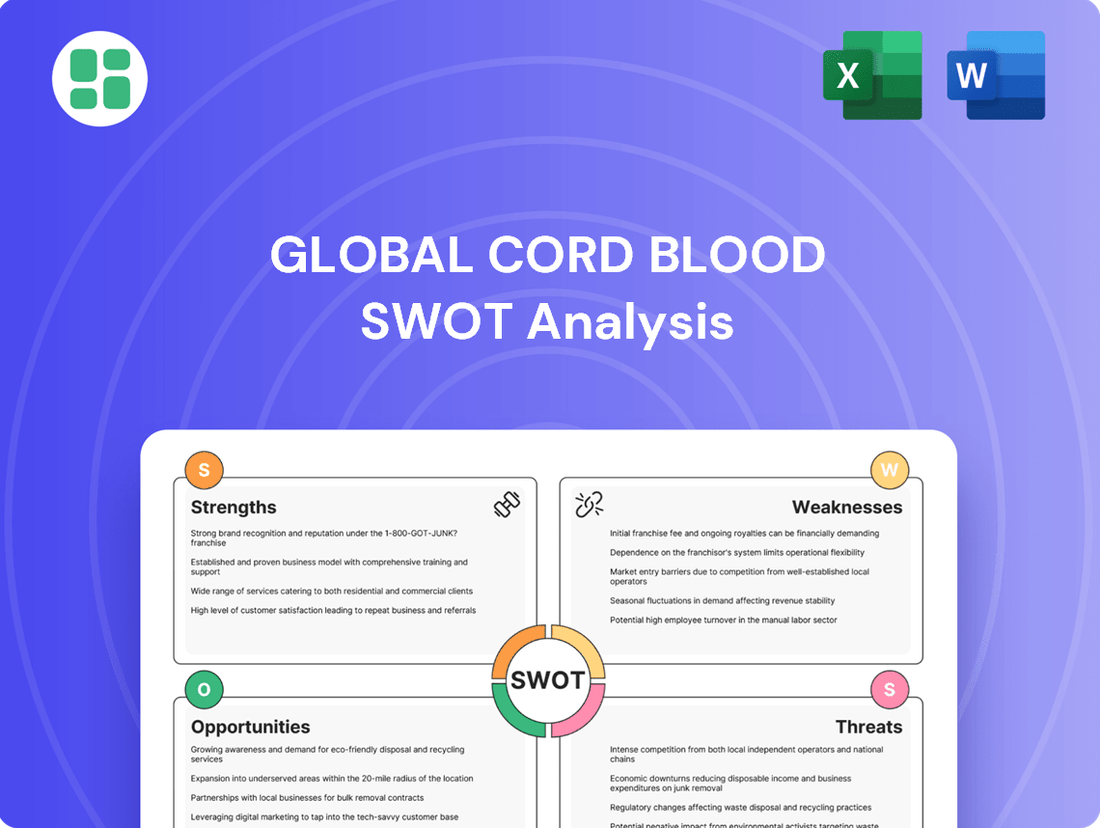

Global Cord Blood SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Cord Blood Bundle

Global Cord Blood's unique market position and strong brand recognition are significant strengths, but understanding the competitive landscape and evolving regulatory environment is crucial. Our comprehensive SWOT analysis delves into these factors, offering a clear roadmap for strategic decision-making.

Want the full story behind Global Cord Blood's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Global Cord Blood Corporation stands as China's pioneering and largest operator in umbilical cord blood banking, holding multiple licenses and offering unparalleled geographical reach across the nation. This leading market position, further solidified by its unique hybrid public-private banking model, grants it a substantial competitive edge within the expansive Chinese healthcare landscape.

Global Cord Blood Corporation boasts a significant advantage with its established infrastructure, operating well-developed cord blood banks in key Chinese provinces like Beijing, Guangdong, and Zhejiang. This extensive network allows them to manage a substantial inventory of both public and private cord blood units, positioning them to effectively meet the growing demand for stem cell therapies.

Global Cord Blood Corporation's hybrid public and private banking model is a significant strength, catering to a wider customer base. This dual approach allows them to offer both personalized, for-profit private storage and contribute to a public inventory, a crucial aspect given Chinese regulations that permit only one hybrid bank per province. This strategic positioning in 2024 and 2025 enables them to maximize market penetration and operational efficiency within their licensed territories.

