GlobalData Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

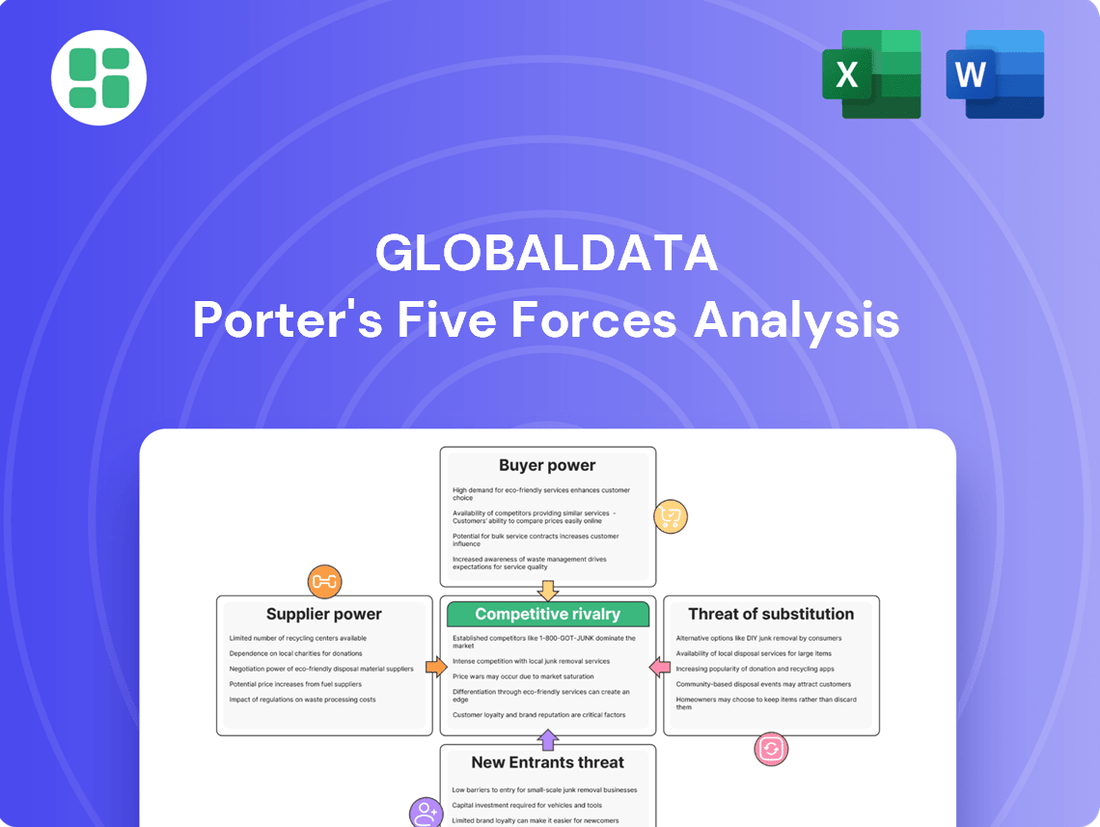

GlobalData's Porter's Five Forces Analysis provides a crucial framework for understanding the competitive landscape and identifying strategic opportunities. By dissecting the forces of rivalry, new entrants, buyer power, supplier power, and substitutes, you gain a comprehensive view of market dynamics. This insight is vital for any business aiming to thrive in today's competitive environment.

The complete report reveals the real forces shaping GlobalData’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GlobalData's strength lies in its proprietary data sources, built over years through organic growth and strategic acquisitions. This unique data collection and analysis capability shields them from the bargaining power of generic data providers, as their value is in the insights derived, not just the raw data itself.

The company's commitment to its 'One Platform' strategy reinforces its internal data infrastructure, reducing reliance on external, commoditized data feeds. For instance, in 2024, GlobalData continued to invest heavily in expanding its data universe, aiming to cover over 185 markets and 400,000 companies, further solidifying its data advantage.

Major cloud providers like AWS, Google Cloud, and Azure hold substantial sway over technology suppliers. Their essential infrastructure and the significant expense of migrating data analytics operations create high switching costs for companies. For instance, in 2024, the global cloud computing market was valued at over $700 billion, highlighting the immense scale and influence of these platforms.

The specialized nature of data analytics and consulting, as practiced by firms like GlobalData, hinges on highly skilled human capital. This includes expert analysts, data scientists, and industry consultants who possess niche knowledge and analytical capabilities. In today's competitive talent market, these professionals often command significant bargaining power, directly influencing GlobalData's operational costs and its capacity to deliver top-tier insights.

