Genco Shipping SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genco Shipping Bundle

Genco Shipping's recent performance reveals key strengths in its modern fleet and strategic market positioning, but also highlights potential weaknesses tied to commodity price volatility. Understanding these dynamics is crucial for navigating the competitive drybulk shipping sector.

Want the full story behind Genco Shipping's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Genco Shipping & Trading Limited boasts a modern and diverse fleet of 42 dry bulk vessels as of Q2 2025. This includes Capesize, Ultramax, and Supramax ships, with an average vessel age of 12.7 years, indicating a commitment to operational efficiency and lower maintenance costs.

The breadth of their fleet, encompassing various vessel types, enables Genco to cater to a wide spectrum of global commodity transportation needs, from major bulks to minor bulks. This adaptability is a significant operational advantage in the dynamic shipping market.

Furthermore, Genco's strategic fleet modernization efforts, highlighted by the recent acquisition of high-specification, scrubber-fitted Capesize vessels, are poised to boost their earning potential. These investments position the company to capitalize on evolving market demands and regulatory requirements.

Genco Shipping boasts a strong financial position, underpinned by a disciplined capital allocation strategy focused on shareholder returns, debt reduction, and fleet modernization. The company has made significant strides in deleveraging, notably reducing its debt burden from prior periods.

Further bolstering its financial flexibility, Genco recently secured a new $600 million revolving credit facility, extending maturity to July 2030. This substantial increase in borrowing capacity, a 50% rise, equips Genco with robust financial resources to pursue future growth initiatives and navigate market dynamics effectively.

Genco Shipping has a proven history of rewarding its shareholders, maintaining an impressive streak of 24 consecutive quarterly dividends. This dedication to consistent payouts, even when adjusting voluntary reserves, underscores their commitment to capital return, a key factor in building investor trust.

Global Reach and Diverse Cargoes

Genco Shipping & Trading Limited leverages its position as a U.S.-based dry bulk ship owner to facilitate the global seaborne transport of vital raw materials. Its diversified cargo portfolio, encompassing iron ore, coal, grain, steel products, bauxite, cement, and nickel ore, significantly reduces dependence on any single commodity, thereby enhancing resilience against market fluctuations.

This broad cargo exposure is a key strength, allowing Genco to capitalize on demand across various industrial sectors. For instance, the ongoing demand for steel production, a major driver for iron ore shipments, remained robust through early 2024. Similarly, global energy needs continued to support coal transportation, a segment Genco actively participates in.

- Diversified Cargo Base: Reduces reliance on single commodities, mitigating risk.

- Global Trade Route Presence: Facilitates transportation of essential raw materials worldwide.

- Market Adaptability: Ability to serve a wide range of industrial demands, from energy to construction.

In-house Commercial Operating Platform

Genco Shipping's in-house commercial operating platform is a significant strength, enabling them to offer comprehensive, full-service logistics. This integrated system allows for greater control over operations, potentially leading to cost savings and improved service delivery. By managing chartering and logistics internally, Genco can foster stronger customer relationships and optimize the performance of its modern fleet.

This internal capability is crucial for their business model, which focuses on owning and operating efficient, reliable vessels. For instance, in 2024, Genco reported that its commercial segment, powered by this platform, played a key role in securing favorable charter rates, contributing to their overall financial performance.

- Enhanced Operational Efficiency: The platform streamlines logistics, reducing turnaround times and optimizing vessel utilization.

- Improved Customer Relationships: Direct management of services allows for tailored solutions and responsive support.

- Optimized Chartering Performance: In-house expertise can lead to better negotiation of freight rates and contract terms.

- Cost Control: Eliminating third-party intermediaries for certain functions can reduce overall operating expenses.

Genco's diverse fleet, comprising 42 dry bulk vessels as of Q2 2025, including Capesize, Ultramax, and Supramax ships, allows them to serve a broad spectrum of global commodity transportation needs. Their commitment to modernization is evident in their average vessel age of 12.7 years and the recent acquisition of high-specification, scrubber-fitted vessels, enhancing earning potential and regulatory compliance.

The company's robust financial health is a key strength, supported by a disciplined capital allocation strategy and a significant reduction in debt. The recent $600 million revolving credit facility, extended to July 2030, further bolsters their financial flexibility, providing ample resources for growth and market navigation.

Genco's consistent shareholder returns are demonstrated by 24 consecutive quarterly dividends, underscoring their dedication to capital distribution and investor confidence. Furthermore, their diversified cargo portfolio, spanning iron ore, coal, grain, and more, mitigates risks associated with single commodity dependence, ensuring resilience in fluctuating markets.

