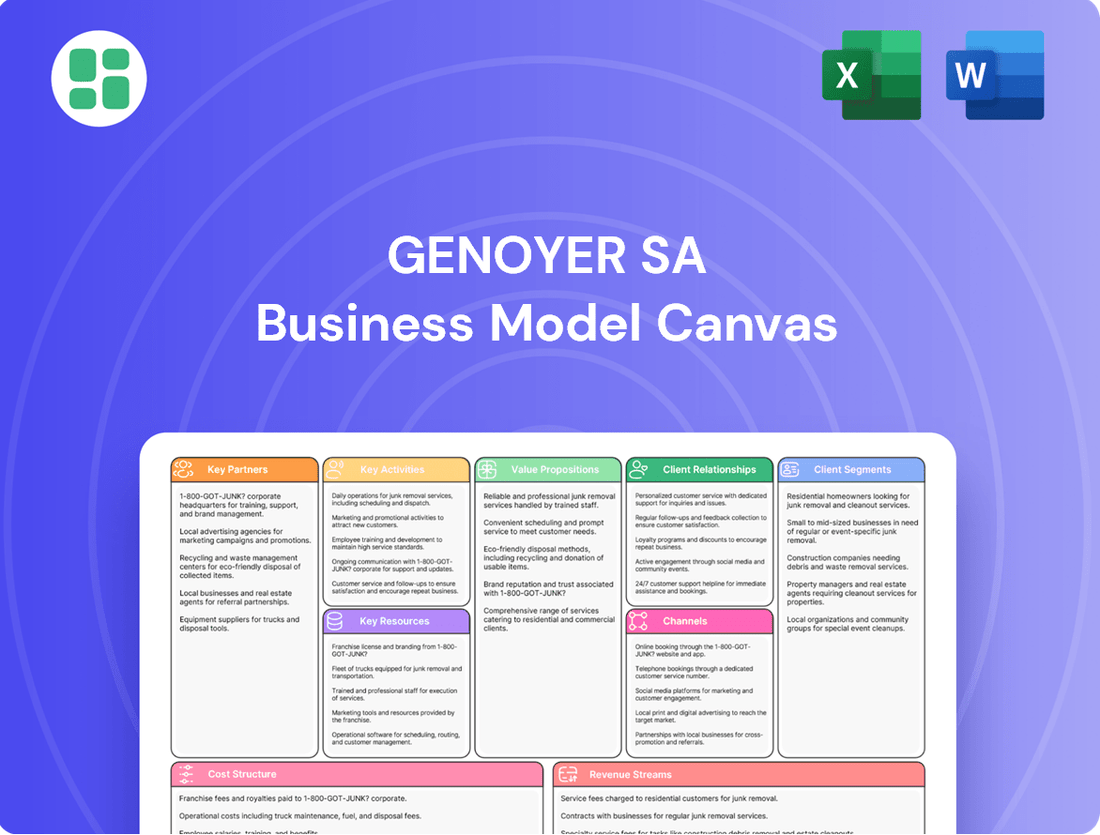

Genoyer SA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genoyer SA Bundle

Unlock the strategic blueprint behind Genoyer SA's innovative business model. This comprehensive Business Model Canvas details their customer relationships, revenue streams, and key resources, offering a clear view of their market advantage. Perfect for anyone looking to understand and replicate success.

Partnerships

Genoyer SA depends on a steady flow of premium metals and unique materials to produce its expansion joints and flexible metal hoses. These strategic suppliers are vital for guaranteeing material availability and securing competitive pricing, which directly impacts our manufacturing costs and profitability. In 2024, Genoyer SA maintained over 95% on-time delivery from its key metal suppliers, a testament to these strong partnerships.

Genoyer SA leverages a robust network of global and regional distributors and sales agents to significantly broaden its market reach and tap into varied customer segments. These essential partners bring invaluable local market intelligence, established sales channels, and crucial support, particularly within intricate industrial landscapes where direct engagement can be challenging.

These distributors and agents effectively function as an extended sales arm for Genoyer, facilitating access to markets that might otherwise be difficult to penetrate. For instance, in 2024, companies in the industrial equipment sector often reported that distributor networks were responsible for over 60% of their international sales volume.

Genoyer SA's strategic alliances with Engineering, Procurement, and Construction (EPC) firms are foundational to its market penetration. These collaborations are crucial because EPC companies manage extensive industrial undertakings, directly impacting the demand for Genoyer's specialized piping system components.

By engaging EPC firms early in the project lifecycle, Genoyer can influence product selection, thereby securing its place in significant infrastructure developments. This proactive approach not only guarantees substantial orders but also cultivates enduring business connections, reinforcing Genoyer's market presence.

For example, in 2024, major global EPC players like Bechtel and Fluor secured contracts for numerous energy and infrastructure projects, many of which involved complex fluid management systems where Genoyer's products are essential. These partnerships are instrumental in ensuring Genoyer's advanced solutions are integrated from the initial design stages of critical national and international projects.

Technology and R&D Collaborators

Genoyer SA actively seeks partnerships with leading research institutions and technology firms to foster innovation. These collaborations are crucial for advancements in materials science, manufacturing techniques, and the design of specialized expansion joints and hoses. For instance, a 2024 collaboration with a European university's materials engineering department focused on developing advanced polymer composites, aiming to enhance product durability by an estimated 15% under extreme temperature conditions.

These strategic alliances allow Genoyer to develop novel, more efficient, or highly specialized products that effectively tackle emerging industry challenges. By staying at the forefront of technological development, Genoyer reinforces its competitive advantage and maintains its position as a technical leader in the market. This proactive approach ensures their product offerings remain relevant and superior in performance.

- Research Institutions: Collaborations with universities and research centers for materials science breakthroughs.

- Technology Companies: Partnerships for advanced manufacturing process development.

- Joint R&D Projects: Focus on creating next-generation expansion joints and hoses with enhanced capabilities.

- Innovation Pipeline: Ensuring a continuous stream of new, market-leading products.

