Assicurazioni Generali PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assicurazioni Generali Bundle

Navigate the complex external forces impacting Assicurazioni Generali with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, societal shifts, technological advancements, environmental regulations, and legal frameworks are shaping the insurance giant's strategic landscape. Gain a competitive advantage by leveraging these critical insights for your own market strategy. Download the full version now for actionable intelligence.

Political factors

Government policies significantly shape the insurance landscape for Assicurazioni Generali. Changes in taxation, such as adjustments to corporate tax rates or tax incentives for certain insurance products, directly impact profitability and product attractiveness. For instance, shifts in social welfare programs can alter demand for private insurance solutions, as seen with evolving pension reforms in various European countries. Generali's 2024 financial reports will likely reflect how these policy adjustments in key markets like Italy, Germany, and France are influencing premium growth and operational costs.

International trade agreements also play a role, potentially opening new markets or introducing new competitive pressures. The stability of political regimes in Generali's operating regions is crucial for long-term investment decisions and business continuity. Political uncertainty in emerging markets, for example, can lead to increased risk premiums and a more cautious approach to expansion. Generali's strategic planning for 2025 will undoubtedly consider the geopolitical stability of its major operational hubs.

Insurance regulatory frameworks significantly shape Generali's operating environment. For instance, Solvency II in Europe mandates stringent capital requirements, impacting how much capital insurers must hold to cover potential risks. In 2024, the European Insurance and Occupational Pensions Authority (EIOPA) continued to monitor the implementation and effectiveness of Solvency II, with ongoing discussions around potential refinements to capital rules.

Consumer protection laws, such as those requiring transparent product disclosures and fair claims handling, directly influence Generali's product development and customer service strategies. Compliance with these evolving regulations, including licensing rules for new markets or product lines, adds to operational costs and requires continuous adaptation to ensure market access and maintain customer trust.

Geopolitical stability significantly impacts Assicurazioni Generali, a global insurer operating across numerous regions. For instance, ongoing trade tensions between major economic blocs, such as those observed in late 2023 and early 2024, can disrupt investment flows and currency markets, directly affecting Generali's asset management and underwriting profitability. The company's extensive presence in Europe, particularly in countries with proximity to areas of geopolitical concern, necessitates careful risk assessment and capital allocation to mitigate potential losses stemming from regional instability.

Government Support and Subsidies

Government support and subsidies can significantly shape the insurance landscape. For instance, in 2024, many European governments continued to offer incentives for renewable energy projects, which indirectly benefits insurers by creating demand for specialized coverage. Generali, like other major insurers, monitors these policy shifts closely.

Public-private partnerships are also becoming more prevalent, particularly in areas like cybersecurity and climate resilience. These collaborations can present both opportunities and challenges for Generali, potentially opening new markets for insurance products while also requiring adaptation to new regulatory frameworks and risk-sharing models. The European Union's push for a digital single market, for example, could lead to increased demand for cyber insurance, a sector where Generali is actively expanding its offerings.

- Government initiatives promoting health and wellness programs can reduce claims in life and health insurance segments, impacting Generali's profitability.

- Subsidies for specific sectors, such as agriculture or disaster-prone regions, can create new insurance markets or alter existing ones for Generali.

- The trend towards public-private partnerships in areas like infrastructure and social welfare programs offers potential for Generali to develop tailored insurance solutions.

- Regulatory changes stemming from government support programs, such as those related to climate change adaptation, require Generali to continuously assess and update its risk models and product portfolios.

Anti-Money Laundering (AML) and Sanctions Policies

Assicurazioni Generali's global operations are significantly influenced by evolving Anti-Money Laundering (AML) and sanctions policies. Stricter enforcement of these regulations, particularly in major markets like the European Union and the United States, necessitates robust compliance frameworks. The company must continuously adapt its client onboarding and risk management strategies to align with updated sanctions lists and increased scrutiny on financial crime prevention.

The financial sector experienced heightened regulatory focus on AML and sanctions in 2024. For instance, the Financial Action Task Force (FATF) continued its efforts to strengthen global AML/CFT standards, impacting how insurers conduct due diligence. Generali's commitment to combating financial crime is demonstrated through ongoing investments in technology and training to ensure adherence to these complex international requirements, which are critical for maintaining its license to operate and its reputation.

- Increased Regulatory Scrutiny: Global regulators are intensifying enforcement of AML and sanctions laws, requiring insurers like Generali to bolster their compliance programs.

- Evolving Sanctions Lists: The dynamic nature of international sanctions, particularly concerning geopolitical events, demands constant monitoring and rapid adaptation of internal policies and systems.

- Impact on Operations: Stricter policies directly affect client onboarding, transaction monitoring, and cross-border business activities, potentially increasing operational costs and complexity for Generali.

