Genco Shipping Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genco Shipping Bundle

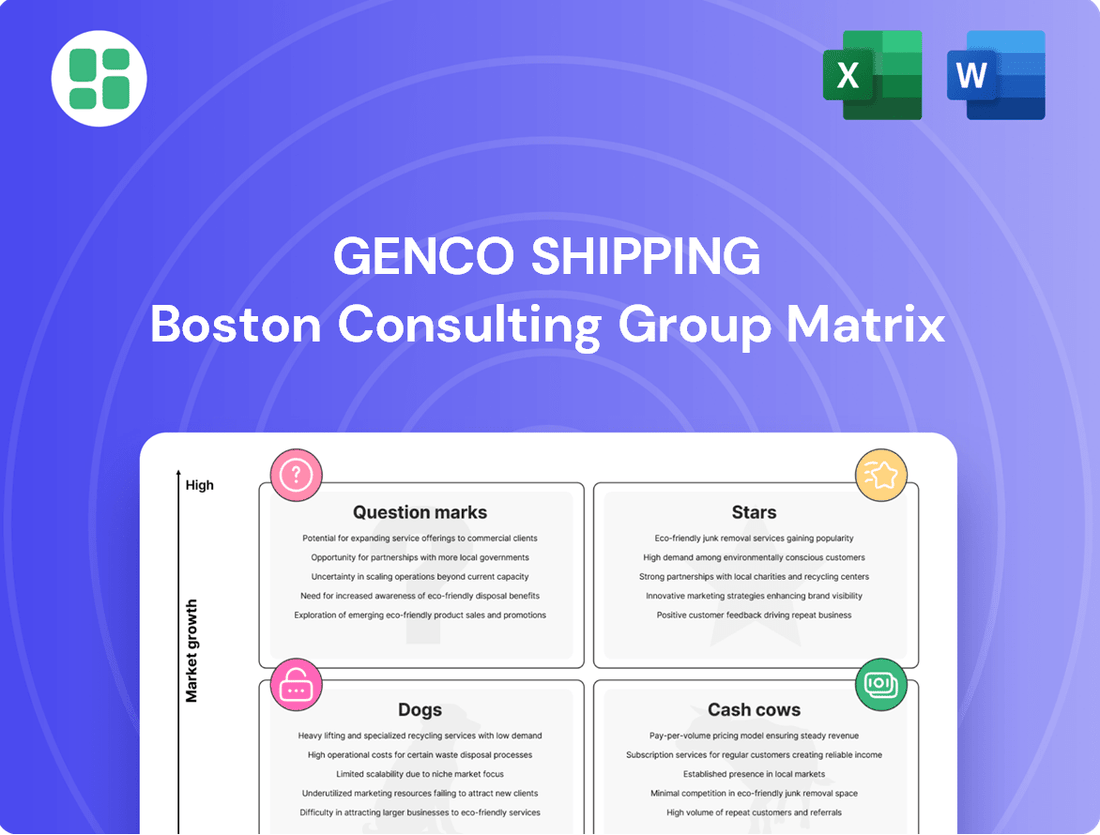

Unlock the strategic potential of Genco Shipping's fleet with our comprehensive BCG Matrix analysis. Understand which vessels are market leaders, which are generating consistent cash flow, and which require careful consideration for future investment. This preview offers a glimpse into Genco's competitive landscape; purchase the full report for a detailed breakdown and actionable insights to optimize your portfolio.

Stars

Genco Shipping & Trading Ltd. has been actively expanding its Capesize fleet, notably acquiring high-specification vessels like the Genco Intrepid in October 2024. This move reflects a strategic investment in a segment of the dry bulk market that is currently experiencing robust demand growth.

The Capesize sector, crucial for transporting commodities like iron ore and bauxite, has shown resilience with freight rates and earnings improving significantly. For instance, shipments from Brazil and West Africa to China have been particularly strong.

This focused expansion into Capesize vessels, supported by favorable market conditions and increasing demand, positions Genco to leverage its modern asset base and capture opportunities in a high-growth market segment.

