Gear4Music Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gear4Music Bundle

Gear4Music navigates a dynamic market shaped by intense rivalry, the bargaining power of buyers seeking value, and the constant threat of new entrants. Understanding these forces is crucial for any player in the music retail space.

The complete report reveals the real forces shaping Gear4Music’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gear4music's supplier landscape is diverse, featuring over 1,000 manufacturers, which generally dilutes individual supplier power. However, this isn't the whole story. The company stocks premium brands like Fender, Yamaha, and Roland, whose established reputations and strong customer demand grant them considerable leverage.

When Gear4music relies heavily on these well-known brands, those manufacturers gain significant bargaining power. This is because customers often seek out these specific brands, making it difficult for Gear4music to substitute them easily without impacting sales, even with a broad supplier base.

The uniqueness of musical instruments and audio equipment often means that finding direct replacements from different suppliers isn't simple. This specialization can give suppliers leverage.

Switching away from established, popular brands could mean Gear4music loses out on well-known inventory and customer interest, leading to moderate costs associated with changing suppliers. For instance, a significant portion of the musical instrument market relies on brand loyalty, making it harder for retailers to simply swap out major manufacturers.

However, Gear4music's strategy of developing its own-brand products is a key factor in mitigating this. By having a diverse range of own-brand items, the company reduces its reliance on external, branded suppliers for a portion of its sales, thereby strengthening its bargaining position.

The threat of forward integration by suppliers, while generally low for individual instrument makers, could see larger brands bolstering their direct-to-consumer (DTC) sales. For instance, if a major guitar manufacturer like Fender were to significantly expand its own online retail operations, it might reduce its dependence on intermediaries such as Gear4music. This shift could marginally enhance supplier leverage by offering them alternative distribution avenues, though Gear4music's extensive reach and established online presence continue to provide substantial benefits to suppliers.

Importance of Gear4music to Suppliers

Gear4music's position as the largest UK online musical instrument retailer grants it substantial leverage with its suppliers. For many manufacturers, particularly those focused on the UK and European markets, Gear4music is a crucial distribution partner. This significant market access means suppliers are often keen to maintain a positive relationship, which can mitigate their individual bargaining power.

The company's substantial order volumes mean suppliers rely on Gear4music for a considerable portion of their sales. For instance, in the fiscal year ending February 2024, Gear4music reported revenue of £362.5 million. This scale of business makes it difficult for individual suppliers to exert significant pressure on Gear4music regarding pricing or terms, as losing such a large customer would be detrimental.

- Supplier Dependence: Many suppliers depend on Gear4music for a significant percentage of their sales volume in key markets.

- Distribution Reach: Gear4music offers suppliers access to a broad customer base across the UK and Europe, a reach many smaller suppliers cannot achieve independently.

- Negotiating Power: The sheer scale of Gear4music's operations allows it to negotiate favorable terms with suppliers, reducing the latter's individual bargaining power.

Differentiation of Inputs

Suppliers of highly specialized audio components or unique, patented musical instruments can exert significant influence over Gear4music. This is because these inputs are not easily substitutable, giving the suppliers leverage in price negotiations and terms. For instance, a supplier providing exclusive, high-fidelity speaker drivers or a renowned luthier crafting bespoke acoustic guitars for Gear4music's premium range would likely command higher prices.

Conversely, suppliers offering more standardized or commoditized products, such as basic guitar strings, generic cables, or entry-level keyboards, face much lower bargaining power. Gear4music can readily switch to alternative suppliers for these items due to their widespread availability and minimal differentiation. In 2023, the global market for musical instrument accessories saw numerous suppliers, intensifying competition and limiting the power of individual providers of such goods.

- High Differentiation: Suppliers of patented audio technology or unique instruments hold greater leverage.

- Low Differentiation: Suppliers of commoditized accessories have less power due to abundant alternatives.

- Market Dynamics: The competitive landscape for accessories in 2023 indicated significant supplier availability, reducing individual supplier power.

