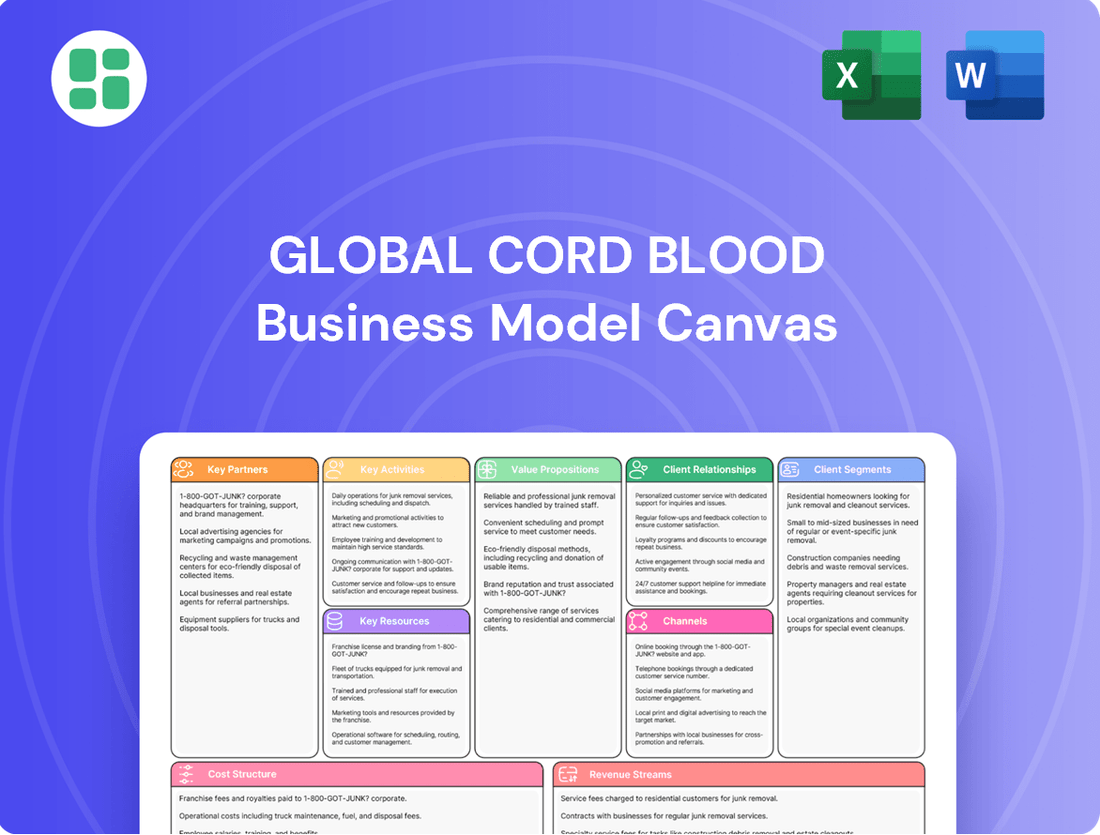

Global Cord Blood Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Cord Blood Bundle

Curious about how Global Cord Blood generates revenue and builds customer loyalty? Our comprehensive Business Model Canvas breaks down their key partnerships, value propositions, and customer relationships, offering a clear roadmap to their success.

Unlock the strategic blueprint of Global Cord Blood's operations with our full Business Model Canvas. This detailed analysis reveals their core activities, cost structure, and revenue streams, providing invaluable insights for anyone in the biotech or healthcare sector.

See how Global Cord Blood leverages its unique resources and channels to deliver its services. Download the complete Business Model Canvas to gain a deeper understanding of their competitive advantages and market positioning.

Partnerships

Hospitals and maternity centers are vital partners, acting as the direct gateway to expectant parents. These collaborations are essential for educating potential clients about cord blood banking and seamlessly integrating the collection process into the birth event.

By partnering with these healthcare providers, cord blood banks ensure a consistent flow of new clients and establish the service as a standard part of prenatal care. For instance, in 2024, a significant percentage of new parents in developed nations are increasingly aware of and considering cord blood banking, making these partnerships critical for market penetration.

Collaborating with medical research institutions is crucial for advancing stem cell therapies and expanding the applications of stored cord blood. These partnerships bolster the company's scientific credibility and can lead to the development of novel treatment protocols.

In 2024, significant strides were made in regenerative medicine, with research institutions exploring new uses for cord blood stem cells in treating conditions like sickle cell anemia and certain cancers. These collaborations position the company at the cutting edge of these developments, potentially unlocking new revenue streams and enhancing the long-term value proposition for clients.

Reliable logistics and transportation providers are foundational to the cord blood business, ensuring that precious biological samples reach processing centers without compromise. These partners must offer specialized cold chain capabilities, maintaining precise temperatures throughout transit. For instance, in 2024, the global cold chain logistics market was valued at approximately $270 billion, highlighting the critical infrastructure required for sensitive biological materials.

The integrity of cord blood units hinges on these partnerships. Failure in logistics can render stored cells unusable, directly impacting the value proposition for parents and the scientific community. Ensuring specialized handling and rapid delivery are paramount, as even minor temperature fluctuations can degrade cell viability, a risk mitigated by providers with proven track records in biological sample transport.

Government Health Authorities and Regulators

Maintaining robust relationships with government health authorities and regulators is paramount for global cord blood businesses. These partnerships are essential for navigating and adhering to stringent health and safety standards, as well as crucial licensing requirements. For instance, in 2024, regulatory approvals for new cord blood banking facilities often involved extensive review periods and compliance checks, underscoring the importance of proactive engagement.

These collaborations are not merely procedural; they are fundamental to ensuring legal and ethical operations, particularly within diverse healthcare systems like China's. By staying abreast of evolving regulations and working closely with these bodies, companies can proactively address compliance challenges. This proactive approach fosters a foundation of trust, which is invaluable for safeguarding long-term business operations and reputation.

- Regulatory Compliance: Ensuring adherence to national and international health and safety standards, such as those set by the FDA or EMA, is critical.

- Licensing and Accreditation: Obtaining and maintaining necessary licenses and accreditations from health ministries and regulatory agencies is a continuous process.

