GERRY WEBER International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GERRY WEBER International Bundle

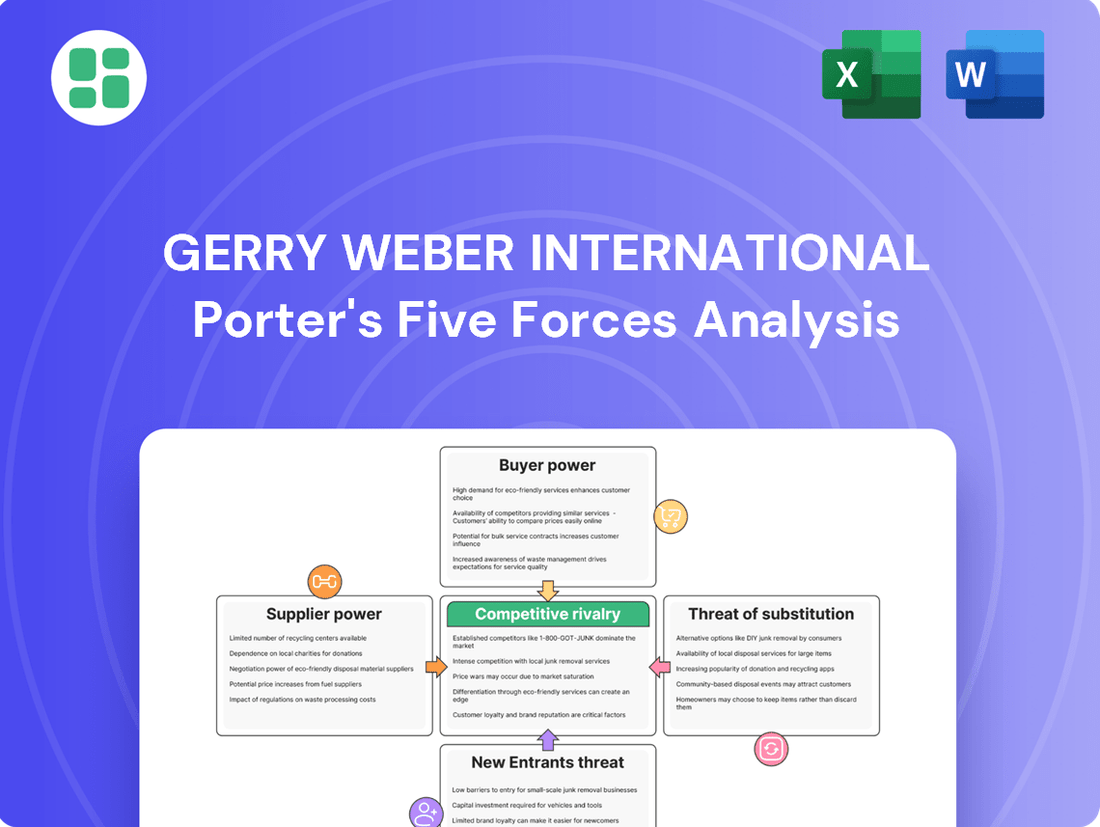

GERRY WEBER International faces significant competitive pressures from rivals and the threat of new entrants in the fashion retail landscape. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping GERRY WEBER International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for sustainable fabrics is quite concentrated, meaning there aren't many suppliers offering these specialized eco-friendly and ethically sourced materials. This limited supply gives these suppliers more leverage. For instance, if GERRY WEBER wants to increase its offering of sustainable clothing, it might find it difficult to switch suppliers if current ones increase prices or change their contract terms.

The increasing consumer and industry demand for sustainable options further strengthens the bargaining power of these niche suppliers. This trend means they can often dictate pricing and other conditions more readily, as companies like GERRY WEBER are eager to meet these growing environmental expectations. In 2024, the global market for sustainable textiles was projected to reach over $10 billion, highlighting the significant demand and potential for supplier influence.