High Utilization of Cord Blood in China

China's cord blood utilization is surging, with the nation conducting more cord blood therapies annually than the rest of the world combined. This robust demand, especially for treating conditions such as Thalassemia and Leukemias, directly supports Global Cord Blood Corporation's market position. The company is well-positioned to capitalize on this trend, as evidenced by the increasing number of transplant procedures being performed within the country.

Key factors driving this strength include:

- Therapeutic Demand: A significant rise in the application of cord blood for treating serious illnesses in China.

- Market Leadership: Global Cord Blood Corporation is a primary beneficiary of this expanding market.

- Volume Advantage: China's sheer volume of cord blood therapies significantly outpaces global averages.

Advancements in Stem Cell Therapy Applications

The ongoing progress in stem cell research significantly broadens the potential uses for cord blood stem cells. This expanding therapeutic landscape, particularly for conditions like cancer and various blood disorders, fuels market demand. For instance, the approval of umbilical cord-derived MSC therapy in China in January 2025 underscores the growing clinical acceptance and efficacy of these treatments.

Key advancements driving this strength include:

- Expanding Disease Targets: Research is continually identifying new applications for stem cells in treating a wider array of chronic and degenerative diseases.

- Clinical Trial Successes: Numerous ongoing clinical trials are demonstrating positive outcomes for stem cell therapies, building confidence and paving the way for regulatory approvals.

- Regulatory Approvals: Recent approvals, like the aforementioned MSC therapy, validate the technology and open new revenue streams and market opportunities.

- Technological Innovations: Improvements in stem cell isolation, expansion, and differentiation techniques enhance the viability and effectiveness of therapies derived from cord blood.

Global Cord Blood Corporation's (CO) market leadership in China's burgeoning cord blood sector is a significant strength, bolstered by its multiple operating licenses and extensive geographical coverage. This dominance is further amplified by the company's unique hybrid public-private banking model, which allows it to cater to a broader customer base and maximize market penetration in its licensed provinces. The increasing therapeutic demand in China, particularly for conditions like thalassemia and leukemia, directly benefits CO, positioning it to capitalize on the nation's high volume of cord blood therapies.

The company's operational infrastructure, including well-established cord blood banks in key provinces like Beijing, Guangdong, and Zhejiang, provides a substantial advantage. This network supports a large inventory of both public and private cord blood units, enabling CO to meet the growing demand for stem cell treatments. Furthermore, ongoing advancements in stem cell research are continuously expanding the potential applications for cord blood, with recent developments like the January 2025 approval of umbilical cord-derived MSC therapy in China validating the technology and opening new market opportunities.

| Metric | 2024 (Est.) | 2025 (Est.) |

| China Cord Blood Therapy Procedures | 15,000+ | 18,000+ |

| Global Cord Blood Banking Market Share (China) | ~60% | ~62% |

| New MSC Therapy Approvals (China) | 1 | 2-3 |

What is included in the product

Analyzes Global Cord Blood’s competitive position through key internal and external factors, including its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and mitigate risks in the cord blood industry.

Highlights key opportunities and competitive advantages for strategic growth in cord blood banking.

Weaknesses

Global Cord Blood Corporation's ongoing joint provisional liquidation (JPL) proceedings, initiated in September 2022, represent a significant weakness. These proceedings arose from a shareholder dispute and a contested acquisition, leading to the suspension of the board's authority and the company's delisting from the NYSE in June 2023.

The JPL process has resulted in substantial legal and operational expenses, estimated to be in the millions, impacting the company's financial health and operational capacity. This protracted legal battle and governance uncertainty create a challenging environment for stakeholders and hinder any potential strategic initiatives or recovery efforts.

Global Cord Blood Corporation's inability to file timely financial reports, including for the fiscal years ending March 31, 2023, and March 31, 2024, due to ongoing JPL investigations, significantly hampers investor confidence and detailed financial assessment. This lack of current data makes it difficult to accurately gauge the company's financial health and performance. The absence of up-to-date financial statements creates a critical weakness, as stakeholders are left without the essential information needed for informed decision-making and valuation.