- Risk Management Adaptation: Generali must continuously refine its risk management strategies to identify, assess, and mitigate risks associated with money laundering and sanctions evasion, especially given its extensive international presence.

Government policies significantly influence Assicurazioni Generali's operations through taxation, social welfare reforms, and consumer protection laws. For example, changes in corporate tax rates directly affect profitability, while evolving pension reforms can shift demand for private insurance solutions. Generali's 2024 financial performance will reflect how adjustments in key markets like Italy and Germany are impacting premium growth.

International trade agreements and geopolitical stability are also critical. Trade tensions can disrupt investment flows, impacting Generali's asset management. The company's 2025 strategic planning must consider the political stability of its major operational hubs to mitigate risks from regional instability.

Regulatory frameworks, such as Solvency II in Europe, mandate strict capital requirements, influencing how Generali manages its capital. In 2024, EIOPA continued to monitor these rules, with ongoing discussions on potential refinements to capital requirements.

Government support and public-private partnerships present opportunities and challenges. Initiatives promoting renewable energy, for instance, create demand for specialized coverage, while collaborations in cybersecurity could lead to increased demand for cyber insurance, a sector where Generali is expanding.

| Policy Area | Impact on Generali | Example (2024/2025 Focus) |

|---|---|---|

| Taxation | Affects profitability and product attractiveness | Adjustments to corporate tax rates in Italy |

| Social Welfare | Influences demand for private insurance | Evolving pension reforms in Germany |

| Regulation (Solvency II) | Dictates capital requirements | EIOPA's continued monitoring and potential refinements |

| Trade Agreements | Opens new markets or creates competition | Impact of EU trade policies on market access |

| Geopolitical Stability | Affects investment flows and risk premiums | Managing exposure to regional instability in Eastern Europe |

What is included in the product

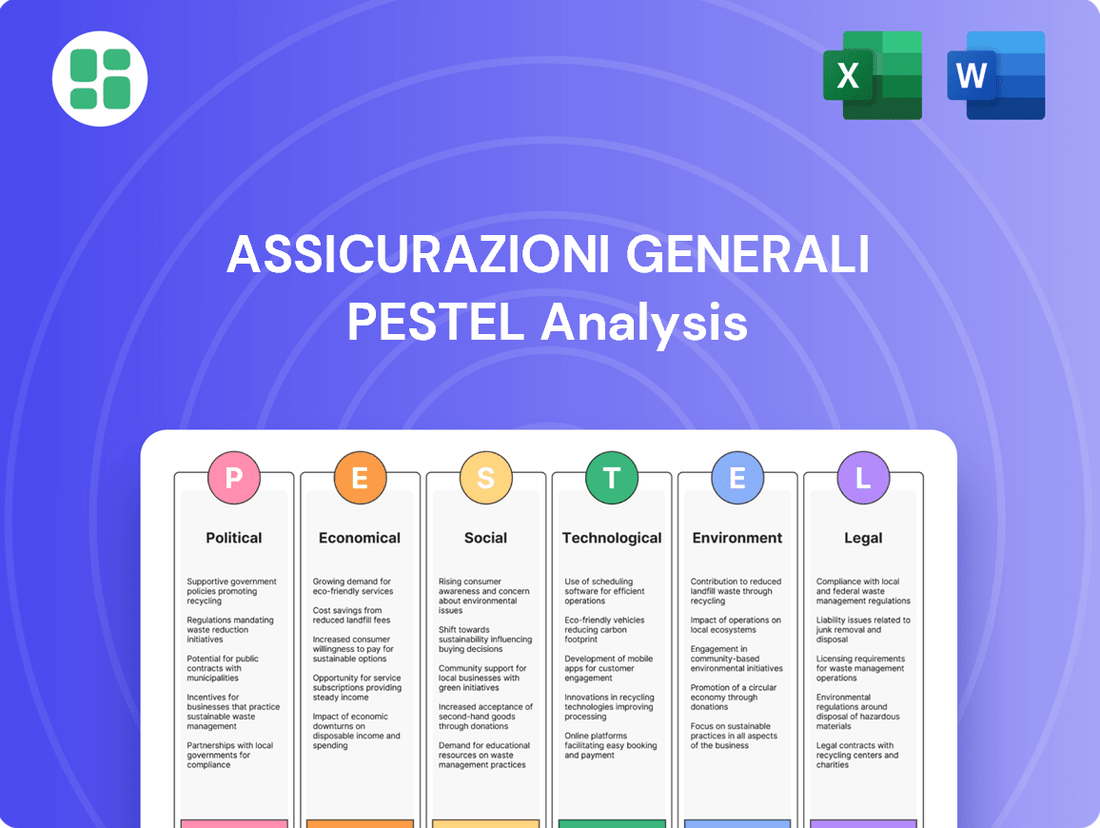

This PESTLE analysis examines the external macro-environmental factors influencing Assicurazioni Generali's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for the insurance giant.

