Gilead Sciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gilead Sciences Bundle

Gilead Sciences operates within a complex web of external forces, from evolving healthcare policies to shifting economic climates and technological advancements in drug discovery. Understanding these PESTLE factors is crucial for navigating the competitive biopharmaceutical landscape and identifying future growth opportunities. Gain a strategic advantage by delving into our comprehensive PESTLE analysis of Gilead Sciences, designed to equip you with actionable intelligence for informed decision-making. Download the full version now to unlock critical insights.

Political factors

Government policies on healthcare spending, drug pricing, and reimbursement are critical for Gilead Sciences. The Inflation Reduction Act (IRA) in the US, enacted in 2022, allows Medicare to negotiate prices for certain high-cost drugs, impacting Gilead's revenue streams. For example, the IRA’s provisions for inflation rebates could affect the profitability of Gilead's key therapies.

European markets also present similar challenges, with governments actively managing pharmaceutical expenditures through price controls and reimbursement negotiations. These policies can influence market access and sales volumes for Gilead’s innovative treatments, requiring strategic adaptation to navigate diverse regulatory landscapes.

The strength and duration of patent protection are paramount for Gilead Sciences to successfully bring its groundbreaking medicines to market and maintain exclusivity. For instance, Gilead's HIV treatment Biktarvy, a significant revenue driver, has patent protection extending to 2033, highlighting the importance of such safeguards. However, upcoming patent expirations for other key products demand a continuous and robust pipeline of new drug development to mitigate potential revenue declines caused by generic competition.

The regulatory environment, overseen by bodies like the FDA in the United States and the EMA in Europe, significantly influences how quickly and expensively Gilead Sciences can introduce new treatments. For instance, in 2023, the FDA approved a substantial number of new molecular entities, but the pathway for each drug can still involve lengthy review periods and significant investment in clinical trials.

Shifting regulatory demands, such as increased emphasis on clinical trial participant diversity or the integration of artificial intelligence in drug discovery, directly affect Gilead's research and development schedules and how it allocates capital. These evolving standards necessitate adaptive strategies to ensure compliance and maintain competitive R&D timelines.

Any efforts to simplify regulatory processes, whether for manufacturing site inspections or the submission of new drug applications, could offer considerable advantages to Gilead by reducing time-to-market and associated costs, potentially accelerating patient access to innovative therapies.

Political Stability and Geopolitical Risks

Gilead Sciences operates in a global landscape where political stability is paramount. Disruptions in key markets, such as the United States or major European nations, can significantly affect research, manufacturing, and sales operations. For instance, the ongoing geopolitical shifts and trade tensions observed in 2024-2025 necessitate a close watch on how these dynamics might influence Gilead's international market access and pricing strategies.

Geopolitical risks, including regional conflicts or trade disputes, pose direct threats to Gilead's supply chain integrity and market penetration. For example, any escalation of trade friction between major economic blocs could impact the cost of raw materials or the ability to distribute finished products efficiently. This can lead to increased operational costs and a need for agile strategic adjustments to mitigate potential disruptions in regions like Asia or Eastern Europe.

- Market Access: Political instability in countries like South Africa, a significant market for HIV treatments, could impact patient access and government procurement cycles.

- Supply Chain Resilience: Geopolitical tensions in regions crucial for pharmaceutical ingredient sourcing, such as parts of Asia, could lead to supply chain vulnerabilities for Gilead's key therapies.

- Healthcare Policy Shifts: Changes in government healthcare spending priorities, driven by political mandates in countries like the UK or Germany, can directly influence demand for Gilead's innovative medicines.

- Regulatory Environment: Evolving political landscapes can lead to changes in drug approval processes and pricing regulations, affecting Gilead's commercialization efforts in diverse markets.

Government Funding for Research and Public Health Initiatives

Government investment in medical research and public health initiatives, especially in areas like HIV, viral hepatitis, and oncology, directly supports Gilead's core therapeutic focus. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $45 billion in fiscal year 2024 towards biomedical research, a significant portion of which benefits infectious diseases and cancer research, areas critical to Gilead's portfolio. This funding can accelerate the development of new treatments and expand access to existing ones.

Such government funding often underpins broader disease awareness campaigns, prevention programs, and the development of healthcare infrastructure. These efforts, which can include public health emergencies like the ongoing efforts to combat COVID-19 and its long-term effects, indirectly boost the uptake and overall impact of Gilead's medicines by creating a more receptive and informed patient population and a stronger healthcare system.

Public health emergencies significantly shape government priorities and funding allocations. For example, the U.S. government's response to the COVID-19 pandemic saw substantial emergency funding directed towards vaccine development and public health infrastructure, highlighting how crises can rapidly shift government focus and financial support towards critical health challenges, potentially benefiting companies like Gilead that offer solutions in related therapeutic areas.