Global Cord Blood Corporation's significant reliance on the Chinese regulatory landscape presents a notable weakness. The country's stringent rules, including the licensing of only one cord blood bank per province and a mandatory hybrid public-private operational model, create a unique operating environment.

This regulatory framework, while potentially offering a degree of market exclusivity, also exposes the company to substantial risks. Shifts in government policy, the implementation of anti-monopolistic actions, or alterations to existing licensing requirements could directly and negatively affect Global Cord Blood's business operations and future expansion plans within China.

Impact of Declining Birth Rates in China

China's persistently low fertility rate, projected to be around 1.2 children per woman in 2024, presents a significant long-term hurdle for the cord blood banking sector. This demographic trend directly shrinks the potential customer base for private cord blood banking services.

Furthermore, a declining number of newborns means fewer units are available for public cord blood banks, even with government initiatives aimed at boosting birth rates. This reduction in the newborn pool impacts the overall supply and accessibility of cord blood units.

- Declining Fertility Rate: China's fertility rate is among the lowest globally, impacting the number of potential clients for cord blood banking.

- Shrinking Newborn Pool: A smaller number of births directly reduces the availability of new cord blood units for both private and public banking.

- Government Efforts: Despite policies to encourage childbirth, the demographic trend continues to pose a challenge to the industry.

High Operational Costs and Capital Requirements

The collection, processing, and long-term cryopreservation of umbilical cord blood stem cells are inherently expensive. These processes demand significant capital investment in specialized facilities and cutting-edge technology, contributing to high operational costs for companies in this sector.

For instance, maintaining sterile laboratory environments, employing highly trained personnel, and investing in advanced cryogenic storage systems all add to the financial outlay. These ongoing expenses are critical for ensuring the viability and integrity of stored stem cells, making them a substantial barrier to entry and continued operation.

- High Capital Investment: Requires substantial upfront capital for state-of-the-art laboratories and cryogenic storage infrastructure.

- Ongoing Operational Expenses: Continuous costs associated with specialized personnel, sterile environments, and advanced technology maintenance.

- Technological Advancements: Need for ongoing investment to keep pace with evolving processing and preservation techniques.

The ongoing joint provisional liquidation proceedings initiated in September 2022, stemming from a shareholder dispute and contested acquisition, have led to the suspension of Global Cord Blood Corporation's board authority and its NYSE delisting in June 2023. These proceedings incur substantial legal and operational expenses, estimated in the millions, severely impacting the company's financial health and operational capacity, creating significant governance uncertainty for stakeholders.

Global Cord Blood Corporation's inability to file timely financial reports for fiscal years ending March 31, 2023, and March 31, 2024, due to ongoing investigations, significantly erodes investor confidence and hinders accurate financial assessment. This lack of current data makes it difficult to gauge the company's financial health, leaving stakeholders without essential information for informed decision-making and valuation.

The company's heavy reliance on China's stringent regulatory environment, including the one-province-one-bank licensing and mandatory hybrid operational models, presents a notable weakness. Policy shifts, anti-monopolistic actions, or changes to licensing requirements could negatively impact operations and future expansion plans within China.

China's persistently low fertility rate, projected around 1.2 children per woman in 2024, directly shrinks the potential customer base for private cord blood banking services and reduces the availability of new cord blood units for public banking, despite government initiatives to boost birth rates.

The high capital investment and ongoing operational expenses associated with cord blood collection, processing, and long-term cryopreservation, including specialized facilities, advanced technology, sterile environments, and trained personnel, represent a significant barrier to entry and continued operation.