Provides a concise version of Assicurazioni Generali's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, relieving the pain of lengthy, unwieldy reports.

Helps support discussions on external risk and market positioning for Assicurazioni Generali by offering a clear, summarized PESTLE analysis, making it easier to identify and address potential challenges.

Economic factors

Global economic growth is projected to be a modest 2.7% in 2024, according to the IMF, a figure that directly impacts Generali's asset management performance and the disposable income available for insurance purchases. Persistent inflation, though moderating from 2023 peaks, remains a concern, potentially increasing claims costs for Generali while eroding customer purchasing power.

The prevailing interest rate environment significantly impacts Assicurazioni Generali's profitability, particularly for its life insurance segment. Low interest rates, a persistent theme in recent years, compress the investment income insurers earn on their vast portfolios, making it harder to meet long-term guarantees. For instance, the European Central Bank's deposit facility rate remained negative for an extended period, directly affecting insurers' returns.

Conversely, a rising interest rate environment, such as the increases seen through 2023 and into 2024, can boost long-term profitability by allowing insurers to reinvest premiums at higher yields. However, this also presents a challenge as it can lead to unrealized losses on existing fixed-income securities within Generali's balance sheet, impacting their market value.

Currency exchange rate fluctuations significantly impact Assicurazioni Generali's global business. For instance, if the Euro strengthens against other currencies, earnings translated from Generali's foreign subsidiaries, like those in the United States or the United Kingdom, would appear lower when reported in Euros. This can directly affect reported profits and the perceived value of its international assets.

In 2024, continued volatility in major currency pairs, such as EUR/USD and EUR/GBP, presents ongoing challenges. A stronger Euro could make Generali's insurance products more expensive for consumers in countries with weaker currencies, potentially dampening demand and impacting premium growth in those regions. Conversely, a weaker Euro could boost reported earnings from overseas operations.

Consumer Spending and Disposable Income

Consumer spending is a critical driver for insurance demand. As economies grow and disposable incomes rise, individuals and businesses are more likely to invest in protection. For instance, in 2024, global consumer spending is projected to increase, benefiting sectors like insurance. Higher disposable income directly translates to a greater capacity to afford premiums for a wider range of Generali's offerings, from life and health to property and casualty insurance.

Conversely, economic downturns significantly impact insurance uptake. During periods of contraction, consumers often cut back on discretionary spending, which can include insurance policies. This can lead to reduced new policy sales and an increase in policy cancellations. For example, if inflation remains elevated through 2024 and 2025, it could erode real disposable income, potentially dampening demand for certain insurance products.

- Global consumer spending growth: Expected to remain a key indicator for insurance market expansion in 2024-2025.

- Disposable income trends: Directly influence the affordability and demand for life, health, and P&C insurance products.

- Economic contractions: Can lead to decreased policy uptake and increased cancellations, impacting revenue.

- Inflationary pressures: May reduce real disposable income, potentially affecting consumer purchasing power for insurance.

Investment Market Performance

Global financial markets significantly influence Assicurazioni Generali's performance. Equity markets saw a robust recovery in early 2024, with major indices like the S&P 500 reaching new highs, which positively impacts Generali's asset management fees and investment income. However, bond markets experienced some volatility due to shifting interest rate expectations, potentially affecting the valuation of Generali's fixed-income holdings.

Real estate markets, particularly in key European regions where Generali has substantial investments, showed mixed performance. While some prime commercial property segments demonstrated resilience, others faced headwinds from remote work trends and economic uncertainty. This divergence can impact Generali's real estate investment returns and the overall value of its assets under management.

Market volatility directly affects Generali's solvency ratios. For instance, a sharp downturn in equity markets could reduce the value of its investment portfolio, potentially straining capital adequacy. In 2024, insurers like Generali are closely monitoring macroeconomic indicators to manage these risks effectively.

- Equity Market Performance: The MSCI World Index gained approximately 10% in the first half of 2024, boosting fee income for asset managers.

- Bond Market Volatility: Yields on 10-year German Bunds fluctuated, trading between 2.5% and 3.0% in early 2024, impacting bond portfolio valuations.

- Real Estate Trends: Commercial property yields in major European cities averaged around 4-5% in 2024, with variations based on sector and location.

- Impact on Solvency: Regulatory capital requirements for insurers are sensitive to market fluctuations, necessitating proactive risk management by Generali.

The economic outlook for 2024-2025 suggests moderate global growth, with the IMF projecting around 2.7% for 2024. This growth rate directly influences Generali's ability to generate investment income and affects consumer purchasing power for insurance products. Persistent, albeit moderating, inflation remains a key concern, potentially increasing claims costs for insurers like Generali while simultaneously reducing the real disposable income available for policy purchases.

