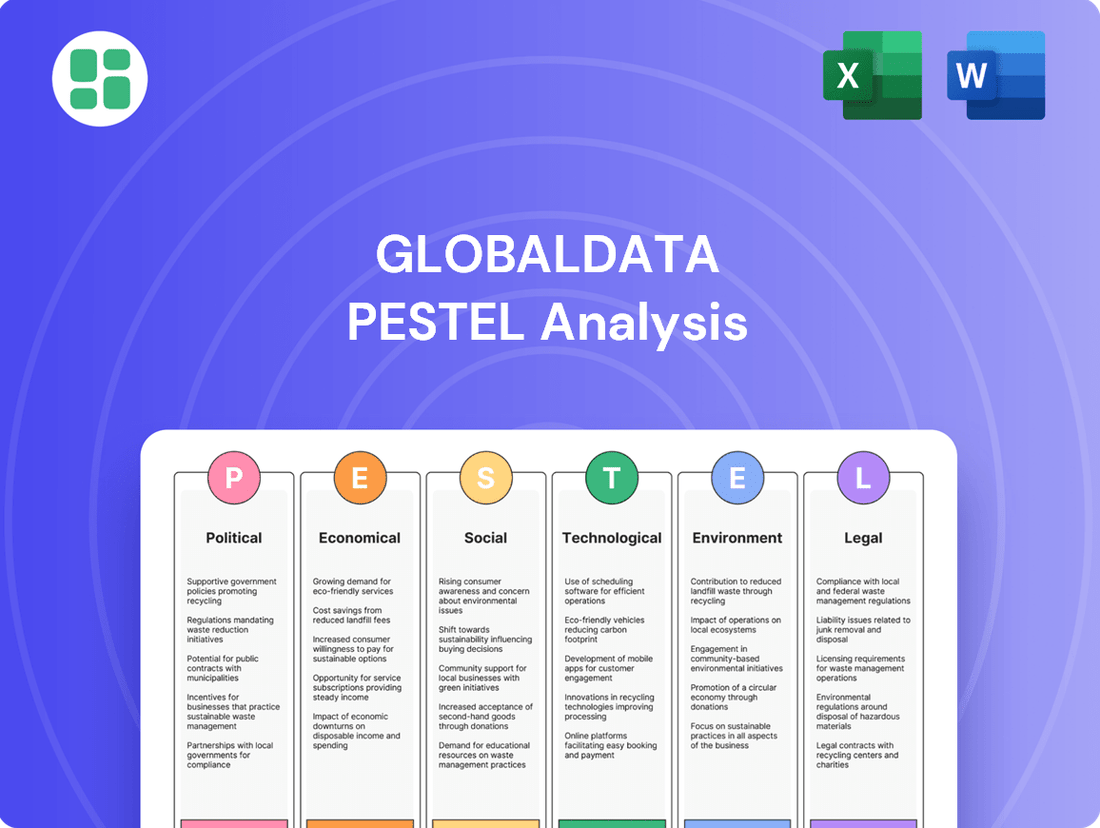

GlobalData PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

Unlock the external forces shaping GlobalData's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions. Gain a competitive advantage by leveraging these expert insights. Download the full PESTLE analysis now to inform your own market strategy and identify critical opportunities and threats.

Political factors

Governments globally are tightening data policies, impacting how companies like GlobalData operate. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data privacy and security, influencing data handling practices worldwide. Many nations are following suit with their own legislation, such as Brazil's LGPD, creating a complex compliance landscape.

GlobalData's reliance on a worldwide client base means geopolitical stability is crucial. Trade disputes and shifting international relations can directly impact market access and client sentiment, potentially affecting demand for market intelligence services. For instance, the ongoing trade friction between major economic blocs in 2024 could lead to increased uncertainty for businesses, impacting their willingness to invest in market research.

Regulatory shifts within sectors like healthcare, energy, and technology directly influence GlobalData's data products and analytical services. For instance, the European Union's Digital Markets Act (DMA), which came into effect in March 2024, imposes stricter rules on large tech platforms, potentially altering how data on these markets is collected and interpreted.

New compliance requirements or data privacy mandates, such as those evolving from GDPR or similar global frameworks, can necessitate adjustments in GlobalData's data collection methodologies and reporting. Failure to adapt to these changes, like updated data retention policies or new consent requirements, could impact the accuracy and comprehensiveness of its industry insights and consulting recommendations.

Government Spending and Procurement

Government spending on data, analytics, and consulting services is a key political factor influencing GlobalData. For instance, in the fiscal year 2024, the US federal government planned to spend over $200 billion on IT services, a segment that often includes data analytics and consulting. Shifts in these budget allocations directly impact the market opportunities available for companies like GlobalData.

Changes in public sector procurement processes, such as the move towards more streamlined digital platforms or increased emphasis on data security, can either facilitate or complicate GlobalData's ability to secure contracts. For example, many governments are actively promoting e-procurement systems to increase transparency and efficiency in awarding contracts, a trend that GlobalData must adapt to.

