Goodyear Tire & Rubber PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodyear Tire & Rubber Bundle

Navigate the complex external forces impacting Goodyear Tire & Rubber with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping the tire industry. Gain a strategic advantage by leveraging these critical insights to inform your business decisions and market positioning. Download the full, actionable analysis now and empower your strategy.

Political factors

Goodyear's global manufacturing footprint means it must navigate a complex web of government regulations. These cover everything from emissions standards, like the Euro 7 regulations impacting vehicle emissions in Europe, to stringent safety requirements for tires. For instance, tire labeling regulations in the EU, which provide consumers with information on fuel efficiency, wet grip, and noise emissions, directly influence product design and marketing.

Trade policies are another critical political factor. Tariffs imposed on imported tires or raw materials, such as natural rubber or synthetic rubber components, can significantly alter Goodyear's cost structure and pricing. For example, in 2024, ongoing trade tensions and potential tariffs on goods between major economic blocs could necessitate adjustments to Goodyear's sourcing strategies and its ability to compete in price-sensitive markets.

Goodyear's operational and sourcing stability hinges on the political climate in its key markets and supply chain origins. Geopolitical shifts, such as the ongoing tensions in Eastern Europe impacting raw material costs, directly influence Goodyear's cost of goods sold. For instance, disruptions in regions like Eastern Europe, which are significant for certain chemical precursors used in tire manufacturing, can lead to price volatility. In 2024, companies like Goodyear continue to navigate the complexities of trade relations and potential sanctions that could affect their global footprint and profitability.

Governments globally are pushing for electric vehicle (EV) adoption through substantial incentives and regulations. For instance, the US Inflation Reduction Act of 2022 offers tax credits up to $7,500 for qualifying EVs, while the EU aims for all new cars sold to be zero-emission by 2035. These policies directly impact Goodyear by driving demand for specialized EV tires, requiring innovation in areas like lower rolling resistance and enhanced durability to meet performance needs.

International Relations and Sanctions

Goodyear's international operations are significantly influenced by global political dynamics, including the potential impact of sanctions. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, as of mid-2025, continue to create uncertainty regarding market access and supply chain stability in affected regions. This necessitates careful management of Goodyear's global footprint to mitigate risks associated with trade restrictions and diplomatic shifts.

The company's ability to source raw materials and distribute finished goods is directly tied to international trade agreements and the imposition of tariffs or sanctions. For example, a tightening of sanctions on a key supplier nation could increase Goodyear's material costs or force a pivot to alternative, potentially more expensive, sourcing options. Navigating these complex international relations requires robust compliance frameworks and adaptive strategies to maintain operational efficiency and market reach.

- Geopolitical Instability: Ongoing conflicts and political realignments in various global regions, as observed through mid-2025, can disrupt Goodyear's supply chains and market access.

- Sanctions Impact: The imposition or lifting of economic sanctions by major economies can directly affect Goodyear's ability to import/export goods and operate in specific countries, influencing revenue streams and operational costs.

- Trade Compliance: Adherence to a complex web of international trade regulations and sanctions regimes is critical for Goodyear to avoid penalties and maintain its global market presence, impacting its overall cost structure.

Labor Laws and Union Influence

Political decisions significantly shape Goodyear's operational landscape, particularly concerning labor. Governments worldwide enact and enforce labor laws, minimum wage requirements, and regulations governing union activities. These policies directly impact Goodyear's workforce management, affecting everything from hiring practices to compensation structures and employee benefits. For instance, in 2024, countries like Germany continued to uphold strong worker protections and collective bargaining rights, influencing Goodyear's manufacturing costs in the region.

The strength and influence of labor unions present another critical political factor. Unions can negotiate wages, working conditions, and benefits, potentially leading to increased labor expenses for Goodyear. In regions with robust union presence, such as parts of North America and Europe, Goodyear must actively manage these relationships to ensure stable production and mitigate the risk of labor disputes. The company's ability to maintain cooperative relationships with unions is vital for operational efficiency and cost control across its global facilities.

- Minimum Wage Impact: Fluctuations in minimum wage laws, as seen in various US states and European nations throughout 2024 and projected into 2025, directly alter Goodyear's direct labor costs.

- Union Negotiations: Major union contracts, such as those with the United Rubber, Cork, Linoleum and Plastic Workers of America (URW) in the US, can set precedents for labor expenses and operational flexibility for Goodyear.

- Global Regulatory Compliance: Goodyear operates in over 20 countries, each with distinct labor laws, requiring continuous adaptation and adherence to diverse political mandates regarding employment.