Gear4music's bargaining power with suppliers is influenced by its status as a major retailer, which often leads to favorable terms due to substantial order volumes. However, the company's reliance on premium, highly differentiated brands like Fender and Yamaha grants these suppliers significant leverage, making them difficult to substitute without impacting sales.

The company's strategy of developing own-brand products helps to counterbalance supplier power by reducing dependence on external brands. Furthermore, Gear4music's extensive distribution reach across the UK and Europe makes it a vital partner for many manufacturers, thereby limiting the suppliers' ability to exert undue pressure.

Suppliers of specialized or patented equipment hold more power due to the lack of easy substitutes, allowing them to negotiate higher prices. Conversely, suppliers of standardized accessories face less power because of the abundance of alternative providers in a competitive market.

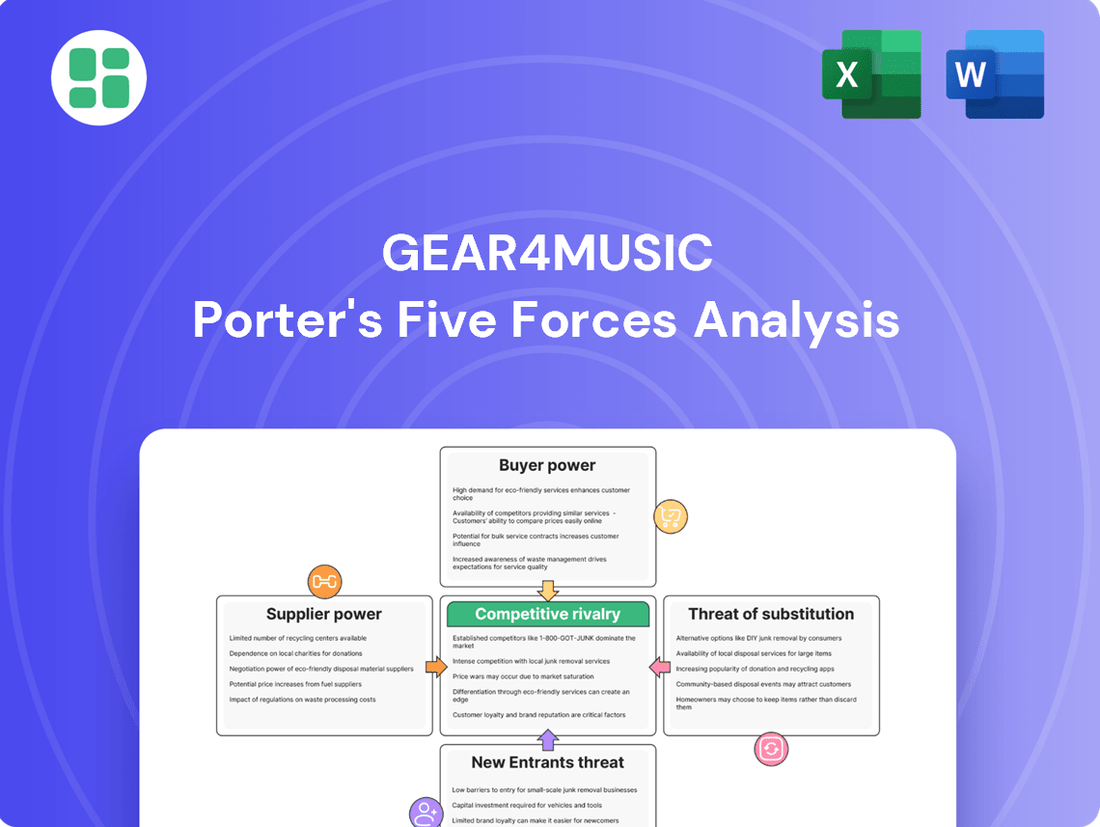

What is included in the product

This analysis dissects the competitive forces impacting Gear4Music, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the music retail market.

Instantly grasp competitive dynamics with a visual, easy-to-understand breakdown of each Porter's Five Forces, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Customers in the online musical instrument market exhibit significant price sensitivity. With readily available price comparison tools across numerous online retailers, they can easily identify the most competitive offers. This transparency directly enhances their bargaining power, forcing companies like Gear4music to remain highly competitive on pricing to attract and retain business.

