Gilead Sciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gilead Sciences Bundle

Gilead Sciences operates in a dynamic pharmaceutical landscape where intense rivalry and the threat of substitutes significantly shape its competitive environment. Understanding the nuances of buyer power, particularly from large healthcare payers, and the influence of powerful suppliers of raw materials and manufacturing services is crucial for strategic planning.

The complete report reveals the real forces shaping Gilead Sciences’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gilead Sciences' reliance on a select group of suppliers for specialized raw materials and Active Pharmaceutical Ingredients (APIs) significantly influences its bargaining power. These unique inputs are vital for Gilead's cutting-edge therapies, and their proprietary nature, coupled with rigorous quality standards, can empower suppliers. For instance, the development and manufacturing of complex biologics often require highly specific cell culture media or purification resins that only a few companies can produce to the required pharmaceutical grade.

Supplier concentration significantly impacts Gilead Sciences' bargaining power. When a limited number of suppliers provide critical components, such as specialized chemical compounds or manufacturing equipment, these suppliers gain considerable leverage. This concentration allows them to dictate pricing and terms, potentially increasing costs for Gilead.

For instance, in the pharmaceutical industry, the production of complex Active Pharmaceutical Ingredients (APIs) often relies on a small pool of highly specialized manufacturers. If Gilead depends heavily on one or two such suppliers for a key drug's API, those suppliers can exert substantial influence over supply availability and cost, directly affecting Gilead's profitability and production schedules.

Switching suppliers in the biopharmaceutical sector, particularly for critical components like active pharmaceutical ingredients (APIs) or specialized manufacturing equipment, carries significant financial and operational burdens for companies like Gilead Sciences. These costs aren't trivial; they encompass the extensive time and resources needed for rigorous regulatory re-approvals, the meticulous re-validation of manufacturing processes to ensure product quality and consistency, and the inherent risk of supply chain disruptions during the transition period. For instance, a single API supplier change could necessitate entirely new clinical trials or extensive bioequivalence studies, potentially costing millions and delaying product launches.

Intellectual Property and Patents

Suppliers who hold intellectual property or patents on critical materials or manufacturing processes can significantly influence Gilead Sciences. This leverage allows them to dictate terms, potentially increasing production costs and affecting timelines for Gilead's innovative therapies. For instance, a supplier with exclusive rights to a key chemical compound essential for a blockbuster drug can command premium pricing.

Gilead's reliance on these patented inputs means that any disruption or unfavorable pricing from such suppliers can directly impact the company's profitability and its ability to bring life-saving treatments to market efficiently. In 2023, Gilead's research and development expenses were approximately $3.5 billion, highlighting the significant investment in novel compounds and processes that often involve proprietary inputs from specialized suppliers.

- Patented Inputs: Suppliers with patents on unique raw materials or manufacturing techniques can exert considerable bargaining power.

- Cost and Timeline Impact: Gilead's dependence on these patented inputs can lead to higher production costs and extended development timelines.

- R&D Investment Context: Gilead's substantial R&D spending underscores the importance of securing reliable access to these specialized, often patented, components.

Global Sourcing and Diversification

Gilead Sciences actively manages its supply chain by sourcing materials globally and diversifying its supplier network. This strategy significantly lessens the bargaining power of individual suppliers. By avoiding over-reliance on any single source or geographic area, Gilead enhances its resilience against potential supply chain interruptions or demands for less favorable contract terms.

This approach is crucial in the pharmaceutical industry, where specialized raw materials and active pharmaceutical ingredients (APIs) are essential. For instance, in 2023, the global pharmaceutical market for APIs was valued at approximately $200 billion, highlighting the critical nature of these inputs. Gilead's proactive diversification allows it to negotiate from a stronger position, as suppliers recognize the company's ability to switch if terms become disadvantageous.

- Global Sourcing: Gilead leverages international markets to secure a wider range of suppliers for its critical components, reducing dependence on any single domestic or regional provider.

- Supplier Diversification: The company actively seeks multiple qualified vendors for key materials, ensuring competitive pricing and mitigating risks associated with supplier-specific issues.

- Resilience Against Disruption: A diversified supplier base strengthens Gilead's ability to maintain production continuity, even if one supplier faces operational challenges or geopolitical instability.

- Negotiating Leverage: By presenting multiple sourcing options, Gilead enhances its bargaining power, enabling more favorable pricing and contract terms for its essential raw materials and manufacturing inputs.