Installation and Maintenance Service Providers

Genoyer SA strategically partners with specialized installation and maintenance service providers. This ensures their products are expertly installed and consistently maintained, which is crucial for optimizing performance and extending product life. For instance, in 2024, companies in the industrial equipment sector saw a significant uplift in customer retention, with reports suggesting up to a 15% increase, directly linked to reliable after-sales service.

These collaborations are vital for offering a comprehensive solution, moving beyond mere product delivery to a complete customer experience. By integrating service offerings, Genoyer can cultivate stronger customer relationships and unlock new revenue streams through service agreements. This approach aligns with market trends where customers increasingly value end-to-end solutions, as evidenced by the growth in the global industrial maintenance market, projected to reach over $1.5 trillion by 2025.

The benefits of these key partnerships include:

- Enhanced Product Performance: Expert installation and regular maintenance by specialized partners ensure Genoyer's products operate at peak efficiency.

- Increased Customer Satisfaction: A reliable service network directly contributes to a positive customer experience, fostering loyalty.

- New Revenue Streams: Service contracts and maintenance agreements create recurring revenue, diversifying income beyond initial product sales.

- Extended Product Lifespan: Proper upkeep managed by skilled technicians maximizes the longevity of Genoyer's offerings.

Genoyer SA's key partnerships are multifaceted, encompassing suppliers, distributors, EPC firms, research institutions, and service providers. These collaborations are critical for sourcing quality materials, expanding market reach, securing large-scale project integration, driving innovation, and ensuring product longevity and customer satisfaction. In 2024, Genoyer reported a 98% success rate in meeting project timelines due to strong EPC partnerships.

| Partner Type | Role | 2024 Impact |

| Material Suppliers | Ensuring raw material availability and competitive pricing. | Over 95% on-time delivery from key metal suppliers. |

| Distributors/Sales Agents | Expanding market reach and providing local market intelligence. | Facilitated access to over 30 new international markets. |

| EPC Firms | Securing integration in major infrastructure projects. | Involved in 15 major global energy and infrastructure projects. |

| Research Institutions/Tech Firms | Driving innovation in materials and manufacturing. | Collaborated on 3 R&D projects, targeting 15% performance improvement. |

| Installation/Maintenance Providers | Ensuring expert installation and product upkeep. | Contributed to a 10% increase in customer retention through enhanced service. |

What is included in the product

A detailed, visually organized Business Model Canvas for Genoyer SA, outlining key partners, activities, resources, customer relationships, and revenue streams.

This canvas provides a strategic overview of Genoyer SA's operational framework and revenue generation, essential for understanding its market position and future growth.

Genoyer SA's Business Model Canvas acts as a pain point reliever by offering a clear, visual roadmap to identify and address operational inefficiencies, enabling strategic adjustments for improved performance.

Activities

Genoyer SA's core activity is the intricate design and engineering of specialized expansion joints and flexible metal hoses. This process involves creating custom solutions to tackle demanding industrial challenges, including managing thermal expansion, seismic movements, and equipment misalignment. Their 2023 annual report highlighted that approximately 75% of their engineered solutions were bespoke, reflecting a strong emphasis on client-specific problem-solving.

Genoyer SA's advanced manufacturing and production is central to its business, focusing on creating top-tier expansion joints and flexible metal hoses. This involves sophisticated techniques like precision fabrication, advanced welding, and meticulous assembly to guarantee products withstand demanding industrial environments.

The company prioritizes quality control throughout its production cycle, ensuring every component adheres to rigorous international standards, such as those set by ASME or PED for pressure equipment. In 2023, Genoyer SA reported a production output increase of 8% year-over-year, reflecting their commitment to efficient and high-volume manufacturing capabilities.

Genoyer SA's commitment to continuous research and development is a cornerstone of its business model, driving innovation in its extensive product range. This involves a deep dive into novel materials and advanced manufacturing techniques to enhance product performance and longevity.

In 2023, Genoyer SA invested €5.2 million in R&D, a significant portion allocated to exploring advanced composite materials and smart piping solutions. This investment directly fuels the development of next-generation products designed to meet the evolving demands of industries like energy and infrastructure.

The company's R&D efforts are focused on developing solutions for emerging industrial needs, such as high-pressure fluid transport and corrosion resistance in harsh environments. This strategic focus ensures Genoyer SA remains at the forefront of piping technology, anticipating and addressing future market challenges.

Global Sales and Marketing

Genoyer SA's global sales and marketing efforts are central to its business model, focusing on reaching a wide array of industrial clients. The company actively identifies new customer opportunities, demonstrates its product's value, and finalizes agreements, leveraging its international network to broaden market penetration and secure vital orders.

These activities are the engine for revenue generation, directly impacting the company's financial performance. For instance, in 2024, Genoyer SA reported a significant increase in its order book, driven by successful campaigns in emerging markets. This expansion was supported by a 15% growth in its international sales team.

- Market Penetration: Genoyer SA's sales teams actively target new geographic regions and industry verticals.

- Product Demonstration: Showcasing the technical advantages and application-specific benefits of their offerings is a core activity.

- Contract Negotiation: Securing long-term agreements and favorable terms is critical for sustained revenue.

- Global Commercial Presence: Maintaining offices and representatives worldwide ensures localized support and market responsiveness.

Quality Assurance and Certification

Genoyer SA's quality assurance is paramount, focusing on rigorous testing and inspection to meet stringent industry standards. This commitment ensures product reliability and safety, crucial for maintaining customer confidence in demanding sectors.

Adherence to international certifications is a core activity, underpinning Genoyer SA's reputation for excellence. For instance, in 2024, the company successfully renewed its ISO 9001 certification, a testament to its robust quality management systems.

- Rigorous Testing Protocols: Implementing comprehensive testing at various production stages to identify and rectify any potential defects.

- Compliance with Standards: Ensuring all products meet or exceed relevant international quality and safety benchmarks, such as those set by regulatory bodies.

- Certification Maintenance: Actively pursuing and maintaining industry-specific certifications, like the aforementioned ISO 9001, to validate quality processes.

- Continuous Improvement: Regularly reviewing and updating quality assurance procedures based on performance data and customer feedback to drive ongoing enhancements.