- Worker Protection Laws: Legislation concerning workplace safety, hours of work, and termination procedures, enforced by political bodies, adds to the complexity and cost of managing Goodyear's global workforce.

Government regulations concerning environmental standards, such as emissions and tire labeling, directly impact Goodyear's product development and compliance costs. Trade policies, including tariffs and trade agreements, significantly influence raw material sourcing and pricing strategies, with ongoing geopolitical tensions in 2024 and 2025 creating price volatility for key components like synthetic rubber.

Geopolitical instability and international sanctions, as of mid-2025, pose risks to Goodyear's supply chains and market access, necessitating adaptive strategies. The global push for electric vehicle adoption, supported by government incentives like the US Inflation Reduction Act, drives demand for specialized EV tires, requiring Goodyear to innovate in tire technology.

Labor laws and union negotiations are critical political factors affecting Goodyear's operational costs and workforce management. For instance, in 2024, minimum wage adjustments in various regions and ongoing union contract discussions, such as with the URW in the US, directly influence labor expenses and operational flexibility.

What is included in the product

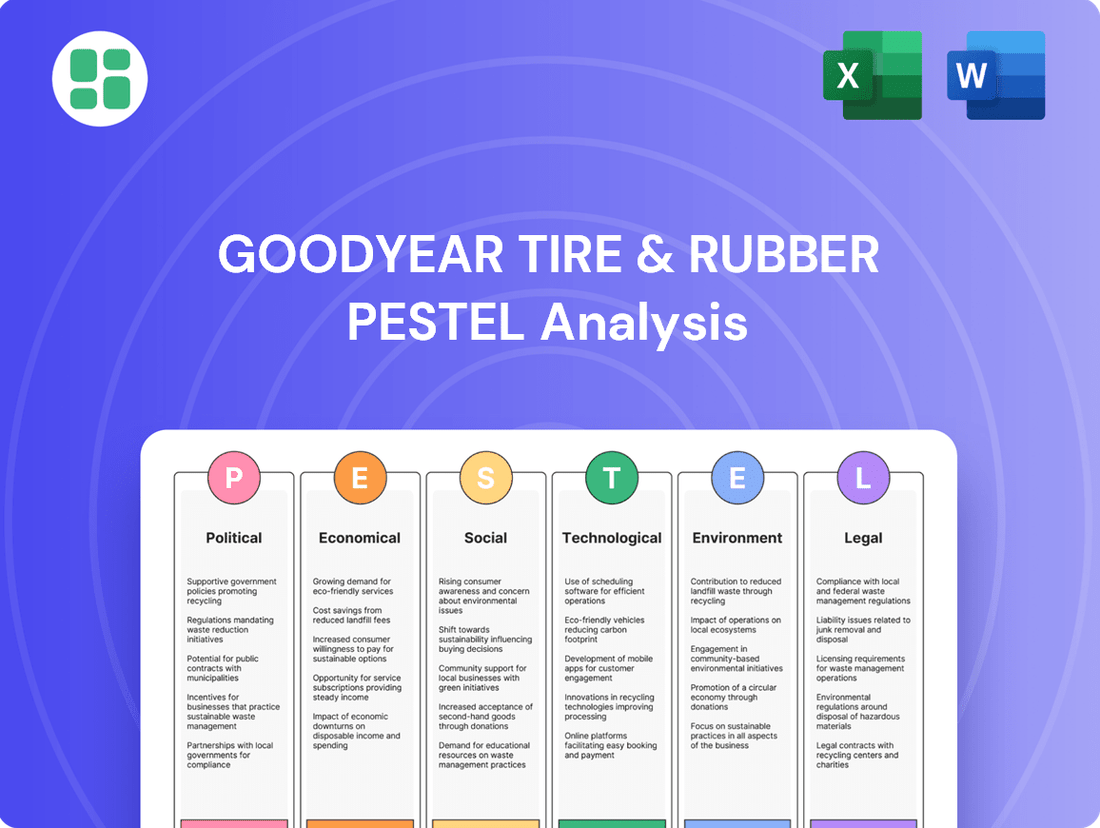

This PESTLE analysis of Goodyear Tire & Rubber examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external forces shaping the tire industry and Goodyear's competitive landscape.

Provides a concise PESTLE analysis of Goodyear, offering actionable insights to mitigate external risks and optimize market strategy, thereby relieving the pain of navigating complex global factors.

