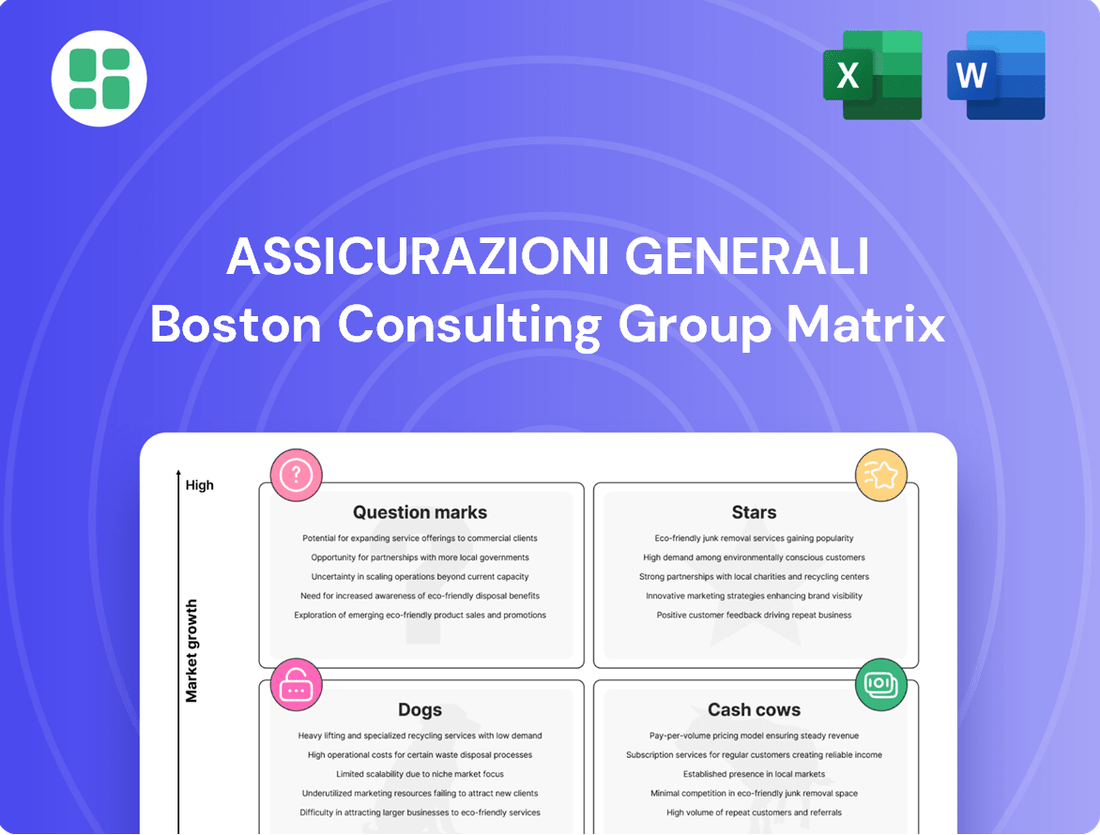

Assicurazioni Generali Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assicurazioni Generali Bundle

Assicurazioni Generali's BCG Matrix reveals a dynamic portfolio, with potential Stars poised for growth and established Cash Cows funding future ventures. Understanding these positions is crucial for strategic resource allocation and maximizing market share.

This preview offers a glimpse into Generali's product landscape, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Purchase the complete BCG Matrix for Assicurazioni Generali to gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Get a complete breakdown and strategic insights you can act on to drive informed decisions and competitive advantage.

Stars

Generali's Property & Casualty (P&C) non-motor insurance segment is a standout performer, demonstrating robust expansion. In the first quarter of 2025, gross written premiums for this sector surged by 8.6%, significantly contributing to the company's overall premium growth. This strong top-line performance is mirrored in the operating result, which climbed by an impressive 18.7% to exceed €1 billion in Q1 2025, indicating enhanced profitability and efficiency within the segment.

