Glacier Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glacier Bank Bundle

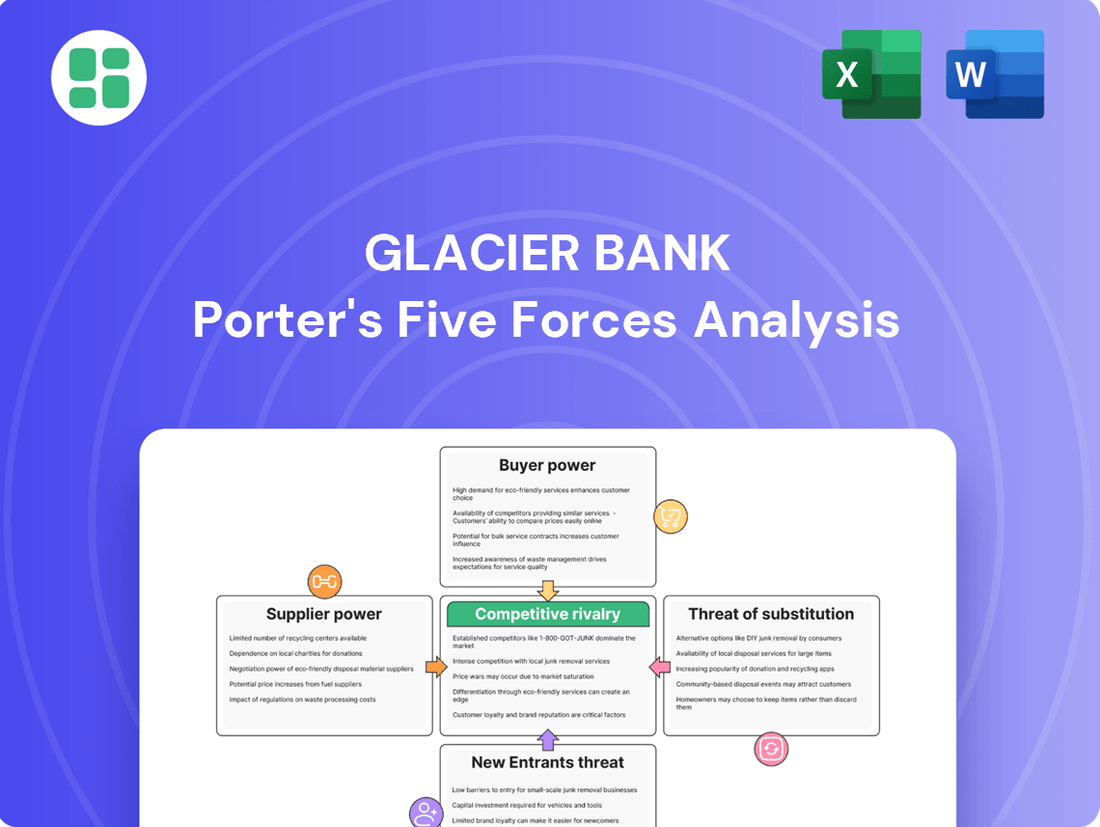

Glacier Bank operates within a dynamic financial landscape, where understanding the interplay of competitive forces is paramount. Our Porter's Five Forces Analysis dissects the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Glacier Bank’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to navigate this complex industry.

Suppliers Bargaining Power

Glacier Bancorp depends on core technology providers for its banking software and IT infrastructure. The market for these essential services is quite competitive, which gives Glacier Bancorp a degree of negotiation power when dealing with them.

However, the significant costs and complexities associated with switching these core systems, coupled with existing long-term contracts, can gradually increase the bargaining power of these suppliers over time, creating a potential constraint.

Skilled banking professionals, particularly those with expertise in commercial lending and risk management, are crucial for Glacier Bank's operations. This demand for specialized talent grants these employees a moderate level of bargaining power, impacting wage and benefit negotiations. For instance, in 2024, the average salary for a risk manager in the banking sector saw an increase of approximately 5% year-over-year, reflecting this demand.

