Green Cross Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Cross Health Bundle

Green Cross Health operates within a dynamic sector where buyer bargaining power, while present, is tempered by the essential nature of healthcare services. The threat of new entrants is moderate, as significant capital investment and regulatory hurdles exist, but innovation can still disrupt the market.

The full Porter's Five Forces Analysis reveals the real forces shaping Green Cross Health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pharmaceutical and medical supply sectors often feature a concentrated supplier base for specialized or patented products. For instance, a few key manufacturers might dominate the production of certain life-saving drugs or advanced medical equipment, giving them significant leverage. In 2024, the global pharmaceutical market was valued at over $1.6 trillion, with a substantial portion driven by patented and specialized treatments, highlighting the importance of these concentrated supply chains.

The bargaining power of suppliers for Green Cross Health is significantly influenced by the uniqueness and differentiation of their offerings. If key suppliers provide highly specialized or patented medications, like certain advanced cancer therapies or unique biologics, Green Cross Health faces limited alternatives. For instance, in 2024, the pharmaceutical industry saw continued innovation in personalized medicine, with some treatments having very few, if any, direct substitutes, placing considerable power in the hands of those suppliers.

The bargaining power of suppliers for Green Cross Health is influenced by the costs associated with switching. If Green Cross Health faces significant expenses, like retraining staff, re-validating its supply chain, or navigating complex regulatory changes, its existing suppliers gain leverage. For instance, in the pharmaceutical sector, the time and cost to qualify new suppliers for critical medications can be substantial, potentially running into millions of dollars and months of delay.

Supplier Power 4

The bargaining power of suppliers is a critical factor for Green Cross Health, particularly concerning the threat of forward integration. If key pharmaceutical manufacturers or medical equipment providers were to enter the retail pharmacy or primary care sectors directly, they could exert considerable leverage over Green Cross Health.

This potential for suppliers to move up the value chain, essentially becoming competitors, would significantly alter the power dynamic. For instance, a major drug producer could decide to open its own branded pharmacies, bypassing Green Cross Health's distribution network.

In 2024, the pharmaceutical industry saw continued consolidation and strategic partnerships, with some larger manufacturers exploring direct-to-consumer models. This trend, if it accelerates, means Green Cross Health must remain vigilant about its supplier relationships and the potential for these suppliers to capture more of the end-customer value.

- Forward Integration Threat: Suppliers like pharmaceutical companies could establish their own retail pharmacies or primary care clinics, directly competing with Green Cross Health.

- Increased Leverage: If suppliers integrate forward, they gain greater control over pricing and distribution, reducing Green Cross Health's bargaining power.

- Industry Trends (2024): Consolidation and exploration of direct-to-consumer models by pharmaceutical firms indicate a growing potential for this type of supplier action.

Supplier Power 5

Green Cross Health's significant purchasing volume can be a key factor in mitigating supplier power. For instance, if suppliers depend heavily on Green Cross Health for a substantial portion of their revenue, they are less likely to dictate unfavorable terms. In 2024, the healthcare sector saw continued consolidation among suppliers of pharmaceuticals and medical devices, potentially increasing their leverage. However, Green Cross Health's scale of operations means it can negotiate from a position of considerable strength.

The bargaining power of suppliers is influenced by several factors, including the concentration of suppliers in the market and the availability of substitutes. For Green Cross Health, this means understanding how many alternative suppliers exist for critical inputs like pharmaceuticals, medical equipment, and even specialized services. A limited supplier base or the absence of viable substitutes would naturally grant suppliers more sway in price and contract negotiations. For example, a report from early 2025 indicated that certain specialized medical consumables had only two primary manufacturers globally, giving those suppliers considerable pricing power.

- Supplier Concentration: Assessing the number of key suppliers for essential goods and services is crucial.

- Availability of Substitutes: The ease with which Green Cross Health can switch to alternative suppliers or products directly impacts supplier power.

