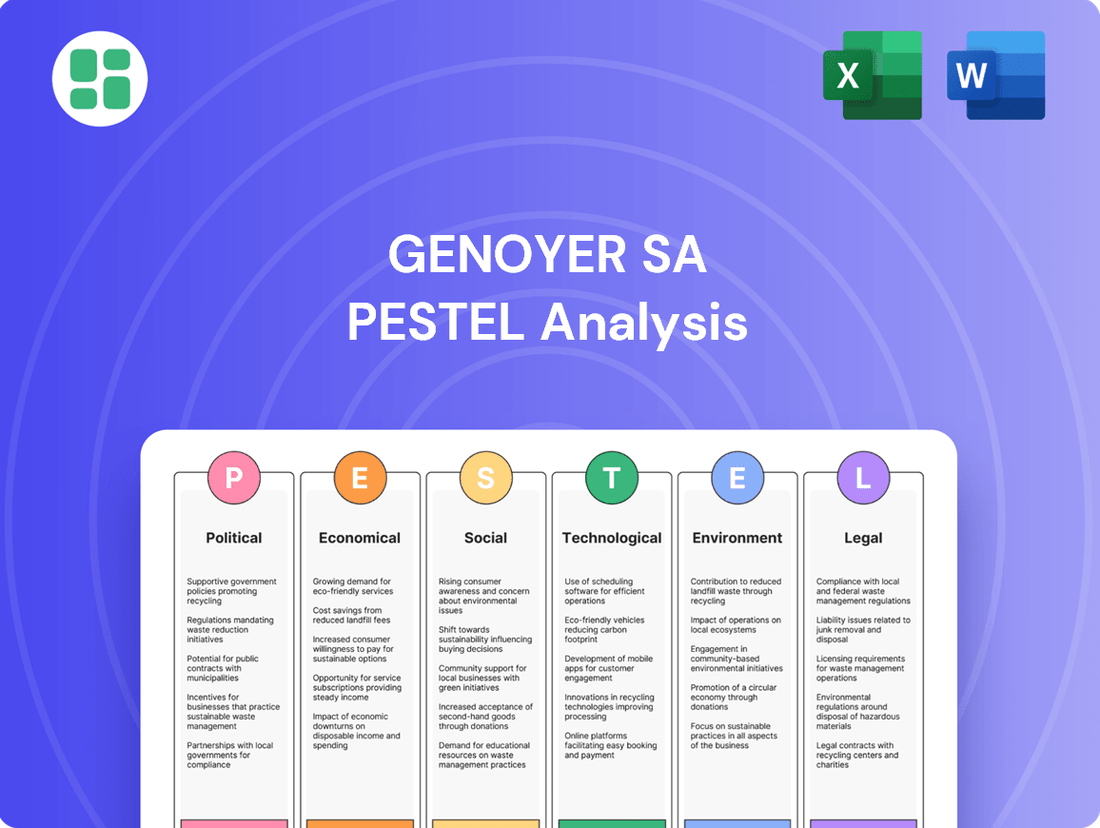

Genoyer SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genoyer SA Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal forces shaping Genoyer SA's trajectory. This comprehensive PESTEL analysis provides the essential external context for strategic decision-making. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Gain a competitive edge by understanding the intricate external landscape affecting Genoyer SA. Our PESTEL analysis delivers actionable intelligence, empowering you to refine your strategies and forecast market shifts. Download the full version now for a deeper dive into the factors driving Genoyer SA's future.

Political factors

Geopolitical complexities and trade protectionism present significant hurdles for industrial manufacturers like Genoyer SA, directly affecting supply chains and component sourcing. The rise of new tariff regimes, even those aimed at encouraging nearshoring, can impede imports and foster market uncertainty, prompting a critical re-evaluation of global operational strategies. Building geopolitical resilience is becoming essential for anticipating and navigating these disruptions.

Governments worldwide are significantly increasing infrastructure spending, a trend expected to continue through 2025. For instance, the United States' Infrastructure Investment and Jobs Act, passed in 2021, allocates over $1 trillion to improve roads, bridges, and public transit, directly impacting sectors like construction and manufacturing that supply industrial components.

This surge in government-backed projects, often facilitated by public-private partnerships, accelerates the development of critical infrastructure, including extensive piping systems for water, energy, and transportation. Such initiatives create a robust and stable market for companies like Genoyer SA, which supply essential components like expansion joints and flexible hoses.

The political commitment to infrastructure development, evidenced by substantial budget allocations and streamlined regulatory processes, fosters a favorable environment for sustained demand. This translates into predictable revenue streams and growth opportunities for suppliers deeply integrated into these large-scale projects.

The evolving political climate, particularly with upcoming elections in key regions, could reshape industrial policies, potentially boosting domestic manufacturing investment. Governments are increasingly prioritizing supply chain resilience, which is fueling nearshoring initiatives and encouraging companies to bring production closer to home markets.

