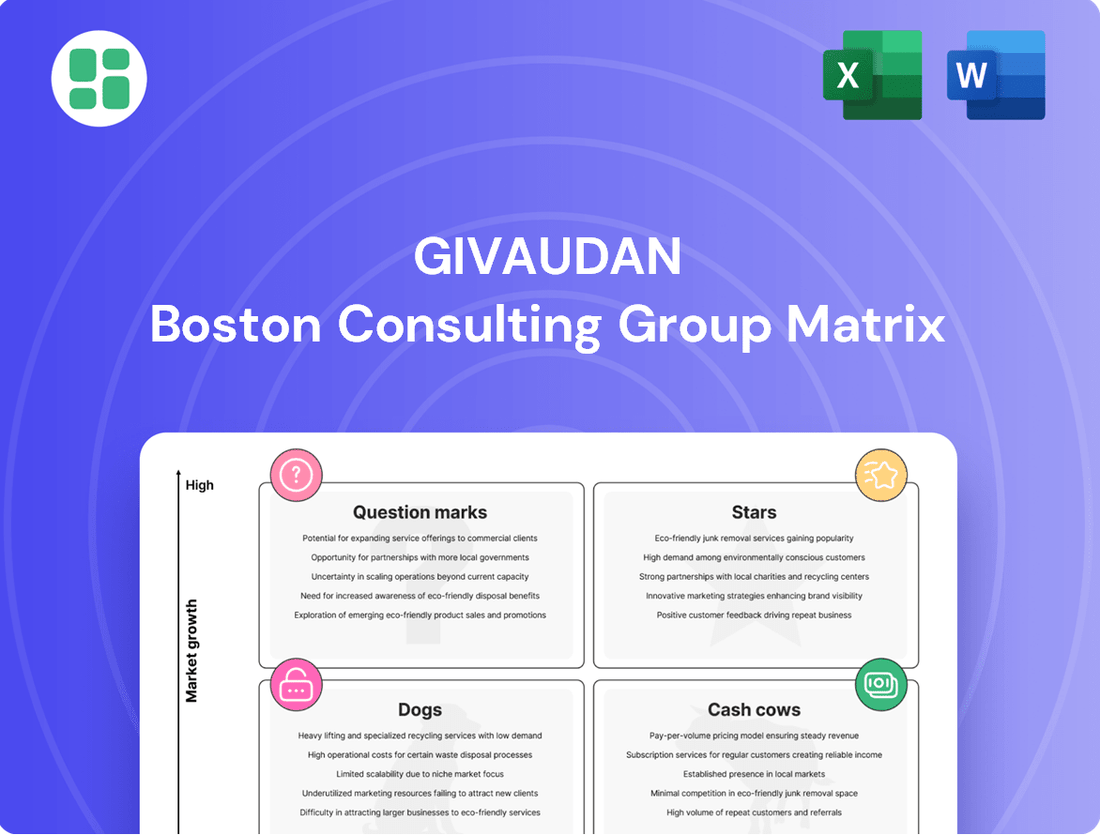

Givaudan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Givaudan Bundle

Curious about Givaudan's product portfolio performance? Our BCG Matrix analysis highlights which segments are driving growth and which might need a strategic rethink. This glimpse into their market position is just the beginning.

Unlock the full potential of this analysis by purchasing the complete Givaudan BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable strategies to optimize your own business decisions.

Don't miss out on the comprehensive breakdown and expert recommendations that will empower your strategic planning. Invest in the full report today for a clear roadmap to competitive advantage.

Stars

Givaudan's fine fragrances are a clear Star in its portfolio, showing robust growth. In Q1 2025, like-for-like sales jumped 16.7%, followed by an 18% increase in the first half of 2025. This exceptional performance, combined with Givaudan's leading market share, highlights the segment's potential and the need for ongoing investment to sustain its competitive edge and leverage premiumization trends.

Givaudan's Active Beauty Ingredients division is a clear Star in its BCG matrix. This segment has experienced explosive growth, climbing from a standing start to over CHF 200 million in sales in just ten years.