- Importance of Volume: The proportion of a supplier's business represented by Green Cross Health can diminish their ability to impose unfavorable terms.

- Switching Costs: High costs associated with changing suppliers can lock Green Cross Health into existing relationships, potentially increasing supplier leverage.

The bargaining power of suppliers for Green Cross Health is substantial when they offer unique or patented products, as alternatives are scarce. For instance, in 2024, the pharmaceutical industry's reliance on specialized biologics and advanced therapies meant that a few key manufacturers held significant sway. This concentration, coupled with high switching costs for Green Cross Health, such as regulatory re-validation, amplifies supplier leverage.

| Factor | Impact on Green Cross Health | Example/2024 Data |

|---|---|---|

| Supplier Concentration | High power for few suppliers | Limited manufacturers for specialized medical devices. |

| Product Differentiation | High power for unique/patented products | Advanced cancer therapies with no direct substitutes. |

| Switching Costs | Increased leverage for suppliers | Millions of dollars and months to qualify new critical drug suppliers. |

| Forward Integration Threat | Potential for direct competition | Pharma companies exploring direct-to-consumer models in 2024. |

What is included in the product

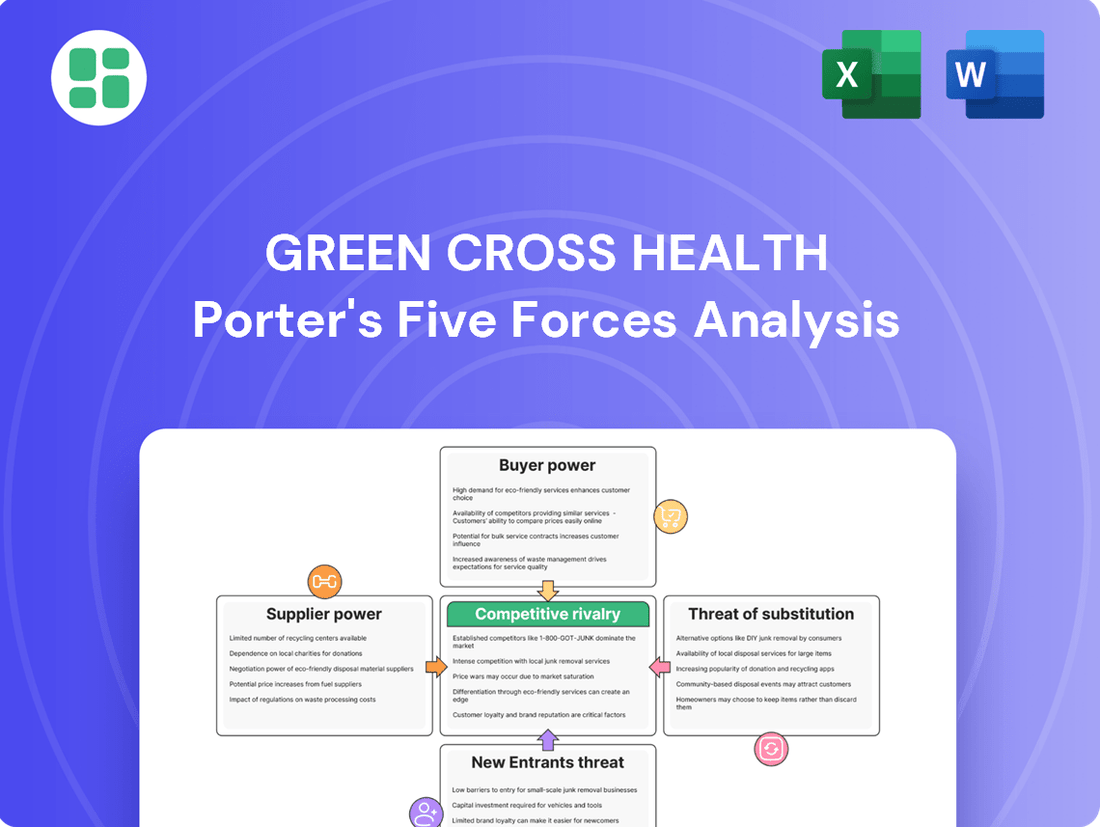

This analysis details the competitive forces impacting Green Cross Health, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare sector.

