Givaudan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Givaudan Bundle

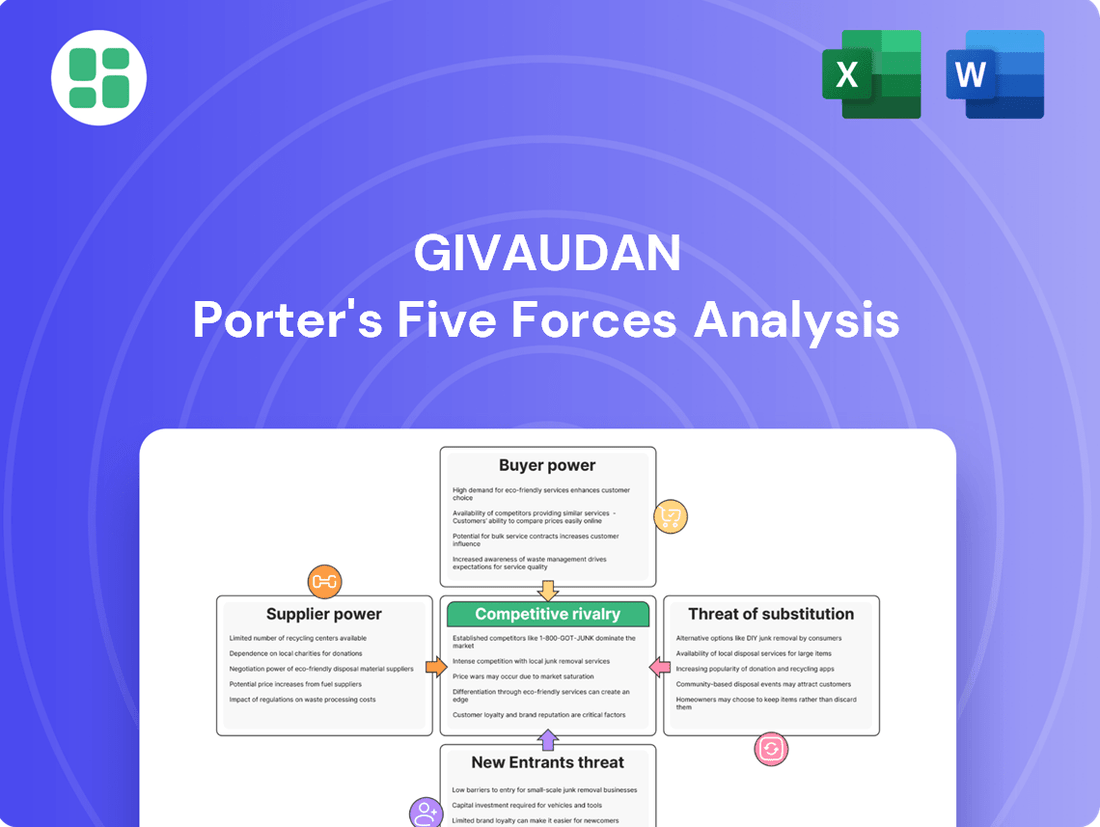

Givaudan, a leader in the flavor and fragrance industry, faces a complex competitive landscape as analyzed through Porter's Five Forces. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Givaudan’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Givaudan's reliance on a wide spectrum of raw materials, from natural extracts to synthetic chemicals, means that the bargaining power of suppliers can vary significantly. When it comes to highly specialized or rare natural ingredients, the supply chain can become concentrated among a limited number of vendors.

This concentration grants these specific suppliers considerable leverage. They can influence pricing and dictate terms regarding supply stability, particularly for ingredients affected by factors like crop yields or limited regional availability. For instance, the availability and cost of vanilla or certain citrus oils are heavily influenced by these concentrated supply dynamics.

When Givaudan incorporates a specific flavor or fragrance compound into its intricate product recipes, and the customer approves it, switching to a different supplier for that ingredient becomes a costly endeavor. This is because significant re-testing, reformulation, and potential re-approval procedures are necessary, which in turn strengthens the negotiating position of the current, reliable suppliers.