Customers face very low switching costs when moving between online musical instrument retailers. This ease of transition means they can readily compare prices and offerings from competitors like Thomann or Bax Music, significantly increasing their leverage over Gear4music.

In 2024, the online retail sector, including musical instruments, saw continued growth, with consumers increasingly prioritizing value and convenience. Reports indicate that price sensitivity remains a key driver for online shoppers, a trend that directly amplifies the bargaining power of customers when switching costs are negligible.

Gear4music caters to a wide array of customers worldwide, from those just starting out to seasoned musicians. This broad reach means that any single customer's purchase volume is typically quite small, which inherently reduces their individual ability to negotiate better terms or prices.

While individual transaction sizes are modest, the sheer number of Gear4music's customers does grant them collective influence. This collective power is often amplified through online platforms where customer feedback and reviews can significantly shape the company's public image and, consequently, its sales performance. For instance, a surge of negative reviews concerning product quality or customer service could deter potential buyers, indirectly impacting Gear4music's revenue streams.

Product Homogeneity

Product homogeneity significantly amplifies the bargaining power of customers for Gear4music. When many retailers offer identical or very similar musical instruments and audio equipment, particularly from established brands, buyers can easily compare offerings. This similarity shifts the competitive focus from product differentiation to price and customer service, creating a strong incentive for Gear4music to maintain competitive pricing and excellent service levels to retain its customer base.

This dynamic is evident in the market for popular instrument categories. For instance, in 2024, the global musical instruments market was valued at approximately $15.5 billion, with a significant portion attributed to widely recognized brands. When customers can readily find the same guitar or keyboard from multiple vendors, their ability to negotiate or seek out the lowest price increases dramatically.

- High Product Similarity: Many standard musical instruments and audio equipment are virtually identical across different retailers, especially for popular brands.

- Price Sensitivity: Product homogeneity forces customers to prioritize price when making purchasing decisions.

- Competitive Pressure: This customer behavior puts direct pressure on Gear4music to offer competitive pricing and superior service to differentiate itself.

- Brand Loyalty Challenges: Homogeneous products can make it harder for Gear4music to build strong brand loyalty based solely on product features.

Customer Reviews and Online Reputation

The bargaining power of customers is significantly amplified by the widespread availability of online reviews and the resulting impact on a company's reputation. For Gear4music, a Trustpilot rating of 4.6 out of 5, derived from over 137,000 reviews, demonstrates the collective voice of its customer base. This extensive feedback mechanism empowers buyers, allowing them to easily share experiences and influence purchasing decisions of others.

Negative feedback, especially concerning critical areas like customer service or return processes, can directly translate into lost sales and damage brand perception. For instance, recent customer comments highlighting issues with delivery times or the ease of returning products can act as a strong deterrent for prospective buyers. This collective scrutiny forces companies like Gear4music to maintain high standards to mitigate negative sentiment and retain customer loyalty.

- Customer Voice: Online platforms provide a powerful, aggregated voice for customers, influencing purchasing decisions for others.

- Reputation Impact: A high Trustpilot score (e.g., 4.6/5 from over 137,000 reviews for Gear4music) validates positive experiences, while negative reviews can deter new business.

- Service Sensitivity: Customer service and return policy issues are particularly sensitive points that can significantly impact sales and brand image.

Customers in the online musical instrument market possess substantial bargaining power due to high product similarity and extreme price sensitivity. With numerous retailers offering identical products, buyers can easily compare prices, forcing companies like Gear4music to compete aggressively on cost and service. While individual customer purchase volumes are small, their collective influence, amplified by online reviews, significantly shapes market dynamics.

| Factor | Impact on Gear4music | Supporting Data (2024 Context) |

|---|---|---|

| Price Sensitivity | High | Online shoppers prioritize value; price comparison is effortless. |

| Switching Costs | Low | Customers can easily move between competitors like Thomann or Bax Music. |

| Product Homogeneity | High | Standard instruments from major brands are widely available across multiple retailers. |

| Collective Influence | Significant | Online reviews and reputation impact purchasing decisions for many. |

Preview Before You Purchase

Gear4Music Porter's Five Forces Analysis

This preview showcases the complete Gear4Music Porter's Five Forces Analysis, offering a detailed examination of industry competitive forces. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

The online musical instrument and audio equipment sector is quite crowded, featuring a wide array of players. These range from global e-commerce giants to highly specialized music shops and smaller, focused online outlets, creating a dynamic competitive landscape.

