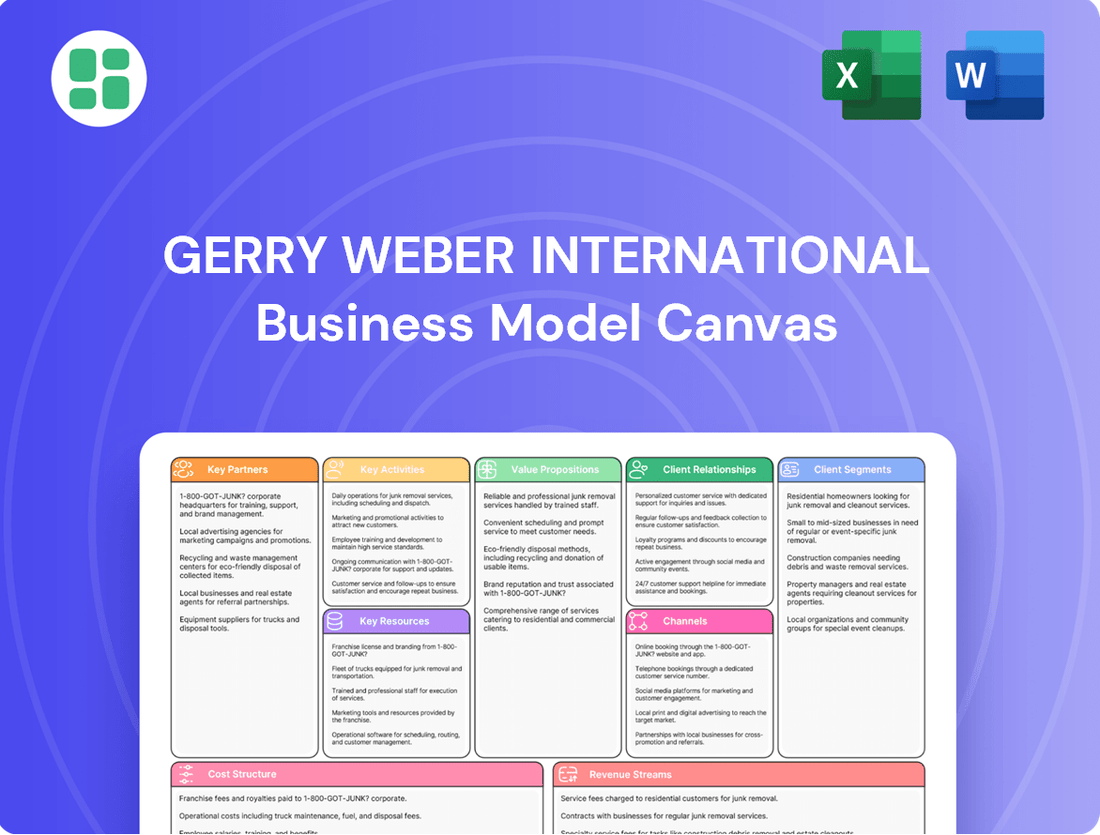

GERRY WEBER International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GERRY WEBER International Bundle

Uncover the strategic core of GERRY WEBER International's operations with our comprehensive Business Model Canvas. This detailed analysis illuminates how they connect with customers, manage resources, and generate revenue in the dynamic fashion industry. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

The acquisition of GERRY WEBER's trademark rights by Spain's Victrix Group, the owner of Punt Roma, marks a pivotal moment, establishing Victrix as the primary strategic ally and new proprietor of the brand.

This alliance fundamentally reshapes GERRY WEBER's operational framework, with Victrix now steering both production and the design of upcoming collections, a crucial move for the brand's ongoing viability and its future sales approach.

This partnership is absolutely essential for GERRY WEBER's survival and its roadmap for future distribution, ensuring its presence in the market continues.

GERRY WEBER's future sales strategy hinges on its multi-brand retail partners across Germany and Europe. These partners are now the primary channel for selling GERRY WEBER women's fashion directly to customers, a significant shift from the previous model of company-owned stores.

This strategic pivot underscores a strong move towards a wholesale-focused distribution approach. For instance, in 2023, GERRY WEBER reported a significant portion of its revenue generated through wholesale channels, reflecting the growing importance of these partnerships.

Victrix Group now handles production, relying on a network of global manufacturers and logistics providers. This ensures GERRY WEBER, TAIFUN, and SAMOON products are sourced efficiently and ethically, reaching customers on time. In 2024, GERRY Weber's supply chain optimization efforts, driven by these partnerships, were a significant focus for operational improvement.

Technology and E-commerce Platform Providers

Victrix, the new owner of the GERRY WEBER brand, will likely lean on technology and e-commerce platform providers to maintain and grow its digital presence, even as the company shutters its own brick-and-mortar stores. These partnerships are crucial for enabling online sales through third-party channels.

Key partnerships would include:

- E-commerce Platform Providers: Collaborating with established platforms like Shopify, Magento, or other marketplace solutions to facilitate online sales and manage inventory efficiently.

- Digital Marketing Agencies: Engaging specialized agencies to drive customer acquisition and brand awareness through targeted online advertising, social media campaigns, and search engine optimization.

- Advanced Analytics Firms: Partnering with firms that can provide insights into customer behavior, sales trends, and market dynamics to optimize digital strategies and product offerings.

Financial and Restructuring Advisors

GERRY WEBER International AG's recent insolvency proceedings highlighted the crucial role of financial and restructuring advisors. These experts guided the company through a complex financial reorganization, a process that is often fraught with challenges and requires specialized knowledge.

These partnerships were instrumental in navigating the intricate legal and financial landscape of the restructuring. Specifically, they were key to securing approval for the acquisition plan, which was vital for the company's continued operation and the preservation of its brand.

