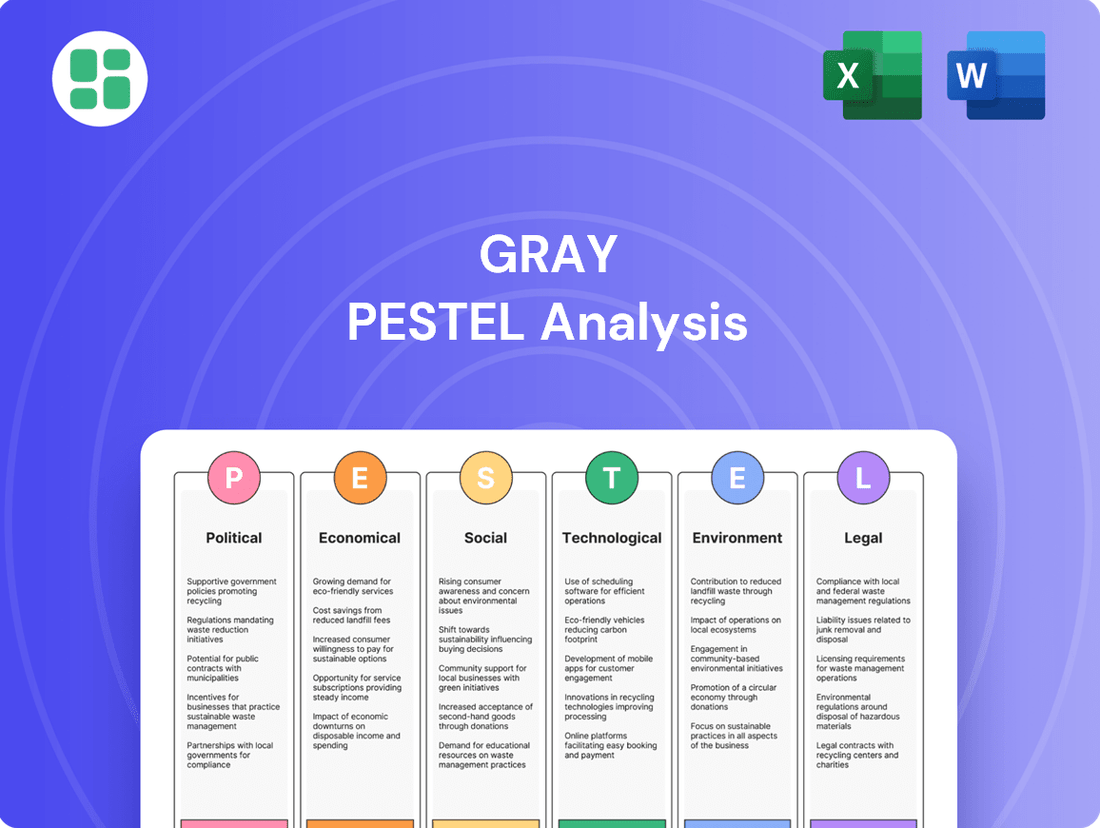

Gray PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gray Bundle

Unlock the critical external factors shaping Gray's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and threats. Equip yourself with actionable intelligence to refine your own strategic planning and gain a competitive advantage. Download the full PESTLE analysis now for immediate, in-depth insights.

Political factors

Government investment in infrastructure, notably through the Infrastructure Investment and Jobs Act (IIJA), is significantly shaping the construction landscape. The IIJA, with its substantial funding, is directly increasing the volume and type of projects available, creating robust demand.

This legislative push is particularly driving opportunities in sectors like manufacturing facilities and data centers, as well as transportation upgrades. For instance, the IIJA allocated $110 billion for roads, bridges, and major projects, directly impacting the types of construction work that are prioritized and funded.

The CHIPS and Science Act further amplifies this by encouraging domestic semiconductor manufacturing, leading to a surge in demand for new industrial facilities. This creates a direct tailwind for construction firms capable of handling these specialized builds.

Trade policies significantly impact the construction sector. For instance, tariffs on imported steel and lumber, like those seen in recent years, directly increase input costs for design-build firms. These tariffs can add substantial percentages to material expenses, impacting project bids and overall profitability.

Supply chain disruptions are another major consequence. When tariffs are imposed or trade agreements shift, the availability and timely delivery of essential materials can be severely affected. This can lead to project delays and increased labor costs as firms scramble to secure necessary components, potentially impacting the 2024 construction outlook.

