Godrej Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Godrej Bundle

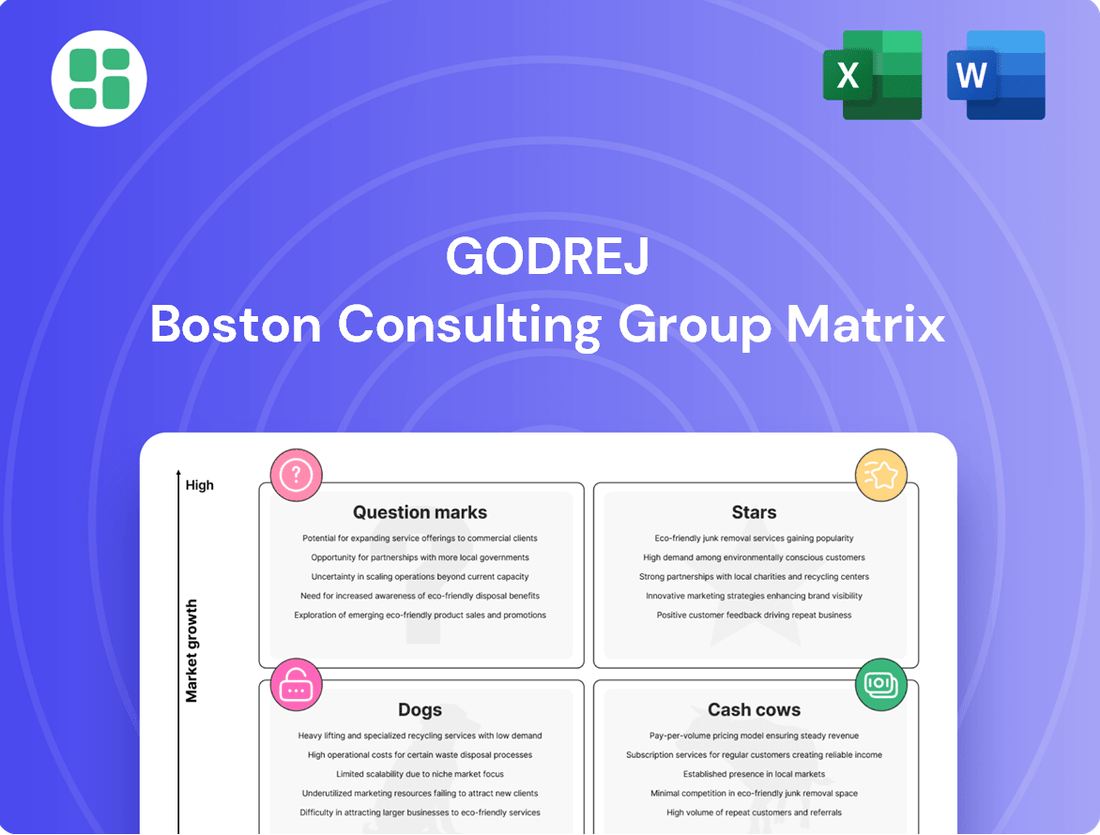

Curious about Godrej's product portfolio? Our BCG Matrix analysis breaks down their offerings into Stars, Cash Cows, Dogs, and Question Marks, giving you a strategic overview.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Godrej.

Stars

Godrej's Household Insecticides (HI) segment, featuring brands like Goodknight and HIT, is a strong performer, bolstered by innovations such as the Renofluthrin molecule and HIT's Thunderbolt Technology. This segment achieved double-digit growth in Q4 FY2025, solidifying its market leadership and reflecting robust demand for advanced pest control solutions.

Godrej Aer, the air freshener brand, is a shining example of a Star product within Godrej's portfolio. It's consistently achieving impressive double-digit volume growth and is actively expanding its market share, solidifying its leadership in the category.

The successful launch of innovative products like the Stella Electric Diffuser has further bolstered Aer's presence. This segment of the market itself is experiencing steady growth, making Aer's strong performance even more significant.

This combination of high market share and a rapidly expanding market firmly places Godrej Aer in the Star quadrant of the BCG matrix.