- Government IT Spending: The US federal government's IT spending is projected to reach approximately $220 billion in 2025, with a significant portion allocated to data-driven initiatives.

- Digital Transformation Initiatives: Many national governments, including the UK and Canada, have launched multi-year digital transformation strategies, increasing demand for advanced analytics and specialized consulting.

- Procurement Reforms: Ongoing reforms in public procurement aim to simplify bidding processes for technology and data services, potentially creating more accessible avenues for GlobalData.

Political Stability in Key Markets

Political stability in key markets where GlobalData operates or has a substantial client base is paramount. For instance, in 2024, the World Bank's Worldwide Governance Indicators reported varying levels of political stability and absence of violence across different regions, directly impacting investor confidence and market predictability. Unforeseen political shifts or instability can introduce significant uncertainty, influencing client investment strategies and the continuity of GlobalData's data collection and analysis processes.

The impact of political factors on GlobalData's operations can be significant. A sudden change in government or policy, such as new regulations on data privacy or international investment in 2024, could necessitate rapid adjustments to business models and operational frameworks. This unpredictability can delay project timelines and affect the accuracy of forecasts derived from market data.

- Geopolitical Risk Index: Monitoring geopolitical risk indices, which saw fluctuations in 2024 due to regional conflicts and trade disputes, helps assess potential disruptions to GlobalData's operations and client markets.

- Regulatory Environment: Changes in financial regulations or data governance laws in major economies, such as the ongoing discussions around AI regulation in the EU and US in 2024, can directly affect how GlobalData collects, processes, and disseminates information.

- Government Spending and Investment Policies: Government decisions on infrastructure spending, R&D funding, and economic stimulus packages, as seen in various national budgets for 2024-2025, can create or diminish market opportunities for GlobalData's clients.

- Election Cycles: Upcoming elections in key markets throughout 2024 and 2025 introduce a degree of political uncertainty, potentially leading to policy shifts that could impact market sentiment and investment flows.

Government policies on data privacy and security continue to evolve, with many nations implementing stricter regulations that impact how companies like GlobalData handle information. For instance, the European Union's Digital Services Act, fully in effect from early 2024, places new obligations on online platforms, influencing data access and reporting for market intelligence. Furthermore, the ongoing global focus on cybersecurity mandates robust data protection measures, requiring continuous adaptation of operational frameworks.

| Political Factor | Impact on GlobalData | 2024/2025 Data/Trend |

|---|---|---|

| Data Privacy Regulations | Increased compliance costs, potential limitations on data collection. | GDPR remains influential; new national laws like Brazil's LGPD are expanding the compliance landscape. |

| Geopolitical Stability | Affects market access, client confidence, and investment in market research. | Trade tensions and regional conflicts in 2024 created market uncertainty, impacting business investment. |

| Government IT Spending | Directly influences demand for analytics and consulting services. | US federal IT spending projected around $220 billion in 2025, with significant data-focused allocations. |

| Regulatory Environment | Impacts data collection, processing, and dissemination, especially in tech and finance. | AI regulation discussions in the EU and US in 2024 highlight evolving governance frameworks. |

What is included in the product

GlobalData's PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors influencing the company's operating landscape.

This analysis offers actionable insights for strategic decision-making by identifying key external drivers and their potential impact on GlobalData's future growth and competitive positioning.

GlobalData's PESTLE Analysis provides a structured framework that eliminates the overwhelm of sifting through vast amounts of external data, offering clear, actionable insights for strategic decision-making.

Economic factors

Global economic growth significantly impacts demand for market intelligence. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, reflecting a stable but moderate expansion. This generally supports increased corporate investment in data and consulting services as businesses feel more confident about future returns.

However, recession risks remain a key consideration. Persistent inflation and geopolitical tensions in 2024 continued to cast a shadow, raising concerns about potential economic slowdowns in major economies. Should these risks materialize into a widespread recession, companies would likely tighten budgets, leading to reduced spending on market intelligence and consulting.

For GlobalData, a slowdown would mean a decrease in new project acquisition and potentially longer sales cycles. Conversely, a robust global economy with sustained growth would fuel demand for their services, as companies seek to capitalize on opportunities and gain a competitive edge through informed decision-making.

Rising inflation presents a significant challenge for GlobalData. For instance, in the US, the Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year as of April 2024. This upward trend directly impacts GlobalData's operational expenses, from the cost of acquiring new data sets to maintaining its technology infrastructure and compensating its skilled workforce, potentially squeezing profit margins.

Interest rate volatility further complicates GlobalData's financial strategy. With the Federal Reserve maintaining a hawkish stance, interest rates have remained elevated, impacting the cost of borrowing. For example, the average interest rate on a 30-year fixed-rate mortgage in the US hovered around 7.0% in early May 2024. This higher cost of capital makes it more expensive for GlobalData to finance potential acquisitions or invest in new growth initiatives, requiring careful financial planning and a more cautious approach to expansion.