Political stability directly influences regulatory consistency within the construction sector. For companies like Gray Construction, shifts in government or policy direction can lead to unpredictable changes in building codes, environmental regulations, and labor laws, impacting project timelines and costs. For instance, a sudden tightening of emissions standards in 2024 could necessitate costly retrofits for existing fleets or new equipment purchases.

Political uncertainty can also deter long-term investment in large-scale construction projects. When governments are perceived as unstable or prone to policy reversals, private investors may hesitate, creating a more challenging environment for securing financing and planning multi-year developments. This was evident in early 2025 discussions around infrastructure spending where partisan disagreements led to project delays.

Government Incentives for Green Building

Government incentives, subsidies, and mandates significantly shape green building projects. These policies encourage the use of eco-friendly materials and energy-efficient designs, creating new market opportunities for sustainable construction. For example, the Inflation Reduction Act of 2022 offers substantial tax credits for renewable energy and energy efficiency improvements, driving demand for green building solutions.

These political drivers directly influence project requirements by setting standards and offering financial advantages for compliance. For instance, many jurisdictions now mandate minimum energy performance standards for new constructions, pushing developers to adopt sustainable practices. The U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) certification, often supported by local government policies, is becoming a benchmark for sustainable development.

- Incentives Drive Adoption: Tax credits and rebates for energy-efficient systems and materials are key drivers for green building.

- Mandates Shape Requirements: Building codes increasingly incorporate sustainability standards, influencing design and material choices.

- Market Opportunities: Government support fosters growth in sectors like renewable energy integration and sustainable material supply chains.

Geopolitical Tensions

Broader geopolitical tensions can significantly impact the construction sector by creating global supply chain volatility. For instance, ongoing conflicts or trade disputes can disrupt the flow of essential materials like steel or lumber, leading to price spikes. In 2024, the lingering effects of global trade friction contributed to an average increase of 5-10% in key construction material costs compared to 2023.

These international relations also influence investment patterns, potentially making large-scale construction projects less feasible. Uncertainty stemming from geopolitical instability can deter foreign direct investment, a crucial component for many major infrastructure developments. This hesitancy was evident in late 2024, with some analysts reporting a 15% decrease in cross-border investment for large infrastructure projects in regions experiencing heightened geopolitical risk.

- Supply Chain Disruptions: Geopolitical events can interrupt the transport of raw materials and finished goods, leading to project delays and increased costs.

- Material Cost Volatility: Tensions often result in fluctuating prices for key construction inputs such as metals, energy, and manufactured components.

- Investment Uncertainty: International instability can make investors cautious, potentially reducing capital available for significant construction ventures.

- Shifts in Demand: Geopolitical factors can alter global economic conditions, indirectly affecting the demand for new construction across various sectors.

Government policies, such as the Infrastructure Investment and Jobs Act (IIJA) and the CHIPS and Science Act, are actively stimulating construction demand, particularly for manufacturing and infrastructure projects. These legislative efforts, backed by billions in funding, are reshaping project pipelines and creating significant opportunities for construction firms in 2024 and beyond.

Trade policies and geopolitical stability directly influence material costs and supply chain reliability. Tariffs on key materials like steel can increase project expenses, while international tensions can lead to price volatility and delivery delays, impacting the feasibility of large-scale developments. For instance, in 2024, construction material costs saw an average increase of 5-10% due to these factors.

Government incentives and mandates are increasingly driving the adoption of green building practices. Tax credits for energy-efficient systems and stricter building codes are creating new market segments and influencing design and material choices, fostering growth in sustainable construction solutions.

| Policy/Factor | Impact on Construction | Example/Data (2024-2025) |

|---|---|---|

| IIJA Funding | Increased infrastructure project volume | $110 billion allocated for roads, bridges, and major projects |

| CHIPS Act | Boosted demand for industrial facilities | Encourages domestic semiconductor manufacturing |

| Trade Tariffs (Steel/Lumber) | Increased material costs | Potential 5-10% increase in key material costs |

| Geopolitical Tensions | Supply chain disruption, investment uncertainty | 15% decrease in cross-border investment for some infrastructure projects |

| Inflation Reduction Act | Incentivizes green building | Tax credits for renewable energy and energy efficiency |

What is included in the product

The Gray PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Gray, providing a comprehensive understanding of its external operating landscape.

Provides a structured framework to identify and mitigate external threats, thereby reducing uncertainty and anxiety surrounding market changes.

Economic factors

Inflationary pressures significantly impact project budgets for design-build firms. For instance, the Producer Price Index for construction materials saw a notable increase throughout 2023 and into early 2024, with specific items like steel mill products and concrete experiencing double-digit percentage hikes year-over-year. This directly escalates the cost of essential components, forcing a re-evaluation of initial project estimates and potentially squeezing profit margins if not adequately managed.