Effortlessly assess competitive intensity and identify strategic opportunities by visualizing Green Cross Health's Porter's Five Forces with an intuitive spider chart.

Customers Bargaining Power

Green Cross Health faces considerable buyer power, particularly from individual patients who are often price-sensitive for pharmacy services and retail health products. This sensitivity drives customers to compare prices and seek out more affordable options, thereby increasing their leverage.

For community health services, potential buyers like District Health Boards or government bodies also exert significant bargaining power. Their purchasing decisions are heavily influenced by budget constraints and the availability of competitive tenders, which can put downward pressure on Green Cross Health's pricing and service terms.

Green Cross Health's customers, particularly those seeking everyday pharmacy goods and primary healthcare services, possess significant bargaining power. This is largely due to the readily available substitutes for many of its offerings. For instance, the New Zealand market in 2024 features a substantial number of independent pharmacies, supermarket-based pharmacies, and online health product retailers, all providing competitive alternatives for prescription and over-the-counter medications.

The ease with which consumers can switch between these providers, driven by price, convenience, or service quality, directly amplifies their leverage. In 2023, the New Zealand pharmacy sector saw a consistent presence of numerous independent operators alongside larger chains, indicating a fragmented market where customer loyalty can be easily swayed by better deals or more accessible locations. This competitive landscape means Green Cross Health must remain highly attuned to customer price sensitivity and service expectations.

Green Cross Health faces significant buyer power when customers are well-informed about pricing and service quality across competing healthcare providers. This information asymmetry is a key driver; for instance, in 2024, the increasing availability of online health comparison tools and patient reviews empowers consumers to make more discerning choices, thereby increasing their leverage.

When consumers can easily switch between providers or have numerous alternatives, their bargaining power intensifies. For example, if a substantial portion of Green Cross Health's customer base actively researches and compares prescription drug prices or specialist fees, they can exert downward pressure on the company's pricing and service offerings.

Buyer Power 4

The bargaining power of customers for Green Cross Health appears to be moderate to high, largely influenced by low switching costs within the pharmacy and healthcare sector. Customers can readily transfer prescriptions between pharmacies, and the digital nature of many health services makes it simple to switch providers. For instance, in 2024, the ease of accessing prescription refill services online or via mobile apps for various pharmacy chains means a customer's loyalty is not heavily entrenched by inconvenience.

This ease of transition directly translates to increased customer leverage. If Green Cross Health's pricing or service offerings become less competitive, customers have readily available alternatives. This is further amplified by the increasing availability of telehealth services and online pharmacies, which offer convenience and potentially lower costs.

- Low Switching Costs: Customers can easily transfer prescriptions and access services from competing pharmacies and healthcare providers.

- Price Sensitivity: Customers are often price-sensitive, especially for routine medications and basic healthcare services, allowing them to shop around.

- Information Availability: Online reviews and price comparison tools empower customers to make informed choices, increasing their bargaining power.

- Fragmented Customer Base: While Green Cross Health serves a broad market, individual customer transactions are often small, but collectively, their demand is significant.

Buyer Power 5

Buyer power within the healthcare sector, particularly for a company like Green Cross Health, is a significant factor. Customers, ranging from individual patients to larger healthcare providers, can exert influence by choosing alternative suppliers or even by seeking to fulfill their needs independently. This ability to bypass traditional channels, often termed backward integration, directly impacts Green Cross Health’s pricing power and market share.

While the highly regulated nature of pharmaceuticals and healthcare services limits the extent of direct backward integration for many patients, the trend towards self-care and direct sourcing of certain health products is growing. For instance, patients might opt for over-the-counter remedies or health supplements instead of prescription medications, or source medical devices directly from manufacturers if regulations permit. In 2024, the global over-the-counter (OTC) drugs market was valued at approximately $150 billion, indicating a substantial segment where consumer choice and direct sourcing are prevalent.