Economic factors

Global economic expansion directly correlates with consumer spending on vehicles and tires. In 2024, the International Monetary Fund projected global growth at 3.2%, a slight slowdown from previous years but still indicating a generally positive economic environment. This growth supports discretionary spending, which is crucial for new car sales and tire replacements.

However, economic headwinds can significantly impact Goodyear. For instance, a slowdown in consumer confidence, as seen in some regions during late 2023 and early 2024 due to inflation concerns, can curb demand for non-essential purchases like new vehicles, thereby affecting tire volumes. Goodyear’s financial reports often highlight how fluctuations in GDP and consumer spending power influence their top-line performance.

Conversely, periods of strong economic growth, like the post-pandemic recovery seen in 2021 and 2022, typically translate into higher sales for Goodyear. This robust growth fuels both original equipment manufacturer (OEM) demand from automakers and the replacement tire market as consumers have more disposable income. Goodyear’s ability to navigate these cycles is key to its profitability.

Goodyear's manufacturing expenses are heavily influenced by the unpredictable costs of essential inputs like natural rubber, synthetic rubber, carbon black, and various petroleum derivatives. For instance, in early 2024, the price of natural rubber saw significant swings, with some benchmarks experiencing a nearly 15% increase over a three-month period due to weather disruptions in key Southeast Asian producing regions.

These shifts in commodity markets, often triggered by global supply chain issues, geopolitical tensions, or unexpected weather events, directly affect Goodyear's profitability. The company must employ flexible sourcing and hedging techniques to navigate these price volatilities and maintain its profit margins.

Rising inflation in 2024 and into 2025 directly impacts Goodyear's operational expenses. We've seen significant increases in raw material costs, with natural rubber prices fluctuating and petrochemicals, essential for synthetic rubber, seeing upward pressure. This, combined with higher energy and transportation costs, means Goodyear's cost of goods sold is likely to be higher.

Furthermore, the prevailing interest rate environment, which remained elevated through much of 2024 and is projected to stay firm in early 2025, increases the cost of capital for Goodyear. This affects their ability to finance large projects, such as factory upgrades or new product development, and makes inventory financing more expensive, potentially squeezing profit margins.

These economic headwinds can also dampen consumer demand. As inflation erodes purchasing power, consumers may delay replacing tires, opting for retreads or driving on existing tires longer, impacting Goodyear's sales volume for replacement tires, which represent a significant portion of their business.

Currency Exchange Rate Fluctuations

Goodyear Tire & Rubber, as a global entity, navigates the complexities of currency exchange rate fluctuations. These movements directly influence how international sales translate into U.S. dollars, impacting the cost of sourcing raw materials from abroad and the ultimate profitability of its overseas ventures. For instance, a stronger U.S. dollar can make Goodyear's imported components more expensive, while a weaker dollar might boost the value of sales made in foreign currencies.

The company's financial performance is therefore susceptible to significant currency shifts. Managing this exposure is critical, often necessitating the implementation of robust hedging strategies to mitigate potential negative impacts on earnings. In 2023, for example, many multinational corporations reported earnings volatility tied to currency headwinds, a trend Goodyear likely also contended with.

- Impact on Sales: A stronger USD can reduce the reported value of sales generated in countries with weaker currencies.

- Raw Material Costs: Fluctuations affect the cost of imported materials, influencing Goodyear's cost of goods sold.

- Foreign Operations Profitability: Profits earned in foreign subsidiaries are revalued upon translation to the reporting currency, leading to potential gains or losses.

- Hedging Necessity: The company likely employs financial instruments to lock in exchange rates and reduce uncertainty.

Automotive Industry Production and Sales Trends

Goodyear's performance is intrinsically linked to the health of the global automotive sector. Shifts in new vehicle production and sales, for both passenger and commercial vehicles, directly influence demand for original equipment (OE) tires. A downturn in automotive manufacturing or a drop in vehicle sales can significantly dampen the OE tire market, which in turn affects the replacement tire segment, ultimately impacting Goodyear's revenue.

For instance, global light vehicle production saw a slight recovery in 2023, reaching approximately 76.5 million units, a notable increase from 2022's figures, signaling a potential tailwind for OE tire demand. However, the automotive industry continues to navigate supply chain challenges and evolving consumer preferences, creating a dynamic environment for tire manufacturers like Goodyear.

- Global light vehicle production in 2023 was around 76.5 million units, up from previous years.

- Commercial vehicle sales, particularly for trucks and buses, also play a crucial role in Goodyear's OE tire business.

- A decline in new vehicle sales directly reduces the demand for tires fitted at the factory.

