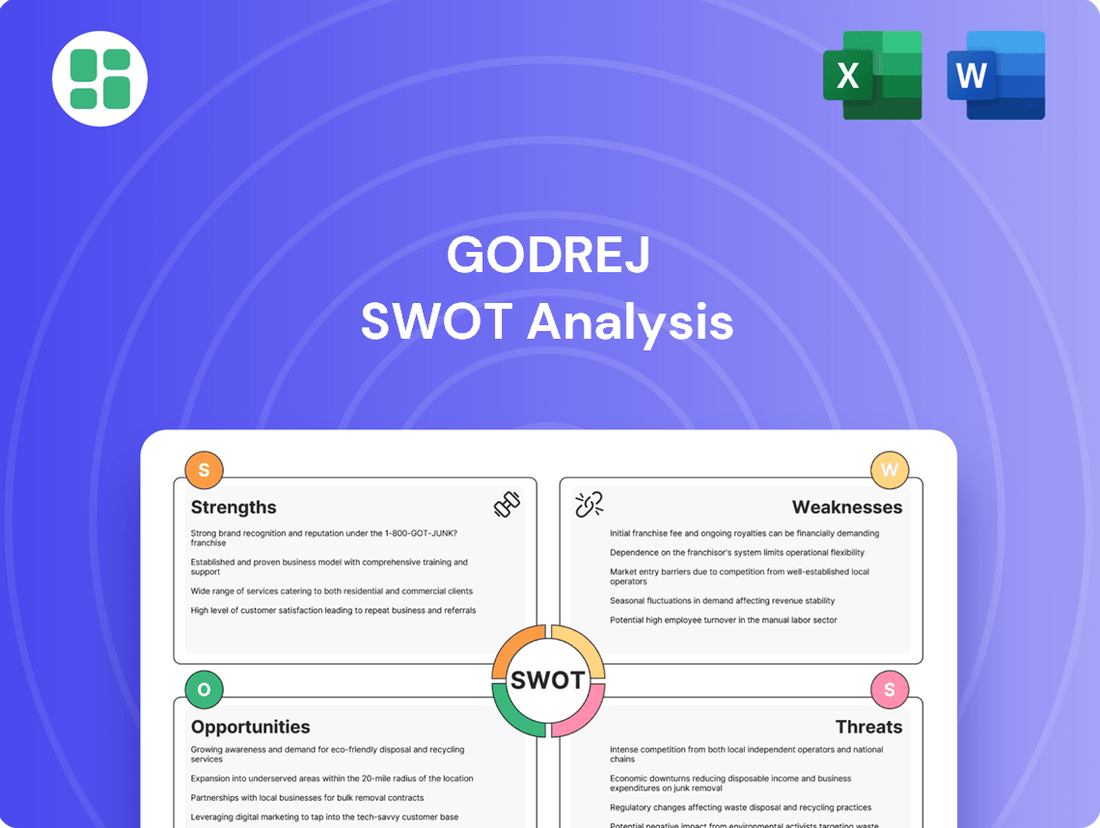

Godrej SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Godrej Bundle

Godrej's diversified portfolio, spanning consumer goods to real estate, presents significant strengths, but also potential weaknesses in managing such a broad scope. Understanding these internal dynamics and external market opportunities and threats is crucial for navigating its future.

Want the full story behind Godrej's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Godrej Consumer Products Limited (GCPL) commands a robust position in India, supported by a wide array of products and a far-reaching distribution system. Brands such as Cinthol, Godrej Expert, and Goodknight are deeply embedded in Indian households, ensuring daily reach to millions across the nation and beyond.

This extensive market reach, coupled with strong brand recognition, grants GCPL a substantial competitive edge. In fiscal year 2024, GCPL reported consolidated revenue of INR 13,900 crore, underscoring its significant market share and consumer trust.

Godrej Consumer Products Limited (GCPL) boasts a strong revenue stream diversified across its core segments: home care, personal care, and hair care. This broad product offering helps to mitigate risks associated with any single category's performance.

Furthermore, GCPL's international presence is a significant strength, with operations spanning key markets in Asia, Africa, Latin America, and the Middle East. For instance, in fiscal year 2024, GCPL reported that its international business contributed approximately 45% to its total revenue, highlighting its reduced dependence on any one region.

Godrej Consumer Products Limited (GCPL) consistently channels resources into research and development, driving innovation and the creation of new product categories. This strategic focus is evident in their expansion into promising, less saturated markets like liquid detergents, deodorants, air fresheners, pet care, and sexual wellness.