GlobalData's strategic focus on enhancing its AI Hub and integrating advanced AI-driven insights further amplifies the demand for a workforce proficient in cutting-edge technologies. This increasing reliance on specialized technological skills means that the bargaining power of these expert analysts and AI specialists is likely to remain a key factor affecting the company's expenses and its ability to innovate.

Software and Analytics Tools Vendors

Software and analytics tool vendors hold moderate bargaining power over GlobalData. While GlobalData develops proprietary platforms, it still utilizes specialized third-party solutions for niche functionalities. The ease of substitution for these tools, coupled with the vendor's unique offerings, dictates their leverage.

GlobalData's 'One Platform' strategy, emphasizing internal development, aims to mitigate this reliance. However, the cost and complexity of replicating highly specialized analytics tools can still grant vendors significant influence. For instance, the market for advanced AI-driven data processing tools is consolidating, potentially increasing the bargaining power of dominant players.

- Reliance on Niche Software: GlobalData may depend on specialized software for unique analytical capabilities not covered by its proprietary platforms.

- Vendor Differentiation: The bargaining power hinges on how unique and difficult to substitute these software offerings are.

- Integration Costs: High costs associated with integrating or switching to alternative software can strengthen vendor power.

- Market Consolidation: Trends like consolidation in the AI and analytics software market can shift bargaining power towards larger vendors.

Content and Media Partnerships

GlobalData's reliance on external content and media partnerships for its industry analysis and market research reports means these suppliers can exert some influence. The criticality and exclusivity of the data or insights provided directly impact their bargaining power.

For instance, if a media partner holds exclusive rights to crucial industry news or proprietary research, their leverage increases significantly. This is particularly true in niche markets where specialized information is scarce.

- Exclusive Content Access: Suppliers providing unique, hard-to-obtain industry data or expert commentary hold a stronger negotiating position.

- Partnership Dependence: The extent to which GlobalData depends on a specific supplier for essential content shapes the supplier's bargaining power.

- Market Niche Criticality: In specialized sectors, suppliers of vital information can command greater influence due to limited alternatives.

Suppliers of specialized data and analytics tools can hold significant bargaining power over GlobalData if their offerings are unique and difficult to substitute. This power is amplified by the costs and complexity associated with integrating or switching to alternative solutions. For example, the market for advanced AI-driven data processing tools saw consolidation in 2024, potentially increasing the leverage of dominant players.

GlobalData's reliance on external content and media partnerships for its industry analysis also presents a factor of supplier bargaining power. When partners provide exclusive or critical data, their negotiating position strengthens, especially in niche markets where such information is scarce. The dependence on specific suppliers for essential content directly shapes their influence.

| Supplier Type | Bargaining Power Factor | Example Impact |

|---|---|---|

| Specialized Software Vendors | Uniqueness & Substitution Difficulty | Increased costs for essential analytics tools |

| Content/Media Partners | Exclusivity & Criticality of Data | Higher fees for unique industry insights |

| Skilled Human Capital | Niche Expertise & Talent Scarcity | Higher salary demands for data scientists/analysts |

What is included in the product

GlobalData's Porter's Five Forces analysis provides a comprehensive framework for understanding the competitive intensity and attractiveness of the data and analytics market. It dissects the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors, offering strategic insights for GlobalData.

Gain immediate clarity on competitive pressures with a visual, easy-to-interpret breakdown of each force, eliminating the guesswork in strategic planning.

Customers Bargaining Power

GlobalData's diverse and global client base, spanning industries from consumer and technology to aerospace and financial services, significantly mitigates the bargaining power of individual customers. This broad reach means no single industry or client holds a disproportionate sway over GlobalData's revenue. In 2023, the company reported a substantial increase in its client acquisition, further solidifying its position against customer concentration.

For clients deeply integrated with GlobalData's proprietary platforms, the costs associated with switching are substantial. This includes the effort and expense of migrating extensive data, retraining personnel on new systems, and adapting to a different intelligence provider's methodologies, all of which contribute to significant customer stickiness.

The high volume of renewals GlobalData experiences, particularly from its larger enterprise clients, directly reflects these high switching costs. This retention is a testament to the ingrained value and operational reliance that clients place on GlobalData's specialized services.

Customers possess significant bargaining power when they have readily available alternatives to a company's offerings. For GlobalData, this means clients can turn to a variety of competing data analytics firms like Gartner, MarketsandMarkets, Informa, Nielsen, and Ipsos, or even specialized market intelligence platforms. The sheer number of substitutes means GlobalData must consistently prove its unique value proposition.

