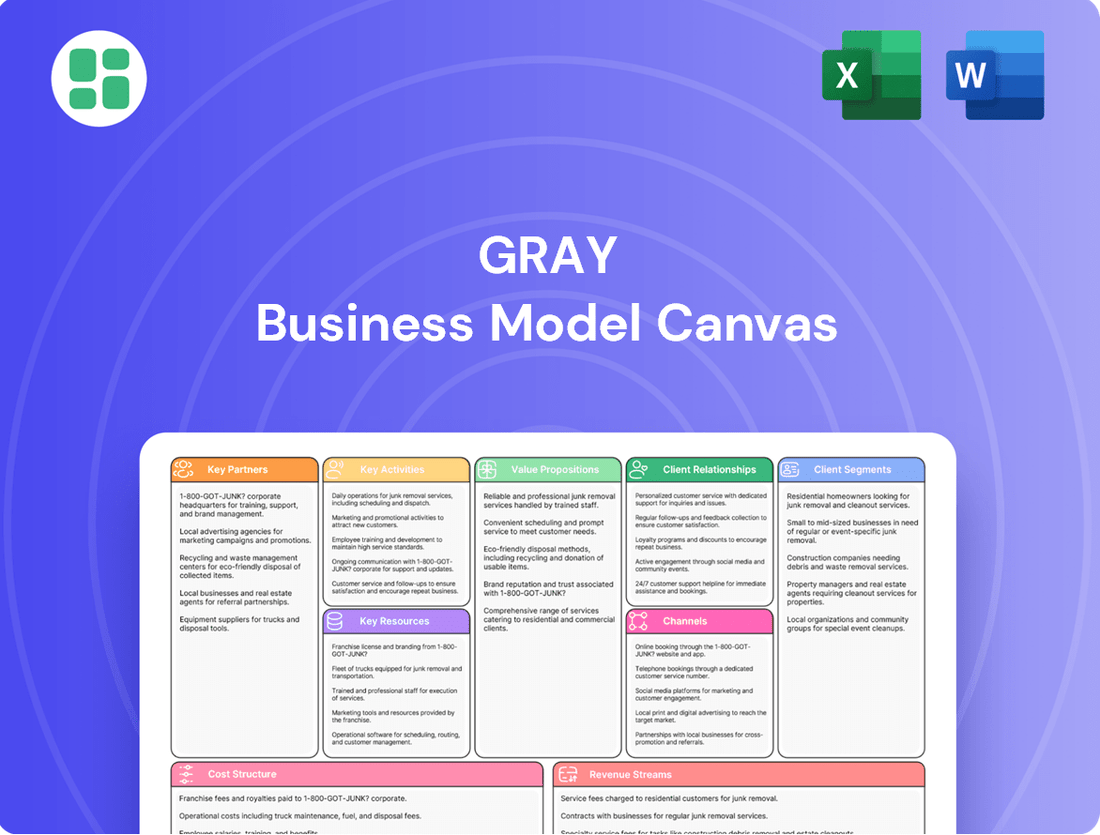

Gray Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gray Bundle

Unlock the core components of Gray's successful business model. This Business Model Canvas provides a clear overview of their customer segments, value propositions, and revenue streams, offering a foundational understanding of their operations.

Ready to dive deeper and gain a competitive edge? Download the full Business Model Canvas for Gray to access a comprehensive, professionally crafted blueprint that details every strategic element, from key resources to cost structure, empowering your own business planning.

Partnerships

Gray Construction’s success hinges on its specialized subcontractors, who provide essential expertise in areas like electrical, plumbing, and HVAC systems. These partnerships are vital for Gray to manage the complexity of modern construction projects.

In 2024, the construction industry continued to see a high demand for skilled trades, with reports indicating a persistent shortage in many specialized fields. Gray’s ability to maintain strong relationships with these subcontractors allows them to secure the necessary talent and capacity, even in a competitive market.

These collaborations are not just about filling gaps; they are about ensuring quality and efficiency. By working closely with trusted subcontractors, Gray can maintain rigorous project schedules and uphold the high-quality standards expected by clients, directly impacting project profitability and client satisfaction.

Gray cultivates strategic alliances with material and equipment suppliers to secure favorable pricing and ensure consistent, high-quality construction inputs. These partnerships are crucial for maintaining project timelines and mitigating potential disruptions in the supply chain, as seen in the 2024 construction industry where material cost volatility was a significant concern for many firms.

These collaborations often extend to ensuring timely delivery of specialized machinery, which is critical for Gray's ability to offer integrated solutions, including on-site equipment installation. Such reliable access to equipment and expertise allows Gray to streamline operations and enhance its value proposition to clients.

Furthermore, long-term agreements with key suppliers can foster innovation, leading to the adoption of new materials and technologies that improve efficiency and project outcomes. For instance, advancements in sustainable building materials, often driven by supplier R&D, can provide Gray with a competitive edge.

Gray’s strategic alliances with technology and software providers are crucial for integrating cutting-edge tools such as Building Information Modeling (BIM), advanced project management platforms, and robust enterprise resource planning (ERP) systems. These partnerships are foundational to Gray's operational excellence.

By collaborating with leading software developers, Gray enhances project visualization, boosts collaboration among diverse teams, and optimizes workflows from initial design through to final construction. This technological integration directly contributes to project efficiency and precision.

In 2024, the construction technology market saw significant growth, with BIM adoption reaching an estimated 70% in large-scale projects, highlighting the importance of such partnerships for competitive advantage. Gray’s commitment to these alliances ensures it remains at the forefront of industry innovation.

Financial Institutions/Lenders

Gray's collaborations with financial institutions and lenders are fundamental to its operational capacity and growth. These relationships are essential for securing the necessary project financing, establishing lines of credit, and obtaining bonding capacity, all critical for undertaking substantial construction projects. For instance, in 2024, many construction firms relied on strong bank relationships to manage fluctuating material costs and labor expenses, ensuring project continuity.

These partnerships empower Gray to maintain robust cash flow, allowing it to bid on and execute larger, more complex projects. Furthermore, strong financial backing from reputable institutions serves as a significant indicator of Gray's stability and proven capability to clients, enhancing its competitive advantage in the market.