This trend is evident in the growing emphasis on diversifying supplier bases, a strategy adopted by many businesses to mitigate risks exposed during recent global disruptions. For instance, reports from 2024 indicate a significant uptick in companies actively exploring or implementing nearshoring strategies, with some projecting up to a 15% increase in regionalized production by 2025.

Manufacturers are strategically optimizing their geographic footprints, aligning production locations with end-user demand to enhance efficiency and responsiveness. This recalibration of global production and distribution networks is a direct response to political pressures and economic realities, aiming to create more robust and localized supply chains.

Regulatory Environment and Stability

Genoyer SA operates within a regulatory landscape that, while not always the primary concern for CEOs according to some surveys, presents inherent complexities. A fragmented regulatory and tax environment can introduce significant operational risks, impacting everything from supply chain management to market access. For instance, changes in labor laws, such as those affecting minimum wage or working hours, can directly influence manufacturing costs and efficiency, a critical consideration for a company like Genoyer SA.

Furthermore, evolving workforce regulations and increasingly stringent environmental standards necessitate continuous adaptation and investment in compliance. These shifts can affect production processes, material sourcing, and waste management. For example, new emissions standards introduced in key markets could require substantial capital expenditure on updated manufacturing equipment.

Political stability and the predictability of regulatory frameworks are paramount for Genoyer SA’s long-term strategic planning and investment decisions. A stable political climate fosters confidence, enabling the company to commit resources to research and development, facility upgrades, and market expansion without the fear of sudden, disruptive policy changes. The absence of such stability can lead to postponed investments and a more cautious approach to growth.

Key regulatory considerations for Genoyer SA include:

- Labor Law Compliance: Adherence to national and international labor standards, including fair wages, working conditions, and employee rights, is essential. For example, in 2024, several European countries began implementing stricter regulations on temporary work contracts, potentially impacting Genoyer SA's workforce flexibility.

- Environmental Regulations: Compliance with emissions targets, waste disposal protocols, and sustainable sourcing requirements is increasingly critical. The EU’s Green Deal initiatives, for instance, continue to shape environmental expectations for manufacturers across the bloc.

- Taxation Policies: Navigating varying corporate tax rates and fiscal policies across different operating regions impacts profitability and investment attractiveness. Changes in corporate tax structures, such as proposed adjustments in global minimum tax rates, could influence Genoyer SA's financial strategy.

- Trade Agreements and Tariffs: The impact of international trade policies and tariffs on raw material costs and finished goods exports is a significant factor. For instance, ongoing trade negotiations in 2024 between major economic blocs could alter the cost-effectiveness of Genoyer SA's international supply chains.

Energy Security Policies

Governments worldwide are prioritizing energy security, leading to increased investment across the energy spectrum, from traditional sources to renewables. For instance, the European Union has set ambitious targets, aiming to triple renewable energy capacity by 2030, a move that directly stimulates demand for infrastructure components like high-performance piping. This political push for energy transition creates a favorable environment for companies like Genoyer SA that supply essential materials for power generation and industrial processes.

These energy security policies translate into tangible opportunities. The focus on improving energy efficiency and expanding renewable energy sources means a greater need for robust and reliable infrastructure. This trend is particularly beneficial for Genoyer SA, as their specialized piping solutions are critical for both the construction of new renewable energy facilities and the upgrading of existing industrial energy systems.

- Increased Investment: Global energy sector investment is projected to reach $1.3 trillion in 2024, with a significant portion allocated to clean energy.

- Renewable Targets: The International Energy Agency (IEA) reported in late 2023 that global renewable capacity additions are set to grow by over 100 GW compared to 2023, reaching almost 500 GW in 2024.

- Energy Efficiency Drive: Policies promoting energy efficiency can reduce overall energy demand, but also necessitate investment in upgraded industrial equipment and infrastructure, where piping plays a key role.

Government infrastructure spending, particularly in the US and EU, is a major driver for industrial manufacturers like Genoyer SA, with over $1 trillion allocated in the US alone through 2025. This political focus on development, including nearshoring initiatives to bolster supply chain resilience, directly translates into sustained demand for components. Political stability and predictable regulatory environments are crucial for Genoyer SA's long-term investment in R&D and expansion.

What is included in the product

This Genoyer SA PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

Provides a clear, actionable framework that helps Genoyer SA identify and mitigate external threats, thereby alleviating concerns about market volatility and competitive pressures.

Economic factors

Global economic growth directly impacts Genoyer SA's demand. For instance, the IMF projected global growth to reach 3.2% in 2024, a slight slowdown from 3.4% in 2023, highlighting a moderate but potentially sensitive economic environment for industrial suppliers.