Godrej's hair colour offerings, particularly the accessible Godrej Expert Rich Crème and the convenient Shampoo Hair Colour, are performing exceptionally well. These products have achieved strong double-digit volume growth, significantly boosting hair colour adoption across India.

This segment is a clear Star in Godrej's portfolio. The company has successfully increased its market share within the rapidly expanding hair colour category, demonstrating a dominant presence. Ongoing innovation and a focus on widespread accessibility are key drivers behind this stellar performance.

Sexual Wellness Products (KamaSutra)

Following the acquisition of Raymond Consumer Care's FMCG business, KamaSutra sexual wellness products have demonstrated robust double-digit volume growth. This performance indicates a significant expansion in market share for the brand within the sexual wellness category.

Godrej Consumer Products Limited (GCPL) views the sexual wellness segment as a 'category of the future,' highlighting its substantial growth potential. KamaSutra is actively solidifying its position in this promising market.

GCPL's strategic initiatives, including increased marketing expenditure, are designed to further bolster KamaSutra's 'Star' status. This focus aims to capitalize on the category's high-growth trajectory.

- Market Share Growth KamaSutra's market share has been steadily increasing, supported by strong volume expansion.

- Category Potential GCPL identifies sexual wellness as a high-growth 'category of the future'.

- Strategic Investment Increased marketing spend is a key strategy to reinforce KamaSutra's market leadership.

Liquid Detergents (Godrej Fab Liquid)

Godrej Fab Liquid has rapidly established itself as a Star in the liquid detergent market. Launched at an accessible price point, it achieved an impressive annualized revenue run rate of ₹250 crore within its first year.

The company has set an ambitious target for Fab Liquid to reach ₹500 crore in revenue by FY26, underscoring its strong growth trajectory. This product is strategically positioned to capture leadership in a large, yet under-penetrated category, signaling substantial future potential and increasing market share.

- Product: Godrej Fab Liquid

- Market Segment: Liquid Detergents

- Key Achievement: ₹250 crore annualized revenue run rate within 12 months.

- Future Target: ₹500 crore revenue by FY26.

- Strategic Positioning: Aiming for leadership in an under-penetrated, high-growth category.

Godrej Aer, Godrej's hair colour products, and KamaSutra sexual wellness products are all strong contenders in their respective markets. These brands are experiencing significant growth, driven by innovation and strategic market positioning. Their high market share and the expanding nature of their categories firmly place them as Stars in Godrej's portfolio.

| Brand | Category | Growth Driver | Market Position | BCG Quadrant |

|---|---|---|---|---|

| Godrej Aer | Air Fresheners | Product Innovation (Stella Electric Diffuser), Market Share Expansion | Category Leader | Star |

| Godrej Hair Colour | Hair Colour | Accessibility (Expert Rich Crème), Convenience (Shampoo Hair Colour), Double-Digit Volume Growth | Increasing Market Share in Growing Category | Star |

| KamaSutra | Sexual Wellness | Acquisition Integration, Robust Double-Digit Volume Growth, Category of the Future | Expanding Market Share | Star |

What is included in the product

The Godrej BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

The Godrej BCG Matrix provides a clear, visual overview of their business units, easing the pain of complex portfolio analysis.

Cash Cows

The Personal Wash category, featuring heritage brands like Godrej No. 1 and Cinthol, represents a significant cash cow for Godrej Consumer Products Limited (GCPL). These brands, while experiencing modest volume growth in recent quarters, maintain a dominant market share.

Despite flattish to mid-high single-digit volume growth, the sheer scale of these established market leaders ensures they remain substantial cash generators for GCPL. Their consistent profitability stems from their strong brand equity and widespread consumer trust.

For instance, GCPL's personal wash segment, heavily reliant on these iconic brands, has been a consistent contributor to the company's overall financial performance. This segment's stability provides a reliable source of funds, allowing GCPL to invest in other growth areas.