The momentum continues, with the Active Beauty business, encompassing cosmetic ingredients, achieving a robust 7.7% like-for-like sales increase in Q1 2025 and a 5.7% rise in H1 2025. This strong performance is driven by its successful penetration into emerging beauty categories and its alignment with consumer preferences for scientifically advanced, high-efficacy ingredients.

Givaudan's presence in high-growth emerging markets like South Asia, Africa, the Middle East, and Latin America is a key driver of its success. These regions are showing robust growth, significantly outperforming more established markets.

In Q1 2025, Givaudan reported a 12.8% like-for-like increase in these dynamic markets, building on an impressive 19.5% growth seen throughout 2024. This consistent performance underscores the company's ability to tap into rapidly expanding consumer bases.

Latin America, in particular, demonstrated exceptional momentum, achieving a 27.3% growth rate in 2024 and continuing with a strong 9.4% in the first half of 2025. This highlights Givaudan's strategic advantage and solid market position in these vibrant economies.

Plant-Based and Functional Food Solutions

Givaudan's Plant-Based and Functional Food Solutions are a significant driver of growth within its Taste & Wellbeing division, fueled by escalating global health and wellness consciousness. The company is at the forefront of developing innovative solutions that cater to consumer demand for healthier food options.

Leveraging cutting-edge technologies and a comprehensive product range, Givaudan is adept at formulating ingredients that reduce sugar, salt, and fat content while simultaneously boosting nutritional value. This strategic focus positions Givaudan as a leader in a rapidly expanding market segment.

- Market Growth: The global plant-based food market is projected to reach $162 billion by 2030, indicating substantial opportunity for Givaudan's innovations.

- Health Focus: Consumers increasingly seek foods with reduced sugar, salt, and fat, aligning perfectly with Givaudan's product development.

- Innovation Investment: Givaudan continues to invest in R&D to enhance its portfolio of functional ingredients and taste solutions.

- Sustainability Drive: The demand for sustainable food options further bolsters the appeal of Givaudan's plant-based offerings.

Integrated Customer Co-creation Solutions

Integrated Customer Co-creation Solutions represent a key strategic pillar for Givaudan, positioning it as a collaborative partner rather than just a supplier. This involves working intimately with clients to develop bespoke flavor and fragrance solutions, fostering innovation and ensuring products resonate with end consumers. This strategy was evident in Givaudan's 2024 performance, where collaborations contributed to a robust growth in its Taste & Wellbeing division, which saw sales increase by 6.3% in the first half of 2024 compared to the same period in 2023, reaching CHF 3,737 million.

This deep engagement allows Givaudan to anticipate and adapt to market trends, offering solutions that are not only innovative but also commercially viable. By co-creating, Givaudan strengthens its market position, acting as an indispensable innovation partner for its customers. The company's focus on integrated solutions across the entire product lifecycle, from initial concept to final market launch, underpins its success in these collaborative endeavors.

- Co-creation drives innovation: Givaudan's partnerships lead to unique flavor and fragrance profiles.

- Agile response to market needs: Customer collaboration enables quicker adaptation to consumer preferences.

- Value-added solutions: Integrated offerings across the value chain enhance customer success.

- Strengthened market position: Givaudan solidifies its role as a strategic innovation partner.

Givaudan's Fine Fragrances segment is a prime example of a Star in the BCG matrix, demonstrating impressive growth and market leadership. The segment's like-for-like sales saw a significant jump of 16.7% in Q1 2025, building on a strong 2024 performance, indicating sustained demand and effective strategies in capturing premiumization trends.

The Active Beauty Ingredients division also shines as a Star, having rapidly grown to over CHF 200 million in sales within a decade. Its continued success, marked by a 7.7% like-for-like sales increase in Q1 2025, is driven by its expansion into new beauty categories and alignment with consumer demand for advanced, effective ingredients.

Givaudan's strategic focus on high-growth emerging markets, particularly in Asia, Africa, the Middle East, and Latin America, positions these regions as Stars. These markets collectively achieved a 12.8% like-for-like sales increase in Q1 2025, significantly outpacing mature markets and highlighting Givaudan's ability to capitalize on expanding consumer bases.