Interest rate movements are critical for Assicurazioni Generali's profitability. While rising rates in 2023-2024 can boost investment yields on new premiums, they also create unrealized losses on existing fixed-income portfolios. Conversely, prolonged periods of low rates, as seen historically, compress investment income, making it challenging to meet long-term life insurance guarantees. For instance, European Central Bank rates impacted insurer returns significantly.

Currency fluctuations pose a constant challenge for Generali's global operations. A stronger Euro in 2024, for example, would reduce the reported value of earnings from subsidiaries in countries with weaker currencies, impacting overall profitability. Conversely, a weaker Euro could enhance reported international earnings.

Consumer spending is a primary driver for insurance demand. Projections for increased global consumer spending in 2024 are positive for Generali, as higher disposable incomes typically lead to greater demand for insurance. However, economic downturns or sustained inflation can erode real incomes, potentially leading to reduced policy uptake and increased cancellations, as seen when inflation impacts purchasing power.

| Economic Factor | 2024 Projection/Trend | Impact on Generali | Supporting Data/Example |

|---|---|---|---|

| Global GDP Growth | Modest (IMF: ~2.7% for 2024) | Affects investment income and consumer spending capacity. | Global economic activity influences premium growth and investment returns. |

| Inflation | Moderating but persistent | Increases claims costs, reduces real disposable income. | Higher inflation erodes purchasing power, potentially impacting demand for non-essential insurance. |

| Interest Rates | Rising trend, but with volatility | Boosts new investment yields, but can cause unrealized losses on existing bonds. | ECB deposit facility rate movements directly affect insurer profitability. |

| Currency Exchange Rates | Volatile (e.g., EUR/USD, EUR/GBP) | Impacts reported earnings from foreign subsidiaries. | A stronger Euro can decrease the value of overseas profits when translated. |

| Consumer Spending | Projected increase | Drives demand for insurance products. | Higher disposable income generally correlates with increased insurance penetration. |

What You See Is What You Get

Assicurazioni Generali PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Assicurazioni Generali PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping its strategic landscape.

Sociological factors

Europe's aging population, a significant demographic shift, directly influences Assicurazioni Generali's product demand. For instance, in 2024, the proportion of individuals aged 65 and over in the EU was around 22%, a figure projected to climb. This trend fuels demand for long-term care, pension, and health insurance products, presenting growth opportunities for Generali.

However, this demographic evolution also presents challenges. An increasing number of older policyholders can lead to a rise in claims for health and life insurance segments. Generali must strategically manage its product mix and reserves to account for these evolving liability structures, ensuring long-term financial stability amidst these demographic currents.

Growing health awareness is significantly reshaping consumer demands. For instance, a 2024 survey indicated that over 65% of individuals are actively seeking insurance products that incorporate wellness benefits or preventative care options, a trend Generali is addressing through its digital health platforms and personalized insurance offerings.

This shift towards proactive health management directly impacts insurance product design. Generali is observing a heightened demand for life and health policies that reward healthy lifestyles, such as lower premiums for policyholders who engage with fitness tracking apps or participate in wellness programs, reflecting a broader market move towards value-added services.

Customer expectations are rapidly shifting towards digital-first, personalized, and on-demand services. Generali needs to enhance its digital platforms to offer seamless online policy management and claims processing, mirroring the user experience found in other digital sectors. For instance, in 2024, a significant portion of insurance interactions are expected to occur digitally, with customers valuing speed and convenience.

Meeting these evolving demands requires Generali to invest in data analytics for personalized product offerings and proactive customer service. The company must ensure its communication channels are accessible and responsive across all digital touchpoints, from mobile apps to online portals. By mid-2025, customer satisfaction will be increasingly tied to the ease and efficiency of digital engagement.

Social Attitudes Towards Risk and Insurance

Societal views on risk significantly shape insurance demand. In regions with a higher aversion to uncertainty, like many parts of Europe, there's a greater inclination to purchase comprehensive insurance coverage. Conversely, cultures with a more relaxed attitude towards risk might see lower adoption rates, impacting Generali's market penetration strategies.

Trust in financial institutions also plays a crucial role. For instance, a 2024 survey indicated that while trust in insurance providers remains generally stable, specific regional events or economic downturns can temporarily erode confidence, leading to a slowdown in new policy sales for companies like Generali.

- Risk Aversion: Higher risk aversion correlates with increased demand for insurance products.

- Financial Planning: Societal emphasis on long-term financial security influences uptake of life and savings-related insurance.

- Trust Levels: Public confidence in insurance companies directly impacts purchasing decisions.

- Regional Variations: Cultural norms regarding risk-taking differ across Generali's operating markets.