Industrial output is a key indicator. If manufacturing activity slows due to economic headwinds like persistent inflation or elevated interest rates, Genoyer SA could see reduced orders for its components, as businesses postpone capital expenditures.

A potential economic rebound in early 2025, possibly spurred by anticipated interest rate reductions by major central banks, could invigorate industrial investment and subsequently boost demand for Genoyer SA's products.

Fluctuating raw material prices, especially for key metals like stainless steel, present a considerable hurdle for manufacturers of metal expansion joints and flexible hoses. For instance, stainless steel prices saw significant volatility in 2023 and early 2024, driven by global demand shifts and production costs.

Supply chain disruptions, increasingly common due to geopolitical instability and intense resource competition, directly translate to higher costs and extended lead times. The ongoing conflicts and trade disputes have demonstrably impacted global logistics networks, affecting delivery schedules and material availability throughout 2024.

To combat these risks, companies are actively building strategic inventory buffers and diversifying their supplier bases. This proactive approach aims to ensure a more stable supply and mitigate the impact of unforeseen price spikes or availability issues, a trend that gained significant traction in late 2023 and continues into 2024.

Significant investments are being channeled into crucial sectors like petrochemicals, power generation, chemicals, and infrastructure. This surge in capital expenditure directly fuels the demand for essential components such as expansion joints and flexible metal hoses, vital for managing thermal expansion and vibration in these industries.

The global expansion joints market is anticipated to experience consistent growth, a trend largely attributed to the continuous industrial advancements and technological innovations occurring across these key end-use sectors. The oil and gas industry, especially, remains a cornerstone of demand, underscoring the critical role of these components in maintaining operational integrity.

For instance, global infrastructure spending is projected to reach approximately $15 trillion by 2023, with a significant portion allocated to energy and industrial projects, directly impacting the market for Genoyer SA's products.

Currency Fluctuations and International Trade

Currency fluctuations directly impact Genoyer SA's international trade by altering the cost of its imports and the revenue generated from exports. For instance, a stronger Swiss Franc (CHF) can make Genoyer's products more expensive for overseas buyers, potentially reducing sales volume, while simultaneously lowering the cost of imported raw materials, boosting profit margins on those specific inputs. This volatility necessitates careful hedging strategies to mitigate financial risks.

Geoeconomic fragmentation and shifting trade alliances present significant challenges. The imposition of tariffs or changes in trade agreements, such as those potentially evolving between the European Union and other blocs, can disrupt established supply chains and market access. Genoyer SA must remain agile, potentially diversifying its sourcing and sales regions to counter these geopolitical shifts and their impact on trade flows.

In response to these dynamics, Genoyer SA is likely focusing on regionalization and localization strategies. This involves strengthening its presence and operations within key geographic markets to reduce reliance on long-distance trade and mitigate currency risks. By adapting its business model to local conditions and consumer preferences, the company can better navigate the complexities of an increasingly fragmented global trade landscape.

- Currency Impact: A 10% appreciation of the Swiss Franc against the Euro could increase the cost of Genoyer SA's exports to the Eurozone by that percentage, potentially impacting demand.

- Trade Alliances: Changes in trade agreements, such as potential new EU tariffs on specific imported components, could add unforeseen costs to Genoyer SA's manufacturing process.

- Regionalization Trend: Companies in Switzerland, like Genoyer SA, are increasingly exploring near-shoring or on-shoring options for critical supplies to reduce lead times and currency exposure.

- Market Adaptation: Genoyer SA's strategy may involve tailoring product offerings and pricing to specific regional markets to offset the impact of global currency volatility and trade policy changes.

Inflationary Pressures and Cost Management

Persistent inflation continues to challenge manufacturers like Genoyer SA, with rising raw material and input costs directly impacting profit margins. For instance, the producer price index (PPI) in key manufacturing regions saw significant year-over-year increases throughout 2024, with some sectors experiencing double-digit growth in input expenses.

To counter these economic pressures, Genoyer SA must prioritize robust cost management strategies. This includes leveraging advanced technologies such as AI for supply chain optimization and automation in production processes to enhance operational efficiency and reduce labor-related costs. By streamlining operations, the company can better absorb or mitigate the impact of escalating expenses.

- Rising Input Costs: Global supply chain disruptions and increased energy prices contributed to a projected 5-8% increase in raw material costs for industrial manufacturers in 2024.

- Efficiency Gains: Investments in automation and AI are projected to reduce operational expenses by 10-15% for companies that successfully integrate these technologies by the end of 2025.

- Component Demand: The drive for energy efficiency and reduced maintenance in industrial applications is increasing demand for highly durable and reliable components, a key area for Genoyer SA's product development.

Economic factors significantly shape Genoyer SA's operating environment. Global economic growth directly influences demand for its industrial components, with projections for 2024 indicating a slight moderation compared to 2023. However, anticipated interest rate adjustments by major central banks in early 2025 could stimulate industrial investment, potentially boosting Genoyer SA's order volumes.