Currency exchange rate volatility presents a significant challenge for GlobalData as a global entity. Fluctuations in foreign exchange markets directly impact the value of its international revenues and expenses. For instance, a strengthening US dollar against other currencies could reduce the reported value of earnings generated in those foreign markets when translated back into dollars, potentially impacting overall profitability.

These shifts also affect GlobalData's competitive pricing strategies in different regions. If the company's home currency strengthens considerably, its products and services priced in local currencies might become more expensive for international customers, potentially hindering sales volume. Conversely, a weaker home currency could make its offerings more attractive abroad.

In 2024, major currency pairs like EUR/USD and GBP/USD experienced notable volatility, driven by differing monetary policies and geopolitical events. For example, the Euro saw periods of weakness against the dollar due to inflation concerns and energy market instability in Europe, directly influencing the dollar-denominated earnings of companies with substantial European operations.

Client Industry Performance and Spending

GlobalData's revenue is intrinsically linked to the economic health of the sectors it serves. For instance, the pharmaceutical industry, a significant client base, saw global healthcare spending reach an estimated $10 trillion in 2023, indicating a strong capacity for investment in market intelligence. Conversely, a slowdown in technology spending, which dipped in certain segments during 2023 due to inflation concerns, could temper demand for GlobalData's insights in that area.

The retail sector's performance is also a key indicator. With global retail e-commerce sales projected to reach $7.5 trillion by 2027, growth in online retail presents opportunities for GlobalData to provide data on consumer behavior and market trends. However, economic headwinds affecting consumer discretionary spending, such as rising interest rates in 2024, could impact the willingness of retail businesses to allocate budgets for external market research.

- Pharmaceutical Spending: Global healthcare expenditure is a robust indicator of potential investment in market intelligence, with significant growth observed in recent years.

- Technology Sector Investment: While generally strong, specific segments within technology can experience cyclical spending adjustments based on macroeconomic conditions and innovation cycles.

- Retail E-commerce Growth: The expanding digital marketplace offers fertile ground for market intelligence services, though consumer spending power remains a critical factor.

- Impact of Economic Downturns: Reduced corporate profits and tighter budgets during economic slowdowns directly translate to decreased demand for market research and consulting services across various industries.

Competitive Landscape and Pricing Pressure

The data analytics and consulting sector is a crowded space, featuring a wide array of competitors from global behemoths to niche data specialists. This high level of competition frequently translates into significant pricing pressure, which can directly affect GlobalData's profitability. To counter this, the company must consistently innovate its services and strengthen its unique value proposition.

For instance, the global data analytics market was valued at approximately $27.19 billion in 2023 and is projected to reach $139.75 billion by 2030, growing at a CAGR of 26.3% during this period. This rapid growth attracts new entrants, intensifying competition and potentially driving down prices for standard services.

- Intense Competition: The market includes large consulting firms, specialized data analytics providers, and in-house data science teams within client organizations.

- Pricing Pressure: Aggressive pricing strategies from competitors can erode profit margins for companies like GlobalData.

- Need for Differentiation: Continuous investment in R&D and unique service offerings is crucial to maintain a competitive edge and justify premium pricing.

- Market Dynamics: The ongoing digital transformation across industries fuels demand but also attracts more players, exacerbating competitive pressures.

Global economic growth significantly impacts demand for market intelligence. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, reflecting a stable but moderate expansion. This generally supports increased corporate investment in data and consulting services as businesses feel more confident about future returns.

However, recession risks remain a key consideration. Persistent inflation and geopolitical tensions in 2024 continued to cast a shadow, raising concerns about potential economic slowdowns in major economies. Should these risks materialize into a widespread recession, companies would likely tighten budgets, leading to reduced spending on market intelligence and consulting.

For GlobalData, a slowdown would mean a decrease in new project acquisition and potentially longer sales cycles. Conversely, a robust global economy with sustained growth would fuel demand for their services, as companies seek to capitalize on opportunities and gain a competitive edge through informed decision-making.

Rising inflation presents a significant challenge for GlobalData. For instance, in the US, the Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year as of April 2024. This upward trend directly impacts GlobalData's operational expenses, from the cost of acquiring new data sets to maintaining its technology infrastructure and compensating its skilled workforce, potentially squeezing profit margins.

Interest rate volatility further complicates GlobalData's financial strategy. With the Federal Reserve maintaining a hawkish stance, interest rates have remained elevated, impacting the cost of borrowing. For example, the average interest rate on a 30-year fixed-rate mortgage in the US hovered around 7.0% in early May 2024. This higher cost of capital makes it more expensive for GlobalData to finance potential acquisitions or invest in new growth initiatives, requiring careful financial planning and a more cautious approach to expansion.