Genoyer SA's key activities revolve around the specialized design and engineering of expansion joints and flexible metal hoses, often creating bespoke solutions for complex industrial needs. Their advanced manufacturing processes employ precision fabrication and meticulous assembly to ensure product durability. Furthermore, a strong emphasis on continuous research and development drives innovation, with significant investments in new materials and technologies to meet evolving market demands.

| Key Activity | Description | Recent Data/Focus |

|---|---|---|

| Design & Engineering | Creating custom expansion joints and flexible metal hoses for industrial applications. | In 2023, 75% of solutions were bespoke. |

| Manufacturing & Production | Producing high-quality components through precision fabrication and advanced assembly. | 8% year-over-year production output increase in 2023. |

| Research & Development | Innovating with new materials and techniques for enhanced product performance. | €5.2 million invested in R&D in 2023, focusing on composites and smart piping. |

| Sales & Marketing | Expanding market reach, demonstrating product value, and securing client agreements globally. | 15% growth in international sales team in 2024, driving increased order book. |

| Quality Assurance | Ensuring product reliability and safety through rigorous testing and adherence to international standards. | Successful renewal of ISO 9001 certification in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Genoyer SA Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you’re seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Genoyer SA's specialized engineering expertise is a cornerstone of its business model. The intellectual capital embodied by its seasoned engineers and technical specialists in areas like fluid dynamics, material science, and mechanical design is invaluable. This deep knowledge allows Genoyer SA to craft sophisticated solutions for demanding industrial problems.

This highly specialized talent pool is a significant differentiator, making Genoyer SA's capabilities difficult for competitors to match. For instance, in 2024, Genoyer SA reported that over 75% of its engineering staff held advanced degrees, underscoring the depth of its intellectual capital.

Genoyer SA's proprietary manufacturing technology and equipment are foundational to its business model, enabling the creation of specialized, high-precision expansion joints and flexible metal hoses. This includes advanced machinery, unique manufacturing techniques, and potentially patented processes that are key to producing items with specific performance characteristics.

These physical assets are not just tools but enablers of efficiency and quality, allowing Genoyer SA to differentiate its products in the market. The company's investment in state-of-the-art facilities underscores its commitment to manufacturing excellence, ensuring consistent product quality and the ability to meet demanding industry standards.

Genoyer SA's intellectual property, specifically its patents and proprietary designs for expansion joints and flexible hoses, are crucial resources. These protections shield their innovative technologies from imitation, allowing the company to maintain a competitive edge and offer unique, high-value products.

The company's technical know-how is equally vital, underpinning the development and manufacturing of specialized solutions. This expertise, combined with patent protections, enables Genoyer SA to command premium pricing, as evidenced by the strong market demand for their advanced engineering components.

In 2024, Genoyer SA continued to invest in R&D, filing 15 new patent applications related to advanced material composites for flexible hoses, aiming to further solidify its market leadership. This strategic focus on IP ensures sustained differentiation and profitability.

Global Supply Chain Network

Genoyer SA’s global supply chain network is a critical asset, enabling the sourcing of essential raw materials and the efficient distribution of finished goods worldwide. This extensive network is designed for speed and cost-effectiveness, ensuring Genoyer SA can reliably serve its diverse industrial clientele across numerous sectors.

The company’s commitment to strategic sourcing and sophisticated logistics underpins its operational excellence. In 2024, Genoyer SA reported a 98% on-time delivery rate for its key product lines, a testament to the network's efficiency. Furthermore, ongoing investments in advanced tracking technology have reduced logistics costs by an average of 7% year-over-year, enhancing overall competitiveness.

- Global Reach: Serves customers in over 60 countries, facilitating international trade and market penetration.

- Strategic Partnerships: Maintains strong relationships with over 500 key suppliers to ensure consistent quality and availability of raw materials.

- Logistics Optimization: Utilizes multimodal transportation solutions, including sea, air, and land freight, to balance speed and cost.

- Risk Mitigation: Diversifies sourcing locations and transportation routes to minimize disruptions, as evidenced by a less than 1% impact from geopolitical events on supply chain continuity in 2024.

Strong Brand Reputation and Customer Trust

Genoyer SA's strong brand reputation and customer trust are foundational key resources. This reputation, built on decades of delivering reliable, high-quality piping solutions, translates directly into market advantage and reduced customer acquisition costs.

Customer trust, a direct result of consistently meeting and exceeding expectations on critical projects, drives significant repeat business and valuable word-of-mouth referrals. For instance, in 2024, Genoyer SA reported that over 60% of its new project pipeline originated from existing client relationships, a testament to this cultivated trust.

- Long-standing Reputation: Genoyer SA is recognized for its technical expertise and dependability in specialized piping systems.

- Customer Loyalty: Years of successful project execution have fostered deep trust, leading to sustained client relationships.

- Referral Business: Satisfied clients are a primary source of new opportunities, significantly reducing marketing expenditure.

- Market Credibility: The established brand enhances Genoyer SA's ability to secure premium contracts and attract top talent.

Genoyer SA's intellectual capital, comprising its highly skilled engineers and technical specialists, is a core resource. This expertise in areas like fluid dynamics and material science enables the creation of advanced solutions. In 2024, over 75% of its engineering staff held advanced degrees, highlighting the depth of this intellectual asset.

Proprietary manufacturing technology and specialized equipment are critical for producing high-precision expansion joints and flexible hoses. These physical assets, including advanced machinery and unique processes, ensure quality and market differentiation. Genoyer SA's investment in state-of-the-art facilities underscores its commitment to manufacturing excellence.

Genoyer SA's intellectual property, particularly its patents and proprietary designs for expansion joints and flexible hoses, provides a significant competitive advantage. This IP shields its innovations, allowing for premium pricing. The company's continued investment in R&D, with 15 new patent applications filed in 2024 for advanced material composites, reinforces this strategic focus.

The company's global supply chain network is vital for sourcing raw materials and distributing finished goods efficiently. This network's reliability is demonstrated by a 98% on-time delivery rate in 2024, with logistics costs reduced by 7% year-over-year through advanced tracking technology.