Their in-house commercial operating platform is a significant advantage, facilitating comprehensive logistics and enabling greater control over operations, potentially leading to cost savings and improved service delivery. This internal capability enhances their ability to secure favorable charter rates and optimize vessel performance.

What is included in the product

Analyzes Genco Shipping’s competitive position through key internal and external factors, detailing its strengths in fleet size, weaknesses in debt, opportunities in market recovery, and threats from global economic volatility.

Highlights key Genco Shipping vulnerabilities and opportunities for targeted risk mitigation and strategic advantage.

Weaknesses

Genco Shipping's performance is significantly tied to the unpredictable nature of dry bulk freight rates. These rates fluctuate based on global trade activity and the demand for raw materials, directly impacting the company's earnings.

The second quarter of 2025 saw Genco report a net loss, with revenue and Time Charter Equivalent (TCE) rates dropping compared to the prior year. This downturn was largely attributed to a decline in market rates, highlighting the sensitivity of their financial results to these external factors.

Looking ahead, the dry bulk sector anticipates a less favorable supply-demand balance throughout 2025 and into 2026. This projected imbalance is likely to exert downward pressure on freight rates, posing a continued challenge for Genco's profitability.

Genco Shipping's exposure to geopolitical instability is a significant weakness. Ongoing tensions, like the Houthi attacks in the Red Sea and broader trade disputes, directly impact the dry bulk shipping sector. These disruptions can force longer routes, increasing fuel costs and operational expenses, as seen with rerouting around the Suez Canal, which adds significant transit time and cost for vessels.

This instability creates considerable uncertainty for global trade and shipping demand. For instance, disruptions in key shipping lanes can delay the delivery of essential commodities, impacting industrial production and consumer prices worldwide. The unpredictability of these events makes it challenging for companies like Genco to forecast revenues and manage operational risks effectively.

While Genco Shipping is actively modernizing its fleet, the average age of its vessels remains at 12.7 years as of early 2025. This aging fleet can translate to increased operational burdens, with older vessels typically requiring more frequent and costly maintenance, repairs, and potentially higher insurance premiums.

Indeed, Genco observed an increase in its daily vessel operating expenses (DVOE) during the first quarter of 2025, a trend that can be partly attributed to the upkeep of its existing fleet. Furthermore, older ships may struggle to meet evolving environmental regulations, necessitating substantial capital outlays for upgrades or potentially limiting their operational lifespan without such investments.

Increased Operating Expenses

Genco Shipping has faced a notable increase in its operating expenses. Beyond routine maintenance, the company has seen higher costs related to crewing and an escalation in repair and maintenance expenditures. These pressures are directly impacting profitability, especially when freight rates are less favorable.

Specifically, drydocking costs experienced an uptick during the first half of 2025. This trend, coupled with rising crew wages and general upkeep, can significantly squeeze profit margins. For instance, if operating expenses rise faster than revenue, net income will inevitably shrink.

- Rising Crew Costs: Increased global demand for skilled maritime personnel has driven up wages.

- Elevated Repair and Maintenance: The age and condition of vessel fleets necessitate more frequent and costly repairs.

- Higher Drydocking Expenses: Essential maintenance and regulatory compliance during drydocking periods have become more expensive.

- Impact on Profitability: These escalating costs directly reduce the company's bottom line, particularly in a volatile freight market.

Reliance on Global Economic and Commodity Demand

Genco Shipping's performance is heavily tied to global economic activity and the demand for commodities. A slowdown in major economies, particularly China, which is a key consumer of raw materials like iron ore and coal, directly impacts cargo volumes and shipping rates. For instance, in early 2024, concerns about China's economic recovery led to volatility in dry bulk markets, affecting companies like Genco.

This reliance on global demand creates inherent vulnerability. If major economies experience a downturn, as seen in some periods of 2023, the demand for shipped goods decreases, putting downward pressure on freight rates. This can significantly impact Genco's revenue and profitability.

- Global Economic Sensitivity: Dry bulk shipping rates are a barometer for global economic health, with downturns in major economies directly reducing cargo volumes.

- China's Influence: China's demand for commodities like iron ore and coal is a critical driver for the dry bulk sector; any slowdown there has a pronounced effect.

- Commodity Price Fluctuations: While not directly Genco's revenue, commodity price swings often correlate with demand for their transport, indirectly impacting shipping volumes.

- Geopolitical Risks: Global trade disruptions, stemming from geopolitical events, can also curtail the movement of goods, negatively affecting shipping demand.