- Government funding for medical research, such as the NIH's projected $45 billion in FY2024, directly supports Gilead's key therapeutic areas.

- Public health initiatives funded by governments can indirectly enhance the market for Gilead's treatments by improving disease awareness and healthcare infrastructure.

- Government responses to public health emergencies, like pandemic-related funding, demonstrate the potential for rapid shifts in financial priorities that can impact the pharmaceutical sector.

Government policies, including the Inflation Reduction Act (IRA) in the US, directly impact Gilead's revenue through drug price negotiations and inflation rebates. European nations also employ price controls and reimbursement strategies that influence market access for Gilead's innovative treatments.

Political stability is crucial for Gilead's global operations, with geopolitical shifts and trade tensions in 2024-2025 necessitating careful monitoring of market access and pricing strategies.

Government funding for medical research, such as the NIH's projected $45 billion in FY2024, directly supports Gilead's core therapeutic areas like oncology and infectious diseases, potentially accelerating new treatment development.

| Political Factor | Impact on Gilead Sciences | Example/Data Point (2024-2025 Focus) |

|---|---|---|

| Healthcare Policy & Regulation | Influences drug pricing, reimbursement, and market access. | IRA drug price negotiation provisions; ongoing EU pricing pressures. |

| Geopolitical Stability & Trade | Affects supply chain integrity, market penetration, and operational costs. | Monitoring trade tensions impacting raw material costs or distribution in Asia. |

| Government Research Funding | Supports development in key therapeutic areas and disease awareness. | NIH funding for infectious diseases and oncology research. |

What is included in the product

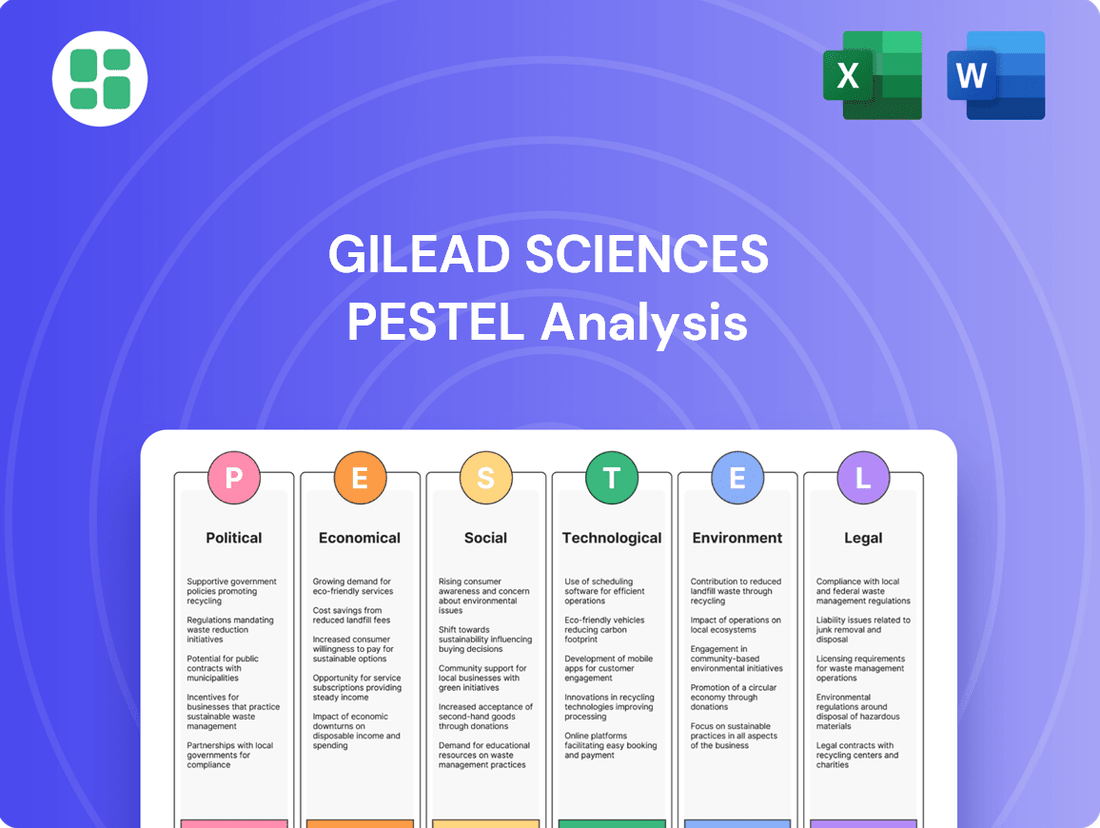

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Gilead Sciences, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities within the biopharmaceutical landscape.