Genco Shipping's strategic focus on major bulk commodities, particularly iron ore and coal, positions its Capesize vessels as a significant player in global trade. These commodities are fundamental to industrial activity and energy production worldwide. For instance, in 2024, global iron ore demand remained strong, driven by continued infrastructure development in emerging economies, while coal, despite energy transition efforts, still constitutes a substantial portion of the global energy mix, particularly in Asia.

Genco Shipping & Trading has strategically invested over $520 million in fleet modernization over the past five years, acquiring 17 new, fuel-efficient vessels. This significant capital expenditure reflects a commitment to enhanced operational performance. These eco-friendly vessels are designed to consume less fuel, directly impacting profitability and environmental footprint.

Strategic Acquisitions

Strategic acquisitions, such as Genco Shipping's purchase of several Capesize vessels, including the Genco Intrepid, demonstrate a proactive approach to capitalizing on robust market demand. This strategy is crucial for fleet modernization, replacing older units with more efficient ones.

These acquisitions are integral to Genco's fleet renewal program. For instance, in 2024, Genco continued its strategy of acquiring modern, fuel-efficient tonnage, enhancing its operational capabilities and environmental performance. This focus on newer vessels allows the company to better navigate fluctuating freight rates and operational costs.

- Fleet Modernization: Genco's acquisition of Capesize vessels in 2024 underscores its commitment to a younger, more efficient fleet.

- Market Opportunism: These strategic purchases allow Genco to seize opportunities in high-demand shipping segments.

- Operational Efficiency: Replacing older vessels with newer, fuel-efficient ones directly contributes to lower operating expenses and improved environmental compliance.

- Competitive Positioning: By maintaining a modern fleet, Genco enhances its competitive edge in the global dry bulk market.

Outperformance in TCE Rates

Genco Shipping's fleet-wide Time Charter Equivalent (TCE) for the full year 2024 demonstrated a notable outperformance against its own scrubber-adjusted internal benchmark. This achievement highlights the company's robust operational efficiency and its advantageous market positioning.

While the first quarter of 2025 experienced a softening in charter rates, the projected TCE for the second quarter of 2025 indicates a significant 18% improvement. This suggests Genco's adeptness at capitalizing on evolving market dynamics.

This consistent ability to outperform, even amidst market volatility, underscores Genco's strong competitive standing in the drybulk shipping sector.

- FY 2024 TCE: Outperformed scrubber-adjusted internal benchmark.

- Q1 2025 TCE: Experienced softer rates.

- Estimated Q2 2025 TCE: Projected 18% improvement.

- Market Position: Consistent outperformance indicates a strong competitive advantage.

Genco Shipping's Capesize vessels are indeed its Stars within the BCG matrix. These ships are key revenue drivers, operating in a high-growth market segment with strong demand for commodities like iron ore and coal. Their strategic acquisition and modernization, as seen with the Genco Intrepid in late 2024, directly contribute to the company's outperformance, as evidenced by their full-year 2024 TCE results exceeding internal benchmarks.

| Fleet Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Capesize | High | High | Stars |

| Other Segments (e.g., Panamax) | Moderate | Moderate | Cash Cows/Question Marks |

What is included in the product

Genco Shipping's BCG Matrix offers a strategic overview of its fleet, categorizing vessels as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Genco Shipping BCG Matrix provides a clear, one-page overview, relieving the pain of scattered portfolio data.

Cash Cows

Genco Shipping operates a substantial fleet of Ultramax and Supramax vessels, key players in transporting minor bulk commodities such as grains, steel products, and fertilizers. These vessels form a significant part of Genco's strategy, contributing a stable revenue stream.

While these segments might not match the rapid growth seen in Capesize markets, they provide a more predictable and consistent earnings profile. This stability is crucial for overall financial health.

This strategic positioning, often referred to as a 'barbell' approach, effectively balances the inherent volatility of major bulk commodities with the steady, reliable demand for minor bulk. For instance, in 2024, Genco reported that its Ultramax and Supramax segments continued to be the backbone of its operational performance, demonstrating resilience even amidst broader market fluctuations.