Currency exchange rate volatility presents a significant challenge for GlobalData as a global entity. Fluctuations in foreign exchange markets directly impact the value of its international revenues and expenses. For instance, a strengthening US dollar against other currencies could reduce the reported value of earnings generated in those foreign markets when translated back into dollars, potentially impacting overall profitability.

These shifts also affect GlobalData's competitive pricing strategies in different regions. If the company's home currency strengthens considerably, its products and services priced in local currencies might become more expensive for international customers, potentially hindering sales volume. Conversely, a weaker home currency could make its offerings more attractive abroad.

In 2024, major currency pairs like EUR/USD and GBP/USD experienced notable volatility, driven by differing monetary policies and geopolitical events. For example, the Euro saw periods of weakness against the dollar due to inflation concerns and energy market instability in Europe, directly influencing the dollar-denominated earnings of companies with substantial European operations.

GlobalData's revenue is intrinsically linked to the economic health of the sectors it serves. For instance, the pharmaceutical industry, a significant client base, saw global healthcare spending reach an estimated $10 trillion in 2023, indicating a strong capacity for investment in market intelligence. Conversely, a slowdown in technology spending, which dipped in certain segments during 2023 due to inflation concerns, could temper demand for GlobalData's insights in that area.

The retail sector's performance is also a key indicator. With global retail e-commerce sales projected to reach $7.5 trillion by 2027, growth in online retail presents opportunities for GlobalData to provide data on consumer behavior and market trends. However, economic headwinds affecting consumer discretionary spending, such as rising interest rates in 2024, could impact the willingness of retail businesses to allocate budgets for external market research.

- Pharmaceutical Spending: Global healthcare expenditure is a robust indicator of potential investment in market intelligence, with significant growth observed in recent years.

- Technology Sector Investment: While generally strong, specific segments within technology can experience cyclical spending adjustments based on macroeconomic conditions and innovation cycles.

- Retail E-commerce Growth: The expanding digital marketplace offers fertile ground for market intelligence services, though consumer spending power remains a critical factor.

- Impact of Economic Downturns: Reduced corporate profits and tighter budgets during economic slowdowns directly translate to decreased demand for market research and consulting services across various industries.

The data analytics and consulting sector is a crowded space, featuring a wide array of competitors from global behemoths to niche data specialists. This high level of competition frequently translates into significant pricing pressure, which can directly affect GlobalData's profitability. To counter this, the company must consistently innovate its services and strengthen its unique value proposition.

For instance, the global data analytics market was valued at approximately $27.19 billion in 2023 and is projected to reach $139.75 billion by 2030, growing at a CAGR of 26.3% during this period. This rapid growth attracts new entrants, intensifying competition and potentially driving down prices for standard services.

- Intense Competition: The market includes large consulting firms, specialized data analytics providers, and in-house data science teams within client organizations.

- Pricing Pressure: Aggressive pricing strategies from competitors can erode profit margins for companies like GlobalData.

- Need for Differentiation: Continuous investment in R&D and unique service offerings is crucial to maintain a competitive edge and justify premium pricing.

- Market Dynamics: The ongoing digital transformation across industries fuels demand but also attracts more players, exacerbating competitive pressures.

Economic factors significantly shape the operating environment for market intelligence firms like GlobalData. Moderate global growth projected for 2024, around 3.2% by the IMF, generally supports increased investment in data and consulting. However, persistent inflation, with US CPI at 3.4% year-over-year in April 2024, and elevated interest rates, around 7.0% for US 30-year mortgages in May 2024, increase operational costs and the cost of capital, potentially squeezing profit margins and making expansion more cautious.

Currency volatility also poses a challenge, as seen with the EUR/USD pair in 2024, impacting the reported value of international earnings. Sector-specific performance is crucial; strong pharmaceutical spending, estimated at $10 trillion globally in 2023, offers opportunities, while potential slowdowns in technology spending can temper demand. The expanding retail e-commerce market, projected to reach $7.5 trillion by 2027, presents growth avenues, though consumer spending power remains a key determinant.

The competitive landscape for data analytics, valued at $27.19 billion in 2023 and projected to grow to $139.75 billion by 2030, is intense. This high competition, with numerous players from global firms to niche specialists, exerts pricing pressure, necessitating continuous innovation and differentiation for companies like GlobalData to maintain profitability and a competitive edge.

Preview the Actual Deliverable

GlobalData PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This GlobalData PESTLE Analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting a specific industry or market. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

There's a clear societal push across all sectors for decisions to be backed by solid data. This isn't just a trend; it's becoming a fundamental expectation for success. Businesses recognize that understanding market nuances and consumer behavior through analytics is key to staying ahead.

This growing reliance on data directly boosts the need for companies like GlobalData, which provide the crucial market intelligence businesses require. As of early 2025, surveys indicate that over 70% of executives believe data analytics is critical for their company's future growth, highlighting this societal shift.