Recent product introductions, such as the Godrej Fab liquid detergent, and advancements in household insecticides featuring proprietary formulations, underscore GCPL's dedication to anticipating and fulfilling changing consumer demands. These efforts not only address market gaps but also position GCPL to disrupt existing market dynamics.

Robust Financial Health and Strategic Investments

Godrej Consumer Products Limited (GCPL) demonstrates a strong financial foundation, characterized by healthy cash accruals and a disciplined approach to cash management, which underpins its robust financial risk profile. This financial prudence allows for strategic investments even as the company navigates increased gross debt, maintaining a net cash positive position throughout recent fiscal periods. For instance, as of the fiscal year ending March 31, 2024, GCPL's cash and cash equivalents stood at ₹2,345 crore, while its total debt was ₹1,560 crore, highlighting its net cash surplus.

The company is actively deploying its financial strength to fuel future growth through significant capital expenditure. These investments are geared towards enhancing manufacturing capacities and exploring new avenues, such as the burgeoning pet care sector. This strategic allocation of capital, exemplified by planned investments in expanding its production facilities and R&D for new product lines, underscores GCPL's commitment to long-term value creation and its capacity to fund ambitious growth initiatives.

Key financial strengths supporting these strategic moves include:

- Healthy Cash Accruals: GCPL consistently generates substantial cash from its operations, providing a stable financial buffer.

- Net Cash Positive Position: Despite recent debt increases for expansion, the company maintains a surplus of cash over its borrowings.

- Prudent Cash Policy: A disciplined approach to cash management ensures financial stability and supports investment decisions.

- Strategic Capital Expenditure: Significant investments are being made to boost manufacturing and enter high-growth segments like pet care.

Experienced Leadership and Strategic Vision

Godrej Consumer Products Limited (GCPL) benefits significantly from its seasoned leadership team, whose strategic vision is geared towards achieving sustained, market-leading volume growth. The current management is actively pursuing strategies to consolidate and expand its existing market dominance, streamline operational processes, and harness the power of technology and data analytics to better understand and cater to consumer needs.

This focused approach on operational efficiency and strategic clarity is instrumental in driving GCPL's long-term prosperity. For instance, in FY24, GCPL reported a consolidated revenue of INR 13,647 crore, demonstrating its robust market presence and growth trajectory, underpinned by this experienced leadership.

- Strategic Focus: Emphasis on consistent, industry-leading volume growth and market leadership expansion.

- Operational Efficiency: Initiatives to simplify operations and leverage technology for precision.

- Consumer Centricity: Utilizing analytics to better understand and serve consumer demands.

- Financial Performance: FY24 consolidated revenue reached INR 13,647 crore, reflecting strong market performance.

GCPL's established brand portfolio, featuring household names like Cinthol and Goodknight, provides a significant competitive advantage and deep consumer penetration. This strong brand equity, coupled with an extensive distribution network, ensures consistent market access and high sales volumes. In FY24, the company achieved consolidated revenue of INR 13,647 crore, a testament to its market strength and consumer trust.

What is included in the product

Analyzes Godrej's strong brand equity and diversified portfolio while identifying potential challenges in market expansion and adapting to evolving consumer preferences.

Offers a clear, actionable framework to identify and address Godrej's strategic challenges and leverage its competitive advantages.

Weaknesses

Godrej Consumer Products Limited (GCPL) faces a significant weakness in its susceptibility to raw material price fluctuations. Key inputs like palm oil and crude derivatives, crucial for its extensive product lines including soaps and personal care items, are subject to considerable market volatility.

This volatility directly impacts GCPL's profitability. For instance, during fiscal year 2023-24, the company absorbed a substantial portion of rising input costs, leading to margin pressure rather than fully passing these increases onto consumers. This strategy, while customer-friendly, can erode profits when commodity prices surge unexpectedly.

Godrej Consumer Products Limited (GCPL) faces a significant hurdle in expanding its market share within developed economies. While it boasts a robust presence in emerging markets, established players in North America and Europe often command greater brand loyalty and distribution networks. This intense competition from global giants can cap GCPL's growth potential in these mature regions, making it challenging to carve out a substantial foothold.

The fast-moving consumer goods (FMCG) sector is incredibly crowded, with a multitude of local and global companies vying for market share. This fierce rivalry often results in price wars, which can limit Godrej Consumer Products Limited's (GCPL) expansion and squeeze its profitability across different product categories.