Genco's profitability is highly susceptible to the volatile nature of dry bulk freight rates, which are influenced by global trade dynamics and commodity demand. The company reported a net loss in the second quarter of 2025, with a notable decline in revenue and Time Charter Equivalent (TCE) rates, underscoring this sensitivity.

The company faces challenges from an aging fleet, with an average vessel age of 12.7 years in early 2025, leading to increased maintenance costs. This was reflected in higher daily vessel operating expenses (DVOE) observed in the first quarter of 2025, impacting overall profitability.

Escalating operating expenses, including crewing, repairs, and drydocking costs, are squeezing Genco's profit margins, particularly when freight rates are unfavorable. For instance, drydocking expenses saw an uptick during the first half of 2025.

Geopolitical instability, such as disruptions in key shipping lanes, poses a significant weakness by increasing operational costs and creating revenue uncertainty.

What You See Is What You Get

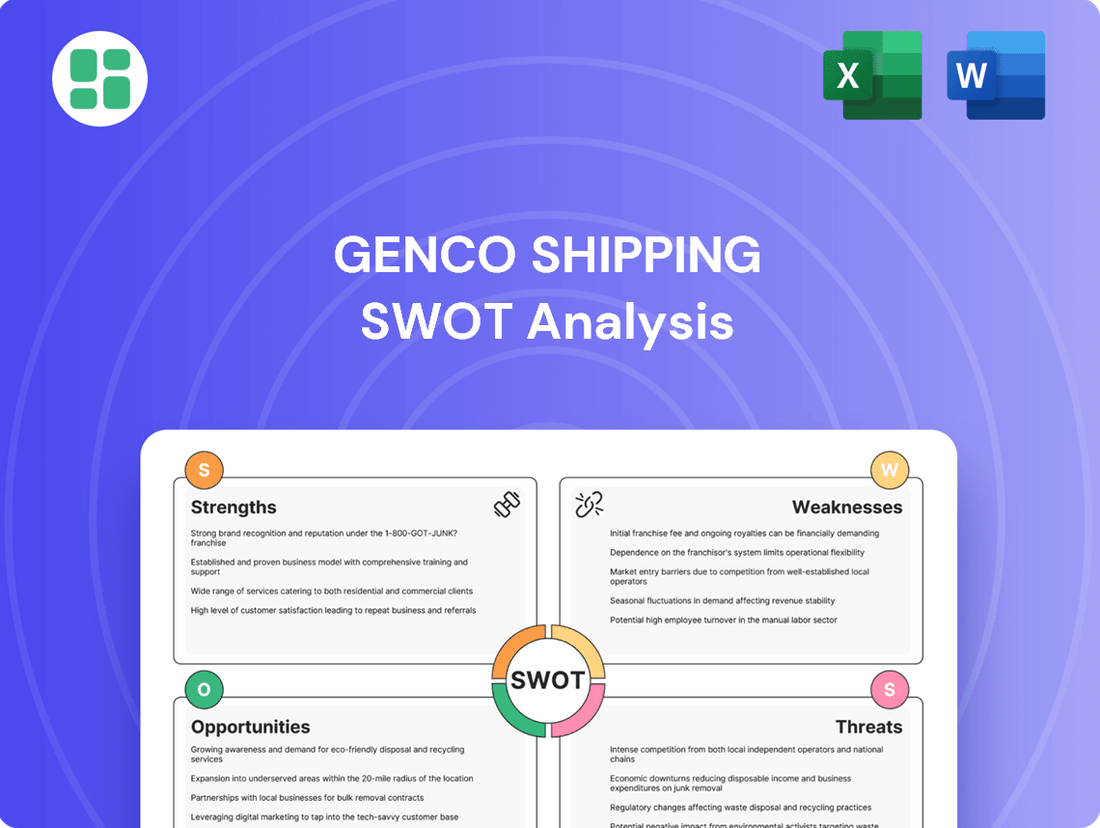

Genco Shipping SWOT Analysis

This is the actual Genco Shipping SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details their internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full Genco Shipping SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive strategic overview.

Opportunities

Genco's strategic focus on upgrading its fleet with modern, fuel-efficient Capesize vessels is a key opportunity. This investment directly addresses the growing demand for environmentally compliant and cost-effective shipping solutions.

The planned acquisition of a 2020-built, scrubber-fitted Capesize vessel in late 2025 exemplifies this strategy. This move is designed to boost earning potential and ensure Genco remains ahead of evolving environmental regulations, a critical factor in the current shipping market.