- Growing Self-Medication Trend: An increasing number of consumers are managing minor ailments with OTC products, reducing reliance on physician prescriptions and, by extension, the need for services from entities like Green Cross Health for those specific needs.

- Direct Sourcing of Health Products: Patients and consumers are increasingly empowered to purchase health-related items, such as vitamins, supplements, and certain medical devices, directly from online retailers or specialized stores, bypassing traditional pharmacy channels.

- Information Accessibility: Enhanced access to health information online allows consumers to make more informed decisions about their health and treatment options, potentially leading them to seek alternatives to Green Cross Health’s offerings if they perceive better value or suitability elsewhere.

- Price Sensitivity: In a market where healthcare costs are a concern, customers are more likely to compare prices and seek out the most cost-effective solutions, thereby increasing the bargaining power of buyers who can easily switch providers or find cheaper alternatives.

Green Cross Health faces significant customer bargaining power due to low switching costs and high price sensitivity, especially for everyday pharmacy goods and basic health services. The availability of numerous alternative providers, including independent pharmacies and online retailers, empowers consumers in 2024 to easily compare prices and seek out better deals, directly pressuring Green Cross Health's pricing and service terms.

Customers are increasingly informed, utilizing online tools and reviews to make choices, which amplifies their leverage. This dynamic is evident in the fragmented New Zealand pharmacy market, where customer loyalty can be easily swayed by competitive offers, forcing Green Cross Health to remain highly responsive to customer expectations regarding both cost and convenience.

The growing trend of self-medication and direct sourcing of health products also contributes to customer power. Consumers are more inclined to manage minor ailments with over-the-counter options or purchase health items directly from alternative channels, reducing their reliance on traditional pharmacy services for specific needs.

In 2023, the New Zealand pharmacy sector comprised over 1,500 pharmacies, with a mix of corporate chains and independent operators, underscoring the competitive landscape and the ease with which customers can switch providers.

| Factor | Impact on Green Cross Health | 2024 Market Context |

|---|---|---|

| Low Switching Costs | Customers can easily transfer prescriptions and access services elsewhere. | Digital prescription services and mobile apps facilitate easy provider changes. |

| Price Sensitivity | Customers actively seek lower prices for medications and health products. | Significant competition from supermarket pharmacies and online retailers. |

| Information Availability | Online reviews and price comparison tools empower informed consumer choices. | Increased use of health comparison websites and patient feedback platforms. |

| Availability of Substitutes | Numerous independent pharmacies, online retailers, and health product stores offer alternatives. | Over 1,500 pharmacies in NZ in 2023, with a growing online health product market. |

Full Version Awaits

Green Cross Health Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Green Cross Health, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

In New Zealand's healthcare sector, Green Cross Health faces significant competitive rivalry. Large pharmacy chains like Chemist Warehouse and Countdown Pharmacies, along with a substantial number of independent pharmacies, directly vie for market share. Furthermore, the presence of other medical centre groups and specialized community health providers intensifies this rivalry, as they offer overlapping services and cater to similar patient needs. This fragmented landscape means Green Cross Health must continuously innovate and differentiate to maintain its competitive edge.

The competitive rivalry within New Zealand's pharmacy and healthcare sectors is intensified by a moderate industry growth rate. While not stagnant, the pace of expansion means established players are often vying for the same customer base. This dynamic encourages aggressive pricing strategies and marketing efforts as companies strive to capture or maintain market share.

In 2024, the New Zealand healthcare sector, including pharmacies, experienced steady but not explosive growth. This environment fosters a situation where companies like Green Cross Health must continually innovate and differentiate to stand out. The presence of both large pharmacy chains and numerous independent operators means there's a constant push for efficiency and customer loyalty, directly impacting competitive intensity.