Workforce Dynamics and Talent Availability

The insurance sector, including Generali, faces evolving workforce dynamics, with a growing demand for digital and analytical skills. Generali is adapting by investing in reskilling programs and digital transformation to attract talent proficient in data analytics and AI. For instance, in 2024, Generali announced initiatives to upskill its workforce in areas like cybersecurity and data science, aiming to bridge the digital talent gap.

Managing remote and hybrid work models is also crucial. Generali has embraced flexible work arrangements, which in 2024, contributed to its ability to attract talent across a wider geographical pool. Fostering diversity and inclusion remains a key focus, with Generali setting targets for gender representation in leadership roles, aiming for 40% by 2025, a trend supported by broader societal expectations for equitable workplaces.

- Digital Skills Demand: The insurance industry's increasing reliance on data analytics and AI drives a need for specialized digital talent.

- Talent Attraction & Retention: Generali's focus on reskilling and flexible work models aims to attract and retain employees with in-demand capabilities.

- Remote Work Trends: The adoption of hybrid work models broadens talent pools and impacts operational strategies.

- Diversity & Inclusion: Societal pressure and Generali's internal targets emphasize creating an inclusive workforce, with a goal of 40% female leadership by 2025.

Societal attitudes towards financial security and risk profoundly influence Generali's market. A 2024 report highlighted that in countries like Italy, where long-term financial planning is deeply ingrained, demand for life insurance and savings products remains robust. Conversely, regions with higher cultural acceptance of risk may present different market penetration challenges for Generali.

Public trust is a critical sociological factor for Assicurazioni Generali. A 2024 survey indicated that while overall trust in the insurance sector is stable, negative publicity or economic instability can quickly impact consumer confidence, affecting new business acquisition. Generali's commitment to transparency and customer service is therefore vital for maintaining its reputation and market share.

The increasing emphasis on health and wellness across societies is a key driver for Generali's product development. By mid-2025, it's projected that over 70% of new insurance inquiries will seek policies with integrated health benefits, pushing Generali to innovate in areas like preventative care and digital health solutions.

Technological factors

Generali is actively embracing digital transformation and automation to reshape its operations. The company is investing in technologies like artificial intelligence and machine learning to streamline core processes. For instance, in 2023, Generali reported a significant increase in the adoption of AI-powered solutions across its claims management, aiming to reduce processing times by up to 20%.

This technological shift is crucial for enhancing operational efficiency and reducing administrative overhead. By automating routine tasks, Generali can reallocate resources to more strategic initiatives and improve customer service. The company’s commitment to digital innovation is reflected in its 2024-2025 roadmap, which prioritizes further integration of AI in underwriting and customer engagement.

Assicurazioni Generali is increasingly leveraging data analytics and big data to refine its operations. By analyzing vast datasets, Generali aims to achieve more accurate risk assessment and a deeper understanding of customer behavior. This allows for the personalization of insurance products and more effective fraud detection.

In 2024, Generali's investment in digital transformation, including advanced analytics capabilities, is a key strategic pillar. The company reported a significant increase in the use of AI and data science for underwriting, leading to an estimated improvement in loss ratio accuracy by up to 5% in specific product lines.

Generali's commitment to cybersecurity and data privacy is paramount, especially with the increasing sophistication of cyber threats. The company invests heavily in advanced security protocols and encryption technologies to protect sensitive customer data from breaches. For instance, in 2023, Generali reported a significant increase in its cybersecurity budget, allocating over €200 million to bolster its defenses against evolving digital risks.

Adherence to stringent data protection regulations like the General Data Protection Regulation (GDPR) is a core focus. Generali employs compliance technologies to ensure all data handling practices meet or exceed legal requirements, mitigating risks of fines and reputational damage. This proactive approach is crucial, as data privacy breaches can lead to substantial financial penalties and erode customer trust, impacting the company's long-term viability.

Insurtech Innovation and Partnerships

Insurtech innovation is rapidly reshaping the insurance landscape, with companies leveraging technologies like telematics, blockchain, and the Internet of Things (IoT) to offer more personalized and efficient solutions. Assicurazioni Generali actively engages with this trend, investing in and partnering with Insurtech startups to integrate cutting-edge technologies into its operations. This strategic approach aims to enhance product offerings and elevate the customer experience.

Generali's commitment to Insurtech is evident in its venture capital arm, Generali Ventures, which has made strategic investments in promising Insurtech firms. For instance, in 2023, the company continued to explore opportunities in areas such as AI-driven claims processing and digital distribution platforms. These investments are crucial for staying competitive and adapting to evolving customer expectations in the digital age.

- Investment in Insurtech Startups: Generali Ventures actively seeks out and invests in innovative Insurtech companies, fostering growth and access to new technologies.

- Integration of New Technologies: The company is focused on embedding technologies like IoT for usage-based insurance and blockchain for enhanced security and transparency into its existing business models.