Material price volatility, exacerbated by ongoing supply chain disruptions, presents a continuous challenge. The cost of electrical components, for example, has been subject to unpredictable fluctuations due to global demand and manufacturing lead times. This unpredictability makes accurate cost forecasting difficult, requiring firms to build in larger contingencies or explore more robust hedging strategies to mitigate the financial risks associated with material procurement.

Fluctuating interest rates significantly impact project financing costs. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, but the expectation of future cuts influenced borrowing costs for construction projects. Higher rates directly translate to increased expenses for developers securing loans, potentially making new commercial and industrial construction less viable.

When borrowing costs rise, the hurdle rate for new investments also increases, prompting private sector investors to scrutinize potential returns more closely. This can lead to a slowdown in construction demand as projects that were once profitable at lower rates become unfeasible. For example, a project requiring substantial debt financing might be shelved if the projected cash flow no longer adequately covers the higher interest payments, particularly in sectors sensitive to economic cycles like commercial real estate.

Economic growth is a significant driver for the construction industry, directly impacting Gray Construction's project pipeline. For instance, the U.S. GDP growth rate was projected to be around 2.3% in 2024, according to the Congressional Budget Office, indicating a steady but not explosive expansion. This level of growth generally supports continued investment across various sectors, including manufacturing, food and beverage, and distribution, all key markets for Gray Construction.

A robust economy translates to increased demand for new facilities and expansions in these sectors. When businesses are confident about future consumer spending and overall economic stability, they are more likely to invest in capital projects. Conversely, an economic slowdown or recession can lead to deferred or canceled projects, directly impacting Gray Construction's order book and revenue projections for 2024 and 2025.

Labor Costs and Availability

Labor shortages and rising wages are significant economic factors impacting the construction industry. In 2024, the U.S. Bureau of Labor Statistics reported that construction wages increased by an average of 4.5% year-over-year, driven by a persistent lack of skilled labor. This upward pressure on costs directly affects project budgets, potentially leading to delays and necessitating careful financial planning.

The scarcity of qualified workers, from electricians to project managers, forces construction firms to compete more aggressively for talent. This competition exacerbates wage inflation and can strain company resources. To combat this, many companies are increasing investment in training and apprenticeship programs, aiming to build a more robust and skilled workforce for the future.

- Wage Inflation: Construction wages saw an average increase of 4.5% in 2024, a direct response to labor demand.

- Skilled Labor Gap: A shortage of skilled tradespeople continues to be a primary driver of increased labor costs.

- Project Impact: Rising labor expenses can inflate project budgets by an estimated 5-10%, potentially delaying completion.

- Workforce Development: Firms are dedicating more resources to training and retention to address the labor availability issue.

Consumer Spending and Market Demand

Consumer spending is a major driver for the food and beverage industry, directly impacting the need for new facilities and expansions. When consumers are confident and spending more, demand for food products rises, prompting companies to invest in new processing plants or distribution centers. For instance, in the first quarter of 2024, U.S. consumer spending increased at a 3.2% annual rate, signaling robust demand that can translate into construction projects for companies like Gray Construction.

Shifts in consumer behavior, such as a growing preference for convenience foods or plant-based alternatives, also influence market demand and, consequently, construction needs. A surge in demand for ready-to-eat meals, for example, might necessitate the construction of specialized facilities equipped for rapid packaging and shorter shelf-life storage. Conversely, economic downturns or changes in consumer preferences can dampen demand, potentially delaying or reducing the need for new construction.

- Consumer Spending Growth: U.S. real consumer spending saw a 3.2% increase in Q1 2024, indicating strong demand that supports capital investments in food and beverage infrastructure.

- Market Demand Fluctuations: Changes in consumer preferences, like the rise of plant-based diets, can create demand for new, specialized food processing facilities.

- Economic Sensitivity: The food and beverage sector's construction needs are sensitive to economic cycles; increased consumer confidence generally leads to more facility development.

- Distribution Network Expansion: Growing e-commerce in the food sector requires investment in advanced distribution centers, influencing the types of construction projects undertaken.

Economic factors significantly shape the construction landscape, influencing everything from material costs to labor availability and overall project demand. Understanding these dynamics is crucial for strategic planning and financial forecasting in the industry.

Inflationary pressures, particularly on construction materials, directly impact project budgets. For instance, the Producer Price Index for construction inputs saw substantial year-over-year increases in late 2023 and early 2024. This volatility necessitates careful cost management and contingency planning.