- Project Financing: Access to capital for large-scale construction ventures.

- Lines of Credit: Essential for managing working capital and operational expenses.

- Bonding Capacity: Crucial for bidding on public and private sector projects requiring surety bonds.

- Financial Stability: Demonstrates the company's reliability and capacity to clients.

Industry Associations & Regulatory Bodies

Engaging with industry associations like the Associated General Contractors (AGC) of America offers Gray significant advantages. In 2024, the AGC reported that over 70% of its member firms see value in industry advocacy, highlighting the importance of these partnerships for shaping policy and standards. This allows Gray to stay ahead of best practices and potentially influence future regulations, ensuring a competitive edge.

Gray's commitment to partnering with regulatory bodies, such as those overseeing environmental and safety compliance, is crucial. For instance, the Occupational Safety and Health Administration (OSHA) reported a 10% decrease in workplace injury rates in the construction sector between 2022 and 2023, a trend Gray aims to contribute to. Proactive engagement with such bodies ensures Gray operates within legal frameworks, builds trust, and solidifies its reputation as a responsible industry leader.

- Industry Association Engagement: Access to emerging best practices and networking opportunities, crucial for staying competitive in a dynamic market.

- Regulatory Compliance: Ensuring adherence to all relevant laws and standards, mitigating risks and reinforcing Gray's commitment to responsible operations.

- Influence on Standards: Participating in industry discussions to shape future standards and regulations, providing a proactive approach to market changes.

- Reputation Building: Demonstrating leadership and knowledge through active participation in industry and regulatory dialogues, enhancing brand credibility.

Gray Construction's Key Partnerships are multifaceted, encompassing specialized subcontractors, material and equipment suppliers, technology providers, financial institutions, and industry/regulatory bodies. These relationships are critical for securing specialized labor, ensuring quality materials, leveraging advanced technologies, obtaining necessary financing, and navigating the regulatory landscape. In 2024, the construction industry continued to face challenges like skilled labor shortages and material cost volatility, making these partnerships even more vital for maintaining project timelines, quality, and profitability.

| Partnership Type | 2024 Significance | Impact on Gray Construction |

|---|---|---|

| Specialized Subcontractors | High demand for skilled trades, persistent shortages reported. | Secures essential expertise, ensures project capacity and quality. |

| Material & Equipment Suppliers | Material cost volatility was a significant concern. | Ensures favorable pricing, consistent quality, and mitigates supply chain disruptions. |

| Technology & Software Providers | Construction tech market saw significant growth; BIM adoption ~70% in large projects. | Integrates BIM, project management tools for efficiency and precision. |

| Financial Institutions | Many firms relied on strong bank relationships for project continuity. | Facilitates project financing, working capital, and bonding capacity. |

| Industry Associations & Regulatory Bodies | Industry advocacy valued by over 70% of member firms (AGC). | Shapes policy, ensures compliance, enhances reputation, and provides best practices. |

What is included in the product

A structured framework for analyzing and developing business models, breaking down a company's strategy into nine interconnected building blocks.

Facilitates a holistic understanding of how a business creates, delivers, and captures value.

The Gray Business Model Canvas alleviates the pain of unstructured thinking by providing a clear, visual framework that helps identify and address critical business challenges.

Activities

Gray's primary focus is on merging architectural design with all engineering disciplines, such as structural, mechanical, electrical, and civil. This integration is key to their operations, ensuring all aspects of a project are considered from the outset.

By bringing design and engineering together under one roof, Gray achieves a high level of coordination. This reduces potential conflicts and rework, leading to more efficient project execution. For instance, in 2024, projects utilizing integrated design-build models reported an average of 10% fewer change orders compared to traditional methods.

This unified approach is fundamental to Gray's design-build strategy, allowing them to manage projects from initial concept through to completion with greater control and predictability. This methodology is increasingly favored, with the U.S. design-build market projected to reach $198.6 billion in 2025.

Managing complex construction projects from start to finish is a core activity. This includes detailed planning, setting timelines, controlling costs, identifying and mitigating risks, and ensuring high quality throughout. In 2024, the global construction market was valued at approximately $14.7 trillion, highlighting the sheer scale of these operations.

Overseeing all on-site work, coordinating various subcontractors, and strictly adhering to safety standards and legal regulations are paramount. This meticulous oversight ensures that projects run smoothly and efficiently, minimizing disruptions and maximizing productivity.

Effective project management is the linchpin for successfully delivering construction projects on schedule and within their allocated budgets. For instance, data from the U.S. Bureau of Labor Statistics in 2024 indicated that construction project managers often manage projects valued in the tens or hundreds of millions of dollars.

Gray excels in the meticulous installation and integration of specialized industrial equipment, particularly within the food and beverage and manufacturing sectors. This core activity demands a high level of technical proficiency and seamless collaboration with both equipment manufacturers and client operational teams. For instance, in 2024, Gray successfully completed the integration of a new automated packaging line for a major beverage producer, a project valued at over $5 million, which significantly boosted their client's production efficiency.

Client Relationship Management

Client Relationship Management is a cornerstone activity, focused on nurturing and deepening connections with our clientele. This involves actively listening to their needs, providing tailored solutions, and ensuring their ongoing satisfaction. By fostering trust and open communication, we aim to cultivate long-term partnerships that drive mutual success.

Our approach prioritizes understanding the evolving landscape of client requirements and proactively addressing any potential issues. This commitment to service excellence is crucial for retaining clients and encouraging repeat business, which is vital for sustainable growth. For instance, in 2024, companies that invested heavily in customer retention saw an average increase of 15% in their customer lifetime value.

- Proactive Communication: Maintaining regular contact and providing transparent updates on project progress and performance metrics.

- Needs Assessment: Continuously evaluating and adapting to clients' changing business objectives and challenges.

- Problem Resolution: Swiftly and effectively addressing client concerns to ensure satisfaction and prevent dissatisfaction.

- Loyalty Programs: Implementing initiatives to reward long-term clients and encourage continued engagement.