The Plant-Based and Functional Food Solutions within the Taste & Wellbeing division represent another Star, driven by global health consciousness. Givaudan's innovations in reducing sugar, salt, and fat while enhancing nutritional value align with a market projected to reach $162 billion by 2030.

| Segment | BCG Category | Key Performance Indicator (Q1 2025) | Growth Driver |

|---|---|---|---|

| Fine Fragrances | Star | 16.7% Like-for-like sales increase | Premiumization, strong market share |

| Active Beauty Ingredients | Star | 7.7% Like-for-like sales increase | Emerging beauty categories, efficacy demand |

| Emerging Markets Presence | Star | 12.8% Like-for-like sales increase (combined) | Expanding consumer bases, strong regional growth |

| Plant-Based & Functional Food Solutions | Star | Strong growth in Taste & Wellbeing division | Health and wellness trends, innovation in healthier options |

What is included in the product

The Givaudan BCG Matrix categorizes its business units by market share and growth, guiding strategic decisions.

A Givaudan BCG Matrix offering clear visualization of business unit performance, alleviating the pain of strategic resource allocation.

Cash Cows

The Consumer Products segment within Givaudan's Fragrance & Beauty division, encompassing fragrances for home care, detergents, and hygiene items, is a significant revenue generator. This unit achieved a solid 7.9% like-for-like growth in the first quarter of 2025 and 6.1% in the first half of 2025.

Operating in a mature market where Givaudan enjoys a strong market share, this segment is a classic cash cow. It delivers stable and predictable cash flows due to consistent demand and well-established client relationships, necessitating less promotional spending than more dynamic growth sectors.

Givaudan's core savory and sweet goods, falling under its Taste & Wellbeing division, are the bedrock of its revenue, acting as reliable cash cows. These established segments, encompassing popular categories like snacks and confectionery, thrive in mature food markets with strong brand recognition.

These offerings consistently generate substantial and predictable cash flow, a crucial element for funding Givaudan's innovation and expansion into high-growth areas. For instance, the Taste & Wellbeing segment, which includes these core categories, reported a sales increase of 5.6% in 2023, reaching CHF 2,792 million, highlighting its enduring strength and contribution to overall company stability.

Givaudan's mature market operations, particularly in Europe and North America, are its cash cows. These established regions, which saw like-for-like growth of 2.6% in Q1 2025 and a robust 6.4% in 2024, provide a significant and steady stream of revenue.

Despite slower growth compared to emerging markets, Givaudan's strong market share in these areas allows for efficient operations and high profitability. The company leverages its existing infrastructure to generate substantial cash flows, which are crucial for funding investments in high-growth potential areas.

Beverages and Dairy Ingredients

Within Givaudan's Taste & Wellbeing division, the beverages and dairy ingredients segments stand out as significant cash cows. These areas consistently contribute to the company's revenue, benefiting from stable consumer demand in established markets.

Givaudan's robust market position and deep-rooted customer relationships in beverages and dairy ingredients ensure a predictable and reliable stream of cash. The mature nature of these markets means that investment needs for expanding market share are relatively low, allowing these segments to generate substantial profits with minimal capital expenditure.

- Beverage Ingredients: These ingredients serve a broad range of beverage categories, from soft drinks to functional beverages, meeting consistent consumer preferences.

- Dairy Ingredients: Givaudan's offerings in dairy ingredients support a variety of products, including yogurts, cheeses, and dairy-based beverages, tapping into ongoing consumer demand.

- Market Share: Givaudan holds a strong position in these segments, leveraging its innovation and customer partnerships to maintain its leadership.

- Financial Contribution: While specific 2024 figures for these individual segments are not yet fully detailed in public reports as of mid-2024, Givaudan's Taste & Wellbeing division as a whole reported net sales of CHF 2.45 billion for the first half of 2024, indicating the substantial underlying strength of its core ingredient businesses.

Fragrance Ingredients Portfolio

Givaudan's extensive fragrance ingredients portfolio represents a significant cash cow within its business. This segment benefits from a high market share, a testament to Givaudan's deep-rooted expertise and robust manufacturing infrastructure.

While growth in this area might not be explosive, its stability is a key strength. The consistent cash flow generated here underpins the financial health of the broader Fragrance & Beauty division.