The ability for customers to develop their own in-house research capabilities further amplifies their leverage. This option, while potentially costly and time-consuming initially, presents a credible threat to data providers. In 2023, the global big data analytics market was valued at approximately $271.8 billion and is projected to grow, indicating a robust ecosystem of solutions and expertise available to potential clients.

The competitive intelligence software market itself is a dynamic landscape, constantly introducing new and varied tools. This rapid evolution means customers are not locked into a single way of gathering insights. For instance, advancements in AI-powered analytics are making it easier for businesses to conduct sophisticated research internally, directly challenging the need for external data providers.

Price Sensitivity and Value Perception

Customers, especially major corporate clients, are quite sensitive to price and want to see a clear return on investment for the money they spend on data and consulting services. Their ability to shop around and compare prices among different providers, as well as negotiate terms based on what they believe they're getting, significantly impacts their bargaining power. For instance, in 2024, many B2B software buyers reported that price was the primary factor in their purchasing decisions, with over 60% indicating they would switch vendors for a lower cost if the functionality was comparable.

GlobalData addresses this by focusing on delivering strategic intelligence and actionable insights. This approach is designed to justify its pricing by clearly demonstrating how its services provide tangible competitive advantages for clients. The company's value proposition centers on enabling clients to make better-informed decisions, which in turn can lead to increased revenue or reduced costs, thereby enhancing the perceived value of GlobalData's offerings.

- Price Sensitivity: A significant portion of B2B purchasing decisions in 2024 was driven by price, with many clients actively seeking cost-effective solutions.

- Value Perception: Clients evaluate the return on investment (ROI) of data and consulting services, influencing their willingness to pay and their negotiation leverage.

- Competitive Benchmarking: The ease with which customers can compare pricing and offerings from various providers strengthens their bargaining position.

- GlobalData's Strategy: The company aims to mitigate customer bargaining power by emphasizing the strategic value and actionable insights derived from its services, justifying its pricing through demonstrable client benefits.

Consolidation of Client Industries

The consolidation within industries that GlobalData serves, such as the automotive sector where major mergers continue to reshape the landscape, can lead to fewer, larger clients. For instance, the proposed merger between Stellantis and Fiat Chrysler Automobiles in 2021, creating one of the world's largest automakers, exemplifies this trend. Such mega-clients wield greater influence, potentially increasing their bargaining power over data and consulting service providers.

This evolving client dynamic requires GlobalData to adapt its sales strategy. A shift towards a solutions-based selling approach, focusing on integrated offerings rather than individual services, is crucial. This also means prioritizing strategic account management to cultivate deeper, more resilient relationships with these increasingly powerful entities.

The impact of this consolidation is evident in the increasing demand for tailored, high-value consulting engagements. For example, in 2024, the average contract value for strategic consulting services in the automotive industry saw a notable increase, reflecting the greater investment by larger, consolidated clients in specialized expertise.

- Industry Consolidation: Fewer, larger clients emerge as companies merge, increasing their market leverage.

- Increased Bargaining Power: Larger clients can negotiate more favorable terms for data and consulting services.

- Strategic Imperative: GlobalData must adopt a solutions-based selling approach and enhance strategic account management.

- Client Relationship Deepening: Building robust, long-term partnerships becomes essential for sustained growth.

Customers' bargaining power is amplified when they have access to numerous alternatives, as seen with GlobalData's clients who can choose from many competing data analytics firms. This competitive landscape, valued at $271.8 billion in 2023 for the big data analytics market, necessitates GlobalData proving its unique value. Furthermore, the increasing ability of clients to develop in-house research capabilities, spurred by advancements in AI analytics, presents a direct challenge to external data providers.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

| Availability of Substitutes | High | Numerous competing data analytics firms and growing in-house research capabilities. Global big data analytics market valued at $271.8 billion in 2023. |

| Switching Costs | Low to Moderate | Clients experience substantial costs and effort in migrating data and retraining staff, fostering stickiness. |

| Price Sensitivity | High | Over 60% of B2B software buyers in 2024 prioritized price, willing to switch for lower costs with comparable functionality. |

| Industry Consolidation | Increasing | Mega-clients emerging from mergers (e.g., Stellantis creation in 2021) wield greater negotiation influence. |

Same Document Delivered

GlobalData Porter's Five Forces Analysis

This preview showcases the exact GlobalData Porter's Five Forces Analysis you will receive immediately after purchase, ensuring transparency and no hidden surprises. The detailed insights into competitive rivalry, new entrants, substitute products, buyer power, and supplier power are all present and professionally formatted for your immediate use. You are looking at the actual, comprehensive document, ready for download and application to your strategic planning the moment you buy.