Suppliers who own unique technologies for creating or processing ingredients can charge more because their products are hard to replicate. This is especially true in the flavor and fragrance industry, where cutting-edge extraction techniques and sustainable sourcing are becoming more important. For instance, a supplier with a patented method for isolating a rare natural compound might see their bargaining power significantly increase.

Impact of Sustainability and Ethical Sourcing Demands

Growing consumer and regulatory pressure for sustainable and ethically sourced ingredients significantly impacts Givaudan's supplier relationships. This heightened demand means Givaudan must increasingly rely on suppliers capable of meeting rigorous environmental and social standards. For instance, by 2024, a significant portion of Givaudan's raw material sourcing is expected to be scrutinized for sustainability metrics, potentially limiting the available supplier base.

This narrowing of eligible suppliers can amplify their bargaining power. When fewer suppliers can meet Givaudan's stringent requirements for traceability and responsible practices, those suppliers gain leverage. This dynamic is particularly evident in specialized ingredient categories where sustainable production methods are less common.

- Increased Supplier Leverage: As sustainability becomes a non-negotiable for Givaudan, suppliers with certified ethical and sustainable practices can command higher prices or more favorable terms.

- Limited Supplier Pool: The rigorous demands for traceability and responsible sourcing can shrink the number of qualified suppliers, giving the remaining ones greater negotiating power.

- Focus on Long-Term Partnerships: Givaudan's commitment to sustainability may foster deeper, long-term relationships with key suppliers, potentially shifting the power balance towards those suppliers who consistently meet evolving criteria.

- Supply Chain Resilience: While increasing supplier power, this focus also drives Givaudan to invest in supply chain resilience, potentially mitigating some of the negative impacts of concentrated supplier power.

Commodity Price Volatility

Commodity price volatility directly impacts Givaudan's input costs. Even though Givaudan focuses on specialized flavors and fragrances, many of its foundational raw materials are derived from commodities like agricultural products or petrochemicals. Fluctuations in the global prices of these base materials, driven by supply, demand, and geopolitical events, can significantly increase Givaudan's expenses. This volatility grants suppliers of these essential commodities more leverage.

For instance, agricultural commodity prices can be highly unpredictable. In 2024, factors such as adverse weather patterns in key growing regions and shifts in global trade policies continued to create price swings for ingredients like vanilla beans or citrus oils. This makes it harder for Givaudan to forecast and manage its raw material expenditures, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

- Agricultural Commodity Dependence: Givaudan relies on agricultural products for many of its natural ingredients, making it susceptible to weather events and crop yields.

- Petrochemical Linkages: Synthetic fragrance and flavor components often originate from petrochemical feedstocks, exposing Givaudan to oil price fluctuations.

- Geopolitical Influences: Global events can disrupt supply chains and impact the availability and cost of raw materials, strengthening supplier bargaining power.

The bargaining power of suppliers for Givaudan is a crucial factor, especially concerning specialized ingredients. When a supplier possesses unique technology or holds patents for essential components, their ability to dictate terms and pricing increases significantly. This is amplified when switching to an alternative supplier involves costly re-testing and re-approval processes for Givaudan's formulations.

Furthermore, the growing emphasis on sustainability and ethical sourcing in 2024 has narrowed the pool of eligible suppliers for Givaudan. Those who can meet stringent environmental and social standards gain considerable leverage, potentially commanding higher prices. This trend also pushes Givaudan towards longer-term partnerships with reliable, compliant suppliers.