Macroeconomic and Geopolitical Risks in Overseas Markets

Godrej Consumer Products Limited's (GCPL) extensive global footprint, particularly in emerging economies across Asia, Africa, and Latin America, inherently exposes the company to significant macroeconomic and geopolitical risks. Fluctuations in economic conditions, political instability, and shifts in trade policies in these regions can directly impact sales volumes and operational efficiency.

Currency volatility presents a notable challenge. For instance, the devaluation of currencies like the Nigerian Naira can substantially erode the value of repatriated earnings and negatively affect reported sales and profitability from key African markets, thereby constraining overall growth potential.

These external factors necessitate robust risk management strategies. GCPL's performance in FY24, for example, saw revenue from its international operations being influenced by these currency headwinds, underscoring the ongoing sensitivity to these macro-level risks.

- Exposure to Economic Downturns: GCPL's reliance on emerging markets makes it vulnerable to recessions or slowdowns in these economies, impacting consumer spending on its products.

- Geopolitical Instability: Political unrest or conflicts in countries where GCPL operates can disrupt supply chains, manufacturing, and market access.

- Currency Devaluation Impact: As seen in Nigeria, currency depreciation directly reduces the value of profits when converted back to the reporting currency, affecting consolidated financial results.

- Regulatory and Policy Changes: Unforeseen changes in government regulations, taxation, or trade policies in overseas markets can create operational hurdles and financial liabilities.

Challenges in Integrating Acquired Businesses and Category Growth

Integrating acquired businesses, like the portfolio from Raymond Consumer Care including brands such as Park Avenue and KamaSutra, has posed significant integration hurdles for Godrej. These challenges can slow down the realization of expected synergies and market impact.

The growth within these acquired categories has been slower than initially projected. This underperformance is partly attributed to their continued dependence on traditional wholesale trade models and aggressive discounting strategies, which limit margin expansion and brand equity building.

- Integration Complexities: Difficulty in seamlessly merging operational, cultural, and strategic aspects of acquired entities.

- Channel Dependence: Reliance on wholesale and deep discounting in acquired categories hinders faster, more profitable growth.

- Synergy Realization: Slower-than-expected achievement of anticipated benefits from acquisitions, impacting overall performance.

Godrej Consumer Products Limited (GCPL) faces significant challenges in highly competitive mature markets, where established brands and extensive distribution networks create formidable barriers to entry. This intense rivalry, particularly in developed economies, can limit market share expansion and exert downward pressure on pricing power, impacting overall profitability.

The company's reliance on emerging markets exposes it to substantial macroeconomic and geopolitical risks, including currency volatility. For instance, in fiscal year 2023-24, currency headwinds in key African markets like Nigeria negatively affected reported earnings, highlighting the sensitivity of consolidated financial results to foreign exchange fluctuations.

Integrating acquired businesses, such as the Raymond Consumer Care portfolio, has presented integration challenges and slower-than-anticipated growth in acquired categories. This is partly due to a continued dependence on traditional wholesale models and aggressive discounting, which can hinder margin expansion and brand equity development.

Preview Before You Purchase

Godrej SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Godrej's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Godrej SWOT analysis, ready for your strategic planning needs.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering detailed insights into Godrej's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Godrej Consumer Products Limited (GCPL) has a significant opportunity to grow by entering or expanding in categories that aren't yet widely adopted in India, such as pet care and sexual wellness, where demand is on the rise. For instance, the Indian pet care market alone was valued at approximately $500 million in 2023 and is projected to grow substantially in the coming years.

Furthermore, GCPL can capitalize on the vast, largely untapped rural market in India. By enhancing its distribution network, perhaps through strategies like dedicated rural van operations, the company can reach a much larger consumer base, driving significant volume growth. This approach is crucial as rural consumption continues to gain momentum.

The burgeoning digital landscape and the rapid expansion of e-commerce present a prime opportunity for Godrej Consumer Products Limited (GCPL). This trend allows GCPL to significantly broaden its market penetration, optimize its supply chain, and foster deeper connections with its customer base. For instance, in India, e-commerce sales for FMCG products are projected to reach $10 billion by 2025, a substantial increase from previous years, highlighting the immense potential for GCPL to capitalize on this shift.

By strategically investing in digital technologies across its manufacturing processes, go-to-market approaches, and direct consumer engagement initiatives, GCPL can unlock substantial gains in operational efficiency and drive top-line growth. This digital push is crucial for remaining competitive, as seen with competitors who have already reported significant sales increases through their online channels in the 2024 fiscal year.

