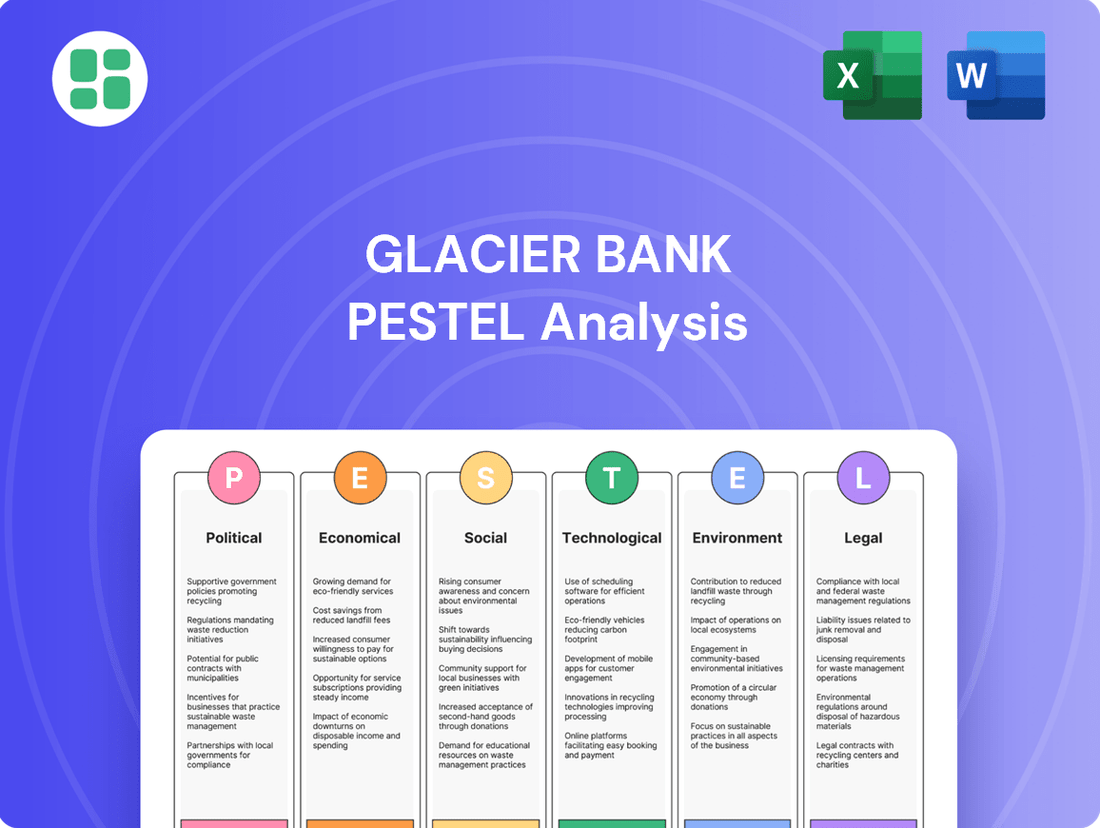

Glacier Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glacier Bank Bundle

Unlock the strategic advantages of understanding Glacier Bank's external environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors influencing its operations. Gain a competitive edge by anticipating market shifts and identifying potential opportunities and threats. Download the full PESTLE analysis now to equip yourself with actionable intelligence for informed decision-making and robust strategic planning.

Political factors

The banking sector is deeply shaped by governmental rules, and any shifts in these can notably affect Glacier Bank's business and earnings. For instance, the Basel III endgame reforms, with final implementation phases expected in 2025, will likely increase capital requirements for many banks, potentially impacting Glacier Bank's lending capacity and profitability metrics like return on equity.

The Federal Reserve's monetary policy, particularly its stance on interest rates, significantly impacts Glacier Bank. Decisions on the federal funds rate directly influence the bank's net interest margin, which is the difference between the interest income generated from loans and the interest paid out on deposits. Lowering rates generally compresses this margin, while raising them can expand it, assuming loan demand remains robust.

As of mid-2024, the Federal Reserve has maintained a cautious approach to rate adjustments, signaling a potential pause or even a slight reduction in rates later in the year or in early 2025, depending on inflation data. For Glacier Bank, a scenario where short-term rates decrease while long-term rates remain stable or slightly increase would be favorable. This yield curve normalization could boost the bank's profitability by reducing funding costs while maintaining attractive returns on longer-term assets like mortgages and corporate loans.