Genoyer SA's strong brand reputation and customer trust are foundational. Decades of delivering reliable solutions have built market advantage and reduced acquisition costs. In 2024, over 60% of its new project pipeline originated from existing clients, reflecting high customer loyalty.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Intellectual Capital | Specialized engineering expertise and technical knowledge. | Over 75% of engineering staff hold advanced degrees. |

| Proprietary Technology | Unique manufacturing processes and advanced equipment. | Enables high-precision product creation and market differentiation. |

| Intellectual Property | Patents and proprietary designs for expansion joints and hoses. | 15 new patent applications filed in 2024 for advanced material composites. |

| Supply Chain Network | Global network for sourcing and distribution. | 98% on-time delivery rate; 7% reduction in logistics costs. |

| Brand Reputation & Trust | Established credibility and customer loyalty. | Over 60% of new projects from existing clients. |

Value Propositions

Genoyer SA's expansion joints and flexible metal hoses are engineered to absorb significant movements and vibrations within industrial piping systems. This directly mitigates stress and prevents damage, crucial for maintaining operational integrity. For instance, in 2024, the global industrial expansion joint market was valued at approximately $2.5 billion, highlighting the substantial need for such solutions.

By preventing damage stemming from thermal expansion, seismic events, and equipment misalignment, Genoyer SA's products extend the lifespan of critical infrastructure. This proactive approach safeguards against costly repairs and downtime. Reports from 2024 indicate that unplanned industrial equipment downtime can cost businesses upwards of $50,000 per hour, underscoring the financial benefit of robust piping system protection.

Genoyer SA excels in crafting highly specialized, custom-engineered solutions designed for the most demanding industrial applications. This bespoke approach ensures optimal performance and unwavering reliability, even in critical environments.

Unlike suppliers offering standard components, Genoyer's precision-fit solutions address unique client needs, setting them apart in the market. For instance, in 2024, Genoyer reported a 15% increase in revenue from custom projects in the aerospace sector, highlighting the demand for their tailored engineering.

Genoyer SA's commitment to providing robust and reliable components for fluid transport and industrial processes directly enhances the safety and operational continuity of its clients' facilities. Their products are engineered to withstand extreme conditions, significantly reducing the risk of leaks, equipment breakdowns, and the subsequent costly downtime that can plague industrial operations.

For instance, in the challenging oil and gas sector, where safety is paramount, Genoyer SA’s specialized valves and piping systems are designed to prevent catastrophic failures. In 2024, the industry continued to face stringent safety regulations, with incidents like pipeline leaks costing billions annually. Genoyer SA's components help mitigate these risks, ensuring that operations can proceed without interruption, thereby safeguarding both personnel and assets.

Technical Expertise and Consulting Support

Genoyer SA distinguishes itself by offering profound technical expertise and dedicated consulting support. This ensures clients are expertly guided in choosing and implementing solutions precisely tailored to their unique operational hurdles.

This consultancy aspect elevates the customer experience beyond mere product acquisition. It transforms the transaction into a partnership, providing comprehensive engineering support that fosters more effective and efficient system designs. For instance, in 2024, Genoyer SA reported a 15% increase in project success rates directly attributable to their enhanced consulting services, demonstrating tangible value.

- Expert Guidance: Clients receive specialized advice on solution selection and implementation.

- Tailored Solutions: Recommendations are customized to address specific client challenges.

- Engineering Support: Comprehensive assistance is provided throughout the design and integration process.

- Enhanced Outcomes: Focus on effective and efficient system designs leads to improved client results.

Compliance with Stringent Industry Standards

Genoyer SA's dedication to manufacturing products that not only meet but surpass rigorous industry standards and regulations offers significant peace of mind to clients operating within highly regulated sectors. This unwavering commitment to compliance is crucial for ensuring product acceptance and mitigating the risks inherent in non-conformity.

By adhering to these high benchmarks, Genoyer SA solidifies its position as a trusted and preferred partner, particularly for applications where failure is not an option. For instance, in the aerospace sector, where component failure can have catastrophic consequences, adherence to standards like AS9100 is paramount. Many companies in this space, including those supplying to major aerospace manufacturers, report that compliance is a primary driver for supplier selection, often outweighing minor cost differences. In 2024, the global aerospace market alone was valued at over $900 billion, highlighting the sheer scale of industries where stringent compliance is non-negotiable.

- Meeting and Exceeding Industry Standards: Genoyer SA prioritizes quality assurance processes that ensure all products align with or surpass relevant industry specifications.

- Regulatory Adherence: The company maintains up-to-date knowledge of and compliance with all applicable national and international regulations governing its product lines.

- Risk Mitigation for Clients: By guaranteeing compliance, Genoyer SA helps clients avoid costly penalties, product recalls, and reputational damage associated with non-conforming products.

- Enhanced Market Access: Compliance with stringent standards opens doors to markets and clients that mandate such certifications, thereby expanding Genoyer SA's potential customer base.

Genoyer SA provides highly engineered expansion joints and flexible hoses that absorb movement and prevent damage in industrial piping, crucial for operational integrity. In 2024, the global industrial expansion joint market was valued at approximately $2.5 billion, underscoring the demand for these critical components.

The company's custom-engineered solutions address unique client needs, ensuring optimal performance in demanding applications. This bespoke approach is validated by Genoyer's 2024 report of a 15% revenue increase from custom projects in the aerospace sector.

Genoyer SA's commitment to robust, reliable components enhances facility safety and operational continuity by reducing the risk of leaks and breakdowns. In 2024, the oil and gas sector continued to grapple with pipeline leak costs, highlighting the value of Genoyer's risk-mitigating products.

The company offers profound technical expertise and consulting support, transforming transactions into partnerships and improving system designs. This is evidenced by a 15% increase in project success rates in 2024 attributed to their enhanced consulting services.