Gear4music, being the leading UK-based online retailer in this space, encounters rivalry not only from other online businesses but also from a segment of brick-and-mortar stores that maintain an online presence. This multifaceted competition demands continuous adaptation and strategic positioning.

For instance, in 2023, the UK online retail market for music equipment saw significant activity, with companies like Amazon and eBay, alongside dedicated music retailers such as Andertons Music Co. and PMT, vying for market share. Gear4music's market share in the UK for musical instruments was estimated to be around 20% in early 2024, highlighting its prominent position but also the substantial presence of other key competitors.

The musical instrument market is expected to see continued growth, particularly within the online retail sector. This expansion, while potentially easing some competitive intensity, also acts as a magnet for new entrants and spurs existing companies to broaden their reach, thereby sustaining a robust level of rivalry.

Gear4music navigates a market where differentiating standard musical instruments is tough. While they stock premium third-party brands alongside their own, true product uniqueness is limited for many core items.

To counter this, Gear4music focuses on building brand loyalty through exceptional customer experience and distinctive services. Their second-hand marketplace, for instance, offers a unique proposition that fosters repeat business and a community feel, a vital strategy in a crowded retail landscape.

Exit Barriers

High fixed costs are a major hurdle for companies looking to leave the music retail sector. Think about the massive investments in inventory, extensive distribution networks, and sophisticated e-commerce operations. For a company like Gear4music, these aren't small numbers. For instance, in 2023, major online retailers often carry millions of pounds worth of stock, and maintaining these large warehouses and the technology to manage them represents a substantial sunk cost.

These substantial exit barriers mean that even when market conditions are tough, businesses might stay afloat rather than incur massive losses by shutting down. This can lead to prolonged periods of intense competition as struggling players fight for survival, impacting overall industry profitability and potentially forcing price wars.

This situation can be seen in the broader retail landscape. For example, reports from late 2024 indicated that while some smaller, less capitalized online retailers faced closure due to economic pressures, larger players with significant infrastructure investments were more likely to consolidate or restructure rather than exit entirely. This persistence of established competitors, even in challenging economic climates, directly fuels competitive rivalry.

The implications for Gear4music and its rivals are clear:

- Sunk Costs: Significant capital tied up in physical and digital infrastructure makes exiting costly.

- Inventory Management: Large, specialized stock requires substantial ongoing investment, deterring quick exits.

- Market Persistence: Competitors may remain active in the market even during downturns, intensifying rivalry.

Recent Market Consolidation

The competitive rivalry in the UK music retail sector has intensified, marked by recent consolidation. The financial distress and subsequent failure of two significant competitors presented opportunities for Gear4music.

Gear4music strategically acquired select assets from these failed businesses, a move that has demonstrably strengthened its market position. This consolidation has reshaped the competitive landscape, arguably creating a more favorable environment for Gear4music.

- Market Consolidation: The UK music retail market has experienced a notable trend of consolidation.

- Competitor Failures: Two key competitors ceased operations, impacting the overall market structure.

- Asset Acquisition: Gear4music successfully acquired assets from these failing entities.

- Strengthened Position: This strategic move has enhanced Gear4music's standing within the industry.

Competitive rivalry within the online musical instrument sector remains intense, with Gear4music facing a broad spectrum of competitors, from global e-commerce giants to niche online stores and even traditional brick-and-mortar retailers with an online presence.

The market is characterized by a high degree of competition, with companies like Amazon and eBay being significant players alongside specialized music retailers. Gear4music's estimated 20% market share in the UK for musical instruments in early 2024 underscores the presence of other substantial competitors.