A concise PESTLE analysis for Gilead Sciences offers a clear, summarized view of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global healthcare spending is on an upward trajectory, fueled by aging populations and the increasing prevalence of chronic diseases. Projections indicate this trend will continue, with global health expenditure expected to reach $10.1 trillion by 2025, up from $7.8 trillion in 2018. This sustained growth directly influences the size and potential of the pharmaceutical market, offering opportunities for companies like Gilead Sciences.

However, regional variations in healthcare spending and the growing adoption of value-based care models present both challenges and opportunities. While some markets may see slower growth, the shift towards outcomes-focused reimbursement can benefit innovative therapies. For instance, the U.S. market, a significant driver of pharmaceutical revenue, is seeing increased scrutiny on drug pricing, impacting strategic decisions.

Governments, insurers, and other payers continue to exert significant pressure on drug pricing. For instance, in the US, proposed changes to Medicare Part D and inflation-based rebate requirements aim to lower out-of-pocket costs, potentially impacting Gilead's net revenue. These economic headwinds require a strong emphasis on demonstrating the cost-effectiveness and superior clinical outcomes of their therapies.

The biopharmaceutical sector demands substantial capital for research and development. Economic downturns and shifts in investor sentiment can directly impact the funding available for Gilead's drug pipeline, potential acquisitions, and collaborations.

Gilead Sciences itself projects its research and development expenditures to remain relatively stable in 2025, expecting them to be approximately unchanged from 2024 levels. This indicates a measured approach to R&D investment amidst evolving economic conditions.

Currency Fluctuations and Global Market Dynamics

Currency fluctuations significantly affect Gilead Sciences, a global player. For instance, in the first quarter of 2024, Gilead reported that unfavorable foreign exchange rates had a negative impact on its reported product sales. This means that as the US dollar strengthens against other currencies, international revenue translates into fewer dollars.

Economic growth rates in key international markets are also critical for Gilead's expansion. Emerging economies, with their growing middle classes and increasing healthcare spending, present significant opportunities for market penetration. However, these markets can also be more volatile, making demand for pharmaceuticals susceptible to economic downturns.

- Impact of FX Rates: Gilead's Q1 2024 results indicated an adverse impact from foreign exchange on reported sales, highlighting the sensitivity of its international revenue to currency movements.

- Emerging Market Potential: Growth in developing economies is crucial for expanding access to Gilead's treatments, but economic stability in these regions directly influences demand.

- Global Economic Health: The overall health of the global economy influences healthcare budgets and patient affordability, impacting sales volumes for Gilead's diverse product portfolio.

Competition from Generics and Biosimilars

The economic landscape for Gilead Sciences is significantly shaped by the impending loss of patent exclusivity for key products. For instance, Biktarvy, a major HIV treatment, is expected to face generic competition around 2033. This loss of market exclusivity presents a substantial economic threat, as the entry of lower-cost generic and biosimilar alternatives can drastically reduce revenue and market share for Gilead's flagship medications.

This competitive pressure necessitates a continuous drive for innovation and strategic diversification within Gilead's product pipeline. The company must actively develop new therapies and explore new market segments to offset the anticipated revenue erosion from established, patent-expired drugs. This proactive approach is crucial for maintaining financial stability and long-term growth in a dynamic pharmaceutical market.

- Patent Expiry Impact: Loss of exclusivity for key products like Biktarvy (around 2033) poses a significant economic risk, potentially leading to substantial revenue decline.

- Generic/Biosimilar Entry: The introduction of generic and biosimilar competitors directly challenges Gilead's market share and pricing power for its established drugs.

- Revenue Erosion: Historically, patent expirations have led to sharp revenue drops for pharmaceutical companies as cheaper alternatives enter the market.

- Innovation Imperative: Gilead's economic strategy must prioritize ongoing research and development to introduce novel treatments and diversify its portfolio, mitigating the impact of generic competition.

Global healthcare spending continues its ascent, projected to reach $10.1 trillion by 2025, a significant increase from $7.8 trillion in 2018. This upward trend directly benefits pharmaceutical companies like Gilead Sciences by expanding the overall market size. However, the increasing adoption of value-based care models and pricing pressures in key markets, such as the U.S., necessitate a strong focus on demonstrating cost-effectiveness and superior clinical outcomes for Gilead's therapies.

Currency fluctuations present a tangible economic challenge for Gilead, a global entity. For instance, in Q1 2024, unfavorable foreign exchange rates negatively impacted reported product sales, illustrating how a stronger U.S. dollar can reduce the value of international revenue. Economic growth in emerging markets offers expansion opportunities, but their inherent volatility can make pharmaceutical demand susceptible to economic downturns.