The textile industry continues to grapple with significant supply chain challenges, marked by escalating transportation expenses, persistent shipping delays, and various international trade restrictions. These factors collectively complicate the efficient movement of raw materials and finished goods, directly impacting operational costs for fashion brands.

Inflationary pressures are particularly squeezing profit margins for textile manufacturers. For instance, the cost of cotton, a key raw material, saw a notable increase throughout 2023 and into early 2024, directly affecting the cost of production for brands like GERRY WEBER. This upward trend in raw material prices grants suppliers greater leverage in their pricing negotiations.

Consumers and regulators are increasingly demanding transparency and accountability in supply chains, pushing brands to uphold fair labor practices and sustainable sourcing. This trend significantly influences the bargaining power of suppliers who can meet these evolving standards.

GERRY WEBER International demonstrates a commitment to ethical sourcing by requiring its suppliers to sign a Code of Conduct and Social Compliance Agreement. This focus on ethical standards means that suppliers who can prove adherence to fair labor practices and sustainability are in a stronger position to negotiate terms.

The emphasis on certified and ethical production can, however, limit the pool of eligible suppliers. This reduction in available options naturally increases the bargaining power of those suppliers who consistently meet GERRY WEBER's stringent ethical and quality criteria, potentially leading to higher costs or more favorable terms for these select partners.

Technological Advancements in Textile Production

Technological advancements like automation, AI, and machine learning are revolutionizing textile production, boosting efficiency and optimizing processes. These innovations, however, demand substantial capital investment. Suppliers capable of adopting these cutting-edge technologies may find themselves in a stronger position, able to offer superior products and services, thereby increasing their bargaining power with companies like GERRY WEBER.

For GERRY WEBER, this translates to a potential shift in supplier dynamics. Suppliers who have embraced automation and AI could command higher prices due to their enhanced production capabilities and potential for greater product traceability. This could particularly impact GERRY WEBER’s sourcing strategies, as it may need to partner with technologically advanced suppliers to maintain its competitive edge.

- Increased Supplier Investment: The adoption of advanced manufacturing technologies in textiles requires significant capital outlay, potentially creating a barrier for smaller suppliers.

- Enhanced Supplier Value: Suppliers integrating automation and AI can offer more efficient, consistent, and traceable production, increasing their perceived value.

- Shifting Bargaining Power: Technologically advanced suppliers may gain leverage, allowing them to negotiate more favorable terms with buyers like GERRY WEBER.

- Impact on Sourcing: GERRY WEBER may need to prioritize partnerships with suppliers demonstrating technological adoption to ensure quality and efficiency in its supply chain.

GERRY WEBER's Financial Restructuring Impact

GERRY WEBER's recent financial difficulties, including insolvencies and restructuring in 2023 and early 2024, have significantly impacted its pre-order volumes from retailers, potentially weakening its bargaining position with suppliers. While some key partners have expressed support for a viable continuation plan, suppliers might perceive increased risk, leading them to demand more stringent payment terms or higher prices.

This shift could translate into a reduced bargaining power for GERRY WEBER, as suppliers may leverage the company's financial instability to secure more favorable agreements. For instance, a supplier previously willing to offer extended credit might now insist on upfront payments or shorter payment windows, impacting GERRY WEBER's cash flow.

- Supplier Risk Perception: GERRY WEBER's financial distress increases the perceived risk for suppliers, potentially leading to less favorable terms.

- Pre-Order Impact: A sharp drop in pre-orders from retailers, a consequence of the restructuring, directly affects the volume commitments suppliers rely on.

- Negotiating Leverage: Suppliers may gain leverage, demanding stricter payment terms or price increases to mitigate their exposure to a financially challenged partner.

- Operational Continuity: While operational partners signal support, the financial strain could still test supplier willingness to maintain current service levels and pricing without adjustments.