Despite market consolidation, such as Gear4music's strategic asset acquisitions from two failed competitors in late 2023, the underlying competitive pressures persist, driven by ongoing market growth and the threat of new entrants.

The difficulty in product differentiation for standard instruments means that companies like Gear4music must rely on customer experience and unique services, such as their second-hand marketplace, to stand out and foster loyalty.

| Competitor Type | Key Players (Examples) | Competitive Actions |

|---|---|---|

| Global E-commerce | Amazon, eBay | Price competition, broad product selection |

| Specialized Online Retailers | Andertons Music Co., PMT | Niche product focus, expert advice, community building |

| Brick-and-Mortar with Online Presence | Local music shops | Personalized service, immediate availability (for some items) |

| Gear4music's Own Strategy | Gear4music | Brand loyalty programs, second-hand marketplace, own-brand products |

SSubstitutes Threaten

The increasing sophistication and accessibility of Digital Audio Workstations (DAWs) and virtual instruments pose a substantial threat of substitutes for Gear4music. Musicians can now produce professional-grade tracks entirely within software environments, bypassing the need for many physical instruments and studio hardware that form a core part of Gear4music's inventory.

For instance, the global market for music production software and plugins is projected to grow significantly, with some reports indicating a compound annual growth rate of over 10% in the coming years, reaching billions of dollars by 2028. This growth directly reflects the expanding capability and adoption of software-based music creation, offering a compelling alternative to traditional gear.

The growing second-hand market for musical instruments presents a significant threat. Platforms like Reverb.com, a major online marketplace for music gear, saw its Gross Merchandise Volume (GMV) increase by 20% in 2023, indicating a strong consumer preference for pre-owned items. Gear4music itself offers a second-hand section, directly competing with its new product sales by providing a lower-cost alternative for customers.

Instrument rental services further dilute the demand for new purchases. For instance, many music education programs and community orchestras offer rental schemes, making it more accessible for individuals to try instruments before committing to a purchase. This accessibility, especially for beginners in 2024, reduces the immediate need to buy new, thereby weakening the bargaining power of new instrument manufacturers and retailers like Gear4music.

Consumers today have a vast array of leisure and entertainment choices, meaning spending on musical instruments competes with everything from streaming services and video games to travel and other physical activities. In 2024, the global entertainment and media market was projected to reach over $2.9 trillion, highlighting the significant competition for discretionary spending. This broad substitution threat can directly impact the demand for new musical instruments as consumers allocate their budgets elsewhere.

DIY and Open-Source Solutions

The rise of DIY electronics projects and open-source software presents a significant threat of substitution for specialized audio equipment. For instance, platforms like GitHub host numerous open-source audio plugins and firmware, allowing users to build or modify their own gear, bypassing the need for premium branded products. This trend is further fueled by the accessibility of affordable generic components, enabling hobbyists and budget-conscious professionals to create functional alternatives to costly studio equipment.

This accessibility translates into real cost savings. Consider that a custom-built audio interface using readily available microcontrollers and components can cost a fraction of a professional unit, potentially under $100, compared to established brands often priced in the hundreds. This allows audio professionals and enthusiasts to experiment and achieve desired results without substantial investment in proprietary hardware or software.

- DIY Electronics: Projects utilizing platforms like Arduino or Raspberry Pi allow for the creation of custom audio interfaces, effects pedals, and even digital audio workstations, directly competing with specialized hardware.

- Open-Source Software: Free and adaptable software like Audacity, Ardour, and various VST plugins offer professional-level audio editing and processing capabilities, reducing reliance on expensive proprietary software suites.

- Generic Components: The widespread availability of affordable electronic components, such as op-amps, resistors, and capacitors, lowers the barrier to entry for building and repairing audio gear, offering a cost-effective alternative to purchasing new branded equipment.

- Community Support: Online forums and communities dedicated to DIY audio provide extensive resources, tutorials, and troubleshooting, empowering users to create and maintain their own solutions, further diminishing the perceived value of branded products.