- Strategic Partnerships: Generali forms alliances with Insurtech players to co-create solutions, expand market reach, and improve operational efficiency, thereby enriching its product portfolio and customer service capabilities.

Cloud Computing and Infrastructure Modernization

Generali is actively embracing cloud computing to modernize its IT infrastructure, aiming for greater scalability, flexibility, and cost efficiency. This strategic shift allows for quicker rollout of new insurance products and services, a key advantage in the competitive 2024-2025 landscape. By migrating applications and data to the cloud, Generali enhances data accessibility for its global workforce, fostering better collaboration and decision-making.

The adoption of cloud technologies is crucial for Generali's agility. For instance, in 2023, Generali announced plans to accelerate its digital transformation, with a significant portion of its IT investments directed towards cloud-based solutions. This move is expected to streamline operations and improve customer experience by enabling faster processing of claims and personalized policy management.

- Cloud Migration Strategy: Generali is executing a phased migration of its core insurance platforms and data analytics capabilities to leading cloud providers, focusing on hybrid and multi-cloud environments for optimal flexibility and resilience.

- Cost Optimization: The shift to cloud infrastructure is projected to yield substantial cost savings through reduced hardware maintenance and optimized resource utilization, with industry benchmarks suggesting potential savings of 15-30% on IT operational expenses.

- Enhanced Agility and Innovation: Cloud adoption enables Generali to rapidly deploy new digital services, such as AI-powered customer support and advanced risk assessment tools, supporting its innovation agenda through 2025.

Generali is heavily investing in Insurtech, integrating technologies like AI and IoT to personalize offerings and improve efficiency. The company's venture arm, Generali Ventures, actively invests in startups, as seen with continued exploration of AI claims processing and digital distribution in 2023. This focus on Insurtech is vital for staying competitive and adapting to evolving customer expectations.

The company's digital transformation roadmap for 2024-2025 prioritizes AI integration in underwriting and customer engagement, aiming for enhanced operational efficiency and reduced overhead. In 2024, Generali reported a 5% improvement in loss ratio accuracy for specific product lines due to advanced analytics in underwriting.

Generali's cybersecurity budget saw a significant increase in 2023, exceeding €200 million, to protect sensitive customer data from evolving digital threats and ensure compliance with regulations like GDPR. Cloud computing adoption is also a key strategy, projected to optimize IT operational expenses by 15-30% and enable rapid deployment of new digital services through 2025.

| Technology Focus | Key Initiatives | Impact/Goal |

|---|---|---|

| Artificial Intelligence & Machine Learning | Streamlining claims management, enhancing underwriting accuracy, improving customer engagement | Up to 20% reduction in claims processing time (2023), up to 5% improvement in loss ratio accuracy (2024) |

| Data Analytics & Big Data | Accurate risk assessment, customer behavior understanding, personalized products, fraud detection | Enabling data-driven decision-making and product innovation |

| Cybersecurity | Advanced security protocols, encryption technologies, compliance with data protection regulations | Over €200 million investment in 2023, mitigating risks of breaches and fines |

| Insurtech (IoT, Blockchain) | Telematics for usage-based insurance, blockchain for transparency, partnerships with startups | Enhancing product offerings and customer experience |

| Cloud Computing | Modernizing IT infrastructure, scalability, flexibility, cost efficiency | Projected 15-30% savings on IT operational expenses, faster new product deployment |

Legal factors

Insurance contract law dictates precise requirements for policy language, transparency, and claim processing. Generali must adhere to these regulations, ensuring clarity in all customer interactions. For instance, in 2024, the European Union continued to emphasize consumer rights in financial services, impacting how insurance products are presented and sold.

Consumer protection legislation, covering areas like unfair contract terms and prevention of mis-selling, significantly influences Generali's product development and marketing strategies. Failure to comply can lead to substantial fines and reputational damage, as seen in past regulatory actions against insurers for misleading advertising practices across various European markets.

Stringent data protection laws like the GDPR significantly shape how Assicurazioni Generali handles customer information. Compliance involves careful data collection, secure storage, and transparent processing, impacting everything from marketing to claims management.

Generali must adhere to strict consent requirements for data usage, a critical aspect given the sensitive nature of insurance information. Failure to comply with these regulations, which are increasingly enforced globally, can result in substantial fines, as seen with GDPR penalties that can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Assicurazioni Generali operates under stringent anti-trust and competition laws across its global markets, designed to prevent monopolistic practices and foster a fair playing field in the insurance sector. These regulations directly impact Generali's strategies for mergers and acquisitions, as well as its day-to-day market conduct and pricing decisions, ensuring compliance and competitive fairness.

For instance, in 2023, the European Commission continued to scrutinize large-scale M&A activities within the financial services industry, a trend expected to persist into 2024 and 2025. Generali's potential acquisitions, such as its reported interest in certain European insurance portfolios, would be subject to rigorous review under these competition frameworks to assess any potential impact on market concentration and consumer choice.