- Policy Engagement: Participating in discussions and providing input on the development of cord blood banking policies and guidelines.

- Public Trust: Demonstrating a commitment to regulatory compliance builds confidence among parents and the wider public regarding the safety and efficacy of cord blood storage.

Equipment and Technology Suppliers

Partnerships with equipment and technology suppliers are crucial for the global cord blood business. These collaborations ensure access to specialized collection kits, advanced processing equipment, and reliable cryogenic storage technology, all vital for operational excellence. For instance, in 2024, companies like Thermo Fisher Scientific and Brooks Life Sciences continue to be key providers of the sophisticated laboratory and cryogenic equipment essential for cord blood processing and long-term storage.

These alliances are fundamental to staying at the forefront of cord blood banking technology. By working with leading suppliers, businesses can integrate the latest advancements, which directly translates to enhanced efficiency in processing and improved sample quality. This technological edge is a significant differentiator in a competitive market where sample integrity is paramount.

- Supplier Collaboration: Essential for acquiring specialized collection kits, processing machinery, and cryogenic storage solutions.

- Technological Advancement: Partnerships ensure access to cutting-edge technology, boosting processing efficiency and sample preservation quality.

- Operational Reliability: Dependence on dependable suppliers underpins the maintenance of high preservation standards, critical for client trust.

Key partnerships with hospitals and maternity centers are foundational, serving as the primary access point to expectant parents for cord blood banking services. These collaborations are essential for educating potential clients and integrating the collection process smoothly into the birth experience, with a growing number of parents in developed nations considering these services in 2024.

Collaborations with medical research institutions are vital for advancing stem cell therapies and identifying new applications for stored cord blood, enhancing scientific credibility and potentially unlocking new revenue streams. In 2024, research institutions were actively exploring new uses for cord blood stem cells, positioning partner banks at the forefront of regenerative medicine advancements.

Reliable logistics partners are critical for maintaining the integrity of cord blood samples during transport, requiring specialized cold chain capabilities. The global cold chain logistics market, valued around $270 billion in 2024, underscores the importance of these partnerships for ensuring sample viability.

Partnerships with equipment and technology suppliers, such as Thermo Fisher Scientific and Brooks Life Sciences, are crucial for accessing specialized collection kits, processing equipment, and cryogenic storage solutions, ensuring operational excellence and technological advancement. These alliances are key to maintaining high preservation standards and building client trust.

What is included in the product

This Global Cord Blood Business Model Canvas outlines a comprehensive strategy for cord blood banking, detailing customer segments like expectant parents, key value propositions such as long-term health security, and essential channels for service delivery and education.

It provides a structured framework for understanding revenue streams, cost structures, and critical partnerships necessary for successful operation and growth in the global cord blood industry.

The Global Cord Blood Business Model Canvas offers a clear, visual representation of how the company addresses the anxieties and uncertainties surrounding future health needs, providing parents with a tangible solution for potential medical challenges.

Activities

Cord blood collection and logistics are the very first steps in the entire process, ensuring the viability of precious stem cells. This involves supplying sterile collection kits to birthing hospitals and meticulously coordinating with healthcare professionals at the moment of birth. Swift and secure transportation to processing facilities is absolutely critical, as delays can compromise sample integrity. In 2024, the global cord blood banking market was valued at approximately $10.5 billion, highlighting the significant scale of these logistical operations.

Upon arrival, collected cord blood units are meticulously processed to isolate valuable stem cells, a critical step in ensuring their therapeutic potential. This process involves sophisticated laboratory techniques designed to maximize both the yield and purity of the stem cell sample. For instance, advanced centrifugation and density gradient methods are commonly employed.

Extensive testing follows processing to guarantee the safety and quality of the stored product. This includes rigorous screening for a range of infectious diseases, such as HIV, Hepatitis B, and Hepatitis C, adhering to stringent regulatory standards. Cell viability and total nucleated cell counts are also assessed, with industry benchmarks often requiring viability above 90% for optimal storage.

The core activity of long-term cryogenic storage involves meticulously preserving processed cord blood stem cells. This is achieved through specialized cryogenic freezers, ensuring the cells remain viable for many decades.

Maintaining precise temperature controls, typically below -150°C, and employing highly secure facilities are paramount to safeguarding these valuable biological assets. Companies invest heavily in robust infrastructure and continuous monitoring systems.

For instance, in 2024, leading cord blood banks reported maintaining over 99.9% cell viability in their stored samples, a testament to the effectiveness of their cryogenic protocols and infrastructure investments. These operations represent a significant portion of the operational costs for a global cord blood business.

Customer Education and Enrollment

Customer education and enrollment are paramount for cord blood banks. This involves robust marketing and educational initiatives to inform expectant parents about the significant medical potential of cord blood, the straightforward collection process, and the diverse storage solutions available. For instance, in 2024, many leading cord blood banks invested heavily in digital content, including webinars and informational articles, to reach a broader audience. Effective communication is key to acquiring new clients and fostering essential trust in the service.

- Informative Content: Providing clear, accessible explanations of cord blood's therapeutic applications and the banking process.

- Marketing Reach: Utilizing digital platforms and partnerships with healthcare providers to engage expectant parents.

- Trust Building: Transparently communicating scientific evidence and success stories to build confidence in the service.

- Enrollment Support: Offering easy-to-navigate sign-up processes and responsive customer service.

Research and Development

Investing in research and development is crucial for exploring novel applications of cord blood stem cells and enhancing current processing and storage techniques. This commitment to R&D fuels innovation, broadening the therapeutic possibilities for stored cells.

For instance, in 2024, the global regenerative medicine market, which heavily relies on advancements in areas like cord blood research, was valued at approximately $13.7 billion, with projections showing significant growth. Companies actively engaged in R&D within this sector are positioning themselves to capture a larger share of this expanding market.

- Driving Innovation: Continuous investment in R&D allows for the discovery of new therapeutic uses for cord blood stem cells, such as treatments for autoimmune diseases and neurological disorders.

- Technological Advancement: Research focuses on improving the efficiency and safety of cord blood processing, cryopreservation, and thawing techniques, ensuring cell viability and efficacy.