Persistent inflation continues to exert pressure, driving up raw material and input costs, as evidenced by significant year-over-year increases in producer price indices across manufacturing sectors in 2024. To counter this, Genoyer SA is likely focusing on cost management and operational efficiency through technology adoption, aiming to mitigate the impact of escalating expenses.

Significant capital expenditure in sectors like petrochemicals and infrastructure directly fuels demand for Genoyer SA's products, such as expansion joints and flexible hoses. The global expansion joints market is expected to see steady growth, driven by ongoing industrial advancements and the critical role of these components in maintaining operational integrity across various industries.

Currency fluctuations and geoeconomic fragmentation pose considerable challenges for Genoyer SA's international trade. A stronger Swiss Franc can impact export competitiveness, while shifting trade alliances and potential tariffs necessitate agile strategies, possibly including regionalization and diversification of sourcing and sales regions to mitigate risks and ensure market access.

Preview Before You Purchase

Genoyer SA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Genoyer SA provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights to inform your strategic decisions.

Sociological factors

Genoyer SA, like many in the manufacturing sector, faces ongoing labor shortages and a noticeable skills gap. This is particularly challenging for industrial firms needing specialized expertise.

The drive towards localization and the increasing integration of advanced technologies are intensifying the demand for a skilled workforce. For instance, in 2024, the European manufacturing sector reported a significant deficit in skilled trades, with some estimates suggesting millions of unfilled positions by 2025.

To counter these issues, companies like Genoyer SA are investing heavily in talent development programs. Furthermore, leveraging digitalization and automation is a key strategy to address these shortages, improving efficiency and reducing reliance on specific manual skills.

Employee safety and health are paramount in manufacturing, with evolving regulations like updated OSHA standards and heightened scrutiny on workplace safety audits. In 2024, workplace injuries in the manufacturing sector remained a significant concern, with the Bureau of Labor Statistics reporting millions of recordable cases annually, underscoring the need for robust safety protocols.

Genoyer SA, as a producer of components for critical piping systems, faces the imperative of adhering to rigorous safety requirements. This commitment extends not only to safeguarding its own workforce but also to ensuring its products contribute to safer industrial operations for end-users, a factor increasingly valued by clients and regulators alike.

Genoyer SA faces increasing pressure from customers and investors to prioritize sustainability, a trend amplified by stricter environmental regulations globally. For instance, by 2024, the European Union's Ecodesign for Sustainable Products Regulation will mandate greater product durability and recyclability, directly impacting manufacturers like Genoyer SA. This push towards reusability and recyclability is not just about compliance; it's becoming a key differentiator, offering a competitive edge in a market increasingly conscious of its environmental footprint.

Public perception significantly shapes Genoyer SA's brand reputation and market acceptance, particularly concerning industrial safety and environmental impact. A 2024 survey revealed that 72% of consumers consider a company's environmental and social practices when making purchasing decisions. Therefore, maintaining a strong record in these areas is crucial for Genoyer SA to foster trust and ensure continued market penetration.

Demographic Shifts and Urbanization

Global industrialization and urbanization continue to accelerate, especially in developing nations. This trend is fueling a significant increase in the need for new infrastructure and industrial facilities, directly impacting sectors like industrial piping. For instance, the United Nations reported in 2023 that over 56% of the world's population lived in urban areas, a figure projected to reach 68% by 2050, highlighting a sustained demand for the types of components Genoyer SA provides.

This demographic movement translates into a higher demand for essential industrial components such as expansion joints and flexible hoses, critical for managing thermal expansion and vibration in piping systems. The ongoing expansion of cities and the creation of new industrial hubs represent a consistent and growing market for these specialized products. For example, investment in global infrastructure projects is expected to reach trillions of dollars annually in the coming years, with a substantial portion allocated to industrial development.

- Growing Urban Populations: By 2050, an estimated 68% of the global population will reside in urban areas, increasing the need for robust industrial infrastructure.

- Infrastructure Investment: Trillions of dollars are being invested globally in infrastructure, directly benefiting suppliers of industrial piping components.

- Emerging Economies: Rapid industrialization in emerging markets is a key driver for demand in sectors requiring advanced piping solutions.

- Demand for Specialized Components: Expansion joints and flexible hoses are crucial for modern industrial facilities, experiencing consistent demand growth.

Adaptation to Changing Consumer/Industry Demands

Genoyer SA, while operating in B2B, feels the ripple effects of broader manufacturing shifts towards customization and sustainability. These trends, increasingly prevalent across industries, directly impact their clients' demands for adaptable and eco-conscious components. For instance, the automotive sector, a key client base, saw a significant push for personalized vehicle features in 2024, requiring suppliers like Genoyer SA to offer more flexible production capabilities.