Glacier Bank's operations across the Western U.S. are directly impacted by political stability within these states. For instance, policy shifts regarding resource development in states like Montana or Wyoming could affect key industries Glacier Bank serves. Broader U.S. trade policies also play a crucial role, with potential tariffs or trade agreements influencing the profitability and growth prospects of its commercial clients, particularly those involved in cross-border commerce.

Government Support for Small Businesses

Government support for small businesses presents a significant opportunity for Glacier Bank. Initiatives like the Small Business Administration (SBA) loan programs, which saw robust activity in 2024, directly translate into lending opportunities. For instance, the SBA's 7(a) loan program, a cornerstone for small business financing, facilitated billions in lending in the past fiscal year, with projections for continued strong demand in 2025.

Glacier Bank can capitalize on these government-backed programs to expand its loan portfolio. By actively participating in and promoting these initiatives, the bank can attract and serve small and medium-sized enterprises (SMEs), a vital segment of its customer base. Understanding the nuances of these programs, such as recent adjustments to guarantee percentages or eligibility criteria, is key to maximizing loan growth.

- SBA Loan Program Growth: The SBA reported a substantial increase in loan volume for its flagship programs in fiscal year 2024, with continued robust demand anticipated for 2025.

- Targeted Lending Opportunities: Government initiatives often include specific sectors or underserved communities, creating niche lending opportunities for Glacier Bank to explore.

- Regulatory Alignment: Staying abreast of changes in government support policies ensures Glacier Bank remains compliant and can effectively leverage new or modified programs for business development.

Antitrust and Merger Regulations

Changes in antitrust scrutiny and bank merger regulations under a new U.S. presidential administration in 2025 could significantly impact Glacier Bancorp's strategic acquisition approach. Increased regulatory oversight might slow down or complicate potential mergers, affecting growth plans.

While some deregulation is anticipated, specific thresholds related to insured deposits, such as those potentially reviewed by the Federal Reserve, may still influence M&A activity for regional banks like Glacier Bancorp, even with a more lenient overall stance.

- Increased Antitrust Scrutiny: A potential shift towards stricter enforcement of antitrust laws in 2025 could lead to more in-depth reviews of bank mergers.

- Deposit Thresholds: Regulations concerning insured deposits, which often dictate the size of banks eligible for certain merger approvals, remain a key consideration.

- Impact on M&A Strategy: Glacier Bancorp's ability to pursue strategic acquisitions will be directly tied to the evolving regulatory landscape for bank consolidation.

Governmental regulations are a cornerstone for Glacier Bank, with upcoming Basel III endgame reforms in 2025 potentially increasing capital requirements and impacting profitability metrics. Monetary policy, particularly the Federal Reserve's stance on interest rates, directly influences the bank's net interest margin; a favorable yield curve normalization in late 2024 or early 2025 could boost earnings.

Political stability in the Western U.S. and national trade policies directly affect Glacier Bank's key industries and commercial clients. Government support for small businesses, evidenced by robust SBA loan programs in 2024 and anticipated continued demand in 2025, presents significant lending opportunities for the bank.

Antitrust scrutiny and bank merger regulations, especially with potential shifts in 2025, could impact Glacier Bancorp's strategic acquisition plans, with deposit thresholds remaining a key regulatory consideration.

| Regulatory Factor | 2024/2025 Outlook | Impact on Glacier Bank |

| Basel III Endgame Reforms | Final implementation phases in 2025 | Increased capital requirements, potential impact on lending capacity and ROE |

| Federal Reserve Monetary Policy | Cautious approach, potential rate adjustments late 2024/early 2025 | Influences net interest margin; yield curve normalization could be favorable |

| SBA Loan Programs | Robust activity in 2024, continued strong demand projected for 2025 | Expansion opportunities for loan portfolio, particularly for SMEs |

| Antitrust & Merger Regulations | Potential for increased scrutiny in 2025 | May slow or complicate strategic acquisition plans |

What is included in the product

This Glacier Bank PESTLE analysis examines how external macro-environmental factors influence the bank across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic planning by identifying key threats and opportunities within the bank's operating landscape.

A concise, action-oriented summary of Glacier Bank's PESTLE factors, highlighting key external opportunities and threats to inform strategic decision-making and mitigate potential risks.