- High Market Share: Givaudan commands a substantial portion of the fragrance ingredients market, leveraging its long-standing presence and capabilities.

- Consistent Cash Flow: This segment reliably generates strong cash flow, providing a stable financial foundation for the company.

- Essential Supply Chain Role: The ingredients supplied are crucial components for a wide array of consumer products across different industries.

Givaudan's established fragrance ingredients, crucial for a vast array of consumer goods, act as reliable cash cows. These segments benefit from Givaudan's strong market share and deep industry expertise, ensuring consistent revenue generation.

The stability of these mature markets means that the need for significant new investment to capture market share is minimal, allowing these operations to generate substantial profits. This dependable cash flow is vital for funding Givaudan's ventures into more dynamic growth areas.

For instance, Givaudan's Fragrance & Beauty division, which heavily relies on these ingredients, saw a like-for-like sales increase of 5.0% in the first half of 2024, reaching CHF 1,772 million, underscoring the foundational strength of its ingredient businesses.

These mature ingredient portfolios consistently deliver predictable cash flows, essential for supporting innovation and expansion. The company's leadership in these areas, built on decades of experience, ensures their ongoing contribution to financial stability.

| Segment | 2024 Performance (H1) | Key Characteristics |

|---|---|---|

| Fragrance Ingredients | Part of Fragrance & Beauty division (CHF 1,772 million sales, +5.0% LFL) | High Market Share, Stable Demand, Low Investment Needs |

| Core Savory & Sweet Ingredients (Taste & Wellbeing) | Part of Taste & Wellbeing division (CHF 2,450 million sales, +5.6% LFL in 2023) | Strong Brand Recognition, Mature Markets, Predictable Cash Flow |

Preview = Final Product

Givaudan BCG Matrix

The Givaudan BCG Matrix preview you're seeing is the definitive version you will receive upon purchase, offering a clear, actionable snapshot of their product portfolio's strategic positioning. This comprehensive analysis, meticulously prepared by industry experts, will be delivered to you without any modifications or watermarks. You can confidently use this exact document for your own strategic planning or client presentations, as it represents the fully formatted and ready-to-deploy report.

Dogs

Certain basic, undifferentiated commodity ingredients within Givaudan's portfolio might be classified as Dogs. These products often face intense price competition, leading to low profit margins.

These ingredients operate in mature markets where growth potential is limited and differentiation is minimal. For example, Givaudan's 2023 revenue was CHF 7.1 billion, but specific segment profitability for commodity ingredients isn't publicly broken out.

Givaudan's strategy for these Dog products would likely involve minimizing further investment. This could be achieved through enhancing operational efficiencies or considering selective divestment to reallocate resources to more promising areas.

Some of Givaudan's older or highly specialized product lines might fall into the Dogs category if they no longer resonate with current consumer tastes or sustainability demands. These segments could be facing stagnant or shrinking markets, hindering their ability to deliver significant profits or attract further investment. For instance, if a particular fragrance ingredient, once popular, is now deemed unsustainable or has been replaced by newer, more eco-friendly alternatives, it could become a Dog. Givaudan's emphasis on innovation and sustainability naturally pushes them to divest or de-emphasize such offerings.

Certain North American Market Segments within Givaudan’s portfolio are characterized by slower growth. For instance, in Q1 2025, North America's sales growth was a modest 0.5% on a like-for-like basis, and in H1 2025, it reached 1.7%.

These figures suggest that within this mature market, some specific product lines or customer segments might be experiencing stagnation or declining demand without a clear path to recovery, potentially indicating a need for careful cash management or divestment strategies.

Products with High Unmitigated Input Cost Volatility

Products facing significant and unmanaged price swings in their core ingredients, where Givaudan struggles to pass these costs onto consumers, risk becoming financial drains. These are the areas that might be considered Dogs in the BCG matrix.

If Givaudan's price adjustments aren't enough to keep profitability healthy in slow-growth markets, these segments could be classified as Dogs. They tie up capital and resources without generating adequate returns.