The impending loss of patent exclusivity for key products, such as Biktarvy around 2033, poses a significant economic threat. The entry of generic and biosimilar competitors will likely lead to substantial revenue erosion and reduced market share for Gilead's established drugs, underscoring the imperative for continuous innovation and portfolio diversification.

| Economic Factor | Description | Impact on Gilead Sciences | Data/Trend (2024/2025) |

|---|---|---|---|

| Global Healthcare Spending | Overall expenditure on healthcare services and products. | Expands market size for pharmaceuticals. | Projected to reach $10.1 trillion by 2025. |

| Pricing Pressures | Government and payer efforts to control drug costs. | Can reduce net revenue and impact profitability. | Continued scrutiny on drug pricing in the U.S. market. |

| Foreign Exchange Rates (FX) | Fluctuations in currency values affecting international revenue. | Adverse FX rates can decrease reported sales. | Q1 2024 results showed a negative impact from FX. |

| Patent Expirations | Loss of market exclusivity for key drugs. | Leads to revenue erosion due to generic competition. | Biktarvy patent expiry expected around 2033. |

Full Version Awaits

Gilead Sciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Gilead Sciences covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic decisions and market position.

Sociological factors

Global demographic trends, notably an aging population, are increasing the incidence of chronic diseases, directly impacting demand for Gilead Sciences' core therapeutic areas. For instance, the World Health Organization reported that in 2023, cancer remained a leading cause of death globally, with an estimated 19.9 million new cases. This trend fuels the need for innovative oncology treatments, a key focus for Gilead.

Furthermore, the persistent prevalence of viral diseases like HIV and viral hepatitis continues to shape market dynamics. In 2024, UNAIDS estimated that 39 million people were living with HIV worldwide, underscoring the ongoing demand for effective antiretroviral therapies, a cornerstone of Gilead's portfolio. Adapting to these evolving disease landscapes is crucial for Gilead's strategic planning and product pipeline development.

Growing public awareness about health conditions, like HIV and viral hepatitis, directly influences demand for Gilead's therapies. Patient advocacy groups are increasingly powerful, impacting treatment guidelines and public perception. For instance, organizations advocating for HIV/AIDS treatment access have been instrumental in shaping policy and encouraging broader adoption of Gilead's antiretroviral drugs.

Gilead's proactive engagement with these patient groups is crucial for its social license to operate. In 2024, the company continued its patient assistance programs, which are vital for ensuring access to its life-saving medications, particularly in lower-income regions. This focus on patient access not only addresses ethical considerations but also bolsters Gilead's reputation and market acceptance.

Societal pressure for equitable access to innovative drugs, particularly in developing nations, directly impacts Gilead's pricing and corporate responsibility efforts. For instance, Gilead's ongoing commitment to expanding access to its HIV prevention treatments in low- and middle-income countries demonstrates a response to these expectations.

In 2023, Gilead continued its efforts to broaden access to its HIV prevention medications, with programs reaching millions of individuals globally. This focus on health equity is increasingly scrutinized by patient advocacy groups and governments, influencing public perception and potentially regulatory approaches.

Public Perception and Corporate Reputation

Public perception significantly shapes the pharmaceutical sector, impacting companies like Gilead Sciences. Concerns over drug pricing, particularly for life-saving treatments, and questions regarding ethical conduct in research and marketing remain prominent. Gilead's 2023 revenue of $27.05 billion, while substantial, operates within a landscape where public scrutiny on pricing practices can influence market access and brand loyalty.

Gilead's corporate reputation is directly tied to how it addresses these societal expectations. Environmental impact, including manufacturing processes and waste management, also plays a role in public opinion. For instance, ongoing efforts to improve sustainability in manufacturing are often highlighted by companies to bolster their image. Maintaining trust requires transparent communication about drug development, pricing strategies, and corporate social responsibility initiatives.

- Drug Pricing Scrutiny: Public discourse around the affordability of prescription drugs continues to be a major factor influencing pharmaceutical companies.

- Ethical Conduct: Perceptions of ethical practices in clinical trials, marketing, and patient engagement are vital for maintaining public trust.

- Environmental Responsibility: Growing awareness of climate change and corporate environmental footprints means that a company's sustainability practices are increasingly under public review.

- Brand Reputation: A strong brand reputation, built on transparency and responsible actions, is crucial for stakeholder relations and long-term business success in the pharmaceutical industry.

Workforce Diversity and Inclusion

Societal expectations for diversity, equity, and inclusion (DEI) are increasingly shaping corporate strategies, impacting how companies like Gilead Sciences attract and retain talent. This emphasis is crucial for fostering an innovative environment and better understanding the diverse needs of patients worldwide.