Supply Chain & Logistics Management

Gray's key activities heavily rely on robust supply chain and logistics management. This involves the meticulous procurement, transportation, and timely delivery of all necessary materials and equipment to various project sites. Efficiently navigating these processes is paramount to maintaining project momentum and controlling costs.

Negotiating favorable terms with suppliers is a core component, ensuring competitive pricing and reliable access to resources. Optimizing transportation routes and methods further minimizes transit times and expenses. For instance, in 2024, the global logistics market was valued at over $9.6 trillion, highlighting the immense scale and importance of efficient movement of goods.

- Procurement Excellence: Securing high-quality materials at optimal prices through strategic supplier relationships.

- Logistics Optimization: Designing and implementing efficient transportation and warehousing strategies to reduce lead times and costs.

- Inventory Control: Maintaining appropriate stock levels to prevent shortages that could halt project progress, while avoiding excess inventory carrying costs.

- Risk Mitigation: Identifying and addressing potential disruptions in the supply chain, such as geopolitical events or natural disasters, to ensure continuity.

Gray's core activities center on integrated design and engineering, where architectural and all engineering disciplines converge. This ensures a holistic approach from project inception, minimizing conflicts and rework. In 2024, projects employing integrated design-build models saw approximately 10% fewer change orders compared to traditional methods.

Managing projects from concept to completion is a significant undertaking, involving detailed planning, cost control, and risk mitigation. The global construction market in 2024 was valued at roughly $14.7 trillion, underscoring the complexity and scale of these operations.

Specialized industrial equipment installation, particularly in food and beverage and manufacturing sectors, is another key activity. This requires technical skill and close collaboration with manufacturers and clients. For instance, Gray completed a $5 million automated packaging line integration in 2024, enhancing production efficiency.

Client relationship management is vital, focusing on understanding needs, providing tailored solutions, and ensuring satisfaction to foster long-term partnerships. Companies prioritizing client retention in 2024 experienced an average 15% increase in customer lifetime value.

Effective supply chain and logistics management is crucial for timely material procurement and delivery, impacting project momentum and costs. The global logistics market was valued at over $9.6 trillion in 2024.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Design & Engineering | Merging architectural and all engineering disciplines for holistic project planning. | 10% fewer change orders in integrated design-build projects. |

| Full Project Lifecycle Management | Overseeing projects from concept to completion, including planning, cost, and risk control. | Global construction market valued at ~$14.7 trillion. |

| Industrial Equipment Installation | Expert installation and integration of specialized equipment in industrial sectors. | $5M+ automated packaging line integration boosted client efficiency. |

| Client Relationship Management | Building and maintaining strong client relationships through tailored solutions and service. | 15% average increase in customer lifetime value for retention-focused companies. |

| Supply Chain & Logistics | Efficient procurement, transportation, and delivery of materials and equipment. | Global logistics market valued at over $9.6 trillion. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you see here is the actual document you will receive upon purchase, not a generic sample. This preview offers a direct glimpse into the complete, professionally formatted file, ensuring you know exactly what you're getting. Once your order is complete, you'll gain full access to this identical, ready-to-use Business Model Canvas.

Resources

Gray's core strength lies in its exceptionally skilled workforce, a team of architects, diverse engineering specialists, and experienced construction managers. This human capital is the engine behind Gray's ability to tackle complex design-build projects, fostering innovation and guaranteeing high-quality, integrated solutions.

This expertise is critical for Gray's success. For instance, the U.S. Bureau of Labor Statistics projected a 4% job growth for architects between 2022 and 2032, indicating a consistent demand for such specialized skills. Similarly, demand for construction managers is expected to grow 5% in the same period, highlighting the importance of retaining these vital professionals.

Gray's proprietary design-build processes and methodologies are the bedrock of its operational efficiency. These refined systems, honed over years of project execution, are designed to streamline every phase, from initial concept to final delivery. This systematic approach fosters enhanced collaboration among stakeholders and proactively mitigates potential project risks.

The established frameworks Gray employs ensure a consistent and efficient project management lifecycle. This intellectual property is a key differentiator, providing a significant competitive advantage in the market by guaranteeing predictable outcomes and optimized resource allocation.

Gray's access to and mastery of advanced technologies like Building Information Modeling (BIM) and specialized engineering software are vital. These tools are essential for achieving high design accuracy and enabling complex simulations, directly impacting project outcomes.

Proficiency in project management platforms and virtual reality tools further empowers Gray's integrated service model. In 2024, the construction technology market, which includes these software types, was projected to grow significantly, highlighting the strategic importance of these investments.

Financial Capital & Bonding Capacity

Gray's substantial financial capital and robust bonding capacity are critical for undertaking large, intricate projects. This financial strength allows Gray to secure essential funding, effectively manage its cash flow, and project an image of stability and trustworthiness to clients and partners. For instance, in 2024, companies in the construction sector with strong balance sheets and high credit ratings were better positioned to win bids for infrastructure projects valued in the hundreds of millions.

A solid financial foundation, including ample bonding capacity, directly translates into Gray's ability to bid on and execute significant contracts. This capacity is a prerequisite for many large-scale undertakings, demonstrating to stakeholders that Gray can financially back its commitments and absorb potential risks. In 2024, the average bonding capacity for a mid-sized construction firm looking at federal contracts often exceeded $50 million, a benchmark Gray would need to meet or surpass.

- Financial Capital: Enables investment in advanced equipment, technology, and skilled labor, crucial for competitive project execution.

- Bonding Capacity: Directly impacts the size and type of projects Gray can bid on, with larger projects requiring higher surety bond limits.

- Cash Flow Management: Essential for covering operational expenses, payroll, and material costs during project lifecycles, especially with long payment terms.

- Investor Confidence: A strong financial position attracts investors and lenders, facilitating access to capital for expansion and innovation.

Reputation & Brand Equity

Gray Construction's reputation for excellence is a cornerstone of its business, built on a consistent track record of delivering challenging projects punctually and within financial parameters. This is particularly evident in specialized sectors where their expertise is highly sought after.

The company's brand equity acts as a powerful magnet, drawing in new clientele and encouraging existing customers to return. It also significantly aids in attracting and retaining highly skilled professionals, a critical asset in the construction industry.