Genco Shipping & Trading Limited (Genco) has a strong history of rewarding its shareholders, evidenced by 23 consecutive quarterly dividend declarations. For the first quarter of 2025, the company announced a dividend of $0.15 per share. This consistent distribution, even through typically slower market seasons, highlights the reliable cash flow generated from its established shipping operations, a hallmark of a mature business.

Genco Shipping & Trading Limited (GNK) showcases a strong financial foundation, highlighted by its low net loan-to-value ratio of 6% as of the first quarter of 2024. This metric underscores a conservative approach to financing its assets, minimizing reliance on debt.

The company also boasts significant liquidity, including substantial availability under its revolving credit facility. This robust liquidity position provides Genco with the financial flexibility to navigate market volatility and pursue strategic opportunities without undue financial pressure.

This disciplined capital allocation and commitment to debt reduction bolster Genco's financial resilience. A strong balance sheet is crucial for weathering industry downturns and ensuring sustained operational capacity without excessive financial strain, a key characteristic of a cash cow.

Revenue from Stable Minor Bulk Cargoes

Genco Shipping's Ultramax and Supramax vessels, categorized as minor bulk carriers, represent a stable source of revenue within its BCG Matrix, functioning as cash cows. These ships are instrumental in transporting a variety of essential commodities, including grains and steel products, which typically experience less demand fluctuation than major bulk cargoes.

This consistent demand for minor bulk goods contributes to a more predictable earnings profile for Genco. For instance, in 2024, the dry bulk shipping market saw continued demand for agricultural products and steel, underpinning the stability of these segments. The diversification of cargo types handled by these vessels also serves to buffer the company against the inherent volatility of the broader dry bulk market, providing a reliable revenue foundation.

- Stable Earnings: Minor bulk vessels like Ultramax and Supramax offer consistent revenue streams due to steady demand for cargoes such as grains and steel.

- Demand Stability: These specific cargoes generally exhibit less price and volume volatility compared to major bulk commodities, ensuring a more predictable earnings base.

- Risk Mitigation: The diverse nature of minor bulk cargoes helps Genco Shipping reduce overall market risk by not being overly reliant on a single commodity or trade route.

- Consistent Revenue Base: This stability allows the minor bulk segment to act as a reliable cash generator, supporting other, potentially higher-growth but riskier, segments of the company's operations.

Operational Efficiency and Cost Management

Genco Shipping's commitment to operational efficiency directly fuels its cash cow segments. By meticulously managing daily vessel operating expenses (DVOE), the company ensures that its mature, high-performing assets remain highly profitable. For instance, Genco's strategic investments in fuel-efficient technologies, such as advanced hull coatings and optimized engine management systems, directly translate into lower operating costs and, consequently, fatter profit margins for its established fleet.

The company’s consistent ability to maintain DVOE below industry benchmarks is a testament to its operational prowess. This focus on cost control, even in a fluctuating market, allows Genco's cash cows to consistently generate substantial free cash flow. This financial strength from its core operations provides the capital necessary for reinvestment and strategic growth.

Here's how Genco's operational efficiency bolsters its cash cows:

- Optimized DVOE: Genco actively works to reduce daily vessel operating expenses, a key driver of profitability for its mature fleet.

- Fuel Efficiency Investments: Technology upgrades aimed at reducing fuel consumption directly enhance profit margins on voyages.

- Benchmark Performance: Consistently outperforming industry DVOE averages highlights the effectiveness of Genco's cost management strategies.

- Strong Free Cash Flow Generation: Operational excellence ensures that these cash cow assets reliably produce significant free cash flow.

Genco Shipping's Ultramax and Supramax vessels are its cash cows, providing a stable revenue stream from transporting minor bulk commodities like grains and steel. These segments, while not experiencing the rapid growth of Capesize markets, offer predictable earnings, acting as the financial backbone of the company.