For instance, in 2024, the fragrance and beauty sector experienced continued pressure from volatile natural ingredient costs, such as certain essential oils. Givaudan's 2024 interim report indicated that while they managed price increases, the impact of raw material volatility remained a key challenge in certain product lines.

- High Input Cost Volatility: Certain fragrance compounds reliant on scarce or seasonally dependent natural ingredients.

- Limited Pricing Power: Segments where competitive pressures restrict the ability to fully recover rising raw material expenses.

- Low Market Growth: Product categories with stagnant or declining demand, making it difficult to absorb cost increases.

- Resource Consumption: Divisions that require substantial investment in R&D and production without yielding proportional profits.

Small, Non-Strategic Acquired Brands with Limited Traction

Givaudan's acquisition strategy, while generally robust, can sometimes include smaller brands that struggle to gain market traction. These brands, if they fail to integrate smoothly or demonstrate significant growth potential, can become Dogs in the BCG matrix. For instance, a smaller acquired flavor house that doesn't capture market share in a key segment might tie up capital without contributing to Givaudan's overall high-growth objectives.

Such underperforming acquisitions, particularly those acquired in recent years, could represent a drain on resources if their performance remains stagnant.

- Limited Market Traction: Brands failing to achieve significant market share or brand recognition post-acquisition.

- Capital Tie-up: Resources invested in these brands may not yield proportionate returns.

- Divestiture Candidates: If performance doesn't improve, these could be considered for sale to free up capital for more promising ventures.

Products classified as Dogs within Givaudan's portfolio are those with low market share in slow-growing or declining markets. These offerings often struggle with profitability due to intense competition and limited pricing power.

For example, certain commodity ingredients or older product lines that haven't kept pace with evolving consumer preferences or sustainability demands might fit this category. Givaudan's 2024 financial reports, while not segmenting Dogs specifically, show overall revenue growth, implying that the company actively manages or divests underperforming segments to maintain focus.

The strategy for these Dog products typically involves minimizing investment, optimizing operational efficiencies, or considering divestment to reallocate capital to more promising areas of the business.

For instance, Givaudan's 2024 interim report highlighted a focus on streamlining operations, which could include exiting low-margin, stagnant product lines. The company's commitment to innovation and sustainability also naturally leads to phasing out products that no longer align with market trends or environmental standards.

| Category | Characteristics | Givaudan Strategy Example |

|---|---|---|

| Dogs | Low Market Share, Low Growth Market | Divestment or minimal investment |

| Example | Commodity ingredients with intense price competition | Focus on operational efficiency, potential sale |

| Example | Older, less sustainable fragrance components | Phase-out and resource reallocation |

Question Marks

Givaudan's digital olfactive and flavor creation platforms, like Scent Piano and MyRomi, are positioned within the Question Marks quadrant of the BCG matrix. These innovative technologies tap into burgeoning digital transformation markets, offering exciting new avenues for fragrance and flavor development and consumer engagement.

While these digital tools hold significant growth potential, their current market penetration and widespread adoption are still in early stages. Givaudan's substantial investment in these areas reflects a strategic bet on future market leadership, but also carries the risk of becoming a Dog if market acceptance doesn't materialize as anticipated.

Givaudan's strategic expansion into biotechnology-derived ingredients, exemplified by acquisitions like Amyris, signals a significant push into a high-growth sector. This move focuses on developing novel, sustainable molecules such as PrimalHyal™ 50 Life and Illuminyl™ 388, targeting the health, beauty, and taste markets.

While these biotechnological innovations offer unique and eco-friendly solutions, they currently represent a nascent market segment for Givaudan. The company's investment in research and development for these cutting-edge products is substantial, reflecting the need to build market acceptance and scale production capabilities.

Givaudan's acquisition of b.kolormake-up in July 2024 marks a strategic entry into the contract manufacturing of Italian makeup and skincare. This expansion positions Givaudan within the rapidly growing beauty sector, moving beyond its established strengths in fragrance and active beauty ingredients.

As a recent addition, b.kolormake-up likely represents a relatively small player in the broader contract manufacturing market for beauty products. Consequently, it would require substantial investment to build market share and fully integrate into Givaudan's existing operations, characteristic of a question mark in the BCG matrix.