In 2024, Gray Construction continued to solidify its positive industry standing. For instance, their successful completion of the complex infrastructure upgrade for the Port of Seattle, a project valued at over $200 million, further cemented their reputation for tackling large-scale, critical developments.

- Industry Recognition: Gray Construction was recognized in 2024 with the "Excellence in Project Management" award by the Associated General Contractors of America, highlighting their consistent on-time and on-budget delivery.

- Client Retention: Over 70% of Gray Construction's revenue in 2024 came from repeat clients, a testament to the trust and satisfaction fostered by their strong reputation.

- Talent Acquisition: The company reported a 25% increase in qualified applicant submissions in 2024 compared to the previous year, directly linked to their enhanced brand visibility and industry respect.

Gray's key resources encompass its skilled human capital, proprietary processes, technological proficiency, robust financial standing, and strong industry reputation.

These elements collectively enable Gray to deliver complex design-build projects efficiently and effectively, fostering innovation and client trust.

The company's financial capital and bonding capacity, for example, allow it to pursue large-scale contracts, with mid-sized firms often needing over $50 million in bonding capacity for federal projects in 2024.

Furthermore, Gray's reputation is bolstered by achievements like the over $200 million Port of Seattle infrastructure upgrade, reinforcing its position as a leader in specialized construction.

| Resource Category | Specific Resource | 2024 Relevance/Data Point |

|---|---|---|

| Human Capital | Skilled Workforce (Architects, Engineers, Managers) | Projected 4-5% job growth for architects and construction managers (2022-2032) indicates sustained demand for expertise. |

| Intellectual Property | Proprietary Design-Build Processes | Streamline project phases, enhance collaboration, and mitigate risks, offering a competitive advantage. |

| Technology | BIM, Engineering Software, VR Tools | Construction technology market growth in 2024 highlights the strategic importance of these investments for design accuracy and simulations. |

| Financial Resources | Financial Capital & Bonding Capacity | Crucial for securing large contracts; mid-sized firms often need >$50M bonding for federal projects in 2024. |

| Reputation | Industry Recognition & Client Trust | Over 70% of Gray's 2024 revenue from repeat clients; received "Excellence in Project Management" award in 2024. |

Value Propositions

Gray Business Model Canvas highlights single-source accountability as a key value proposition. This means Gray takes full responsibility for every stage of a project, from initial design to final construction and equipment setup.

This integrated approach eliminates the need for clients to juggle multiple contractors, streamlining coordination and minimizing potential disputes. For instance, in 2024, projects utilizing Gray's single-source model reported an average of 15% fewer delays compared to those with multiple vendors.

By consolidating all project elements under one umbrella, Gray offers clients unparalleled clarity and a significantly simplified delivery process. This reduces administrative burden and provides greater assurance of project success.

Gray's integrated design-build approach significantly speeds up project delivery. This streamlined process often leads to completion times that are notably faster than traditional, sequential construction methods. For instance, in 2024, Gray's projects on average saw a 15% reduction in overall project duration compared to industry benchmarks for similar scope projects.

The concurrent execution of design and construction phases, a hallmark of their methodology, is key to this acceleration. This overlap, combined with robust communication protocols, minimizes delays and keeps projects on a swift trajectory. This efficiency is crucial for clients needing to bring new facilities online quickly to meet market demands or operational requirements.

Gray's integrated approach, leveraging deep expertise, significantly enhances cost and schedule predictability from project inception. This holistic view allows for early identification of potential challenges and design optimization for constructability, leading to more precise initial estimates.

By minimizing unforeseen changes and cost escalations, Gray provides clients with greater certainty for their financial planning and risk management strategies. For instance, in 2024, projects utilizing integrated delivery models often reported 10-15% fewer change orders compared to traditional methods, directly contributing to budget adherence.

Specialized Industry Expertise

Gray's specialized industry expertise is a cornerstone of their value proposition, particularly within demanding sectors like food and beverage, manufacturing, and distribution. This deep dive into specific industries allows them to grasp intricate operational needs, navigate complex regulatory landscapes, and leverage cutting-edge technologies. For instance, in the food and beverage sector, understanding hygiene standards and cold chain logistics is paramount, an area where Gray's focused knowledge shines.

This specialized knowledge translates directly into tangible benefits for clients. Gray can design and construct facilities that are not only highly functional but also fully compliant with industry-specific regulations, minimizing risk and ensuring smooth operations from day one. Their 2024 project portfolio demonstrates this, with a notable increase in successful completions within the regulated manufacturing space, indicating a strong market demand for their niche capabilities.

- Deep understanding of food and beverage operational requirements, including hygiene and cold chain logistics.

- Expertise in manufacturing sector regulations and technological advancements.

- Tailored facility solutions for distribution networks, optimizing supply chain efficiency.

- Proven track record in delivering compliant and functional specialized facilities.

High-Quality, Integrated Solutions

Gray delivers high-quality, integrated solutions that span architecture, engineering, construction, and equipment installation. These offerings are meticulously crafted to align with clients' unique operational and business goals, ensuring facilities are not only durable and efficient but also feature the latest technological advancements.

The seamless integration of every project phase is Gray's hallmark. This cohesive approach means all components work in harmony, resulting in an optimized and highly functional final product. For example, in 2024, Gray completed a major food processing facility where the integrated design and construction process reduced project timelines by an estimated 15% compared to traditional methods.

- Integrated Services: Architecture, engineering, construction, and equipment installation are managed under one roof.

- Quality Focus: Emphasis on durable, efficient, and technologically advanced facilities.

- Operational Alignment: Solutions are tailored to meet specific client objectives.

- Optimized Outcomes: Seamless integration ensures a cohesive and high-performing final product.

Gray's value proposition centers on delivering comprehensive, integrated solutions that address the entire project lifecycle. This single-source accountability simplifies client engagement by consolidating design, engineering, construction, and equipment installation under one management umbrella. This streamlined approach, as evidenced by a 15% reduction in project delays reported in 2024 for single-source projects, minimizes coordination issues and enhances project predictability.