In the pharmacy and healthcare sector, Green Cross Health faces a competitive landscape where product differentiation is often limited, especially for basic prescription fulfillment. This standardization means that price becomes a significant battleground, driving up rivalry. For instance, in 2024, major pharmacy chains continued to compete fiercely on prescription costs and loyalty programs, with some offering discounts for generic medications to attract price-sensitive customers.

While core pharmacy services are largely commoditized, Green Cross Health can mitigate intense rivalry by focusing on unique value-added services. Offering specialized health advice, convenient primary care clinics within pharmacies, or unique wellness programs can create differentiation. Companies that successfully integrate these services, like expanding telehealth consultations or offering personalized medication management, find they can command greater customer loyalty and reduce direct price comparisons.

Competitive Rivalry 4

The competitive rivalry within New Zealand's healthcare sector is influenced by substantial exit barriers. These include significant investments in specialized medical equipment and facilities, which are difficult to repurpose or sell quickly. Furthermore, the need for highly trained and certified healthcare professionals, often bound by long-term employment agreements or professional development pathways, makes rapid workforce divestment challenging.

These high exit barriers mean that even companies experiencing financial difficulties may be compelled to continue operating, potentially leading to intensified price competition and aggressive market strategies. For instance, the specialized nature of diagnostic imaging equipment or aged care facilities can create a situation where exiting the market at a favourable price point is exceptionally difficult, forcing incumbents to remain active competitors.

- High Capital Investment: Significant upfront costs for medical technology and infrastructure create a financial disincentive to exit.

- Specialized Workforce: The reliance on qualified medical practitioners and support staff with specific certifications makes staff reduction or relocation complex.

- Regulatory Hurdles: Compliance with healthcare regulations and licensing requirements can add complexity and cost to winding down operations.

- Long-Term Contracts: Commitments to service providers, suppliers, and patients can lock companies into ongoing operations, hindering a swift exit.

Competitive Rivalry 5

The competitive landscape for Green Cross Health is characterized by a diverse array of players, ranging from large, established pharmacy chains to nimble independent operators and emerging disruptors. This heterogeneity fuels intense rivalry as each segment pursues distinct strategies and objectives, impacting market share dynamics. For instance, in 2024, the Australian pharmacy market, which Green Cross Health operates within, saw continued consolidation among larger groups while independent pharmacies focused on specialized services and community engagement.

This blend of competitor types creates unpredictable competitive dynamics. Large chains often compete on price and convenience, leveraging economies of scale, while smaller independents differentiate through personalized customer service and tailored offerings. New entrants, on the other hand, might disrupt the market with innovative digital platforms or unique healthcare solutions, forcing incumbents to adapt rapidly.

- Diverse Competitor Strategies: Large chains focus on scale and price, independents on personalized service, and new entrants on digital innovation.

- Market Share Dynamics: The mix of competitor types leads to constant shifts in market share as different strategies gain traction.

- Intensified Rivalry: The varied approaches to market penetration and customer acquisition inherently intensify competition across the sector.

- Adaptability is Key: Companies like Green Cross Health must continuously adapt their strategies to counter the diverse threats and opportunities presented by this varied competitive environment.

Competitive rivalry is a significant force for Green Cross Health, primarily driven by the presence of numerous competitors, including large pharmacy chains like Chemist Warehouse and Countdown Pharmacies, alongside many independent pharmacies. This fragmented market means Green Cross Health must constantly innovate and differentiate its offerings to maintain its position.

In 2024, the intensity of this rivalry was further fueled by a moderate industry growth rate, leading to aggressive pricing and marketing efforts as companies vied for market share. The commoditization of basic pharmacy services, particularly prescription fulfillment, often makes price a key battleground, with major players offering discounts on generic medications.

Green Cross Health can mitigate this rivalry by focusing on value-added services such as specialized health advice, integrated primary care clinics, and unique wellness programs, which foster customer loyalty and reduce direct price comparisons.