For Glacier Bank, depositors are a crucial source of capital. While individual depositors typically wield very little influence over deposit rates, the situation changes with large institutional depositors or a coordinated effort by many smaller depositors. These groups could potentially exert pressure to negotiate higher interest rates, similar to how other suppliers might demand better terms.

However, in the highly competitive banking landscape, Glacier Bank, like its peers, generally sets its deposit rates based on prevailing market conditions and the overall demand for funds. This means that rather than reacting to the specific demands of individual or even large depositors, rates are more often a reflection of broader economic factors and the bank's own funding needs. For instance, as of early 2024, the Federal Reserve's monetary policy decisions significantly influenced deposit rates across the industry, with many banks adjusting their offerings in response to benchmark rate changes.

Low Bargaining Power of General Service Providers

The bargaining power of general service providers for Glacier Bancorp is notably low. This is primarily because the market for services like office supplies, cleaning, and basic utilities is highly fragmented, with a vast number of suppliers readily available. Glacier Bancorp can leverage this abundance of choice to negotiate favorable pricing and terms.

For instance, in 2024, the office supply market alone saw numerous companies competing, offering discounts to secure contracts with larger clients. Glacier Bancorp’s ability to easily switch between these providers means suppliers have limited leverage to dictate terms. This dynamic ensures that Glacier Bancorp can maintain cost efficiencies in its operational overhead.

- Abundant Alternatives: The market for general services is characterized by a high number of competing suppliers, reducing the leverage of any single provider.

- Cost Efficiencies: Glacier Bancorp can readily switch providers to secure competitive pricing, contributing to lower operational costs.

- Limited Supplier Dependence: Glacier Bancorp is not heavily reliant on any single general service provider, further diminishing supplier bargaining power.

Indirect Influence from Regulatory Bodies

Regulatory bodies, while not direct suppliers of goods or services, wield substantial indirect influence over Glacier Bank. They dictate compliance standards and impose fees, effectively adding to the bank's operational costs. For instance, in 2024, banks faced increased scrutiny and compliance burdens related to data privacy and cybersecurity, leading to significant investments in technology and personnel to meet these evolving mandates.

The absolute power of these bodies, stemming from their ability to levy severe penalties for non-compliance, translates into significant indirect supplier power. This forces financial institutions like Glacier Bank to adapt their operational frameworks and manage expenses to adhere to regulations, impacting strategic decisions and financial planning.

- Regulatory Compliance Costs: Increased investment in cybersecurity and data privacy measures in 2024 due to heightened regulatory focus.

- Penalties for Non-Compliance: The threat of substantial fines for failing to meet regulatory requirements drives operational adherence.

- Indirect Cost of Doing Business: Regulatory fees and the cost of implementing compliance programs represent a significant, albeit indirect, supplier cost.

- Influence on Operational Frameworks: Regulations shape how banks operate, manage risk, and invest in technology, demonstrating a powerful indirect supplier role.

Glacier Bancorp’s bargaining power with suppliers is generally moderate, influenced by the nature of the supplier and the availability of alternatives. While core technology providers and skilled professionals hold some leverage due to switching costs and demand, general service providers have minimal power due to market fragmentation. Regulatory bodies, however, exert significant indirect power by imposing compliance requirements and potential penalties, impacting operational costs and strategies.

| Supplier Type | Bargaining Power Level | Key Factors |

|---|---|---|

| Core Technology Providers | Moderate to High | Switching costs, long-term contracts |

| Skilled Banking Professionals | Moderate | Demand for specialized skills (e.g., risk management) |

| Depositors (Institutional) | Low to Moderate | Potential for coordinated action, market rates |

| General Service Providers | Low | Fragmented market, abundant alternatives |

| Regulatory Bodies | High (Indirect) | Compliance mandates, penalties for non-compliance |

What is included in the product

This analysis unpacks the competitive forces impacting Glacier Bank, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Quickly identify and address competitive threats with a visually intuitive breakdown of each Porter's Force, enabling proactive strategy adjustments.