Gilead Sciences faces moderate bargaining power from its suppliers, largely due to the specialized nature of pharmaceutical inputs and the concentration of certain manufacturers. While Gilead's global sourcing and diversification strategies aim to mitigate this, dependence on a few key suppliers for critical Active Pharmaceutical Ingredients (APIs) or patented materials can still grant them leverage. This means suppliers can influence pricing and terms, potentially impacting Gilead's production costs and timelines.

The pharmaceutical industry's stringent regulatory environment and the high cost of switching suppliers, involving re-validation and potential delays, further strengthen supplier positions. For example, the development of novel biologics often necessitates unique cell culture media or purification resins from a limited number of qualified providers. In 2023, Gilead's significant investment in R&D, amounting to approximately $3.5 billion, underscores the critical need for reliable access to these specialized components, making supplier relationships a key consideration.

| Factor | Impact on Gilead | Example |

| Supplier Concentration | Moderate to High | Limited manufacturers for specialized APIs |

| Switching Costs | High | Regulatory re-approvals, process re-validation |

| Intellectual Property | Moderate to High | Patented raw materials or manufacturing processes |

| Gilead's Mitigation Strategies | Reduces power | Global sourcing, supplier diversification |

What is included in the product

Tailored exclusively for Gilead Sciences, this analysis dissects the competitive forces shaping its industry, including buyer and supplier power, threat of new entrants and substitutes, and existing rivalry.

Effortlessly assess Gilead's competitive landscape, highlighting threats and opportunities from new entrants and substitutes.

Customers Bargaining Power

Gilead Sciences faces considerable customer bargaining power, especially from large institutional buyers like Pharmacy Benefit Managers (PBMs), major hospital systems, and government healthcare programs. These entities are highly sensitive to drug pricing due to ongoing healthcare cost containment efforts.

These powerful customers actively leverage their purchasing volume to negotiate aggressively for lower prices, substantial discounts, and rebates. This persistent pressure directly impacts Gilead's revenue streams, forcing a constant focus on cost containment and pricing strategies.

For instance, in 2024, PBMs continued to play a pivotal role in drug pricing negotiations, often dictating formulary placement and reimbursement rates, which directly affects Gilead's market access and profitability for its key therapies.

The increasing consolidation of customers into large Pharmacy Benefit Managers (PBMs) and Group Purchasing Organizations (GPOs) significantly strengthens their bargaining power against pharmaceutical companies like Gilead Sciences. These entities, by aggregating the purchasing volume of numerous smaller buyers, gain substantial leverage to negotiate more favorable pricing and contract terms. For instance, in 2024, major PBMs continued to wield considerable influence over drug formularies and pricing, directly impacting the revenue streams of drug manufacturers by demanding significant rebates and discounts.

The growing presence of generic and biosimilar drugs significantly amplifies customer bargaining power. As patents for Gilead's blockbuster medications expire, the market opens up to lower-cost alternatives, giving patients and healthcare providers more options. This competitive pressure forces Gilead to be more strategic with its pricing to retain market share.

Informed Buyers and Transparency Initiatives

Customers, particularly in the pharmaceutical sector, are becoming significantly more informed. This is driven by increased access to data regarding drug efficacy, comparative pricing, and the availability of alternative treatments. Initiatives promoting transparency in healthcare pricing and clinical trial results directly contribute to this trend, empowering patients and payers alike to scrutinize offerings more closely.

This heightened awareness translates into greater bargaining power for customers. They are more likely to demand better value, negotiate pricing, and switch to competitors if Gilead Sciences' products are perceived as less competitive in terms of cost-effectiveness or clinical outcomes. For instance, by 2024, many health insurance providers and government bodies are actively comparing drug costs and effectiveness data to secure more favorable terms, directly impacting pharmaceutical companies' pricing strategies.

- Increased Information Access: Online resources and advocacy groups provide extensive data on drug performance and pricing.

- Transparency Initiatives: Mandates for price disclosure and clinical trial data reporting enhance buyer knowledge.

- Demand for Value: Informed customers prioritize cost-effectiveness and superior clinical benefits.

- Negotiating Leverage: Buyers can leverage comparative data to negotiate better terms and pricing.