Godrej Magic Handwash, a standout in the Godrej Consumer Products portfolio, continues to impress with its unique powder-to-liquid formulation, consistently achieving double-digit volume growth and expanding its market share. This innovative approach has solidified its position in a category that, while seeing some post-pandemic normalization, still benefits from Magic Handwash's distinct offering.

The product's established market presence allows it to generate significant cash flow with comparatively lower promotional spending. This efficiency is a hallmark of a cash cow, demonstrating strong profitability and reliable returns for Godrej.

Godrej's Fabric Care segment, featuring brands like Genteel and the traditional Godrej Fab variants, continues to be a robust performer. This category consistently achieves strong double-digit volume growth, indicating a healthy expansion and increasing market share. These established products are dependable revenue and profit contributors for Godrej Consumer Products Limited (GCPL).

The maturity of the fabric care market, coupled with the strong brand presence of Genteel and Godrej Fab, ensures stable and predictable cash flows. Their consistent performance solidifies their position as reliable cash generators for the company, underpinning GCPL's overall financial strength.

Household Insecticides (Established formats like Coils and Mats in mature markets)

Established household insecticide formats like coils and mats, particularly under brands such as Goodknight and HIT in India, represent Godrej Consumer Products Limited's (GCPL) Cash Cows. These products, despite operating in mature markets, continue to command substantial market share and provide a reliable revenue stream.

While the broader household insecticide segment can experience seasonal fluctuations, these core offerings benefit from a deeply entrenched consumer base and GCPL's leadership position. This stability makes them a foundational element of the company's home care business, consistently generating strong cash flows.

- Market Dominance: Goodknight and HIT coils and mats hold significant market share in India, a key mature market for GCPL.

- Stable Revenue: These established formats provide a consistent and predictable revenue base, insulating GCPL from some market volatility.

- Strong Cash Generation: Due to their low R&D requirements and high brand loyalty, these products are significant cash generators for the company.

- Foundational Portfolio: They form the bedrock of GCPL's home care segment, supporting investment in newer, high-growth areas.

Indonesia Business (Overall Portfolio)

Godrej Consumer Products Limited's (GCPL) Indonesia business is a prime example of a cash cow within its portfolio. This segment consistently demonstrates strong financial health, characterized by impressive volume growth, often in the 7-12% range in recent quarters. This steady expansion translates directly into robust revenue growth, further bolstered by expanding EBITDA margins.

As GCPL's second-largest market after India, Indonesia holds significant strategic importance. The company commands leading market positions across key categories, including household insecticides, air fresheners, and wet tissues. This dominance ensures a stable and predictable revenue stream.

The Indonesian operations serve as a vital cash cow, contributing reliably to GCPL's overall profitability. Its consistent performance provides a strong foundation for the company's financial stability and enables investment in other growth areas.

- Consistent Volume Growth: 7-12% in recent quarters, indicating strong consumer demand.

- Leading Market Positions: Dominant presence in household insecticides, air fresheners, and wet tissues.

- Significant Profit Contributor: The second-largest market for GCPL, ensuring stable and increasing profitability.

- Improving Financials: Demonstrated revenue growth alongside enhancing EBITDA margins.

The Personal Wash category, anchored by heritage brands like Godrej No. 1 and Cinthol, continues to be a significant cash cow for Godrej Consumer Products Limited (GCPL). These brands maintain a dominant market share, contributing substantially to the company's financial stability.

Despite modest volume growth, their established brand equity and widespread consumer trust ensure consistent profitability. This segment provides a reliable source of funds, enabling GCPL to allocate capital towards emerging opportunities.

The fabric care segment, featuring brands such as Genteel and Godrej Fab, also acts as a dependable cash generator. These products consistently achieve strong double-digit volume growth, reflecting their expanding market share and robust revenue contribution.

Established household insecticide formats, including Goodknight and HIT coils and mats in India, are key cash cows. These mature products, benefiting from deep consumer loyalty and market leadership, provide a stable revenue stream and strong cash flows with minimal R&D investment.