Interest rate fluctuations also play a critical role, affecting the cost of financing for new projects. Higher rates can increase borrowing expenses for developers, potentially making some projects financially unviable and reducing overall construction demand.

Labor shortages and the resulting wage inflation are ongoing concerns. In 2024, construction wages rose by approximately 4.5% on average, driven by a persistent demand for skilled workers. This trend requires firms to invest more in workforce development and competitive compensation packages.

| Economic Factor | Impact on Construction | Data Point (2023-2024) |

|---|---|---|

| Inflation (Materials) | Increased project costs, reduced profit margins | PPI for construction materials up double digits year-over-year |

| Interest Rates | Higher financing costs, reduced project viability | Benchmark rates held steady in early 2024, with market anticipating future cuts |

| Labor Costs | Escalating wages, competition for talent | Construction wages increased ~4.5% year-over-year |

| Economic Growth (GDP) | Influences project pipeline and demand | U.S. GDP projected around 2.3% for 2024 |

Preview the Actual Deliverable

Gray PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gray PESTLE analysis provides a detailed examination of the external factors impacting a business. You can trust that the insights and structure you see are precisely what you'll download.

Sociological factors

Persistent labor shortages, particularly in skilled trades, are a significant hurdle for the construction sector. This demographic challenge is exacerbated by an aging workforce, with many experienced professionals nearing retirement. For instance, a 2024 report indicated that over 40% of construction workers are aged 45 or older, highlighting the impending knowledge and skills gap.

These demographic shifts demand strategic talent attraction, retention, and robust training programs. Companies must invest in apprenticeships and upskilling initiatives to ensure they have the necessary workforce to handle increasingly complex projects. The need for new talent is critical, as the industry faces a projected shortfall of hundreds of thousands of workers in the coming years.

The construction industry faces a growing demand for specialized skills, particularly in areas like digital modeling, prefabrication, and green building technologies. For instance, a 2024 report indicated that 70% of construction firms are experiencing a shortage of workers with digital construction skills.

Continuous training and apprenticeships are crucial to bridge this gap. In 2025, vocational training programs saw a 15% increase in enrollment, reflecting a growing awareness of the need for updated skill sets to handle complex, technology-driven projects and maintain a competitive edge in the evolving market.

Societal attitudes are increasingly steering the construction industry towards sustainability. There's a noticeable surge in public and client demand for environmentally responsible building practices. This shift means construction firms are now prioritizing ESG factors, influencing everything from the materials they choose to how they engage with local communities.

For example, a 2024 survey revealed that over 70% of potential homebuyers consider a property's energy efficiency and sustainable features a key decision-making factor. This growing awareness directly translates into project design and material selection, with firms actively seeking out green certifications and eco-friendly options to meet market expectations and enhance their brand reputation.

Urbanization and Population Growth

Global population growth, projected to reach 9.7 billion by 2050, coupled with increasing urbanization, fuels a significant demand for new infrastructure, housing, and commercial spaces. This surge in urban living, with over 55% of the world's population already residing in cities, necessitates continuous investment in construction services. Major urban centers are at the forefront of this development, requiring large-scale projects to accommodate expanding populations and economic activity.

The ongoing migration to cities creates a constant need for construction. For instance, in 2024, global construction spending is anticipated to grow, driven by infrastructure upgrades and residential development in metropolitan areas. This trend directly translates into sustained demand for construction companies and related industries, particularly for complex, large-scale urban projects.

- Global Population Growth: Expected to reach 9.7 billion by 2050, putting pressure on resources and infrastructure.

- Urbanization Rate: Over 55% of the global population currently lives in urban areas, a figure projected to rise.

- Infrastructure Demand: Urban expansion requires significant investment in transportation, utilities, and public facilities.

- Construction Market Growth: Driven by housing needs and commercial development in rapidly growing cities.

Health and Safety Culture

Societal expectations for rigorous health and safety on construction sites are paramount, with a growing intolerance for workplace fatalities or injuries. The construction industry in the UK, for instance, saw 39 worker fatalities in 2023/24, a slight increase from the previous year, underscoring the ongoing need for vigilance.

A robust safety culture, bolstered by evolving regulations and the integration of advanced technologies like AI-powered monitoring systems, is now indispensable. This focus not only safeguards worker well-being but also significantly influences public perception and operational efficiency, as demonstrated by companies with strong safety records often experiencing lower insurance premiums and fewer project delays.

- Worker Fatalities: The Health and Safety Executive (HSE) reported 39 construction worker fatalities in Great Britain in 2023/24.

