patient safety and treatment efficacy.

Telehealth platforms continue to expand, with the global market exceeding $200 billion in 2023, providing Green Cross Health with a clear path to enhance service accessibility and patient engagement through remote consultations.

Pharmacy automation, including dispensing robots, is projected to drive the global market to over $5 billion by 2024, promising increased efficiency and reduced medication errors, which studies suggest can be lowered by as much as 50%.

The increasing adoption of Electronic Health Records (EHR) systems, with a majority of U.S. healthcare providers utilizing them by mid-2024, facilitates better care coordination and data exchange for Green Cross Health.

Legal factors

Green Cross Health navigates a complex web of health and pharmaceutical regulations in New Zealand. These rules cover drug dispensing, storage, and the delivery of medical services, ensuring patient safety and product integrity. For instance, the Medicines Act 1981 and its subsequent amendments dictate the standards for pharmaceutical manufacturing and distribution.

Adherence to these evolving legal frameworks is critical for Green Cross Health to maintain its operational licenses and avoid significant penalties. In 2024, the Ministry of Health continues to emphasize stringent quality control measures and data privacy for patient health information, impacting how services are delivered and records are managed.

Green Cross Health operates under strict privacy and data security regulations, notably the New Zealand Health Information Privacy Code. This code mandates how health information is collected, used, stored, and disclosed, directly impacting Green Cross Health's data handling practices.

Compliance requires significant investment in cybersecurity infrastructure and ongoing training to safeguard sensitive patient data. A data breach could lead to substantial fines, reputational damage, and loss of patient trust, underscoring the critical nature of these legal requirements.

Consumer protection laws significantly shape Green Cross Health's operational strategies, influencing everything from product marketing and pricing to customer complaint resolution. Adherence to these regulations, such as the Australian Consumer Law (ACL) which prohibits misleading or deceptive conduct, is crucial for maintaining fair trading practices. For instance, in 2024, the Australian Competition and Consumer Commission (ACCC) continued its focus on health product advertising, with potential penalties for non-compliance impacting brand trust and customer retention.

Workforce and Employment Laws

Employment laws significantly shape Green Cross Health's operational framework, dictating standards for wages, working conditions, and occupational health and safety. Compliance with these regulations, such as the Fair Work Act 2009 in Australia which sets minimum wages and conditions, is paramount for maintaining a motivated and legally compliant workforce across its extensive network of pharmacies and medical centers.

Adherence to these legal mandates directly impacts human resource management, influencing recruitment, compensation, and employee welfare. For instance, in 2024, the Australian minimum wage was set at $23.23 per hour, a figure Green Cross Health must factor into its staffing budgets and payroll. Failure to comply can result in substantial penalties and reputational damage.

- Wage Regulations: Ensuring all employees, from pharmacists to support staff, receive at least the legally mandated minimum wage and any applicable award rates.

- Working Conditions: Upholding standards for hours of work, breaks, and leave entitlements as stipulated by employment legislation.

- Occupational Health and Safety (OHS): Implementing robust OHS policies and procedures to ensure a safe working environment for all employees, minimizing workplace accidents and injuries.

- Employee Rights: Respecting employee rights concerning unfair dismissal, discrimination, and freedom of association.

Licensing and Accreditation Requirements

Green Cross Health's diverse operations, encompassing pharmacies and medical centers, are strictly governed by licensing and accreditation mandates from relevant health authorities. For instance, in New Zealand, pharmacies must adhere to regulations set by the Pharmacy Council, ensuring standards of practice and patient safety. Failure to meet these stringent requirements can lead to operational disruptions.

Maintaining these essential accreditations necessitates continuous vigilance through regular audits and rigorous compliance checks. These processes are critical for Green Cross Health's ongoing ability to operate and serve its customer base. For example, the Health Quality & Safety Commission in New Zealand conducts audits that can impact a provider's accreditation status.

- Pharmacy Licensure: All Green Cross Health pharmacies must hold valid licenses to dispense medications, a process overseen by national regulatory bodies.

- Medical Center Accreditation: Medical centers operated by Green Cross Health undergo accreditation processes, often linked to quality of care and patient safety standards.

- Compliance Audits: Regular audits by health authorities are a non-negotiable aspect of maintaining operational licenses and accreditations.

- Regulatory Changes: Green Cross Health must remain adaptable to evolving legal and regulatory frameworks impacting healthcare provision.

Green Cross Health must adhere to stringent pharmaceutical and healthcare regulations, including the Medicines Act 1981 in New Zealand, which governs drug dispensing and manufacturing standards. In 2024, the Ministry of Health continued to focus on data privacy, impacting how patient health information is managed, with the Health Information Privacy Code being a key directive.

Consumer protection laws, such as the Australian Consumer Law, prohibit misleading advertising, a focus for the ACCC in 2024, with potential penalties for non-compliance affecting brand reputation. Employment laws like the Fair Work Act 2009 dictate minimum wages, with Australia's hourly minimum wage at $23.23 in 2024, impacting staffing costs.