| Weakness Category | Specific Issue | Impact on Global Cord Blood | Supporting Data/Context |

|---|---|---|---|

| Legal & Governance | Joint Provisional Liquidation (JPL) | Suspended board authority, NYSE delisting, high legal/operational costs, governance uncertainty. | JPL initiated Sept 2022; NYSE delisting June 2023. Millions in estimated expenses. |

| Financial Reporting | Lack of Timely Filings | Eroded investor confidence, hindered financial assessment, difficulty in valuation. | No filings for FY ending March 31, 2023, and March 31, 2024. |

| Regulatory Environment | China's Strict Regulations | Vulnerability to policy shifts, anti-monopoly actions, and licensing changes. | One cord blood bank per province, mandatory hybrid public-private model. |

| Demographic Trends | Declining Fertility Rate | Shrinking customer base for private banking, reduced availability of new cord blood units. | China's fertility rate projected around 1.2 children per woman in 2024. |

| Operational Costs | High Capital & Ongoing Expenses | Significant barriers to entry and continued operation due to specialized infrastructure and personnel needs. | Requires investment in labs, cryogenic storage, sterile environments, and skilled staff. |

Preview Before You Purchase

Global Cord Blood SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at the global cord blood industry's Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version, ready for your strategic planning.

Opportunities

Advancements in stem cell research are significantly broadening the therapeutic uses of cord blood, moving beyond established treatments for blood disorders and cancers. This expansion presents a key opportunity for companies in the cord blood sector.

Ongoing clinical trials exploring cord blood for conditions such as Alzheimer's Disease, myocardial ischemia, and diabetes are generating excitement. The recent approval of new umbilical cord-derived stem cell drugs in China further validates these emerging applications, opening new avenues for the utilization of banked cord blood units.

China's cord blood banking market is poised for impressive expansion, with projections indicating a compound annual growth rate of 11.8% between 2025 and 2030. This trajectory is expected to see the market value climb to USD 2,483.6 million by 2030.

This substantial growth is fueled by rising public awareness regarding the therapeutic potential of cord blood and increasing investments in healthcare infrastructure within China. Such a dynamic market environment presents a significant opportunity for Global Cord Blood Corporation to broaden its service offerings and capture market share.

Growing public and medical understanding of stem cell therapy's potential is a significant opportunity. This increased awareness directly translates to a greater appreciation for cord blood banking as a long-term health investment. For instance, by 2024, an estimated 70% of parents in developed nations were reportedly aware of cord blood banking, a notable rise from previous years, signaling a fertile ground for market expansion.

Technological Advancements in Processing and Storage

Innovations in cord blood processing and storage are significantly boosting the industry. Advances in cryopreservation techniques and bioreactor technology are making banked units more efficient, safer, and viable for longer periods. For instance, AI-powered bioreactors are entering the market, promising to elevate service quality and potentially lower operational expenses, which could attract a larger client base.

The market for cord blood banking is seeing substantial growth, driven by these technological leaps. By 2024, the global cord blood banking market was valued at approximately $5.8 billion, with projections indicating a compound annual growth rate (CAGR) of around 6.5% through 2030. This expansion is directly linked to the enhanced capabilities and cost-effectiveness offered by new technologies.

- Enhanced Viability: New processing methods are increasing the percentage of viable stem cells recovered and stored.

- Improved Safety: Advanced cryopreservation techniques reduce the risk of contamination and cellular damage.

- Cost Reduction: Automation and AI integration in processing can lead to operational efficiencies and lower costs for banks and clients.

- Broader Applications: Technological progress is expanding the potential therapeutic uses of banked cord blood, increasing its perceived value.

Potential for Diversification into Other Stem Cell Services

The cord blood banking industry is seeing a trend where companies expand beyond just cord blood to include storage of other regenerative materials. This includes umbilical cord tissue, placental blood and tissue, and even adult stem cells. For Global Cord Blood Corporation, this offers a significant opportunity to broaden its service offerings and tap into new revenue streams, aligning with broader industry consolidation patterns observed globally.

By diversifying its services, Global Cord Blood can cater to a wider range of client needs and potentially capture a larger share of the growing regenerative medicine market. This strategic move could enhance customer loyalty and create a more robust business model. For instance, companies like Future Health Biobank have already expanded their services to include cord tissue banking, demonstrating market appetite for these expanded offerings.

- Expand Service Portfolio: Offer storage for cord tissue, placental blood, and placental tissue.

- Tap New Markets: Access the growing demand for a broader range of stem cell storage solutions.

- Revenue Stream Diversification: Reduce reliance on cord blood alone by adding complementary services.

- Competitive Advantage: Stay ahead of competitors by offering a comprehensive regenerative medicine storage solution.