The concentration within the sustainable fabric market, coupled with rising consumer demand for eco-friendly options, significantly bolsters supplier bargaining power. This means suppliers can often dictate terms, as demonstrated by the over $10 billion global sustainable textile market in 2024. Additionally, industry-wide supply chain disruptions, including increased transportation costs and trade restrictions, further empower suppliers by complicating sourcing for brands like GERRY WEBER.

Escalating raw material costs, such as the notable increase in cotton prices through early 2024, directly enhance supplier leverage in price negotiations. Companies like GERRY WEBER must also contend with increasing demands for supply chain transparency and ethical labor practices, which strengthens the position of suppliers who can meet these stringent criteria. This focus can limit the supplier pool, giving certified and ethical producers greater negotiating power.

Technological advancements in textile production, like AI and automation, require substantial investment, creating a barrier for some suppliers but empowering those who adopt them. These technologically advanced suppliers can offer superior products and traceability, allowing them to negotiate more favorable terms, potentially increasing costs for GERRY WEBER. The company's financial restructuring in 2023-2024 also weakens its position, with suppliers potentially demanding stricter payment terms or higher prices due to perceived risk.

| Factor | Impact on Supplier Bargaining Power | Relevance to GERRY WEBER |

| Market Concentration (Sustainable Fabrics) | High | Limited switching options for GERRY WEBER |

| Consumer Demand for Sustainability | High | Increases supplier pricing power |

| Supply Chain Disruptions | Moderate to High | Increases operational costs and supplier leverage |

| Raw Material Cost Increases (e.g., Cotton) | High | Directly impacts GERRY WEBER's cost of goods |

| Ethical/Transparency Demands | High | Favors compliant suppliers, potentially limiting GERRY WEBER's options |

| Technological Adoption by Suppliers | Moderate to High | Empowers advanced suppliers, potentially leading to higher costs for GERRY WEBER |

| GERRY WEBER's Financial Instability | High | Weakens GERRY WEBER's negotiating position, increases supplier risk premium |

What is included in the product

This analysis unpacks the competitive forces shaping GERRY WEBER International's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the fashion industry.

Effortlessly visualize the competitive landscape for GERRY WEBER International with a dynamic spider chart, instantly highlighting key pressure points across all five forces.

Customers Bargaining Power

Consumers are definitely watching their wallets more closely these days. Many are cutting back on fashion purchases, prioritizing value and looking for items that last. This means they're more likely to shop around for the best prices, making it harder for brands to rely solely on style to keep customers.

In 2024, this price sensitivity is a major factor. For instance, reports indicate a significant shift towards discount retailers, with some segments of the apparel market seeing growth primarily in the off-price sector. This highlights that customers have substantial power to influence pricing and demand by readily comparing options and seeking promotions, impacting GERRY WEBER's ability to maintain premium pricing based on fashion alone.

The accelerating shift towards omnichannel and e-commerce has amplified customer bargaining power. With online platforms, consumers can effortlessly compare prices, product features, and reviews across numerous brands, forcing companies to compete more aggressively on value and convenience. This digital landscape empowers shoppers with readily available information, making them less reliant on single retailers.

In Germany, online retail continues its upward trajectory, particularly within the fashion sector. Data from 2024 indicates that a substantial portion of German adults regularly engage in online shopping, with apparel and accessories being a key category. This trend necessitates that companies like GERRY WEBER International invest heavily in seamless e-commerce experiences and integrated multi-channel strategies to cater to evolving consumer demands for accessibility and personalized service.

Consumers are increasingly scrutinizing brands for their environmental impact and ethical treatment of workers. This shift means that companies like GERRY WEBER must demonstrate genuine commitment to sustainability and fair labor practices to retain customer loyalty. For instance, a 2024 survey indicated that 60% of consumers consider a brand's sustainability efforts when making purchasing decisions.