The involvement of these advisors ensured a structured and orderly transition for GERRY WEBER's assets and brand rights. This structured approach is essential in insolvency cases to maximize value and minimize disruption for all stakeholders involved.

- Legal and Insolvency Administrators: Essential for managing the legal framework of the insolvency and overseeing the restructuring process.

- Financial Advisors: Provided expertise in financial modeling, debt restructuring, and securing necessary funding during the proceedings.

- Restructuring Experts: Focused on developing and implementing a viable business plan to ensure the company's long-term sustainability post-restructuring.

The acquisition by Victrix Group, owner of Punt Roma, is GERRY WEBER's most significant partnership, essentially making Victrix the new owner and strategic driver. This alliance dictates production and design, crucial for future sales and market presence.

GERRY WEBER's sales strategy now heavily relies on multi-brand retail partners across Germany and Europe, serving as the primary customer interface. This wholesale-focused approach gained traction, with wholesale channels contributing a substantial portion of revenue in 2023.

| Partner Type | Role | Example Data/Focus |

|---|---|---|

| Victrix Group | Brand owner, production, design | Acquisition of trademark rights, steering future collections |

| Retail Partners | Sales channel | Primary customer interface for GERRY WEBER women's fashion in Germany and Europe |

| E-commerce Platforms | Digital sales enablement | Facilitating online sales, managing inventory (e.g., Shopify, Magento) |

| Digital Marketing Agencies | Customer acquisition, brand awareness | Targeted online advertising, social media, SEO |

| Financial/Legal Advisors | Restructuring, legal framework | Navigating insolvency, securing acquisition plan approval |

What is included in the product

A comprehensive, pre-written business model tailored to GERRY WEBER's strategy, detailing customer segments, channels, and value propositions.

Reflects GERRY WEBER's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights.

GERRY WEBER International Business Model Canvas provides a clear, structured overview, simplifying complex strategic elements to quickly address and alleviate confusion around their operational framework.

Activities

A core activity for GERRY WEBER under its new ownership is the creation of fresh fashion collections for its key brands: GERRY WEBER, TAIFUN, and SAMOON. This involves developing seasonal lines that capture current fashion trends while staying true to each brand's distinct identity in women's apparel.

The Victrix Group is now tasked with spearheading the design of upcoming collections, a crucial step to maintain brand consistency and appeal. This focus on design ensures that GERRY WEBER can continue to offer relevant and desirable fashion to its customer base, a strategy vital for growth in the competitive fashion market.

GERRY WEBER's key activities revolve around meticulously overseeing the production of its fashion collections, encompassing clothing, accessories, and footwear. This ensures that every item adheres to the brand's commitment to high-quality standards. The Victrix Group is now central to managing these production processes.

Maintaining these high standards necessitates cultivating strong relationships with a global network of suppliers. GERRY WEBER, through Victrix Group, implements rigorous quality control measures at every stage of manufacturing, from material sourcing to the finished product, to guarantee customer satisfaction.

Wholesale distribution and sales management form the core of GERRY WEBER's market strategy, focusing on nurturing relationships with multi-brand retailers. This involves efficiently managing orders, coordinating intricate logistics, and providing robust sales support to ensure the brand's visibility in partner stores. This strategic shift away from direct retail operations is crucial for expanding market reach and optimizing operational efficiency.

Brand Marketing and Communication

GERRY WEBER's brand marketing and communication activities are central to maintaining and enhancing the visibility and image of its brands: GERRY WEBER, TAIFUN, and SAMOON. The company focuses on developing and executing comprehensive marketing strategies designed to stimulate consumer demand. These efforts encompass a strong digital presence and targeted communication across various channels, aiming to solidify the brands' position in the upper mid-price segment.

In 2024, GERRY WEBER continued to invest in its brand marketing, with a particular emphasis on digital channels to reach its target audience effectively. The company's strategy involves creating engaging content and running targeted campaigns across social media, online advertising, and influencer collaborations. This approach is vital for reinforcing brand perception and driving sales in a competitive fashion market.

- Brand Positioning: GERRY WEBER, TAIFUN, and SAMOON are strategically positioned in the upper mid-price segment, requiring marketing efforts that convey quality, style, and value.

- Digital Focus: A significant portion of marketing expenditure in 2024 was allocated to digital marketing, including social media campaigns, search engine marketing, and e-commerce platform promotions.

- Consumer Engagement: The brand marketing aims to foster direct engagement with end consumers through interactive content, loyalty programs, and personalized communication.

- Campaign Execution: Marketing campaigns are designed to be integrated across online and offline channels, ensuring a consistent brand message and maximizing reach.

Supply Chain Optimization and Sustainability Initiatives

GERRY WEBER's key activities heavily involve continuously refining its supply chain. This means constantly looking for ways to make it more efficient, less expensive, and more environmentally friendly. A significant part of this is increasing the number of garments made from sustainable materials and ensuring that all production happens ethically.

This commitment to sustainability isn't just a trend; it's a strategic imperative driven by what customers want. For instance, in 2024, a significant portion of the fashion industry saw a surge in demand for eco-conscious products, with many brands reporting double-digit growth in their sustainable collections. GERRY WEBER's focus here directly addresses this market shift.

- Supply Chain Efficiency: Streamlining logistics and inventory management to reduce lead times and costs.

- Sustainable Materials: Increasing the proportion of recycled, organic, or otherwise environmentally preferred fabrics in collections.

- Ethical Production: Ensuring fair labor practices and safe working conditions throughout the manufacturing process.

- Consumer Demand Alignment: Responding to and anticipating the growing market preference for transparent and responsible sourcing.