The demand for data science and analytics professionals continues to outstrip supply. Globally, there's a significant shortage of individuals with advanced skills in areas like machine learning, artificial intelligence, and big data management. For instance, reports from late 2024 indicated that the number of open data science positions was more than double the number of qualified candidates available in major tech hubs.

This scarcity directly impacts companies like GlobalData, which depend on a highly skilled workforce for their core operations. Acquiring and retaining top talent in these specialized fields becomes a major hurdle, influencing the company's ability to innovate and maintain its competitive edge in research and platform development.

The widespread adoption of hybrid and remote work models is fundamentally altering how consulting services are both provided and utilized. This seismic shift necessitates that GlobalData re-evaluate its operational frameworks, investing in advanced collaboration technologies and refining client interaction strategies to align with the growing demand for accessible and agile insights.

Public Trust in Data and AI

Public trust in data and AI is a critical sociological factor influencing GlobalData's operations. Concerns about data privacy, algorithmic bias, and the ethical implications of AI are significant. A 2024 survey indicated that 68% of consumers are worried about how their personal data is used by companies, directly impacting how they perceive data-driven insights.

To navigate these concerns, GlobalData must prioritize transparency in its data collection and analysis methodologies. Adhering to stringent ethical guidelines and demonstrating a commitment to fairness in AI applications is paramount for building and maintaining trust with both the public and its clients. This proactive approach is essential for long-term credibility in the data analytics sector.

- Data Privacy Concerns: A significant portion of the population expresses apprehension regarding the use of their personal data, influencing their willingness to engage with data-centric services.

- Algorithmic Bias: The potential for AI algorithms to perpetuate or even amplify existing societal biases poses a risk to the perceived fairness and reliability of data insights.

- Ethical AI Use: Societal expectations for responsible and ethical deployment of AI technologies are increasing, demanding clear frameworks and accountability from data providers.

- Trust as a Differentiator: Companies that can demonstrably build and maintain public and client trust through transparent and ethical data practices are likely to gain a competitive advantage.

Demographic Shifts and Consumer Behavior

Global demographic shifts, like the increasing proportion of older adults in many developed nations and the burgeoning middle class in emerging economies, directly shape the market research needs of GlobalData's clients. For instance, the growing demand for healthcare and retirement services in regions with aging populations, such as Japan and Western Europe, necessitates specialized market intelligence. By 2023, the global population aged 65 and over was projected to reach over 770 million, a figure expected to climb significantly in the coming years, underscoring this trend.

To remain relevant, GlobalData must constantly refine its data collection and analytical techniques to capture and predict these evolving consumer behaviors. This includes adapting to new purchasing patterns driven by digital native generations and understanding the preferences of increasingly diverse consumer segments worldwide. The rise of the Gen Z demographic, for example, with their distinct digital habits and brand loyalties, presents a dynamic challenge and opportunity for market research firms.

- Aging Populations: By 2023, over 770 million people globally were aged 65 and over, a demographic trend demanding tailored market insights for sectors like healthcare and finance.

- Emerging Consumer Segments: The rapid expansion of the middle class in Asia, particularly in countries like India and China, is creating new demand for goods and services, requiring updated consumer behavior analysis.

- Digital Natives: Understanding the purchasing power and preferences of Gen Z, who are projected to account for a significant portion of consumer spending by 2025, is crucial for market research accuracy.

- Data Evolution: GlobalData's commitment to updating methodologies ensures its data reflects the nuanced and rapidly changing landscape of consumer decision-making across diverse global markets.

Societal expectations are increasingly centered on data-driven decision-making, making robust market intelligence essential for business success. This has amplified the demand for companies like GlobalData, with over 70% of executives in early 2025 deeming data analytics critical for growth.

The shortage of skilled data science professionals, with open positions often outnumbering qualified candidates by more than two-to-one in late 2024, directly impacts GlobalData's ability to innovate and maintain its competitive edge.

Public trust in data and AI is a significant sociological factor, with 68% of consumers in a 2024 survey expressing concerns about personal data usage, necessitating transparency and ethical AI practices from data providers.

Demographic shifts, such as the growing global population aged 65 and over (exceeding 770 million by 2023), shape market research needs, requiring firms like GlobalData to adapt their methodologies to capture evolving consumer behaviors, especially from digital native generations like Gen Z.

Technological factors

The rapid evolution of artificial intelligence (AI), machine learning (ML), and big data analytics is fundamentally reshaping how businesses understand and interact with markets. For a company like GlobalData, these technological leaps offer significant opportunities to refine its analytical capabilities. By integrating advanced AI and ML algorithms into its platforms, GlobalData can automate complex data processing tasks, leading to faster and more efficient insights delivery.

These advancements directly translate into improved predictive accuracy. For instance, by analyzing vast datasets with sophisticated ML models, GlobalData can identify emerging trends and forecast market shifts with greater precision. This allows clients to make more informed, data-driven decisions, whether they are navigating investment strategies or developing new business plans. The ability to process and interpret massive volumes of unstructured data, a hallmark of big data, further empowers the delivery of more granular and actionable intelligence.