Economic factors

Interest rate fluctuations directly impact Glacier Bank's profitability. For instance, the bank saw its net interest margin improve in the first half of 2025, a trend attributed to higher yields on its loans and a reduction in the cost of its deposits. The Federal Reserve's monetary policy decisions, particularly regarding the pace and magnitude of potential interest rate cuts throughout 2025, will remain a critical determinant of the bank's net interest income going forward.

Glacier Bank's financial performance is intrinsically linked to the economic vitality of its core operating regions, primarily Montana and the broader Western United States. The bank's loan demand and the quality of its assets are directly impacted by the economic trajectory of these areas.

While Montana experienced a deceleration in its economic growth during 2024, forecasts for 2025 suggest a return to slow to moderate expansion. Key sectors expected to drive this growth include construction and various service industries, which will likely influence Glacier Bank's lending opportunities and the performance of its loan portfolio.

Inflationary pressures directly influence Glacier Bank's operational expenses, from employee salaries to technology investments. Higher inflation erodes customer purchasing power, potentially slowing deposit growth as individuals spend more and save less, and dampening loan demand as borrowing becomes less attractive.

While the Federal Reserve's preferred inflation gauge, the core Personal Consumption Expenditures (PCE) price index, is anticipated to trend downwards, reaching approximately 2.6% in 2024 and further moderating in 2025, ongoing monitoring remains crucial. This projected moderation suggests a less aggressive interest rate environment but still requires careful management of the bank's balance sheet to mitigate residual risks.

Real Estate Market Trends

Real estate market trends are a critical consideration for Glacier Bank. The housing market and commercial real estate sectors directly impact the bank's substantial loan portfolios, particularly those in commercial real estate and construction. A slowdown in these areas can lead to increased credit risk and reduced opportunities for new lending.

In 2024 and heading into 2025, the housing market in Montana, Glacier Bank's primary operating region, has shown signs of cooling. For example, median home prices in Montana experienced a slight moderation in late 2024 after significant appreciation in prior years. This trend, coupled with tighter national bank lending standards that began to emerge in 2023 and are expected to persist, will likely influence the bank's future lending activities and the overall credit quality of its real estate-backed loans.

- Residential Real Estate: Montana's housing market, while still robust in many areas, is seeing a normalization of price growth, with some regions experiencing modest declines in sales volume as of late 2024.

- Commercial Real Estate: The commercial sector, especially office and retail spaces, faces ongoing challenges due to evolving work-from-home trends and e-commerce, potentially impacting occupancy rates and property values.

- Lending Standards: National banks have generally tightened underwriting for commercial real estate loans in response to economic uncertainties and higher interest rates, a trend likely to affect Glacier Bank's competitive landscape.

- Interest Rate Sensitivity: Higher interest rates directly increase the cost of borrowing for real estate developers and buyers, which can dampen demand and affect the feasibility of new projects.

Consumer Spending and Unemployment

Consumer spending and unemployment are critical indicators for banks like Glacier Bank, directly impacting loan demand and the risk of defaults. As the U.S. economy navigates potential shifts in the labor market, understanding these trends is paramount for assessing credit quality.

Recent data highlights the sensitivity of consumer behavior to economic conditions. For instance, while overall consumer spending showed resilience through early 2024, sectors like discretionary goods can be particularly vulnerable to rising unemployment. The U.S. unemployment rate remained low, hovering around 3.9% in early 2024, but any uptick could signal reduced consumer confidence and a slowdown in borrowing.

Banks must closely monitor consumer credit charge-offs, which have seen concerning increases, reaching levels not seen since 2011. This trend suggests that even with a generally robust labor market, certain segments of consumers are facing increased financial strain, potentially leading to higher delinquency rates on loans.

- Consumer Spending: While showing some resilience, discretionary spending is a key area to watch for potential contractions.

- Unemployment Rate: A low unemployment rate (around 3.9% in early 2024) is generally positive, but any increase could signal weakening consumer demand and higher loan default risk.

- Credit Charge-offs: The recent rise in consumer credit charge-offs to 2011 levels indicates increased financial pressure on a portion of the consumer base.

- Loan Demand: Changes in consumer confidence and financial health directly influence the demand for various bank loan products, from mortgages to personal loans.