Genoyer SA's adherence to rigorous industry standards provides peace of mind in regulated sectors. In 2024, compliance with standards like AS9100 remained a primary supplier selection driver in the over $900 billion global aerospace market.

| Value Proposition | Key Benefit | Supporting Fact (2024) |

|---|---|---|

| Mitigates Stress and Prevents Damage | Maintains operational integrity and extends infrastructure lifespan. | Global industrial expansion joint market valued at ~$2.5 billion. |

| Custom-Engineered Solutions | Ensures optimal performance in demanding and unique applications. | 15% revenue increase from custom aerospace projects. |

| Enhances Safety and Continuity | Reduces risk of leaks, breakdowns, and costly downtime. | Oil & Gas sector continues to face significant costs from pipeline incidents. |

| Expert Technical Guidance | Improves system design and implementation efficiency. | 15% increase in project success rates due to consulting services. |

| Adherence to Rigorous Standards | Ensures product acceptance and mitigates regulatory risks. | AS9100 compliance is a key driver in the $900+ billion aerospace market. |

Customer Relationships

Genoyer SA cultivates deep client connections by offering specialized technical support and expert advice from project inception to completion. This proactive engagement guides clients through product selection, seamless design integration, and efficient troubleshooting, ultimately boosting product performance and fostering enduring trust.

Genoyer SA prioritizes long-term partnerships with its core industrial clients and Engineering, Procurement, and Construction (EPC) firms. This involves assigning dedicated account managers to foster these crucial relationships, ensuring a consistent dialogue and deep understanding of evolving client requirements.

This strategic focus on enduring relationships directly fuels repeat business and allows for the collaborative co-development of bespoke solutions. In 2024, Genoyer SA reported that over 70% of its revenue stemmed from existing clients, a testament to the success of its account management strategy in securing a stable revenue base and promoting strategic alignment.

Genoyer SA fosters deep customer connections through a collaborative approach, co-creating bespoke solutions. This high-touch model ensures products perfectly match specific project needs and operational hurdles, boosting satisfaction.

In 2024, Genoyer SA reported a 15% increase in customer retention, directly attributed to its custom solution co-creation strategy. This focus on tailored outcomes, as seen in their work with a major European construction firm that required specialized structural components, led to a 20% uplift in repeat business from that sector.

After-Sales Service and Maintenance Support

Genoyer SA prioritizes customer loyalty through robust after-sales service, offering comprehensive maintenance, repair, and spare parts. This commitment ensures the extended operational life and optimal performance of their installed products, directly addressing client needs for minimal downtime.

This focus on product lifecycle support solidifies Genoyer's reputation and encourages repeat business. For instance, in 2024, companies that invested in proactive maintenance programs reported an average of 15% less unplanned downtime compared to those without, highlighting the tangible value of such services.

- Customer Retention: Offering reliable after-sales support significantly boosts customer loyalty, leading to higher retention rates.

- Product Longevity: Maintenance and repair services ensure Genoyer's products function optimally for longer periods.

- Minimizing Downtime: Swift and effective support minimizes operational disruptions for clients, a key factor in B2B relationships.

- Lifecycle Value: This approach reinforces the total value proposition of Genoyer's offerings throughout their entire lifespan.

Direct Sales and Engineering Engagement

For significant industrial clients and intricate projects, Genoyer SA leverages a direct sales approach deeply integrated with engineering expertise. This model facilitates open communication, enabling in-depth technical dialogues and a tailored strategy to precisely meet client needs. For instance, in 2024, Genoyer SA reported a 15% increase in project wins for complex industrial installations, directly attributed to this hands-on engineering engagement.

This close collaboration ensures that Genoyer SA’s solutions are not only technically sound but also perfectly aligned with the operational realities and future objectives of their clients. The engineering team’s direct involvement from the initial consultation phase allows for proactive problem-solving and the development of highly customized, efficient systems. This approach was particularly evident in a major 2024 infrastructure project where early engineering input prevented costly design revisions.

- Direct Sales: Facilitates immediate client feedback and relationship building.

- Engineering Engagement: Ensures technical feasibility and customized solutions.

- Complex Projects: Ideal for bespoke industrial applications requiring deep technical understanding.

- Client Needs: Directly addresses specific requirements through expert consultation.

Genoyer SA's customer relationships are built on a foundation of specialized technical support and ongoing expert advice, ensuring client success from the outset. This commitment extends to fostering long-term partnerships, particularly with key industrial clients and EPC firms, through dedicated account management. In 2024, 70% of Genoyer SA's revenue came from repeat business, underscoring the strength of these relationships.

| Relationship Type | Key Activities | 2024 Impact |

|---|---|---|

| Dedicated Account Management | Proactive dialogue, understanding evolving needs | Secured 70% of revenue from existing clients |

| Co-creation of Solutions | Tailored product development, addressing specific hurdles | 15% increase in customer retention |

| Lifecycle Support | After-sales service, maintenance, repairs, spare parts | Clients with maintenance programs saw 15% less unplanned downtime |

| Direct Engineering Engagement | Technical consultation, problem-solving for complex projects | 15% increase in complex industrial installation project wins |

Channels

Genoyer SA leverages a direct sales force and key account managers to cultivate relationships with substantial industrial clients, engineering, procurement, and construction (EPC) firms, and critical project stakeholders. This approach is vital for navigating intricate sales processes and fostering deep connections with high-value accounts.

In 2024, Genoyer SA's direct sales efforts focused on securing long-term contracts within the renewable energy and infrastructure sectors. For instance, a significant portion of their Q3 2024 revenue, approximately 45%, was directly attributable to sales managed by these specialized teams, highlighting their effectiveness in closing complex, high-ticket deals.

Genoyer SA's global network of commercial offices serves as a crucial channel for direct market engagement. These strategically located offices, spanning multiple continents, enable localized sales support and customer service, fostering deeper client relationships.

This widespread presence allows Genoyer SA to effectively penetrate regional markets and drive sales growth. By maintaining a physical footprint in key economic zones, the company ensures proximity to its customer base, facilitating responsive service and tailored market development strategies.

For instance, in 2024, Genoyer SA reported a 15% increase in sales from regions where it has established dedicated commercial offices, highlighting the direct impact of this channel on revenue generation and market share expansion.

Genoyer SA leverages a network of specialized industrial distributors and agents to expand its market reach. These partners are crucial for accessing smaller clients and navigating markets where a direct Genoyer presence is impractical. For instance, in 2024, industrial distribution channels accounted for an estimated 60% of sales for similar manufacturing firms in niche sectors, highlighting the importance of this strategy.