The escalating sophistication of cyber threats presents a substantial risk to data analytics firms like GlobalData, given their extensive handling of sensitive client information. In 2023, the average cost of a data breach reached $4.45 million globally, a figure that underscores the financial and reputational damage such incidents can inflict.

Maintaining robust cybersecurity is therefore paramount for GlobalData to safeguard client data, ensure data integrity, and protect its reputation. The company's reliance on data analytics means that any breach could compromise proprietary information and client trust, impacting future business operations.

GlobalData's commitment to leveraging advanced cloud computing is a significant technological driver. The widespread adoption of cloud platforms allows for highly scalable data storage and processing, crucial for managing the vast datasets GlobalData analyzes. This infrastructure underpins their ability to deliver timely market intelligence and sophisticated analytical tools to their diverse client base.

The financial benefits of cloud adoption are substantial. By migrating to cloud infrastructure, companies like GlobalData can significantly reduce capital expenditure on physical servers and data centers, translating to lower operational costs. For instance, many businesses reported savings of 15-30% on IT infrastructure costs after moving to the cloud in 2024, a trend expected to continue.

Furthermore, cloud computing enhances data accessibility and facilitates rapid innovation. It allows GlobalData to deploy new analytical platforms and services more quickly, responding effectively to evolving market demands. This agility is key in the fast-paced information services sector, enabling quicker insights and competitive advantages for their clients.

Emergence of New Data Sources and Tools

The explosion of new data sources, including the Internet of Things (IoT), alternative datasets, and social media analytics, offers significant opportunities for GlobalData. For instance, by 2024, the global data sphere was projected to reach 221.2 zettabytes, a substantial increase from previous years, highlighting the sheer volume of information available. GlobalData must actively integrate these diverse datasets and develop sophisticated tools to glean actionable intelligence, ensuring they remain at the forefront of market understanding and anticipate evolving client needs.

Leveraging these emerging data streams allows for a more nuanced and predictive market analysis. For example, the adoption of AI in data analytics is expected to grow significantly, with the global AI market size reaching an estimated $200 billion in 2024, according to some projections. This technological advancement is crucial for GlobalData to not only process but also interpret the vast amounts of unstructured data effectively.

- IoT Data: Billions of connected devices are generating real-time operational and behavioral data, offering insights into industry trends and asset performance.

- Alternative Data: Satellite imagery, geolocation data, and consumer transaction records provide non-traditional views of economic activity and market sentiment.

- Social Media Analytics: Monitoring online conversations and sentiment analysis can reveal emerging consumer preferences and brand perception shifts.

- AI and Machine Learning Tools: Advanced algorithms are essential for processing and extracting value from these complex and high-volume data sources.

Digital Transformation of Client Industries

Client industries are heavily investing in digital transformation, with a significant portion of their IT budgets allocated to cloud computing, AI, and data analytics. For instance, a 2024 survey indicated that over 70% of businesses plan to increase their spending on digital transformation initiatives in the next two years. This widespread adoption of technology means clients increasingly depend on data-driven insights and efficient digital operations, directly boosting demand for GlobalData's intelligence and analytics services.

This digital shift necessitates that GlobalData not only provides valuable data but also ensures its solutions seamlessly integrate with clients' existing digital infrastructure. The ability to offer interoperable platforms and APIs is becoming a critical differentiator. For example, many clients are now prioritizing vendors who can demonstrate robust integration capabilities with their CRM and ERP systems, as highlighted by a 2025 industry report showing that 65% of enterprise software purchasing decisions are influenced by integration potential.

- Increased Demand: Digital transformation fuels the need for data and analytics, a core offering of GlobalData.

- Integration Imperative: Clients expect solutions that work within their digital ecosystems, requiring interoperability.

- Technology Adoption: Sectors like finance and healthcare are leading digital adoption, creating significant opportunities for data providers.

The rapid advancement of AI, machine learning, and big data analytics is revolutionizing how businesses operate and understand markets. GlobalData leverages these technologies to enhance its analytical capabilities, automating data processing and delivering faster, more accurate insights. The increasing sophistication of cyber threats, with global data breach costs averaging $4.45 million in 2023, necessitates robust cybersecurity measures for data integrity and client trust.

Cloud computing adoption provides GlobalData with scalable infrastructure, reducing capital expenditure and operational costs, with many businesses seeing 15-30% IT savings post-cloud migration in 2024. The proliferation of new data sources, such as IoT and alternative data, is expanding the information landscape, with the global data sphere projected to reach 221.2 zettabytes by 2024, requiring sophisticated tools for extraction and analysis.