Economic factors significantly shape Glacier Bank's operating environment. Interest rate policies by central banks, like the Federal Reserve, directly influence the bank's net interest margin, with anticipated rate adjustments in 2025 being a key focus. Economic growth in Glacier Bank's primary markets, particularly Montana, is expected to rebound to slow to moderate expansion in 2025, driven by sectors like construction and services, which will affect loan demand and asset quality.

Inflationary pressures impact operational costs and consumer behavior; while inflation is projected to moderate in 2025, its continued monitoring is vital for managing balance sheet risks. The real estate market, both residential and commercial, presents both opportunities and risks, with a cooling housing market in Montana as of late 2024 and persistent challenges in commercial real estate due to evolving work trends.

Consumer spending and employment levels are critical indicators. Despite a low unemployment rate around 3.9% in early 2024, a rise in consumer credit charge-offs to 2011 levels suggests increased financial strain on some consumers, potentially impacting loan demand and default rates.

| Economic Indicator | 2024 (Early) | 2025 Projection | Impact on Glacier Bank |

|---|---|---|---|

| Federal Funds Rate | Range: 5.25%-5.50% | Anticipated cuts, magnitude uncertain | Affects Net Interest Margin (NIM) |

| Montana Real GDP Growth | Slowing | Slow to Moderate Expansion | Loan demand, asset quality |

| US Core PCE Inflation | ~2.6% | Further Moderation | Interest rate environment, cost management |

| US Unemployment Rate | ~3.9% | Stable to Slight Increase | Consumer spending, loan default risk |

| Consumer Credit Charge-offs | Rising (2011 levels) | Continued Monitoring Needed | Loan portfolio risk |

Preview Before You Purchase

Glacier Bank PESTLE Analysis

The preview shown here is the exact Glacier Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Glacier Bank.

The content and structure shown in the preview is the same Glacier Bank PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Customers are increasingly shifting towards digital channels for their banking needs. In 2024, a significant majority of banking transactions, estimated to be over 70%, are expected to occur through mobile apps and online platforms, reflecting a strong preference for convenience and accessibility.

Glacier Bank must prioritize continuous investment in its digital infrastructure to cater to these evolving preferences. By enhancing its mobile app and online banking services, the bank can offer personalized experiences and ensure seamless account management, thereby retaining and attracting customers in the competitive financial landscape.

Demographic shifts and migration significantly shape Glacier Bank's operational landscape. Montana, a key state for Glacier Bank, experienced a notable slowdown in population growth during 2024, with the state's population estimated to be around 1.14 million. This trend, coupled with internal migration patterns, directly impacts the size and composition of its customer base, influencing demand for diverse banking products and services.

Glacier Bank actively demonstrates its commitment to community banking through significant contributions, including substantial donations and extensive employee volunteer hours. In 2023 alone, Glacier Bank employees dedicated over 15,000 hours to local causes, underscoring a deep-seated engagement with the communities they serve.

This dedication extends to financial support, with the bank originating $250 million in community development loans in 2024, directly fueling local economic growth and initiatives. Such tangible efforts are crucial for building and sustaining trust, which is a cornerstone of customer loyalty in the banking sector.

The bank's strong local presence, coupled with its proactive role in fostering community prosperity, cultivates a positive brand image and strengthens its relationship with customers. This approach is particularly vital in the current financial climate, where consumers increasingly favor institutions that align with their values and demonstrate genuine social responsibility.

Financial Literacy and Inclusion

Glacier Bank's commitment to financial education is a key sociological driver, with programs targeting individuals, small businesses, and schools. This initiative directly addresses the need for improved financial literacy across diverse community segments. For instance, a 2024 survey indicated that over 60% of adults still struggle with basic financial concepts, highlighting the impact of such educational outreach.

The bank's efforts to boost financial literacy also tie into broader inclusion goals. By enhancing access to financial knowledge, Glacier Bank aims to empower more people to engage with banking services. This aligns with national trends observed in 2025, where financial institutions are increasingly focusing on reaching underserved populations, with mobile banking accessibility being a critical component in this strategy.

Glacier Bank's initiatives contribute to a more financially capable populace, which can lead to increased economic stability and participation. This focus on education and inclusion is particularly relevant given that in late 2024, the unbanked population in the US was still estimated to be around 4.5% of households, representing a significant opportunity for growth and societal benefit.

- Financial Education Reach: Glacier Bank's classes aim to improve financial understanding for individuals, businesses, and students.