- The aftermarket (replacement) tire market is also influenced by the total number of vehicles on the road, which is a function of past sales trends.

Economic growth directly fuels consumer spending on vehicles and tires, with global growth projected around 3.2% in 2024 by the IMF. However, inflation and interest rates, which remained elevated into early 2025, increase Goodyear's operating costs and cost of capital. Fluctuations in commodity prices, such as natural rubber, also significantly impact manufacturing expenses, as seen with a nearly 15% increase in some benchmarks in early 2024.

Currency exchange rate volatility affects Goodyear's international sales translation and raw material import costs. For example, a stronger USD can reduce the reported value of sales from countries with weaker currencies, impacting overall earnings. The company's performance is also tied to the automotive sector, with global light vehicle production around 76.5 million units in 2023, influencing demand for original equipment tires.

| Economic Factor | Impact on Goodyear | Data Point (2023-2025 Projection) |

|---|---|---|

| Global Economic Growth | Drives vehicle and tire demand | IMF projected 3.2% in 2024 |

| Inflation & Interest Rates | Increases operating costs and cost of capital | Rates remained elevated into early 2025 |

| Commodity Prices | Affects raw material costs (e.g., natural rubber) | Natural rubber prices saw ~15% increase in early 2024 |

| Currency Exchange Rates | Impacts international sales and import costs | Volatility noted in 2023 for multinational corporations |

| Automotive Production | Influences demand for original equipment tires | Global light vehicle production ~76.5 million units in 2023 |

Preview the Actual Deliverable

Goodyear Tire & Rubber PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Goodyear Tire & Rubber provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

Global consumers are increasingly prioritizing sustainable products, with a noticeable shift towards items manufactured with reduced environmental footprints. This trend directly impacts the automotive sector, including tire manufacturers like Goodyear. For instance, a 2024 survey indicated that over 60% of consumers consider a product's environmental impact when making purchasing decisions.

Goodyear's strategy must actively incorporate the development of tires utilizing recycled materials and cleaner production methods to resonate with this growing eco-conscious demographic. Failing to adapt could lead to a loss of market share, especially as competitors highlight their sustainability initiatives. This consumer preference is a significant driver for Goodyear's research and development, pushing for innovation in materials science and manufacturing efficiency.

Societal shifts are profoundly impacting how people get around, especially in cities. The rise of ride-hailing services like Uber and Lyft, coupled with the growing acceptance of car-sharing platforms, suggests a potential dip in traditional individual car ownership in urban areas. This trend directly affects tire demand, as fewer personally owned vehicles mean fewer tire replacements. For instance, a 2024 report indicated that in major European cities, the average age of vehicles on the road is increasing, partly due to the appeal of mobility-as-a-service alternatives.

Goodyear must navigate these changing mobility patterns by adapting its business strategy. This could involve a greater emphasis on providing durable, long-lasting tires suitable for high-mileage fleet usage, or developing specialized tires for the burgeoning autonomous vehicle market. The company's 2025 product development roadmap is reportedly exploring innovative tire solutions designed for shared mobility fleets, aiming to capture a segment of this evolving market.

Growing public and regulatory focus on road safety significantly shapes consumer preferences for advanced tire features. Goodyear's commitment to innovation in areas like enhanced wet-weather traction and shorter stopping distances is crucial for maintaining market share and meeting stringent safety mandates across different regions.

Demographic Shifts and Urbanization

Global demographic shifts are fundamentally reshaping the automotive landscape, directly influencing Goodyear's market. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant jump from 56% in 2021. This increasing urbanization often leads to greater demand for smaller, more fuel-efficient vehicles in congested city centers, while also potentially increasing the need for durable tires suited for diverse urban road conditions.

Furthermore, an aging global population in many developed nations may alter vehicle ownership and usage patterns, potentially favoring comfort and safety features. Conversely, growing middle classes in emerging markets, particularly in Asia, are driving demand for personal mobility, including new vehicle purchases and replacement tires. Goodyear must adapt its product development and marketing strategies to align with these evolving consumer needs and preferences across different age groups and living environments.

- Urbanization Trend: Global urban population expected to reach 68% by 2050 (UN data).

- Aging Demographics: Increasing proportion of older adults in developed countries may influence vehicle preferences.

- Emerging Market Growth: Rising middle class in Asia fuels demand for vehicles and replacement tires.

- Regional Demand Variation: Shifting demographics necessitate tailored product offerings and distribution strategies for urban vs. rural markets.