Commodity price volatility, driven by factors like weather and geopolitical events, also empowers suppliers of base materials. For instance, fluctuations in agricultural commodity prices in 2024 impacted the cost of ingredients like vanilla and citrus oils, directly affecting Givaudan's input expenses and strengthening supplier negotiating positions.

| Factor | Impact on Givaudan | Supplier Leverage |

|---|---|---|

| Specialized/Patented Ingredients | High switching costs, reformulation needs | Significant leverage due to uniqueness |

| Sustainability & Ethical Sourcing (2024 focus) | Limited supplier pool, increased compliance costs | Higher leverage for certified suppliers |

| Commodity Price Volatility | Increased input costs, margin pressure | Increased leverage for base material suppliers |

What is included in the product

This analysis dissects the competitive forces impacting Givaudan, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and Givaudan's strategic positioning within the fragrance and flavor industry.

Instantly understand strategic pressure with a powerful spider/radar chart of Givaudan's competitive landscape.

Customers Bargaining Power

Givaudan serves a clientele of major global corporations, including giants like Nestlé, Unilever, and Procter & Gamble, across the food, beverage, consumer goods, and fragrance sectors. These significant customers represent substantial buying power due to their large order volumes and considerable sway in their respective markets.

The sheer scale of these major clients grants them considerable leverage in negotiations, enabling them to effectively influence pricing structures and contractual terms. This concentration of powerful buyers directly translates to increased bargaining power for customers within the flavor and fragrance industry.

Givaudan's customers, particularly large food and beverage manufacturers and consumer goods companies, hold significant bargaining power. While flavors and fragrances are vital for product appeal, many standard offerings can be viewed as commodities, making customers highly sensitive to price. For instance, in 2023, the food and beverage sector, a key Givaudan market, continued to face cost pressures, amplifying customer demands for competitive pricing.

However, Givaudan mitigates this power through its expertise in creating highly customized, innovative, and value-added solutions. For example, its success in the premium fine fragrance segment and its ability to develop complex taste profiles for new product development make its offerings less substitutable. This specialization reduces customer power by making Givaudan's unique capabilities indispensable and challenging for competitors to replicate, as evidenced by Givaudan's strong market share in these high-value segments.

For Givaudan's customers, switching a flavor or fragrance in an established product line involves significant costs and risks. These can include extensive reformulation, rigorous product stability testing, obtaining new regulatory re-approvals, and potentially costly marketing re-launches to introduce the new formulation.

These substantial switching costs inherently reduce a customer's incentive to frequently change suppliers for their existing product lines. This diminished willingness to switch suppliers directly translates to a weaker bargaining position for customers concerning the prices and terms of Givaudan's established solutions.

Potential for Backward Integration

Customers, especially large ones, might explore developing some basic flavor and fragrance capabilities internally. This could be a way to lessen their dependence on suppliers like Givaudan. For instance, a major beverage company might look into creating simpler flavor blends on their own.

However, the reality of backward integration for sophisticated needs is quite different. The significant capital required for specialized research and development, building extensive ingredient portfolios, and acquiring the deep technical know-how that Givaudan possesses makes it a very difficult and expensive undertaking for most clients. Givaudan's commitment to innovation, evidenced by its substantial R&D spending, which is a key differentiator, is hard to replicate.

- High R&D Investment: Givaudan invests heavily in innovation, a barrier for customer integration.

- Expertise and Scale: Replicating Givaudan's specialized knowledge and operational scale is challenging.

- Ingredient Libraries: Access to Givaudan's vast and diverse ingredient palette is a significant advantage.

- Cost Prohibitive: For most customers, the cost of developing these capabilities outweighs the benefits.

Price Sensitivity in Mass Market Segments

Customers in mass-market consumer product segments are exceptionally price-sensitive. This heightened sensitivity stems from the fierce competition these customers face within their own industries, compelling them to seek cost advantages wherever possible.

Consequently, Givaudan experiences persistent pressure to maintain competitive pricing, especially for flavor and fragrance components that are less differentiated or are purchased in high volumes. This dynamic directly impacts Givaudan's profit margins in these specific market segments.

- Price Sensitivity: Mass-market customers often operate on thin margins, making them highly attuned to price changes.

- Competitive Landscape: The crowded nature of many consumer goods markets forces buyers to prioritize cost-effectiveness.

