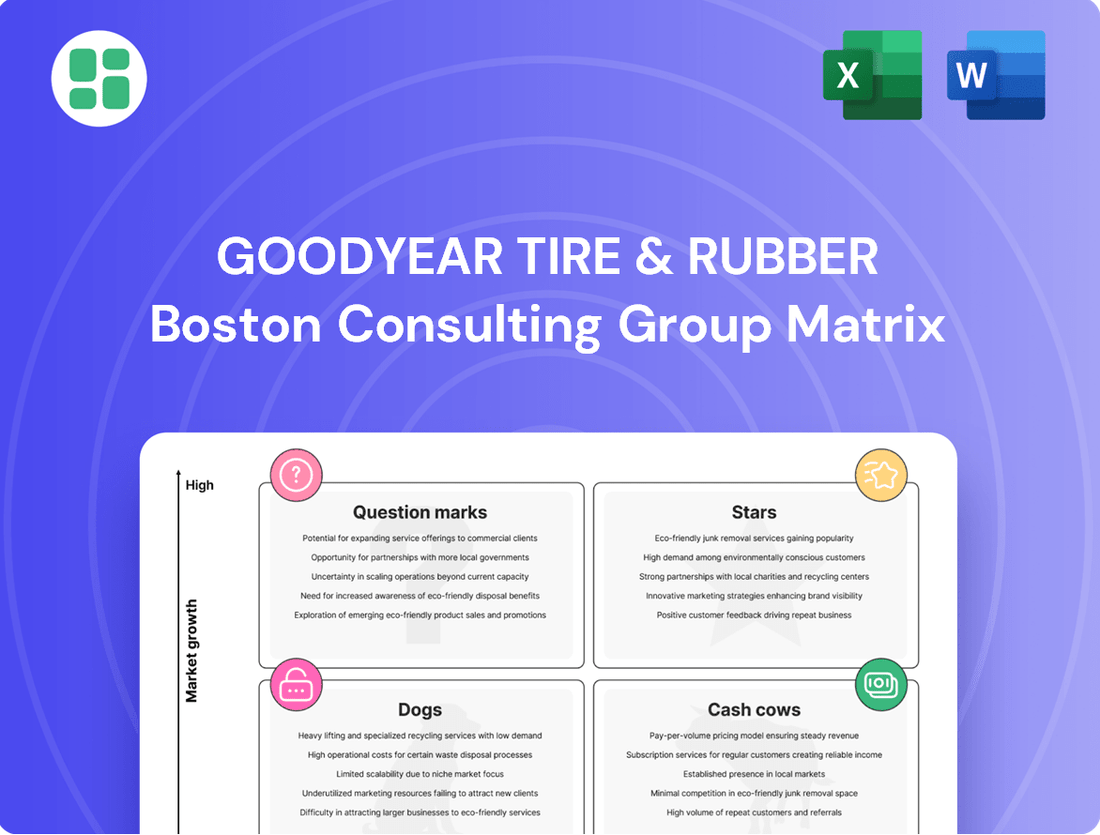

Goodyear Tire & Rubber Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodyear Tire & Rubber Bundle

Curious about Goodyear's product portfolio performance? Our BCG Matrix analysis offers a glimpse into which tires are market leaders and which might be holding them back. Understand the strategic implications for resource allocation and future growth.

Don't stop at the surface-level insights. Purchase the full Goodyear Tire & Rubber BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your tire investments.

Stars

Goodyear's EV Tire Portfolio, including the ElectricDrive™ 2 and EDS tire, represents a significant strategic focus on the burgeoning electric vehicle market. These tires are engineered to meet the unique demands of EVs, such as increased torque and weight, while also emphasizing sustainability. This investment positions Goodyear to capitalize on the projected substantial growth in EV sales, which reached over 13 million units globally in 2023, a testament to the segment's rapid expansion.

Goodyear is strategically focusing on the premium and luxury consumer tire segments, a lucrative area driven by consumer demand for advanced technology and top-tier performance. This high-margin market is experiencing robust growth.

In 2025, Goodyear plans to launch new product lines specifically targeting these premium and luxury segments. This expansion aims to capture a larger share of a market where consumers readily invest more in higher-value tires for their vehicles.

This strategic pivot is anticipated to be a significant driver of Goodyear's future profitability. For instance, the premium tire segment in North America alone saw a growth of approximately 8% in 2024, indicating a strong market opportunity.

Goodyear has made impressive strides in the Original Equipment (OE) tire market, especially in the United States and Europe, the Middle East, and Africa (EMEA). These regions saw substantial market share increases for Goodyear in 2024, highlighting strong partnerships with car manufacturers and the successful adoption of their tires on new vehicle production lines. This OE success is a critical driver for future replacement tire demand, solidifying Goodyear's enduring market presence.