Labor Force Dynamics and Skill Availability

Goodyear's success hinges on navigating evolving labor force dynamics. In 2024, the manufacturing sector faces a critical need for skilled technicians, with projections indicating a continued shortage. For instance, the U.S. Bureau of Labor Statistics anticipates a need for over 4.6 million manufacturing jobs by 2026, many requiring advanced technical skills that Goodyear must cultivate.

Attracting and retaining talent is paramount, especially as the workforce ages. By 2025, a significant portion of experienced manufacturing workers will be nearing retirement age, creating knowledge gaps. Goodyear's investment in apprenticeship programs and continuous training is crucial to bridge these gaps and equip its workforce with skills for automation and advanced manufacturing, such as robotics and data analytics.

The availability of specialized talent in research and development is also a key consideration. As automotive technology advances, Goodyear requires engineers and scientists proficient in areas like battery technology, sustainable materials, and connected vehicle systems. The company's ability to secure these highly sought-after professionals will directly impact its innovation pipeline and competitive edge in the coming years.

- Talent Shortage: An estimated 2.4 million manufacturing jobs could go unfilled in the U.S. between 2024 and 2028, highlighting a significant skills gap.

- Aging Workforce: By 2025, nearly 30% of the U.S. manufacturing workforce is expected to be 55 or older, posing retention and knowledge transfer challenges.

- Skill Evolution: Demand for workers with skills in areas like AI, robotics, and advanced materials is projected to grow by over 20% by 2027, necessitating proactive upskilling initiatives.

Consumer preferences are increasingly driven by ethical considerations and brand reputation, impacting purchasing decisions for automotive products like tires. Goodyear must actively communicate its commitment to corporate social responsibility, including fair labor practices and community engagement, to build trust and loyalty. For instance, a 2024 Nielsen report found that 70% of consumers are willing to pay more for sustainable products from brands they trust.

The growing emphasis on health and well-being extends to vehicle usage, influencing demand for tires that offer a smoother, quieter ride and contribute to overall vehicle efficiency. Goodyear's innovation in tire design, focusing on reduced rolling resistance and improved ride comfort, directly addresses these evolving consumer expectations. This focus is vital as consumers increasingly view their vehicles as extensions of their personal living spaces.

Societal trends toward shared mobility and reduced private car ownership, particularly in urban centers, are reshaping tire demand patterns. Goodyear needs to adapt by focusing on tires designed for high-mileage fleet use and potentially exploring new service models for mobility providers. For example, by 2025, it's projected that ride-sharing services will account for over 15% of all vehicle miles traveled in major metropolitan areas globally.

| Sociological Factor | Impact on Goodyear | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Ethical Consumerism | Increased demand for transparent supply chains and CSR initiatives. | 70% of consumers willing to pay more for sustainable products (Nielsen, 2024). |

| Health & Well-being | Preference for tires offering comfort, quietness, and fuel efficiency. | Growing consumer interest in vehicle cabin experience as a key purchase driver. |

| Shared Mobility Trends | Shift in demand towards fleet-specific, durable tires. | Ride-sharing to comprise >15% of global metro vehicle miles by 2025. |

Technological factors

Goodyear's competitive edge is deeply tied to its pursuit of cutting-edge tire materials, including sustainable polymers, and advanced manufacturing processes. These innovations, such as increased automation and AI in quality assurance, are crucial for staying ahead in the market.

These technological leaps directly translate to better tire performance, lower manufacturing expenses, and the potential for entirely new product lines, all of which bolster Goodyear's market position.

The burgeoning electric vehicle (EV) market is fundamentally reshaping tire manufacturing, demanding specialized products. EVs, with their instant torque and heavier curb weights from battery packs, necessitate tires engineered for enhanced durability and grip. Furthermore, optimizing EV range hinges on tires with significantly lower rolling resistance, a key performance metric. Goodyear's 2024 and 2025 strategy must prioritize substantial investment in research and development to create and refine tires that meet these unique EV performance and efficiency demands.

Goodyear is actively developing smart tire technology. These advanced tires incorporate sensors to monitor crucial data like tire pressure, temperature, and tread wear in real-time. This innovation allows for proactive maintenance, improving safety and efficiency for drivers and fleet operators alike.

The integration of the Internet of Things (IoT) into Goodyear's tire offerings opens up significant opportunities. By providing valuable data through connected tires, Goodyear can offer enhanced services, potentially creating new revenue streams beyond traditional tire sales. This connectivity also allows for stronger, data-driven relationships with customers.