Customers Bargaining Power

Large commercial borrowers, especially those seeking substantial real estate or construction financing, often possess significant bargaining power. In 2024, these clients typically have access to a wider array of lenders, including national banks and alternative financing sources, allowing them to solicit competitive bids and negotiate better interest rates and loan covenants. This competitive landscape means Glacier Bancorp must offer attractive terms to secure and retain such business, as these borrowers can readily shift their substantial loan portfolios elsewhere.

Individual depositors and small to medium-sized businesses face a competitive banking landscape, with many alternatives like credit unions and online banks readily available. This accessibility means customers can easily switch providers, often influenced by factors such as interest rates, account fees, or the quality of customer service. For instance, in 2024, the average interest rate on savings accounts across the US hovered around 0.46%, but competitive online banks often offered significantly higher rates, providing a clear incentive for customers to move their funds.

This ability to shift their business grants these customer segments a moderate level of bargaining power over Glacier Bancorp. They can leverage better offers from competitors to negotiate more favorable terms or simply move their accounts if Glacier's offerings are not perceived as competitive. This dynamic necessitates Glacier Bancorp to remain diligent in its pricing, service delivery, and product innovation to retain its customer base.

For standard deposit accounts like checking and savings, customers face minimal financial and logistical hurdles when switching banks. This ease of transition empowers them to shop around for better interest rates or improved services.

In 2024, the competitive landscape for these basic banking products means that banks must remain attractive to retain customers. For instance, a difference of even 0.25% in an annual percentage yield (APY) on savings accounts can be enough to prompt a customer to move their funds, highlighting the sensitivity to rate changes.

Sensitivity to Interest Rates and Loan Terms

Customers, particularly those looking for loans or depositing funds, are acutely aware of interest rate differentials and loan conditions. Glacier Bancorp must actively monitor and adjust its offerings to remain competitive, as customers can easily switch to institutions providing more favorable terms. This price sensitivity directly amplifies customer bargaining power.

For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, leading many banks to offer slightly varied Certificate of Deposit (CD) rates. A difference of even 0.25% can sway depositors, especially for larger sums. Similarly, mortgage rate variations, even small ones, significantly impact a borrower's total repayment over the life of the loan, giving customers leverage in negotiations.

- Interest Rate Sensitivity: Customers actively compare deposit yields and loan rates across financial institutions.

- Loan Term Flexibility: The ability to negotiate loan duration, repayment schedules, and associated fees empowers borrowers.

- Competitive Landscape: The presence of numerous banks and credit unions offering similar products intensifies customer options and their bargaining strength.

- Information Accessibility: Online comparison tools and financial advisory services make it easier for customers to identify the best available rates and terms.

Access to Diverse Financial Products and Providers

The sheer volume of financial products and services available from a multitude of providers significantly amplifies customer bargaining power. This includes not only traditional banks but also a growing number of non-bank lenders and innovative digital platforms, offering consumers a wider selection of options than ever before.

For instance, in 2024, the fintech sector continued its rapid expansion, with digital lenders and neobanks capturing an increasing share of the market. This proliferation of alternatives means customers are less reliant on any single institution, such as Glacier Bancorp, to meet their banking and lending requirements.

- Increased Choice: Customers can readily compare rates, terms, and features across numerous financial institutions.

- Reduced Switching Costs: Digital platforms often simplify the process of opening new accounts or transferring funds, lowering the effort for customers to switch providers.

- Access to Niche Products: Specialized lenders and platforms cater to specific customer needs, offering alternatives that traditional banks may not provide.

- Price Sensitivity: The availability of competitive offers makes customers more sensitive to pricing and less willing to accept less favorable terms from a single provider.

Customers possess moderate bargaining power due to the competitive banking environment and their sensitivity to rates and fees. This is evident as individuals and businesses can easily switch providers for better terms. For instance, in 2024, a difference of just 0.25% in APY on savings accounts could prompt customers to move their funds, highlighting the impact of even small rate variations.