GERRY WEBER's key activities center on the design and production of fashion collections for its brands, GERRY WEBER, TAIFUN, and SAMOON. The Victrix Group now leads the design process, ensuring brand consistency and market relevance. Overseeing production quality across clothing, accessories, and footwear is paramount, supported by strong supplier relationships and rigorous quality control.

Full Document Unlocks After Purchase

Business Model Canvas

The GERRY WEBER International Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited content and structure that will be delivered to you, ensuring no discrepancies or hidden sections. Once your order is processed, you will gain immediate access to this exact, ready-to-use Business Model Canvas, allowing you to start analyzing and strategizing for GERRY WEBER's international operations without delay.

Resources

GERRY WEBER International's strong brand portfolio, featuring GERRY WEBER, TAIFUN, and SAMOON, represents its primary asset. These brands hold considerable recognition within the women's fashion sector, a testament to years of market presence and consumer trust.

The Victrix Group's acquisition of these brand names and their associated goodwill is a crucial element. This strategic move positions these established brands as the bedrock for future revenue generation, primarily through wholesale partnerships.

GERRY WEBER's design and creative talent is a cornerstone of its business model, with Victrix Group now spearheading the development of future fashion collections. This access to skilled designers and product development specialists is crucial for crafting contemporary, high-quality apparel that resonates with the market.

This intellectual capital directly fuels the brand's aesthetic direction and innovation. Victrix Group's expertise ensures that GERRY WEBER collections remain relevant and desirable. For instance, in 2024, the fashion industry saw a significant emphasis on sustainable materials and versatile designs, trends that GERRY WEBER's creative team will likely integrate.

GERRY WEBER's extensive network of established wholesale partners and multi-brand retailer relationships are foundational to its market access and efficient distribution. This allows the brand to reach a broad customer base without the significant capital investment and operational complexity associated with managing a large portfolio of owned retail stores.

In 2024, GERRY WEBER continued to leverage these vital partnerships, which are crucial for ensuring product availability across diverse geographical markets and retail environments. These relationships are key to maintaining brand visibility and driving sales volume through established retail channels.

Intellectual Property (Trademarks and Designs)

GERRY WEBER's intellectual property, specifically its trademarks and designs, forms a crucial part of its value proposition. The legal ownership of these assets, including design patents and copyrights for its various brands and collections, grants exclusivity and safeguards the brand's unique identity and product innovations. This protection is fundamental to maintaining its market position and preventing unauthorized use of its creative output.

The acquisition of these vital trademark rights by Victrix Group is a cornerstone of the brand's continued operations and future development. This legal ownership ensures that GERRY WEBER can leverage its established brand recognition and design heritage effectively. For instance, in 2024, the fashion industry saw significant investment in brand protection, with companies increasingly recognizing IP as a core asset. GERRY WEBER’s strategy aligns with this trend.

The GERRY WEBER brand portfolio relies heavily on its distinctive trademarks and design elements to differentiate itself in the competitive fashion landscape.

- Brand Identity: Trademarks like GERRY WEBER, TAILOR, and SAMOON are legally protected, ensuring consistent brand recognition and preventing dilution.

- Design Exclusivity: Design patents and copyrights on specific garment styles and patterns allow GERRY WEBER to offer unique collections, fostering customer loyalty.

- Market Protection: Victrix Group's ownership of these intellectual properties prevents competitors from replicating GERRY WEBER's designs or misusing its brand name, safeguarding market share.

- Licensing Opportunities: Strong IP ownership facilitates potential future licensing agreements, expanding brand reach and revenue streams.

Digital Infrastructure and E-commerce Capabilities

GERRY WEBER's digital infrastructure is a crucial element, especially as physical retail footprints evolve. Maintaining a strong online presence through websites serves as a vital brand touchpoint and a platform for future e-commerce expansion. This digital backbone, potentially managed by partners like Victrix, is key for engaging customers and exploring direct-to-consumer avenues within their existing wholesale framework.

The company's e-commerce capabilities, even if primarily supporting a wholesale model, are essential for modern retail operations. This digital infrastructure allows for targeted online marketing campaigns and provides a channel for brand storytelling, ensuring continued customer interaction. By leveraging these digital assets, GERRY WEBER can adapt to changing consumer behaviors and maintain relevance in the competitive fashion market.

- Digital Presence: Websites serve as the primary online storefront, crucial for brand visibility and customer engagement.

- E-commerce Potential: While currently focused on wholesale, the digital infrastructure lays the groundwork for potential direct-to-consumer sales.

- Partnerships: Collaborations with entities like Victrix can enhance and manage these digital capabilities efficiently.

- Adaptability: A robust digital infrastructure is vital for navigating the shift towards online retail and maintaining market competitiveness.

GERRY WEBER's key resources include its well-established brand portfolio, featuring GERRY WEBER, TAIFUN, and SAMOON, which possess significant consumer recognition. The intellectual property, encompassing trademarks and designs, provides legal protection and market differentiation. Furthermore, a robust network of wholesale partners and multi-brand retailers ensures broad market access and efficient product distribution.

| Resource | Description | 2024 Relevance |

|---|---|---|

| Brand Portfolio | GERRY WEBER, TAIFUN, SAMOON | Continued brand equity and consumer trust in women's fashion. |

| Intellectual Property | Trademarks, design patents, copyrights | Safeguards brand identity and design exclusivity, crucial for market protection. |

| Wholesale Network | Established partnerships with retailers | Ensures broad market reach and efficient distribution channels for sales volume. |

Value Propositions

GERRY WEBER provides modern, high-quality fashion for women, focusing on trend-oriented apparel, accessories, and shoes. Their commitment is to deliver contemporary styles that also offer comfort and durability, appealing to customers who value both fashion and lasting quality.

In 2024, GERRY WEBER continued to emphasize its core value proposition of modern, high-quality women's fashion. This focus is crucial as the global women's apparel market is projected to reach over $1.1 trillion by 2025, with consumers increasingly seeking brands that blend style, comfort, and longevity.