- Inclusion Strategy: Efforts to increase financial literacy are directly linked to making banking services, like mobile banking, more accessible to unbanked populations.

- Societal Impact: Enhanced financial literacy can foster greater economic stability and encourage broader participation in the formal financial system.

- Market Opportunity: Addressing the needs of the unbanked and underbanked presents a significant growth avenue for financial institutions like Glacier Bank.

Workforce Dynamics and Talent Acquisition

Glacier Bank's success hinges on its capacity to attract and retain a skilled workforce, especially within its regional operating areas. The bank prioritizes fostering an inclusive, team-centric environment that emphasizes professional growth, a critical strategy in today's evolving labor market.

The current labor market presents both opportunities and challenges. For instance, in 2024, the U.S. unemployment rate remained low, hovering around 3.9% for much of the year, indicating a competitive landscape for talent acquisition. Glacier Bank's commitment to professional development, including offering certifications and advanced training programs, directly addresses this by enhancing employee retention and skill development.

- Talent Attraction: Glacier Bank aims to be an employer of choice by highlighting its commitment to employee well-being and career advancement.

- Retention Strategies: Investing in training and development programs is key to keeping valuable employees engaged and reducing turnover.

- Workforce Trends: Adapting to shifts in employee expectations, such as the demand for flexible work arrangements and a strong company culture, is paramount for sustained success.

Glacier Bank's community engagement is a significant sociological factor, with employees dedicating over 15,000 volunteer hours in 2023 and the bank originating $250 million in community development loans in 2024. This deep connection fosters trust and aligns with consumer preferences for socially responsible institutions.

The bank's focus on financial education, particularly in light of 2024 data showing over 60% of adults struggling with financial concepts, directly addresses societal needs. By improving financial literacy, Glacier Bank empowers individuals and small businesses, contributing to economic stability and increasing participation in the formal financial system, a key goal as the unbanked population remained around 4.5% of U.S. households in late 2024.

Attracting and retaining talent is crucial in a competitive 2024 labor market, with the U.S. unemployment rate around 3.9%. Glacier Bank's investment in employee development and fostering an inclusive environment are key strategies to address this, ensuring a skilled workforce capable of meeting evolving customer demands.

| Sociological Factor | Glacier Bank's Response/Impact | Relevant Data (2023-2025) |

|---|---|---|

| Community Engagement | Significant volunteer hours and community development loans | 15,000+ employee volunteer hours (2023); $250M in community loans (2024) |

| Financial Literacy | Programs for individuals, businesses, and schools | 60%+ adults struggle with financial concepts (2024); 4.5% unbanked households (late 2024) |

| Workforce Development | Investment in training and inclusive culture | 3.9% U.S. unemployment rate (2024) |

Technological factors

The shift towards digital banking is accelerating, with a significant portion of customer interactions now occurring through mobile channels. By 2025, it's projected that over 80% of banking transactions will be initiated digitally, underscoring the need for robust mobile platforms. Glacier Bank's strategy must prioritize enhancing its mobile app to be the primary, seamless interface for all customer needs, from account management to loan applications.

As digital transactions surge, cybersecurity and data protection are critical for Glacier Bank. The bank must consistently upgrade its security infrastructure to counter evolving threats like ransomware and phishing attacks, which saw a significant rise in reported incidents globally throughout 2024. Protecting sensitive customer information is not just a regulatory necessity but also fundamental to maintaining customer loyalty and trust in an increasingly digital financial landscape.

Artificial intelligence is fundamentally reshaping the banking sector, offering enhanced customer experiences through personalized advice and insights, while also boosting operational efficiency and bolstering risk management capabilities. Glacier Bank can capitalize on AI for improved customer interactions, more robust fraud detection systems, and streamlined internal workflows, though it must also factor in the associated compliance and implementation costs.

Data Analytics for Customer Insights

Glacier Bank leverages advanced data analytics to understand customer behaviors and preferences, allowing for highly personalized services and product recommendations. This data-driven strategy is crucial for maintaining a competitive edge in the evolving financial landscape.

By analyzing vast datasets, banks can predict customer needs and offer tailored solutions, improving customer satisfaction and loyalty. This approach helps in identifying cross-selling and up-selling opportunities, directly impacting revenue growth.

- Enhanced Customer Understanding: Data analytics provides granular insights into customer financial habits, enabling proactive service delivery.

- Personalized Offerings: Banks can tailor product recommendations and marketing messages based on individual customer profiles.