Reimbursement Policies and Government Regulation

Government healthcare policies and reimbursement regulations, like the Medicare Part D redesign, wield considerable influence over customer purchasing decisions and Gilead Sciences' revenue streams. These evolving policies can steer the payer mix towards segments that demand higher discounts, thereby amplifying customer bargaining power and affecting sales performance.

For instance, changes in reimbursement rates or the introduction of new pricing controls directly impact how much payers are willing to spend on Gilead's products. This can force Gilead to offer greater concessions, effectively increasing the bargaining power of its customers, which include governments, insurance providers, and pharmacy benefit managers.

- Government Regulation Impact: Medicare Part D redesigns can alter patient access and out-of-pocket costs, influencing prescription volumes for Gilead's drugs.

- Payer Mix Shift: A move towards more heavily discounted payer segments can reduce Gilead's average selling price per unit.

- Negotiating Leverage: Increased government oversight and payer consolidation provide customers with greater leverage to negotiate lower prices.

- Revenue Sensitivity: Gilead's revenue is sensitive to these policy shifts, as evidenced by past impacts on drug pricing and market access.

Gilead Sciences faces significant customer bargaining power, primarily from large entities like Pharmacy Benefit Managers (PBMs) and government programs. These powerful buyers, driven by healthcare cost containment, leverage their substantial purchasing volume to negotiate lower prices and demand rebates. This dynamic directly pressures Gilead's revenue and necessitates strategic pricing.

| Customer Type | Bargaining Power Drivers | Impact on Gilead |

|---|---|---|

| PBMs & GPOs | Volume aggregation, formulary control | Price negotiations, rebate demands, market access |

| Government Programs (e.g., Medicare) | Pricing regulations, reimbursement policies | Revenue sensitivity, pricing controls |

| Large Hospital Systems | Bulk purchasing, value-based purchasing | Discount requirements, contract terms |

Preview the Actual Deliverable

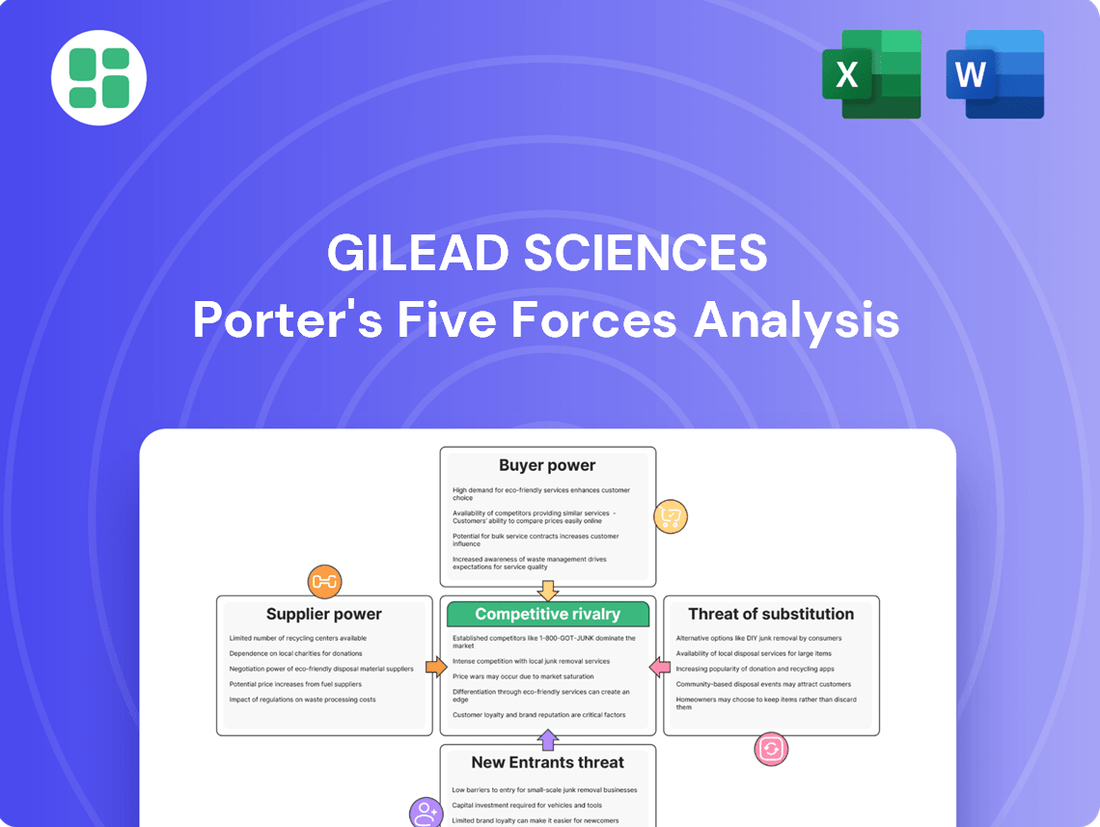

Gilead Sciences Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Gilead Sciences, offering a thorough examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can expect a professionally written and formatted analysis that provides actionable insights into Gilead's competitive landscape.