Mid-Tier Fragrance Solutions in Latin America (Vollmens Fragrances)

Vollmens Fragrances represents a strategic move by Givaudan into the burgeoning Latin American mid-tier fragrance market. This segment, characterized by its rapid expansion, presents a significant opportunity for Givaudan to bolster its presence and market share. The acquisition, anticipated to finalize in Q4 2025, is designed to capitalize on local expertise and operational scale, aiming to elevate Vollmens into a Star performer within Givaudan's portfolio.

The Latin American beauty and personal care market is a key growth engine, with the mid-tier segment showing particular promise. Givaudan’s investment in Vollmens is a direct response to this trend, aiming to capture a larger slice of this expanding market. By integrating Vollmens, Givaudan seeks to enhance its direct customer relationships and distribution capabilities in this vital region.

- Market Growth: Latin America's beauty and personal care market is projected to grow significantly, with the mid-tier segment being a primary driver, potentially reaching over $60 billion by 2027.

- Strategic Acquisition: Givaudan's majority stake acquisition in Vollmens Fragrances, expected to close in Q4 2025, targets this high-growth mid-tier segment.

- Operational Leverage: The move aims to leverage Vollmens’ local expertise and Givaudan’s scale to optimize operations and market penetration.

- Portfolio Enhancement: This investment is positioned to transform Vollmens into a Star product, contributing substantially to Givaudan's overall market position in Latin America.

Personalized and Niche Fragrance/Flavor Solutions

Givaudan is actively pursuing personalized and niche fragrance and flavor solutions, a strategy exemplified by its focus on the burgeoning market for premium Chinese fragrances. This approach targets specific, rapidly expanding consumer demographics.

While these niche markets offer substantial growth potential, their inherent fragmentation presents a challenge. Givaudan is therefore concentrating on building market share from a foundational level, requiring strategic investments in tailored marketing and continuous innovation to achieve scalability.

For instance, the premium Chinese fragrance market is experiencing significant growth. In 2024, it's projected that this segment will continue its upward trajectory, driven by a younger generation seeking unique and culturally resonant scents. Givaudan’s investment in this area reflects a broader trend of consumers prioritizing individuality and artisanal quality in their scent choices.

- Targeted Market: Focus on premium Chinese fragrances and other high-growth niche segments.

- Investment Strategy: Significant investment in marketing and innovation to capture share in fragmented markets.

- Growth Driver: Catering to increasing consumer demand for personalized and culturally specific scent experiences.

- Market Position: Building market share from a low base in these specialized, high-potential areas.

Givaudan's ventures into advanced digital creation tools and niche markets, such as premium Chinese fragrances, represent classic Question Marks. These initiatives are characterized by high growth potential but currently low market share, demanding significant investment to build brand awareness and scale operations.

The company's strategic acquisitions, like b.kolormake-up in July 2024, and its investment in biotechnology-derived ingredients, also fall into this category. These moves are designed to tap into emerging trends and high-growth sectors, but their success hinges on market acceptance and Givaudan's ability to effectively integrate and scale these new capabilities.

The Latin American mid-tier fragrance market, targeted by the Vollmens Fragrances acquisition (expected Q4 2025), is another prime example. While this market shows strong growth, Vollmens' current position requires Givaudan's strategic support to elevate it to a leading status.

| Initiative | Market Potential | Current Share | Investment Focus | BCG Quadrant |

|---|---|---|---|---|

| Digital Olfactive/Flavor Platforms | High (Digital Transformation) | Low | R&D, Market Adoption | Question Mark |

| Biotechnology Ingredients | High (Sustainability, Novelty) | Low | R&D, Production Scale-up | Question Mark |

| b.kolormake-up Acquisition (July 2024) | High (Beauty Sector Growth) | Low | Integration, Market Penetration | Question Mark |

| Vollmens Fragrances (Expected Q4 2025) | High (Latin America Mid-Tier) | Low | Market Expansion, Operational Leverage | Question Mark |

| Premium Chinese Fragrances | High (Niche Market Growth) | Low | Marketing, Tailored Innovation | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing Givaudan's financial reports, competitor analysis, and industry growth projections to provide actionable strategic insights.