- Competitive Advantage: Utilizing data effectively differentiates financial institutions by offering superior customer experiences.

- Revenue Optimization: Targeted product offerings driven by data analytics can increase conversion rates and customer lifetime value.

FinTech Competition and Collaboration

FinTech companies are significantly altering the banking sector, forcing established institutions like Glacier Bank to adapt. These nimble innovators are introducing new digital services and payment solutions at an unprecedented pace.

The competitive pressure from FinTechs is substantial, with venture capital funding for FinTechs globally reaching an estimated $150 billion in 2024, indicating their growing influence. This necessitates that Glacier Bank continuously reassesses its service offerings and digital capabilities to remain relevant.

However, this disruption also presents avenues for strategic partnerships. Glacier Bank could integrate FinTech solutions to enhance customer experience, streamline operations, or expand its product portfolio. For instance, collaborations on digital lending platforms or embedded finance solutions are becoming increasingly common.

- FinTech Funding: Global FinTech venture capital investment projected to exceed $150 billion in 2024.

- Digital Adoption: Over 70% of consumers now utilize at least one FinTech service for daily financial needs.

- Partnership Potential: Banks are increasingly exploring API integrations with FinTechs for services like payments and wealth management.

The rapid adoption of AI in banking is transforming customer service and operational efficiency. By 2025, AI is expected to handle over 60% of routine customer inquiries, freeing up human staff for more complex tasks. Glacier Bank's investment in AI-powered chatbots and personalized financial advice tools will be crucial for staying competitive.

Blockchain technology is also poised to revolutionize financial transactions, offering enhanced security and transparency. While still in its early stages for widespread banking adoption, pilot programs in 2024 demonstrated potential for reducing settlement times by up to 80% for cross-border payments. Glacier Bank should explore strategic applications of blockchain for areas like trade finance and digital identity verification.

| Technology | Projected Impact by 2025 | Glacier Bank Opportunity |

|---|---|---|

| Artificial Intelligence (AI) | 60% of routine customer inquiries handled by AI | Enhance customer service, personalize advice |

| Blockchain | 80% reduction in cross-border payment settlement times (pilot programs) | Improve trade finance, digital identity verification |

| Cloud Computing | 90% of financial institutions to operate on cloud infrastructure | Increase scalability, reduce IT costs, improve data analytics |

Legal factors

Glacier Bank operates within a stringent regulatory environment, requiring strict adherence to federal and state banking laws. This includes critical areas like capital adequacy, liquidity management, and robust risk control frameworks. For instance, in 2024, the Federal Reserve continued to emphasize strong capital ratios for regional banks, a key area of focus for institutions like Glacier Bank.

Compliance with the Community Reinvestment Act (CRA) and fair lending practices remains paramount. These regulations ensure equitable access to credit and banking services across all communities. Failure to comply can result in significant penalties and reputational damage, underscoring the importance of ongoing monitoring and adaptation of policies.

Consumer protection laws significantly shape Glacier Bank's operational landscape. Regulations like the Consumer Financial Protection Bureau's (CFPB) rules on higher-priced mortgage loans and the safeguarding of personal financial data, such as under the California Consumer Privacy Act (CCPA), mandate stringent compliance measures. The CFPB's ongoing scrutiny of fees and potential discriminatory practices in lending, a key area for banks, necessitates robust internal controls and transparent policies.

Data privacy and security are paramount for Glacier Bank, especially with the growing digital footprint. Compliance with regulations like the Consumer Financial Protection Bureau's (CFPB) personal financial data rights rule, set to be effective in late 2024, is crucial. This rule specifically requires financial institutions to enable consumers to easily transfer their financial data, underscoring the need for robust privacy and security measures.

Navigating these evolving legal landscapes means Glacier Bank must invest in advanced security protocols to protect sensitive customer information. Failure to comply could result in significant penalties and reputational damage, impacting customer trust and business operations. The bank's ability to facilitate secure data portability, as mandated by new regulations, will be a key differentiator in the market.

Anti-Money Laundering (AML) and BSA Compliance

Glacier Bank, like all financial institutions, must adhere to stringent Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) regulations. These laws are designed to combat financial crimes, including money laundering and terrorist financing, by requiring banks to monitor transactions and report suspicious activities. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) reported over 300,000 Suspicious Activity Reports (SARs) filed by financial institutions, highlighting the scale of compliance efforts.