The competitive landscape is further shaped by high exit barriers within the healthcare sector, stemming from significant capital investments in specialized equipment and the reliance on a qualified, certified workforce. These factors can compel companies to remain operational even when facing difficulties, potentially leading to prolonged price competition.

| Competitor Type | Key Strategies | Impact on Rivalry |

|---|---|---|

| Large Pharmacy Chains | Economies of scale, price competition, loyalty programs | Drives down prices, emphasizes convenience |

| Independent Pharmacies | Personalized service, community focus, specialized offerings | Fosters customer loyalty, niche market competition |

| New Entrants/Disruptors | Digital platforms, innovative healthcare solutions | Forces incumbents to adapt, introduces new competitive pressures |

SSubstitutes Threaten

Customers can address their healthcare and pharmaceutical needs through various substitutes, reducing reliance on Green Cross Health. For instance, the prevalence of self-medication for minor ailments is significant; a 2024 survey indicated that over 60% of individuals with common colds opt for self-treatment rather than consulting a healthcare professional.

Furthermore, the widespread availability of over-the-counter (OTC) medications in supermarkets and convenience stores presents a readily accessible alternative. In 2023, sales of OTC pharmaceuticals through non-pharmacy retail channels in Australia reached an estimated AUD 1.5 billion, demonstrating a strong consumer preference for convenience.

Seeking advice from non-medical professionals, such as pharmacists for basic queries or even online health forums, also serves as a substitute. While difficult to quantify precisely, the increasing digitalization of health information suggests a growing trend in consumers accessing health advice outside traditional medical channels, potentially impacting demand for Green Cross Health's direct services.

The threat of substitutes for Green Cross Health's services, particularly within the healthcare sector, is moderate. While direct substitutes for comprehensive healthcare are few, alternative wellness and preventative care options are emerging. For instance, the growing popularity of telehealth platforms and at-home diagnostic kits, which saw significant adoption in 2023 and continued into 2024, offers a lower-cost, more convenient alternative for certain non-critical health needs. These substitutes may not offer the same breadth of services but can address specific patient requirements effectively.

The threat of substitutes for Green Cross Health is moderate to high, driven by the increasing accessibility of alternative healthcare solutions. Customers can easily switch to purchasing medications online from international pharmacies, often at lower prices, bypassing traditional retail channels. For instance, the global online pharmacy market was valued at approximately USD 66.5 billion in 2023 and is projected to grow significantly, indicating a strong substitution trend.

Furthermore, the rise of telehealth platforms and virtual consultations offers a convenient alternative for many routine medical needs, reducing the reliance on in-person visits to pharmacies or clinics. This shift is supported by data showing a substantial increase in telehealth utilization; a survey in early 2024 indicated that over 75% of consumers who had used telehealth were likely to continue using it. Such readily available and often cost-effective alternatives directly challenge Green Cross Health's traditional service model.

4

The threat of substitutes for Green Cross Health's services is moderate. Customers increasingly view digital health platforms and apps as viable alternatives for managing minor health concerns and accessing health information. For example, in 2024, the global digital health market was valued at over $300 billion, indicating a significant shift towards these alternatives.

These digital substitutes offer convenience and often lower costs, directly impacting the perceived value of traditional healthcare services. Public health campaigns also play a role by educating individuals on preventative measures and self-care, potentially reducing reliance on professional consultations for certain issues.

- Digital Health Adoption: Increased consumer comfort with telehealth and health apps for routine advice and monitoring.

- Cost-Effectiveness: Substitutes like free health information websites or low-cost apps present a cheaper alternative for basic health queries.

- Convenience Factor: On-demand access to information and services through digital channels can be more appealing than scheduling appointments.

- Preventative Focus: Growing emphasis on public health and wellness programs empowers individuals to manage their health proactively, reducing the need for reactive medical intervention.