While cost is always a factor, a growing segment of the market actively seeks out and is willing to pay a premium for products made with recycled materials or produced under fair trade conditions. GERRY WEBER's investment in certified sustainable materials directly addresses this demand, as failing to do so risks alienating these conscious consumers and potentially losing market share to more transparent competitors.

Impact of Brand Reputation and Restructuring News

GERRY WEBER's recurring insolvency proceedings and restructuring initiatives, which have led to store closures and job cuts, can significantly erode customer confidence and brand loyalty. Despite periods where sales in their retail locations remained stable, the constant stream of negative publicity can make consumers wary, giving them greater leverage to opt for brands perceived as more secure and reputable.

The bargaining power of customers is amplified when a brand's stability is in question. For GERRY WEBER, this translates to customers having more sway in their purchasing decisions, potentially demanding better prices or simply shifting their patronage to competitors. This dynamic was evident as the company navigated its financial challenges.

- Brand Perception: Repeated restructuring can damage the perception of quality and reliability.

- Customer Hesitancy: Negative news may cause customers to delay or avoid purchases.

- Increased Leverage: Customers can use their choices to pressure the company or seek alternatives.

- Competitive Shift: Consumers may gravitate towards competitors with stronger financial footing and positive brand image.

Influence of Social Media and Personalization

Social media and the demand for personalized experiences significantly boost customer bargaining power. In 2024, a substantial portion of consumers, often exceeding 60%, consult platforms like Instagram and TikTok to research brands before making a purchase. This digital engagement provides consumers with extensive information and direct comparison capabilities, strengthening their position.

The drive for hyper-personalization, fueled by AI and data analytics, further empowers customers. They expect tailored product recommendations and customized shopping journeys, forcing companies to invest in sophisticated customer relationship management. This shift means brands must actively engage across digital touchpoints to meet evolving consumer expectations and maintain loyalty.

- Consumer Research Habits: Over 60% of consumers in 2024 research brands on social media before buying.

- Personalization Demand: Consumers increasingly expect AI-driven personalized product suggestions and experiences.

- Information Access: Digital platforms provide consumers with unprecedented access to product information and competitor comparisons.

- Brand Engagement: Companies must actively engage on social media to influence purchasing decisions and build loyalty.

Customer bargaining power remains a significant force for GERRY WEBER, particularly with increased price sensitivity observed in 2024. Consumers are actively comparing options and seeking value, making it harder for brands to command premium prices based solely on fashion. This trend is further amplified by the ease of online price comparison and the growing influence of social media for research, giving customers more leverage than ever.

The company's past financial instability and restructuring have also played a role, potentially eroding customer confidence and encouraging a shift towards more stable competitors. As consumers increasingly prioritize brands that demonstrate financial security and positive brand perception, GERRY WEBER faces pressure to not only offer competitive pricing but also to rebuild trust and loyalty.

In 2024, the digital landscape empowers consumers with readily available information, making them less reliant on single retailers and forcing companies to compete aggressively on value and convenience. This necessitates substantial investment in seamless e-commerce and multi-channel strategies to meet evolving demands for accessibility and personalized service.

Furthermore, a growing consumer segment in 2024 actively seeks out and is willing to pay more for sustainable and ethically produced goods. For GERRY WEBER, failing to demonstrate genuine commitment in these areas risks alienating conscious consumers and losing market share to more transparent competitors.

What You See Is What You Get

GERRY WEBER International Porter's Five Forces Analysis

This preview showcases the complete GERRY WEBER International Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the fashion industry. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for immediate application.

Rivalry Among Competitors

The women's apparel market in Germany and Europe is a crowded space, featuring a vast array of businesses from boutique shops to global fashion giants. This fragmentation means GERRY WEBER is up against a multitude of rivals, each vying for consumer attention across different price segments and fashion trends.

In 2024, the German apparel market alone is projected to reach approximately €36.6 billion, highlighting the sheer scale of competition GERRY WEBER navigates. The presence of numerous independent retailers and established brands creates a dynamic environment where differentiation is key to survival and growth.