Gilead's commitment to DEI is reflected in its workforce composition and initiatives. For instance, as of 2024, the company reported that women held 45% of management positions, and 37% of its global workforce identified as belonging to underrepresented ethnic groups. These figures underscore a strategic effort to build a team that mirrors the global patient populations it serves.

- Talent Acquisition: A strong DEI focus can broaden the talent pool, attracting candidates from various backgrounds who may be overlooked by less inclusive organizations.

- Innovation: Diverse teams are often linked to increased creativity and problem-solving capabilities, as different perspectives can lead to novel solutions for complex scientific and business challenges.

- Patient Understanding: A workforce that reflects the diversity of patients is better equipped to understand and address the unique health needs and cultural nuances of different communities.

- Corporate Reputation: Demonstrating a genuine commitment to DEI enhances Gilead's reputation among employees, patients, investors, and the broader community.

Societal expectations for health equity and access to medicine are paramount, influencing Gilead's market strategies. The company's commitment to expanding access to HIV prevention treatments in low- and middle-income countries in 2023, reaching millions, reflects this pressure. Public scrutiny on drug pricing, as evidenced by Gilead's $27.05 billion in revenue in 2023, remains a significant factor impacting its brand and market acceptance.

Technological factors

Breakthroughs in biotechnology, genomics, proteomics, and computational biology are fundamentally changing how new medicines are found. These advancements allow for a deeper understanding of diseases at a molecular level, speeding up the identification of potential drug targets.

Gilead Sciences is actively embracing these technological shifts. Their strategic collaborations, like the one with Genesis Therapeutics, aim to harness artificial intelligence for discovering and refining novel small molecule therapies. This partnership, announced in 2023, is designed to accelerate the drug development pipeline.

These technological factors are critical for Gilead's future growth, enabling them to develop more effective treatments faster. For instance, AI-driven approaches can significantly reduce the time and cost associated with preclinical drug discovery, a process that historically could take many years and billions of dollars.

Artificial intelligence and data analytics are transforming the pharmaceutical industry, impacting everything from drug discovery to patient care. Gilead Sciences is actively integrating these technologies across its operations. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at enhancing efficiency and reducing costs through AI-driven processes.

The application of AI in clinical trial design and execution is a key area of focus, promising faster development cycles and more targeted patient recruitment. Furthermore, AI's ability to analyze vast datasets is crucial for generating real-world evidence, which is increasingly important for understanding drug effectiveness and safety post-market. Gilead's strategic push into these technological advancements is designed to unlock new avenues for innovation and operational excellence.

Gilead Sciences is increasingly leveraging innovations in pharmaceutical manufacturing, such as advanced manufacturing technologies (AMTs) and automation, to boost operational efficiency and product quality. These advancements are crucial for maintaining competitiveness and ensuring supply chain robustness, especially in the face of evolving market demands. For instance, the adoption of continuous manufacturing processes, a key AMT, promises to reduce waste and production cycle times.

Regulatory bodies globally, including the U.S. Food and Drug Administration (FDA), are actively encouraging the adoption of these cutting-edge manufacturing techniques. The FDA's Advanced Manufacturing Initiative, for example, aims to foster innovation and improve the quality of medicines by supporting the implementation of new technologies. This regulatory push provides a favorable environment for companies like Gilead to invest in and scale up automated and advanced manufacturing capabilities, potentially leading to significant cost reductions and enhanced product consistency.

Digital Health and Patient Monitoring

The growing adoption of digital health tools, including wearable devices and remote patient monitoring, is reshaping how pharmaceutical companies like Gilead Sciences can interact with patients and gather crucial data. These technologies allow for continuous tracking of patient health metrics, offering new insights into treatment efficacy and adherence. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating a strong trend towards data-driven healthcare solutions.

This technological shift presents Gilead with opportunities to enhance patient engagement strategies and streamline the collection of real-world evidence. By integrating digital health platforms, Gilead can potentially improve patient outcomes through personalized treatment adjustments and better monitoring of side effects. The ability to collect real-time data from patients remotely can also accelerate clinical trial processes and post-market surveillance, providing a more comprehensive understanding of drug performance in diverse populations.

- Enhanced Patient Monitoring: Wearable devices can track vital signs and adherence, providing continuous data streams.

- Real-World Data Collection: Digital platforms facilitate the gathering of real-world evidence for drug efficacy and safety.

- Improved Patient Engagement: Telehealth and digital tools foster closer patient-provider communication and support.

- Streamlined Clinical Trials: Remote monitoring can reduce patient burden and accelerate data acquisition in research.

Gene Editing and Cell Therapies

The rapid evolution of gene editing tools like CRISPR-Cas9 presents a dual-edged sword for Gilead Sciences. While these advancements offer the potential for groundbreaking treatments, they also intensify the competitive landscape, requiring continuous investment in research and development to maintain leadership in personalized medicine.