Genco Shipping's recent establishment of a $600 million revolving credit facility significantly bolsters its financial flexibility. This enhanced borrowing capacity provides substantial dry powder for strategic growth initiatives.

This financial maneuver allows Genco to pursue accretive fleet expansion, acquire opportunistic vessels, or invest in other value-enhancing projects. This agility is crucial for capitalizing on favorable market conditions and strengthening its competitive position in the drybulk sector.

The long-term demand for dry bulk commodities is expected to see sustained growth, primarily fueled by ongoing global economic expansion and significant infrastructure projects, especially within the Asia-Pacific region. This trend bodes well for companies like Genco Shipping, a major transporter of these vital raw materials.

For instance, the International Monetary Fund (IMF) projected global economic growth to be around 3.1% in 2024, a figure expected to rise slightly in subsequent years, indicating a steady increase in the need for shipped goods. Genco's strategic position in this market allows it to capitalize on this persistent demand.

Competitive Advantage from Environmental Regulations

Increasingly stringent environmental regulations, like the International Maritime Organization's (IMO) greenhouse gas emission targets and the EU Emissions Trading System (EU ETS), are pushing the shipping industry towards greener operations. Genco Shipping's investment in modern, fuel-efficient vessels equipped with scrubbers positions it favorably to meet these evolving standards.

This focus on sustainability can translate into a competitive edge. As older, less compliant ships are phased out, Genco's fleet is better positioned to capture market share. For instance, the IMO's 2023 strategy aims for net-zero GHG emissions from international shipping by or around 2050, with indicative checkpoints for 2030 and 2040. Companies like Genco that proactively invest in cleaner technologies will likely benefit from this industry-wide transition.

- Regulatory Alignment: Genco's fleet modernization directly addresses IMO and EU ETS requirements, reducing compliance risks.

- Scrubber Technology: The installation of scrubbers allows vessels to continue burning compliant fuels while mitigating sulfur emissions, a key environmental concern.

- Fleet Efficiency: Newer, eco-efficient vessels consume less fuel, leading to lower operating costs and a reduced carbon footprint.

- Supply Tightening: As older, less efficient vessels are scrapped due to environmental pressures, Genco's modern fleet gains a relative advantage in a potentially tighter market.

Potential for Market Consolidation

Challenging market conditions, marked by fluctuating freight rates and ongoing geopolitical uncertainties, are creating a fertile ground for consolidation within the dry bulk shipping industry. This environment pressures smaller operators, potentially making their fleets attractive acquisition targets for financially robust companies like Genco Shipping.

Genco's solid financial standing and clear strategic objectives position it well to capitalize on these trends. The company could pursue acquisitions of distressed fleets, thereby increasing its operational capacity and market presence. Alternatively, strategic alliances or joint ventures could also be explored to enhance efficiency and competitive advantage.

- Market Volatility: The Baltic Dry Index (BDI) experienced significant fluctuations throughout 2024, reflecting the challenging operational environment.

- Financial Strength: Genco Shipping reported a strong balance sheet at the end of Q3 2024, providing capital for potential strategic moves.

- Economies of Scale: Acquiring or partnering with smaller entities could lead to improved cost efficiencies and greater bargaining power in chartering.

- Market Share Expansion: Consolidation offers a direct path to increasing Genco's share of the global dry bulk market.

Genco's strategic fleet modernization, including the acquisition of eco-friendly vessels, positions it to meet stringent environmental regulations and capitalize on growing demand for sustainable shipping. The company's enhanced financial flexibility through its credit facility provides the capital needed for opportunistic fleet expansion and value-enhancing projects.

The sustained global economic growth, particularly in Asia, underpins long-term demand for dry bulk commodities, benefiting Genco's core business. Furthermore, industry consolidation, driven by market volatility and regulatory pressures, presents opportunities for Genco to expand its market share through strategic acquisitions or partnerships.

| Opportunity | Description | Supporting Data/Fact |

| Fleet Modernization & Efficiency | Investing in newer, fuel-efficient vessels to meet environmental standards and reduce operating costs. | Acquisition of a 2020-built, scrubber-fitted Capesize vessel planned for late 2025. IMO 2023 strategy targets net-zero GHG emissions by ~2050. |

| Financial Flexibility | Leveraging a substantial credit facility for strategic growth and acquisitions. | $600 million revolving credit facility established, providing significant capital for expansion. |

| Sustained Commodity Demand | Benefiting from long-term global economic growth and infrastructure development, especially in Asia. | IMF projected global economic growth of ~3.1% for 2024, with expectations of continued expansion. |

| Industry Consolidation | Capitalizing on market consolidation by acquiring smaller, potentially distressed fleets. | Baltic Dry Index (BDI) volatility in 2024 creating an environment for consolidation; Genco's strong balance sheet. |

Threats

The dry bulk shipping sector is grappling with a significant risk of vessel oversupply. Projections suggest ongoing fleet expansion, especially within the Supramax and Ultramax categories, potentially exceeding demand growth through 2025 and 2026. This imbalance exerts downward pressure on freight rates, weakening the industry's supply and demand dynamics and directly impacting Genco's earnings potential.