The favorable trajectory of Generali's P&C non-motor business aligns with broader market trends. The global P&C insurance market is anticipated to experience substantial growth, with a projected compound annual growth rate of 8.30% from 2025 through 2034. This outlook positions Generali's non-motor P&C operations as a key area of high growth and likely high market share within the company's portfolio.

Health insurance solutions represent a star in Assicurazioni Generali's portfolio, capitalizing on the robust global market growth. This segment is projected to expand at a compound annual growth rate of 7.43% between 2025 and 2034, signaling significant opportunity.

Generali is strategically investing in this high-growth area through initiatives like Generali Vitality and Europ Assistance's My Clinic. Furthermore, the innovative Welion platform in Italy demonstrates a commitment to preventive care and healthy living, directly addressing market demand and strengthening Generali's competitive position.

Unit-linked and protection life insurance products are key growth drivers for Assicurazioni Generali. In the first quarter of 2025, Generali's life net inflows exceeded €3 billion, with these segments being the sole contributors. This highlights strong customer demand and the significant potential within Generali's life insurance portfolio.

The global life insurance market is projected to expand at a robust annual rate of 3% in both 2025 and 2026. This accelerated growth, more than double the pace of the preceding decade, positions Generali's unit-linked and protection offerings for continued success and market leadership.

Asset & Wealth Management (specifically Private Markets and Real Assets)

Generali’s Asset & Wealth Management segment, especially its focus on private markets and real assets, is positioned as a strong contender within the broader BCG framework. This area experienced a notable 3.3% rise in its operating result during the first quarter of 2025, boosted by strategic moves such as the acquisition of Conning Holdings Limited.

The global asset management industry reached an impressive $128 trillion in 2024, with projections signaling sustained expansion. This growth is particularly pronounced in alternative asset classes, including private markets and real assets, which are key strategic areas for Generali’s investment capabilities development.

- Market Growth: The global asset management industry hit $128 trillion in 2024, with alternatives like private markets and real assets showing robust growth potential.

- Generali's Strategy: Generali is actively expanding its investment capabilities in these high-growth alternative asset classes.

- Performance Driver: The acquisition of Conning Holdings Limited contributed to a 3.3% increase in the segment's operating result in Q1 2025.

- Strategic Positioning: Generali's investments in private markets and real assets align with industry trends, suggesting a 'Star' or 'Question Mark' potential depending on market share gains.

Digital and AI-driven Insurance Solutions

Generali's strategic focus on digital and AI-driven insurance solutions aligns with its 'Lifetime Partner 27: Driving Excellence' plan, which earmarks substantial investment in these areas. The company is actively enhancing customer experience and operational efficiency through AI-powered claims adjudication, AI voicebots, and digital health services like My Clinic and VitalSigns&Care. These innovative offerings are positioned as high-growth opportunities where Generali aims to capture significant market share through continuous technological advancement.

In 2024, Generali's commitment to digital transformation is evident in its ongoing rollout of AI capabilities. For instance, AI in claims processing is designed to expedite settlements and improve accuracy, a critical factor in customer satisfaction. The development of AI voicebots aims to provide instant, 24/7 customer support, freeing up human agents for more complex inquiries. These digital initiatives are not just about efficiency; they are about building a more responsive and personalized insurance experience.

- AI in Claims Adjudication: Aims to reduce processing times by an estimated 30% in pilot programs.

- AI Voicebots: Handling over 1 million customer interactions annually, with a 90% first-contact resolution rate.

- Digital Health Services (My Clinic, VitalSigns&Care): Growing user base by 25% year-over-year, indicating strong market adoption.

- Investment in AI and Digital Transformation: Over €1 billion allocated within the 'Lifetime Partner 27' plan.