Rivalry Among Competitors

The data analytics and consulting market is incredibly fragmented, meaning GlobalData contends with a vast array of rivals. These competitors span from massive, well-established global players and niche specialists to nimble, emerging startups, all vying for market share. This intense competition forces a constant drive for innovation and unique offerings to stand out.

GlobalData itself has pinpointed more than 100 active competitors, underscoring the sheer density of the market. This crowded environment means that staying ahead requires not just offering quality services but also a clear strategy for differentiation and continuous adaptation to client needs and technological advancements.

GlobalData faces intense competition from established industry giants such as Gartner, MarketsandMarkets, RELX, Informa, Nielsen, and Ipsos. These firms possess substantial resources, strong brand equity, and deep-rooted enterprise relationships, which significantly escalate the competitive landscape.

The rise of major technology companies like Microsoft, Google, and Amazon, offering sophisticated cloud-native analytics services, further intensifies this rivalry. Their extensive capabilities and market penetration present a formidable challenge to GlobalData's market position.

In 2023, the global market for market research and competitive intelligence was valued at approximately $75 billion, with these major players holding significant shares, underscoring the high stakes involved in this competitive arena.

GlobalData is sharpening its competitive edge by heavily investing in artificial intelligence and its unique, proprietary data sets. This strategy is designed to create a unified 'One Platform' experience, setting it apart in a crowded market.

The swift uptake of AI-driven insights by more than 42,000 users on its AI Hub underscores the critical importance of this technology. This indicates that AI is a major battleground where companies are vying for dominance.

Other players in the industry are also channeling significant resources into AI and sophisticated analytics. This widespread investment signals an intense race to achieve technological superiority and offer the most advanced solutions.

Strategic M&A and Organic Growth Initiatives

GlobalData's competitive rivalry is intensified by its dual approach of aggressive mergers and acquisitions (M&A) alongside robust organic growth strategies. The company executed four acquisitions in late 2024 and a further acquisition in early 2025, demonstrating a clear intent to consolidate its market position and broaden its integrated 'One Platform' capabilities.

This M&A activity is complemented by significant investments in organic expansion. GlobalData is actively growing its sales force, prioritizing new product development, and fostering deeper relationships with existing clients. This comprehensive strategy directly confronts competitors by enhancing service offerings and market reach.

- M&A Activity: Four acquisitions in late 2024, one in early 2025.

- Organic Growth Drivers: Increased sales headcount, product development, enhanced client engagement.

- Strategic Objective: Strengthen competitive position and expand 'One Platform' offering.

Pricing Pressure and Value Delivery

The competitive landscape for data analytics and intelligence firms like GlobalData is characterized by significant pricing pressure. This stems from the need to constantly prove a strong return on investment to clients who are increasingly demanding tangible business outcomes from their data expenditures.

In 2024, many clients across industries like technology, healthcare, and finance are scrutinizing their software and data subscriptions more closely. They are looking for solutions that directly contribute to revenue growth or cost reduction, rather than generic data access. This focus on demonstrable value makes it challenging for companies to compete solely on price.

GlobalData's strategic approach addresses this by concentrating on providing mission-critical data and actionable insights to its global customer base. This focus aims to foster long-term client relationships and secure recurring revenue streams, thereby mitigating the impact of pure price-based competition.

- Pricing Pressure: Intense competition forces GlobalData to justify its pricing through superior value.

- Client Demands: Customers seek tailored solutions and clear business outcomes from data investments.

- Strategic Focus: GlobalData emphasizes mission-critical data for global clients to ensure long-term contracts.

- Competitive Differentiation: The strategy aims to move beyond price-based competition by delivering essential insights.

The competitive rivalry within the data analytics and consulting market is fierce, with GlobalData facing over 100 rivals ranging from established giants like Gartner and RELX to tech titans such as Microsoft and Google. This intense competition, underscored by a global market valuation of approximately $75 billion in 2023 for market research and competitive intelligence, necessitates continuous innovation and differentiation.

GlobalData is actively combating this by investing heavily in AI and its proprietary data, aiming for a unified 'One Platform' experience, as evidenced by over 42,000 users on its AI Hub. This strategic focus on AI is mirrored by competitors, highlighting it as a key battleground for market dominance.