Advanced Radial Technologies in Aviation

Goodyear's advanced radial technologies in aviation represent a strong 'Star' in its BCG Matrix. The company holds a dominant position in the aviation tire sector, a market defined by consistent expansion and stringent performance demands. Global airline fleets rely on Goodyear's cutting-edge radial tire solutions, a testament to over a century of accumulated knowledge and robust partnerships with original equipment manufacturers (OEMs).

This specialized segment offers Goodyear a reliable source of high-margin income. For instance, in 2024, the global aviation tire market was projected to reach approximately $7.5 billion, with radial tires accounting for a significant portion due to their fuel efficiency and durability benefits. Goodyear's continued innovation in this area, such as its Flight Radial technology, ensures its competitive edge.

- Market Leadership: Goodyear is a recognized leader in the aviation tire market.

- Technological Prowess: Advanced radial tire technology is a key differentiator.

- Stable Revenue: The niche aviation segment provides consistent, high-value revenue.

- OEM Partnerships: Strong relationships with manufacturers bolster its market presence.

Goodyear Forward Transformation Benefits

The Goodyear Forward transformation plan is a significant strategic undertaking designed to boost financial performance. It focuses on expanding profit margins, refining the company's product portfolio, and lowering its debt burden. By the close of 2025, this initiative is expected to yield substantial annual run-rate benefits, signaling a robust internal growth strategy aimed at enhancing overall company performance and delivering value to shareholders across its various business segments.

- Margin Expansion: Goodyear aims to increase profitability through operational efficiencies and pricing strategies.

- Portfolio Optimization: The company is streamlining its product offerings to focus on higher-margin segments.

- Debt Reduction: A key objective is to deleverage the balance sheet, improving financial flexibility.

- Projected Benefits: Goodyear anticipates significant annual run-rate benefits by the end of 2025 from this transformation.

Goodyear's aviation tire segment stands out as a strong performer, a true 'Star' in its BCG Matrix. This is due to its market leadership, advanced radial technologies, and consistent high-margin revenue streams, bolstered by robust original equipment manufacturer (OEM) partnerships. The global aviation tire market, projected to reach approximately $7.5 billion in 2024, sees Goodyear's radial tires playing a crucial role due to their efficiency and durability.

| Segment | Market Position | Growth Potential | Profitability |

|---|---|---|---|

| Aviation Tires | Market Leader | Stable & Consistent | High Margin |

| EV Tires | Emerging Star | High Growth | Growing Margin |

| Premium/Luxury Tires | Targeted Growth | High Growth | High Margin |

| OE Tires (US/EMEA) | Strong Growth | Consistent Demand Driver | Moderate Margin |

What is included in the product

The Goodyear Tire & Rubber BCG Matrix categorizes its product lines based on market share and growth, guiding investment decisions.

The Goodyear Tire & Rubber BCG Matrix provides a clear, actionable roadmap, relieving the pain of strategic uncertainty by pinpointing where to invest and divest.

Cash Cows

Goodyear's commercial truck tire segment is a classic cash cow, demonstrating a robust and enduring market presence. This sector, characterized by consistent demand and a mature industry landscape, reliably fuels Goodyear's revenue streams.

With a long-standing reputation for durability and performance, Goodyear commands a significant market share among commercial fleets. This strong brand loyalty translates into predictable sales and substantial cash generation, essential for funding other business ventures.

The trucking industry's continuous need for tire replacement and maintenance ensures a steady inflow of cash. For instance, in 2024, the global commercial vehicle tire market was valued at approximately $45 billion, with replacement tires forming a significant portion of this figure, underscoring the stability of this segment for Goodyear.

Goodyear's established consumer replacement tires, particularly those shielded from aggressive low-cost imports, hold a substantial share in a mature market. These tires benefit from robust brand loyalty and predictable replacement schedules, generating a steady and significant revenue flow. In 2024, the global tire replacement market was valued at approximately $130 billion, with consumer replacement tires forming a significant portion of this. Goodyear's strong brand equity within this segment ensures consistent cash generation despite potentially modest growth.

Goodyear's core brand offerings in North America, encompassing a wide range of tires, are indeed its cash cows. These products benefit from decades of brand building and a deeply entrenched distribution system across the continent. In 2023, Goodyear's North America segment generated approximately $11.5 billion in net sales, underscoring its significant contribution to the company's overall revenue and profitability.