Gilead's existing cell therapy portfolio, notably its CAR T-cell therapies, is directly impacted by these technological leaps. To stay competitive, the company must actively integrate new gene editing techniques to enhance the efficacy, safety, and manufacturing processes of its cell-based treatments.

The market for gene and cell therapies is experiencing significant growth. For instance, the global cell therapy market was valued at approximately USD 12.1 billion in 2023 and is projected to reach USD 45.5 billion by 2030, growing at a CAGR of 20.9%. This trajectory underscores the critical need for Gilead to innovate within this space.

- CRISPR advancements offer new avenues for treating genetic diseases, potentially complementing or competing with Gilead's existing therapeutic areas.

- Cell therapy innovation is crucial for Gilead to defend and expand its market share in oncology and other areas where cell-based treatments are emerging.

- Investment in R&D focusing on next-generation gene editing and cell therapy platforms is essential for Gilead to capitalize on market opportunities and mitigate competitive threats.

- Strategic partnerships or acquisitions in the gene editing space could accelerate Gilead's ability to leverage these technologies.

Gilead Sciences is heavily influenced by rapid advancements in artificial intelligence and data analytics, which are transforming drug discovery and clinical trial processes. The company's strategic collaborations, such as the one with Genesis Therapeutics announced in 2023, highlight its commitment to leveraging AI for faster development of novel therapies. In 2024, Gilead continued to invest in digital transformation, aiming to boost operational efficiency and reduce costs through AI-driven operations.

Innovations in pharmaceutical manufacturing, including advanced manufacturing technologies (AMTs) and automation, are key for Gilead to enhance efficiency and product quality. The FDA's encouragement of these techniques, through initiatives like the Advanced Manufacturing Initiative, creates a favorable environment for Gilead to invest in automation, potentially lowering costs and improving product consistency.

The rise of digital health tools, such as wearables and remote patient monitoring, is reshaping patient interaction and data collection for Gilead. The global digital health market, valued at approximately $200 billion in 2023, demonstrates a strong trend towards data-driven healthcare, offering Gilead opportunities to improve patient engagement and gather real-world evidence.

The evolution of gene editing tools like CRISPR-Cas9 presents both opportunities and competitive challenges for Gilead's cell therapy portfolio. The cell therapy market's projected growth, from USD 12.1 billion in 2023 to USD 45.5 billion by 2030, necessitates continuous R&D investment and potential strategic partnerships to maintain leadership.

Legal factors

Government regulations on drug pricing, like the Inflation Reduction Act (IRA) in the US, directly affect Gilead's revenue streams. The IRA, enacted in 2022, allows Medicare to negotiate prices for certain high-cost drugs, potentially impacting Gilead's top-selling products. For instance, if Gilead's blockbuster HIV medication Biktarvy were subject to negotiation, it could lead to reduced revenue compared to previous pricing power.

Reimbursement policies and health technology assessments (HTAs) in countries like Germany or the UK also play a crucial role in market access and pricing. These frameworks evaluate a drug's clinical and economic value, influencing whether it will be covered by national health systems. Gilead's ability to secure favorable reimbursement for new therapies, such as its oncology treatments, is therefore paramount for commercial success.

Penalties for exceeding inflation rates on drug prices, as stipulated by the IRA, create a direct financial risk for Gilead. Companies must carefully manage price adjustments to avoid these penalties, which could shave off a percentage of revenue from affected products. This regulatory environment necessitates a strategic approach to pricing and market access negotiations.

Patent laws are the bedrock of Gilead Sciences' business, safeguarding its substantial investments in research and development. These protections are crucial for recouping the billions spent on discovering and bringing new therapies to market.

The company's financial health is directly tied to the strength and duration of its patents. For instance, the patent for its blockbuster HIV medication, Biktarvy, is set to expire in the coming years, making the landscape of patent enforcement and potential challenges from generic competitors a critical factor for future revenue streams.

Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) maintain rigorous standards for clinical trials, focusing on data integrity, patient safety, and proven efficacy. For instance, in 2023, the FDA continued to emphasize robust data collection and analysis for drug approvals, impacting development timelines and costs for companies like Gilead.

Evolving regulations surrounding clinical trial design, data privacy (such as GDPR compliance for European data), and the integration of artificial intelligence (AI) in trial management are significant factors. These changes, which became increasingly prominent in 2024, will necessitate adaptation in Gilead's research and development strategies, potentially influencing the pace of bringing new therapies to market.

Antitrust and Competition Laws

Gilead Sciences, as a major player in the biopharmaceutical industry, faces ongoing scrutiny under antitrust and competition laws. Regulatory bodies, including the Federal Trade Commission (FTC) in the United States and the European Commission, closely monitor its market practices, particularly concerning drug pricing, patent settlements, and potential monopolistic behavior. Ensuring strict adherence to these regulations is paramount to prevent costly legal battles and maintain a reputation for fair competition.