Rivalry Among Competitors

Gilead Sciences navigates fiercely competitive landscapes within its core therapeutic areas. In HIV, for instance, it contends with major players like ViiV Healthcare and Merck, while the viral hepatitis market sees significant rivalry from AbbVie and others. The oncology sector is particularly dynamic, with numerous companies vying for market share, including giants like Pfizer, Bristol Myers Squibb, and Novartis.

This intense rivalry fuels a constant need for innovation, pushing Gilead to invest heavily in research and development to maintain its edge. For example, in 2023, Gilead's R&D expenses were approximately $3.7 billion, reflecting this commitment to staying ahead. This competitive pressure also translates into significant pricing challenges and a continuous battle to protect and expand market share across its key product lines.

Gilead Sciences faces intense pressure from competitors with robust research and development pipelines, as companies like ViiV Healthcare and Merck continue to invest heavily in discovering and launching innovative treatments. For instance, ViiV Healthcare's focus on long-acting injectables for HIV prevention directly challenges Gilead's established oral therapies.

The success of rival pipelines, particularly in crucial therapeutic areas such as oncology and HIV, significantly intensifies the competitive landscape for Gilead. In 2024, the pharmaceutical industry saw substantial R&D spending, with major players allocating billions to innovation, directly impacting market share and the introduction of next-generation therapies.

Gilead Sciences faces a substantial threat from upcoming patent expirations on several of its major drugs, especially within its highly successful HIV treatment portfolio. For instance, patents for Truvada and Descovy, key components of HIV prevention and treatment, are approaching their expiration dates, creating a significant vulnerability.

This loss of patent protection directly invites generic and biosimilar competitors into the market. These new entrants typically offer their products at substantially lower prices, which can rapidly erode Gilead's market share and lead to significant price reductions for its branded medications.

The impact of generic competition is stark; for example, after the patent expiration of a major drug, the average price can fall by 80-90% within the first year. This dynamic directly pressures Gilead's revenue streams and profitability for these once-dominant therapies.

Strategic Acquisitions and Partnerships

Competitors in the biopharmaceutical sector frequently pursue strategic mergers, acquisitions, and partnerships to bolster their product pipelines and enhance their operational capabilities, especially within rapidly evolving therapeutic areas. This ongoing consolidation reshapes the competitive environment, often introducing potent new market players.

For instance, in 2024, Bristol Myers Squibb completed its acquisition of Karuna Therapeutics for approximately $14 billion, aiming to strengthen its neuroscience portfolio. Similarly, Eli Lilly continued its aggressive expansion through strategic deals, including a significant investment in a new manufacturing facility in 2024 to meet surging demand for its diabetes and obesity drugs.

- M&A Activity: Competitors actively merge, acquire, or partner to gain market share and technological advancements.

- Portfolio Expansion: These moves are particularly focused on high-growth therapeutic areas like oncology and immunology.

- Competitive Landscape Shift: Such transactions can rapidly elevate new companies to major competitor status, impacting established players like Gilead.

Product Differentiation and Innovation Pressure

Gilead Sciences operates in a highly competitive landscape where maintaining market leadership hinges on continuous product differentiation. This means consistently offering therapies with superior efficacy, better safety profiles, or entirely novel mechanisms of action compared to competitors. For instance, in the HIV market, Gilead has historically relied on developing next-generation treatments that offer improved convenience and reduced side effects, a strategy crucial for retaining patient and physician loyalty.

The pressure to innovate is relentless, pushing Gilead to invest heavily in research and development to bring breakthrough therapies to market. This is particularly evident in areas like oncology and liver diseases, where emerging competitors are constantly challenging existing treatment paradigms. Gilead’s significant R&D expenditure, which was approximately $3.4 billion in 2023, underscores this commitment to staying ahead of rivals and securing a competitive edge.