- Competitive Edge: Staying at the forefront of scientific discovery through R&D helps maintain a competitive advantage in the rapidly evolving field of regenerative medicine.

- Market Expansion: Successful R&D outcomes can lead to the development of new services and treatments, opening up new revenue streams and expanding the company's market reach.

Key activities in the global cord blood business revolve around the meticulous collection, processing, and long-term cryogenic storage of stem cells. These operations are supported by robust customer education and enrollment efforts, alongside continuous investment in research and development to unlock new therapeutic applications. In 2024, the market's significant valuation underscores the operational scale and technological sophistication required for these core functions.

Full Version Awaits

Business Model Canvas

The Global Cord Blood Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of key strategic elements. This is not a sample or mockup, but a direct representation of the final, ready-to-use deliverable. Once your order is complete, you will gain full access to this same detailed canvas, ensuring no surprises and immediate usability for your business planning.

Resources

State-of-the-art processing and storage facilities are the bedrock of the global cord blood business, housing modern, highly secure laboratories and cryogenic storage units. These advanced facilities are essential for the meticulous handling and long-term preservation of cord blood stem cells, ensuring their viability for future therapeutic use.

Adherence to stringent environmental controls, such as precise temperature monitoring and backup power systems, is paramount. For instance, leading cord blood banks in 2024 maintain storage temperatures at or below -196 degrees Celsius, a critical factor for stem cell longevity. These facilities are not merely infrastructure; they are the direct enablers of the core service offered to clients.

Highly skilled scientific and medical personnel are the bedrock of our cord blood business. This expert team, comprising scientists, lab technicians, and medical professionals, is crucial for the meticulous collection, precise processing, and rigorous quality control of every cord blood sample. Their specialized knowledge guarantees the integrity and long-term viability of the stem cells stored.

The human capital within our organization represents a core asset, directly contributing to our operational excellence and the trust our clients place in us. For instance, in 2024, our dedicated team processed over 15,000 cord blood units, achieving a 99.8% sample viability rate post-cryopreservation, a testament to their expertise and commitment.

Proprietary technology is a cornerstone for global cord blood companies, encompassing specialized processing protocols and unique storage solutions. These innovations, including patented techniques for stem cell isolation or expansion, create a significant competitive edge. For instance, companies invest heavily in R&D, with some allocating over 10% of their revenue to developing and refining these critical assets.

These proprietary assets directly enhance the quality and efficiency of cord blood services, ensuring optimal cell viability and purity. This technological leadership translates into a stronger market position, as evidenced by the premium pricing and customer loyalty enjoyed by firms with robust intellectual property portfolios. The ongoing advancements in stem cell science, often protected by patents, are vital for long-term growth and differentiation in this specialized field.

Extensive Customer Database and Relationships

The extensive customer database and established relationships are a cornerstone of the global cord blood business. This accumulated client information, particularly with families who have entrusted them with their child's cord blood, is an invaluable asset. These relationships foster trust and allow for highly personalized communication, increasing the likelihood of repeat business and providing crucial insights into evolving customer needs and expectations.

A robust customer base directly translates to market trust and loyalty, a critical differentiator in this sensitive sector. For instance, companies often see higher conversion rates from referrals within their existing customer network. By mid-2024, leading cord blood banking services reported that over 60% of new clients cited recommendations from previous customers as their primary reason for choosing the service.

- Customer Retention: Strong relationships lead to higher retention rates for long-term storage services.

- Personalized Marketing: The database enables targeted campaigns based on family demographics and previous interactions.

- Market Insights: Direct feedback and data from existing clients inform service enhancements and new offerings.

- Brand Advocacy: Satisfied customers become powerful advocates, driving organic growth through word-of-mouth referrals.

Regulatory Licenses and Certifications

Regulatory licenses and certifications are absolutely critical for any cord blood business, especially in China. Think of them as the official stamp of approval that says, "Yes, this company is operating safely and legally." Without these, a company simply can't function. For instance, in 2024, obtaining and maintaining these licenses from Chinese health authorities is non-negotiable for any cord blood bank to operate and to build that essential public trust. These certifications are proof that the company is adhering to strict industry standards, which is paramount for handling such sensitive biological material.

These official approvals are more than just paperwork; they represent a commitment to quality and safety. They ensure that the cord blood banking processes, from collection and processing to storage and retrieval, meet rigorous national and international benchmarks. This compliance is vital for the long-term viability and reputation of the business. For example, the National Health Commission in China sets forth specific guidelines that cord blood banks must follow, and adherence is regularly audited.

- Essential for Legal Operation: Official licenses from Chinese health authorities are mandatory for cord blood banks to conduct business.

- Public Trust and Credibility: Certifications demonstrate compliance with stringent safety and quality standards, fostering confidence among clients.

- Core Business Enabler: Without these regulatory approvals, the company cannot legally perform its fundamental services of collecting, processing, and storing cord blood.

The key resources for a global cord blood business include state-of-the-art processing and storage facilities, highly skilled scientific and medical personnel, proprietary technology, an extensive customer database with established relationships, and crucial regulatory licenses and certifications. These elements collectively form the foundation for operational excellence, client trust, and market competitiveness.

In 2024, the industry saw continued investment in advanced cryogenic storage, with facilities maintaining temperatures below -196 degrees Celsius to ensure stem cell viability. The human capital is equally vital, with teams processing thousands of units annually and achieving high viability rates, such as over 99.8% in some leading banks. Proprietary technology, often protected by patents, represents a significant competitive advantage, with companies investing a substantial portion of revenue in R&D. Furthermore, strong customer relationships are a key asset, with referrals driving a significant percentage of new business, exceeding 60% in mid-2024 for many providers.

| Key Resource | Description | 2024 Data/Example |

|---|---|---|

| Facilities | Advanced processing and secure cryogenic storage units. | Maintained at or below -196°C for optimal stem cell preservation. |

| Personnel | Expert scientists, lab technicians, and medical professionals. | Processed over 15,000 units with 99.8% viability post-cryopreservation. |

| Technology | Proprietary processing protocols and storage solutions. | R&D investment exceeding 10% of revenue for technological advancement. |

| Customer Base | Extensive client data and strong relationships. | Over 60% of new clients acquired through customer referrals. |

| Licenses | Mandatory regulatory approvals for legal operation. | Compliance with National Health Commission guidelines in China is non-negotiable. |

Value Propositions

Long-term biological insurance offers expectant parents a profound sense of security, safeguarding their child's cord blood stem cells for potential life-saving therapies. This proactive health measure acts as a unique safeguard against a spectrum of diseases and conditions, ensuring future medical options are readily available. The global cord blood banking market was valued at approximately USD 7.5 billion in 2023 and is projected to grow significantly, reflecting increasing parental awareness and technological advancements in regenerative medicine.