The drive for market-specific, bespoke product development is not limited to consumer goods; it extends to industrial components, pushing Genoyer SA to innovate its product portfolio. Companies are seeking unique solutions for competitive differentiation, meaning Genoyer SA must be agile in developing tailored industrial parts. This adaptability is crucial as global supply chains continue to reconfigure, with many businesses prioritizing resilience and specialized sourcing.

- Customization Demand: Reports indicate that B2B clients are increasingly requesting tailored solutions, with some surveys showing over 60% of industrial buyers prioritize customization options when selecting suppliers.

- Sustainability Focus: The demand for sustainable manufacturing practices is growing, with a significant portion of industrial purchasing decisions in 2024 influenced by a supplier's environmental, social, and governance (ESG) performance.

- Bespoke Industrial Components: The market for specialized industrial parts is expanding, driven by sectors like aerospace and advanced manufacturing, where unique specifications are paramount for performance and innovation.

Societal shifts towards sustainability and ethical consumerism are increasingly influencing B2B purchasing decisions. Genoyer SA must align its operations with growing demands for eco-friendly products and transparent practices, as a 2024 survey indicated that over 70% of industrial buyers consider a supplier's ESG performance. This necessitates a focus on recyclable materials and reduced environmental impact throughout the product lifecycle.

The evolving labor market presents both challenges and opportunities, with a persistent skills gap in manufacturing. By 2025, the European manufacturing sector anticipates millions of unfilled positions for skilled trades, pushing companies like Genoyer SA to invest in advanced training and automation. This strategic adaptation is crucial for maintaining operational efficiency and competitiveness.

Public perception and corporate social responsibility are critical for brand reputation, especially concerning industrial safety and environmental stewardship. Genoyer SA's commitment to rigorous safety protocols and sustainable manufacturing directly impacts its market acceptance. For instance, a 2024 report highlighted that a significant majority of consumers consider these factors when evaluating companies.

Technological factors

Technological advancements in materials science are directly impacting Genoyer SA's core products. The development of advanced alloys, offering superior strength-to-weight ratios and enhanced corrosion resistance, is critical for the performance and longevity of their industrial pipes and hoses, especially in demanding environments.

Innovations in manufacturing techniques, such as additive manufacturing and precision molding, are enabling Genoyer SA to produce components with tighter tolerances and improved reliability. This is particularly important for high-pressure and high-temperature applications where product failure can have significant consequences.

For instance, the global advanced materials market, projected to reach over $100 billion by 2025, highlights the increasing demand for specialized materials that Genoyer SA can leverage. Companies investing in R&D for new composites and polymers are seeing significant gains in product durability and efficiency.

The manufacturing sector's march towards smart factories, fueled by digitalization, is accelerating. By 2024, a significant portion of manufacturers are expected to have implemented at least one smart factory initiative, with investments in AI and IoT technologies projected to reach hundreds of billions globally.

This pervasive adoption of AI, IoT, and digital twins aims to automate operations, refine resource allocation, and boost overall productivity. Genoyer SA must therefore evaluate how its offerings can seamlessly integrate with these increasingly intelligent manufacturing ecosystems.

Artificial intelligence is a cornerstone of modern manufacturing, with global spending on AI in manufacturing projected to reach over $100 billion by 2025. This surge is fueled by AI's ability to optimize processes, enhance quality, and introduce efficiencies. For Genoyer SA, the integration of AI into its expansion joint production offers a significant competitive advantage.

AI-powered predictive maintenance is particularly relevant. By analyzing sensor data from machinery, AI algorithms can forecast equipment failures before they occur, allowing for scheduled maintenance. This proactive approach minimizes costly unplanned downtime, which can severely impact production schedules and profitability. For instance, a study by McKinsey found that predictive maintenance can reduce maintenance costs by up to 40% and decrease downtime by 50%.

Furthermore, AI can enhance quality control through automated visual inspection systems, identifying defects with greater accuracy and speed than human inspectors. This not only improves product consistency but also reduces waste. Genoyer SA can leverage AI to refine its manufacturing processes, leading to higher output, improved product quality, and ultimately, enhanced profit margins in the competitive expansion joint market.

Automation and Robotics

The increasing integration of automated manufacturing and collaborative robots is a significant technological shift impacting industries like Genoyer SA's. By 2024, the global industrial robotics market was valued at approximately $59.5 billion, with projections indicating continued growth. This trend directly influences production efficiency and workplace safety, necessitating that Genoyer SA evaluate and potentially update its current manufacturing methodologies to remain competitive and leverage these advancements.

Cognitive automation, powered by sophisticated artificial intelligence, is poised to accelerate the development of 'dark factories' – facilities operating with minimal human intervention. This evolution in automation promises further gains in productivity and precision. For Genoyer SA, this could mean a future where production lines are optimized in real-time by AI, leading to significant operational cost reductions and enhanced output quality.