The fashion industry faces heightened competition from online giants like Zalando, which provides an extensive selection and often aggressive pricing. This digital marketplace dominance forces established brands, including GERRY WEBER, to continuously refine their e-commerce presence and customer engagement strategies to stand out.

The rapid ascent of ultra-fast fashion players, exemplified by Shein and Temu, further intensifies this rivalry. These newcomers leverage speed and affordability, setting new benchmarks for product turnover and consumer expectations, compelling traditional retailers to innovate their supply chains and marketing approaches to maintain market share.

GERRY WEBER's recurring financial instability, marked by multiple insolvency proceedings, significantly erodes its competitive rivalry. The company's deep restructuring efforts, including the sale of its own brands and the focus on licensing, highlight a struggle to maintain market share against more financially robust competitors.

The company's strategic adjustments, driven by a challenging consumer climate and declining pre-orders, underscore its difficulty in competing effectively. For instance, in 2023, GERRY WEBER reported a revenue of €330.9 million, a decrease from the previous year, reflecting these ongoing market pressures and internal challenges.

Shifting Consumer Preferences and Market Slowdown

The fashion industry, especially for non-essential apparel, is navigating a noticeable growth slowdown. This is largely attributed to economic uncertainty and a general trend of consumers becoming more cautious with their discretionary spending. In 2023, global retail sales growth for apparel and footwear was projected to be modest, reflecting this cautious sentiment.

This economic climate naturally amplifies competitive rivalry. Brands are intensely vying for a larger slice of a shrinking pie of consumer spending. Companies are therefore compelled to differentiate themselves not just on price, but also on other key factors.

Consumers are increasingly prioritizing value for money, ethical and sustainable production practices, and unique shopping experiences. This shift in consumer focus forces brands to innovate rapidly to capture and retain market interest. For instance, a growing segment of consumers actively seeks out brands with transparent supply chains and eco-friendly materials, influencing purchasing decisions significantly.

- Economic Uncertainty Impacts Spending: Global economic headwinds in 2023 and early 2024 led to a more conservative approach to discretionary purchases, including fashion items.

- Value and Sustainability Drive Choices: Consumer surveys from late 2023 and early 2024 consistently highlight value and sustainability as key purchasing drivers, pressuring brands to adapt their offerings and messaging.

- Intensified Competition for Market Share: With slower overall market growth, brands are experiencing heightened competition, leading to increased promotional activities and a greater emphasis on brand loyalty programs.

- Innovation as a Differentiator: Brands that successfully integrate innovative designs, sustainable materials, and engaging customer experiences are better positioned to stand out in a crowded and challenging market.

Differentiation through Brand Identity and Multi-channel Strategy

GERRY WEBER differentiates itself through distinct core brands: GERRY WEBER, TAIFUN, and SAMOON, each targeting women with modern, high-quality fashion. This brand portfolio aims to capture a broad segment of the fashion-conscious female demographic, a key strategy in a crowded marketplace.

The company's multi-channel sales approach, encompassing wholesale, direct retail, and a robust e-commerce presence, ensures accessibility and convenience for its customers. This integrated strategy is vital for maintaining customer loyalty and attracting new shoppers amidst intense competition.

- Brand Portfolio: GERRY WEBER, TAIFUN, SAMOON

- Target Audience: Women seeking modern, high-quality fashion

- Sales Channels: Wholesale, Retail, E-commerce

- Competitive Imperative: Brand differentiation and channel integration are critical for customer retention and acquisition.

The competitive rivalry for GERRY WEBER is exceptionally high due to a fragmented European apparel market, where numerous players compete across various price points and styles.

In 2024, the German apparel market's estimated €36.6 billion value underscores the intense battle for market share, further exacerbated by online giants like Zalando and the rapid growth of ultra-fast fashion brands.