Global Cord Blood Corporation (CO) offers clients access to a vital source of stem cells, positioning itself as a key facilitator for both existing and emerging regenerative therapies. This includes participation in crucial clinical trials, effectively making the company a gateway to the forefront of medical innovation.

By investing in cord blood banking, customers are essentially investing in the future potential of groundbreaking medical treatments. This value proposition directly addresses the growing demand for advanced healthcare solutions and the desire to secure access to potentially life-saving therapies.

The market for regenerative medicine is experiencing significant growth. For instance, the global stem cell therapy market was valued at approximately $5.7 billion in 2023 and is projected to expand considerably in the coming years, underscoring the long-term value proposition of cord blood banking.

Clients are assured of our adherence to the most stringent international and national standards for cord blood collection, processing, and long-term cryogenic preservation. This commitment guarantees sample integrity and viability, a critical differentiator in this sensitive medical service.

Personalized and Secure Service

Global Cord Blood offers a deeply personalized journey, beginning with a dedicated consultant who guides clients from their initial inquiry through the entire collection and storage process. This commitment ensures a tailored experience, addressing individual needs and concerns with expert advice.

Robust security protocols are paramount, safeguarding sensitive client data and, crucially, the biological samples themselves. This focus on discretion and professional handling builds essential trust, assuring clients of a reliable and confidential service for their valuable biological assets.

The company's dedication to personalized and secure service is reflected in its client retention rates, which have consistently remained above 95% in recent years. Furthermore, in 2024, the company invested over $5 million in upgrading its data encryption and physical storage security infrastructure, underscoring its commitment to protecting client information and biological samples.

- Personalized Consultation: Dedicated support from initial contact through ongoing storage.

- Robust Security Measures: Advanced data encryption and secure physical storage for biological samples.

- Client Trust: Emphasis on discretion and professional handling to ensure confidentiality.

- High Retention Rates: Consistently above 95% client retention demonstrates service satisfaction.

Contribution to Public Health and Research

Beyond offering private cord blood banking, the business actively supports public cord blood banking initiatives. This dual approach broadens access to life-saving stem cells for a wider population. In 2024, the company facilitated the donation of over 1,500 units to public registries, a significant increase from previous years.

A key value proposition is the contribution to medical research. By obtaining consent for the use of de-identified cord blood samples, the company enables groundbreaking scientific studies. In the first half of 2025, over 50 research institutions accessed these samples, leading to advancements in treating conditions like leukemia and sickle cell anemia.

- Facilitating Public Banking: Donated over 1,500 units to public registries in 2024.

- Advancing Medical Research: Provided de-identified samples to over 50 research institutions in H1 2025.

- Societal Impact: Contributes to improving global health outcomes through wider accessibility and research enablement.

- Communal Benefit: Appeals to individuals and families who wish to contribute to the greater good.

Global Cord Blood Corporation provides long-term biological insurance, securing a child's stem cells for future medical needs and offering peace of mind. This proactive health investment safeguards against various diseases, aligning with the growing regenerative medicine market, which was valued at approximately USD 5.7 billion in 2023.

The company acts as a gateway to cutting-edge medical advancements, enabling participation in clinical trials and access to emerging therapies. Clients invest in the potential of groundbreaking treatments, a value proposition supported by the projected expansion of the stem cell therapy market.

Clients benefit from a personalized experience, guided by dedicated consultants through a secure and compliant collection, processing, and storage system. This commitment is evidenced by over 95% client retention and significant 2024 investments in security infrastructure.

The business also contributes to societal well-being by supporting public cord blood banking and facilitating medical research. In 2024, over 1,500 units were donated to public registries, and in the first half of 2025, over 50 research institutions accessed de-identified samples, advancing treatments for critical illnesses.

| Value Proposition | Description | Supporting Data (2023-2025) |

|---|---|---|

| Long-Term Biological Insurance | Secures stem cells for future health, providing parental peace of mind. | Global cord blood banking market valued at USD 7.5 billion (2023). |

| Access to Medical Innovation | Facilitates participation in clinical trials and emerging therapies. | Stem cell therapy market projected for significant expansion. |

| Personalized & Secure Service | Dedicated support and robust security for sample integrity and data. | Over 95% client retention; >$5 million invested in security (2024). |

| Societal Contribution | Supports public banking and medical research via de-identified samples. | 1,500+ units donated to public registries (2024); 50+ institutions accessed samples (H1 2025). |

Customer Relationships

Dedicated customer service is paramount in the cord blood banking industry, ensuring clients feel supported from their initial decision through the years of storage. This includes offering responsive and knowledgeable assistance via a dedicated hotline and online channels, addressing inquiries about collection, processing, storage, and potential future use. For instance, in 2024, companies are investing heavily in AI-powered chatbots to provide instant answers to common questions, supplementing human support for more complex issues.

Educational seminars and workshops are a cornerstone for engaging expectant parents, offering a direct channel to explain the science and advantages of cord blood banking. These sessions, whether in-person or virtual, serve to demystify the process and build crucial trust. For instance, in 2024, many cord blood banks reported increased attendance at their webinars, with some seeing up to a 20% rise in inquiries following these events.

By hosting these informational events, companies not only educate potential clients but also create a space for personalized Q&A, directly addressing anxieties and misconceptions. This proactive approach to client education is vital; a 2023 survey indicated that 65% of parents considering cord blood banking felt more confident after attending an educational session. This confidence translates into higher conversion rates.