Furthermore, GlobalData employs a dual strategy of aggressive mergers and acquisitions, including four acquisitions in late 2024 and one in early 2025, alongside robust organic growth initiatives like expanding its sales force and product development. This approach aims to consolidate its market position and enhance its integrated platform capabilities.

| Competitor Type | Key Players | Strategic Focus |

|---|---|---|

| Established Giants | Gartner, RELX, Informa, Nielsen, Ipsos | Brand Equity, Enterprise Relationships, Resources |

| Tech Titans | Microsoft, Google, Amazon | Cloud-Native Analytics, Market Penetration |

| Niche Specialists & Startups | Numerous smaller firms | Agility, Specialized Offerings |

| GlobalData | Self | AI Investment, Proprietary Data, 'One Platform', M&A, Organic Growth |

SSubstitutes Threaten

Large corporations, a key client base for data analytics providers, are increasingly building their own in-house capabilities. For instance, in 2024, many Fortune 500 companies reported significant investments in data science teams and advanced analytics platforms, aiming to reduce external dependencies.

The proliferation of user-friendly data analysis tools and the growing availability of skilled data professionals further empower these organizations to develop proprietary solutions. This trend directly substitutes the need for external market intelligence and analytics services, especially for companies with unique or confidential data requirements.

Clients seeking strategic advice can often turn to broader business intelligence software providers or large, general management consulting firms. While these alternatives might not possess GlobalData's specialized industry data, they offer comprehensive strategic guidance and data analytics services. For instance, major consulting players like Deloitte, Accenture, and Tata Consultancy Services (TCS) provide extensive consulting capabilities that can serve as substitutes for GlobalData's core offerings, potentially impacting market share.

The rise of free or low-cost information sources presents a significant threat to GlobalData. Platforms offering publicly available data, industry news aggregators, and even social media analytics can fulfill some basic market intelligence needs, particularly for smaller businesses or those conducting initial research.

For example, in 2024, the accessibility of vast datasets through open-source initiatives and government portals means that many companies can gather foundational market insights without incurring substantial costs. While these sources often lack the specialized depth and proprietary analysis that GlobalData provides, their availability can reduce the perceived value of paid-for intelligence for certain segments of the market.

Specialized Point Solutions and Niche Platforms

The market is seeing a rise in specialized software tools that provide intelligence for very specific areas. For instance, companies like Crayon and Klue focus on automating competitive intelligence, while Similarweb offers detailed digital market and competitor traffic analysis. AlphaSense, on the other hand, leverages AI for financial intelligence.

These niche platforms can directly substitute for particular functions within GlobalData's broader suite of services. For example, a business primarily needing automated competitive intelligence might opt for a dedicated solution like Crayon rather than a comprehensive market intelligence platform.

- Specialized Tools: Platforms like Crayon, Klue, Similarweb, and AlphaSense offer focused capabilities in competitive intelligence, digital traffic analysis, and AI-powered financial intelligence.

- Niche Substitution: These specialized solutions can replace specific modules or functionalities that GlobalData provides, offering a targeted alternative for distinct business needs.

- Market Impact: The availability of these focused tools increases competitive pressure by providing businesses with alternatives that may be more cost-effective or better suited for specific intelligence requirements.

Academic Research and Independent Analysts

Academic research and independent analysts can pose a threat of substitutes for GlobalData's services. Clients seeking highly specialized insights for niche strategic questions might opt for bespoke research projects commissioned from universities or independent consultants.

These specialized engagements, while often less scalable than GlobalData's offerings, can provide tailored perspectives that directly address unique client needs. For instance, a boutique consulting firm specializing in a specific emerging technology might be preferred over a broader market intelligence provider for a highly technical market entry strategy.

The market for independent research and analysis is substantial. In 2024, the global management consulting market was valued at approximately $320 billion, with a significant portion dedicated to strategic advisory and specialized research, indicating a strong appetite for alternative expertise.

- Customization: Independent analysts offer highly tailored research, a key differentiator from standardized reports.

- Specialization: Access to niche expertise not always available through larger, diversified firms.

- Cost-Effectiveness: For very specific, limited-scope projects, engaging independent analysts can sometimes be more economical.

- Agility: Independent researchers can often adapt more quickly to evolving client needs compared to larger organizations.

The threat of substitutes is significant as clients can leverage in-house data science teams or user-friendly tools to generate their own insights, reducing reliance on external providers. In 2024, many Fortune 500 companies increased their investments in data analytics capabilities, indicating a growing trend towards self-sufficiency.