For instance, a fleet management system using Goodyear's smart tires could leverage real-time data to optimize routes based on tire performance and road conditions, potentially saving fuel costs. As of early 2024, the global smart tire market is projected for substantial growth, indicating strong demand for these technological advancements.

Automation and Industry 4.0 in Production

Goodyear's integration of automation, robotics, and Industry 4.0 principles is a key technological driver. These advancements are designed to boost manufacturing efficiency, lower labor expenses, and ensure greater product uniformity. This focus on modernizing production lines is vital for Goodyear to stay competitive and speed up the introduction of innovative tire models to the market.

The company's strategic investments in these areas are already showing results. For instance, by 2024, Goodyear aims to have a significant portion of its manufacturing processes enhanced by smart technologies. This push towards Industry 4.0 is expected to contribute to a substantial reduction in operational costs, potentially by 5-10% in automated facilities by 2025, according to industry projections for similar large-scale manufacturing operations.

- Enhanced Production Efficiency: Automation and robotics streamline assembly, leading to higher output volumes.

- Cost Reduction: Reduced reliance on manual labor directly impacts operational expenses.

- Improved Product Quality: Consistent execution of manufacturing processes minimizes defects and variations.

- Faster Innovation Cycles: Agility in production allows for quicker implementation of new tire designs and technologies.

Digitalization in Sales, Distribution, and Customer Service

Technological progress is fundamentally reshaping how Goodyear Tire & Rubber operates, particularly in sales, distribution, and customer service. Advancements in e-commerce platforms, sophisticated supply chain management software, and powerful data analytics are transforming these core functions. This digital shift allows Goodyear to enhance its reach and efficiency across the board.

Leveraging digitalization offers significant advantages. Improved supply chain visibility, for instance, helps optimize logistics, ensuring tires reach their destinations more efficiently. Furthermore, online channels are crucial for enhancing the customer experience, providing easier access to products and support. Crucially, data-driven insights gleaned from these digital interactions empower more targeted marketing and sales strategies.

- E-commerce Growth: Goodyear’s investment in digital sales channels is evident, with online tire sales continuing to grow as a percentage of the overall market. For example, by late 2024, online tire purchases are projected to represent a significant portion of consumer spending, a trend Goodyear actively addresses.

- Supply Chain Optimization: Companies like Goodyear are increasingly adopting AI-powered logistics and inventory management systems. These technologies aim to reduce delivery times and costs, with industry reports in 2024 indicating potential savings of 10-15% on transportation expenses through better route planning and load optimization.

- Data Analytics for Customer Engagement: Goodyear utilizes data analytics to understand customer behavior and preferences. This allows for personalized marketing campaigns and improved customer service interactions, leading to higher customer satisfaction rates, with some studies showing a 5-10% increase in repeat business for digitally engaged customers.

Technological advancements are driving significant changes in tire manufacturing and product development for Goodyear. The company is focusing on sustainable materials and advanced manufacturing processes, including increased automation and AI for quality control, to maintain its competitive edge.

The rise of electric vehicles (EVs) presents a substantial technological challenge and opportunity, requiring tires with enhanced durability, grip, and lower rolling resistance to optimize EV range and performance. Goodyear's R&D in 2024-2025 is heavily geared towards meeting these specific EV demands.

Goodyear is also investing in smart tire technology, integrating sensors to monitor tire pressure, temperature, and wear in real-time, which enhances safety and efficiency. This IoT integration creates opportunities for new data-driven services and revenue streams beyond traditional tire sales.

The company's adoption of Industry 4.0 principles, including automation and robotics, is boosting production efficiency, reducing labor costs, and improving product consistency. By 2024, Goodyear aims for a significant portion of its manufacturing to be enhanced by smart technologies, potentially reducing operational costs by 5-10% in automated facilities by 2025.

Legal factors

Goodyear navigates a complex web of global product liability and safety regulations, impacting everything from tire design to rigorous testing protocols. Failure to adhere to these standards, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US or the UNECE regulations in Europe, can result in substantial financial penalties and brand erosion. For instance, recalls, a direct consequence of safety non-compliance, can cost millions; in 2023, the automotive industry saw significant recall expenses, underscoring the financial risk. Goodyear's commitment to meeting and exceeding these requirements across its diverse markets is paramount, requiring substantial investment in quality control and compliance infrastructure.

Goodyear operates under a complex web of environmental protection laws. These regulations govern everything from manufacturing processes and waste disposal to air emissions and water discharge. For instance, the U.S. Environmental Protection Agency (EPA) sets stringent standards that Goodyear must adhere to.