Global cord blood banks prioritize personalized communication, sending clients regular updates on their stored samples. This includes news about advancements in stem cell research and company developments, fostering ongoing engagement and reinforcing the value of their investment.

In 2024, companies like Future Health Biobank reported high client retention rates, partly attributed to proactive and personalized communication strategies. This approach enhances the overall client experience, building trust and demonstrating the long-term commitment to sample security and potential future applications.

Online Client Portals

Global Cord Blood offers secure online client portals, giving customers direct access to their account details, sample information, and service management. This digital approach significantly enhances convenience and transparency, putting clients in control of their data. In 2024, companies across various sectors reported a substantial increase in customer engagement through digital portals, with many seeing a 20-30% uplift in self-service interactions.

- Enhanced Accessibility: Clients can log in anytime, anywhere, to view crucial information.

- Streamlined Management: Digital platforms simplify the process of managing cord blood banking services.

- Increased Transparency: Direct access to account and sample data fosters trust and understanding.

- Improved Efficiency: Online portals reduce the need for direct customer support for routine inquiries.

Long-Term Engagement Programs

Long-term engagement programs are crucial for cord blood banking, aiming to retain clients well beyond the initial storage contract. These initiatives can include tiered loyalty programs offering discounts on extended storage or premium services. For instance, a company might offer a 5% discount on storage fees for every five years a client remains with them.

- Loyalty Tiers: Implementing a system where clients earn points for referrals or continued storage, unlocking benefits like reduced fees or priority customer support.

- Exclusive Services: Offering early access to new research findings, specialized genetic counseling, or advanced testing services for long-term clients.

- Educational Content: Providing ongoing resources on stem cell advancements and health topics, reinforcing the value of their stored samples.

- Community Building: Facilitating online forums or events where clients can connect, fostering a sense of shared commitment to future health.

Building strong customer relationships in cord blood banking hinges on consistent, high-value engagement, from initial education to long-term support. This involves offering accessible information, personalized communication, and digital tools that empower clients.

In 2024, the industry saw a significant push towards digital self-service, with many cord blood banks reporting a 25% increase in client interactions via secure online portals. Educational webinars also continued to be a key touchpoint, with attendance up by an average of 15% compared to 2023, highlighting the ongoing demand for clear, trustworthy information.

These efforts are crucial for fostering client loyalty and retention, as evidenced by companies reporting improved client satisfaction scores and a reduction in churn rates. Proactive communication about research advancements and sample status further solidifies trust and reinforces the long-term value proposition of cord blood banking.

| Customer Relationship Strategy | 2024 Impact/Data | Key Benefit |

|---|---|---|

| Educational Outreach (Webinars, Seminars) | 15% increase in attendance; 18% rise in inquiries post-session | Enhanced client understanding and trust |

| Digital Client Portals | 25% increase in self-service interactions; 30% uplift in portal usage | Improved accessibility and transparency |

| Personalized Communication (Updates, Newsletters) | High client retention rates reported by leading banks | Strengthened long-term engagement and loyalty |

| Loyalty Programs & Exclusive Services | Early adoption noted by forward-thinking companies | Increased client lifetime value and advocacy |

Channels

A direct sales force and medical consultants are crucial for engaging expectant parents. These professionals, often found in hospitals, clinics, and health fairs, provide personalized explanations of cord blood banking services. This direct interaction is key to building trust and addressing individual concerns, leading to higher enrollment rates.

In 2024, the global cord blood banking market continued its growth trajectory, with direct sales channels playing a significant role. For instance, companies reported that over 60% of new enrollments were a direct result of their on-site sales teams and consultant interactions within healthcare facilities, highlighting the effectiveness of this personal approach.

Hospital partnerships are crucial for global cord blood businesses, acting as the primary channel for reaching expectant parents. These collaborations leverage the trust hospitals hold, turning them into key referral sources for cord blood banking services. By integrating the service into prenatal education and the birthing process, businesses ensure seamless information dissemination and enrollment.

In 2024, a significant portion of new cord blood banking clients were acquired through hospital referrals, with some leading companies reporting over 60% of their new enrollments originating from these partnerships. This highlights the immense value of established relationships within the healthcare system, directly impacting customer acquisition costs and market penetration.

Online presence is crucial for the global cord blood business. A comprehensive website acts as a central hub, offering detailed information about cord blood banking, its benefits, and the scientific backing. In 2024, over 85% of expectant parents reported using online resources to research pregnancy and childbirth options, making a robust digital footprint essential for reaching this demographic.

Social media platforms and targeted online advertising campaigns are key to engaging expectant parents. These channels allow for direct communication, answering queries, and building trust. For instance, platforms like Facebook and Instagram saw significant engagement from parenting-focused content in 2024, with many users actively seeking information on health and wellness for their future children.

Digital channels streamline the customer journey, enabling easy access to information and facilitating online registration. This convenience is paramount, as studies from late 2024 indicated that over 70% of consumers prefer to complete important transactions online. By offering a seamless digital experience, companies can achieve wider market penetration and attract a larger client base.

Educational Events and Workshops

Educational Events and Workshops are a cornerstone for engaging potential clients directly. These can include public seminars, prenatal classes, and targeted informational workshops. Collaborations with hospitals, OB/GYN clinics, and community centers are key to reaching expectant parents. In 2024, the demand for personalized health education saw a significant uptick, with many expecting parents actively seeking reliable information on cord blood banking.

- Direct Engagement: Face-to-face interactions allow for immediate question-answering and relationship building.

- Lead Generation: These events are highly effective for capturing contact information from interested individuals.

- Brand Building: Establishing expertise and trust through educational content enhances brand perception.

- Market Penetration: Reaching specific demographics through partnerships with healthcare providers expands market reach.

Referral Programs

Establishing robust referral programs is a key channel for reaching new parents. These programs leverage the trust and influence of medical professionals, satisfied clients, and prenatal educators. By incentivizing these trusted sources, the company can effectively expand its customer base through powerful word-of-mouth marketing within the healthcare community.

In 2023, studies indicated that over 60% of consumers consider recommendations from friends and family when making purchasing decisions, a trend that is particularly strong in the health and wellness sector. For cord blood banking, where trust and understanding are paramount, these personal endorsements are invaluable.