Client industries are prioritizing digital transformation, with over 70% of businesses planning increased spending on digital initiatives in 2024-2025, driving demand for data-driven insights. Seamless integration with clients' existing digital ecosystems is crucial, with 65% of enterprise software decisions in 2025 influenced by integration potential.

| Technology Area | Impact on GlobalData | Key Data Point/Trend |

|---|---|---|

| AI & Machine Learning | Enhanced predictive accuracy, automated data processing | Global AI market projected to reach $200 billion in 2024 |

| Cybersecurity | Mitigation of data breach risks, protection of client data | Average cost of data breach: $4.45 million (2023) |

| Cloud Computing | Scalable infrastructure, reduced IT costs, faster innovation | 15-30% IT infrastructure cost savings reported by cloud adopters (2024) |

| Big Data & New Data Sources | Deeper market understanding, identification of emerging trends | Global data sphere to reach 221.2 zettabytes by 2024 |

| Digital Transformation | Increased demand for analytics, focus on interoperability | 70%+ businesses increasing digital transformation spending (2024-2025) |

Legal factors

The global data protection landscape is constantly shifting, with significant updates to regulations like the GDPR and CCPA. In 2024, we're seeing continued enforcement actions and the emergence of new regional laws, particularly in Asia and Latin America, which will impact how GlobalData handles data. Adhering to these evolving rules, which govern data collection, processing, and cross-border transfers, is paramount for maintaining client trust and operational integrity.

Protecting GlobalData's proprietary market research, databases, analytical models, and software platforms through robust intellectual property rights is paramount for maintaining its competitive edge. This includes patents for unique analytical processes and copyrights for its extensive data compilations.

Legal frameworks governing data ownership, licensing agreements, and the ethical use of third-party data sources directly shape GlobalData's business model. For instance, compliance with GDPR and similar data privacy regulations impacts how customer and market data can be collected, stored, and utilized, influencing its operational costs and market reach.

GlobalData, as a significant entity in the data analytics and consulting sector, operates under strict antitrust and competition laws designed to foster fair market practices. The company must be vigilant regarding its mergers and acquisitions, ensuring they do not lead to undue market concentration or stifle competition. For instance, regulatory bodies worldwide, including the European Commission and the US Federal Trade Commission, actively review large-scale consolidations in the technology and data services space to prevent monopolistic tendencies.

Pricing strategies employed by GlobalData are also subject to scrutiny to prevent predatory pricing or price fixing, which could harm smaller competitors and consumers. Maintaining market dominance requires careful consideration of how services are offered and priced to avoid accusations of anti-competitive behavior. Failure to comply can result in substantial fines and legal challenges, impacting the company's reputation and financial performance.

Contractual Agreements and Client Liability

GlobalData's contractual agreements with its international clients are critical for defining the scope of services, data access, and intellectual property rights. These agreements are meticulously crafted to ensure clarity on service level agreements (SLAs), data usage permissions, and robust confidentiality clauses, thereby safeguarding sensitive information and fostering trust.

Liability limitations are a cornerstone of these contracts, designed to manage potential legal risks and protect GlobalData from unforeseen claims. For instance, a typical contract might stipulate that GlobalData's liability for breaches related to data accuracy is capped at the fees paid by the client for the specific service in question over a defined period, such as the preceding 12 months.

- Service Level Agreements (SLAs): Clearly outline performance metrics, uptime guarantees, and support response times.

- Data Usage Rights: Specify how clients can utilize the data provided by GlobalData, including restrictions on redistribution or resale.

- Confidentiality Clauses: Mandate the protection of proprietary information shared between GlobalData and its clients.

- Liability Limitations: Define the extent of responsibility for service failures or data inaccuracies, often capped at contract value.

International Business Laws and Compliance

Operating internationally means GlobalData must navigate a complex landscape of international business laws. These cover areas like trade regulations, varying tax structures, employment standards, and anti-bribery conventions across different countries. Staying compliant is essential for minimizing legal exposure and securing the right to operate in these markets.

Failure to adhere to these diverse legal frameworks can lead to significant penalties, reputational damage, and even operational shutdowns. For instance, the OECD's Foreign Bribery Report 2023 highlighted ongoing enforcement actions against companies for corrupt practices in international business dealings, underscoring the importance of robust compliance programs.

- Trade Compliance: Adherence to World Trade Organization (WTO) agreements and bilateral trade pacts is crucial, with global trade disputes impacting supply chains.

- Taxation: Navigating differing corporate tax rates and transfer pricing regulations, such as those influenced by the OECD's Base Erosion and Profit Shifting (BEPS) project, is a constant challenge.

- Employment Law: Compliance with local labor laws, including hiring practices, wages, and employee rights, varies significantly by region.

- Anti-Bribery and Corruption: Adherence to laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is paramount, with significant fines for violations.

GlobalData's operations are heavily influenced by evolving data privacy laws like GDPR and CCPA, with continued enforcement and new regulations emerging globally in 2024. Compliance with these rules for data handling and cross-border transfers is vital for client trust and operational continuity.