Generali's P&C non-motor insurance segment and its health insurance solutions are clear stars, exhibiting strong growth and market potential. The unit-linked and protection life insurance products are also stars, driven by increasing net inflows and favorable global market expansion. These segments represent areas of high growth and likely market leadership for Generali.

| Segment | Growth Driver | Q1 2025 Performance | Market Outlook |

|---|---|---|---|

| P&C Non-Motor | Robust expansion | Gross Written Premiums +8.6%; Operating Result +18.7% | Global P&C Market CAGR 8.30% (2025-2034) |

| Health Insurance | Capitalizing on market growth | Strategic investments in Vitality, Europ Assistance | Global Health Insurance CAGR 7.43% (2025-2034) |

| Life (Unit-Linked & Protection) | Key growth drivers | Net Inflows > €3 billion (sole contributors) | Global Life Insurance CAGR 3% (2025-2026) |

What is included in the product

Assicurazioni Generali's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework helps identify which units to invest in, hold, or divest based on market growth and relative market share.

A clear BCG matrix visualizes Generali's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Traditional life savings products, while experiencing a 4.5% dip in gross written premiums in Q1 2025, remain a significant cash generator for Assicurazioni Generali. The life segment's operating result climbed to €992 million, underscoring the profitability of these mature offerings.

These products are considered cash cows due to their strong, stable cash flows, a result of their high market share in established European markets. Despite not being a high-growth area, their consistent performance provides a reliable income stream for Generali.

Generali's established European Property & Casualty (P&C) motor insurance segment, a key component of its BCG matrix, is performing as a strong cash cow. In the first quarter of 2025, this sector experienced a healthy 7.2% increase in its dominant markets, including Germany, Italy, France, Austria, and Central and Eastern Europe. This growth in a mature market highlights Generali's solid footing and the consistent demand for its motor insurance products.

This stable and mature segment is a reliable generator of cash for Generali. The P&C operating result surpassed €1 billion in Q1 2025, with the motor line being a significant contributor. Its established nature means it requires minimal investment in aggressive marketing or rapid expansion, allowing it to consistently funnel profits back into the company.

Generali's corporate and commercial insurance in mature European markets, including its P&C segments, represents a significant cash cow. The company commands a leading position across these established lines, which, while not experiencing rapid expansion, are characterized by substantial market share.

These mature segments are crucial contributors to Generali's overall profitability. For instance, the company reported a strong combined ratio of 89.7% in Q1 2025 for its P&C business, underscoring the efficiency and high profitability generated by these steady income streams.

Banca Generali (Wealth Management)

Banca Generali, a key component of Assicurazioni Generali's Asset & Wealth Management division, consistently demonstrates robust financial performance. Its established presence and deep client relationships within the mature wealth management sector solidify its status as a cash cow.

This business unit generates substantial cash flow, exceeding its investment needs, which is characteristic of a mature and stable market player. In 2024, Assicurazioni Generali reported a significant contribution from its asset and wealth management activities, with Banca Generali being a primary driver of this success.

- Banca Generali's operating result is a consistent contributor to Assicurazioni Generali's Asset & Wealth Management segment.

- The wealth management market, while growing, is mature, allowing Banca Generali to leverage its established client base for steady cash generation.

- In 2024, the company's focus on high-value services and a strong market position ensured it generated more cash than it required for operations and expansion.

Real Estate Investments (Generali Real Estate)

Generali Real Estate manages a substantial property portfolio, emphasizing enhanced environmental performance and the integration of ESG considerations. These investments represent stable, long-term assets that, while not experiencing rapid growth, deliver reliable income streams. They are crucial for Assicurazioni Generali's overall financial stability, functioning as a dependable cash cow within the company's business portfolio.

The Group's commitment to ESG in real estate aligns with broader industry trends and investor expectations. For instance, by 2024, Generali Real Estate aims to achieve specific targets for energy efficiency and sustainable building practices across its managed properties. This focus on sustainability not only mitigates risk but also enhances the long-term value and attractiveness of these real estate assets.

- Stable Income Generation: Generali's real estate holdings provide consistent rental income, contributing predictable cash flows to the Group.

- ESG Integration: A strategic focus on environmental, social, and governance factors enhances the long-term value and resilience of these assets.

- Financial Solidity: These mature, income-producing assets bolster Assicurazioni Generali's overall financial strength and stability.

Generali's traditional life savings products, despite a slight dip in Q1 2025 gross written premiums, remain a core cash cow. The life segment's operating result reached €992 million, showcasing the enduring profitability of these mature offerings. Their high market share in established European markets ensures stable cash flows, requiring minimal new investment.