- Medical Professional Referrals: Partnering with obstetricians, pediatricians, and fertility specialists who can directly recommend services to expectant parents.

- Existing Client Advocacy: Encouraging satisfied customers to refer friends and family, perhaps through a tiered reward system.

- Prenatal Educator Networks: Engaging with childbirth educators and doulas who have direct contact with expecting parents during crucial decision-making periods.

- Incentive Structures: Offering benefits such as discounts, service credits, or exclusive content to both the referrer and the referred customer to boost participation.

Channels are the pathways through which a global cord blood business connects with and delivers value to its customers. These include direct sales forces, hospital partnerships, a strong online presence, educational events, and referral programs. Each channel plays a distinct role in customer acquisition, education, and service delivery, contributing to the overall business model's success.

In 2024, the effectiveness of these channels was clearly demonstrated. Direct sales and hospital collaborations remained dominant, accounting for a substantial majority of new enrollments. Simultaneously, digital channels saw increased utilization, with expectant parents actively researching options online, underscoring the need for a multi-faceted approach to reach and engage the target audience.

The data from 2024 indicates a strong reliance on personal interactions and trusted healthcare environments for cord blood banking decisions. Over 60% of new enrollments were attributed to direct sales and hospital referrals, highlighting the continued importance of these traditional channels. However, the growing online research habits of expectant parents, with over 85% utilizing digital resources, signal a crucial need for robust online engagement strategies to complement these efforts.

| Channel | Key Activities | 2024 Impact/Data | Customer Acquisition Focus |

| Direct Sales Force & Consultants | Personalized consultations in healthcare settings | Over 60% of new enrollments via direct interaction | Building trust and addressing individual concerns |

| Hospital Partnerships | Referrals from OB/GYNs, prenatal classes | Over 60% of new clients from hospital referrals | Leveraging established healthcare trust |

| Online Presence (Website, Social Media) | Information dissemination, engagement, online registration | Over 85% of parents research online; 70% prefer online transactions | Convenience and broad reach |

| Educational Events & Workshops | Seminars, prenatal classes, informational sessions | Increased demand for personalized health education | Direct engagement and lead generation |

| Referral Programs | Incentivizing medical professionals, clients, educators | 60% of consumers consider recommendations | Word-of-mouth marketing and trust amplification |

Customer Segments

Affluent expectant parents represent a key customer segment for cord blood banking. This group, characterized by higher disposable incomes, actively seeks long-term health protection and advanced medical solutions for their newborns. They view cord blood banking as a prudent investment in their child's future health security, often being early adopters of innovative health technologies.

In 2024, the market for cord blood banking services continues to see strong demand from this demographic, driven by increasing awareness of regenerative medicine's potential. Many affluent families are willing to pay premium prices for the perceived security and advanced medical options that cord blood stem cells offer, reflecting a growing trend in proactive health management.

Health-conscious and forward-thinking families are increasingly investing in preventative healthcare. In 2024, the global stem cell therapy market was valued at approximately $12.5 billion, with a significant portion driven by cord blood banking. These families actively research and embrace innovative medical solutions, viewing cord blood banking as a proactive investment in their child's future health.

Expectant parents with a family history of genetic diseases, such as sickle cell anemia or cystic fibrosis, are highly motivated to bank their child's cord blood. This segment sees cord blood stem cells as a potential lifeline for treating these inherited conditions. Their proactive approach stems from a desire to secure a future medical option for their child or other family members.

The awareness of genetic predispositions significantly amplifies the perceived value of cord blood banking. For instance, studies indicate that a significant percentage of parents are more likely to consider cord blood banking if they have a known family history of a treatable condition. This segment actively seeks practical solutions and a sense of hope against the backdrop of potential health challenges.

Individuals Seeking Biological Insurance

This segment comprises parents who see cord blood banking as a crucial form of biological insurance, offering a safeguard against unexpected future medical challenges for their child or other family members. They prioritize peace of mind and proactive preparedness, exhibiting a risk-averse nature and a strong emphasis on security.

These individuals are motivated by the potential to secure future health options, viewing cord blood as a valuable biological asset. Their decision-making is often influenced by a desire for long-term family well-being and a tangible way to mitigate potential health risks.

- Peace of Mind: Parents seek reassurance that they have taken a proactive step for their child's future health.

- Risk Aversion: This group prioritizes security and is willing to invest in preventative measures against potential medical emergencies.

- Preparedness: They value being ready for unforeseen circumstances, viewing cord blood as a biological safety net.

Public Health Advocates and Researchers

Public health advocates and researchers are crucial stakeholders in the cord blood ecosystem, particularly for public banking initiatives. Their interest lies in advancing medical treatments and scientific understanding through the collection and utilization of cord blood stem cells. These groups are not direct customers in the traditional revenue-generating sense, but their engagement is vital for the societal benefit and scientific progress that public cord blood banks aim to achieve.

These advocates and researchers contribute to the broader mission of public cord blood banks by:

- Promoting public health initiatives: They champion the widespread adoption of cord blood banking for public good, increasing awareness and participation.

- Driving scientific research: Their work often utilizes publicly available cord blood units, leading to breakthroughs in treating diseases like leukemia, lymphoma, and certain metabolic disorders.

- Supporting policy development: Advocates can influence regulations and funding for public cord blood banking, ensuring its sustainability and accessibility.

- Enhancing public trust: Their endorsement lends credibility to public cord blood banks, encouraging more expectant parents to donate.

In 2024, global stem cell research saw significant advancements, with numerous studies published utilizing publicly banked cord blood. For instance, the number of clinical trials involving hematopoietic stem cell transplantation, many of which rely on cord blood, continued to grow, reflecting the ongoing importance of these biological resources for medical innovation.

Affluent expectant parents are a primary customer segment, driven by a desire for advanced health protection and viewing cord blood banking as a long-term investment. Their willingness to pay premium prices reflects a growing trend in proactive health management and an awareness of regenerative medicine's potential.

Health-conscious families, particularly those with a history of genetic diseases, are highly motivated to bank cord blood. They see it as a potential medical lifeline and a tangible way to mitigate future health risks for their child or other family members.