Environmental factors

Clients are increasingly tasked with meeting rigorous Environmental, Social, and Governance (ESG) reporting standards. This trend directly influences their need for detailed environmental data and sustainability analysis from providers like GlobalData.

The demand for GlobalData's environmental data and sustainability insights is escalating as clients strive to comply with evolving regulations and investor expectations. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which fully applies from 2024 for large companies, mandates extensive ESG disclosures, creating a significant market for specialized data services.

Businesses and investors are prioritizing environmental data, with a growing demand for insights into climate risk and sustainable operations. This trend is reshaping how companies assess their impact and manage their portfolios. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, underscoring the financial significance of environmental factors.

GlobalData has a significant opportunity to enhance its environmental intelligence services. By providing robust data and analytics on environmental impact, climate change mitigation, and adaptation strategies, the company can empower clients to navigate complex sustainability challenges and conduct thorough risk assessments, aligning with the increasing investor focus on ESG metrics.

Climate change presents significant physical and transitional risks across key sectors like energy, agriculture, and infrastructure, impacting GlobalData's client base. For instance, the agricultural sector, a crucial client industry, is already experiencing yield reductions due to extreme weather events, with projections suggesting a potential 10-25% decline in global crop yields by 2050 under certain warming scenarios.

GlobalData's market analysis must therefore increasingly integrate climate-related impacts to offer clients crucial foresight. Understanding how shifting weather patterns, regulatory changes, and evolving consumer preferences due to climate concerns will reshape their operational landscapes and market dynamics is paramount for strategic planning and investment decisions.

Resource Consumption and Carbon Footprint

GlobalData's reliance on data centers and IT infrastructure means substantial energy consumption, directly impacting its carbon footprint. As of 2024, the global IT sector's energy use is projected to account for a significant portion of electricity demand, with data centers being a major contributor. Addressing this consumption is crucial for environmental stewardship.

Demonstrating a commitment to reducing its carbon footprint can significantly bolster GlobalData's brand image. Many of its clients and stakeholders, particularly in 2024 and 2025, are increasingly prioritizing partners with strong environmental, social, and governance (ESG) credentials. This alignment with sustainability values can translate into competitive advantages.

- Energy Consumption: Data centers powering GlobalData's operations require substantial electricity, contributing to its environmental impact.

- Carbon Footprint Management: Proactive strategies to reduce greenhouse gas emissions from IT infrastructure are essential.

- Stakeholder Expectations: Growing demand from clients and investors for demonstrable sustainability efforts.

- Brand Reputation: Environmental responsibility is becoming a key differentiator in the market.

Corporate Social Responsibility Expectations

Stakeholders, from employees to investors and clients, are increasingly scrutinizing companies' commitment to corporate social responsibility (CSR) and environmental stewardship. This trend is particularly evident in 2024 and projected into 2025, with a growing demand for transparency and tangible action on sustainability issues.

For GlobalData, a strong CSR program is not just about good ethics; it's a strategic imperative. Demonstrating genuine environmental sustainability can significantly boost talent attraction, as a majority of job seekers, especially millennials and Gen Z, prioritize working for environmentally conscious organizations. Furthermore, this commitment positively influences investor relations, as ESG (Environmental, Social, and Governance) factors are becoming critical in investment decisions. In 2024, for instance, ESG-focused funds saw continued inflows, highlighting investor preference for sustainable companies.

- Talent Attraction: Companies with strong CSR initiatives report higher employee engagement and a more robust employer brand, crucial in competitive labor markets.

- Investor Relations: A 2024 report indicated that over 70% of institutional investors consider ESG performance when making investment choices.

- Market Standing: Positive CSR practices enhance brand reputation and customer loyalty, translating into a stronger market position and potential for premium pricing.

- Risk Mitigation: Proactive environmental management can reduce regulatory risks and operational disruptions, safeguarding long-term business continuity.

The increasing focus on environmental factors is driving demand for sustainability data. Clients are actively seeking information to meet ESG reporting standards, with regulations like the EU's CSRD, fully in effect for large companies from 2024, mandating extensive disclosures.

Climate change poses tangible risks to key industries, impacting client operations and investment strategies. For instance, the agricultural sector faces projected yield declines due to extreme weather, underscoring the need for climate-resilient business models.

The global sustainable investment market, valued at an estimated $35.3 trillion in early 2024, highlights the financial significance of environmental considerations. This trend necessitates that companies like GlobalData integrate climate impacts into their market analysis to provide clients with crucial foresight.

GlobalData's operational energy consumption, particularly from data centers, contributes to its carbon footprint. As of 2024, the IT sector's energy use is substantial, making carbon footprint management a critical aspect of environmental stewardship and brand reputation, especially given stakeholder expectations for ESG credentials.

PESTLE Analysis Data Sources

Our PESTLE analysis is powered by a comprehensive blend of data from reputable global economic organizations, leading market research firms, and official government publications. This ensures each insight into political, economic, social, technological, legal, and environmental factors is grounded in factual, up-to-date information.