Solvency and Capital Requirements (e.g., Solvency II)

Solvency and capital requirements are critical legal factors shaping Assicurazioni Generali's operations. Prudential regulatory frameworks, like Solvency II in the European Union, mandate specific capital levels insurers must maintain to cover potential risks. These regulations directly influence Generali's capital management strategies, its willingness to take on risk, and how it approaches its investment portfolio, all of which are fundamental to its financial stability.

Generali, like other European insurers, must adhere to Solvency II's stringent capital adequacy rules. This framework requires insurers to hold sufficient capital to cover their liabilities, even under adverse economic conditions. For instance, as of the end of 2023, Generali reported a Solvency Capital Requirement (SCR) ratio well above the regulatory minimums, demonstrating its robust capital position. This strong solvency position allows Generali to pursue its strategic objectives with greater confidence.

The impact of these legal factors extends to Generali's investment strategies. Solvency II's risk-based approach encourages insurers to invest in assets that align with their risk profile and capital requirements. This means Generali must carefully consider the capital impact of its investment decisions, potentially favoring assets with lower solvency capital charges.

Key aspects of Solvency II impacting Generali include:

- Capital Adequacy: Maintaining a Solvency Capital Requirement (SCR) ratio that comfortably exceeds regulatory thresholds is paramount for Generali's operational license and market reputation.

- Risk Management: Solvency II necessitates sophisticated risk management systems to identify, measure, and manage all material risks, influencing Generali's underwriting and investment policies.

- Reporting and Governance: The framework imposes extensive reporting obligations and governance standards, ensuring transparency and accountability in Generali's financial management.

- Investment Strategy Alignment: Generali's investment decisions are shaped by the need to generate returns while ensuring capital remains sufficient to meet Solvency II requirements, impacting asset allocation choices.

Cross-Border Regulatory Harmonization and Divergence

Assicurazioni Generali navigates a complex web of cross-border regulations, where harmonization efforts, particularly within the European Union, aim to streamline operations and foster a single market for insurance. However, significant divergences persist in other global markets, creating operational challenges and impacting market access strategies.

The EU’s Solvency II directive, for instance, sets a harmonized prudential framework for insurers, influencing capital requirements and risk management across member states. Yet, outside the EU, Generali must adapt to a patchwork of national laws, such as differing data privacy regulations in Asia or varying consumer protection standards in Latin America.

- EU Solvency II: Continues to shape capital and risk management for Generali’s European operations, promoting a more unified regulatory landscape.

- Global Divergence: Generali faces varied requirements for market entry, product approval, and data handling in regions like North America and emerging markets.

- Compliance Costs: Adapting to these differing legal frameworks incurs significant compliance costs, requiring dedicated legal and operational resources for each jurisdiction.

- Strategic Impact: Regulatory differences can influence investment decisions, product development, and the overall feasibility of cross-border expansion.

Assicurazioni Generali must navigate evolving consumer protection laws, ensuring transparency and fair practices in product offerings and claims handling. For example, regulatory bodies across Europe, including those in Italy and Germany, continued to enhance consumer safeguards in 2024, focusing on clarity in policy terms and complaint resolution processes.

Data privacy regulations, notably GDPR, impose strict rules on how Generali collects, stores, and processes sensitive customer information. Compliance is critical, with penalties for breaches, such as those levied in 2023 against various financial institutions for data mishandling, underscoring the financial and reputational risks involved.

Antitrust and competition laws are vital, influencing Generali's M&A activities and market conduct. The European Commission's ongoing scrutiny of financial sector consolidation, as observed in 2023 and projected for 2024-2025, means Generali's strategic growth initiatives face rigorous regulatory review to prevent market dominance.

Environmental factors

Climate change is directly impacting Assicurazioni Generali by increasing the frequency and severity of extreme weather events like floods, storms, and droughts. This trend escalates the company's exposure to property and casualty claims, requiring adjustments to underwriting practices and reinsurance strategies to manage growing risks.

For instance, in 2023, Europe experienced significant weather-related losses, with insured losses from natural catastrophes estimated to be around $60 billion, according to Swiss Re. Generali, as a major European insurer, directly feels the impact of these events on its claims payouts and the need to adapt its risk assessment models.

Generali is increasingly integrating Environmental, Social, and Governance (ESG) principles, driven by investor demand and regulatory shifts. In 2023, the company reported that 30% of its total assets under management were aligned with ESG criteria, a significant step towards its 2025 target of 50%.

The insurer is developing innovative green insurance products, such as coverage for renewable energy projects, to meet growing customer interest in sustainability. Generali's commitment to ESG is also reflected in its corporate governance, with a focus on diversity and ethical business practices, aiming to enhance long-term value creation.