5

Technological advancements are significantly increasing the threat of substitutes for Green Cross Health's traditional offerings. The rise of direct-to-consumer online pharmacies, for instance, offers a convenient alternative to brick-and-mortar stores, potentially eroding market share. Wearable health technology and AI-powered diagnostic tools are also emerging as substitutes, enabling individuals to monitor their health and even receive preliminary diagnoses outside of traditional healthcare settings. This shift could reduce reliance on pharmacy services for certain needs.

These evolving substitutes present a tangible challenge. For example, the global telehealth market was valued at approximately $140 billion in 2023 and is projected to grow substantially, indicating a clear trend toward remote healthcare solutions. Similarly, the increasing adoption of health monitoring wearables, with sales reaching over 100 million units globally in 2023, signifies a growing consumer preference for self-managed health insights that may bypass traditional pharmacy interactions.

- Online Pharmacies: Offer convenience and often competitive pricing, directly challenging traditional pharmacy sales.

- Wearable Health Tech: Empowers consumers with data, potentially reducing the need for routine pharmacy consultations.

- AI Diagnostics: Provides preliminary health assessments, creating an alternative to in-person medical advice.

The threat of substitutes for Green Cross Health is moderate to high, driven by accessible alternatives in healthcare. Customers can turn to online pharmacies, with the global market valued at approximately USD 66.5 billion in 2023, or telehealth platforms, which saw over 75% of users in early 2024 likely to continue using them. These options offer convenience and cost-effectiveness, directly impacting traditional service models.

Digital health platforms and apps are increasingly viewed as viable alternatives for managing minor health concerns, with the global digital health market exceeding $300 billion in 2024. Public health campaigns also promote self-care, potentially reducing reliance on professional consultations.

Technological advancements further amplify this threat. Online pharmacies provide convenience and competitive pricing, while wearable health technology and AI diagnostics empower individuals with self-monitoring and preliminary assessment capabilities, potentially bypassing traditional pharmacy interactions.

| Substitute Type | Market Value (2023) | Consumer Adoption Trend (2024) | Impact on Green Cross Health |

| Online Pharmacies | USD 66.5 billion | Significant growth | Erosion of brick-and-mortar sales |

| Telehealth Platforms | USD 140 billion | Over 75% likely to continue use | Reduced need for in-person consultations |

| Digital Health Apps | Global market > $300 billion | Increasing adoption for minor concerns | Shift in perceived value of traditional services |

| Wearable Health Tech | Over 100 million units sold | Growing preference for self-managed insights | Potential bypass of pharmacy interactions |

Entrants Threaten

The threat of new entrants for Green Cross Health is moderately low due to significant regulatory hurdles and licensing requirements in New Zealand's healthcare sector. Establishing new pharmacies or community health services necessitates navigating complex approval processes, which can be time-consuming and costly.

For instance, the Medicines Act 1981 and associated regulations govern the dispensing of pharmaceuticals, requiring pharmacists to be registered with the Pharmacy Council of New Zealand. This rigorous registration process, coupled with stringent facility standards, acts as a substantial barrier to entry for aspiring new pharmacy operators.

The threat of new entrants for Green Cross Health is generally moderate. Establishing a new pharmacy or healthcare service requires significant capital investment. This includes costs for prime retail locations, substantial inventory, specialized medical equipment, and robust IT infrastructure for patient records and dispensing. For instance, setting up a new community pharmacy in a developed market can easily run into hundreds of thousands of dollars in initial outlay.

The threat of new entrants for Green Cross Health is moderate, largely due to the significant economies of scale enjoyed by established players. For instance, in 2024, major pharmaceutical distributors in Australia, a key market for Green Cross Health, reported operating margins around 2-4%, indicating intense price competition where scale is crucial for profitability. New companies entering the market would find it extremely difficult to match the purchasing power and efficient distribution networks that Green Cross Health has cultivated over years, making it challenging to compete on price and achieve initial market penetration.