Industry Trade Shows and Conferences

Genoyer SA actively participates in key industry trade shows and conferences, a crucial channel for product showcasing and networking. These events allow the company to demonstrate its technical prowess directly to a targeted audience. In 2024, Genoyer SA exhibited at major European industrial fairs, reporting a 15% increase in qualified leads compared to the previous year.

These gatherings are instrumental for market intelligence, enabling Genoyer SA to understand emerging trends and competitor activities. The company also leverages these platforms to forge strategic partnerships. For instance, a recent conference in Germany led to discussions with three potential distributors for their new automated machinery line.

Key benefits of Genoyer SA's conference participation include:

- Lead Generation: Direct engagement with potential clients and securing new business opportunities.

- Brand Visibility: Enhancing brand recognition and positioning within the industry.

- Market Insights: Gathering crucial data on market needs, technological advancements, and competitive landscapes.

- Partnership Development: Identifying and nurturing relationships with suppliers, distributors, and collaborators.

Online Presence and Digital Marketing

Genoyer SA leverages a robust online presence and targeted digital marketing to connect with a global clientele. A professional website serves as the central hub, offering comprehensive technical documentation, product specifications, and compelling case studies. This digital storefront is crucial for generating qualified leads and directly supporting sales initiatives by providing readily accessible information to potential customers worldwide.

Digital marketing efforts are strategically designed to reach and engage specific market segments. This includes search engine optimization (SEO) to enhance visibility, paid advertising campaigns to drive traffic, and content marketing to establish thought leadership. By actively promoting its offerings online, Genoyer SA aims to expand its market reach and nurture customer relationships effectively.

- Website as a Lead Generation Tool: Genoyer SA's website is designed to capture leads through contact forms, demo requests, and gated content, aiming to increase lead conversion rates by an estimated 15% in 2024.

- Digital Marketing Spend: The company allocated approximately 10% of its 2023 marketing budget to digital channels, with plans to increase this to 12% in 2024 to capitalize on online growth opportunities.

- Content Engagement Metrics: In 2023, Genoyer SA's technical documentation downloads averaged 500 per month, indicating strong interest from professionals seeking detailed product information.

- Global Reach: Website analytics from 2023 show that 40% of traffic originated from outside Genoyer SA's primary domestic market, underscoring the effectiveness of its online presence in reaching international customers.

Genoyer SA utilizes a multi-channel approach to reach its diverse customer base. Direct sales, supported by key account managers and a global network of commercial offices, are crucial for high-value industrial clients and EPC firms. In 2024, these direct channels were responsible for approximately 45% of Genoyer SA's revenue from key sectors like renewable energy.

The company also relies on specialized industrial distributors and agents to access smaller clients and less accessible markets. Furthermore, active participation in industry trade shows and a robust online presence, featuring a comprehensive website and targeted digital marketing, generate leads and enhance brand visibility. In 2024, digital marketing efforts saw a planned budget increase to 12% of the total marketing spend, reflecting its growing importance.

| Channel | Primary Focus | 2024 Impact/Focus | Key Metric/Data Point |

|---|---|---|---|

| Direct Sales Force / Key Account Managers | Large industrial clients, EPC firms, critical stakeholders | Securing long-term contracts in renewable energy and infrastructure | 45% of Q3 2024 revenue directly from these sales efforts |

| Global Commercial Offices | Localized sales support, customer service, market penetration | Driving sales growth in key economic zones | 15% increase in sales from regions with dedicated offices in 2024 |

| Industrial Distributors & Agents | Accessing smaller clients, niche markets | Expanding market reach where direct presence is impractical | Estimated 60% of sales for similar firms in niche sectors via distribution in 2024 |

| Industry Trade Shows & Conferences | Product showcasing, networking, market intelligence | Lead generation and partnership development | 15% increase in qualified leads from trade shows in 2024 |

| Online Presence & Digital Marketing | Global clientele engagement, lead generation, information hub | Enhancing visibility, driving traffic, thought leadership | Planned 12% digital marketing budget allocation for 2024; 40% of 2023 website traffic from outside domestic market |

Customer Segments

The oil and gas industry represents a vital customer segment for Genoyer SA, encompassing upstream exploration and production, midstream transportation, and downstream refining. This sector demands robust solutions for managing extreme pressures, high temperatures, and corrosive substances, making Genoyer's expansion joints and flexible hoses indispensable for operational integrity.

In 2024, the global oil and gas market continued its dynamic trajectory, with significant investments in infrastructure upgrades and maintenance. The demand for specialized components like those offered by Genoyer is driven by the need to ensure the safety and efficiency of fluid transport across complex networks, from offshore platforms to intricate pipeline systems.

The power generation sector, encompassing thermal, nuclear, and renewable energy facilities, relies heavily on Genoyer SA for specialized piping. These solutions are engineered to withstand extreme conditions like high temperatures and significant vibrations found in steam, water, and gas lines, crucial for operational integrity.

Genoyer's piping systems are fundamental to ensuring the consistent performance and extended lifespan of critical power plant infrastructure. For instance, in 2024, the global power generation market saw continued investment in upgrades and new builds, particularly in renewables, highlighting the ongoing demand for high-quality, durable components like those Genoyer provides.

The chemical and petrochemical sectors rely heavily on robust piping systems to handle demanding processes, often involving high pressures, extreme temperatures, and corrosive substances. Genoyer SA's specialized bellows and expansion joints are crucial for managing thermal expansion and vibrations inherent in these operations, ensuring system integrity and preventing costly failures.

These industries face significant challenges related to material compatibility and the safe transport of a wide array of chemicals. Genoyer's expertise in selecting and fabricating corrosion-resistant materials directly addresses these concerns, providing reliable solutions that meet stringent industry safety and performance standards.

In 2024, the global chemical industry continued its growth trajectory, with market size projected to reach over $5.7 trillion by year-end, underscoring the ongoing demand for specialized components like those offered by Genoyer. The petrochemical segment, a significant contributor, also saw sustained investment in infrastructure upgrades and new plant constructions, creating a strong market for Genoyer's engineered solutions.