GCPL's Indonesia operations are a prime example of a cash cow, consistently delivering 7-12% volume growth in recent quarters. This strong performance, coupled with leading market positions in key categories, translates into robust revenue growth and expanding EBITDA margins, making it a vital profit contributor.

| Category | Key Brands | Market Position | Growth Driver | Cash Flow Contribution |

| Personal Wash | Godrej No. 1, Cinthol | Dominant Market Share | Brand Equity, Consumer Trust | Substantial & Stable |

| Fabric Care | Genteel, Godrej Fab | Expanding Market Share | Double-Digit Volume Growth | Reliable Revenue & Profit |

| Household Insecticides (India) | Goodknight, HIT (Coils/Mats) | Market Leadership | Consumer Loyalty, Mature Market | Strong & Predictable |

| Indonesia Operations | Various | Leading Positions | 7-12% Volume Growth, Margin Expansion | Vital Profit Contributor |

Preview = Final Product

Godrej BCG Matrix

The Godrej BCG Matrix document you are currently previewing is the identical, fully polished report you will receive immediately after purchase. This means no watermarks, no introductory pages, and no demo content—just the complete, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and visualizations presented here are precisely what you'll be working with to understand Godrej's product portfolio and guide future investments.

Dogs

Certain older, less differentiated soap variants within Godrej's extensive personal wash portfolio may be facing challenges. These products, often characterized by lower market share and stagnant or declining volume growth, are particularly vulnerable in today's competitive landscape. For instance, while Godrej No. 1 and Cinthol remain robust performers, some niche or legacy soap SKUs could be struggling to gain traction in a saturated market where consumer preferences are rapidly evolving towards specialized or premium offerings.

These underperforming variants could be considered cash traps. They might necessitate ongoing marketing investments simply to maintain their current, minimal sales levels, diverting resources that could be better allocated to higher-growth potential products. In 2024, the Indian soap market, while large, has seen increased fragmentation, with smaller players and private labels gaining ground, putting further pressure on established but undifferentiated offerings.

Certain products within Godrej Consumer Products Limited's (GCPL) Africa, USA, and Middle East (GAUM) business are positioned as potential 'Dogs' in the BCG Matrix. This segment has experienced significant headwinds, with organic sales in INR terms seeing declines of 10-25% in recent quarters, indicating a challenging market environment for some offerings.

Despite these overall declines, off-takes, which represent customer demand, remain robust in certain pockets of the GAUM region. However, GCPL's strategic focus on margin improvement and business streamlining through reorganization suggests a critical look at underperforming product lines.

Specifically, product lines within GAUM that hold low market share in low-growth or volatile sub-markets are candidates for the 'Dog' category. These products might require a strategic review, potentially leading to divestiture or significant restructuring to improve their market standing.

Prior to its strategic overhaul and the acquisition of Park Avenue, some of Godrej Consumer Products Limited's (GCPL) deodorant offerings likely struggled in a crowded market. These specific variants, facing intense competition and a prevalence of price-based promotions, found it challenging to carve out a significant market presence or achieve healthy profit margins.

Products affected by SKU Rationalization

Godrej Consumer Products Limited (GCPL) has been strategically reducing its Stock Keeping Unit (SKU) count since 2022 as part of its value realization efforts. This process involves discontinuing smaller brands and underperforming products that don't contribute significantly to the company's growth. These rationalized SKUs are typically those with a low market share, fitting the profile for the 'question mark' quadrant in a BCG matrix analysis, suggesting they consume resources without generating substantial returns.

This SKU rationalization directly impacts product portfolios by focusing resources on higher-potential offerings. For instance, GCPL has identified and phased out numerous SKUs that were not meeting performance benchmarks. This streamlining is crucial for improving operational efficiency and reducing the costs associated with managing a vast number of low-volume products. The company's focus is on enhancing profitability and ensuring that its product range aligns with its overall strategic objectives.

- SKU Rationalization Focus: GCPL's ongoing initiative since 2022 to phase out low-performing brands and products.

- Strategic Rationale: Aligns with value realization strategy by eliminating SKUs with low market share and minimal growth contribution.

- Impact on Portfolio: Aims to boost operational efficiency and reduce waste by concentrating on core, high-potential products.