- Impact on Givaudan: Givaudan's pricing power is diminished for commoditized or high-volume ingredients, affecting profitability.

- 2024 Data Point: While specific Givaudan margin data for 2024 isn't publicly available for this granular level, the broader trend of input cost inflation in 2023 and early 2024, as reported by industry analysts, suggests continued pressure on suppliers like Givaudan to absorb some of these costs to retain high-volume customers.

Givaudan's customers, particularly large players like Nestlé and Unilever, possess significant bargaining power due to their substantial order volumes and market influence. This leverage allows them to push for competitive pricing, especially on more commoditized flavor and fragrance components.

While Givaudan mitigates this through innovation and customization, the price sensitivity of mass-market clients remains a constant pressure. For instance, the ongoing trend of input cost inflation in early 2024 continued to amplify customer demands for cost-effectiveness from suppliers.

The bargaining power of Givaudan's customers is also influenced by switching costs, which are generally high for established product lines, and the limited feasibility of backward integration for complex needs due to Givaudan's R&D and ingredient expertise.

Customers' ability to negotiate is further strengthened by their own competitive environments, where cost efficiency is paramount. This dynamic can limit Givaudan's pricing flexibility for less differentiated offerings.

| Customer Type | Bargaining Power Factor | Impact on Givaudan |

|---|---|---|

| Large Corporations (e.g., Nestlé) | High Volume Purchases, Market Influence | Pressure on pricing, contract terms |

| Mass-Market Consumer Goods | Price Sensitivity, Competitive Pressure | Reduced pricing power for commoditized items |

| Food & Beverage Manufacturers | Cost Pressures in their own sector | Increased demand for cost-effective solutions |

Preview the Actual Deliverable

Givaudan Porter's Five Forces Analysis

This preview showcases the comprehensive Givaudan Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the flavor and fragrance industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain immediate access to this ready-to-use document, allowing you to leverage its insights without delay.

Rivalry Among Competitors

The global flavors and fragrances industry is characterized by high concentration, with a few major players holding substantial market power. Givaudan, IFF, Symrise, and DSM-Firmenich (formed by the merger of Firmenich and DSM) collectively account for a significant portion of the market share, creating an oligopolistic environment.

This dominance intensifies rivalry as these giants fiercely compete for market share, drive innovation, and vie for crucial customer relationships. For instance, in 2023, Givaudan reported net sales of CHF 7.1 billion, highlighting its scale within this concentrated market.

Competitive rivalry in the flavors and fragrances industry is intensely driven by a relentless pursuit of innovation. Companies like Givaudan are constantly investing in research and development to pioneer new product formulations, advance sensory science, and develop more sustainable offerings. This focus on R&D is crucial for staying ahead, as evidenced by Givaudan's significant R&D expenditure, which represented approximately 8.1% of sales in 2023, amounting to CHF 720 million.

This commitment to innovation is a key battleground, as firms strive to create novel and appealing flavors and fragrances that resonate with shifting consumer tastes and regulatory requirements. The ability to consistently introduce differentiated products that meet evolving demands for natural ingredients, ethical sourcing, and unique sensory experiences directly impacts market share and profitability.

Competitors intensely battle for a truly global presence, aiming to deliver uniform service to multinational clients across various regions. This necessitates robust manufacturing, intricate supply chains, and widespread customer service infrastructure, giving a significant edge to companies that have already built extensive global networks.

Strategic Acquisitions and Partnerships

The flavor and fragrance industry is characterized by continuous strategic acquisitions and partnerships. Major companies actively pursue these moves to broaden their product offerings, acquire cutting-edge technologies, and solidify their market positions. For instance, in 2024, Givaudan itself completed several strategic acquisitions, including that of a leading natural ingredient supplier, enhancing its portfolio in high-growth segments.

These consolidation efforts significantly heighten competitive rivalry. By integrating new capabilities and expanding their reach, key players can outmaneuver smaller competitors and reshape the market dynamics. This trend forces all participants to constantly innovate and adapt to maintain their competitive edge.