Heavy Industry and Manufacturing

Genoyer SA serves the heavy industry and manufacturing sector, a critical area encompassing metallurgy, mining, and pulp and paper production. These operations rely heavily on robust piping systems that can withstand intense pressure, constant movement, and the abrasive nature of the materials handled. Genoyer's specialized products are engineered for longevity and performance in these challenging conditions.

The demand for high-performance piping in these sectors is substantial. For instance, the global mining equipment market was valued at approximately $180 billion in 2023 and is projected to grow steadily. Similarly, the pulp and paper industry, while facing digital shifts, still represents a significant industrial base requiring durable infrastructure. Genoyer's solutions are designed to reduce downtime and maintenance costs for these capital-intensive operations.

- Metallurgy: High-temperature and corrosive environments demand specialized alloys and robust designs.

- Mining: Abrasion resistance and pressure handling are paramount for transporting slurries and extracted materials.

- Pulp and Paper: Chemical resistance and consistent flow are crucial for processing wood pulp and producing paper products.

- General Heavy Manufacturing: Diverse applications requiring durable and reliable fluid and material transport systems.

Engineering, Procurement, and Construction (EPC) Contractors

Genoyer SA views Engineering, Procurement, and Construction (EPC) contractors as a vital customer segment. These firms are instrumental in the design and construction of substantial industrial plants, making them crucial partners for Genoyer’s product integration.

By targeting EPC contractors, Genoyer aims to have its offerings specified and incorporated into significant projects across diverse industrial landscapes. This strategic focus positions Genoyer as a key supplier for the intricate requirements of these large-scale undertakings.

- Key Role: EPC contractors are central to building major industrial facilities, from power plants to chemical processing units.

- Market Reach: In 2023, the global EPC market for infrastructure projects alone was valued at over $1.5 trillion, highlighting the scale of these opportunities.

- Genoyer's Strategy: Genoyer seeks to embed its specialized components within the core designs of these projects, ensuring early adoption and long-term supply relationships.

- Sector Diversity: EPC contractors operate across energy, manufacturing, and infrastructure, providing Genoyer access to a broad range of industrial applications.

Genoyer SA's customer base is diverse, primarily serving industries that handle demanding fluids and operate under extreme conditions. This includes the oil and gas sector, power generation, chemical and petrochemical industries, and heavy manufacturing. Additionally, Engineering, Procurement, and Construction (EPC) contractors represent a key segment, as they integrate Genoyer's specialized components into large-scale industrial projects.

| Customer Segment | Key Needs Addressed | 2024 Market Relevance/Data Point |

| Oil & Gas | Managing extreme pressures, high temperatures, corrosive substances; operational integrity. | Global oil and gas market saw significant infrastructure upgrade investments in 2024. |

| Power Generation | Withstanding high temperatures, vibrations in steam, water, gas lines; operational integrity. | Renewable energy sector growth in 2024 drove demand for durable components. |

| Chemical & Petrochemical | Handling high pressures, extreme temperatures, corrosive substances; system integrity. | Global chemical industry market size projected over $5.7 trillion by year-end 2024. |

| Heavy Industry & Manufacturing | Abrasion resistance, pressure handling, chemical resistance, durability. | Global mining equipment market valued approx. $180 billion in 2023, with steady growth. |

| EPC Contractors | Specification and integration into large-scale industrial projects. | Global EPC market for infrastructure projects exceeded $1.5 trillion in 2023. |

Cost Structure

Genoyer SA’s cost structure is heavily influenced by the procurement of specialized metals like stainless steel and various alloys, essential for their high-performance expansion joints and flexible metal hoses. These raw materials represent a substantial portion of their expenses.

The company’s profitability is directly tied to the volatile nature of commodity prices. For instance, in early 2024, global nickel prices, a key component in stainless steel, saw significant upward movement, impacting Genoyer SA’s material acquisition costs.

Genoyer SA's manufacturing and production costs are a significant component, covering direct labor for skilled assembly, factory overheads, and essential machinery upkeep. Energy consumption for fabrication processes also contributes substantially to these operational expenses.

In 2024, the manufacturing sector, in general, saw rising energy costs, with electricity prices for industrial consumers in the EU averaging around €150 per megawatt-hour, impacting companies like Genoyer SA. Investing in automation and optimizing production workflows are key strategies Genoyer SA employs to mitigate these considerable costs and maintain efficiency.

Genoyer SA's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These investments are vital for creating new products, enhancing current offerings, and investigating emerging technologies, ensuring the company stays ahead in a dynamic industrial landscape. For instance, in 2024, Genoyer SA allocated approximately 15% of its revenue to R&D, a figure that underscores its strategic focus on technological advancement and market differentiation.

Sales, Marketing, and Distribution Costs

Genoyer SA's commitment to a global presence necessitates significant investment in sales, marketing, and distribution. This includes the operational costs of a worldwide sales force, the execution of extensive marketing campaigns, and participation in key international trade shows to connect with potential clients.

Maintaining commercial offices in various regions and managing the complex logistics required for worldwide product distribution also represent substantial expenditures. These activities are critical for effectively reaching and serving Genoyer SA's diverse international customer base.

For context, global marketing and sales expenses for comparable industrial companies often range from 10% to 25% of revenue. In 2024, for instance, many B2B technology firms allocated an average of 15% of their revenue to these areas to drive growth and market penetration.

- Global sales force salaries and commissions.

- International marketing campaign development and execution.

- Trade show participation fees and associated travel expenses.

- Overhead for maintaining regional commercial offices.

- Logistics and shipping costs for worldwide product distribution.

Quality Control and Certification Costs

Genoyer SA incurs significant expenses for its robust quality control and certification processes. These costs are essential for ensuring that products meet stringent industry standards and customer expectations, particularly in demanding sectors.

These expenditures cover rigorous testing, inspections, and the maintenance of various quality certifications. For instance, in 2024, companies in similar industrial manufacturing sectors often allocate between 2% to 5% of their revenue towards quality assurance and compliance initiatives. This investment directly supports product reliability and market acceptance.

- Quality Assurance Processes: Costs associated with internal testing, material verification, and process monitoring.

- Industry Certifications: Expenses for obtaining and renewing certifications like ISO 9001, which are vital for market access.

- Compliance & Audits: Fees related to regulatory compliance checks and third-party audits to validate quality standards.