Furthermore, broad business intelligence software providers and large management consulting firms offer comprehensive strategic guidance and analytics, acting as viable alternatives. The market for management consulting alone was valued at approximately $320 billion in 2024, highlighting the scale of these substitute services.

Specialized software platforms focusing on specific functions like competitive intelligence or digital traffic analysis, such as Crayon or Similarweb, also present direct substitutes. These niche tools cater to specific needs, potentially fragmenting the market for comprehensive intelligence providers.

Finally, academic research and independent analysts offer highly customized and specialized insights, particularly for unique strategic questions. This bespoke approach can be a strong substitute for clients seeking tailored perspectives, especially in niche or emerging markets.

Entrants Threaten

Entering the data analytics and consulting arena at GlobalData's level demands substantial capital for proprietary data acquisition, cutting-edge technology, and ongoing research. For instance, developing and maintaining the vast datasets and advanced AI-driven analytical tools that define market leaders requires millions in upfront and sustained investment, creating a formidable hurdle for newcomers.

GlobalData's competitive advantage is deeply rooted in its proprietary data sets, meticulously curated and difficult for newcomers to replicate. This unique data forms the bedrock of its insights, making it a significant barrier to entry for potential competitors seeking to offer similar analytical depth.

Building a robust brand reputation and fostering trust across a global client base is another formidable challenge for new entrants. These elements, cultivated over years of consistent performance and client engagement, are not easily acquired, thus protecting GlobalData's market position.

The industry's reliance on highly specialized talent, such as data scientists and AI experts, presents a significant hurdle for new entrants. Attracting and retaining this skilled workforce is both challenging and costly, as established players often have robust recruitment pipelines and competitive compensation packages. For instance, GlobalData's continued investment in its AI capabilities and sales force underscores the critical role of human capital in maintaining a competitive edge.

Regulatory and Data Privacy Complexities

The escalating complexity surrounding data governance and privacy regulations, such as the GDPR, presents a formidable barrier for new entrants. Successfully navigating these requirements demands significant investment in legal expertise and robust technical infrastructure, thereby increasing both the cost and difficulty of market entry.

Established companies, including GlobalData, benefit from pre-existing compliance frameworks and extensive experience in managing these intricate regulatory landscapes. This established infrastructure provides a distinct advantage, making it harder for newcomers to compete effectively.

- Regulatory Hurdles: New entrants must contend with evolving data privacy laws globally, requiring substantial upfront investment in compliance.

- Infrastructure Costs: Building the necessary legal and technical systems to meet data governance standards is a significant capital expenditure.

- Established Expertise: Companies like GlobalData possess years of experience and established processes for managing data privacy, creating a competitive moat.

- Compliance Burden: The ongoing effort to maintain compliance with diverse and changing regulations adds to operational complexity and cost for new players.

Customer Lock-in and Network Effects

GlobalData benefits significantly from customer lock-in, a potent barrier for new entrants. This lock-in stems from the deep integration of GlobalData's services into clients' existing workflows and the inherent value derived from long-term, established data relationships. For instance, a significant portion of GlobalData's revenue often comes from recurring subscriptions, indicating a sticky customer base.

New entrants face a considerable challenge in dislodging these entrenched relationships. Building a critical mass of users on a new platform is also difficult, especially since the value of data analytics platforms like GlobalData's often escalates with the sheer volume and variety of data clients consume. In 2023, for example, companies heavily reliant on data analytics often saw their investment in such platforms increase by 10-15% year-over-year, highlighting the growing importance and stickiness of these services.

- Customer Lock-in: GlobalData's integration into client workflows creates high switching costs.

- Network Effects: The value of GlobalData's data analytics increases with the number of users and data points.

- Barrier to Entry: New entrants must overcome established relationships and build a critical mass to compete.

- Data Relationship Value: Long-term data partnerships amplify the stickiness of GlobalData's offerings.

The threat of new entrants in the data analytics and consulting sector, where GlobalData operates, is significantly mitigated by the immense capital required for data acquisition, technology development, and ongoing research. For instance, building and maintaining the sophisticated AI-driven analytical tools and vast datasets characteristic of market leaders necessitates millions in initial and sustained investment, presenting a substantial barrier for any newcomer. This high cost of entry, coupled with the need for specialized talent and established brand trust, makes it exceptionally challenging for new players to gain a foothold against established entities like GlobalData.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry association publications, and specialized market research databases to provide a comprehensive view of competitive dynamics.