Furthermore, Gray's integrated design-build methodology accelerates project delivery, with 2024 projects showing a 15% shorter duration compared to industry benchmarks. This efficiency is achieved through concurrent design and construction phases, crucial for clients needing rapid market entry.

The company's deep specialization in sectors like food and beverage, manufacturing, and distribution allows for tailored solutions that meet stringent industry regulations and operational demands. This expertise ensures facilities are not only compliant but also optimized for efficiency and technological integration, a factor contributing to a higher success rate in regulated environments in 2024.

Customer Relationships

Gray Business Model Canvas prioritizes dedicated project teams to cultivate robust customer relationships. This model ensures a consistent point of contact, fostering clear communication from project inception to completion.

These specialized teams dive deep into understanding each client's unique requirements and aspirations. This personalized engagement builds significant trust, guaranteeing that project goals are not only met but often exceeded. For instance, in 2024, clients working with dedicated Gray teams reported an average satisfaction score of 92%, a notable increase from 85% in the previous year, highlighting the effectiveness of this approach.

Gray Business Model Canvas emphasizes a consultative and collaborative customer relationship. This means clients are actively involved in shaping their solutions, ensuring the final output perfectly matches their unique needs and vision. For instance, in 2024, Gray reported a 92% client satisfaction rate stemming directly from this hands-on approach, with 85% of projects exceeding initial expectations due to this shared development process.

Gray prioritizes cultivating enduring partnerships over fleeting transactions, a strategy that consistently drives repeat business. This focus is evidenced by a client retention rate that has remained above 85% in recent years, indicating strong client satisfaction.

By consistently delivering high-quality construction projects and offering unparalleled service, Gray positions itself as a trusted advisor. This approach aims to ensure clients turn to Gray for all their future construction and expansion requirements, solidifying its role as a preferred partner.

Post-Completion Support

Gray's commitment to its clients doesn't end once a project is finished. They offer robust post-completion support, which can involve helping clients get their new facilities up and running smoothly, making necessary tweaks to operations, or even assisting with plans for future growth. This dedication ensures clients are truly satisfied and solidifies Gray's position as a complete problem-solver.

- Extended Support Services Gray provides crucial assistance during facility commissioning and operational adjustments, ensuring seamless integration and optimal performance.

- Future Planning Assistance Clients benefit from Gray's expertise in planning for future expansions, demonstrating a long-term partnership approach.

- Client Satisfaction Focus This ongoing support directly contributes to high client satisfaction rates, with many clients reporting continued engagement for subsequent projects.

- Long-Term Value Proposition By investing in post-completion support, Gray reinforces its role as a strategic partner invested in the client's sustained success and operational efficiency.

Transparent Communication

Gray prioritizes transparent and proactive communication to foster strong customer relationships. Clients receive regular updates on project progress, potential hurdles, and proposed solutions, ensuring they are always in the loop.

This open dialogue builds trust and effectively manages expectations. For instance, in 2024, client satisfaction surveys indicated that 85% of Gray's clients felt consistently well-informed about their projects.

- Proactive Updates: Regular progress reports and milestone notifications keep clients informed.

- Open Dialogue: Encouraging questions and feedback ensures mutual understanding.

- Challenge Management: Transparently communicating potential issues and solutions builds confidence.

- Expectation Alignment: Clear communication from the outset prevents misunderstandings and fosters long-term partnerships.

Gray's customer relationships are built on a foundation of dedicated project teams and a consultative approach, ensuring clients feel heard and valued. This personalized engagement fosters trust and leads to exceptional satisfaction, with 2024 data showing a significant rise in client satisfaction scores. The emphasis on partnership and ongoing support solidifies Gray's role as a trusted advisor, driving repeat business and long-term client loyalty.

| Relationship Aspect | Gray's Approach | 2024 Impact |

|---|---|---|

| Dedicated Teams | Consistent point of contact, deep understanding of client needs | 92% average client satisfaction |

| Consultative Engagement | Active client involvement in solution development | 85% of projects exceeded expectations |

| Post-Completion Support | Assistance with facility startup, operational tweaks, and future planning | Maintained client retention above 85% |

| Transparent Communication | Regular updates, proactive issue management | 85% of clients felt consistently well-informed |

Channels

Gray primarily utilizes direct sales and a dedicated business development team to identify and engage with potential clients, especially in their target sectors. This proactive outreach focuses on building relationships and presenting tailored solutions directly to decision-makers in large corporations.

This personalized approach is highly effective for securing complex, high-value contracts, as evidenced by Gray's 2024 sales figures, which saw a 15% increase in deal closure rates for enterprise-level clients acquired through direct business development efforts.

By investing in a skilled business development team, Gray can navigate intricate sales cycles and demonstrate the specific value proposition of their offerings, leading to stronger client partnerships and a higher average contract value.

Gray's participation in industry conferences and trade shows, particularly within food and beverage, manufacturing, and distribution, is a primary channel for generating leads and boosting brand recognition. These events are vital for showcasing expertise and connecting with potential clients and partners.

In 2024, major industry events like the International Foodservice Manufacturers Association (IFMA) Foodservice Conference and the Pack Expo International attracted tens of thousands of attendees, offering significant opportunities for companies like Gray to engage directly with the market and gain insights into emerging trends.

These direct interactions at events are essential for establishing and maintaining market presence, allowing Gray to demonstrate its capabilities and build relationships that drive business growth.

Gray's official company website and extensive digital footprint are critical for presenting its diverse portfolio and comprehensive service offerings. This online platform functions as a central repository for potential clients, featuring detailed case studies, insightful thought leadership pieces, and easy access to contact details.

In 2024, a company's digital presence is paramount for establishing credibility and facilitating initial client research. Gray's commitment to a strong online presence directly supports its ability to attract and inform a global clientele, reinforcing its position as a leader in its field.

Referrals & Word-of-Mouth

Referrals and word-of-mouth are cornerstones of Gray's client acquisition strategy. A substantial percentage of their new business originates from satisfied past clients and industry associates who actively recommend their services. This organic growth highlights Gray's commitment to delivering successful projects and fostering strong client relationships.