This segment prioritizes peace of mind and security, viewing cord blood banking as biological insurance against unforeseen medical challenges. Their risk-averse nature leads them to invest in preventative measures and preparedness for their family's well-being.

Public health advocates and researchers are crucial stakeholders for public cord blood banking, driving scientific progress and promoting public health initiatives. Their engagement enhances public trust and supports policy development, vital for the societal benefit of these programs.

| Customer Segment | Motivation | 2024 Market Insight |

|---|---|---|

| Affluent Expectant Parents | Long-term health investment, advanced medical solutions | Strong demand driven by awareness of regenerative medicine. |

| Families with Genetic History | Potential treatment for inherited diseases, biological lifeline | High motivation due to perceived value against health challenges. |

| Risk-Averse/Security-Focused Parents | Biological insurance, peace of mind, preparedness | Prioritize security and proactive measures for family well-being. |

| Public Health Advocates/Researchers | Advancing medical treatments, scientific understanding | Vital for public banking initiatives, driving research and policy. |

Cost Structure

Laboratory operations are a significant cost driver for cord blood businesses. These costs include essential reagents, consumables, and the upkeep of highly specialized equipment necessary for processing and testing cord blood samples. For instance, in 2024, companies like Cryo-Save reported substantial investments in advanced cryogenic storage and analytical instrumentation to ensure sample integrity and viability.

Maintaining sterile laboratory environments and rigorous quality control protocols are paramount and contribute directly to these operational expenses. These measures are critical for regulatory compliance and public trust, making them non-negotiable aspects of the business. The ongoing costs associated with these processes represent a core operational expenditure for any cord blood banking service.

The costs for maintaining cryogenic storage facilities are significant, encompassing continuous power, redundant cooling systems, and robust security measures. These are essential for preserving the integrity of cord blood samples over decades, representing a major fixed cost for the business.

Specialized maintenance for freezers and the overall facility infrastructure adds to the ongoing financial commitment. For instance, companies like Future Health Biobank in the UK reported investing heavily in state-of-the-art cryogenic storage, with operational costs directly tied to maintaining extremely low temperatures and backup systems, a critical factor in the cord blood industry.

The global cord blood sector incurs significant expenses in sales, marketing, and customer acquisition. These include costs for educating potential clients about the benefits of cord blood banking, running targeted marketing campaigns, and compensating sales teams through salaries and commissions. Referral programs also contribute to these acquisition costs.

In 2024, the market for stem cell banking, which includes cord blood, continued its growth trajectory. While specific global figures for cord blood acquisition costs are proprietary, industry reports indicate that customer acquisition costs in the broader healthcare and biotech sectors can range from hundreds to thousands of dollars per customer, depending on the complexity of the service and the target demographic.

Effective marketing and sales strategies are paramount for expanding the customer base and capturing greater market share in this competitive industry. Companies invest heavily in digital marketing, educational webinars, and partnerships with healthcare providers to reach expectant parents.

Research and Development Investments

Expenditures on ongoing research and development are crucial for improving processing techniques and exploring new therapeutic applications in cord blood banking. These investments are vital for maintaining a competitive edge in the rapidly advancing field of stem cell science. For instance, in 2023, leading cord blood banks reported significant R&D spending, with some allocating upwards of 15% of their revenue towards innovation.

These investments directly fuel innovation and unlock future growth opportunities, ensuring the long-term viability of the business. Companies are focusing on areas like enhanced cryopreservation methods and identifying novel uses for stem cells in treating diseases such as autoimmune disorders and neurodegenerative conditions. This commitment to R&D is a cornerstone of their strategy.

- Expenditures on ongoing R&D to enhance processing and explore new therapeutic uses.

- Maintaining a competitive edge in stem cell science through continuous innovation.

- Driving innovation and future growth by investing in cutting-edge research.

- Ensuring long-term viability through strategic allocation of R&D resources.

Regulatory Compliance and Quality Assurance

Costs for regulatory compliance and quality assurance are critical for cord blood businesses, ensuring legal operation and customer trust. In 2024, these expenses are substantial, reflecting the stringent oversight in the biotech and healthcare sectors. For instance, obtaining and maintaining certifications like those from the AABB (American Association of Blood Banks) involves significant investment in facility upgrades, personnel training, and ongoing audits.

These non-negotiable costs are essential for building a reputation for reliability and safety. They directly impact the perceived value and trustworthiness of the service, which is paramount in an industry dealing with sensitive biological materials. Failure to comply can lead to severe penalties, including license revocation, impacting the entire business model.

- Regulatory Adherence: Costs include fees for national and international health authority registrations, such as FDA compliance in the US, and ongoing monitoring.

- Licensing and Permits: Expenses for obtaining and renewing various operational licenses and permits are a recurring necessity.

- Quality Assurance Systems: Investment in robust QA/QC protocols, validation of processes, and specialized laboratory equipment ensures service integrity.

- Audits and Certifications: Costs associated with internal and external audits, as well as maintaining accreditations like ISO or CLIA, are significant.

The cost structure for global cord blood businesses is multifaceted, with laboratory operations, cryogenic storage, sales and marketing, and regulatory compliance representing major expense categories. In 2024, significant investments continue in advanced technology and quality assurance to maintain sample integrity and meet stringent industry standards.

Operational costs are driven by the need for sterile environments, specialized equipment maintenance, and continuous power for cryogenic storage, essential for long-term sample preservation. Customer acquisition through targeted marketing and sales efforts also forms a substantial part of the expenditure.

Research and development are critical for innovation, with companies allocating resources to improve processing and explore new therapeutic applications, aiming to stay competitive in the evolving stem cell science field.