- Innovation in Antivirals: Gilead's development of novel antiviral compounds, such as those targeting complex viral mutations, directly addresses the need for differentiation in a crowded market.

- Oncology Pipeline Advancement: The company’s strategic focus on advancing its oncology pipeline, including CAR T-cell therapies, aims to capture market share by offering innovative cancer treatments.

- HIV Treatment Evolution: Gilead continues to evolve its HIV treatment portfolio, introducing long-acting injectables that differentiate from daily oral regimens, enhancing patient adherence and convenience.

- Investment in Novel Modalities: Significant R&D investment is directed towards exploring new therapeutic modalities, such as antibody-drug conjugates and gene therapies, to create truly differentiated products.

The competitive rivalry for Gilead Sciences is intense, stemming from numerous well-established pharmaceutical giants and emerging biotechs across its key therapeutic areas like HIV, viral hepatitis, and oncology. Companies such as ViiV Healthcare, Merck, AbbVie, Pfizer, Bristol Myers Squibb, and Novartis are formidable rivals, constantly innovating and vying for market share. This pressure necessitates substantial investment in research and development, with Gilead allocating billions annually, for example, $3.7 billion in 2023, to maintain its competitive edge and introduce next-generation therapies.

The threat of patent expirations, particularly for its flagship HIV treatments like Truvada and Descovy, is a significant driver of competitive pressure, opening the door for lower-priced generic alternatives. This dynamic can lead to rapid market share erosion and substantial price reductions, impacting Gilead’s revenue streams. Furthermore, the industry's trend of mergers and acquisitions, such as Bristol Myers Squibb's $14 billion acquisition of Karuna Therapeutics in 2024, continually reshapes the competitive landscape by creating larger, more integrated entities with expanded portfolios.

| Key Competitors | Primary Therapeutic Areas of Overlap | Notable 2024 Strategic Moves (Examples) |

| ViiV Healthcare | HIV | Continued investment in long-acting injectables. |

| Merck | HIV, Oncology | Focus on expanding oncology pipeline and vaccine development. |

| AbbVie | Viral Hepatitis, Immunology | Strategic partnerships to bolster its immunology portfolio. |

| Pfizer | Oncology, Infectious Diseases | Integration of acquired assets, focus on mRNA technology. |

| Bristol Myers Squibb | Oncology, Immunology | Acquisition of Karuna Therapeutics for $14 billion to strengthen neuroscience. |

SSubstitutes Threaten

Patients and healthcare providers might choose alternative treatment regimens for conditions like HIV or hepatitis C that don't involve Gilead's specific drugs. These could include lifestyle changes, surgical options, or other medical approaches. For instance, in HIV management, adherence to antiretroviral therapy (ART) is crucial, but advancements in long-acting injectables or even potential future gene therapies represent substitutes that could shift market dynamics away from daily oral medications.

The increasing availability of generic versions of Gilead Sciences' own drugs, or biosimilars for its biologics, presents a significant threat. These lower-cost alternatives directly substitute Gilead's products, especially as key patents expire.

For instance, the expiration of patents for blockbuster drugs like Sovaldi and Harvoni has already opened the door for generic competition, potentially leading to substantial revenue erosion for Gilead in the coming years.

The threat of substitutes for Gilead Sciences' treatments is significantly influenced by preventive measures and vaccines. For infectious diseases, the widespread adoption of effective vaccines can directly reduce the demand for treatment drugs. This is a crucial factor, particularly in areas like HIV prevention, where Gilead is actively involved in developing new preventative options.

For instance, the ongoing advancements in PrEP (pre-exposure prophylaxis) for HIV, with Gilead being a key player, represent a substitute for treatment. As PrEP becomes more accessible and effective, it could potentially lower the incidence of HIV, thereby impacting the long-term market for HIV therapies. In 2023, the global PrEP market was valued at approximately $1.5 billion and is projected to grow, underscoring the increasing importance of prevention.

Emerging Technologies and Therapies

Advancements in medical science, particularly in areas like gene and cell therapies from competing firms, pose a significant threat of substitution for Gilead Sciences. These novel approaches can bypass traditional drug classes, potentially rendering existing treatments obsolete. For instance, the rapid development of personalized medicine could offer alternatives that are more effective or have fewer side effects than Gilead's current portfolio.