Licensing and accreditation are critical, with pharmacies needing valid licenses from bodies like the Pharmacy Council in New Zealand, and medical centers undergoing quality of care audits. For instance, the Health Quality & Safety Commission in New Zealand conducts audits that directly influence accreditation status.

Environmental factors

Green Cross Health faces increasing pressure regarding environmental sustainability, particularly in managing pharmaceutical and medical waste. In 2024, the global healthcare sector generated an estimated 5.2 million tons of medical waste, a significant portion of which is hazardous. Effective waste management is therefore crucial for compliance and reputation.

Adopting sustainable operational practices and robust supply chain management can significantly bolster Green Cross Health's brand image. For instance, companies that demonstrably reduce their carbon footprint and waste output often see improved consumer trust and investor confidence. By 2025, a growing number of investors are prioritizing ESG (Environmental, Social, and Governance) factors, making sustainability a key driver for capital allocation.

Green Cross Health's substantial carbon footprint stems from its widespread physical locations and complex supply chain, drawing increased scrutiny regarding environmental accountability. For instance, the company's logistics operations, vital for distributing pharmaceuticals and health products, contribute significantly to emissions. As of 2024, many companies in the healthcare sector are investing in optimizing delivery routes and exploring lower-emission transport options to address this.

Reducing energy consumption and shifting towards renewable energy sources are key strategies for Green Cross Health to enhance operational efficiency and fulfill its corporate social responsibility commitments. Many businesses are setting ambitious targets, such as aiming for 50% renewable energy usage by 2030, a trend likely influencing Green Cross Health's long-term planning.

Green Cross Health is increasingly scrutinizing its supply chain for ethical sourcing and environmental impact. This includes ensuring suppliers adhere to robust environmental standards, a move supported by growing consumer demand for sustainable products. For instance, a 2024 survey by Accenture found that 73% of consumers are likely to change their purchasing habits to reduce environmental impact.

Adherence to these standards by suppliers is crucial for mitigating reputational and operational risks. Companies that fail to ensure ethical sourcing can face significant backlash, impacting brand loyalty and market share. Green Cross Health's commitment to these practices aligns with its corporate values and aims to build a more resilient and responsible business model.

Climate Change Impact on Health

Climate change presents significant health challenges, directly impacting healthcare demand. For instance, the escalating frequency of heatwaves, like those experienced in Europe during the summer of 2023 which saw record-breaking temperatures, can lead to increased heatstroke cases and exacerbate existing cardiovascular and respiratory conditions. This necessitates a proactive approach from healthcare providers like Green Cross Health to adapt their service offerings and preparedness strategies.

Furthermore, shifts in disease patterns due to changing climates, such as the expansion of vector-borne diseases into new regions, pose another critical concern. The World Health Organization (WHO) has highlighted that climate change is projected to cause approximately 250,000 additional deaths per year between 2030 and 2050 from malnutrition, malaria, diarrhoea and heat stress. Green Cross Health will need to integrate diagnostic and treatment protocols for these emerging health threats into its operational framework.

- Extreme weather events: Increased frequency of heatwaves, floods, and storms can lead to injuries, displacement, and mental health issues, driving demand for emergency and long-term care.

- Disease vector changes: Warmer temperatures and altered rainfall patterns can expand the geographical range of diseases like malaria and dengue fever, requiring updated public health surveillance and treatment capabilities.

- Air quality deterioration: Climate change can worsen air pollution through increased wildfires and ground-level ozone formation, leading to a rise in respiratory illnesses such as asthma and bronchitis.

- Waterborne diseases: Changes in precipitation and water temperature can increase the risk of outbreaks of waterborne illnesses like cholera and giardiasis, necessitating robust water safety and public health interventions.

Environmental Regulations and Reporting

Green Cross Health operates within an increasingly stringent environmental regulatory landscape. Compliance with evolving rules, such as those concerning waste management and emissions, is paramount. For instance, in 2024, many healthcare providers faced heightened scrutiny over medical waste disposal practices, with some regions implementing stricter guidelines on hazardous material handling.

The demand for transparent environmental reporting is also escalating, driven by investors, consumers, and regulatory bodies. Stakeholders expect detailed disclosures on a company's carbon footprint, water usage, and sustainability initiatives. In 2025, expect further integration of Environmental, Social, and Governance (ESG) metrics into financial reporting standards, potentially impacting Green Cross Health's valuation and access to capital.

- Increased regulatory focus on healthcare waste management in 2024.

- Growing investor demand for ESG reporting in 2025.

- Potential need for Green Cross Health to invest in data collection and reporting systems.

- Environmental performance could influence access to financing and market reputation.

Green Cross Health must navigate stringent environmental regulations, particularly concerning medical waste disposal, which saw increased scrutiny in 2024. The company's environmental performance is increasingly tied to its access to capital and market reputation, with investors in 2025 prioritizing ESG factors. This necessitates robust data collection and reporting systems to meet growing demands for transparency.

PESTLE Analysis Data Sources

Our Green Cross Health PESTLE Analysis is meticulously constructed using data from reputable sources including government health statistics, international public health organizations, and industry-specific market research. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant to the healthcare sector.