This segment's strength lies in its ability to consistently generate substantial cash flow, thanks to high market share in a mature yet profitable tire market. The brand's established reputation and the loyalty of its customer base ensure steady demand. This reliable income stream is crucial for funding research and development, expanding into new markets, and supporting other business units within Goodyear's portfolio.

Tire Service and Maintenance Network

Goodyear's extensive network of tire service and maintenance centers acts as a significant cash cow, generating steady revenue beyond tire manufacturing. These services are crucial for customer loyalty and provide a reliable income source in a stable market. For instance, in 2023, Goodyear's company-owned retail stores generated substantial revenue, contributing to the overall profitability.

- Recurring Revenue: Tire repair, rotation, and alignment services offer a consistent income stream, bolstering Goodyear's financial stability.

- Customer Retention: Providing comprehensive service enhances customer loyalty, encouraging repeat business and reducing churn.

- Market Stability: The demand for tire maintenance is relatively inelastic, ensuring a dependable revenue base even during economic downturns.

- Operational Synergy: The service network complements the manufacturing arm, creating a vertically integrated business model that optimizes operations.

Select Off-Highway/Industrial Tires (Retained Segments)

Goodyear’s retained off-highway/industrial tire segments likely function as Cash Cows within its BCG Matrix. These specialized tires, serving industries like agriculture and construction, often hold dominant market positions. This dominance translates into consistent revenue streams with relatively low investment needs, a hallmark of a Cash Cow.

These segments benefit from mature, stable markets where growth is modest but predictable. For instance, agricultural tire demand, while subject to seasonal cycles, remains a steady component of the off-highway market. Goodyear’s continued presence in these niches suggests a strong competitive advantage, allowing them to command pricing power and generate substantial cash flow.

- High Market Share: Goodyear likely maintains a leading position in specific industrial and agricultural tire sub-segments.

- Stable Demand: These niche markets typically experience less cyclicality compared to the broader automotive sector.

- Strong Profitability: Specialized tires often command higher margins due to their unique performance requirements.

- Cash Generation: The combination of market share and stable demand allows these segments to generate significant, consistent cash for Goodyear.

Goodyear's commercial truck tire segment is a prime example of a Cash Cow. This sector benefits from consistent demand and a mature market, reliably generating substantial revenue for Goodyear. The company's strong brand loyalty among commercial fleets ensures predictable sales, with the global commercial vehicle tire market valued at approximately $45 billion in 2024, a significant portion of which comes from replacement tires.

Goodyear's established consumer replacement tires also operate as Cash Cows. These products benefit from robust brand loyalty and predictable replacement cycles in a mature market. The global tire replacement market was valued at around $130 billion in 2024, and Goodyear's strong brand equity in this segment guarantees consistent cash generation, even with modest growth prospects.

The company's core brand offerings in North America, supported by decades of brand building and an extensive distribution network, are also considered Cash Cows. In 2023, Goodyear's North America segment achieved net sales of approximately $11.5 billion, highlighting its significant contribution to overall revenue and profitability through consistent cash flow generation.

Goodyear's retained off-highway and industrial tire segments likely function as Cash Cows. These specialized tires, serving stable markets like agriculture and construction, often hold dominant positions. This translates into consistent revenue streams with relatively low investment needs, a key characteristic of a Cash Cow, with strong profitability often seen in these niche markets.

| Segment | BCG Category | Key Characteristics | Relevant 2024 Data/Context |

| Commercial Truck Tires | Cash Cow | Consistent demand, mature market, strong brand loyalty | Global commercial vehicle tire market valued at ~$45 billion |

| Consumer Replacement Tires | Cash Cow | Predictable replacement cycles, strong brand equity | Global tire replacement market valued at ~$130 billion |

| North America Core Brands | Cash Cow | High market share, established distribution, brand loyalty | North America net sales ~$11.5 billion in 2023 |

| Off-Highway/Industrial Tires | Cash Cow | Dominant niche positions, stable demand, strong profitability | Mature, predictable markets with less cyclicality |

Preview = Final Product

Goodyear Tire & Rubber BCG Matrix

The Goodyear Tire & Rubber BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. What you see is the actual file, immediately downloadable and editable for your business planning needs. This BCG Matrix report is crafted by strategy experts and is ready to be integrated into your presentations or competitive analysis, offering actionable insights into Goodyear's product portfolio.

Dogs

Goodyear's divestiture of its Off-the-Road (OTR) tire business in February 2025 signals its classification as a Dog in the BCG Matrix. This move suggests the segment had limited growth potential and a weak market position, making it a strategic decision to shed underperforming assets.