GERRY WEBER's own financial challenges, including restructuring and insolvency proceedings, weaken its position against more financially stable competitors, making differentiation and customer retention paramount.

The company's strategy relies on its core brands—GERRY WEBER, TAIFUN, and SAMOON—and a multi-channel sales approach to navigate this fierce competitive landscape.

| Brand | Target Audience | Key Strategy | Competitive Factor |

|---|---|---|---|

| GERRY WEBER | Women seeking modern, high-quality fashion | Brand differentiation | Market share capture |

| TAIFUN | (Implicitly women) | Brand differentiation | Market share capture |

| SAMOON | (Implicitly women) | Brand differentiation | Market share capture |

| Overall | European women | Multi-channel sales (Wholesale, Retail, E-commerce) | Customer retention and acquisition |

SSubstitutes Threaten

The burgeoning second-hand and rental fashion markets pose a substantial threat of substitution for traditional apparel retailers like GERRY WEBER. Consumers are increasingly drawn to these options for their affordability and environmental benefits, diverting spending away from new purchases. For instance, the global second-hand apparel market was projected to reach $350 billion by 2027, according to ThredUp's 2023 Resale Report.

Major fashion brands are acknowledging this shift by incorporating resale or rental services. This strategic pivot suggests a recognition of evolving consumer values, where sustainability and cost-effectiveness are becoming key purchasing drivers. Brands like Levi's and Patagonia have embraced resale programs, indicating a broader industry trend that directly challenges the demand for new GERRY WEBER garments.

Consumers are increasingly price-sensitive, leading to a significant rise in 'dupe' purchases. Nearly 30% of shoppers actively seek out lower-priced alternatives that mimic premium products, directly impacting demand for established brands.

This trend is amplified by the growing popularity of private label brands. These store-owned products offer compelling value propositions, presenting a direct substitute for GERRY WEBER's offerings and challenging brand loyalty.

European consumers are increasingly prioritizing value and longevity, leading to a growing preference for capsule wardrobes. This trend, which emphasizes versatile and durable clothing items, directly impacts the fast fashion model. For instance, a 2024 survey indicated that over 60% of European fashion consumers are now actively seeking out garments with a longer lifespan.

This shift away from frequent seasonal purchases means that brands like GERRY WEBER face a reduced demand for new collections. Consumers are opting to invest in fewer, higher-quality pieces that can be mixed and matched, thereby lowering their overall purchase frequency. This poses a significant threat as it directly curtails the volume of sales for new, trend-driven items.

Availability of Diverse Fashion Alternatives

The vast apparel market presents numerous substitutes for GERRY WEBER's offerings. Consumers can opt for fast fashion brands, vintage or secondhand clothing, or even engage in DIY fashion projects. These alternatives can siphon consumer spending, particularly as environmental consciousness grows, making the threat of substitutes significant.

For instance, the global secondhand apparel market was valued at approximately $100 billion in 2023 and is projected to reach $350 billion by 2027, demonstrating a substantial shift in consumer preferences towards more sustainable and budget-friendly options. This growing segment directly competes with traditional new apparel retailers like GERRY WEBER.

- Fast Fashion Dominance: Brands like Shein and Zara offer trendy, low-cost clothing, directly appealing to price-sensitive consumers.

- Secondhand Market Growth: Platforms like Vinted and Depop are experiencing rapid expansion, making pre-owned clothing increasingly accessible and desirable.

- DIY and Upcycling Trends: A growing movement encourages consumers to create or modify their own clothing, reducing reliance on new purchases.

- Rental Services: Clothing rental services provide access to designer and occasion wear without the commitment of ownership, further fragmenting the market.

Changing Lifestyles and Athleisure Trends

The rise of athleisure and casual wear presents a significant threat of substitutes for traditional women's apparel. Consumers increasingly prioritize comfort and versatility, blurring the lines between activewear and everyday fashion. This shift means that items like leggings, stylish sneakers, and comfortable knitwear can replace dresses, skirts, and more structured outfits for many occasions.