Ongoing geopolitical instability, particularly attacks on commercial vessels in critical maritime routes like the Red Sea, presents a significant threat. These disruptions can lengthen transit times and inflate operational expenses, directly impacting Genco's efficiency and profitability.

The potential for new trade wars or retaliatory tariffs, such as proposed US port fees on Chinese-built vessels, could further complicate global trade dynamics. Such measures often lead to reduced trade volumes and increased costs, creating headwinds for companies like Genco that rely on robust international shipping activity.

Volatile fuel prices, often referred to as bunker costs, pose a significant threat to Genco Shipping's profitability. These fluctuations directly impact voyage expenses, a substantial portion of operating costs. For instance, in early 2024, global oil prices experienced considerable swings, directly affecting the cost of fuel for Genco's fleet.

Beyond fuel, Genco faces rising operational expenditures across the board. Increased costs for skilled crew, essential vessel maintenance, and rising insurance premiums are squeezing margins. These combined cost pressures can make financial planning and maintaining healthy profit margins a complex undertaking for the company.

Stricter Environmental Compliance Costs

Stricter environmental compliance presents a significant financial challenge for Genco Shipping. The International Maritime Organization's (IMO) mandates, like those targeting carbon emissions, require substantial investments in more efficient vessels and alternative fuel technologies. For instance, the IMO 2023 GHG Strategy aims to achieve net-zero GHG emissions by or around 2050, necessitating substantial fleet upgrades.

These evolving regulations, including potential carbon taxes in various regions, translate directly into increased capital expenditure and operational costs. Genco's ability to absorb these costs or pass them on to customers will be critical. Failure to adapt or unexpected spikes in compliance expenses could negatively impact profitability and competitive positioning.

- Increased Capital Expenditure: Investments in scrubbers, ballast water treatment systems, and potentially new fuel-efficient vessels are necessary.

- Operational Cost Increases: The adoption of cleaner fuels, which may be more expensive, will raise operating expenses.

- Regulatory Uncertainty: Evolving regulations and potential for new carbon pricing mechanisms create financial unpredictability.

- Potential for Fines: Non-compliance with environmental standards can result in significant penalties, impacting financial performance.

Global Economic Downturn

A significant global economic slowdown or recession poses a substantial threat to Genco Shipping. Such a downturn would likely curb demand for the dry bulk commodities Genco transports, leading to lower shipping volumes and a sharp drop in freight rates. This cyclical sensitivity means a severe economic contraction could significantly hurt Genco's financial results and operational stability.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.8% in 2024, down from 3.2% in 2023, highlighting potential headwinds. A further deceleration, or an outright recession in major economies, could directly impact the demand for key dry bulk goods like iron ore and coal. This would translate into fewer voyages for Genco's fleet, directly affecting revenue and profitability.

- Reduced Demand: A global recession typically dampens industrial activity, decreasing the need for raw materials, thus lowering demand for dry bulk shipping.

- Freight Rate Volatility: The dry bulk market is highly susceptible to economic cycles; a downturn can cause freight rates to plummet, impacting Genco's earnings.

- Operational Impact: Lower shipping volumes can lead to underutilization of Genco's fleet, increasing per-unit operating costs and reducing overall efficiency.

- Financial Strain: A prolonged period of low freight rates and reduced demand could strain Genco's financial health, potentially affecting its ability to service debt or invest in fleet modernization.

The dry bulk shipping sector faces a persistent threat from fleet oversupply, with projections indicating continued expansion, particularly in Supramax and Ultramax vessels, potentially outpacing demand growth through 2025 and 2026. This imbalance puts downward pressure on freight rates, directly impacting Genco's revenue potential. Geopolitical instability, such as attacks in the Red Sea, further exacerbates risks by lengthening transit times and increasing operational costs.

SWOT Analysis Data Sources

This analysis is built on a foundation of Genco Shipping's official financial filings, comprehensive industry market research, and expert commentary from maritime analysts to ensure a robust and accurate SWOT assessment.