- Acquisition Drivers: Companies acquire to gain access to new technologies, expand geographic reach, and diversify product portfolios.

- Market Consolidation: Strategic partnerships and mergers lead to a more consolidated industry structure, increasing the power of larger players.

- Competitive Impact: These activities intensify rivalry by creating stronger, more integrated competitors, raising barriers to entry for new firms.

- Examples in 2024: Givaudan's acquisition of a key natural ingredient producer exemplifies the industry's trend towards portfolio enhancement through M&A.

Sustainability and Clean Label Trends

Competitive rivalry in the flavor and fragrance industry is intensifying as companies like Givaudan increasingly focus on meeting consumer demand for natural, organic, and sustainable ingredients, alongside clean label products. This shift means rivals are actively competing to showcase their superior sustainability credentials, ethical sourcing practices, and environmentally friendly manufacturing processes. For instance, by 2024, many major players are expected to have significantly increased their investment in renewable energy sources for their operations, aiming to reduce their carbon footprint.

This focus on sustainability and clean labels translates into a fierce competition for market share, where demonstrating tangible progress in these areas becomes a key differentiator. Companies are investing heavily in research and development to create innovative solutions that align with these evolving consumer preferences. For example, Givaudan reported in their 2023 annual results that a substantial portion of their new product pipeline was dedicated to natural and sustainable offerings, a trend that is projected to continue and accelerate through 2024 and beyond.

- Rivals are differentiating through sustainability: Companies are actively showcasing their commitment to ethical sourcing and eco-friendly production.

- Consumer demand drives innovation: The push for natural, organic, and clean label ingredients fuels R&D efforts.

- Investment in green practices: Expect increased investment in renewable energy and sustainable manufacturing by 2024.

- Market share tied to eco-credentials: Demonstrating strong sustainability performance is becoming crucial for competitive advantage.

The competitive rivalry within the flavors and fragrances sector is exceptionally high, primarily due to the industry's oligopolistic nature. Major players like Givaudan, IFF, Symrise, and DSM-Firmenich dominate, leading to intense competition for market share and innovation.

This rivalry is fueled by continuous investment in research and development, with companies like Givaudan dedicating significant resources, such as 8.1% of sales (CHF 720 million in 2023) to R&D. This focus on creating novel, sustainable, and natural ingredients is a key battleground for capturing consumer preference and market share.

Strategic acquisitions and partnerships further intensify competition, as companies consolidate to expand their portfolios and technological capabilities. Givaudan's own strategic acquisitions in 2024, including a natural ingredient supplier, highlight this trend, strengthening their market position and raising the bar for competitors.

The drive for global presence necessitates robust supply chains and customer service infrastructure, favoring established players with extensive networks. This, combined with the increasing consumer demand for sustainable and clean-label products, creates a dynamic environment where differentiation through eco-credentials and innovation is paramount for survival and growth.

| Key Competitors | 2023 Net Sales (CHF billions) | R&D as % of Sales (approx.) | Key Strategic Focus |

| Givaudan | 7.1 | 8.1% | Innovation, Sustainability, Acquisitions |

| IFF | ~12.7 (pro forma 2023) | N/A (specific figures vary) | Integration, Innovation, Sustainability |

| Symrise | ~4.0 (EUR 4.0 billion in 2023) | N/A (specific figures vary) | Sustainability, Innovation, Geographic Expansion |

| DSM-Firmenich | ~13.1 (combined pro forma 2023) | N/A (specific figures vary) | Synergies, Innovation, Sustainability |

SSubstitutes Threaten

Some large multinational customers, particularly those in the food and beverage or consumer goods sectors, may develop limited in-house capabilities for basic flavor and fragrance formulation. This is often driven by a desire for greater control over specific product lines or to reduce reliance on external suppliers for less complex or proprietary ingredients. For instance, a major beverage company might create its own proprietary cola flavor base, thereby reducing its need for Givaudan's services for that particular component.