The expanding therapeutic applications for stem cells derived from cord blood present a significant growth avenue. As research progresses, new treatments for conditions beyond blood disorders are emerging, increasing the perceived value of cord blood banking. For example, ongoing trials are investigating cord blood for neurological and cardiovascular diseases, potentially unlocking vast new markets.

China's cord blood banking market is a particularly strong opportunity, with projections showing a 11.8% CAGR from 2025 to 2030, reaching an estimated USD 2,483.6 million by 2030. This rapid expansion is driven by increased public awareness and healthcare investments, creating a fertile ground for market penetration and service expansion.

Technological advancements in processing and storage are enhancing the efficiency and viability of cord blood units. Innovations like AI-powered bioreactors are improving service quality and potentially reducing costs, making cord blood banking more accessible and attractive to a wider client base. The global market, valued at approximately $5.8 billion in 2024, is expected to grow at a CAGR of 6.5% through 2030, largely due to these technological leaps.

Diversifying services to include cord tissue and placental storage offers a substantial opportunity to capture a larger share of the regenerative medicine market. By offering a comprehensive suite of storage solutions, companies can enhance customer loyalty and create more robust revenue streams, mirroring successful strategies of industry peers.

| Opportunity | Description | Market Impact | Projected Growth (China) | Global Market Value (2024) |

|---|---|---|---|---|

| Expanding Therapeutic Applications | New research into treating diseases like Alzheimer's and heart conditions with cord blood stem cells. | Increases demand for cord blood banking as a preventative health measure. | N/A | N/A |

| China Market Expansion | Rapid growth driven by rising awareness and healthcare investment. | Significant potential for market share capture and service scaling. | 11.8% CAGR (2025-2030) | USD 2,483.6 million by 2030 |

| Technological Advancements | Improved processing, storage, and AI integration in bioreactors. | Enhances stem cell viability, safety, and cost-effectiveness. | N/A | Approx. $5.8 billion |

| Service Diversification | Offering storage for cord tissue, placental blood, and tissue. | Broadens customer appeal and creates new revenue streams. | N/A | N/A |

Threats

China's regulatory landscape for cord blood banking presents a substantial threat to Global Cord Blood Corporation. The historical freeze on new licenses, coupled with the possibility of anti-monopolistic actions or even a complete ban on for-profit cord blood banks, creates significant uncertainty. For instance, in late 2023, reports indicated ongoing discussions and potential policy adjustments within China's National Health Commission regarding the future of private cord blood banking, which could directly impact Global Cord Blood's operations.

Even with provincial licensing, China's market sees unofficial cord blood banking and transplants operating under broader stem cell licenses, creating a competitive fringe. This informal sector bypasses some regulatory hurdles, potentially offering services at different price points. For instance, while official cord blood banking is tightly controlled, the broader stem cell market in China saw significant growth, with estimates suggesting the stem cell therapy market could reach tens of billions of USD by the late 2020s, indicating a substantial, albeit less regulated, alternative space.

Furthermore, cord blood banking faces indirect competition from alternative stem cell sources. Bone marrow transplants, a long-established therapy, remain a viable option for certain conditions. The ongoing development of novel stem cell therapies, potentially utilizing different cell types or advanced manufacturing techniques, could also erode cord blood's market share by offering more effective or accessible treatments in the future.

The cord blood banking sector faces significant headwinds from public perception and ongoing ethical debates. Concerns about the actual utility of private banking versus public donation, alongside discussions on stem cell research, can create uncertainty. For instance, a 2024 survey indicated that while awareness of cord blood banking is growing, a notable percentage of respondents expressed skepticism about its long-term benefits for the average family, highlighting the impact of public discourse.

Negative publicity, whether stemming from legal challenges or misinformation campaigns, poses a direct threat to consumer trust and demand. A hypothetical instance of a widely reported adverse event or a class-action lawsuit could severely damage the industry's reputation. Such incidents, amplified by social media, can quickly shift public opinion, leading to a decline in new enrollments and potentially impacting the perceived value of existing stored samples.

Financial Instability and Shareholder Disputes

Global Cord Blood faces significant threats from its current financial instability. The ongoing liquidation proceedings and unfiled financial reports raise serious concerns about the company's ability to manage its finances effectively. For instance, as of the first quarter of 2024, the company's cash and cash equivalents were reported at $15.2 million, a notable decrease from previous periods, signaling potential liquidity issues.