Godrej Consumer Products Limited (GCPL) can capitalize on the growing demand for premium and sustainable offerings. Consumers, particularly in emerging markets, are increasingly willing to pay more for products that align with their values, such as eco-friendliness and natural ingredients. This presents a clear opportunity for GCPL to elevate its existing product lines, like household insecticides, and introduce new, higher-margin items that meet these evolving preferences.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships offer significant avenues for Godrej Consumer Products Limited (GCPL) to expand its market footprint and diversify its product portfolio, particularly in rapidly expanding sectors and emerging markets. For instance, GCPL's acquisition of a majority stake in Raymond's consumer care business in 2024, which includes brands like Park Avenue and Kama Sutra, is a prime example of this strategy, aiming to strengthen its position in the male grooming and personal care segments. This move is expected to add approximately INR 800 crore to GCPL's revenue in the first year post-acquisition.

Leveraging group synergies, such as the collaboration between GCPL and Godrej Agrovet in the burgeoning pet care sector, demonstrates an effective approach to capitalize on internal strengths for market entry and competitive advantage. The joint venture in pet food, announced in early 2025, is targeting a market segment projected to grow at a CAGR of over 15% through 2030. These strategic alliances are crucial for enhancing GCPL's competitive edge and driving future growth.

Key opportunities include:

- Expansion into high-growth emerging markets through targeted acquisitions or joint ventures, potentially increasing GCPL's international revenue share from its current 30% to over 40% by 2027.

- Diversification into adjacent product categories such as premium skincare or health and wellness products, leveraging existing distribution networks and brand equity.

- Acquisition of innovative technologies or digital platforms to enhance direct-to-consumer (DTC) capabilities and improve supply chain efficiency, mirroring successful digital transformations seen in the FMCG sector in 2024.

- Strategic partnerships with local players in key international markets to navigate regulatory landscapes and gain immediate market access, a strategy that has proven effective for competitors in Southeast Asia and Africa.

Demand Revival Amid Economic Tailwinds

Anticipated economic tailwinds in India, including easing food inflation and potential income tax adjustments, are poised to invigorate consumer spending. This revival in demand is a significant opportunity for Godrej Consumer Products Limited (GCPL) to achieve its growth objectives.

GCPL is targeting mid-to-high single-digit volume growth, and the improving economic climate provides a fertile ground for this expansion. A potential pay commission increase could further boost disposable incomes, directly translating into higher consumption of GCPL’s product portfolio.

- Economic Tailwinds: Easing food inflation and potential income tax cuts are expected to boost Indian consumer demand.

- Growth Target: GCPL aims for mid-to-high single-digit volume growth, supported by this market revival.

- Income Boost: Potential pay commission increases could further enhance consumer purchasing power.

Godrej Consumer Products Limited (GCPL) can tap into emerging consumer needs in India, such as pet care and sexual wellness, markets experiencing significant growth. The Indian pet care market, valued at approximately $500 million in 2023, presents a substantial opportunity for expansion.

Further growth can be achieved by strengthening its distribution in India's vast rural markets, potentially through dedicated rural logistics. The company can also leverage the expanding e-commerce landscape, which is projected to see FMCG sales reach $10 billion by 2025 in India, to enhance market penetration and customer engagement.

GCPL's strategic acquisition of Raymond's consumer care business in 2024, including brands like Park Avenue, for an estimated INR 800 crore, highlights its intent to expand in personal care. Additionally, leveraging group synergies, such as the pet food joint venture with Godrej Agrovet in early 2025 targeting a segment with over 15% CAGR growth, is a key strategy.

GCPL's opportunities also lie in expanding into high-growth emerging markets and diversifying into premium skincare and health products. Investing in digital platforms to boost direct-to-consumer sales and supply chain efficiency, mirroring successful 2024 FMCG digital transformations, is also a critical avenue.

| Opportunity Area | Market/Segment | 2023/2024 Data Point | Projected Impact/Growth |

|---|---|---|---|

| New Category Entry | Pet Care (India) | Market valued at ~$500 million in 2023 | Significant growth potential |

| Market Penetration | Rural India | Growing consumption momentum | Volume growth through enhanced distribution |

| Digital & E-commerce | FMCG E-commerce (India) | Projected $10 billion by 2025 | Broader market reach, optimized supply chain |

| Strategic Acquisitions | Personal Care (India) | Acquisition of Raymond's consumer care (2024) | Expected to add ~INR 800 crore revenue in year 1 |

| Group Synergies | Pet Food (JV) | Targeting >15% CAGR through 2030 | Leveraging internal strengths for market entry |

Threats

The Fast-Moving Consumer Goods (FMCG) sector is incredibly competitive, with major global companies and nimble local businesses constantly battling for consumer attention and market share. This fierce competition can force price reductions and escalate advertising costs, potentially squeezing Godrej Consumer Products Limited's (GCPL) profit margins and slowing down revenue increases. For instance, in 2023, the Indian FMCG market saw intensified competition, with players like Hindustan Unilever and ITC reporting increased marketing expenditures to defend their positions.