The established European Property & Casualty (P&C) motor insurance sector is another strong cash cow for Generali. With a 7.2% increase in dominant markets like Germany and Italy in Q1 2025, this mature segment continues to generate substantial cash. The P&C operating result exceeded €1 billion in Q1 2025, with motor insurance being a key contributor.

Banca Generali, a cornerstone of Generali's Asset & Wealth Management, functions as a reliable cash cow. Its established market position and deep client relationships in wealth management generate significant cash flow, exceeding operational needs. In 2024, this unit was a primary driver of the segment's strong financial performance.

Generali Real Estate's property portfolio, with its focus on ESG and long-term value, acts as a dependable cash cow. These assets provide stable rental income, bolstering Generali's financial stability. By 2024, the company was actively pursuing energy efficiency targets across its managed properties, enhancing asset resilience.

| Business Segment | BCG Category | Q1 2025 Performance Highlight | 2024 Contribution Highlight | Key Characteristic |

| Traditional Life Savings | Cash Cow | Operating Result: €992 million | Stable income generation | High market share, mature markets |

| P&C Motor Insurance | Cash Cow | 7.2% growth in key European markets | Operating Result > €1 billion (P&C) | Dominant position, consistent demand |

| Banca Generali (Wealth Management) | Cash Cow | Strong financial performance | Primary driver of Asset & Wealth Management success | Established client base, stable cash flow |

| Generali Real Estate | Cash Cow | Focus on ESG and long-term value | Stable rental income, enhanced asset resilience | Substantial property portfolio, predictable income |

What You’re Viewing Is Included

Assicurazioni Generali BCG Matrix

The Assicurazioni Generali BCG Matrix preview you are viewing is the exact, complete document you will receive immediately after your purchase. This comprehensive analysis, devoid of any watermarks or sample content, is fully formatted and ready for immediate strategic application within your business planning and decision-making processes. You can trust that what you see is precisely what you will download, offering a clear and actionable roadmap for understanding Generali's business portfolio.

Dogs

While Assicurazioni Generali has demonstrated robust overall performance, certain geographic segments or older product lines may be experiencing sluggish growth coupled with a limited market presence. These areas can become cash traps, tying up capital without generating significant returns.

The divestment of TUA Assicurazioni and its operations in the Philippines during 2024 highlights a deliberate strategy to exit underperforming or non-core business units. This move is indicative of Generali's commitment to optimizing its portfolio for greater efficiency and profitability.

Some traditional savings products offered by Assicurazioni Generali, particularly those with fixed, low interest rates, are likely experiencing a decline in popularity. This is driven by evolving customer demand for more dynamic investment options like unit-linked policies and a greater emphasis on pure protection coverage. For instance, in 2024, many insurers saw a significant shift away from guaranteed-return products as interest rate environments, while improving, still haven't fully compensated for years of low yields.

Reports in early 2024 suggested Assicurazioni Generali's board was evaluating the potential sale of Banca Generali. This move, if it materializes, would likely position Banca Generali as a 'Dog' within Generali's BCG matrix. While Banca Generali has been a profitable entity, its potential divestment signals a strategic decision to streamline operations or redirect capital towards more promising, higher-growth segments of the insurance and financial services market.

Segments with High Expense Ratios and Low Efficiency

Within Assicurazioni Generali, segments exhibiting high expense ratios coupled with low efficiency, often referred to as Dogs in a BCG Matrix context, represent areas that drain resources without delivering commensurate value. These could include certain legacy administrative functions or specific, underperforming product lines that haven't kept pace with market demands or technological advancements. For instance, if a particular insurance product line consistently requires a high percentage of its revenue for operational costs and administrative overhead, yet shows minimal premium growth or market share expansion, it would fit this description.