This divestment aligns with Goodyear's objective to streamline its operations and improve its financial standing. Such a sale often occurs when a business unit requires significant capital investment without commensurate returns, or if it was a drain on resources, fitting the profile of a Dog needing to be exited.

Goodyear's decision to divest the Dunlop brand, with the sale expected to finalize by mid-2025, strongly suggests its placement as a 'dog' within the BCG Matrix for specific markets. This strategic move indicates that Dunlop likely faced limited growth prospects or struggled with market share in key competitive areas, prompting Goodyear to shed it to reallocate resources.

The divestiture of Dunlop, a brand with a long history, reflects Goodyear's ongoing portfolio management to concentrate on more profitable and high-growth segments. For instance, in 2023, Goodyear reported net sales of $19.7 billion, and optimizing its brand portfolio is crucial for maintaining financial health and driving future returns.

Goodyear's strategic divestment from specific low-margin replacement tire markets in the Asia-Pacific region underscores their classification as 'dogs' within the BCG matrix. These segments were characterized by a weak market position and minimal growth potential, making them unattractive for continued investment.

This move, aimed at enhancing profitability, reflects Goodyear's focus on optimizing resource allocation. By exiting these highly competitive and less profitable areas, the company can redirect capital towards more promising ventures, thereby improving its overall financial performance and reducing exposure to underperforming assets.

Certain Legacy Product SKUs

Certain legacy product SKUs within Goodyear's vast tire offerings can be categorized as dogs in the BCG Matrix. These are older models or those with diminishing market share, often struggling against newer, more competitively priced options. For instance, while Goodyear reported strong performance in its consumer replacement business in 2024, some niche or outdated SKUs might be contributing less to overall growth.

These underperforming products typically demand significant resources for marketing and inventory management without yielding substantial returns. Goodyear's strategic initiatives, such as the 'Goodyear Forward' plan, often target such SKUs for potential discontinuation or repositioning to streamline operations and focus on higher-growth areas.

- Declining Market Share: Older tire designs may have lost ground to newer, more technologically advanced or cost-effective competitors.

- Resource Drain: Maintaining inventory and marketing for low-demand SKUs can divert capital and attention from more profitable product lines.

- Strategic Rationalization: These products are prime candidates for pruning from the product portfolio to enhance overall efficiency and profitability.

- Focus on Core Strengths: Divesting or phasing out these legacy items allows Goodyear to concentrate on its star and cash cow products.

Segments Heavily Impacted by Low-Cost Imports

Goodyear's consumer replacement tire segments in the U.S. are particularly vulnerable to low-cost imports, placing them in the 'dog' category of the BCG Matrix. These product lines face intense price competition, directly impacting their market share and profitability.

The pressure from imported tires has led to declining unit volumes for these Goodyear segments. This reduced demand, coupled with lower pricing power, significantly curtails their contribution to the company's overall financial performance.

- Declining Market Share: U.S. consumer replacement tire segments directly facing low-cost imports are seeing their market share erode.

- Profitability Squeeze: Intense price competition from imports is significantly pressuring profit margins in these specific product lines.

- Reduced Unit Volumes: The competitive landscape has resulted in a noticeable decrease in the number of tires sold within these vulnerable segments.

- Lower Financial Contribution: The combination of reduced market share and profitability means these 'dog' segments contribute less to Goodyear's overall revenue and earnings.

Goodyear's divestiture of its Off-the-Road (OTR) tire business in February 2025, and the planned sale of the Dunlop brand by mid-2025, strongly signals their classification as 'dogs' within the BCG Matrix. These moves reflect segments with limited growth potential and weak market positions, prompting Goodyear to shed underperforming assets to streamline operations and improve financial standing. For instance, in 2023, Goodyear reported net sales of $19.7 billion, making portfolio optimization crucial. Certain legacy product SKUs also fall into this category, demanding resources without substantial returns, a situation Goodyear aims to address through strategic initiatives like the 'Goodyear Forward' plan.

| BCG Category | Goodyear Examples | Characteristics | Strategic Implications |

|---|---|---|---|

| Dogs | Off-the-Road (OTR) tire business (divested Feb 2025), Dunlop brand (sale expected mid-2025), certain legacy SKUs, specific low-margin replacement tire markets in Asia-Pacific, U.S. consumer replacement tire segments facing low-cost imports | Low market share, low growth potential, declining unit volumes, price competition, resource drain | Divestment, discontinuation, repositioning, resource reallocation to higher-growth areas |

Question Marks

Goodyear's ambition to achieve 100% sustainable material tires by 2030 is a significant move, highlighted by their EDS tire already boasting over 70% sustainable content. This positions them to capitalize on the burgeoning market for eco-friendly products.