The company's acquisition strategy is also a key area of antitrust focus. For instance, while Gilead's acquisition of Kite Pharma in 2017 for approximately $11.9 billion was a significant move into cell therapy, it, like all major pharmaceutical mergers, underwent rigorous antitrust review. Future large-scale acquisitions or collaborations will continue to be evaluated for their potential impact on market competition and patient access to medicines.

- Antitrust Oversight: Gilead operates under the watchful eye of global antitrust regulators, who examine pricing strategies and market dominance.

- Merger Scrutiny: Acquisitions, such as the $11.9 billion Kite Pharma deal in 2017, are subject to extensive antitrust reviews to prevent market concentration.

- Compliance Imperative: Maintaining compliance with evolving competition laws is critical to avoid legal penalties and safeguard business operations.

Data Privacy and Cybersecurity Laws

Gilead Sciences operates within a complex legal landscape shaped by data privacy and cybersecurity laws. The increasing digitization of research and development, clinical trial data, and patient management systems means Gilead must adhere to stringent regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Failure to comply can result in substantial fines and reputational damage.

These legal frameworks mandate robust cybersecurity measures to safeguard sensitive patient and proprietary company information. For instance, the GDPR, which came into full effect in 2018, imposes strict rules on how personal data is collected, processed, and stored. In 2024, companies are seeing continued enforcement and evolving interpretations of these privacy rights, requiring ongoing investment in compliance and security infrastructure.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- HIPAA Penalties: Violations of HIPAA can result in penalties ranging from $100 to $50,000 per violation, with annual caps.

- Cybersecurity Investment: The global cybersecurity market was projected to reach over $200 billion in 2024, reflecting the critical need for advanced security solutions.

- Data Breach Costs: The average cost of a data breach in the healthcare industry continues to be among the highest across all sectors, underscoring the financial risk.

Government regulations significantly impact Gilead's operations, particularly concerning drug pricing and market access. The Inflation Reduction Act (IRA) of 2022, for example, allows Medicare to negotiate prices for certain high-cost drugs, potentially affecting revenue from key products. Reimbursement policies and health technology assessments in various countries also dictate market access and pricing for Gilead's therapies, making favorable outcomes crucial for commercial success.

Patent laws are fundamental to Gilead's business model, protecting its R&D investments and revenue streams. The expiration of patents for major drugs, such as its HIV medication Biktarvy, presents a critical challenge, opening the door for generic competition and necessitating strategic planning for future revenue generation.

Antitrust and competition laws are a constant consideration for Gilead, with regulators scrutinizing pricing, market dominance, and mergers. The company must ensure strict compliance to avoid legal penalties and maintain its reputation, especially as it pursues strategic acquisitions in the evolving biopharmaceutical landscape.

Data privacy and cybersecurity regulations, including GDPR and HIPAA, impose stringent requirements on Gilead's handling of sensitive patient and proprietary data. Adherence to these laws is vital to prevent substantial fines and reputational damage, requiring ongoing investment in robust security infrastructure and compliance measures.

Environmental factors

The environmental footprint of pharmaceutical production, encompassing energy, water, and waste, faces growing public and regulatory attention. Gilead Sciences is actively addressing this by setting ambitious targets for reducing carbon emissions, water consumption, and waste generation, aiming for 100% renewable electricity for its operations by 2025.

Climate change is increasingly impacting public health by altering the patterns of infectious diseases. For Gilead Sciences, this means a potential shift in demand for its antiviral treatments as certain diseases might become more prevalent or spread to new regions. For example, the World Health Organization has noted that changing temperature and rainfall patterns can expand the range of mosquito-borne illnesses, which could indirectly influence the market for antiviral medications.

Furthermore, the heightened frequency and intensity of extreme weather events, such as hurricanes and floods, pose a significant risk to Gilead's global supply chain and manufacturing facilities. Disruptions in these operations could lead to shortages of critical medications or delays in product delivery, directly affecting the company's ability to meet patient needs and market demand. In 2023 alone, numerous regions experienced record-breaking heatwaves and severe storms, highlighting the vulnerability of global infrastructure.

Gilead Sciences faces significant environmental considerations regarding waste management and its product lifecycle. The proper disposal of pharmaceutical waste, encompassing hazardous materials from manufacturing processes and expired medications, presents a key challenge. In 2023, the company reported a 5% reduction in hazardous waste generation compared to the previous year, demonstrating a focus on minimizing this impact.