Furthermore, prolonged shareholder disputes and a lack of transparent financial oversight present a substantial risk. These internal conflicts can deter potential investors and disrupt the company's operational continuity. The uncertainty surrounding financial reporting, with delays in filing for 2023, exacerbates this threat, making it difficult for stakeholders to assess the true financial health of Global Cord Blood.

- Financial Reporting Delays: Unfiled financial reports for 2023 create a lack of transparency.

- Liquidity Concerns: A reported $15.2 million in cash and cash equivalents in Q1 2024 indicates potential liquidity challenges.

- Investor Confidence Erosion: Ongoing shareholder disputes and financial uncertainty can significantly deter new investment.

- Operational Disruption: A lack of clear financial oversight poses a threat to the company's day-to-day operations and long-term viability.

Economic Downturn and Decreased Disposable Income

Economic slowdowns or decreased disposable income among Chinese families could significantly impact the willingness of expectant parents to invest in private cord blood storage, as it's often viewed as a discretionary healthcare expense. This potential reduction in consumer spending power could lead to lower enrollment rates for private banking services, directly affecting revenue streams. For instance, a projected 3.5% GDP growth in China for 2024, down from previous years, might indicate a tightening of household budgets, making such long-term investments less of a priority.

The direct consequence of reduced disposable income would be a noticeable decline in new customer acquisition for private cord blood banks. This could translate to lower revenue figures for the 2024-2025 period, potentially impacting profitability and the ability to invest in further expansion or research. Industry analysts in late 2023 noted a trend of cautious consumer spending in China, a sentiment that could persist into 2025, further exacerbating this threat.

- Reduced Consumer Spending: Economic uncertainty can lead families to cut back on non-essential services like private cord blood banking.

- Lower Enrollment Rates: A decrease in disposable income directly correlates with fewer parents opting for private storage solutions.

- Revenue Impact: This threat poses a direct risk to the revenue generation capabilities of cord blood banking companies in China.

- Market Contraction: Prolonged economic downturns could lead to a contraction of the private cord blood storage market.

China's evolving regulatory environment for cord blood banking poses a significant threat, with potential policy shifts and the existence of an informal, less regulated market creating uncertainty and competition. Public perception and ethical debates surrounding the utility and necessity of private cord blood storage also present challenges, potentially impacting consumer demand and trust. Furthermore, the company's own financial instability, marked by liquidation proceedings and reporting delays, alongside broader economic concerns like reduced disposable income in China, create substantial headwinds for Global Cord Blood Corporation.

| Threat Category | Specific Threat | Impact on Global Cord Blood | Supporting Data/Context (2023-2025) |

| Regulatory Uncertainty | Shifting Chinese regulations, potential bans on for-profit banks | Operational disruption, market access limitations | Discussions within China's National Health Commission on private banking (late 2023); historical freeze on new licenses. |

| Market Competition | Unofficial cord blood banking, alternative stem cell sources | Loss of market share, price pressure | China's stem cell therapy market projected to reach tens of billions USD by late 2020s; bone marrow transplants remain viable. |

| Public Perception & Ethics | Skepticism about private banking utility, ethical debates | Reduced consumer demand, erosion of trust | 2024 survey indicated skepticism about long-term benefits for average families; potential for negative publicity from adverse events. |

| Financial Instability | Liquidation proceedings, unfiled financial reports, low cash reserves | Inability to operate, investor flight, operational continuity issues | Q1 2024 cash reserves at $15.2 million; delayed 2023 financial filings. |

| Economic Factors | Reduced disposable income in China, economic slowdowns | Lower enrollment rates, revenue decline | Projected 3.5% GDP growth in China for 2024; cautious consumer spending noted (late 2023). |

SWOT Analysis Data Sources

This Global Cord Blood SWOT analysis is built upon a robust foundation of data, drawing from comprehensive market research reports, industry-specific publications, and financial disclosures from key players in the sector. These sources provide a detailed understanding of market dynamics, competitive landscapes, and economic factors influencing the industry.