These "Dog" segments are characterized by their cash consumption and lack of competitive edge, making them prime candidates for strategic review. Generali, like many large insurers, continually assesses its operational efficiency. In 2024, the company has been focused on digital transformation and streamlining processes to reduce costs across the board. Areas with persistently high expense ratios, particularly those not directly contributing to revenue growth or strategic market positioning, would be prioritized for efficiency drives or potential divestment.

Identifying these areas is crucial for resource allocation. Generali’s commitment to improving profitability necessitates a close examination of all business units. Specific examples of such segments might involve outdated IT systems in administrative departments or niche insurance products with declining customer interest and high servicing costs. The goal is to reallocate capital and management attention towards Generali's Stars and Cash Cows.

- High Expense Ratio Segments: Areas where operational costs significantly outweigh revenue generated.

- Low Efficiency: Lack of productivity or cost-effectiveness in specific business lines or administrative functions.

- Cash Consumption: Segments that require ongoing investment without yielding proportionate returns.

- Strategic Review Targets: Areas identified for potential restructuring, cost reduction, or divestment to improve overall company performance.

Certain Mature Market Motor Insurance Sub-segments

Certain mature market motor insurance sub-segments, particularly those in highly saturated regions with intense price competition, can be classified as Dogs in the BCG Matrix. These segments are characterized by low growth and low market share, demanding significant investment for little to no return.

For instance, in 2024, the traditional private car insurance market in Western Europe exhibits these traits. High vehicle ownership, coupled with aggressive pricing strategies from numerous insurers, limits profitability and growth potential.

- Low Growth: Mature markets often see stagnant or declining new vehicle sales, directly impacting the growth of motor insurance.

- Intense Competition: Price comparison websites and a crowded marketplace drive down premiums, squeezing margins for insurers.

- High Investment Needs: Maintaining market share in these segments requires continuous marketing spend and product development, with minimal uplift.

- Optimization Focus: Insurers may consider divesting from or significantly reducing their exposure to these sub-segments to reallocate capital to more promising areas.

Segments identified as Dogs within Assicurazioni Generali's portfolio are characterized by low market share and low growth, often requiring significant capital investment without generating substantial returns. These units can act as cash drains, hindering overall profitability and strategic focus. For example, in 2024, Generali's strategic review of its Italian life insurance operations identified certain legacy products with declining customer demand and high servicing costs as potential Dogs.

The divestment of TUA Assicurazioni in 2024, and the potential sale of Banca Generali, are clear indicators of Generali's proactive approach to shedding underperforming assets. These actions align with the strategy of eliminating or restructuring "Dog" business units to optimize capital allocation towards higher-growth, more profitable ventures. This focus on portfolio optimization is critical for enhancing shareholder value.

Mature, highly competitive markets, such as certain sub-segments of motor insurance in Western Europe during 2024, exemplify the characteristics of Dogs. These areas demand continuous investment for minimal market share gains and face intense price pressure, leading to low profitability and limited growth prospects.

The presence of "Dog" segments necessitates a rigorous evaluation of their long-term viability and strategic fit within Generali's broader objectives. By identifying and addressing these underperforming areas, the company aims to improve operational efficiency and redirect resources towards its more promising business units.

Question Marks

Generali's strategic focus on emerging markets like select Asian and Latin American nations positions them as potential Stars in the BCG matrix. These regions offer substantial growth opportunities in the insurance sector, driven by increasing disposable incomes and a rising middle class.

While Generali's footprint is expanding, some of these emerging markets may currently represent Question Marks. This means they possess high growth potential but a relatively low market share for Generali. Significant investment is needed to build brand recognition, distribution networks, and product offerings to capture a larger portion of these lucrative markets.

For instance, in 2024, the Asian insurance market, excluding Japan, was projected to grow at a compound annual growth rate of around 8-10%, according to industry reports. Similarly, Latin America's insurance penetration is still lower than developed markets, presenting a clear avenue for expansion and potential market leadership for Generali.

Generali's commitment to digital innovation is substantial, with a €1.1 billion investment in technology and a dedicated €250 million insurtech venture fund. This strategic allocation fuels the development of new digital-only insurance ventures and platforms.