The proliferation of fintech and digital platforms in 2024 further empowers customers by offering more choices and reducing switching costs. This increased accessibility to alternative lenders and specialized products means customers are less dependent on traditional institutions like Glacier Bancorp, allowing them to negotiate more effectively for favorable loan terms or deposit rates.

| Customer Segment | Bargaining Power Factor | 2024 Impact Example |

|---|---|---|

| Large Commercial Borrowers | Access to multiple lenders, ability to solicit competitive bids | Negotiate lower interest rates and more favorable covenants by comparing offers from national banks and alternative financing sources. |

| Individual Depositors & SMBs | Availability of credit unions and online banks, ease of switching | Move funds to online banks offering significantly higher savings account rates than the average 0.46% national rate. |

| All Customers | Price sensitivity to interest rates and loan conditions | Switch providers based on small differences in Certificate of Deposit (CD) rates or mortgage rates, impacting total repayment costs. |

Preview Before You Purchase

Glacier Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Glacier Bank, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Rivalry Among Competitors

Glacier Bancorp faces significant competitive pressure from a multitude of regional and community banks. These institutions actively compete for the same customer base, which includes individuals, small and medium-sized businesses, and public sector entities. This crowded marketplace necessitates constant efforts in pricing, product development, and marketing to maintain market share and attract new clients.

Glacier Bancorp, despite its strong regional presence, contends with formidable competition from large national and global banks. These behemoths often leverage their vast financial resources, offering a wider array of products and services that can be difficult for regional players to match. For instance, in 2024, the largest global banks reported trillions in assets under management, allowing them to invest heavily in technology and customer acquisition.

The competitive pressure from these larger institutions manifests in several ways. They can often offer more attractive interest rates on loans and deposits due to their scale and lower cost of funds. Furthermore, their sophisticated digital platforms and comprehensive wealth management services can draw away customers seeking a one-stop financial solution, directly impacting Glacier Bancorp's market share and profitability.

Credit unions pose a notable threat to Glacier Bancorp due to their member-focused approach and tax-exempt status, allowing them to offer more attractive rates on savings and loans. For instance, in 2024, credit unions continued to grow their asset base, with the National Credit Union Administration reporting total assets for federally insured credit unions exceeding $2.1 trillion by the end of the first quarter of 2024. This financial strength enables them to compete effectively for customer deposits and loan business.

While individual credit unions may be smaller than Glacier Bank, their strong local ties and emphasis on community can resonate deeply with customers, drawing them away from larger institutions. This localized competition, particularly in the communities where Glacier Bancorp operates, can fragment market share and intensify the rivalry for both deposits and lending opportunities, impacting Glacier's growth potential.

Emergence of Fintech Companies

Fintech companies are significantly reshaping the competitive landscape for traditional banks like Glacier Bancorp. These agile firms are increasingly offering specialized financial services, often with a digital-first approach. This includes areas like online lending, streamlined payment processing, and user-friendly digital investment platforms, directly challenging established players.

While not always aiming to be full-service banks, these focused fintech offerings can erode Glacier Bancorp's market share in specific, profitable niches. This creates a more fragmented and competitive environment. For instance, by mid-2024, the global fintech market was projected to reach over $33 billion, demonstrating substantial growth and the increasing influence of these specialized providers.

- Specialized Offerings: Fintechs excel in niche areas like digital payments and online lending.

- Market Share Erosion: Focused services can chip away at Glacier Bancorp's customer base in specific segments.

- Intensified Rivalry: The rise of fintechs means Glacier Bancorp faces competition from both traditional banks and nimble digital disruptors.

- Digital Dominance: Fintechs often leverage technology to offer more convenient and cost-effective solutions, forcing traditional banks to adapt.

Local Market Saturation and Consolidation Trends

Many banking markets, particularly in established regions, are quite mature. This maturity often translates to saturation, meaning there aren't many new customers to acquire, forcing banks like Glacier Bancorp to intensely compete for the existing customer base. For instance, in 2024, the U.S. banking industry saw a continued trend of slow organic growth, with many regional banks reporting single-digit percentage increases in net interest income, underscoring the challenge of market saturation.

The banking sector is also experiencing significant consolidation. Mergers and acquisitions are becoming more common, creating larger, more powerful financial institutions. This means Glacier Bancorp could find itself competing against banks that are substantially bigger and have greater resources due to these industry-wide mergers. As of early 2025, several large regional bank mergers were either completed or in advanced stages, reshaping the competitive landscape and potentially increasing the market share of the surviving entities.