Brands like Lululemon and Nike have capitalized on this trend, with athleisure sales continuing to grow. For instance, the global activewear market was valued at approximately $352 billion in 2023 and is projected to reach around $570 billion by 2029, indicating a strong consumer preference for these comfortable alternatives. GERRY WEBER, if not adapting its product offerings to include more casual and versatile pieces, faces the risk of losing customers to competitors who cater to these evolving lifestyle demands.

- Athleisure's Dominance: The athleisure market continues its upward trajectory, with consumers embracing comfort-driven fashion for a wider range of activities.

- Lifestyle Shift: Changing daily routines and a greater emphasis on work-life balance contribute to the demand for adaptable clothing.

- Brand Adaptation: Fashion brands that successfully integrate athleisure elements into their collections are better positioned to retain and attract customers.

- Market Share Risk: Companies failing to acknowledge and respond to the growing popularity of casual and athletic wear risk ceding market share to more agile competitors.

The surge in the secondhand and rental fashion markets presents a significant threat to GERRY WEBER. Consumers are increasingly opting for these more affordable and sustainable alternatives, diverting spending from new apparel purchases. This trend is underscored by the global second-hand apparel market's projected growth to $350 billion by 2027, as reported by ThredUp in 2023.

Furthermore, the growing popularity of private label brands and the consumer trend towards 'dupes' directly challenge established brands like GERRY WEBER. Nearly 30% of shoppers actively seek lower-priced alternatives that mimic premium products, impacting demand for higher-priced new items.

The increasing preference for capsule wardrobes and durable clothing, particularly in Europe, means consumers are buying less frequently. A 2024 survey indicated over 60% of European fashion consumers seek longer-lasting garments, reducing the need for seasonal GERRY WEBER collections.

| Substitute Category | Key Drivers | Impact on GERRY WEBER |

| Secondhand & Rental Market | Affordability, sustainability, access to variety | Reduced demand for new items, potential market share loss |

| Fast Fashion | Low price point, trend responsiveness | Direct competition on price and trend relevance |

| Private Labels & Dupes | Value for money, accessibility | Erosion of brand loyalty, price pressure |

| Capsule Wardrobes & Durability | Longevity, versatility, reduced consumption | Lower purchase frequency, decreased sales volume for new collections |

Entrants Threaten

The significant capital needed to establish a physical fashion retail presence, encompassing prime real estate leases, substantial initial inventory purchases, and extensive marketing campaigns, acts as a formidable deterrent for aspiring competitors. Established brands like GERRY WEBER leverage their existing store networks and brand equity, creating a substantial hurdle for new entrants aiming to achieve comparable market penetration and visibility.

The threat of new entrants for GERRY WEBER is amplified by the significantly lower barriers to entry in the e-commerce space. Unlike traditional brick-and-mortar retail, which requires substantial investment in physical locations, inventory, and staffing, online platforms allow new businesses to launch with minimal overhead. This ease of entry means that digitally native brands can emerge and quickly gain traction, directly challenging GERRY WEBER's online sales channels and its relationships with wholesale partners.

Established brands like GERRY WEBER benefit from deep-rooted customer loyalty, a significant barrier for newcomers. In 2024, the fashion retail landscape continues to see consumers gravitating towards brands they trust, making it difficult for new entrants to gain traction without substantial investment in marketing and a compelling unique selling proposition.

Challenges in Building Resilient Supply Chains

New entrants in the fashion sector, including brands like GERRY WEBER, grapple with substantial barriers when constructing robust supply chains. These challenges are amplified by persistent global disruptions, escalating labor expenses, and intricate geopolitical landscapes. For instance, the average lead time for apparel production can extend to six months, making it difficult for new players to react swiftly to market shifts or secure consistent material flow.