The company is actively working to integrate sustainable design principles into its new projects and product packaging strategies. This approach aims to reduce the overall environmental footprint associated with its products from development through to end-of-life management. Gilead's 2024 sustainability report highlights increased use of recycled materials in product packaging, reaching 30% across key product lines.

Resource Scarcity and Supply Chain Resilience

Gilead Sciences, like many pharmaceutical companies, faces risks from resource scarcity and the need for robust supply chains. Dependence on specific raw materials and complex global networks means environmental disruptions, such as extreme weather events or geopolitical instability impacting key regions, can directly affect production. For instance, a drought in a region crucial for a specific plant-derived compound or a shipping disruption due to a hurricane could halt the manufacturing of vital medicines.

Ensuring a resilient and sustainable supply chain is paramount for Gilead's continuous drug production and market availability. This involves diversifying sourcing, building strategic inventory, and investing in technologies that enhance visibility and predictability within their supply network. The company's commitment to sustainability often includes assessing the environmental impact of its suppliers and working towards more localized or diversified production capabilities to mitigate these risks.

Gilead's 2023 sustainability report highlighted efforts to strengthen supply chain resilience, with a focus on ethical sourcing and reducing environmental footprint. While specific data on resource scarcity impacts is often proprietary, the industry trend shows increased investment in supply chain diversification. For example, the pharmaceutical sector as a whole saw a significant uptick in spending on supply chain technologies and risk management solutions in 2024, aiming to counter the vulnerabilities exposed by recent global events.

- Supply Chain Diversification: Gilead actively seeks to broaden its supplier base for critical raw materials to reduce reliance on single geographic regions or suppliers.

- Environmental Risk Assessment: The company integrates environmental risk assessments into its supplier selection and ongoing monitoring processes to identify potential vulnerabilities.

- Sustainability Initiatives: Efforts are underway to promote sustainable practices throughout the supply chain, which can indirectly enhance resilience by reducing reliance on environmentally sensitive resources.

- Logistics Optimization: Gilead invests in optimizing its logistics and distribution networks to minimize transit times and reduce exposure to potential disruptions.

Environmental, Social, and Governance (ESG) Reporting

Investor and stakeholder scrutiny of environmental, social, and governance (ESG) performance is intensifying, driving a need for transparent and detailed reporting. Gilead Sciences addresses this by publishing its annual Responsible Business and Impact Report, which outlines its progress and future goals in critical areas such as climate change mitigation and energy efficiency. This commitment to comprehensive ESG reporting is integral to shaping Gilead's corporate sustainability narrative and attracting environmentally conscious investment.

Gilead's ESG reporting in 2023 detailed significant strides, including a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline, and a 90% renewable energy procurement for its global operations. The company also reported on water conservation efforts, achieving a 10% decrease in water intensity across its manufacturing sites.

- Climate Action: Gilead aims to achieve net-zero greenhouse gas emissions by 2045, with interim targets for emission reductions across its value chain.

- Energy Management: The company is increasing its use of renewable energy sources, targeting 100% renewable electricity for all owned and operated facilities by 2025.

- Water Stewardship: Gilead is implementing water management strategies to reduce consumption and improve water quality in water-stressed regions where it operates.

- Waste Reduction: Efforts are underway to minimize waste generation, with a focus on increasing recycling rates and diverting waste from landfills.

Gilead Sciences is actively managing its environmental impact, with a focus on reducing carbon emissions and waste. The company has set a target to use 100% renewable electricity for its operations by 2025 and reported a 5% reduction in hazardous waste generation in 2023.

Climate change presents both risks and opportunities, potentially altering disease patterns and impacting antiviral treatment demand. Extreme weather events also pose a threat to Gilead's global supply chain, as seen with numerous severe storms and heatwaves in 2023.

The company is integrating sustainable design into its packaging, utilizing 30% recycled materials in key product lines in 2024, and is committed to net-zero greenhouse gas emissions by 2045.

Investor scrutiny on ESG performance is driving transparent reporting, with Gilead's 2023 report showing a 15% reduction in Scope 1 and 2 greenhouse gas emissions against a 2019 baseline.

| Environmental Focus Area | Gilead's Targets/Performance | Year |

|---|---|---|

| Renewable Electricity Use | 100% target | 2025 |

| Hazardous Waste Reduction | 5% reduction | 2023 |

| Recycled Materials in Packaging | 30% usage | 2024 |

| Scope 1 & 2 GHG Emissions Reduction | 15% reduction (vs. 2019) | 2023 |

| Net-Zero Emissions Goal | By 2045 |

PESTLE Analysis Data Sources

Our Gilead Sciences PESTLE Analysis is built on a robust foundation of data from leading financial news outlets, government health agencies, and reputable pharmaceutical industry reports. We incorporate insights from global economic indicators, regulatory updates, and technological advancements to provide a comprehensive overview.