- Market Saturation: Mature banking markets limit new customer acquisition, intensifying competition for existing deposits and loans.

- Consolidation Impact: Mergers and acquisitions create larger competitors with potentially greater scale and market power.

- 2024/2025 Trends: Observed slow organic growth in many U.S. banking markets and significant consolidation activity highlight these pressures.

Glacier Bancorp faces intense rivalry from a diverse set of competitors. Regional and community banks vie for the same customer segments, necessitating continuous innovation in pricing and product offerings. Large national and global banks, with their vast resources and broader service portfolios, also present a significant competitive challenge, often offering more attractive rates and sophisticated digital solutions.

The competitive landscape is further complicated by credit unions, which leverage their member-centric models and tax advantages to offer favorable terms, and by agile fintech companies specializing in niche digital financial services. These various players collectively intensify rivalry, forcing Glacier Bancorp to remain highly competitive in its market approach.

| Competitor Type | Key Strengths | Impact on Glacier Bancorp |

|---|---|---|

| Regional/Community Banks | Local market knowledge, strong customer relationships | Direct competition for deposits and loans, market share fragmentation |

| National/Global Banks | Vast resources, wider product range, economies of scale | Ability to offer lower rates, advanced technology, and comprehensive services |

| Credit Unions | Member focus, tax-exempt status, community ties | Attractive rates on savings and loans, potential customer loyalty |

| Fintech Companies | Digital-first approach, specialized services, agility | Erosion of market share in specific profitable niches, pressure to innovate digitally |

SSubstitutes Threaten

Online lending platforms present a substantial threat of substitution for Glacier Bancorp. Customers, particularly those seeking personal or small business loans, are increasingly finding these digital alternatives appealing due to their speed and often more competitive interest rates. For instance, the online lending market saw significant growth in 2024, with platforms facilitating billions in new loan originations, directly competing with traditional banks.

The threat of substitutes for traditional savings accounts at Glacier Bancorp is significant, primarily from investment firms and brokerages. These entities offer a diverse range of investment products such as mutual funds, stocks, and bonds, which historically have provided higher potential returns compared to savings accounts. For instance, in 2024, the average savings account yield hovered around 4-5%, while the S&P 500 saw a notable increase, demonstrating the potential for greater wealth accumulation elsewhere.

This availability of higher-yielding alternatives directly siphons funds that customers might otherwise deposit with Glacier Bancorp. As of early 2025, data suggests a continued trend of retail investors seeking growth opportunities beyond traditional banking products. The ease of access through online platforms and mobile apps further lowers the barrier to entry for these substitute services, making it simpler for customers to move their money to potentially more lucrative avenues.

Peer-to-peer (P2P) lending platforms offer an alternative to traditional bank loans, allowing individuals and businesses to borrow directly from other individuals. This disintermediation can be a significant substitute for services Glacier Bancorp provides, particularly for consumer and small business financing. For instance, by mid-2024, the P2P lending market continued its expansion, with platforms facilitating billions in loans globally, presenting a growing competitive pressure on banks like Glacier Bancorp to innovate and maintain competitive interest rates.

Digital Payment Systems and Mobile Wallets

The rise of digital payment systems and mobile wallets presents a significant threat of substitutes for traditional banking services. These platforms, such as PayPal, Apple Pay, and Venmo, are increasingly handling everyday transactions, reducing customer reliance on checking accounts for daily financial needs. In 2024, global mobile payment transaction value was projected to exceed $2.5 trillion, highlighting a substantial shift away from traditional banking channels for a growing segment of consumers and businesses.

This trend directly impacts Glacier Bank by offering convenient alternatives that bypass conventional banking infrastructure. As more users adopt these digital solutions for peer-to-peer transfers, online purchases, and bill payments, the perceived necessity of a traditional bank account for transactional purposes diminishes. This erosion of core banking functions can lead to reduced customer engagement and loyalty.