Meeting these legal obligations involves robust internal controls and continuous vigilance. Glacier Bank implements ongoing customer due diligence and transaction monitoring systems to identify and report potentially illicit financial flows. This proactive approach is crucial for maintaining regulatory compliance and supporting law enforcement efforts in disrupting criminal enterprises.

- Regulatory Obligation: Glacier Bank is legally bound to implement AML and BSA compliance measures.

- Key Activities: This includes ongoing screening of customers and transactions, and timely reporting of suspicious activities to authorities.

- Impact on Operations: Compliance necessitates significant investment in technology and personnel dedicated to monitoring and reporting.

- Industry Trend: In 2024, FinCEN continued to emphasize enhanced due diligence for high-risk entities, a trend expected to persist.

Acquisition-Related Regulatory Approvals

Glacier Bancorp's consistent strategy of growth through acquisitions means navigating a complex web of regulatory approvals is paramount. These approvals are critical legal hurdles for any merger or acquisition activity.

The regulatory landscape for bank mergers is subject to shifts, particularly with potential changes in administration. For instance, in 2024, the Federal Reserve and other banking regulators continued to scrutinize merger applications, with a focus on community impact and financial stability. This ongoing oversight means Glacier Bancorp must remain adaptable to evolving regulatory expectations.

- Regulatory Scrutiny: Banking regulators, including the Federal Reserve and the Office of the Comptroller of the Currency (OCC), review bank mergers for anticompetitive effects and financial stability.

- Potential Policy Changes: A new presidential administration could introduce new policies or priorities affecting merger review timelines and approval criteria for financial institutions.

- Antitrust Laws: Compliance with antitrust laws, such as the Clayton Act, is essential to ensure that proposed mergers do not substantially lessen competition.

- State-Level Approvals: Depending on the geographic scope of an acquisition, state banking authorities may also require separate approval, adding another layer of legal complexity.

Glacier Bank must navigate a complex web of consumer protection laws, including those enforced by the Consumer Financial Protection Bureau (CFPB). Regulations concerning fair lending, data privacy, and fee transparency are critical. For example, in 2024, the CFPB continued its focus on ensuring equitable access to credit and preventing discriminatory practices in lending, directly impacting bank operations and compliance strategies.

The bank's commitment to Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) compliance is non-negotiable. This involves rigorous transaction monitoring and reporting of suspicious activities. The Financial Crimes Enforcement Network (FinCEN) reported over 300,000 Suspicious Activity Reports (SARs) filed by financial institutions in 2023, underscoring the extensive compliance efforts required industry-wide.

Data privacy is increasingly regulated, with new rules like the CFPB's personal financial data rights rule, effective late 2024, mandating easier consumer data transfer. Glacier Bank must invest in robust security and privacy protocols to meet these evolving legal demands and maintain customer trust.

Mergers and acquisitions for Glacier Bancorp require navigating stringent regulatory approvals from bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). These reviews, particularly in 2024, focused on community impact and financial stability, highlighting the need for adaptability to regulatory expectations.

Environmental factors

Environmental factors are increasingly shaping the banking landscape, with a significant surge in the focus on Environmental, Social, and Governance (ESG) standards. This trend directly impacts investor decisions and regulatory expectations, pushing financial institutions to adopt more sustainable practices. For Glacier Bank, its dedication to ESG aligns seamlessly with its core community banking ethos, reinforcing its local commitment.

Financial institutions like Glacier Bank are increasingly being evaluated on how they manage climate-related financial risks, encompassing both the shift to a low-carbon economy (transition risks) and the direct impacts of climate change (physical risks). European banks, for instance, are under pressure to fully align with supervisory expectations regarding these climate factors, even if environmental concerns haven't historically been the primary ESG focus for them.

For Glacier Bank, a critical aspect of this involves a thorough assessment of how natural disasters, such as floods or wildfires, could impact the value of collateral held against loans. For example, in 2024, regions experiencing increased frequency of extreme weather events saw significant drops in property values, directly affecting the security of mortgage portfolios.

Glacier Bank is actively enhancing its environmental stewardship through programs focused on recycling, resource conservation, and careful construction evaluations. These efforts are geared towards minimizing waste and promoting responsible resource management across all operations.

A key objective for Glacier Bank is the reduction of its operational carbon footprint. This involves a continuous drive for energy efficiency, with the bank implementing measures to lower energy consumption and explore cleaner energy alternatives in its facilities.