As environmental regulations tighten globally, Goodyear faces increasing pressure to invest in sustainable practices and advanced pollution control technologies. Failure to comply can result in substantial fines, legal challenges, and damage to its brand reputation. In 2023, for example, companies in the automotive supply chain faced increased scrutiny over their carbon footprint, with many setting ambitious emission reduction targets for 2030 and beyond.

Goodyear operates under a vast array of labor and employment regulations globally, covering everything from minimum wage and workplace safety to anti-discrimination statutes and unionization rights. For instance, in the United States, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, while the National Labor Relations Act (NLRA) protects collective bargaining. Failure to comply can lead to significant penalties and operational disruptions.

Antitrust and Competition Laws

Goodyear, as a dominant force in the global tire industry, operates under stringent antitrust and competition laws. These regulations are in place to foster fair market practices, preventing monopolies, collusion on pricing, and other anti-competitive behaviors.

The company must meticulously align its marketing strategies, sales practices, and collaborative ventures with these legal frameworks. Failure to comply can result in significant financial penalties and protracted legal battles with governmental oversight bodies.

- Regulatory Scrutiny: Goodyear faces ongoing scrutiny from agencies like the U.S. Federal Trade Commission (FTC) and the European Commission's Directorate-General for Competition.

- Merger & Acquisition Scrutiny: Any potential mergers or acquisitions undertaken by Goodyear are subject to rigorous review to ensure they do not unduly restrict competition.

- Pricing Practices: Goodyear's pricing strategies are closely monitored to prevent any form of price-fixing or predatory pricing that could harm smaller competitors or consumers.

- Market Share Thresholds: In various regions, Goodyear's significant market share means it must be particularly cautious about actions that could be perceived as leveraging dominance unfairly.

Intellectual Property Rights and Patents

Goodyear Tire & Rubber's commitment to innovation is underscored by its substantial investment in research and development, which has resulted in a significant portfolio of patents protecting its advanced tire technologies and manufacturing methods. For instance, in 2023, the company reported R&D expenses of $439 million, a key component in securing its technological edge. This robust patent protection is vital for maintaining its competitive standing and deterring rivals from replicating its proprietary advancements.

The company actively pursues global patent registration and employs rigorous enforcement strategies to safeguard its intellectual property. This proactive approach ensures that Goodyear can capitalize on its innovations, preventing unauthorized use and potential dilution of its market position. As of early 2024, Goodyear holds thousands of active patents worldwide, a testament to its continuous innovation pipeline.

- Global Patent Portfolio: Goodyear holds over 10,000 patents globally, covering a wide array of tire design, material science, and manufacturing process innovations.

- R&D Investment: In 2023, Goodyear invested $439 million in research and development, a critical driver for its ongoing patent generation and technological advancements.

- Competitive Advantage: Patents are instrumental in protecting Goodyear's proprietary technologies, enabling it to maintain a distinct competitive advantage in the global tire market.

- Enforcement Strategies: The company actively monitors for and litigates against patent infringements to protect its market share and revenue streams derived from its innovations.

Goodyear operates under a framework of international trade laws and agreements, impacting its import and export activities and tariffs. Compliance with regulations like those from the World Trade Organization (WTO) is crucial for global market access and cost management. Fluctuations in trade policies, such as those seen with tariffs in 2023 impacting automotive components, directly affect Goodyear's supply chain and pricing strategies.

The company must also adhere to consumer protection laws, ensuring product safety, accurate labeling, and fair advertising. Violations can lead to significant fines and reputational damage, as demonstrated by past recalls in the automotive sector. Goodyear's ongoing efforts to maintain product integrity and transparent communication are essential for consumer trust and legal compliance.

Goodyear's global operations are subject to varying legal systems, requiring careful navigation of contract law, corporate governance, and dispute resolution mechanisms. For instance, the company's adherence to corporate governance standards, as overseen by bodies like the Securities and Exchange Commission (SEC) in the US, is vital for investor confidence and regulatory compliance. In 2023, increased focus on ESG reporting meant companies like Goodyear had to ensure their legal compliance extended to environmental and social governance mandates.

Environmental factors

Growing environmental awareness is fueling a significant shift towards tires manufactured using sustainable, renewable, and recycled materials. This trend aims to decrease dependence on traditional fossil-fuel-based resources, with consumers increasingly seeking eco-friendly options. For instance, by 2024, the global market for recycled tires was projected to reach over $8 billion, indicating a strong consumer preference for sustainable solutions.