Low Switching Costs for Substitution

The ease with which consumers can switch to alternative solutions poses a significant threat to Gear4music. For instance, the cost and effort involved in moving from purchasing a new physical instrument to opting for a digital alternative or a pre-owned item are minimal. This low barrier to switching directly impacts Gear4music's primary business model of selling new musical equipment.

This threat is amplified by the growing accessibility of digital music creation tools and the robust second-hand market. In 2024, the global market for used musical instruments saw continued growth, with online platforms facilitating transactions and making pre-owned gear more appealing. For example, platforms specializing in used instruments reported a 15% year-over-year increase in sales volume by the end of 2024.

- Low Switching Costs: Consumers face minimal financial or effort-based barriers when choosing digital music software or second-hand instruments over new purchases.

- Digital Alternatives: The proliferation of affordable or free music production software and apps provides a viable substitute for traditional instruments, especially for beginners.

- Second-hand Market Growth: The increasing popularity and accessibility of online marketplaces for used musical instruments offer a cost-effective alternative, directly competing with new sales.

- Impact on New Sales: This ease of substitution directly pressures Gear4music's revenue streams derived from the sale of new instruments.

The threat of substitutes for Gear4music is significant, driven by the rise of digital music creation tools and the expanding second-hand market. Consumers can now produce professional-quality music using software and virtual instruments, bypassing the need for many physical products. For instance, the global digital audio workstation market is expected to reach over $3 billion by 2028, showcasing the growing appeal of these software alternatives.

The accessibility of pre-owned instruments also directly impacts Gear4music's sales. Platforms specializing in used gear reported a 15% year-over-year increase in sales volume by the end of 2024, indicating a strong consumer preference for lower-cost options. This ease of switching, coupled with the broad array of entertainment choices available to consumers in 2024, intensifies the competitive landscape.

| Substitute Category | Description | Market Trend/Data (2024/Projected) | Impact on Gear4music |

|---|---|---|---|

| Digital Music Creation Tools | DAWs, virtual instruments, plugins | Global market projected to exceed $3 billion by 2028 (CAGR >10%) | Reduces demand for physical instruments and studio hardware |

| Second-hand Market | Pre-owned instruments and gear | Sales volume increased by 15% YoY by end of 2024 on specialized platforms | Offers a lower-cost alternative, directly competing with new sales |

| Instrument Rental Services | Temporary access to instruments | Integral part of music education programs, reducing immediate purchase needs | Dilutes demand for new instrument purchases, especially among beginners |

| DIY Electronics & Open-Source Software | Custom-built audio gear, free software | Affordable components allow DIY audio interfaces under $100 vs. hundreds for branded units | Provides cost-effective alternatives to specialized audio equipment |

| Broader Entertainment Options | Streaming, gaming, travel | Global entertainment & media market projected over $2.9 trillion in 2024 | Competes for discretionary spending, diverting funds from instrument purchases |

Entrants Threaten

The online musical instrument retail market demands substantial upfront investment. This includes acquiring a broad inventory, setting up and maintaining warehousing facilities, and building a robust global logistics system. For instance, Gear4music's vast product catalog, boasting 63,000 SKUs, and its network of multiple distribution centers highlight the considerable capital commitment necessary to operate at a competitive scale.

Established retailers like Gear4music benefit from years of building brand recognition and customer trust, presenting a significant hurdle for newcomers. For instance, in 2024, customer loyalty programs and positive reviews continued to be key differentiators in the competitive music retail landscape.

New entrants would require substantial marketing expenditures to achieve comparable visibility and establish credibility. This investment is crucial to overcome the existing trust advantage held by established players like Gear4music, who have cultivated a loyal customer base.

Gear4music's strong supplier relationships pose a significant barrier to new entrants. The company has cultivated long-term partnerships with over 1,000 manufacturers, including highly sought-after premium brands such as Fender and Yamaha.

This extensive network makes it incredibly difficult for new competitors to gain access to desirable product lines or secure favorable terms from these established suppliers. In 2023, Gear4music's ability to source a wide variety of popular instruments and accessories directly contributed to its robust revenue streams, a testament to the value of these supplier connections.