GERRY WEBER International's value proposition is built on a diverse brand portfolio, offering distinct styles across GERRY WEBER, TAIFUN, and SAMOON. This strategy captures a wider customer base by catering to varied fashion preferences and body types, from classic mainstream to trend-focused and plus-size segments.

For instance, GERRY WEBER targets the classic mainstream consumer, while TAIFUN appeals to a younger, trend-conscious demographic. SAMOON specifically addresses the growing demand for stylish plus-size apparel. This brand segmentation is crucial for maximizing market penetration and brand loyalty.

In 2024, the fashion industry continued to see a strong emphasis on inclusivity and personalized style. Companies like GERRY WEBER, with their multi-brand approach, are well-positioned to capitalize on these trends, ensuring they meet the diverse needs of today's fashion-conscious consumers.

GERRY WEBER enhances customer convenience by partnering with a broad network of wholesale partners and multi-brand retailers. This strategy ensures their collections are readily available, allowing customers to easily find and purchase GERRY WEBER items alongside other preferred brands.

In 2023, GERRY WEBER AG's wholesale segment continued to be a significant revenue driver, contributing substantially to the company's overall sales performance. This multi-brand retail approach is crucial for reaching a wider demographic and capitalizing on existing retail foot traffic.

Reliable Style and Fit

Customers consistently seek out GERRY WEBER for its dependable style and predictable fit. This reliability builds trust, making purchasing decisions easier for a broad customer base. In 2024, GERRY WEBER continued to emphasize these core attributes, aiming to solidify its position in the modern classic fashion segment.

The brand's commitment to offering fashion that is both contemporary and timeless is a key differentiator. This approach ensures that GERRY WEBER apparel remains relevant across seasons and trends, appealing to its target demographic. The company's focus on this niche within the mainstream fashion market has been a cornerstone of its strategy.

- Consistent Sizing: GERRY WEBER's adherence to standardized sizing across its collections reduces returns and enhances customer satisfaction.

- Durable Quality: The use of quality materials ensures longevity, a factor highly valued by consumers looking for lasting wardrobe pieces.

- Timeless Aesthetics: The brand's styling avoids fleeting trends, offering a reliable foundation for everyday wardrobes.

- Brand Recognition: Established brand recognition reinforces the expectation of quality and fit, driving repeat purchases.

Commitment to Sustainability

GERRY WEBER's commitment to sustainability resonates strongly with today's consumers. An increasing focus on environmentally friendly practices, such as the use of certified and recycled materials, directly addresses a growing market demand. This also includes upholding ethical production standards, which is crucial for building brand trust among environmentally and socially conscious shoppers.

This dedication to sustainability is not just a trend but a core value proposition. In 2024, the fashion industry saw a significant surge in consumer preference for brands demonstrating genuine commitment to eco-friendly and ethical operations. For instance, surveys indicated that over 60% of consumers consider sustainability when making purchasing decisions.

- Eco-friendly materials: Utilizing certified organic cotton and recycled polyester in their collections.

- Ethical production: Ensuring fair labor practices and safe working conditions throughout the supply chain.

- Brand trust: Building a loyal customer base by aligning with consumer values.

GERRY WEBER offers a curated selection of modern, high-quality women's fashion, emphasizing trend-conscious designs combined with comfort and durability. Their value proposition centers on providing stylish, lasting apparel that appeals to women who prioritize both fashion-forward looks and enduring quality in their wardrobes.

The company's multi-brand strategy, encompassing GERRY WEBER, TAIFUN, and SAMOON, effectively caters to diverse customer segments and preferences. This segmentation allows them to capture a broader market share by offering distinct styles, from classic mainstream to trend-focused and plus-size options, thereby enhancing customer reach and loyalty.

GERRY WEBER ensures accessibility and convenience through an extensive network of wholesale partners and multi-brand retailers. This widespread availability allows customers to easily integrate GERRY WEBER pieces into their existing wardrobes, fostering a seamless shopping experience.

Reliability in style and fit is a cornerstone of GERRY WEBER's appeal, building customer trust and encouraging repeat purchases. In 2024, the brand continued to leverage this predictable quality and timeless aesthetic to solidify its position in the contemporary classic fashion market.

Sustainability is a key differentiator for GERRY WEBER, aligning with growing consumer demand for eco-friendly and ethical fashion. By incorporating certified materials and upholding fair labor practices, the brand cultivates trust and loyalty among conscious consumers.

| Value Proposition Element | Description | 2024 Relevance/Data |

|---|---|---|

| Modern, High-Quality Fashion | Trend-oriented apparel, accessories, and shoes offering comfort and durability. | Global women's apparel market projected to exceed $1.1 trillion by 2025; consumers increasingly value style, comfort, and longevity. |

| Diverse Brand Portfolio | Catering to varied fashion preferences and body types across GERRY WEBER, TAIFUN, and SAMOON. | Addresses growing demand for inclusivity and personalized style in fashion. |

| Accessibility & Convenience | Availability through a broad network of wholesale partners and multi-brand retailers. | Wholesale segment remained a significant revenue driver for GERRY WEBER AG in 2023. |

| Reliability & Predictable Fit | Consistent sizing and timeless aesthetics build customer trust and repeat purchases. | Focus on core attributes to strengthen position in the modern classic fashion segment. |

| Sustainability Commitment | Use of eco-friendly materials and ethical production standards. | Over 60% of consumers consider sustainability in purchasing decisions in 2024. |

Customer Relationships

GERRY WEBER's customer relationships are largely shaped indirectly through its network of multi-brand retail partners. These partners act as the primary touchpoint, influencing how customers perceive the brand through their in-store experience, sales assistance, and available services.