Goodyear is actively responding to this demand by investing in material science innovation and fostering collaborations with suppliers. The goal is to integrate more environmentally sound components into their tire production, aligning with both consumer expectations and evolving regulatory frameworks that champion circular economy principles. This strategic focus is crucial for maintaining market relevance and meeting the growing demand for sustainable mobility solutions.

Goodyear is under increasing pressure to shrink its carbon footprint throughout its manufacturing, logistics, and supply chain. This means investing in cleaner energy, making factories more energy-efficient, and finding smarter ways to transport goods to cut down on greenhouse gas emissions, all in an effort to meet global climate goals and their own sustainability targets.

In 2023, Goodyear reported a 3% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2019 baseline, reaching 2.4 million metric tons of CO2e. Their goal is to achieve a 40% reduction by 2030, with a focus on renewable energy procurement, which saw a 15% increase in their manufacturing facilities in 2023.

The growing environmental concern around end-of-life tires is driving stricter regulations for waste management and recycling globally. Goodyear, like other major tire manufacturers, faces pressure to actively engage in or pioneer advanced tire recycling technologies. This proactive approach supports a circular economy for its products, significantly reducing landfill burden and bolstering its environmental credentials.

In 2023, the U.S. Environmental Protection Agency (EPA) reported that approximately 290 million tires were generated as waste, with a substantial portion still ending up in landfills or being improperly disposed of. Goodyear's commitment to initiatives like the Tire Industry Project (TIP), which focuses on sustainable tire design and end-of-life management, directly addresses this challenge. Such programs are vital for demonstrating corporate responsibility and mitigating environmental risks.

Impact of Climate Change on Supply Chain

Climate change poses significant threats to Goodyear's supply chain. Extreme weather events, such as intensified hurricanes and prolonged droughts, can directly disrupt the cultivation of natural rubber, a key raw material. For instance, the 2023 hurricane season in the Americas saw disruptions that impacted various agricultural sectors, indirectly affecting the availability and cost of natural rubber.

These climatic shifts also lead to increased transportation risks. Flooding can render roads impassable, while rising sea levels can threaten port operations, both of which are critical for moving raw materials and finished goods globally. Goodyear must actively assess and implement strategies to build resilience against these climate-related disruptions to maintain operational continuity and mitigate financial impacts.

To address these challenges, Goodyear is focusing on several key areas:

- Diversifying sourcing regions for natural rubber to reduce reliance on climate-vulnerable areas.

- Investing in more resilient logistics and transportation networks, including exploring alternative shipping routes and modes.

- Enhancing predictive analytics to better anticipate and respond to extreme weather events impacting operations.

Compliance with Global Environmental Standards and Certifications

Goodyear Tire & Rubber faces increasing pressure to meet diverse global environmental standards and certifications, such as ISO 14001. This compliance is not merely about regulatory adherence; it's a critical component of corporate responsibility, directly impacting brand perception and market access, especially in regions with stringent environmental mandates.

Meeting these evolving requirements necessitates substantial investment in robust environmental management systems and sustainable manufacturing processes. For instance, in 2024, companies globally are seeing increased scrutiny on Scope 3 emissions, which for tire manufacturers like Goodyear, includes the entire value chain from raw material sourcing to end-of-life product management. Failing to meet these standards can result in significant penalties and loss of competitive advantage.

- ISO 14001 Certification: Goodyear's commitment to environmental management is often demonstrated through ISO 14001 certification, a globally recognized standard for environmental management systems.

- Regulatory Compliance: Adherence to regulations like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) impacts the chemical composition of tires, influencing product development and sourcing.

- Sustainability Reporting: Companies are increasingly expected to provide transparent reporting on environmental performance, including metrics on energy consumption, water usage, and waste generation. For example, Goodyear's 2023 sustainability report highlighted progress in reducing greenhouse gas emissions intensity.

- Market Access: In many developed markets, compliance with environmental standards is a prerequisite for market entry, influencing supplier selection and product design to meet local requirements.

Goodyear is navigating stricter global environmental regulations, particularly concerning chemical usage and end-of-life tire management. Compliance with standards like the EU's REACH impacts product development and sourcing, with market access often contingent on meeting these stringent requirements. For example, Goodyear's 2023 sustainability report detailed progress in reducing greenhouse gas emissions intensity, underscoring the growing importance of transparent environmental performance reporting.

PESTLE Analysis Data Sources

Goodyear's PESTLE analysis is informed by a comprehensive review of official government publications, reputable market research firms, and leading economic and industry reports. This approach ensures that insights into political stability, economic trends, environmental regulations, technological advancements, and societal shifts are grounded in factual data.