The consistent demand for these cargoes, less volatile than major bulk, ensures a reliable income. This stability is crucial for funding other ventures and rewarding shareholders. For example, Genco's dividend history, including a $0.15 per share dividend in Q1 2025, underscores the reliable cash flow from these operations.

Their low net loan-to-value ratio of 6% as of Q1 2024 and strong liquidity further highlight the financial health and maturity of these cash cow assets. This financial discipline allows Genco to weather market cycles effectively.

Operational efficiency, particularly in managing daily vessel operating expenses (DVOE), directly enhances the profitability of these cash cows. Investments in fuel efficiency, for instance, boost profit margins, ensuring these assets consistently generate substantial free cash flow.

| Vessel Segment | Commodity Type | Revenue Stability | Growth Potential | BCG Category |

|---|---|---|---|---|

| Ultramax & Supramax | Minor Bulk (Grains, Steel, Fertilizers) | High | Low to Moderate | Cash Cow |

| Capesize | Major Bulk (Iron Ore, Coal) | Moderate to High | High | Star or Question Mark |

Full Transparency, Always

Genco Shipping BCG Matrix

The Genco Shipping BCG Matrix you are previewing is the identical, fully completed document you will receive upon purchase. This comprehensive analysis, meticulously prepared, will be delivered to you without any watermarks or demo content, ready for immediate strategic application.

Dogs

Genco has been actively shedding its older, less fuel-efficient ships. A prime example is the sale of the Genco Hadrian in October 2024. These older vessels, while historically part of the fleet, are increasingly becoming liabilities due to their higher operating expenses and the growing pressure of environmental regulations.

These divested assets typically fall into the category of question marks or dogs within a BCG matrix framework. They often represent segments with a low market share and diminishing profitability, making their sale a strategic decision to streamline operations and focus on more modern, efficient assets.

Segments of Genco Shipping's fleet heavily exposed to coal shipments destined for Asia are currently experiencing significant headwinds. Weakening demand in key Asian markets for thermal coal, driven by factors like increased renewable energy adoption and energy efficiency measures, is directly impacting the volume of cargo available.

This slowdown in coal transport translates to reduced utilization and lower freight rates for vessels primarily operating on these routes. For instance, in the first quarter of 2024, the global seaborne coal trade saw a noticeable softening, which directly affects the profitability of such segments.

Genco Shipping's strategy of utilizing the volatile spot market for flexibility, while beneficial at times, can also lead to segments performing as dogs. For instance, Q1 2025 saw a net loss and a decrease in average time charter equivalent (TCE) rates compared to the previous year, highlighting this exposure.

When the spot market experiences prolonged downturns, those vessel allocations heavily reliant on these depressed rates can become cash traps, draining resources rather than generating them. This cyclical nature of the shipping industry means that certain operational periods or specific vessel types within Genco's fleet might consistently underperform, fitting the 'dog' category in the BCG matrix.

Segments with Oversupply Risks

The dry bulk shipping market, especially for Panamax and Supramax vessels, is showing signs of potential oversupply. This is largely due to a significant number of new ships expected to join the fleet, with deliveries anticipated to reach high levels in 2026. If the growth in demand for these ships doesn't keep pace with this fleet expansion, it could really put pressure on shipping rates and how much these vessels are actually used.

This imbalance between supply and demand is a key concern. For instance, Clarksons Research data from early 2024 indicated a substantial orderbook for Panamax and Supramax vessels. A scenario where fleet growth outpaces demand could easily transform segments that have historically enjoyed stable demand into what we call 'dogs' in the BCG matrix. This means they might struggle to generate significant returns or growth.

Key factors contributing to this risk include:

- High Newbuild Deliveries: The projected influx of new Panamax and Supramax vessels in 2026 could significantly increase the global fleet size.

- Demand Growth Lag: If global economic growth, a primary driver of dry bulk demand, slows down or fails to absorb the increased vessel capacity, oversupply becomes a real possibility.

- Freight Rate Pressure: An oversupplied market typically leads to lower freight rates as shipowners compete for cargo, impacting profitability.