These emerging digital platforms, though operating within a rapidly expanding technological sector, currently hold a modest market share. They necessitate significant capital infusion to achieve widespread adoption and reach profitability.

The cyber insurance market is experiencing significant expansion, driven by escalating digital threats and the increasing reliance on technology across all sectors. This dynamic environment presents a prime opportunity for insurers like Generali.

Generali is strategically positioned to capitalize on this growth by offering specialized cyber insurance products tailored to evolving risks. These offerings likely address a range of vulnerabilities, from data breaches to ransomware attacks.

As a burgeoning segment, specialized cyber insurance represents a high-growth potential area where Generali is actively investing in market share and developing crucial expertise. For instance, the global cyber insurance market was valued at approximately $10.2 billion in 2023 and is projected to reach $37.2 billion by 2030, demonstrating robust compound annual growth.

New ESG-focused Insurance Products

Generali's new ESG-focused insurance products represent a strategic move into a burgeoning market. The company aims to grow premiums from these sustainability-linked solutions, reflecting a broader commitment to embedding ESG principles across its operations. While the market for these products is expanding rapidly and shows strong demand, Generali is still in the early stages of building significant market share and scaling adoption.

- Market Growth: The global ESG insurance market is projected for substantial growth, with analysts anticipating a compound annual growth rate (CAGR) of over 10% in the coming years, driven by increasing regulatory pressure and investor demand for sustainable investments.

- Generali's Ambition: Generali has publicly stated its goal to significantly increase the proportion of premiums derived from ESG-aligned products, aiming for a double-digit percentage increase by 2025.

- Product Development: Recent product launches include policies that offer coverage for renewable energy projects and provide incentives for policyholders who adopt eco-friendly practices, such as reduced premiums for electric vehicle usage.

- Scaling Challenges: Despite market potential, Generali, like many insurers, faces the challenge of educating consumers and distribution partners about the benefits and intricacies of ESG insurance, which impacts the speed of adoption.

Expansion into New Niche P&C Lines

Generali is strategically targeting expansion into niche Property & Casualty (P&C) lines to capitalize on high-growth areas. This involves identifying emerging risks and evolving consumer demands where the company currently holds a smaller market share. Significant investment will be required to build technical expertise and establish a stronger presence in these specialized segments.

The insurer's focus on preferred profit pools means they are actively seeking out areas with robust earning potential. By entering new niche P&C lines, Generali aims to diversify its portfolio and tap into markets less saturated by competitors. This proactive approach is designed to drive accelerated growth and improve overall profitability.

- Targeting High-Growth Niche P&C Markets: Generali is focusing on specialized insurance segments experiencing rapid expansion due to new risks or changing customer preferences.

- Investment in Technical Proficiency: The company recognizes the need to invest in developing strong technical underwriting capabilities to succeed in these niche areas.

- Low Initial Market Share Strategy: Generali is prepared to enter markets where its current market share is low, viewing this as an opportunity for substantial growth with dedicated investment.

- Alignment with Profit Pool Strategy: This expansion directly supports Generali's broader objective of focusing on and growing within its preferred profit pools.

Generali's ventures into emerging markets and specialized insurance sectors, such as cyber and ESG-focused products, represent classic Question Marks in the BCG matrix. These areas offer considerable growth potential, but Generali's current market share is relatively low, necessitating significant investment to build brand presence and distribution. For example, the global cyber insurance market, valued at approximately $10.2 billion in 2023, is expected to reach $37.2 billion by 2030, highlighting the growth trajectory Generali is targeting.

| Business Area | Market Growth Potential | Generali's Current Market Share | Investment Required | BCG Category |

|---|---|---|---|---|

| Emerging Markets (Asia, LatAm) | High | Low to Moderate | High | Question Mark |

| Digital Insurance Ventures | High | Low | High | Question Mark |

| Cyber Insurance | Very High | Low to Moderate | High | Question Mark |

| ESG-Focused Insurance | High | Low | High | Question Mark |

| Niche P&C Lines | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Assicurazioni Generali BCG Matrix is built on a foundation of robust data, integrating financial disclosures, industry growth rates, and competitor performance metrics.