Building agility and diversifying sourcing are critical for resilience, but these strategies demand significant upfront investment and established relationships, which are often lacking for newcomers. In 2024, the cost of raw materials like cotton saw fluctuations, with some varieties increasing by as much as 15% year-over-year, further complicating cost management for emerging brands.

- Supply Chain Complexity: New entrants face difficulties in navigating complex global logistics and securing reliable manufacturing partners, particularly in regions affected by trade tensions or natural disasters.

- Rising Costs: Increased costs for raw materials, labor, and transportation in 2024 present a significant financial hurdle for brands trying to establish competitive pricing.

- Ethical Sourcing Demands: Growing consumer and regulatory pressure for ethical and sustainable sourcing requires new entrants to invest heavily in supply chain transparency and compliance from the outset.

- Geopolitical Instability: Political unrest and trade policy changes in key manufacturing hubs can disrupt production and create uncertainty, making long-term supply chain planning arduous for those without established contingency plans.

Regulatory and Sustainability Compliance Demands

The fashion industry, including brands like GERRY WEBER, faces escalating regulatory and sustainability compliance demands. These requirements act as a significant barrier to entry for new players. For instance, the European Union's proposed Ecodesign for Sustainable Products Regulation (ESPR) aims to set stringent environmental standards for a wide range of products, including textiles. New entrants must therefore build their entire supply chain with these evolving regulations in mind from day one, which can necessitate substantial upfront investment in compliance and ethical sourcing.

New fashion brands must also contend with growing consumer expectations for ethical production and environmental responsibility. This translates into a need for transparency across the entire value chain, from raw material sourcing to manufacturing processes. For example, many consumers now actively seek out certifications like GOTS (Global Organic Textile Standard) or Fair Trade. Establishing these credentials and maintaining transparent operations can require considerable financial commitment and robust internal systems, making it harder for nascent companies to compete with established players who may already have these processes in place.

- Increasing Regulatory Burden: New entrants must navigate complex and evolving environmental and social regulations, such as the EU's ESPR, impacting product design and lifecycle.

- Sustainability Investment: Significant capital is required for new brands to implement and certify sustainable practices across their entire value chain, from sourcing to production.

- Consumer Demand for Ethics: Brands need to demonstrate transparency and adherence to ethical standards, often requiring certifications like GOTS or Fair Trade, which adds to initial costs.

While the digital realm offers lower entry costs, the fashion industry, including brands like GERRY WEBER, still presents significant barriers for new entrants. These include the substantial capital required for physical retail, the need for strong brand equity, and the challenge of building consumer loyalty in a crowded market.

New players must also overcome complex supply chains, navigate rising costs for materials and labor, and meet increasing demands for ethical and sustainable practices. For example, in 2024, the cost of cotton saw increases of up to 15% year-over-year, impacting new brands' ability to price competitively.

| Barrier | Description | 2024 Impact/Example |

|---|---|---|

| Capital Investment (Physical Retail) | High costs for prime real estate, inventory, and marketing. | Securing a prime retail location can cost hundreds of thousands of euros in rent and fit-out. |

| Brand Equity & Loyalty | Established brands have existing customer bases and recognition. | Consumers in 2024 continue to favor trusted brands, making it hard for newcomers to capture market share without significant marketing spend. |

| Supply Chain Complexity & Costs | Navigating global logistics, securing manufacturing, and dealing with rising input costs. | Average apparel production lead times can be six months; raw material costs, like cotton, increased by up to 15% in 2024. |

| Regulatory & Sustainability Demands | Compliance with environmental and social standards and consumer expectations. | Meeting EU's ESPR or obtaining certifications like GOTS requires substantial upfront investment for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GERRY WEBER International is built upon a foundation of publicly available financial reports, including annual and quarterly statements, alongside industry-specific market research and competitor analysis from reputable sources.

We leverage data from industry associations, trade publications, and economic databases to understand the broader market landscape and the specific competitive dynamics affecting GERRY WEBER International.