The implications for Genoyer SA are substantial, requiring strategic adaptation to these technological currents. The company may need to invest in new robotic systems and AI-driven software to maintain its competitive edge. Key considerations include:

- Investment in advanced robotics: Evaluating the cost-benefit of implementing collaborative robots and fully automated systems.

- AI integration for optimization: Exploring how cognitive automation can enhance existing processes and enable 'dark factory' capabilities.

- Workforce retraining: Preparing the existing workforce for roles that complement or manage automated systems.

3D Printing and Additive Manufacturing

The advancement of 3D printing and additive manufacturing presents a significant technological shift, particularly for industries involved in complex component design and production. For Genoyer SA, these innovations could unlock new avenues for creating specialized expansion joints and hose components. Imagine the possibility of rapid prototyping, allowing for quicker iteration and testing of new designs, or the development of highly customized solutions tailored to specific client needs.

The potential for on-demand production is another compelling aspect. Instead of relying on traditional manufacturing lead times, Genoyer SA could leverage additive manufacturing to produce niche or specialized parts as needed, potentially reducing inventory costs and improving responsiveness to market demands. The global additive manufacturing market was valued at approximately $19.1 billion in 2023 and is projected to grow significantly, indicating a strong trend towards adopting these technologies across various sectors.

- Rapid Prototyping: Accelerate product development cycles by quickly creating and testing new expansion joint and hose designs.

- Customization: Offer bespoke solutions for clients with unique specifications, enhancing product differentiation.

- On-Demand Production: Manufacture specialized components as required, optimizing inventory and reducing lead times.

- Material Innovation: Explore new material possibilities for enhanced performance and durability in demanding applications.

Technological advancements are reshaping Genoyer SA's operational landscape, particularly in materials science and manufacturing processes. The increasing demand for advanced alloys, driven by the global advanced materials market projected to exceed $100 billion by 2025, offers opportunities for enhanced product performance in Genoyer SA's offerings.

Digitalization and smart factory initiatives are accelerating, with significant investments in AI and IoT technologies. By 2024, a substantial portion of manufacturers were expected to adopt smart factory strategies, aiming to automate operations and boost productivity. Genoyer SA needs to ensure its products integrate with these evolving intelligent manufacturing ecosystems.

AI's role in manufacturing, with global spending projected to surpass $100 billion by 2025, is critical for process optimization and quality enhancement. Predictive maintenance, for instance, can cut maintenance costs by up to 40% and reduce downtime by 50%, directly impacting Genoyer SA's profitability and efficiency in expansion joint production.

The integration of advanced robotics and automation is a key trend. The global industrial robotics market, valued at approximately $59.5 billion in 2024, necessitates Genoyer SA's evaluation of its manufacturing methodologies to stay competitive. Cognitive automation and 'dark factories' represent the next frontier, promising further gains in productivity and precision for companies like Genoyer SA.

| Technology Area | Market Projection/Value (2024-2025) | Impact on Genoyer SA |

|---|---|---|

| Advanced Materials | Global Advanced Materials Market > $100 Billion (by 2025) | Enhanced product performance, durability, and corrosion resistance for industrial pipes and hoses. |

| AI in Manufacturing | Global AI Spending in Manufacturing > $100 Billion (by 2025) | Process optimization, predictive maintenance (up to 40% cost reduction, 50% downtime reduction), improved quality control. |

| Industrial Robotics | Global Industrial Robotics Market ~$59.5 Billion (2024) | Increased production efficiency, workplace safety, need for updated manufacturing methodologies. |

| Additive Manufacturing | Global Additive Manufacturing Market ~$19.1 Billion (2023) | Rapid prototyping, customization, on-demand production of specialized components. |

Legal factors

New environmental regulations are set to significantly impact industrial operations. For instance, the Draft Regulation on the Management of Industrial Emissions, anticipated in 2025, will introduce stricter controls on air, water, and soil pollution. This includes more rigorous emission limit values (ELVs) and the mandatory acquisition of Green Transformation Certificates, signaling a push towards more sustainable manufacturing practices.

Genoyer SA, operating within the iron and steel manufacturing sector, faces direct implications from these changes. The company must adhere to these updated standards, particularly concerning hazardous air pollutants. Compliance will likely necessitate investments in new technologies and process improvements to meet the heightened environmental performance requirements, potentially affecting operational costs and strategic planning.

Genoyer SA operates in sectors like oil and gas, chemical, and aerospace, where stringent safety and quality standards are paramount due to the potentially severe consequences of failure. Products such as expansion joints and flexible metal hoses must adhere to specific certifications and safety requirements to guarantee dependable and safe performance, especially under extreme operational conditions.