The increasing consumer preference for 'clean label' and minimalist products, particularly in food and beverages, represents a significant threat of substitution for traditional flavor and fragrance suppliers like Givaudan. This trend favors naturally occurring flavors and aromas, reducing the demand for externally supplied, often synthesized, ingredients.

This shift is not just a preference but a growing market reality. For example, in 2024, the global clean label market was projected to reach over $60 billion, indicating a substantial consumer base actively seeking products with fewer artificial additives and more natural components. This directly impacts the market for added flavors and fragrances.

Brands are increasingly exploring alternative differentiation strategies beyond intricate flavor and fragrance profiles. For instance, a focus on texture, striking visual appeal, or innovative packaging can capture consumer attention, potentially diminishing the perceived necessity of highly sophisticated sensory solutions. This shift could impact demand for specialized ingredients.

In 2024, the global food and beverage market saw continued investment in product presentation and functional benefits, with some segments experiencing growth driven by visual appeal and convenience. Companies are allocating significant marketing budgets to packaging design and the promotion of functional attributes like added vitamins or sustainable sourcing, diverting resources that might otherwise be spent on complex flavor development.

Advancements in Synthetic Biology and AI-driven Creation

Emerging technologies like synthetic biology and AI are revolutionizing how aroma and flavor compounds are created. These advancements offer the potential to bypass traditional agricultural sourcing and complex chemical synthesis.

If these new methods become cost-effective, produce high-quality outputs, and can be scaled efficiently, they represent a significant threat to existing flavor and fragrance production. For instance, companies are exploring AI to design novel molecules with specific scent profiles, potentially reducing reliance on natural extracts. The global synthetic biology market was valued at approximately USD 10.5 billion in 2023 and is projected to grow substantially, indicating increasing investment and development in this area. This growth suggests a future where lab-grown ingredients could compete directly with, or even surpass, naturally derived ones in terms of consistency and cost.

- AI-driven molecule design: Creating novel aroma compounds with precise characteristics.

- Synthetic biology for flavor production: Utilizing microorganisms to produce complex flavor molecules.

- Cost-effectiveness and scalability: The key factors determining the competitive threat from these technologies.

- Market growth in bio-based ingredients: Indicating increasing industry adoption and potential disruption.

Rise of 'Dupe' Culture in Fragrances

The rise of dupe culture in fragrances poses a significant threat of substitutes for premium scent brands. Consumers are increasingly seeking out more affordable alternatives that closely mimic popular luxury fragrances, thereby reducing the perceived value and necessity of purchasing the original, higher-priced products.

This trend is particularly evident in the online beauty community, where influencers and consumers actively share and promote these less expensive dupes. For instance, platforms like TikTok have seen numerous viral videos showcasing fragrance dupes that are remarkably similar to designer scents, driving consumer interest away from established brands.

The economic implications are substantial. As consumers opt for dupes, sales volumes for original luxury fragrances could decline. This shift is fueled by the accessibility of these alternatives, allowing a broader consumer base to experience sought-after scents without the premium price tag, directly impacting market share for established players.

- Market Penetration: The global fragrance market, valued at approximately $50 billion in 2023, faces pressure as dupe fragrances gain traction.

- Consumer Behavior Shift: A significant portion of consumers, especially younger demographics, are prioritizing value and accessibility, making them more receptive to dupes.

- Brand Loyalty Erosion: The availability of close scent matches at lower prices can weaken brand loyalty for premium fragrance houses.

- Impact on Innovation: Reduced margins due to dupe competition might force fragrance companies to re-evaluate R&D investments in new scent development.

The threat of substitutes for Givaudan arises from several fronts, including in-house formulation by large clients, a growing consumer preference for natural and 'clean label' products, and alternative product differentiation strategies. Furthermore, emerging technologies like AI and synthetic biology offer new ways to create flavor and fragrance compounds, potentially bypassing traditional methods. The rise of 'dupe' culture in fragrances also presents a significant challenge, as consumers seek more affordable alternatives that mimic popular scents.