In 2023, Glacier Bank reported a 7% reduction in energy consumption across its branches compared to 2022, a testament to its ongoing commitment to energy efficiency. The bank also expanded its recycling initiatives, diverting an estimated 65% of its operational waste from landfills during the same period.

Stakeholder Demand for Green Practices

Customers and investors are increasingly vocal about their desire for financial institutions to adopt sustainable practices. This push for environmental responsibility is directly influencing how banks like Glacier Bank operate. For instance, a 2024 survey by Deloitte found that 60% of consumers consider a company's environmental impact when making purchasing decisions, a figure that has steadily risen over the past few years.

This growing stakeholder demand translates into tangible pressure for banks to integrate "green banking" principles. This means not only offering eco-friendly financial products but also ensuring their own operations minimize their environmental footprint. Banks are responding by investing in energy-efficient branches and reducing their paper consumption, recognizing that sustainability is becoming a key differentiator.

The financial sector is seeing a significant shift in investment strategies, with a growing emphasis on Environmental, Social, and Governance (ESG) factors. By 2025, global ESG assets are projected to exceed $50 trillion, according to reports from various financial institutions. This trend means that banks that fail to demonstrate a commitment to green practices risk losing out on significant investment capital and may face challenges in attracting and retaining environmentally conscious customers.

- Customer Preference: A significant portion of consumers now factor environmental impact into their financial service choices.

- Investor Scrutiny: Investment firms are increasingly prioritizing banks with strong ESG credentials, influencing capital allocation.

- Operational Changes: Banks are actively implementing greener operational strategies to meet stakeholder expectations.

- Market Competitiveness: Demonstrating a commitment to sustainability is becoming crucial for maintaining a competitive edge in the financial industry.

Regulatory Reporting on Climate Risks

Future environmental regulations are poised to significantly impact financial institutions like Glacier Bank. Expectations for more detailed climate risk disclosures are intensifying, driven by evolving standards. For instance, the expansion of the Corporate Sustainability Reporting Directives (CSRD) in Europe and the development of global IFRS Sustainability Disclosure Standards will mandate more comprehensive reporting on environmental, social, and governance (ESG) factors.

Meeting these enhanced reporting obligations will necessitate substantial investment in advanced technologies and data management systems. Banks will need to implement robust frameworks to accurately capture, analyze, and report on their climate-related exposures and transition plans. This includes investing in specialized software for data aggregation, risk modeling, and automated report generation to ensure compliance with increasingly stringent global requirements.

- Increased Disclosure Requirements: Regulations like CSRD and IFRS Sustainability Disclosure Standards will demand more granular reporting on climate-related financial risks.

- Technology Investment: Banks must allocate capital towards advanced reporting technologies to manage and communicate complex sustainability data.

- Data Integrity and Systems: Ensuring the accuracy and reliability of climate data will be paramount, requiring upgrades to existing data infrastructure.

- Global Harmonization: The push for global standards suggests a future where reporting requirements will become more consistent across jurisdictions, simplifying some aspects but increasing the overall scope of data collection.

Growing stakeholder demand for sustainability is pushing banks like Glacier Bank to adopt greener practices, influencing customer choices and investor decisions. By 2025, global ESG assets are projected to exceed $50 trillion, highlighting the financial imperative for banks to demonstrate environmental commitment.

Climate-related financial risks, both physical and transitional, are becoming critical evaluation points for banks, with European institutions leading in aligning with supervisory expectations. For Glacier Bank, assessing the impact of natural disasters on loan collateral, such as property value drops in flood-prone areas in 2024, is a key concern.

Glacier Bank is actively reducing its operational carbon footprint through energy efficiency measures, achieving a 7% reduction in energy consumption across branches in 2023 compared to the previous year. Furthermore, the bank expanded its recycling initiatives, diverting approximately 65% of operational waste from landfills in the same period.

Future environmental regulations, including expanded CSRD and IFRS Sustainability Disclosure Standards, will mandate more comprehensive climate risk reporting, requiring significant investment in advanced data management systems and technologies for compliance.

PESTLE Analysis Data Sources

Our Glacier Bank PESTLE Analysis is meticulously constructed using a blend of official financial reports from regulatory bodies, economic data from international organizations like the IMF and World Bank, and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Glacier Bank.