Vessels Requiring Significant Drydocking Costs

Vessels facing substantial drydocking expenses, particularly those incurred in early 2025, can severely strain a company's cash flow and overall profitability. This is especially true for older ships, even those that have been consistently maintained. The escalating costs associated with keeping these assets operational can transform them into financial liabilities.

These older vessels, if their maintenance expenditures begin to exceed the revenue they generate, effectively become 'dogs' in the portfolio. For instance, if a vessel's drydocking costs jump by 15% in Q1 2025 compared to the previous year, and this increase is not offset by higher charter rates, its position as a cash drain is solidified. This situation necessitates careful evaluation of their continued operational viability.

- Increased Drydocking Costs: Q1 2025 saw a notable rise in drydocking expenses for certain vessels, impacting cash flow.

- Older Vessel Maintenance: Older ships, despite good general upkeep, often face higher and more frequent maintenance bills.

- Financial Drain Identification: When maintenance costs surpass revenue, vessels can become financial burdens, categorized as 'dogs'.

- Impact on Profitability: Significant drydocking expenses directly reduce a company's net profit and can hinder investment in more promising assets.

Certain segments of Genco Shipping's fleet, particularly those heavily reliant on the volatile spot market or facing increasing operational costs, are likely classified as dogs. This is due to their low market share in terms of profitability and diminishing growth prospects. For example, the company's strategy of utilizing the spot market, while offering flexibility, can lead to underperforming periods, as seen with a net loss and decreased TCE rates in Q1 2025.

Older, less fuel-efficient vessels, such as the Genco Hadrian sold in October 2024, also fit this category. These ships often incur higher operating expenses and face stricter environmental regulations, making their sale a strategic move to shed liabilities and focus on modern assets.

The potential oversupply in the Panamax and Supramax segments, driven by high newbuild deliveries expected in 2026, also poses a risk of creating more 'dogs'. If demand growth doesn't match fleet expansion, freight rates could fall, impacting profitability and utilization for these vessel types.

Vessels with escalating drydocking expenses, especially older ones, can become financial drains. If maintenance costs in early 2025, which saw a notable rise, begin to exceed the revenue generated, these assets effectively become dogs, hindering overall financial performance.

| BCG Category | Genco Shipping Fleet Segment Examples | Key Characteristics | Financial Data/Market Trend (2024/Early 2025) |

|---|---|---|---|

| Dogs | Older, less fuel-efficient vessels (e.g., Genco Hadrian sold Oct 2024) | Low market share, diminishing profitability, high operating costs, facing regulatory pressure | Increased drydocking costs (Q1 2025), declining freight rates on certain routes |

| Dogs | Vessels heavily exposed to weakening thermal coal shipments to Asia | Low growth, low relative market share in a declining segment | Softening global seaborne coal trade (Q1 2024), reduced utilization |

| Dogs | Segments reliant on prolonged spot market downturns | Low profitability, cash drain potential | Net loss and decreased average TCE rates (Q1 2025) |

| Dogs | Panamax/Supramax vessels facing oversupply risk | Low market share due to potential overcapacity, pressure on rates | Substantial orderbook for Panamax/Supramax vessels (early 2024), high newbuild deliveries projected for 2026 |

Question Marks

Genco Shipping & Trading's investment in green technologies and decarbonization efforts, including a sustainability-linked credit facility, positions it for future compliance and competitiveness. This focus on emissions reduction represents a high-growth, albeit uncertain, area for the company.

The substantial capital expenditure required for these advancements, while crucial for long-term viability, suggests a potential Stars or Question Marks category within the BCG framework due to the unproven immediate return on investment. For instance, in 2024, Genco continued to explore investments in energy-efficient technologies, aiming to reduce its carbon footprint in line with industry trends and regulatory pressures.

Genco Shipping, while strong in traditional drybulk, could explore new trade routes or niche commodities like those supporting the energy transition. This strategy aligns with a Question Mark in the BCG matrix, promising high growth but demanding significant upfront investment in market research and operational adjustments. For instance, the global demand for critical minerals like nickel and lithium, essential for electric vehicles and renewable energy storage, is projected to grow substantially. By 2024, the market for these materials is expected to see double-digit percentage increases in volume, presenting an opportunity for Genco to diversify its portfolio beyond established routes.