- Digital Payment Growth: Global mobile payment transaction value is expected to surpass $2.5 trillion in 2024, indicating a strong preference for digital alternatives.

- Reduced Reliance on Banks: Consumers and businesses are increasingly using mobile wallets for daily transactions, lessening their dependence on traditional checking accounts.

- Convenience Factor: Platforms like Apple Pay and PayPal offer seamless user experiences for a wide range of payments, directly competing with bank-provided services.

Alternative Financial Services (e.g., Payday Lenders, Check Cashing)

Alternative financial services, such as payday lenders and check-cashing businesses, pose a threat to Glacier Bank by catering to specific customer needs. These services offer quick access to funds, which can be appealing to individuals who require immediate financial solutions, even if they come with higher fees. For instance, the payday loan industry in the U.S. is substantial, with millions of Americans utilizing these services annually, highlighting a segment of the population that may not be fully served by traditional banking.

These substitutes can siphon off customers who prioritize speed and convenience over cost. For some, the accessibility of these alternative providers, often found in easily reachable locations or through simple online interfaces, outweighs the benefits of a traditional bank relationship. In 2023, the Consumer Financial Protection Bureau reported that a significant number of consumers rely on short-term, small-dollar loans, indicating a persistent demand that substitutes are meeting.

- Threat of Substitutes: Alternative financial services like payday lenders and check-cashing outlets offer immediate cash access, appealing to segments prioritizing speed over cost.

- Market Penetration: Millions of Americans use payday loans annually, demonstrating a clear demand that traditional banks may not fully satisfy.

- Customer Preference: Convenience and accessibility of alternative providers can draw customers away from traditional banking relationships.

- Regulatory Landscape: While often more expensive, these services fill a niche, particularly for individuals with immediate, short-term financial needs.

The threat of substitutes for Glacier Bancorp is multifaceted, encompassing digital lending platforms, alternative investment vehicles, and peer-to-peer lending. These alternatives often offer greater speed, convenience, and potentially higher returns, directly challenging traditional banking services. For instance, in 2024, the digital lending market facilitated billions in new loan originations, while the S&P 500 saw a notable increase, outperforming average savings account yields.

Furthermore, digital payment systems and mobile wallets are increasingly handling everyday transactions, reducing reliance on traditional checking accounts. Global mobile payment transaction value was projected to exceed $2.5 trillion in 2024, underscoring a significant shift away from conventional banking channels for many consumers and businesses.

| Substitute Type | Key Features | Impact on Glacier Bancorp | 2024 Data Point |

| Online Lending Platforms | Speed, competitive rates | Direct competition for loans | Billions in new loan originations |

| Investment Firms/Brokerages | Higher potential returns (stocks, bonds) | Siphons deposits from savings accounts | S&P 500 growth vs. ~4-5% savings yields |

| Digital Payment Systems | Convenience for daily transactions | Reduced reliance on checking accounts | > $2.5 trillion global mobile payment value |

| P2P Lending Platforms | Direct borrowing/lending | Alternative to consumer/small business loans | Billions in global P2P loans |

Entrants Threaten

The banking sector, including institutions like Glacier Bancorp, faces formidable regulatory hurdles. Obtaining banking licenses, adhering to stringent capital adequacy ratios, and navigating a complex web of compliance laws demand substantial investment and expertise, effectively deterring many potential new entrants from establishing full-service operations.

The banking sector is experiencing a significant threat from digital-only challenger banks. These new entrants, unburdened by the extensive physical infrastructure of traditional institutions like Glacier Bancorp, can operate with substantially lower overhead costs. Their agility allows them to leverage cutting-edge technology and innovative business models to attract customers.

These digital banks often focus on niche markets or specific customer needs, offering highly intuitive mobile banking experiences and attractive interest rates. For instance, by mid-2024, several neobanks reported rapid customer acquisition, with some doubling their user base year-over-year, directly impacting the market share of established players.

Fintech firms are increasingly broadening their offerings, moving beyond niche services to encompass more traditional banking functions. This expansion is driven by technological innovation and a desire to capture a larger share of the financial services market. For instance, many fintechs are obtaining their own limited banking charters or forming strategic alliances with incumbent banks, allowing them to offer a wider array of products and services directly to consumers.