- BCG Matrix Alignment: Rationalized SKUs often represent products that would fall into the 'question mark' quadrant, requiring careful resource allocation.

Niche or legacy products with declining relevance

Within Godrej Consumer Products Limited's (GCPL) diverse range, certain niche or legacy products might exhibit declining consumer interest. These products often operate in shrinking markets, holding a minimal market share and potentially just covering their costs, thereby consuming valuable resources without generating substantial profits. For instance, in 2024, GCPL's strategic reviews likely identified such items, possibly including older formulations of personal care products or specific regional offerings that no longer resonate with the broader consumer base.

These "Dogs" in the BCG Matrix framework are characterized by their low growth and low market share. They represent a challenge for resource allocation, as continued investment may not yield significant returns. GCPL's management would typically consider options such as divesting these products, phasing them out, or attempting a revitalization strategy if a niche market still exists and can be profitably served. For example, a legacy soap brand that once dominated might now only cater to a small, loyal segment, making its continued presence in a large portfolio questionable from a return-on-investment perspective.

- Low Market Share: Products with a minimal percentage of the total market sales.

- Declining Market Growth: Operating in industries or categories that are shrinking.

- Limited Profitability: Often break-even or low-profit items that tie up capital.

- Resource Drain: Require management attention and investment without commensurate returns.

Certain legacy soap variants within Godrej's extensive personal wash portfolio are likely positioned as 'Dogs' in the BCG Matrix. These products, characterized by low market share and operating in stagnant or declining market segments, may require ongoing investment simply to maintain their current sales levels. For instance, while Godrej No. 1 and Cinthol remain strong, some older, less differentiated soap SKUs could be struggling against evolving consumer preferences for specialized offerings.

These underperforming products can become cash traps, diverting resources from higher-growth potential areas. In 2024, the Indian soap market's increasing fragmentation, with the rise of smaller players and private labels, further pressures established but undifferentiated offerings. Godrej Consumer Products Limited (GCPL) has been actively rationalizing its Stock Keeping Unit (SKU) count since 2022, phasing out products with low market share and minimal growth contribution to improve efficiency and focus on core, high-potential products.

Products within GCPL's Africa, USA, and Middle East (GAUM) business that hold low market share in low-growth or volatile sub-markets are also candidates for the 'Dog' category. This segment has faced significant headwinds, with organic sales in INR terms experiencing declines. GCPL's strategic focus on margin improvement and business streamlining suggests a critical review of these underperforming product lines, potentially leading to divestiture or significant restructuring.

| Product Category | BCG Quadrant (Likely) | Market Share (Est.) | Market Growth (Est.) | Strategic Consideration |

|---|---|---|---|---|

| Legacy Soap Variants | Dog | Low | Stagnant/Declining | Divestment or Niche Revitalization |

| Underperforming GAUM Products | Dog | Low | Low/Volatile | Strategic Review/Divestment |

| Phased-out SKUs (Pre-2022) | Dog/Question Mark | Very Low | Negligible/Declining | Discontinued |

Question Marks

Godrej Ninja, launched in April 2024 in Tamil Nadu, represents Godrej Consumer Products Limited's (GCPL) foray into the burgeoning Indian pet care market. This segment is valued at an estimated ₹5,000 crore and exhibits strong double-digit growth potential, positioning Ninja as a potential star in GCPL's portfolio.

Despite the market's attractiveness, Godrej Ninja is a new entrant with a currently negligible market share. The significant ₹500 crore investment planned over five years, with operations set to ramp up in the latter half of FY2026, underscores the need for substantial capital to capture market share and establish its presence.

Park Avenue Deodorants, now part of Godrej Consumer Products Limited (GCPL) following its acquisition in 2023, is positioned as a Question Mark in the BCG Matrix. While it commands the second-largest market share in the deodorant category, its recent integration presents a dynamic situation. GCPL's strategic focus on reconfiguring the price, pack, and channel strategy for Park Avenue highlights the brand's current transitional phase.