- Societal Pressure: Increased public awareness and media scrutiny amplify the demand for safer construction practices.

- Technological Impact: Innovations in safety technology are actively being adopted to improve site monitoring and risk assessment.

- Reputational Risk: Poor safety performance can lead to significant reputational damage and loss of business opportunities.

Societal expectations are increasingly prioritizing sustainable and eco-friendly construction practices. This is evident in a 2024 survey where over 70% of homebuyers considered a property's energy efficiency a key factor. Consequently, construction firms are integrating green building technologies and materials to meet this growing demand and enhance their brand image.

The global population is projected to reach 9.7 billion by 2050, with over 55% of people already living in urban areas. This urbanization trend fuels a constant demand for new infrastructure and housing, driving construction market growth, particularly in metropolitan centers. For instance, global construction spending in 2024 is expected to rise due to infrastructure upgrades and residential development in these expanding cities.

Worker safety remains a critical societal concern within the construction industry. In Great Britain, 39 construction worker fatalities were reported in 2023/24, highlighting the ongoing need for stringent safety measures. Advanced technologies are being adopted to improve site monitoring and risk assessment, as poor safety records can lead to significant reputational damage and business losses.

| Sociological Factor | 2024/2025 Data Point | Impact on Construction |

|---|---|---|

| Demand for Sustainability | 70% of homebuyers consider energy efficiency (2024 Survey) | Increased adoption of green building practices and materials. |

| Global Population Growth | Projected 9.7 billion by 2050 | Sustained demand for housing and infrastructure development. |

| Urbanization Rate | Over 55% of global population lives in urban areas | Focus on large-scale urban projects and infrastructure upgrades. |

| Worker Safety Concerns | 39 construction worker fatalities in GB (2023/24) | Emphasis on safety culture, technology integration, and regulatory compliance. |

Technological factors

Building Information Modeling (BIM) continues its rapid evolution, becoming indispensable for integrated design, engineering, and construction processes. Advanced BIM capabilities significantly improve project planning, foster seamless collaboration among stakeholders, and enable early clash detection, ultimately boosting efficiency across the entire project lifecycle.

For design-build firms, the adoption of BIM is not just about digital models; it's about creating a single source of truth that streamlines workflows. For instance, a 2024 Autodesk survey indicated that 70% of construction professionals reported improved project outcomes directly attributable to BIM implementation, highlighting its tangible impact on project delivery and cost savings.

Artificial intelligence and automation are rapidly transforming the construction industry. In 2024, AI is being integrated into everything from predictive analytics for project timelines to sophisticated robotic equipment for tasks like bricklaying and welding. This technological shift is significantly boosting productivity and driving down operational costs.

These advancements are not just about efficiency; they are also enhancing safety on job sites. AI-powered systems can monitor worker behavior and environmental conditions to predict and prevent accidents. For instance, autonomous drones are increasingly used for site surveying and progress monitoring, reducing the need for human personnel in hazardous areas, a trend expected to accelerate through 2025.

The optimization of resource allocation is another key benefit. AI algorithms can analyze vast datasets to manage materials, equipment, and labor more effectively, minimizing waste and downtime. This intelligent management, projected to see a 15% increase in adoption by construction firms by the end of 2025, directly contributes to improved project profitability and sustainability.

Modular and prefabricated construction is gaining significant traction, with the global modular construction market projected to reach $257.2 billion by 2027, growing at a CAGR of 7.1% from 2021. This trend involves manufacturing building components off-site in controlled factory environments, allowing for quicker assembly on location.

These methods significantly reduce construction waste, with estimates suggesting up to 90% less material waste compared to traditional on-site building. This efficiency, coupled with enhanced quality control due to factory settings, leads to faster project delivery and improved sustainability, aligning with increasing environmental regulations and corporate ESG (Environmental, Social, and Governance) goals.

Adoption of IoT and Data Analytics

The construction industry is seeing a significant uptick in the use of Internet of Things (IoT) devices on job sites. These devices are crucial for gathering real-time data, which is then analyzed to improve operations. For instance, sensors on equipment can monitor performance and predict potential failures, reducing downtime.

Leveraging big data, sourced from IoT sensors, drones, and project management software, is transforming decision-making. This analysis allows for better resource allocation and risk management. In 2024, it's estimated that the construction IoT market will reach over $10 billion globally, highlighting the growing reliance on these technologies for enhanced operational insights and predictive maintenance on complex projects.

- IoT Adoption Growth: The construction IoT market is projected to surpass $10 billion in 2024, indicating a strong trend towards data-driven site management.