Product liability laws underscore the critical need for Genoyer SA to maintain robust quality control and design integrity throughout its manufacturing processes. For instance, in the aerospace sector, compliance with standards like AS9100 is essential, reflecting the high stakes involved in aviation safety. Failure to meet these rigorous demands can lead to significant legal repercussions and reputational damage.

Changes in international trade laws and tariffs directly affect Genoyer SA's global operations. For instance, the World Trade Organization reported that global trade growth slowed to an estimated 0.9% in 2023, down from 2.7% in 2022, partly due to increased protectionist measures and trade restrictions. This slowdown necessitates a careful review of Genoyer SA's sourcing and distribution networks to mitigate potential cost increases on raw materials and finished products.

Navigating these evolving trade landscapes is crucial for Genoyer SA's market access and competitive pricing. The ongoing geopolitical shifts, such as the trade disputes between major economic blocs, are prompting many companies, including Genoyer SA, to reconsider their reliance on single-country sourcing. This strategic re-evaluation aims to build more resilient supply chains, potentially leading to diversified manufacturing locations and altered cost structures for the company's product portfolio.

Labor Laws and Workforce Regulations

Genoyer SA, like all industrial manufacturers, faces significant risks stemming from labor laws and workforce regulations. Adherence to these rules, covering aspects like working conditions, minimum wage requirements, and the right to unionize, is paramount for smooth operations. For instance, in 2024, many European countries are reviewing or implementing stricter regulations on working hours and employee benefits, potentially increasing Genoyer SA's labor costs.

Changes in these legal frameworks can directly impact operational expenses and how the company manages its workforce. For example, a new law mandating higher overtime pay or enhanced safety equipment could add millions to Genoyer SA's annual budget.

- Compliance Costs: In 2024, the estimated cost of non-compliance with labor laws for industrial firms in the EU averaged 5% of annual revenue, a figure Genoyer SA must actively manage.

- Wage Pressures: Minimum wage increases in key operating regions, such as Germany and France, are projected to rise by an average of 3-4% annually through 2025, directly affecting Genoyer SA's payroll.

- Unionization Trends: A notable trend in 2024 has been increased union activity in manufacturing sectors across North America and Europe, potentially leading to new collective bargaining agreements that could alter Genoyer SA's labor cost structure.

- Workplace Safety Regulations: Stricter enforcement of workplace safety standards, particularly concerning heavy machinery and chemical handling, is expected to drive investment in new safety protocols and training for Genoyer SA's employees in 2024-2025.

Intellectual Property Rights and Patents

Protecting intellectual property rights, particularly patents for innovative expansion joint and flexible hose designs and manufacturing processes, is paramount for Genoyer SA to sustain its market edge. These legal protections are vital for safeguarding proprietary technologies and discouraging unauthorized use by competitors.

The strength and scope of intellectual property laws directly influence Genoyer SA's strategic decisions regarding research and development investments. For instance, in 2024, companies in the industrial manufacturing sector saw patent filings increase by an average of 5% globally, indicating a growing emphasis on IP as a competitive differentiator.

- Patent Protection: Genoyer SA leverages patents to shield its unique expansion joint and flexible hose technologies from imitation.

- Deterrent to Infringement: Robust IP laws act as a strong deterrent against competitors copying Genoyer SA's innovations.

- R&D Investment Driver: The assurance of IP protection encourages continued investment in developing new and improved products.

- Market Competitiveness: Safeguarding intellectual property is a key strategy for maintaining Genoyer SA's competitive standing in the global market.

Genoyer SA must navigate evolving environmental regulations, such as the anticipated 2025 Draft Regulation on the Management of Industrial Emissions, which imposes stricter pollution controls and mandates Green Transformation Certificates. The company's compliance with product liability laws, particularly in high-stakes sectors like aerospace with standards like AS9100, is crucial to avoid legal repercussions. Furthermore, changes in international trade laws and tariffs, evidenced by the 2023 global trade growth slowdown to 0.9%, necessitate a review of supply chains to mitigate cost impacts.

Environmental factors

Global efforts to meet 2030 climate goals, including tripling renewable energy capacity and doubling energy efficiency, are fueling significant investment in green technologies. For Genoyer SA, a company in an energy-intensive industry, this translates to pressure to decarbonize its manufacturing processes and a potential avenue for growth by supplying solutions for green energy infrastructure, particularly in reducing industrial greenhouse gas emissions.

The push for sustainability in manufacturing is intensifying, with a significant focus on enhancing product reusability and recyclability. This trend directly impacts companies like Genoyer SA, requiring them to rethink their production cycles and material sourcing to meet evolving consumer and regulatory expectations.

Resource scarcity, especially concerning critical minerals and raw materials essential for many manufacturing processes, poses a substantial risk to supply chain stability. For instance, the International Energy Agency reported in 2024 that demand for critical minerals like cobalt and lithium, vital for batteries, is projected to increase by over 40 times by 2040 under net-zero emissions scenarios, highlighting the pressure on availability and price.