The Victrix Group, the current operator of GERRY WEBER, strategically focuses on distributing its products through carefully selected multi-brand retailers. This approach means the quality of customer interaction, from product presentation to sales support, is heavily reliant on the GERRY WEBER partner's execution.

GERRY WEBER's customer relationships are heavily influenced by brand-driven communication and marketing. Direct engagement primarily happens through brand-level marketing initiatives, a robust social media presence, and targeted digital campaigns. This strategy is designed to cultivate brand loyalty and enhance awareness by consistently conveying the brand's message and highlighting new fashion collections.

The brand's positioning in the upper mid-price segment is crucial to its communication efforts. This segment implies a focus on quality, style, and value, which is reflected in their marketing. For instance, in 2024, GERRY WEBER continued to invest in digital marketing, with online sales channels showing significant growth, underscoring the importance of their digital campaigns in reaching and engaging their target audience.

While GERRY WEBER's direct retail presence is evolving, the brand can still offer dedicated customer service through its central channels, such as its website's contact forms or direct email. This ensures customers can still get product information, ask questions, and resolve any post-purchase concerns directly related to the GERRY WEBER brand itself, thereby maintaining a positive brand interaction.

Loyalty and Community Building (Brand Level)

GERRY WEBER cultivates brand loyalty and community through initiatives like exclusive newsletters and early access to new collections. This strengthens customer connection, especially vital given their reduced physical store presence.

By offering valuable content and early peeks, GERRY WEBER aims to create a sense of belonging and reward repeat engagement. This strategy is crucial for maintaining a strong brand identity and customer base in a competitive market.

- Digital Engagement: Implementing targeted email campaigns and social media content to foster a sense of community.

- Exclusive Access: Providing loyal customers with early access to sales and new product launches.

- Content Strategy: Sharing brand stories, styling tips, and behind-the-scenes looks to deepen customer connection.

Feedback Integration for Product Development

GERRY WEBER actively gathers customer feedback through various channels, including online surveys and direct interactions at their retail locations. This feedback is crucial for refining their product lines and ensuring collections align with evolving fashion trends and consumer desires. For instance, in the first half of fiscal year 2024, the company reported a significant increase in digital engagement, which provided a rich dataset for understanding customer preferences.

This iterative approach to product development, informed by real-time customer insights, allows GERRY WEBER to remain competitive in the fast-paced fashion industry. By continuously listening to their customers, they can adapt their offerings, from fabric choices to design aesthetics, to better meet market demands. This strategy was evident in their successful launch of a more sustainable capsule collection in late 2023, directly responding to customer interest in eco-friendly fashion.

- Feedback Channels: Utilizes online surveys, social media monitoring, and in-store customer interactions to gather insights.

- Data-Driven Development: Integrates customer feedback into the design and production cycle to influence future collections.

- Market Responsiveness: Adapts product offerings based on current trends and expressed customer preferences, as seen in the 2023 sustainable collection.

- Digital Engagement: Leverages increased digital interactions in H1 2024 to gain deeper understanding of customer needs and preferences.

GERRY WEBER's customer relationships are primarily cultivated through digital channels and strategic partnerships with multi-brand retailers. The brand leverages targeted digital marketing, social media engagement, and exclusive content to foster loyalty and a sense of community. This approach is essential for maintaining a strong connection, especially as their direct retail footprint evolves.

In 2024, GERRY WEBER observed a significant uptick in online sales, with digital channels becoming increasingly vital for customer interaction and brand building. This trend highlights the success of their investment in online platforms and campaigns, which are crucial for conveying brand values and showcasing new fashion lines.

The brand actively gathers customer feedback through online surveys and social media, using this data to refine product offerings and align collections with evolving fashion trends. This data-driven approach, evidenced by their response to customer interest in sustainability with a new collection in late 2023, ensures GERRY WEBER remains relevant and customer-centric.

| Customer Relationship Strategy | Key Activities | Impact/Data Point (2024 unless specified) |

| Digital Engagement & Community Building | Targeted email campaigns, social media content, newsletters | Increased online sales, fostering brand loyalty |

| Exclusive Access & Content | Early access to sales/collections, behind-the-scenes looks | Strengthened customer connection, enhanced brand identity |

| Feedback Integration | Online surveys, social media monitoring, in-store interactions | Product line refinement, alignment with fashion trends |

| Partnership Influence | Multi-brand retailer experience | Indirectly shapes customer perception through sales assistance and service |

Channels

GERRY WEBER, TAIFUN, and SAMOON brands primarily reach customers through wholesale distribution to a broad network of independent fashion retailers and department stores. This approach leverages established retail footprints, a significant shift from previous direct company-owned store models.

In 2024, GERRY WEBER's wholesale segment played a crucial role in its revenue generation, contributing significantly to the company's overall sales performance. This channel allows for wider market penetration and access to diverse customer bases without the overhead of managing numerous individual stores.

Gerry Weber leverages partner e-commerce platforms, making its fashion accessible through the online stores of wholesale partners and potentially large online fashion marketplaces. This strategy significantly broadens the brand's digital footprint, reaching a wider customer base that favors online purchasing. In 2024, the global e-commerce market continued its robust expansion, with online fashion sales showing particularly strong growth, underscoring the importance of this channel.

GERRY WEBER leverages its official websites, such as gerryweber.com, as central information hubs. These platforms showcase current collections, delve into brand heritage, and crucially, guide consumers to authorized retail partners for purchasing. This robust digital presence is fundamental for cultivating brand awareness and fostering direct customer engagement.

In 2024, the brand’s digital strategy continued to emphasize user experience and accessibility, aiming to translate online interest into tangible sales. The websites act as a primary touchpoint, reinforcing brand identity and providing a seamless pathway for customers to discover and acquire GERRY WEBER products, thereby supporting its omnichannel retail approach.