- Predictive Maintenance Savings: Early adoption of IoT for equipment monitoring can reduce maintenance costs by an estimated 10-15% through proactive interventions.

- Enhanced Project Efficiency: Data analytics from IoT deployments are improving project timelines and budget adherence by providing real-time visibility into progress and potential bottlenecks.

New Materials and Construction Techniques

The construction industry is seeing a significant shift towards new materials and techniques aimed at sustainability and efficiency. For instance, the adoption of low-carbon concrete, which can reduce embodied carbon by up to 40% compared to traditional Portland cement, is gaining traction. This innovation is crucial for meeting global climate targets.

Recycled materials are also playing a larger role. In 2023, the global market for recycled construction materials was valued at approximately $45 billion, with projections indicating continued growth. These materials, like recycled steel and aggregate, not only divert waste from landfills but also often offer cost savings and reduced environmental impact.

Smart materials, capable of responding to environmental changes, are another area of rapid development. Examples include self-healing concrete and phase-change materials for improved thermal regulation. These advancements contribute to more resilient infrastructure and energy-efficient buildings, with the smart materials market expected to reach over $70 billion by 2028.

- Low-Carbon Concrete: Offers up to 40% reduction in embodied carbon.

- Recycled Materials Market: Valued at $45 billion in 2023, with strong growth anticipated.

- Smart Materials: Expected market value of over $70 billion by 2028, enhancing building performance.

Technological advancements are fundamentally reshaping construction, driving efficiency and sustainability. Building Information Modeling (BIM) is now a cornerstone for integrated project delivery, with 70% of construction professionals reporting improved outcomes in a 2024 survey. Artificial intelligence and automation are boosting productivity, with AI-powered robotics handling tasks like bricklaying, and predictive analytics optimizing project timelines.

The Internet of Things (IoT) is enabling real-time data collection for enhanced site management, contributing to the construction IoT market projected to exceed $10 billion in 2024. This data facilitates predictive maintenance, potentially cutting costs by 10-15%. Furthermore, the industry is embracing sustainable materials, with low-carbon concrete reducing embodied carbon by up to 40% and the recycled materials market valued at $45 billion in 2023.

| Technology | Key Impact | 2024/2025 Data/Projections |

| BIM | Integrated project delivery, improved outcomes | 70% of professionals report improved outcomes (2024 Autodesk survey) |

| AI & Automation | Increased productivity, predictive analytics | AI-driven robotics for tasks like bricklaying; predictive analytics for timelines |

| IoT | Real-time data, predictive maintenance | Construction IoT market >$10 billion (2024); 10-15% maintenance cost reduction |

| Sustainable Materials | Reduced carbon footprint, waste reduction | Low-carbon concrete: up to 40% less embodied carbon; Recycled materials market: $45 billion (2023) |

Legal factors

Building codes and safety regulations are constantly evolving, impacting construction and renovation projects. For instance, the International Building Code (IBC) is updated periodically, with the 2021 edition introducing new provisions for fire resistance and seismic design. Compliance with these national and local mandates, including fire safety regulations and structural integrity standards, is crucial. Failure to adhere to enhanced safety measures, such as mandated sprinkler system installations or specific material requirements, can lead to significant penalties and costly legal disputes, as seen in cases where non-compliance resulted in substantial fines for developers.

The legal landscape for environmental and green building standards is rapidly evolving, impacting construction and real estate development. Certifications like LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and the International Green Construction Code (IGCC) are becoming increasingly influential, with many jurisdictions incorporating their principles into building codes and zoning regulations. For instance, as of early 2024, cities like New York and Seattle have implemented stricter energy efficiency mandates for existing large buildings, directly influencing operational costs and renovation strategies.

Stricter environmental reporting requirements, such as those related to embodied carbon and lifecycle assessments, are now a significant consideration. In 2024, the U.S. Green Building Council reported a 15% increase in LEED project registrations compared to the previous year, signaling growing industry adoption. Furthermore, carbon emission limits and enhanced waste management regulations are reshaping how projects are designed and executed, often requiring developers to invest in sustainable materials and waste diversion strategies, which can add to initial project costs but potentially yield long-term savings and improved marketability.

Recent legal shifts in labor and employment significantly impact construction firms. For instance, updates to fair wage standards, such as potential increases in minimum wage laws in various states during 2024 and 2025, directly affect labor costs. Changes in worker protection regulations, like enhanced safety protocols or mandated benefits, can also increase operational expenses and require adjustments in workforce management, including contractor obligations.