In response, Genoyer SA has an opportunity to explore and integrate sustainable materials and innovative processes. This strategic move not only aligns with global environmental objectives but can also lead to cost efficiencies and a stronger brand reputation by demonstrating a commitment to circular economy principles and responsible resource management.

Evolving environmental regulations, particularly concerning hazardous waste and emerging contaminants like PFAS, directly influence industrial operations. For instance, in 2024, the US EPA continued to strengthen regulations around PFAS, impacting industries that use or generate these chemicals. Genoyer SA must adapt by prioritizing waste reduction at the source and adopting comprehensive pollution prevention strategies.

Stricter air emission standards also necessitate significant investment in control technologies. Metal fabrication processes, a core activity for Genoyer SA, often generate particulate matter and volatile organic compounds that require careful management. Compliance with these evolving standards, which are increasingly harmonized internationally, is crucial for maintaining operational licenses and market access.

Energy Efficiency and Electrification

The global push for energy efficiency is accelerating, with industries investing heavily in electrification and process optimization. For instance, the International Energy Agency reported in 2024 that industrial energy efficiency improvements are critical to meeting climate goals, with electrification being a key driver. Genoyer SA's vibration and movement absorption products play a role here, ensuring piping systems operate smoothly and efficiently, which can translate into reduced energy consumption for their clients. This focus on operational efficiency directly fuels demand for components that enhance system performance and longevity.

Genoyer SA's offerings align with this trend by mitigating energy loss caused by excessive vibration and inefficient fluid dynamics in piping. As companies worldwide, including major industrial players in Europe and North America, are setting ambitious energy reduction targets for 2025 and beyond, the value proposition of components that improve system efficiency becomes even more pronounced.

- Growing Demand for Energy-Saving Solutions: Industries are prioritizing investments in technologies that reduce operational energy costs.

- Electrification as a Key Trend: The shift to electric power in industrial processes creates new opportunities for efficiency-enhancing components.

- Genoyer SA's Contribution: Products that absorb vibration and movement contribute to smoother, more energy-efficient piping system operation.

Impact of Extreme Weather and Climate Events

Extreme weather events, such as the record-breaking heatwaves and intensified storms observed in 2024, pose a significant threat to Genoyer SA's operations. These events can directly disrupt global supply chains, damage manufacturing facilities, and alter consumer demand patterns, impacting project timelines and costs for clients. For instance, the severe flooding in Southeast Asia in late 2024 caused widespread factory closures, affecting the availability of key components for numerous industries.

Building resilience is therefore crucial. Genoyer SA must proactively diversify its supplier base, ensuring that reliance on single geographic regions or suppliers is minimized. Strengthening infrastructure at its own facilities and encouraging clients to do the same for their projects can mitigate physical damage and operational downtime. This strategic approach to risk management is becoming increasingly vital as climate volatility escalates.

- Supply Chain Vulnerability: In 2024, an estimated 15% of global shipping routes experienced significant delays due to extreme weather, impacting delivery times for critical materials.

- Infrastructure Risk: The cost of weather-related damage to industrial infrastructure globally is projected to exceed $500 billion by 2025, highlighting the need for robust protective measures.

- Demand Fluctuation: Climate-driven changes in consumer behavior, such as increased demand for cooling solutions during heatwaves or reduced outdoor activity during storms, can create unpredictable market shifts.

- Operational Continuity: Proactive measures like backup power generation and flexible work arrangements can ensure business continuity even when faced with severe weather disruptions.

The increasing global focus on sustainability and climate action, driven by targets like the 2030 climate goals, is pushing industries towards decarbonization and the adoption of green technologies. For Genoyer SA, this presents both a challenge to reduce its own environmental footprint and a significant opportunity to supply components that support green energy infrastructure, particularly in reducing industrial emissions.

Resource scarcity, especially for critical minerals like cobalt and lithium, is a growing concern, with demand projected to surge significantly by 2040. Genoyer SA can mitigate this risk by exploring sustainable materials and innovative processes, aligning with circular economy principles and enhancing its brand reputation.

Stricter environmental regulations, including those for hazardous waste and air emissions, are compelling companies like Genoyer SA to invest in pollution prevention and control technologies. Compliance with these evolving standards is essential for maintaining operational licenses and market access in 2024 and beyond.

Extreme weather events, which intensified in 2024, pose direct threats to supply chains and infrastructure. Genoyer SA must build resilience by diversifying suppliers and strengthening its facilities to ensure operational continuity amidst escalating climate volatility.

PESTLE Analysis Data Sources

Our Genoyer SA PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable industry research, and widely recognized economic data providers. This ensures that each factor, from political stability to technological advancements, is grounded in factual and current information.