In 2024, the global clean label market was projected to exceed $60 billion, highlighting a strong consumer demand for products with fewer artificial ingredients. This trend directly impacts the market for synthesized flavors and fragrances. Concurrently, the global synthetic biology market, valued at approximately $10.5 billion in 2023, is experiencing substantial growth, indicating increasing investment in technologies that could produce flavor and aroma compounds more efficiently and cost-effectively.

The fragrance market, estimated at around $50 billion in 2023, is also feeling the pressure from dupe fragrances. This phenomenon, amplified by social media platforms, erodes brand loyalty for premium scents by offering similar olfactory experiences at lower price points. Companies are also investing heavily in product presentation and functional benefits, as seen in the food and beverage sector in 2024, which can divert focus from complex flavor development.

| Threat of Substitutes | Key Factors | Impact on Givaudan | 2024/2023 Data Points |

| In-house Formulation | Large clients developing own basic formulations | Reduced demand for Givaudan's services for certain components | N/A (Specific client actions) |

| Clean Label Trend | Consumer preference for natural ingredients | Decreased demand for synthesized flavors/fragrances | Global Clean Label Market > $60 billion (projected 2024) |

| Alternative Differentiation | Focus on texture, visual appeal, packaging | Diminished perceived need for complex sensory solutions | Increased marketing budgets for packaging/functional benefits in F&B |

| Emerging Technologies | AI, Synthetic Biology | Potential to bypass traditional production, offering cost-effective alternatives | Synthetic Biology Market ~$10.5 billion (2023) |

| Dupe Fragrances | Affordable alternatives mimicking luxury scents | Erosion of brand loyalty, potential sales volume decline for premium products | Global Fragrance Market ~$50 billion (2023) |

Entrants Threaten

The flavor and fragrance industry, where Givaudan operates, presents a formidable barrier to new entrants due to its exceptionally high capital intensity. Establishing a competitive presence necessitates massive investments in cutting-edge research and development laboratories, sophisticated manufacturing facilities, and a robust global supply chain network. For instance, companies looking to rival Givaudan's scale must be prepared to allocate hundreds of millions, if not billions, of dollars to build and maintain these essential operational pillars.

The threat of new entrants in the flavor and fragrance industry, particularly for a company like Givaudan, is significantly mitigated by extensive regulatory and compliance hurdles. Navigating the complex global landscape of food safety, cosmetic ingredient approvals, environmental impact assessments, and chemical handling regulations requires substantial expertise and investment.

New players must dedicate considerable resources to understand and adhere to varying international standards, such as REACH in Europe or FDA regulations in the United States, which can take years and millions of dollars to achieve. For instance, obtaining necessary certifications for new chemical compounds or food additives is a lengthy and costly process, acting as a strong barrier to entry.

The flavors and fragrances industry, where Givaudan operates, requires a significant depth of specialized expertise. Success hinges on professionals skilled in chemistry, biology, sensory science, and application technology, alongside creative artistry. For instance, developing a novel fragrance compound can involve years of research and development by highly educated chemists.

Attracting and retaining this elite talent pool presents a substantial barrier for potential new entrants. The cost associated with recruiting and maintaining such specialized personnel is considerable, making it difficult for newcomers to compete with established players like Givaudan, which has a long history of investing in R&D talent.

Established Customer Relationships and Switching Costs

Established players like Givaudan benefit from deep, long-standing relationships with major global consumer product companies. These partnerships are built on trust, consistent quality, and tailored solutions, creating a significant barrier for newcomers. For instance, Givaudan's extensive client base includes many of the world's leading food and beverage, and fragrance manufacturers.

The threat of new entrants is further diminished by substantial switching costs for existing customers. These costs are not merely financial; they encompass the extensive time and resources required for reformulation, rigorous product testing, and navigating complex regulatory approval processes. In 2024, the average time for a new fragrance or flavor to be fully integrated into a major consumer product line can extend beyond 18 months, involving multiple stages of consumer testing and compliance checks.