Contract Law and Dispute Resolution

Contract law in the construction sector is increasingly focused on fostering greater transparency and fairness. Recent legislative changes, particularly in 2024 and early 2025, are introducing stricter guidelines for payment terms, aiming to prevent delayed payments to subcontractors and suppliers. For instance, some jurisdictions are implementing statutory payment timelines, where payments must be made within a specified number of days after receiving a valid invoice, with penalties for non-compliance.

Dispute resolution mechanisms are also undergoing significant evolution, with a growing emphasis on faster, more cost-effective methods like adjudication. This process allows for interim decisions on payment and other contractual disputes, keeping projects moving. In 2024, reports indicated a rise in the use of adjudication in the UK, with over 80% of disputes being resolved through this method, showcasing its growing importance in managing project agreements and mitigating risk.

- Enhanced Payment Security: New regulations in several countries are mandating shorter payment cycles and introducing penalties for late payments in construction contracts, aiming to improve cash flow for smaller firms.

- Mandatory Adjudication: The adoption of statutory adjudication as a primary dispute resolution method is becoming more common, providing a swift process for resolving payment and scope variation disputes.

- Increased Liability for Variations: Contractual clauses are being scrutinized to ensure clearer definitions and fairer processes for managing variations to the original scope of work, thereby clarifying liability.

Permitting and Entitlement Processes

Navigating the permitting and entitlement processes presents significant legal hurdles for development projects. Legislative shifts, such as extended permit expiration dates or new approval mandates, can substantially alter project schedules and viability. For instance, in 2024, several states introduced legislation to streamline housing development approvals, but these often come with new environmental review requirements, adding layers of complexity.

These legal frameworks are dynamic. Changes in zoning laws, environmental regulations, or building codes can introduce unforeseen costs and delays. For example, a proposed change to a local zoning ordinance in mid-2025 could require a developer to revise architectural plans, impacting a project's budget by an estimated 5-10% if significant redesign is needed.

- Legislative Changes: Laws impacting permit duration or approval criteria directly influence project timelines.

- Regulatory Compliance: Adherence to evolving environmental and building standards is critical.

- Impact on Feasibility: New requirements can increase project costs and extend development cycles.

- Legal Challenges: Potential litigation over permit denials or regulatory interpretations adds risk.

Legal frameworks surrounding construction are increasingly emphasizing timely payments and fair dispute resolution. New legislation in 2024 and 2025 is mandating shorter payment cycles for subcontractors and suppliers, with penalties for delays, aiming to improve cash flow. Adjudication is also gaining traction as a swift method for resolving contractual disputes, with reports indicating its widespread use in managing project agreements and mitigating risk.

| Legal Factor | Impact on Construction | 2024/2025 Trend/Data |

|---|---|---|

| Payment Security | Improved cash flow for subcontractors and suppliers | Mandated shorter payment cycles; penalties for late payments |

| Dispute Resolution | Faster, more cost-effective conflict management | Increased use of adjudication; over 80% of disputes resolved this way in some regions |

| Contractual Clarity | Reduced ambiguity in project scope and liability | Scrutiny of clauses for variations and fair processes |

Environmental factors

The construction industry is facing growing pressure to build structures that can withstand the intensifying effects of climate change, such as more frequent and severe storms, floods, and heatwaves. This means a shift towards designing for resilience.

Regulations are evolving to mandate more robust building standards. For instance, updated building codes in many regions now require higher wind load resistance and improved floodproofing measures. Client demand is also a significant driver, with many organizations and individuals seeking properties that offer greater long-term security and lower insurance premiums in the face of climate risks.

This push for resilience translates into the adoption of advanced design techniques and materials. Architects and engineers are increasingly specifying materials with enhanced durability and incorporating features like elevated foundations, reinforced structures, and advanced drainage systems. The global market for green building materials, which often contribute to resilience, was projected to reach over $500 billion by 2025, indicating a substantial investment in these solutions.

The construction sector is increasingly prioritizing waste reduction and circular economy models, driven by stricter regulations and industry demand for sustainability. Practices such as reusing salvaged materials, recycling construction and demolition debris, and designing buildings for easier disassembly are becoming standard for environmental compliance.

For instance, the European Union's Construction and Demolition Waste Directive aims to improve waste management, with member states targeting recycling rates of at least 70% of non-hazardous construction and demolition waste by 2020. By 2025, the UK government is aiming for a 65% recycling rate for construction and demolition waste, a significant increase from previous years.

The construction industry is increasingly focused on energy efficiency and reducing its carbon footprint. Mandates for nearly Zero Energy Buildings (nZEB) and Zero Emissions Buildings (ZEB) are becoming more common globally. For instance, the European Union's Energy Performance of Buildings Directive aims for all new buildings to be nZEB by 2020, with a focus on existing buildings being renovated to similar standards.