The market is constantly evolving, with new therapeutic modalities emerging that could directly compete with Gilead's established drug franchises. By mid-2024, the pipeline for cell and gene therapies across the biopharmaceutical industry showed substantial growth, with numerous companies investing heavily in these areas. This creates a dynamic environment where a breakthrough therapy from a competitor could quickly disrupt Gilead's market share.

The threat is amplified by the potential for these new therapies to fundamentally alter treatment paradigms. A shift towards curative rather than chronic management approaches, for example, could diminish the long-term revenue streams from Gilead's existing products. This necessitates continuous innovation and adaptation from Gilead to remain competitive.

Key areas of emerging substitution include:

- Gene therapies: Offering potentially one-time cures for genetic disorders, substituting for chronic medication.

- Cell therapies: Utilizing engineered cells to combat diseases like cancer, providing an alternative to chemotherapy or immunotherapy.

- Precision medicine: Tailoring treatments based on individual genetic profiles, which may offer superior efficacy over broader-acting drugs.

- CRISPR-based technologies: Enabling direct genetic editing, which could address the root cause of diseases currently managed by pharmaceuticals.

Off-label Use of Existing Drugs

The threat of substitutes for Gilead Sciences, particularly concerning off-label drug use, presents a unique challenge. Physicians might prescribe existing, perhaps older or less expensive, drugs for conditions that Gilead has patented solutions for. This can siphon off patient populations, indirectly impacting the market share for Gilead's specific, approved indications.

For instance, while not a direct substitute in the traditional sense of a competing product with similar development pathways, the practice of off-label prescribing can effectively divert patients. This diversion can diminish the demand for Gilead's patented therapies, even if those therapies are clinically superior or specifically designed for a particular ailment. This is a nuanced form of substitution that relies on physician discretion rather than direct product competition.

In 2023, the pharmaceutical industry saw continued reliance on off-label prescribing across various therapeutic areas. While specific data for Gilead's portfolio isn't publicly detailed in this context, the broader trend indicates that physicians often turn to established medications when new treatments are costly or when existing drugs show efficacy in unapproved uses. This practice underscores the importance of Gilead's ongoing research and development to demonstrate the clear advantages of its patented offerings.

Key considerations regarding off-label use as a substitute threat include:

- Physician Prescribing Practices: The willingness of doctors to prescribe off-label can directly impact Gilead's market penetration for specific indications.

- Cost-Effectiveness: Older, off-patent drugs are often more affordable, making them an attractive substitute for patients and healthcare systems.

- Unmet Medical Needs: In cases where Gilead's patented drugs have limitations or side effects, physicians may explore off-label alternatives.

- Regulatory Landscape: While off-label prescribing is common, the regulatory environment and payer policies can influence its prevalence.

The threat of substitutes for Gilead Sciences is significant, encompassing alternative treatments, generics, prevention strategies, and novel therapies. For instance, advancements in long-acting injectables or potential gene therapies for HIV could shift market dynamics away from daily oral medications. In 2023, the global PrEP market, a preventative substitute for HIV treatment, was valued at approximately $1.5 billion, highlighting the growing importance of prevention.

The expiration of patents for key drugs like Sovaldi and Harvoni has already paved the way for generic competition, directly impacting Gilead's revenue streams. Furthermore, emerging cell and gene therapies from competitors, offering potentially curative solutions, pose a substantial threat by bypassing traditional drug classes and altering treatment paradigms. By mid-2024, the biopharmaceutical industry's investment in these advanced therapies underscored this disruptive potential.

| Substitute Type | Example for Gilead | Impact on Gilead | Relevant Data Point (2023/2024) |

|---|---|---|---|

| Alternative Treatment Regimens | Long-acting injectables for HIV | Reduced demand for daily oral ART | Growing market for long-acting injectables |

| Generic/Biosimilar Competition | Generic versions of Hepatitis C drugs | Revenue erosion due to lower pricing | Patent expiries leading to increased generic entry |

| Preventive Measures | HIV PrEP | Lower incidence reduces treatment demand | Global PrEP market valued at ~$1.5 billion (2023) |

| Novel Therapies | Gene/Cell therapies for genetic disorders | Potential obsolescence of existing chronic treatments | Significant industry investment in cell & gene therapy pipelines (mid-2024) |

Entrants Threaten

The biopharmaceutical sector, where Gilead Sciences operates, is characterized by extraordinarily high research and development (R&D) expenditures. Developing a new drug can cost billions of dollars, with estimates often exceeding $2 billion per approved drug. This massive financial outlay, coupled with a high probability of failure at various clinical trial stages, presents a formidable barrier for any new company looking to enter the market.