The deodorant market is a growing segment, offering significant potential for Park Avenue. However, GCPL's performance in FY25, achieving growth closer to 10% against an ambitious target of 20-25%, underscores the challenges faced. This growth gap suggests that substantial investment and targeted marketing initiatives are crucial for Park Avenue to fully leverage its market position and expand its share under GCPL's ownership.

Cinthol Foam Bodywash, launched by Godrej Consumer Products Limited (GCPL) in April 2024, enters the rapidly expanding bodywash market. This new product is positioned as a potential 'Star' in the BCG matrix, given its entry into a high-growth category.

The immediate challenge for Cinthol Foam Bodywash is to gain market share in a competitive landscape. GCPL's investment in marketing and distribution will be crucial for its success, aiming to transition it from a question mark to a star performer.

New product innovations in Household Insecticides (e.g., Goodknight Agarbatti with RMF)

New product innovations like Goodknight Agarbatti with the patented RMF molecule, launched in early 2024, are positioned as potential Stars within the Household Insecticides category. This segment is experiencing high growth, fueled by continuous innovation and the need to counter unregulated incense sticks. For instance, the Indian household insecticide market alone was valued at approximately USD 1.2 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030.

- Innovation Driver: The RMF molecule offers a novel approach to insect repellency, differentiating it from traditional offerings.

- Market Potential: The household insecticides market in India is robust, with increasing consumer awareness and demand for effective solutions.

- Growth Stage: Despite the promising innovation, these products are in an early adoption phase, requiring significant investment in distribution and consumer education.

- Strategic Focus: Success hinges on rapidly scaling market penetration and achieving widespread consumer acceptance to solidify its Star status.

Strategic entries into underpenetrated categories (e.g., affordable antiperspirants like Block)

Godrej Consumer Products Limited (GCPL) is making strategic moves to capture market share in underpenetrated categories, exemplified by its entry into the affordable antiperspirant segment with products like Block, priced at ₹99. This initiative aims to broaden the total addressable market by making quality antiperspirants accessible to a wider consumer base. By focusing on value-driven offerings, GCPL is targeting high-growth, yet underserved, consumer segments, a classic BCG Matrix strategy for potential stars.

The success of these affordable antiperspirants will depend on GCPL's ability to drive market adoption and build strong brand equity. Significant investment in marketing and distribution will be crucial to establish a foothold and gain traction against established players. This approach aligns with the BCG Matrix's emphasis on investing in promising ventures to foster growth and market leadership.

- Strategic Entry: GCPL is targeting the underpenetrated antiperspirant market with affordable options like Block at ₹99.

- Market Expansion: The goal is to increase the total addressable market by catering to price-sensitive consumers.

- Growth Potential: This strategy focuses on capturing market share in high-growth, underserved consumer segments.

- Key Success Factors: Effective market adoption, brand building, and robust distribution are vital for success.

Park Avenue Deodorants, acquired by GCPL in 2023, is currently a Question Mark. Despite holding the second-largest market share, its recent integration necessitates strategic adjustments in pricing, packaging, and distribution channels. The company's FY25 growth of approximately 10%, falling short of its 20-25% target, highlights the need for focused investment to capitalize on its market position.

The antiperspirant segment, particularly the affordable tier, represents an opportunity for GCPL. Products like Block, priced at ₹99, aim to expand the market by targeting price-sensitive consumers. This strategy focuses on underserved segments, a key approach for turning Question Marks into Stars.

The success of these affordable antiperspirants hinges on effective market penetration and brand building. GCPL's investment in marketing and distribution will be critical to compete and gain traction in this developing market.

| Product/Brand | Category | BCG Status | Market Share | Growth Potential | GCPL Strategy |

|---|---|---|---|---|---|

| Park Avenue Deodorants | Deodorants | Question Mark | 2nd largest | Growing | Price, pack, channel reconfiguration |

| Affordable Antiperspirants (e.g., Block) | Personal Care | Question Mark | Nascent/Targeting underpenetrated | High (expanding market) | Price accessibility, market expansion |

BCG Matrix Data Sources

Our Godrej BCG Matrix is built on a foundation of robust data, integrating internal financial statements, market research reports, and competitor analysis to provide strategic clarity.