While the demand for sustainable tires is strong, Goodyear's current market share in this advanced segment, especially for non-EV applications, is still in its nascent stages. This represents a developing, high-growth opportunity.

Substantial investment will be crucial for Goodyear to scale production of these innovative tires, enabling them to secure a dominant position in this environmentally driven market segment.

Goodyear's investment in smart tire technologies, like its SightLine and TPMS Connect solutions, positions it for growth in connected mobility and fleet management. These advancements provide real-time insights into tire condition and road surfaces, a significant leap forward in vehicle intelligence.

While these innovative technologies hold considerable promise, their market penetration is still developing. Consequently, Goodyear's current market share in this emerging sector is modest, indicating a need for continued investment and strategic market expansion to capitalize on this potential.

Goodyear is pushing forward with airless tire development, aiming for a commercial rollout by 2030, with a keen eye on the electric vehicle sector. This innovation promises to reshape tire technology and upkeep, catering to the demands of future mobility. As of 2024, airless tires are not yet established in the market, classifying them as a question mark in the BCG matrix due to their pre-commercial, high-risk, high-reward nature.

Goodyear Farm Tires with Low Sidewall Technology (LSW) Expansion

Goodyear Farm Tires is expanding its Low Sidewall Technology (LSW) line in 2025, a move that positions them to capitalize on the growing agricultural sector's demand for specialized equipment. This expansion targets a niche within the broader farm tire market, potentially placing LSW tires in a "question mark" category within the BCG matrix.

The agricultural industry's increasing adoption of precision farming and advanced mechanization suggests a high growth potential for innovative tire solutions like LSW. However, Goodyear's current market share in this specific segment is likely nascent, necessitating significant investment to establish a strong foothold and drive future growth.

- Expansion into LSW technology aligns with agricultural trends towards efficiency and reduced soil compaction.

- The market for advanced agricultural tires shows strong growth potential, with the global agricultural tire market projected to reach approximately $20 billion by 2028.

- Goodyear's investment in LSW technology targets a segment that may require substantial marketing and development to gain significant market share.

- The success of LSW technology will depend on its ability to demonstrate clear benefits, such as improved load-carrying capacity and reduced soil pressure, to farmers.

New Product Lines for Emerging High-Value Segments

Goodyear's strategic move to launch five new product lines in the U.S. during 2025, specifically targeting premium and high-margin segments, places these offerings squarely in the question mark category of the BCG matrix.

These new ventures represent speculative investments, betting on areas with strong perceived growth potential, but their ultimate success in capturing significant market share and delivering substantial returns remains uncertain. Goodyear's approach involves careful observation and the potential for additional investment as these product lines evolve.

- Targeting Premium Segments: The introduction of five new product lines in the U.S. in 2025 focuses on premium and high-margin segments, aiming to capture value in specialized markets.

- Speculative Investment: These new offerings are viewed as question marks, signifying investments in areas with high growth potential but unproven market acceptance and profitability.

- Uncertain Market Share: The success of these new product lines in gaining significant market share and generating substantial returns is yet to be determined, requiring ongoing evaluation.

- Strategic Monitoring: Goodyear's strategy necessitates close monitoring of these question mark products, with the potential for increased investment to support their growth or divestment if they fail to gain traction.

Goodyear's ventures into airless tires and specialized agricultural tires, like their LSW line, represent significant investments in potentially high-growth markets. These are classified as question marks because their market acceptance and profitability are still developing, requiring substantial investment to build market share.

The company's introduction of five new product lines in the U.S. targeting premium segments in 2025 also falls into this category. These are speculative plays on perceived growth areas, with their ultimate success and market penetration yet to be proven.

Goodyear's investment in smart tire technologies, while promising for connected mobility, also sits in the question mark quadrant due to its nascent market penetration.

The success of these question mark products will hinge on Goodyear's ability to effectively market their benefits and secure significant market share in these emerging or specialized sectors.

| Product/Technology | Market Potential | Current Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| Airless Tires | High (EV sector focus) | Nascent | Substantial R&D and production scaling | Question Mark |

| Goodyear Farm Tires (LSW) | Growing (Precision farming) | Niche/Developing | Marketing and further development | Question Mark |

| Smart Tire Technologies (SightLine, TPMS Connect) | High (Connected mobility) | Modest | Market expansion and integration | Question Mark |

| New Premium U.S. Product Lines (2025) | Perceived High Growth | Unproven | Strategic marketing and potential scaling | Question Mark |

BCG Matrix Data Sources

Our Goodyear Tire & Rubber BCG Matrix is built on robust data, incorporating financial disclosures, market share reports, and industry growth forecasts to provide strategic clarity.