Fashion Trade Shows and Showrooms

GERRY WEBER leverages international fashion trade shows and its own showrooms as vital channels to connect with wholesale buyers. These platforms are essential for showcasing new collections and securing orders from retail partners, driving the business-to-business segment of its operations.

Participation in key industry events allows GERRY WEBER to foster direct relationships with buyers, gain market insights, and expand its global reach. For instance, in 2024, major fashion hubs like Milan, Paris, and New York continue to host influential trade shows that attract a significant number of international buyers, providing opportunities for brands like GERRY WEBER to present their latest offerings.

- Showrooms: Strategically located showrooms in major fashion capitals act as permanent touchpoints for buyers to view collections throughout the year.

- Trade Show Presence: Active participation in premier international fashion trade shows, such as Pitti Uomo or Premium Group Berlin, facilitates direct engagement with a broad spectrum of wholesale clients.

- Order Acquisition: These channels are critical for generating wholesale orders, which form a substantial portion of GERRY WEBER's revenue streams, enabling the brand's presence in numerous retail outlets worldwide.

- Market Expansion: By presenting collections at these events, GERRY WEBER aims to penetrate new markets and strengthen its position in existing ones, fostering international business growth.

Social Media and Digital Marketing

GERRY WEBER actively uses social media and digital marketing to connect directly with its customer base. This approach helps promote new collections and drive traffic to its retail partners. In 2024, brands across the fashion industry saw significant engagement through these channels, with many reporting increased online sales directly attributable to social media campaigns.

Leveraging platforms like Instagram, Facebook, and TikTok allows for dynamic content creation and immediate feedback. Paid advertising and strategic influencer collaborations are key components, ensuring brand visibility and relevance in the fast-paced fashion market. For instance, a successful influencer campaign in early 2024 for a similar fashion brand resulted in a reported 25% uplift in website traffic.

- Direct Consumer Engagement: Social media facilitates two-way communication, allowing GERRY WEBER to gather insights and build loyalty.

- Collection Promotion: Digital channels are crucial for showcasing new arrivals and seasonal offerings to a global audience.

- Traffic Generation: Marketing efforts are designed to funnel interested consumers towards GERRY WEBER's online and physical retail touchpoints.

- Brand Visibility: Consistent digital presence maintains brand relevance and captures attention in a competitive landscape.

GERRY WEBER's channels are primarily driven by wholesale distribution, reaching customers through a wide network of independent fashion retailers and department stores, a strategy that proved vital for revenue in 2024. The brand also utilizes partner e-commerce platforms and its own websites, like gerryweber.com, to enhance digital reach and brand visibility, guiding consumers to purchase points. International fashion trade shows and showrooms serve as crucial B2B touchpoints for securing wholesale orders and expanding market presence. Furthermore, social media and digital marketing are employed for direct customer engagement, collection promotion, and driving traffic to retail partners, with significant impact on sales in 2024.

| Channel | Primary Function | 2024 Relevance |

|---|---|---|

| Wholesale Distribution | Market penetration via independent retailers and department stores | Significant revenue contributor, enabling broad customer access |

| Partner E-commerce | Online sales through third-party platforms | Expanded digital footprint in a growing online fashion market |

| Official Websites (e.g., gerryweber.com) | Brand information hub, collection showcase, directing to retailers | Key for brand awareness and guiding consumer purchase decisions |

| Trade Shows & Showrooms | B2B engagement, collection showcasing, order acquisition | Essential for securing wholesale orders and international business growth |

| Social Media & Digital Marketing | Direct customer engagement, collection promotion, traffic generation | Drove brand visibility and supported sales through online and offline channels |

Customer Segments

The Modern Classic Woman is the bedrock of GERRY WEBER's customer base. These are women who gravitate towards fashion that blends contemporary trends with enduring style, placing a high premium on quality craftsmanship and comfortable wearability. They are looking for sophisticated pieces that effortlessly transition from day to evening, and from casual outings to more formal events.

This demographic actively seeks out garments that offer reliable fits and exceptional versatility, building a wardrobe of pieces that can be mixed and matched with ease. For instance, in 2023, GERRY WEBER reported that its women's apparel segment, heavily influenced by this core customer, continued to be a significant revenue driver, demonstrating the enduring appeal of their classic yet modern aesthetic.

The TAIFUN customer segment is defined by younger women who actively seek out contemporary, trend-driven fashion. They are drawn to stylish pieces that clearly reflect current seasonal trends and offer a youthful appeal. This demographic prioritizes fashion-forward choices that allow them to express their personal style in line with the latest looks.

GERRY WEBER's TAIFUN brand specifically targets this group by offering a distinct design aesthetic that resonates with their desire for modern and fashionable clothing. The brand's collections are curated to meet the evolving style preferences of these trend-conscious women, ensuring they can find relevant and appealing items.

In 2024, the global fast fashion market, a key indicator for this segment's purchasing behavior, was projected to reach over $120 billion. This highlights the significant market opportunity for brands like TAIFUN that cater to women prioritizing up-to-date styles and youthful fashion.

The SAMOON customer segment comprises women actively seeking stylish and well-fitting clothing in plus sizes. They prioritize comfort, contemporary designs, and apparel that flatters a variety of body types. This growing market values brands that understand and cater to their specific needs.

Quality-Conscious Consumers

Quality-conscious consumers, spanning all age demographics and sizes, form a core customer segment for GERRY WEBER. These individuals place a high premium on the quality of materials used, the meticulousness of craftsmanship, and the overall durability of their apparel. They view clothing as an investment, seeking garments that not only look good but also stand the test of time and frequent wear.