4

Green Cross Health benefits from considerable brand loyalty and established customer relationships, particularly through its Unichem and Life Pharmacy brands. This strong recognition and trust act as a significant barrier for potential new entrants seeking to capture market share. For instance, in the 2024 financial year, Green Cross Health reported a 5.9% increase in revenue, reaching NZ$439.1 million, which reflects continued customer engagement and reliance on their established services.

The company's extensive network of pharmacies across New Zealand also presents a hurdle. Newcomers would face substantial investment costs and time to replicate this reach and accessibility.

- Brand Recognition: Unichem and Life Pharmacy are well-known and trusted names in the New Zealand healthcare sector.

- Customer Loyalty: Existing customer bases are less likely to switch to new, unproven brands.

- Network Effect: The widespread presence of Green Cross Health pharmacies makes it convenient for a large segment of the population.

- Switching Costs: While not always financial, the effort and perceived risk of switching to a new pharmacy can deter customers.

5

The threat of new entrants for Green Cross Health is moderate, largely due to the significant barriers to entry in the healthcare and pharmaceutical sectors. Established players benefit from strong relationships and deep integration within existing distribution channels, making it difficult for newcomers to secure access to essential pharmaceutical supply chains or government funding for vital community health services. For instance, in 2024, the pharmaceutical distribution market is characterized by consolidation, with a few major players controlling a substantial share of the logistics, requiring significant investment and established trust for new companies to gain traction.

New entrants face considerable hurdles in replicating the extensive networks and long-standing relationships that incumbent firms like Green Cross Health have cultivated. These established connections are crucial for navigating regulatory landscapes, securing favorable supplier agreements, and building patient and provider trust. The capital required to establish a comparable operational footprint and brand recognition is substantial, further deterring potential competitors.

Key barriers include:

- Distribution Channel Access: Difficulty in securing contracts with major pharmaceutical wholesalers and pharmacies, which are often dominated by a few large incumbents.

- Regulatory Hurdles: Navigating complex healthcare regulations and obtaining necessary licenses and accreditations can be time-consuming and costly.

- Capital Requirements: Significant upfront investment is needed for infrastructure, technology, inventory, and marketing to compete effectively.

- Brand Loyalty and Reputation: Established brands often enjoy higher patient and provider trust, making it challenging for new entrants to gain market share.

The threat of new entrants for Green Cross Health remains moderate. Significant capital investment is required for establishing new pharmacies or healthcare services, encompassing prime retail locations, substantial inventory, and advanced IT systems. For instance, setting up a new community pharmacy in 2024 can easily cost hundreds of thousands of dollars in initial outlay.

Regulatory hurdles and licensing, such as those under the Medicines Act 1981, present substantial barriers. The rigorous registration process for pharmacists and stringent facility standards demand considerable compliance efforts, deterring many potential new operators.

Economies of scale also play a crucial role. In 2024, major pharmaceutical distributors in Australia, a market relevant to Green Cross Health, operated with margins around 2-4%, highlighting intense price competition where scale is vital for profitability. New entrants struggle to match the purchasing power and efficient distribution networks of established entities.

Furthermore, Green Cross Health benefits from strong brand loyalty through its Unichem and Life Pharmacy brands. In FY2024, the company reported a 5.9% revenue increase to NZ$439.1 million, reflecting sustained customer engagement and trust, which new competitors find challenging to overcome.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment for infrastructure, inventory, and technology. | Significant financial barrier to entry. |

| Regulatory Hurdles | Complex licensing and compliance with healthcare laws. | Time-consuming and costly process to gain approval. |

| Economies of Scale | Established players benefit from bulk purchasing and efficient distribution. | New entrants face difficulty competing on price. |

| Brand Loyalty & Network | Strong customer trust and widespread pharmacy presence. | Difficult for new brands to gain market share and customer switching. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Green Cross Health is built upon a foundation of publicly available financial statements, annual reports from industry participants, and insights from reputable market research firms. This blend of primary and secondary data allows for a comprehensive understanding of competitive pressures.