- Customer Loyalty: Givaudan's strong client relationships, cultivated over decades, foster significant loyalty.

- High Switching Costs: Reformulation, testing, and regulatory hurdles make it costly and time-consuming for customers to change suppliers.

- Incumbent Advantage: Existing suppliers like Givaudan possess deep market knowledge and established supply chains, which new entrants lack.

- Market Penetration Difficulty: The combination of loyalty and switching costs makes it exceptionally challenging for new companies to gain meaningful market share.

Strong Intellectual Property and Patent Portfolios

Givaudan's robust intellectual property (IP) and extensive patent portfolios present a significant threat to new entrants. Incumbent companies, like Givaudan, have amassed vast collections of patents covering unique molecules, innovative manufacturing processes, and proprietary product formulations. These IP assets, alongside closely guarded trade secrets, establish a high barrier to entry.

This strong IP protection makes it exceptionally difficult for new players to replicate Givaudan's existing successful products or technologies without infringing on their protected intellectual property. For instance, in the flavors and fragrances industry, patents on novel aroma chemicals or extraction methods can lock in market share for years. Givaudan's commitment to R&D, with significant investment in innovation, continuously strengthens this IP moat. In 2023, Givaudan reported CHF 1.1 billion in R&D expenses, a testament to their focus on creating and protecting new intellectual property.

- High R&D Investment: Givaudan's substantial R&D spending, reaching CHF 1.1 billion in 2023, fuels the creation of new patents and proprietary technologies.

- Patent Portfolio Breadth: The company holds numerous patents on aroma molecules, flavor compounds, and encapsulation technologies, making replication difficult.

- Trade Secret Protection: Beyond patents, Givaudan safeguards critical manufacturing processes and formulation know-how as trade secrets, adding another layer of defense.

- Barriers to Replication: The complexity and legal protection surrounding Givaudan's IP significantly increase the cost and time required for new entrants to develop comparable offerings.

The threat of new entrants into the flavor and fragrance sector, where Givaudan is a dominant player, is considerably low. This is due to a combination of immense capital requirements, stringent regulatory landscapes, and the need for highly specialized expertise. For example, establishing state-of-the-art research facilities and global supply chains can easily run into hundreds of millions of dollars.

Furthermore, navigating complex international regulations for food safety and cosmetic ingredients, such as REACH and FDA standards, demands significant time and financial investment, often taking years and millions to achieve compliance. The industry also relies on a unique blend of scientific knowledge, creative artistry, and sensory science, making it difficult for newcomers to build the necessary talent pool quickly.

Established players like Givaudan benefit from deep customer loyalty and high switching costs, as reformulating and retesting products with new suppliers is a lengthy and expensive process. In 2024, integrating a new flavor or fragrance into a major product line can take over 18 months. Givaudan's substantial investment in research and development, with CHF 1.1 billion spent in 2023, further solidifies its competitive advantage through a robust intellectual property portfolio, making replication by new entrants exceedingly difficult.

| Barrier Type | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Capital Intensity | Very High | Hundreds of millions to billions required for R&D and manufacturing. |

| Regulatory Hurdles | High | Years and millions needed for compliance with standards like REACH and FDA. |

| Specialized Expertise | High | Requires skilled chemists, sensory scientists, and creative perfumers. |

| Customer Loyalty & Switching Costs | High | 18+ months for new product integration; significant reformulation costs. |

| Intellectual Property | Very High | CHF 1.1 billion R&D spend in 2023; extensive patent portfolios. |

Porter's Five Forces Analysis Data Sources

Our Givaudan Porter's Five Forces analysis is built upon a robust foundation of data, including Givaudan's annual reports, investor presentations, and publicly available financial statements. We also incorporate insights from industry-specific market research reports, trade publications, and competitor analyses to provide a comprehensive view of the competitive landscape.