Stringent regulatory approval processes, such as the U.S. Food and Drug Administration (FDA) review, present a significant threat to new entrants in the biopharmaceutical industry. These processes demand extensive and costly clinical trials, often spanning many years, to demonstrate drug safety and efficacy. For instance, the average development time for a new drug from discovery to market approval was approximately 10 years as of recent data, with costs often exceeding $2 billion.

Gilead Sciences benefits significantly from strong intellectual property and patent protection for its groundbreaking pharmaceuticals. This legal shield prevents competitors from easily replicating their successful treatments, granting Gilead a crucial period of market exclusivity. For instance, in 2023, Gilead's revenue from its HIV franchise, heavily reliant on patent-protected therapies, remained a substantial contributor to its overall financial performance, underscoring the value of these protections.

Economies of Scale and Established Distribution Networks

Gilead Sciences, like many established pharmaceutical giants, benefits significantly from economies of scale. This means they can produce drugs at a lower cost per unit due to high-volume manufacturing. For instance, in 2023, Gilead reported a total revenue of $27.0 billion, indicating substantial production and sales volumes that new entrants would find difficult to match.

Newcomers face a steep challenge in replicating Gilead's extensive distribution networks and deep-rooted relationships with healthcare providers and payers. Building these channels and gaining trust takes considerable time and investment, creating a substantial barrier. Gilead's established presence ensures their products reach patients efficiently, a feat that requires immense capital and strategic partnerships for any new competitor.

- Economies of Scale: Gilead's large-scale operations lead to lower per-unit costs in research, development, manufacturing, and marketing, making it hard for smaller companies to compete on price.

- Established Distribution: The company possesses well-developed supply chains and strong relationships with pharmacies, hospitals, and doctors, ensuring broad market access.

- Brand Recognition and Trust: Years of successful product launches and patient treatment have built significant brand equity and trust among healthcare professionals and patients.

- Regulatory Expertise: Navigating complex regulatory pathways for drug approval is a costly and time-consuming process, which Gilead has mastered over decades.

Brand Loyalty and Physician Trust

Gilead Sciences has built substantial brand loyalty and physician trust, especially within its established HIV treatment portfolio. This deep-seated recognition and reliance on Gilead's therapies create a significant barrier for new competitors aiming to penetrate the market and challenge existing, highly regarded treatments.

The company's consistent delivery of effective and innovative solutions has fostered a strong, almost ingrained, preference among healthcare providers. For instance, Gilead's HIV medications have long been considered gold standards, making it difficult for newer entrants to convince physicians to switch from familiar and proven regimens.

This loyalty translates into a formidable hurdle for new entrants. They must not only offer comparable or superior efficacy but also overcome the inertia and established relationships that Gilead has cultivated over years of reliable performance and physician education.

Gilead's strong brand equity means new entrants face an uphill battle to gain market share, requiring substantial investment in marketing and clinical data to even begin chipping away at the trust and loyalty already in place.

The threat of new entrants for Gilead Sciences is relatively low, primarily due to the immense capital required for research and development, coupled with lengthy and complex regulatory approval processes. For example, the average cost to bring a new drug to market can exceed $2 billion, a substantial barrier for any newcomer.

Gilead's established patent portfolio and economies of scale further solidify this position. Their ability to produce at high volumes, as evidenced by their $27.0 billion revenue in 2023, allows for cost efficiencies that are difficult for nascent companies to match. Furthermore, extensive distribution networks and strong physician relationships built over years create significant hurdles for new entrants seeking market access and acceptance.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High R&D costs (>$2 billion per drug) | Very High |

| Regulatory Hurdles | Lengthy FDA approval processes (avg. 10 years) | Very High |

| Intellectual Property | Patent protection on key therapies | High |

| Economies of Scale | Lower per-unit costs due to high volume production | High |

| Distribution & Relationships | Established networks and physician trust | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gilead Sciences is built upon a foundation of comprehensive data, including Gilead's annual reports, SEC filings, and investor presentations. We also incorporate insights from reputable industry research firms and pharmaceutical market intelligence reports to capture competitive dynamics.