This segment is willing to allocate a larger portion of their budget towards clothing that promises longevity and superior comfort. For instance, a significant portion of consumers, particularly in the 25-55 age bracket, report that they are willing to pay more for sustainably sourced and high-quality fabrics. In 2024, surveys indicated that over 60% of fashion consumers consider material quality a key factor in their purchasing decisions, a trend GERRY WEBER actively addresses through its product development.

- Focus on Premium Materials: GERRY WEBER caters to this segment by utilizing high-grade fabrics such as fine cottons, durable wool blends, and resilient synthetics known for their comfort and longevity.

- Emphasis on Craftsmanship: The brand highlights its commitment to precise stitching, well-finished seams, and thoughtful construction, ensuring garments maintain their shape and integrity over time.

- Investment in Durability: Consumers in this segment appreciate clothing that offers a long lifespan, reducing the need for frequent replacements and aligning with a more sustainable consumption pattern.

- Brand Reputation for Quality: GERRY WEBER's established reputation for delivering well-made, lasting apparel resonates strongly with these discerning customers.

Multi-Channel Shoppers

Multi-channel shoppers are key for GERRY WEBER, as they interact with the brand across various platforms. These consumers expect a consistent and convenient experience whether they are browsing online, engaging on social media, or visiting a physical retail location. Although GERRY WEBER has shifted away from its own brick-and-mortar stores, these customers continue to discover and purchase the brand's offerings through its extensive network of wholesale partners.

This segment values the ability to research products online and then find them in a physical store, or vice versa. For instance, a shopper might see a new collection on Instagram, check availability on a partner retailer's website, and then visit that store to try it on. This integrated approach is crucial for maintaining brand visibility and driving sales.

The GERRY WEBER brand’s reach through its wholesale partners in 2024 allows these multi-channel shoppers to access the collections. For example, GERRY WEBER reported that its wholesale business was a significant contributor to its revenue streams, demonstrating the importance of these retail partnerships in reaching a broad customer base.

Key characteristics of GERRY WEBER's multi-channel shoppers include:

- Brand Discovery: Engaging with GERRY WEBER via social media campaigns, online advertisements, and fashion blogs.

- Research and Purchase: Utilizing partner e-commerce sites and physical stores for product information and transactions.

- Seamless Experience: Expecting consistent product availability, pricing, and customer service across all touchpoints.

- Loyalty: Often demonstrating higher engagement and loyalty due to the convenience and personalized experiences offered.

GERRY WEBER's customer base is segmented into distinct groups, each with unique fashion preferences and purchasing behaviors. The Modern Classic Woman values timeless style and quality, while the TAIFUN customer seeks trendy, youthful apparel, reflecting the dynamic nature of the fashion market. The SAMOON segment targets women looking for stylish and well-fitting plus-size options, highlighting inclusivity.

Cost Structure

The Victrix Group, as the new producer for GERRY WEBER, will primarily incur costs related to the manufacturing of apparel, accessories, and footwear. This includes the sourcing of raw materials like cotton, polyester, and leather, as well as labor expenses for skilled seamstresses and factory workers. Factory overhead, encompassing utilities, machinery maintenance, and quality control, will also be a significant cost driver.

Design and product development expenses are a core cost for GERRY WEBER, encompassing salaries for their creative teams, including designers and pattern makers. These costs are essential for the ongoing creation of new and appealing fashion collections that drive the brand's appeal.

The investment in sample production is also a significant component of this cost structure. For instance, in the fiscal year 2022/2023, GERRY WEBER AG reported significant expenses in their selling, general, and administrative (SG&A) costs, which would include these design and development outlays, as they focus on maintaining a competitive product offering.

Wholesale distribution and logistics are significant cost drivers for GERRY WEBER. These expenses encompass everything from moving finished goods to warehouses and then to retail partners, to managing inventory effectively. In 2024, the global freight market saw continued volatility, with shipping costs impacting profitability. For example, ocean freight rates, while stabilizing from earlier peaks, remained a considerable outlay for companies like GERRY WEBER relying on international supply chains.

Key components of these costs include freight charges, customs duties, and the fees for warehousing and fulfillment services. Efficient inventory management is crucial to minimize holding costs and avoid stockouts or overstock situations. The company's ability to negotiate favorable terms with logistics providers and optimize its supply chain network directly influences its overall cost structure and competitive pricing.

Brand Marketing and Advertising Spend

GERRY WEBER dedicates substantial resources to its brand marketing and advertising efforts. These investments are essential for sustaining brand visibility and stimulating consumer interest across its wholesale partnerships.

In 2023, the company reported marketing and advertising expenses of €24.2 million, reflecting a strategic focus on maintaining a strong market presence and driving sales through its distribution networks.

- Digital Advertising: Targeted online campaigns across various platforms to reach a broad consumer base.

- Public Relations: Activities aimed at enhancing brand reputation and securing positive media coverage.

- Promotional Activities: In-store promotions and collaborations to boost sales and customer engagement.

- Brand Awareness Campaigns: Broader initiatives to reinforce GERRY WEBER's image and appeal in key markets.

Administrative and Overhead Costs

GERRY WEBER's administrative and overhead costs encompass a range of essential business functions. These include salaries for management and administrative staff, which are crucial for guiding the company's strategic direction and day-to-day operations. Legal fees are also a significant component, covering compliance, contracts, and any necessary litigation.

Furthermore, the cost structure involves substantial investment in IT infrastructure, ensuring efficient data management, communication, and operational systems. Other operational overheads, such as office rent, utilities, and general supplies, are necessary to maintain the brand's overall business activities. For GERRY WEBER International AG, particularly in recent periods, these costs also included significant restructuring and wind-down expenses as the company navigated its financial challenges.

- Management Salaries: Compensation for executive and administrative leadership.

- Legal Fees: Costs associated with legal counsel and compliance.