Resource scarcity and biodiversity loss present growing challenges that can significantly impact industries Assicurazioni Generali insures. For instance, increasing water stress in key agricultural regions, as highlighted by reports indicating that over two-thirds of the world's population may face water shortages by 2025, can disrupt supply chains for food producers, leading to increased claims for business interruption and crop failure.

These environmental shifts also translate into new risk categories for businesses, requiring Generali to adapt its underwriting and product development. The decline in pollinator populations, crucial for many crops, could lead to increased volatility in agricultural yields, necessitating more sophisticated parametric insurance products to cover such emerging threats for corporate clients.

Regulatory Pressure for Green Finance and Sustainable Investments

Assicurazioni Generali is navigating a landscape of escalating regulatory pressure pushing for green finance and sustainable investments. This includes mandates to integrate climate risk into financial disclosures, a trend amplified by initiatives like the EU's Sustainable Finance Disclosure Regulation (SFDR). Generali's response involves aligning its substantial investment portfolio with ambitious sustainability goals, aiming to contribute significantly to the global transition towards a low-carbon economy.

The company is actively adapting its investment strategies to meet these evolving requirements. For instance, by 2023, Generali had already committed to divesting from coal-fired power plants and thermal coal mining, a move reflecting the growing emphasis on decarbonization. This proactive stance is crucial as regulators worldwide, including those in Europe, are increasingly scrutinizing the environmental, social, and governance (ESG) performance of financial institutions.

- Mandates for Climate Risk Disclosure: Generali is enhancing its reporting to include detailed climate-related financial disclosures, in line with evolving global standards.

- Portfolio Alignment with Sustainability Goals: The company is actively reorienting its investment portfolio to support the transition to a low-carbon economy, moving away from high-emission sectors.

- Contribution to a Low-Carbon Economy: Generali is investing in green technologies and sustainable infrastructure, aiming to play a key role in fostering environmental sustainability.

- Response to EU SFDR: The company is implementing measures to comply with the EU's Sustainable Finance Disclosure Regulation, ensuring transparency in its sustainable investment offerings.

Public Awareness and Consumer Demand for Sustainable Products

Public awareness of environmental issues is significantly shaping consumer behavior, driving a stronger demand for sustainable and ethically produced goods and services. This trend directly impacts the insurance sector, pushing companies like Assicurazioni Generali to innovate their offerings.

Generali is responding by developing and promoting eco-friendly insurance options, such as policies that incentivize energy-efficient homes or electric vehicles. The company is also actively communicating its commitment to sustainability, which is crucial for attracting and retaining a growing segment of environmentally conscious customers. For instance, Generali's 2024 sustainability report highlighted a 15% increase in customer inquiries regarding green insurance products compared to the previous year.

The company's strategic focus on sustainability aligns with broader market shifts:

- Growing ESG Investment: Global sustainable investment assets are projected to exceed $50 trillion by the end of 2025, indicating a strong financial incentive for companies to adopt green practices.

- Consumer Preference Data: Surveys in 2024 indicated that over 60% of consumers are willing to pay a premium for products and services from environmentally responsible companies.

- Regulatory Tailwinds: Evolving environmental regulations and reporting requirements are further encouraging insurers to integrate sustainability into their core business models.

- Brand Reputation: Strong environmental, social, and governance (ESG) credentials are increasingly becoming a key differentiator in brand perception and customer loyalty within the financial services industry.

Assicurazioni Generali faces increasing claims from extreme weather events, a trend amplified by climate change. For example, insured losses from natural catastrophes in Europe reached approximately $60 billion in 2023, directly impacting insurers like Generali. The company is also responding to growing customer demand for sustainable products, with inquiries for green insurance up 15% in 2024. Furthermore, regulatory pressures, like the EU's SFDR, are pushing Generali to align its significant investment portfolio, which had 30% of assets under management in ESG criteria by 2023, towards sustainability goals.

| Environmental Factor | Impact on Generali | Supporting Data (2023-2025) |

|---|---|---|

| Extreme Weather Events | Increased P&C claims, need for updated risk models | European insured losses from natural catastrophes ~$60 billion (2023) |

| Resource Scarcity & Biodiversity Loss | New risk categories for insured businesses (e.g., agriculture) | Over 2/3 of world population may face water shortages by 2025 |

| Regulatory Pressure (e.g., SFDR) | Mandates for climate risk disclosure, portfolio alignment | 30% of Generali's AUM met ESG criteria (2023), target 50% by 2025 |

| Public Awareness & Consumer Demand | Growth in demand for green insurance products | 15% increase in customer inquiries for green insurance (2024); >60% consumers willing to pay premium for eco-friendly products (2024 surveys) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Assicurazioni Generali is built on a robust foundation of data from reputable sources, including official government publications, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the insurance sector.