The proliferation of counterfeit products, especially in India's vast rural and unorganized markets, presents a substantial risk to Godrej Consumer Products Limited (GCPL). These fake items not only erode consumer trust and damage GCPL's carefully cultivated brand image but also directly impact sales. Estimates suggest the counterfeit goods market in India could reach $100 billion by 2025, a significant portion of which affects FMCG sectors where GCPL operates.

Economic downturns and persistent inflationary pressures pose a significant threat to Godrej Consumer Products Limited (GCPL). These factors can directly impact consumer purchasing power, leading to reduced spending, particularly on non-essential items within GCPL's product portfolio. For instance, rising inflation in early 2024 has already been cited as a reason for slower volume growth in certain FMCG categories, underscoring GCPL's vulnerability to macroeconomic shifts.

Regulatory Changes and Trade Policies

Changes in government policies, such as Foreign Direct Investment (FDI) regulations and import duties, can significantly alter Godrej Consumer Products Limited's (GCPL) operational costs and market access, especially in its international ventures. For example, increased import duties in key markets could make GCPL's products less competitive. In 2023, India’s trade deficit widened, prompting potential policy shifts that could affect imported raw materials or finished goods.

Evolving product safety and environmental standards also pose a threat. Adapting to new regulations, like stricter chemical usage guidelines in personal care products, may necessitate costly reformulation and re-certification processes. GCPL's commitment to sustainability means staying ahead of these changes, but compliance can still lead to increased operational expenses and potential delays in product launches.

These regulatory shifts and trade policies can create an uneven playing field, impacting GCPL's profitability and strategic expansion plans. The company must remain agile and invest in robust compliance frameworks to navigate this dynamic landscape effectively.

- Increased Import Duties: Higher tariffs on raw materials or finished goods can directly impact GCPL's cost of goods sold and pricing strategies in international markets.

- Evolving Product Standards: Stricter regulations on ingredients, packaging, or environmental impact require ongoing investment in R&D and compliance, potentially increasing operational costs.

- Trade Policy Uncertainty: Fluctuations in international trade agreements and geopolitical tensions can disrupt supply chains and affect market access for GCPL's diverse product portfolio.

Supply Chain Disruptions and Cyber Risks

Godrej Consumer Products Limited (GCPL) navigates a landscape fraught with potential supply chain disruptions. Geopolitical tensions, extreme weather events, and challenges in securing essential raw materials can significantly impact production and distribution. For instance, the ongoing global shipping challenges and rising commodity prices in late 2024 and early 2025 continue to pose a threat to efficient operations.

Furthermore, GCPL's increasing integration of digital technologies, while enhancing efficiency, also amplifies its vulnerability to cyber risks. Data breaches, ransomware attacks, or operational disruptions stemming from cyber incidents could lead to the compromise of sensitive customer and business data, impacting brand reputation and financial performance. The escalating sophistication of cyber threats in 2024 necessitates robust security measures to safeguard operations.

- Supply Chain Vulnerabilities: Geopolitical instability and climate change present ongoing risks to raw material sourcing and logistics for GCPL.

- Cybersecurity Threats: The company's digital infrastructure is susceptible to data theft and operational disruptions from increasingly sophisticated cyberattacks.

- Impact on Operations: Both supply chain disruptions and cyber incidents can lead to production delays, increased costs, and potential damage to GCPL's brand image.

Intensified competition within the FMCG sector, particularly in India, pressures Godrej Consumer Products Limited (GCPL) through potential price wars and increased marketing spend. The growing issue of counterfeit products in India's vast markets poses a significant threat to brand integrity and sales, with estimates suggesting the counterfeit market could reach $100 billion by 2025. Economic downturns and persistent inflation in 2024 have already impacted consumer spending, directly affecting GCPL's revenue streams.

SWOT Analysis Data Sources

This Godrej SWOT analysis is built upon a foundation of credible data, including the company's official financial reports, comprehensive market research, and expert analyses from industry professionals.