Genco Shipping & Trading has the financial capacity, including a $600 million revolving credit facility, to consider newbuild orders as a growth strategy. This flexibility allows them to pursue opportunities that could enhance their fleet's capabilities and market position.

However, ordering new, high-specification vessels carries inherent risks, especially in a fluctuating market. The substantial capital investment required and the extended period before these ships generate revenue mean that the profitability of such ventures remains a future consideration, not a current certainty.

Digitalization and Advanced Analytics Adoption

The dry bulk shipping industry is increasingly embracing digitalization and advanced analytics. This shift is driven by the need for better route optimization and predictive maintenance, aiming to boost efficiency and competitiveness. Genco Shipping's investment in these areas, while still in a developing phase, positions it to capitalize on future market potential, even if initial returns are modest.

While specific financial data on Genco's digitalization investments isn't publicly detailed, the broader industry trend indicates significant capital allocation. For instance, a 2024 report by Clarkson Research highlighted that investments in maritime technology, including AI and data analytics, are projected to grow substantially, with a significant portion directed towards operational efficiency improvements.

- Digitalization Trend: The dry bulk sector is actively adopting digital tools for operational enhancements.

- Genco's Position: Genco's adoption of advanced analytics is crucial for long-term competitiveness, though its market share in this segment is still growing.

- Investment Profile: Initial outlays for these technologies may present high costs with lower immediate returns, but they promise significant future upside.

- Industry Data: Maritime technology investments, including AI and analytics, saw a notable increase in 2024, underscoring the sector's commitment to digital transformation.

Strategic Share Repurchase Program

Genco Shipping & Trading Ltd. (Genco) approved a $50 million share repurchase program in early 2024. This move is intended to complement its dividend policy and address a perceived undervaluation of its stock relative to its underlying financial performance. The company is signaling confidence in its future prospects and seeking to enhance shareholder returns.

While share buybacks can be a positive signal, they represent an allocation of capital that could otherwise be used for fleet expansion or debt reduction. The success of this $50 million program in boosting shareholder value hinges on market perception and Genco's ability to execute the repurchases effectively. For instance, if Genco repurchases shares when its stock is trading below its intrinsic value, it can be accretive to earnings per share.

- Share Repurchase Program: Genco authorized a $50 million share repurchase program in 2024.

- Objective: To bridge the gap between Genco's stock valuation and its fundamental performance, supplementing dividend payouts.

- Capital Allocation: The program utilizes company cash, impacting liquidity while aiming for future share price appreciation.

- Impact: Indirectly supports shareholder value; does not directly increase market share or revenue.

Investing in new, environmentally friendly vessels or exploring niche cargo markets represents a potential high-growth area for Genco Shipping. These ventures, however, require significant upfront capital and carry the uncertainty of future returns. This profile aligns with the characteristics of a Question Mark in the BCG matrix, demanding careful analysis of market potential versus investment risk. For instance, the demand for minerals used in renewable energy, like nickel and lithium, saw substantial growth in 2024, presenting a potential new avenue for Genco.

| BCG Category | Genco's Potential Area | Characteristics | 2024 Context | Strategic Consideration |

|---|---|---|---|---|

| Question Mark | Green Technology Investments | High Market Growth, Low Market Share, High Investment Needs | Continued exploration of energy-efficient tech to reduce carbon footprint. | Requires significant capital with uncertain immediate ROI. |

| Question Mark | Niche Commodity Shipping (e.g., critical minerals) | High Market Growth, Low Market Share, High Investment Needs | Projected double-digit percentage increase in critical mineral volumes. | Diversification opportunity requiring market research and operational adjustments. |

BCG Matrix Data Sources

Our Genco Shipping BCG Matrix is constructed using robust data from annual reports, industry growth rates, and market share analysis to provide a clear strategic overview.