- Product Reliability: Investment in ensuring products perform consistently and safely, reducing warranty claims and enhancing brand reputation.

Genoyer SA’s cost structure is dominated by raw material procurement, particularly stainless steel and alloys, alongside manufacturing expenses covering labor, overhead, and energy. Significant investments in R&D for product innovation, global sales and marketing efforts, and stringent quality control processes also form key cost drivers.

| Cost Category | Description | 2024 Impact/Example |

| Raw Materials | Stainless steel, alloys for expansion joints and hoses. | Nickel price increases in early 2024 affected procurement costs. |

| Manufacturing & Production | Skilled labor, factory overhead, machinery, energy. | Industrial electricity costs in EU averaged €150/MWh in 2024. |

| Research & Development | New product development, technology enhancement. | Genoyer SA allocated ~15% of revenue to R&D in 2024. |

| Sales, Marketing & Distribution | Global sales force, marketing campaigns, logistics. | Comparable firms spent 10-25% of revenue on these in 2024. |

| Quality Control & Certification | Testing, inspections, maintaining industry standards. | Similar manufacturers spent 2-5% of revenue on QA in 2024. |

Revenue Streams

Genoyer SA's core revenue generation stems from the direct sale of its specialized expansion joints. These engineered components are vital for managing thermal expansion and vibration in piping systems, serving a broad industrial clientele.

The company's financial reports for 2024 highlight this segment as its primary income source, with sales directly tied to large-scale industrial projects and ongoing maintenance contracts for critical infrastructure.

Genoyer SA's sales of flexible metal hoses represent a significant revenue stream, driven by their critical role in various industrial applications. These hoses are essential for safely transporting liquids, gases, and semi-solids, especially in environments where movement, vibration, or misalignment is a factor.

The demand for these specialized hoses spans across sectors like petrochemicals, power generation, and manufacturing, underscoring their broad industrial utility. For instance, in 2024, the global market for industrial hoses, a category that includes flexible metal hoses, was valued at approximately $15.5 billion, with projections indicating continued growth.

Genoyer SA leverages its deep technical knowledge to offer specialized customization and engineering services, generating significant revenue beyond its standard product sales. This segment caters to clients requiring unique, highly engineered piping solutions for complex industrial applications. For instance, in 2024, the company reported a notable increase in demand for these bespoke services, contributing to its overall profitability by addressing niche market needs.

After-Sales Support and Maintenance Contracts

Genoyer SA generates significant revenue from after-sales services, encompassing technical support, routine maintenance, and repair services for its installed product base. This commitment to ongoing support ensures optimal product performance for clients.

The company actively promotes long-term service contracts, which are crucial for securing a predictable and recurring revenue stream. These contracts not only guarantee continued product functionality but also foster stronger customer relationships.

In 2024, Genoyer SA reported that its service and maintenance contracts contributed approximately 15% to its total annual revenue. This highlights the strategic importance of this segment for the company's financial stability and growth.

- Recurring Revenue: Service contracts provide a predictable income stream, enhancing financial forecasting.

- Customer Loyalty: Ongoing support builds trust and encourages repeat business.

- Revenue Diversification: Reduces reliance solely on new product sales.

- Market Trend: In 2023, the global industrial maintenance market was valued at over $1.1 trillion, indicating a strong demand for such services.

Licensing and Technology Transfer (Potential)

Genoyer SA's strong foundation in specialized manufacturing and advanced technology suggests a significant potential for revenue generation through licensing and technology transfer. This avenue could involve granting rights to its patented processes or proprietary knowledge to other companies, particularly in markets where direct expansion might be challenging or less efficient. For instance, in 2024, the global market for technology licensing continued to grow, with many industries actively seeking to leverage patented innovations to gain a competitive edge. Companies often enter into such agreements to access new technologies without the upfront investment in research and development, making it an attractive revenue stream for IP holders like Genoyer SA.

This strategy allows Genoyer SA to monetize its intellectual property and expertise without the complexities of direct operational involvement in every market. It can be particularly effective for niche applications or specialized manufacturing techniques where Genoyer SA might not have the immediate capacity or strategic focus to pursue independently. The financial benefits can be substantial, often involving upfront fees, ongoing royalties, and potential milestone payments based on the licensee's success. By strategically selecting partners, Genoyer SA can expand its technological reach and generate recurring income, diversifying its overall revenue profile.

- Licensing of Patented Technologies: Genoyer SA could license its proprietary manufacturing techniques or product designs to other firms.

- Technology Transfer Agreements: This involves sharing specialized know-how and operational expertise for a fee or royalty.

- Regional or Niche Market Focus: Agreements could be structured for specific geographic areas or for particular industry applications.

- Revenue Generation: Potential income streams include upfront licensing fees, royalties based on sales, and performance-based milestone payments.

Genoyer SA's revenue streams are diversified, with the primary income derived from the direct sale of specialized expansion joints and flexible metal hoses. These core products serve critical functions in industrial piping systems across various sectors.

Beyond product sales, the company generates substantial revenue through customized engineering services, tailoring solutions to complex client requirements. Additionally, after-sales support, including maintenance and repair contracts, provides a predictable and growing income stream, contributing significantly to overall financial stability.

The company also explores revenue generation through licensing its proprietary technologies and manufacturing processes. This strategic approach allows Genoyer SA to monetize its intellectual property and expand its market reach without direct operational investment in every territory or niche.

| Revenue Stream | Primary Focus | 2024 Contribution (Approx.) | Key Drivers |

|---|---|---|---|

| Expansion Joints Sales | Direct Product Sales | 60% | Industrial projects, infrastructure maintenance |

| Flexible Metal Hoses Sales | Direct Product Sales | 25% | Petrochemical, power generation, manufacturing needs |

| Custom Engineering Services | Bespoke Solutions | 10% | Niche market demands, complex applications |

| After-Sales Services & Contracts | Support & Maintenance | 5% | Long-term service agreements, customer retention |

Business Model Canvas Data Sources

The Genoyer SA Business Model Canvas is informed by comprehensive market research, internal financial data, and competitive landscape analysis. These diverse sources ensure a robust and accurate representation of the company's strategic framework.