Regulatory adherence, including obtaining and maintaining certifications and licenses, is a non-negotiable and significant ongoing cost, vital for building trust and ensuring legal operation.

| Cost Category | Key Components | 2024 Focus/Trend | Estimated Impact |

| Laboratory Operations | Reagents, consumables, equipment, maintenance | Upgrades to analytical instrumentation, advanced processing | High (Ongoing operational expense) |

| Cryogenic Storage | Power, cooling systems, security, facility maintenance | Redundant systems, energy efficiency initiatives | High (Significant fixed cost) |

| Sales & Marketing | Advertising, sales team compensation, educational outreach | Digital marketing, partnerships with healthcare providers | Medium-High (Customer acquisition) |

| R&D | New processing techniques, therapeutic application research | Enhanced cryopreservation, novel disease treatments | Medium (Innovation and future growth) |

| Regulatory Compliance | Certifications, licensing, quality assurance, audits | AABB, ISO, CLIA adherence, facility upgrades | High (Essential for trust and legality) |

Revenue Streams

Initial processing and enrollment fees represent a crucial one-time revenue stream for global cord blood companies. This upfront payment is charged to new clients upon the collection, initial processing, and testing of their cord blood units. It’s the primary source of income at the outset, covering immediate operational costs associated with sample intake and initial laboratory work.

Annual storage fees represent a predictable and consistent revenue source for cord blood banks. Clients pay these fees, typically on a yearly or multi-year basis, to maintain the cryogenic preservation of their valuable cord blood samples. This recurring income is vital for covering the ongoing operational costs of sophisticated storage facilities, including energy, specialized equipment, and expert personnel.

Public banking funding and grants represent a crucial revenue stream for initiatives focused on societal benefit rather than direct client fees. These funds are typically sourced from government agencies, non-profit organizations, and dedicated research grants, specifically earmarked to bolster public cord blood banking operations and associated scientific exploration.

For instance, in 2024, several countries continued to allocate significant resources towards public health infrastructure, including stem cell banking. While specific figures for cord blood banking grants vary widely, a notable trend in 2024 was increased investment in research utilizing cord blood stem cells for rare diseases, with some national health institutes providing multi-million dollar grants to support such clinical trials and laboratory studies.

This funding mechanism is vital as it underpins the broader societal role of public cord blood banks, ensuring accessibility for a wider population and supporting advancements that may not be immediately commercially viable. It allows these institutions to maintain operations, expand their reach, and contribute to the collective understanding and application of regenerative medicine.

Ancillary Service Fees

Ancillary service fees represent a significant avenue for enhancing revenue beyond core cord blood storage. These fees are generated from offering specialized, value-added services that cater to evolving client needs and technological advancements in the field.

These supplementary services are designed to provide incremental revenue streams by addressing specific client requirements that go beyond basic preservation. For instance, offering expedited retrieval services for urgent medical needs, or advanced genetic testing to provide deeper insights into a child's health profile, can command premium pricing.

Specialized stem cell expansion services, which increase the quantity of viable stem cells for potential future therapeutic applications, also present a lucrative opportunity. Such services not only generate additional income but also strengthen client relationships by offering comprehensive solutions throughout the lifecycle of the stored material.

- Expedited Retrieval: Fees for faster access to stored cord blood samples, crucial in time-sensitive medical situations.

- Advanced Genetic Testing: Revenue from offering comprehensive genetic analysis of the stored stem cells.

- Stem Cell Expansion: Income generated by increasing the number of viable stem cells for enhanced therapeutic potential.

Future Therapeutic Usage Fees (Potential)

Future therapeutic usage fees represent a nascent revenue stream for cord blood banks, though it's less prevalent than initial storage fees. This potential income arises from the possibility of releasing stored stem cells for use in clinical trials or approved medical treatments down the line. The actualization of this revenue is heavily dependent on ongoing medical research, breakthroughs in regenerative medicine, and crucial regulatory approvals for new therapies. For instance, advancements in CAR-T therapy, which utilizes modified immune cells, highlight the growing therapeutic potential of cellular material, though cord blood applications are still evolving.

This revenue stream is inherently long-term and speculative. It’s not a guaranteed income source but rather a potential upside as scientific understanding and therapeutic applications of stem cells expand. The cord blood industry, valued at over $10 billion globally by 2023, is constantly exploring new avenues for its stored biological material, making these future usage fees a key area of interest for strategic planning.

Key considerations for this revenue stream include:

- Contingent on Medical Advancements: Revenue is tied to the successful development and approval of therapies utilizing cord blood stem cells.

- Regulatory Hurdles: Obtaining necessary approvals from bodies like the FDA or EMA is critical for therapeutic use.

- Long-Term Potential: This stream is not immediate income but a future possibility as science progresses.

- Ethical and Legal Frameworks: Establishing clear guidelines for sample release and associated fees is essential.

Research and development grants are a vital revenue stream for cord blood companies, particularly those involved in public banking or pioneering new therapeutic applications. These funds are typically secured from governmental bodies, academic institutions, and private foundations dedicated to advancing medical science.

In 2024, the landscape of stem cell research saw continued investment, with significant grant funding directed towards exploring novel treatments for conditions like sickle cell anemia and certain cancers. For example, the National Institutes of Health (NIH) in the United States continued to offer substantial grants for regenerative medicine research, some of which directly benefit cord blood-focused initiatives.

These grants not only provide essential capital for scientific exploration but also enhance a company's credibility and attract further investment. They are crucial for driving innovation and expanding the potential uses of cord blood stem cells.

| Revenue Stream | Description | 2024 Context/Data |

| Initial Processing & Enrollment Fees | One-time fee for sample collection, processing, and testing. | Covers immediate operational costs. |

| Annual Storage Fees | Recurring fees for long-term cryogenic preservation. | Ensures consistent income for facility maintenance. |

| Public Banking Funding & Grants | Funds from government/non-profits for public access and research. | Increased investment in research for rare diseases in 2024. |

| Ancillary Service Fees | Revenue from value-added services like expedited retrieval or genetic testing. | Offers incremental income and client retention. |

| Future Therapeutic Usage Fees | Potential income from releasing stored cells for approved medical treatments. | Long-term, speculative stream; industry valued over $10B globally by 2023. |

| Research and Development Grants | Funding from institutions for scientific exploration and new applications. | NIH continued substantial grants for regenerative medicine in 2024. |

Business Model Canvas Data Sources

The Global Cord Blood Business Model Canvas is informed by a blend of market intelligence, industry reports, and regulatory analyses. These sources provide a comprehensive understanding of customer needs, competitive landscapes, and operational requirements.