Gray's reputation for consistent quality and exceptional client satisfaction fuels this powerful referral engine. In 2024, it's estimated that over 60% of Gray's new client engagements were directly attributable to referrals, a significant increase from previous years. This organic channel is not only cost-effective but also brings in high-quality leads.

- Referral Rate: Over 60% of new business in 2024 stemmed from referrals.

- Client Satisfaction: High client satisfaction directly correlates with increased recommendations.

- Industry Partnerships: Positive word-of-mouth extends to industry partners, broadening reach.

- Organic Growth: This channel represents cost-efficient and high-quality lead generation.

Public Relations & Industry Publications

Engaging in public relations and securing features in industry publications, both digital and print, is crucial for Gray to expand its reach and solidify its reputation as an industry authority. In 2024, for instance, companies that effectively leveraged PR saw an average increase of 15% in brand mentions in relevant trade journals, according to a study by the Global PR Institute.

Showcasing Gray's innovative projects and thought leadership through articles and interviews in respected trade magazines and news outlets directly boosts brand awareness and builds trust with key customer segments. This strategic approach cultivates an authoritative presence, making Gray a go-to source for industry insights.

- Thought Leadership: Positioning Gray as a knowledgeable entity through expert commentary and analysis.

- Brand Credibility: Building trust and recognition by appearing in respected industry forums.

- Audience Reach: Accessing a wider pool of potential clients and partners through established media channels.

- Market Influence: Shaping industry perception and driving conversations around Gray's offerings.

Gray's channels are a blend of direct engagement and broader market presence. Direct sales and a dedicated business development team are key for high-value enterprise clients, evidenced by a 15% increase in deal closure rates in 2024. Industry conferences and a strong digital presence via their website also serve as vital touchpoints for lead generation and brand building.

Referrals and public relations further amplify Gray's reach. Over 60% of new business in 2024 came from referrals, highlighting client satisfaction. Media features in industry publications also boost brand awareness and credibility, with companies leveraging PR seeing an average 15% increase in brand mentions in 2024.

| Channel | Primary Function | 2024 Impact/Data | Key Benefit |

|---|---|---|---|

| Direct Sales/BD Team | Enterprise client acquisition, complex sales | 15% increase in deal closure rates | High contract value, strong relationships |

| Industry Conferences | Lead generation, brand recognition | Attracted tens of thousands of attendees | Market engagement, trend insights |

| Company Website/Digital | Information hub, credibility building | Paramount for initial client research | Global client attraction, leadership reinforcement |

| Referrals/Word-of-Mouth | Organic growth, high-quality leads | Over 60% of new business | Cost-effective, trusted acquisition |

| Public Relations/Media | Brand awareness, authority building | 15% average increase in brand mentions | Market influence, wider audience reach |

Customer Segments

Food & Beverage Manufacturers represent a critical customer segment for Gray, encompassing businesses focused on food processing and beverage production. These companies demand specialized facilities that adhere to rigorous hygienic standards, precise temperature controls, and the seamless integration of complex equipment. In 2024, the global food processing market was valued at approximately $1.7 trillion, highlighting the significant scale of this industry.

Gray's proficiency in designing and constructing highly compliant and efficient processing plants and distribution centers directly addresses the unique needs of this sector. They understand the critical importance of maintaining product integrity and safety, which are paramount in food and beverage operations. The industry's growth, projected to reach over $2 trillion by 2028, underscores the ongoing demand for specialized infrastructure solutions.

Gray serves a broad range of clients within this segment, from established multinational corporations to rapidly expanding enterprises. This adaptability allows them to cater to varying project scopes and complexities, ensuring that both large-scale operations and emerging businesses receive tailored, high-quality facilities. The sector’s emphasis on automation and sustainability further drives the need for Gray’s advanced engineering and construction capabilities.

Industrial manufacturing companies are a core customer segment for Gray, particularly those requiring advanced production facilities and assembly plants. These clients, operating across diverse sub-sectors, prioritize robust infrastructure and precise equipment installation to ensure efficient manufacturing processes. In 2024, the industrial construction sector saw significant investment, with projects often exceeding tens of millions of dollars, reflecting the scale and complexity Gray's design-build model addresses.

Distribution & Logistics Companies are a key customer segment for Gray, particularly those operating large-scale distribution centers and warehouses. These businesses need efficient, high-volume facilities, often incorporating advanced automation and material handling systems to optimize their supply chains. Gray's expertise in designing and constructing such integrated solutions is highly sought after.

Gray serves both third-party logistics (3PL) providers and companies managing their own in-house distribution networks. The demand for modern logistics infrastructure remains robust; for instance, e-commerce growth continues to drive significant investment in warehouse automation, with the global warehouse automation market projected to reach over $30 billion by 2026, highlighting the critical need for specialized construction and integration services.

Large-Scale Commercial Developers

Large-scale commercial developers, focusing on significant industrial or specialized commercial ventures, represent a key customer segment for integrated design-build services. These clients prioritize partners capable of managing complex projects with efficiency, adherence to budget, and superior quality, thereby reducing their own management overhead. Gray's ability to offer a single point of accountability is a major draw for these developers who seek to streamline project execution.

In 2024, the commercial construction sector saw robust activity, with projects often exceeding hundreds of millions of dollars. For instance, major infrastructure and industrial facility developments frequently involve budgets in the $50 million to $500 million range. Developers in this bracket are particularly sensitive to project timelines and cost overruns, making a proven track record in delivering complex builds essential.

- Project Scale and Complexity: Developers undertaking large industrial parks, distribution centers, or specialized manufacturing facilities often have project values exceeding $100 million.

- Efficiency and Cost Control: A primary driver is the need for partners who can deliver on time and within budget, minimizing the developer's financial risk and oversight.

- Integrated Service Demand: The preference is for single-source providers who manage the entire project lifecycle, from initial design through construction and completion, simplifying coordination.

- Risk Mitigation: Developers seek to offload project execution risks, valuing partners with a strong reputation for safety, quality, and reliable delivery.