This shift necessitates the integration of renewable energy solutions like solar panels and advanced insulation materials. Carbon accounting tools are also gaining traction, allowing companies to measure and manage their environmental impact throughout the building lifecycle. In 2023, the global green building materials market was valued at over $250 billion, demonstrating significant investment in these areas.

Sustainable Materials and Sourcing

The construction sector is seeing a significant surge in demand for sustainable, eco-friendly, and locally sourced materials. This trend is driven by both consumer preference and increasingly stringent environmental regulations. For instance, the UK government's Net Zero Strategy aims to reduce emissions from buildings, influencing material choices towards those with lower embodied carbon.

Procurement and design decisions are now heavily influenced by the embodied carbon footprint of materials, the percentage of recycled content, and the transparency of supply chains. Companies are actively seeking materials that minimize environmental impact throughout their lifecycle. The global market for green building materials was valued at approximately $256.5 billion in 2022 and is projected to reach $576.7 billion by 2030, indicating strong growth in this segment.

- Embodied Carbon Focus: A growing number of projects prioritize materials like sustainably harvested timber and low-carbon concrete alternatives to reduce their carbon footprint.

- Recycled Content Mandates: Regulations are increasingly encouraging or mandating the use of recycled materials, such as recycled steel and aggregate, in construction projects.

- Supply Chain Scrutiny: Buyers are demanding greater transparency regarding the origin and ethical sourcing of materials, favoring suppliers with robust sustainability credentials.

- Local Sourcing Benefits: Sourcing materials locally reduces transportation emissions and supports regional economies, aligning with broader sustainability goals.

Biodiversity and Land Use Impact

Environmental factors significantly influence the construction and real estate sectors, particularly concerning biodiversity and land use. Regulations and growing societal pressure are increasingly demanding that new projects minimize ecological disruption. This means careful consideration of habitat protection and the integration of biodiversity into architectural design itself.

This push is leading to the adoption of green infrastructure. Think of features like green roofs and urban gardens, which not only enhance aesthetics but also contribute to local ecosystems. For instance, by 2024, cities like Singapore have seen a significant increase in green building certifications, with many projects incorporating extensive vertical gardens and rooftop farms, demonstrating a tangible commitment to biodiversity.

The financial implications are also substantial. Companies are investing in sustainable land management practices and biodiversity offsetting programs. For example, in the UK, new housing developments are often required to demonstrate a net gain in biodiversity, which can involve creating new habitats or contributing to conservation funds. This trend is expected to continue, with projections indicating a growing market for ecological consultancy and green infrastructure solutions throughout 2024 and 2025.

Key considerations for businesses include:

- Compliance with evolving land use regulations and habitat protection laws.

- Investment in green infrastructure to meet sustainability targets and enhance project value.

- Opportunities in ecological consulting and biodiversity offsetting services.

- Managing reputational risk associated with environmental impact.

Environmental considerations are reshaping the construction industry, pushing for greater resilience against climate change impacts like extreme weather events. This translates into updated building codes and a growing demand for durable, climate-resistant structures. The market for green building materials, a key component of resilience, was valued at over $250 billion in 2023, highlighting significant investment in sustainable solutions.

The sector is also heavily focused on reducing waste and carbon emissions, with an increasing emphasis on circular economy principles and energy-efficient designs. Mandates for nearly Zero Energy Buildings are becoming more prevalent globally, driving the adoption of renewable energy sources and advanced insulation. The UK government's Net Zero Strategy, for instance, directly influences material choices towards those with lower embodied carbon.

Biodiversity and land use are also critical environmental factors, with regulations and public pressure encouraging minimized ecological disruption. This has led to the rise of green infrastructure, such as green roofs and vertical gardens, which enhance local ecosystems. For example, new housing developments in the UK are often required to demonstrate a net gain in biodiversity, spurring investment in ecological consulting and conservation efforts.

| Environmental Factor | Trend | Impact on Construction | Data Point (2023/2024) |

|---|---|---|---|

| Climate Resilience | Increasing | Demand for climate-resistant designs and materials | Green building materials market valued over $250 billion |

| Waste Reduction & Emissions | Increasing | Focus on circular economy, energy efficiency, nZEB mandates | EU aims for nZEB standards in new buildings |

| Biodiversity & Land Use | Increasing | Minimizing ecological disruption, green infrastructure adoption | UK housing developments require net biodiversity gain |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government statistics, reputable financial institutions, and comprehensive industry research. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable and current data.