This trend poses a significant threat to established institutions like Glacier Bancorp. As fintechs gain more comprehensive banking capabilities, they become more direct competitors, potentially eroding market share and customer loyalty. The digital-native nature of these companies often allows them to operate with lower overheads and offer more agile, customer-centric solutions, putting pressure on traditional banks to adapt quickly.

Technological Disruption and Innovation

Technological disruption poses a significant threat from new entrants, especially those leveraging advanced capabilities. Fintech firms, for instance, are increasingly using artificial intelligence, blockchain, and sophisticated data analytics to create more streamlined and personalized banking experiences. This allows them to challenge traditional models and attract customers away from established institutions like Glacier Bancorp.

These tech-savvy newcomers can often operate with lower overheads, bypassing the extensive branch networks and legacy systems that can burden incumbent banks. For example, in 2024, neobanks and digital-only banks continued to gain market share, with some reporting double-digit percentage growth in customer acquisition, demonstrating their ability to quickly scale and disrupt.

- AI-powered customer service: New entrants are deploying AI chatbots that can handle a significant volume of customer inquiries, reducing operational costs and improving response times.

- Blockchain for efficiency: The use of blockchain technology is being explored for faster and more secure cross-border payments and transaction processing, offering an alternative to traditional methods.

- Big data for personalization: Advanced analytics allow new players to offer highly personalized financial products and advice, a key differentiator in attracting and retaining customers.

- Digital-first customer experience: Mobile-first design and seamless online onboarding are standard for new entrants, setting a higher expectation for user experience across the industry.

Brand Loyalty and Trust as a Barrier (for Incumbents)

Established financial institutions, including Glacier Bancorp, leverage deeply ingrained brand loyalty and customer trust as a significant deterrent to new competitors. These existing relationships, cultivated over extended periods, represent a formidable barrier that newcomers find challenging to surmount quickly.

Building this level of trust, particularly for sensitive financial services such as managing deposits and securing loans, is a protracted process. For instance, in 2024, the average customer tenure at a large regional bank often exceeds 10 years, indicating the stickiness of established client bases.

- Brand Recognition: Glacier Bancorp benefits from decades of consistent brand messaging and service delivery.

- Customer Trust: A proven track record in handling financial assets fosters confidence, a critical factor in banking.

- Switching Costs: While not always direct financial penalties, the effort and perceived risk of moving accounts can deter customers from new banks.

- Market Perception: New entrants must overcome initial skepticism regarding their stability and reliability compared to well-established entities.

The threat of new entrants into the banking sector, impacting institutions like Glacier Bancorp, is amplified by technological advancements and evolving customer expectations. Digital-only banks and fintech firms are increasingly able to offer competitive services with lower overheads, directly challenging traditional players.

These new entrants often leverage AI for customer service and big data for personalized offerings, creating a seamless digital experience. For example, by mid-2024, some neobanks reported doubling their user base year-over-year, highlighting their rapid growth and ability to attract customers from established banks.

While established banks like Glacier Bancorp benefit from strong brand loyalty and customer trust, a factor that can deter new entrants, the agility and lower operational costs of digital-native competitors continue to pose a significant challenge. The ability of new players to innovate rapidly means that established institutions must continually adapt to remain competitive.

| New Entrant Type | Key Differentiators | Market Impact (Mid-2024 Example) | Barrier to Entry for Newcomers |

|---|---|---|---|

| Digital-Only Banks (Neobanks) | Lower overhead, mobile-first experience, competitive rates | Rapid customer acquisition, market share gains | High regulatory compliance, building trust |

| Fintech Firms | Niche services, innovative technology (AI, blockchain), partnerships | Expanding service offerings, direct competition | Access to capital, regulatory navigation |

Porter's Five Forces Analysis Data Sources

Our Glacier Bank Porter's Five Forces analysis leverages data from annual reports, regulatory filings with the SEC, and industry-specific market research reports. We also incorporate insights from financial news outlets and economic databases to provide a comprehensive view of the competitive landscape.