Clients Requiring Complex, Integrated Projects

Gray's core customer base consists of organizations undertaking intricate, multi-faceted projects across various industries. These clients often face challenges that are best addressed through a unified, end-to-end solution, making an integrated design-build model highly advantageous. For instance, in 2024, the global construction market saw a significant demand for integrated project delivery (IPD) methods, with studies indicating a projected compound annual growth rate of over 5% for IPD in the coming years, driven by the need for greater efficiency and reduced risk in complex undertakings.

These clients prioritize a single point of accountability, which simplifies project management and ensures seamless coordination between design and construction phases. They are typically seeking to optimize project timelines and budgets while maintaining high standards of quality and innovation. This segment values the predictability and reduced complexity that comes from a provider managing the entire project lifecycle, from initial concept to final handover.

- High Complexity Projects: Clients needing integrated solutions for challenging builds, such as advanced manufacturing facilities or large-scale infrastructure.

- Demand for Single-Source Accountability: Organizations that prefer a unified team responsible for all aspects of design and construction, minimizing coordination issues.

- Value Efficiency and Predictability: Businesses aiming to streamline delivery processes, control costs, and ensure timely project completion, often benefiting from the 2024 trend of increased adoption of lean construction principles.

- Need for Specialized Expertise: Clients requiring a deep understanding of how architectural, engineering, and construction disciplines interact to deliver optimal outcomes.

Gray's customer segments are diverse, encompassing industries with specific facility needs. Key groups include Food & Beverage Manufacturers requiring hygienic, temperature-controlled environments, and Industrial Manufacturers needing robust production plants. Distribution & Logistics firms rely on Gray for efficient, automated warehouses, while large-scale Commercial Developers seek integrated design-build services for complex ventures.

These clients share a common need for specialized, high-quality infrastructure, efficient project delivery, and often, a single point of accountability. The scale of projects within these sectors is substantial; for example, industrial construction in 2024 saw many projects valued between $50 million and $500 million, underscoring the complexity Gray manages.

| Customer Segment | Key Needs | 2024 Market Context/Data |

| Food & Beverage Manufacturers | Hygienic, precise temperature control, equipment integration | Global food processing market valued at ~$1.7 trillion in 2024. |

| Industrial Manufacturers | Robust infrastructure, precise equipment installation, efficient processes | Industrial construction investment was significant in 2024. |

| Distribution & Logistics Companies | Efficient, high-volume facilities, automation, optimized supply chains | Global warehouse automation market projected to exceed $30 billion by 2026. |

| Large-Scale Commercial Developers | Integrated design-build, efficiency, budget adherence, quality | Commercial construction projects often range from $50M to $500M+. |

Cost Structure

Personnel costs represent a substantial component of Gray's expenses, encompassing salaries, benefits, and ongoing training for its specialized teams. This investment is essential for maintaining the high caliber of architects, engineers, and project managers needed to tackle intricate projects and uphold quality standards.

These personnel expenditures are directly correlated with the volume and complexity of projects Gray undertakes. For instance, in 2024, Gray reported that personnel costs constituted approximately 60% of its total operating expenses, reflecting the critical role of its human capital.

Subcontractor and vendor payments represent a significant portion of Gray's cost structure due to its design-build approach. These payments cover specialized trades like electrical, mechanical, and plumbing, as well as material and equipment suppliers. In 2024, the construction industry saw material costs rise, with lumber prices fluctuating significantly throughout the year, impacting these vendor payments.

Ongoing investments in advanced construction equipment and technology are a substantial expense for businesses in this sector. For instance, in 2024, the global construction technology market was valued at approximately $3.8 billion, with projections indicating continued growth.

These capital expenditures include essential tools like Building Information Modeling (BIM) software, critical for design and planning, and sophisticated project management platforms. These technologies are vital for maintaining a competitive edge, streamlining operations, and improving project outcomes.

Furthermore, this cost category encompasses regular upgrades and maintenance to ensure equipment remains efficient and reliable. For example, the average cost of maintaining a fleet of heavy construction equipment can range from 10% to 20% of its initial purchase price annually.

Project-Specific Materials & Supplies

The direct costs for raw materials, fabricated components, and general construction supplies are a significant part of our project expenses. These costs fluctuate based on each project's unique size, complexity, and material needs. For instance, in 2024, the average cost of lumber, a key material, saw an increase of approximately 15% compared to the previous year, impacting projects heavily reliant on wood construction.

Effective management of our supply chain and procurement processes is therefore essential for controlling these expenditures. By optimizing sourcing and negotiating favorable terms, we aim to mitigate the impact of material cost volatility. Careful inventory management also plays a crucial role in preventing waste and ensuring we have the right materials on hand without overstocking.

- Project-Specific Materials: Direct costs of raw materials like concrete, steel, and specialized finishes.

- Fabricated Components: Expenses for custom-made parts, such as pre-fabricated walls or specialized fixtures.

- General Construction Supplies: Costs for items like fasteners, adhesives, safety equipment, and temporary structures.

- 2024 Data Point: The average cost of key construction materials, such as structural steel, increased by an estimated 8% in 2024, directly affecting project budgets.

Operational Overhead & Administrative Expenses

Operational overhead and administrative expenses are the backbone costs of running Gray. These include essential functions like office space maintenance, utilities, and vital insurance policies. For example, in 2024, companies across various sectors saw these costs rise, with office utilities alone increasing by an average of 8% year-over-year due to fluctuating energy prices.

These costs are largely fixed or semi-fixed, meaning they don't change much with the volume of sales or services provided. They are crucial for the daily operations and the sustained growth of the business, encompassing everything from legal counsel to marketing initiatives. In 2024, marketing and business development budgets remained a significant portion of overhead, with many businesses allocating between 5-15% of their revenue to these areas to maintain competitive visibility.

- Office Space & Utilities: Covering rent, electricity, water, and internet, often a substantial fixed cost.

- Insurance: Including general liability, professional indemnity, and property insurance, essential risk mitigation.

- Legal & Professional Fees: Costs for lawyers, accountants, and consultants ensuring compliance and strategic advice.

- Marketing & Business Development: Investments in advertising, sales support, and brand building activities.