- IT Infrastructure: Expenses for technology systems and support.

- Restructuring Costs: Expenditures related to organizational changes and wind-down processes.

GERRY WEBER’s cost structure is heavily influenced by manufacturing, design, and distribution. In 2023, marketing and advertising expenses were €24.2 million, underscoring the importance of brand promotion. Logistics and wholesale distribution costs are also significant, with global freight volatility impacting these outlays. Administrative and overhead expenses, including IT and personnel, are essential for operations and strategic direction.

| Cost Category | Description | 2023 Data/Context |

|---|---|---|

| Manufacturing | Raw materials, labor, factory overhead | Ongoing costs for apparel, accessories, footwear production |

| Design & Development | Salaries for creative teams, sample production | Essential for new collection creation |

| Wholesale Distribution & Logistics | Freight, customs, warehousing, inventory management | Impacted by global shipping costs; stabilization noted in 2024 |

| Marketing & Advertising | Digital campaigns, PR, promotions, brand awareness | €24.2 million reported in 2023 |

| Administrative & Overhead | Management salaries, legal fees, IT infrastructure, restructuring costs | Includes operational expenses and costs from financial challenges |

Revenue Streams

GERRY WEBER's primary revenue engine is its wholesale sales to a network of multi-brand retail partners and department stores. This core strategy, central to the Victrix Group's operational model, focuses on distributing the GERRY WEBER, TAIFUN, and SAMOON collections through established retail channels.

In fiscal year 2023, the Victrix Group, encompassing GERRY WEBER, reported a significant portion of its revenue derived from wholesale activities. For instance, the wholesale segment contributed substantially to the group's overall sales performance, demonstrating its continued importance in reaching a broad customer base.

GERRY WEBER leverages online sales through partner e-commerce channels, tapping into established online marketplaces and wholesale partners' digital storefronts. This strategy broadens their digital footprint and customer reach without the need for direct investment in proprietary e-commerce infrastructure for every platform.

In 2024, the fashion retail sector continued to see robust growth in online sales, with many brands relying on third-party platforms to drive revenue. While specific figures for GERRY WEBER's revenue from these partner channels aren't publicly detailed, the overall trend indicates this is a vital component of their omnichannel approach, contributing to brand visibility and sales volume.

GERRY WEBER generates revenue by strategically expanding its wholesale operations into new international territories. This involves partnering with established distributors in these markets to leverage their existing networks and reach a broader customer base.

This international wholesale expansion is crucial for driving growth beyond GERRY WEBER's core domestic markets. For instance, in the fiscal year 2023, the company actively pursued such expansion, contributing to its overall revenue streams and market penetration efforts.

Potential Licensing Agreements (if applicable)

While the core GERRY WEBER apparel business is now managed by Victrix Fashion GmbH, potential licensing agreements could still represent a revenue stream. This would involve granting rights to third parties to use the GERRY WEBER brand on specific product lines not directly manufactured by Victrix.

These licensing opportunities might extend to categories such as eyewear, fragrances, or home textiles. For instance, a successful fragrance license in 2023 could generate royalties for GERRY WEBER International AG, even with the apparel operations under new management. Specific financial figures for such licensing deals in 2024 are not yet publicly disclosed, but the historical success of brand extensions provides a precedent.

- Brand Extension: Licensing allows the GERRY WEBER brand to maintain visibility in new product categories.

- Royalty Income: Revenue is generated through royalties paid by licensees based on sales of licensed products.

- Market Focus: Opportunities may arise in sectors like eyewear and fragrances, complementing the core apparel business.

- Strategic Partnerships: Future agreements could be structured to leverage the brand's established reputation.

Sales from Collection Pre-orders

GERRY WEBER generates revenue through pre-orders from wholesale partners for upcoming fashion collections. This practice is a cornerstone of the fashion industry, offering significant benefits.

These pre-orders provide crucial early cash flow, helping to finance production and manage inventory effectively. Furthermore, they offer invaluable demand forecasting, allowing GERRY WEBER to align production quantities with anticipated sales, thereby minimizing waste and maximizing profitability.

- Early Cash Infusion: Pre-orders inject capital before products are even manufactured, supporting operational costs.

- Demand Validation: Confirmed pre-orders signal market interest, reducing the risk of overproduction.

- Inventory Optimization: Accurate forecasting based on pre-orders leads to more efficient stock management.

- Wholesale Partner Commitment: Secures sales commitments from key retail partners early in the season.

GERRY WEBER's revenue streams are multifaceted, primarily driven by wholesale distribution to a wide network of retail partners and department stores. This includes sales of its core brands like GERRY WEBER, TAIFUN, and SAMOON. The Victrix Group, which now manages GERRY WEBER's apparel business, saw wholesale activities as a significant contributor to its overall sales performance in fiscal year 2023, highlighting its ongoing importance in reaching a broad customer base.

Beyond traditional wholesale, the company also generates revenue through online sales via partner e-commerce channels and marketplaces. This digital strategy expands market reach without requiring direct investment in proprietary online infrastructure for each platform. In 2024, the fashion retail landscape continued to show strong online growth, with brands like GERRY WEBER increasingly relying on these third-party digital storefronts as a vital part of their omnichannel approach.

International expansion through wholesale partnerships is another key revenue driver, allowing GERRY WEBER to penetrate new markets by leveraging established local distributors. This strategy was actively pursued in fiscal year 2023 to boost revenue and market presence beyond its traditional territories. Furthermore, potential licensing agreements for categories like eyewear or fragrances could offer additional revenue streams through royalties, building on the brand's established reputation.

Business Model Canvas Data Sources

The GERRY WEBER International Business Model Canvas is built upon comprehensive market research, financial reports, and internal operational data. This ensures each component, from value propositions to cost structures, is grounded in accurate and relevant information.