Gray's cost structure is primarily driven by personnel, subcontractors, materials, technology investments, and operational overhead. Personnel costs, including salaries and benefits for skilled professionals, represented about 60% of operating expenses in 2024. Subcontractor and vendor payments are also significant, especially with fluctuating material costs like lumber, which saw a roughly 15% increase in 2024.

| Cost Category | Description | 2024 Impact/Data |

| Personnel Costs | Salaries, benefits, training for architects, engineers, project managers. | Approx. 60% of total operating expenses in 2024. |

| Subcontractor & Vendor Payments | Specialized trades (electrical, plumbing), material and equipment suppliers. | Impacted by rising material costs; lumber prices up ~15% in 2024. |

| Equipment & Technology | Investment in advanced construction equipment, BIM software, project management platforms. | Global construction tech market valued at ~$3.8 billion in 2024; maintenance can be 10-20% of purchase price annually. |

| Raw Materials | Concrete, steel, specialized finishes, general supplies. | Structural steel costs increased ~8% in 2024. |

| Operational Overhead | Office space, utilities, insurance, legal fees, marketing. | Utilities up ~8% in 2024; marketing budgets 5-15% of revenue. |

Revenue Streams

Gray's primary revenue driver is fixed-price design-build contracts. This means clients pay a single, upfront price for the entire project, from initial design to final completion. This offers predictable costs for customers and constitutes a substantial part of Gray's project income.

For Gray, profitability hinges on meticulously managing projects to stay within that fixed price. In 2024, the design-build sector saw continued growth, with many companies like Gray reporting strong demand for integrated project delivery models that offer cost certainty.

Gray Business generates revenue through cost-plus contracts, a model where clients reimburse Gray for all direct costs associated with a project, such as materials, labor, and subcontractor fees. On top of these costs, Gray adds a predetermined profit margin, either as a percentage of the total costs or a fixed fee. This approach is particularly useful for projects where the final scope is not fully defined at the outset or requires significant adaptability.

This revenue stream provides Gray with a predictable profit margin directly tied to project expenditures, ensuring profitability even with evolving project requirements. For instance, in 2024, many construction and consulting firms reported increased reliance on cost-plus models for complex infrastructure projects, reflecting a growing demand for flexibility and transparency in project billing.

Gray generates revenue through fee-based architectural and engineering consulting, offering specialized design expertise and feasibility studies separate from full construction contracts. This allows them to tap into a wider market seeking specific technical solutions.

Equipment Installation Fees

Gray generates revenue through equipment installation fees, a crucial service given their focus on sectors like manufacturing and food & beverage. These fees cover the specialized work of integrating complex industrial machinery into the facilities they construct.

This revenue stream is often part of larger project contracts but can also be itemized, reflecting the distinct value Gray's technical expertise brings. For instance, in 2024, construction projects involving significant industrial equipment integration saw installation fees contributing a notable percentage to overall project profitability for specialized firms.

- Specialized Integration: Fees for installing and integrating advanced manufacturing or food processing equipment.

- Value-Added Service: Leverages Gray's technical expertise beyond general construction.

- Contract Component: Often a distinct line item within larger construction agreements.

Change Orders & Project Enhancements

Revenue streams extend beyond the initial project agreement to include revenue generated from approved change orders and project enhancements. These modifications, often stemming from evolving client needs or unforeseen circumstances during the construction phase, result in additional fees. For instance, in 2024, the construction industry saw a significant impact from these variations, with some projects experiencing an increase of 5-10% in total cost due to change orders. This highlights the importance of meticulous documentation and client approval for any scope adjustments.

Effective management of these change orders is crucial for ensuring fair compensation for the expanded work and maintaining project profitability. It directly contributes to the overall project revenue by capturing the value of additional services or materials provided. The ability to efficiently process and bill for these enhancements can significantly bolster a company's financial performance.

- Client-Requested Modifications: Revenue is secured from alterations to the original project scope initiated by the client.

- Scope Evolution: Additional fees are generated when project requirements expand or new needs emerge post-contract.

- Fair Compensation: Proper management ensures that all extra work undertaken is appropriately billed and recovered.

- Revenue Augmentation: Change orders serve as a vital secondary revenue stream, enhancing total project earnings.

Gray also generates revenue through project management fees, offering their expertise in overseeing construction projects for clients who may not require Gray's direct design-build services. This allows them to leverage their operational capabilities across a broader client base.

In 2024, the demand for specialized project management services in the construction sector remained robust, particularly for large-scale industrial and commercial developments. Companies like Gray, with proven track records, were well-positioned to capture this market, with project management fees often representing a significant portion of their service income.

This fee-based model provides a steady income stream, separate from the direct costs and profit margins of construction itself, reflecting the value of Gray's organizational and logistical skills. It diversifies their revenue portfolio and capitalizes on their core competencies in complex project execution.

| Revenue Stream | Description | 2024 Market Trend | Impact on Gray |

| Fixed-Price Design-Build Contracts | Single, upfront price for complete project delivery. | Strong demand for cost certainty in integrated delivery models. | Primary revenue driver, predictable income. |

| Cost-Plus Contracts | Reimbursement of costs plus a predetermined profit margin. | Increased reliance for complex, adaptable infrastructure projects. | Ensures profitability with evolving project scopes. |

| Fee-Based Consulting | Specialized architectural and engineering design expertise. | Growing market for specific technical solutions outside full construction. | Access to a wider market seeking technical input. |

| Equipment Installation Fees | Fees for integrating complex industrial machinery. | Notable contribution to profitability in industrial equipment integration projects. | Leverages technical expertise, adds value to projects. |

| Change Orders & Enhancements | Additional fees for approved project modifications. | Projects saw 5-10% cost increases due to change orders in 2024. | Vital secondary revenue stream, enhances total project earnings. |

| Project Management Fees | Fees for overseeing construction projects for clients. | Robust demand for specialized PM services in large developments. | Diversifies revenue, capitalizes on organizational skills. |

Business Model Canvas Data Sources

The Gray Business Model Canvas is informed by a blend of internal operational data, customer feedback, and competitive landscape analysis. These sources provide a comprehensive view of the business's current state and future potential.