Economies of Scale in Operations and Marketing

Existing large online music retailers, like Gear4music itself, leverage significant economies of scale in their operations and marketing efforts. This allows them to negotiate more favorable terms with suppliers and achieve lower per-unit costs for advertising and logistics. For instance, in 2023, major online retailers often secured bulk discounts on inventory, which smaller, newer entrants struggle to match.

These scale advantages translate directly into competitive pricing and broader market reach. A large player can absorb higher marketing spend per customer acquisition initially, knowing that their overall volume will drive down the average cost over time. This creates a substantial barrier for new companies trying to enter the market and gain traction against established giants.

Consider these points regarding economies of scale:

- Purchasing Power: Large retailers can buy inventory in massive quantities, leading to significant discounts from manufacturers and wholesalers.

- Logistical Efficiency: Established players have optimized distribution networks, reducing shipping costs per item.

- Marketing Reach: Higher advertising budgets allow for broader campaigns and better rates on digital ad placements.

- Brand Recognition: Scale often correlates with brand awareness, reducing the marketing effort needed to attract customers.

Proprietary Technology and Data

Gear4music's investment in its proprietary e-commerce platform, which supports multiple languages and currencies, creates a substantial barrier to entry. This sophisticated digital infrastructure, coupled with their extensive customer data, makes it challenging for newcomers to replicate their online operational capabilities and personalized customer engagement strategies. For instance, in 2024, Gear4music continued to enhance its platform's AI-driven recommendation engine, aiming to further personalize the customer journey and boost conversion rates, a feat requiring significant ongoing technological investment.

The threat of new entrants is therefore moderated by the high upfront capital and specialized expertise needed to develop and maintain a comparable e-commerce ecosystem. Building a robust, scalable, and user-friendly platform that can effectively manage a vast product catalog, diverse payment options, and international logistics is a complex undertaking. Furthermore, the ability to effectively gather, analyze, and utilize customer data for targeted marketing and service improvements requires advanced data science capabilities, which are not easily acquired by nascent competitors.

- Proprietary Technology: Gear4music's bespoke e-commerce platform represents a significant technological hurdle for new entrants.

- Data Accumulation: The company's extensive customer data provides a competitive advantage in marketing and personalization.

- Investment Barrier: Developing a similar multilingual, multicurrency platform requires substantial capital and technical expertise.

- Competitive Edge: This technological and data-driven approach differentiates Gear4music and discourages new market participants.

The threat of new entrants into the online musical instrument market is considerably low, largely due to the substantial barriers established by companies like Gear4music. These barriers include significant capital investment for inventory and logistics, the need for strong brand recognition, and the high cost of marketing to achieve visibility. For instance, in 2024, the ongoing investment in digital marketing and customer acquisition costs remained a key challenge for smaller players attempting to gain market share.

Furthermore, Gear4music's established supplier relationships, with over 1,000 manufacturers including major brands, make it difficult for newcomers to secure desirable product lines or favorable terms. Economies of scale also play a crucial role, enabling larger retailers to offer more competitive pricing due to bulk purchasing and logistical efficiencies. By 2023, major online retailers were leveraging these scale advantages to negotiate better deals, a feat difficult for new entrants to replicate.

Gear4music's proprietary e-commerce platform, supporting multiple languages and currencies, represents another significant hurdle, demanding substantial technological investment and expertise to match. The accumulation and effective utilization of customer data further enhance this competitive advantage, making it challenging for new entrants to replicate the personalized customer engagement strategies that drive loyalty and sales.

| Barrier Type | Description | Impact on New Entrants | Gear4music Example (2023/2024) |

|---|---|---|---|

| Capital Investment | High upfront costs for inventory, warehousing, and logistics. | Significant financial hurdle. | 63,000 SKUs; multiple distribution centers. |

| Brand Recognition & Trust | Years of building customer loyalty and positive reputation. | Difficult to overcome existing trust advantage. | Continued focus on customer loyalty programs and positive reviews. |

| Supplier Relationships | Long-term partnerships with key manufacturers. | Limited access to popular products and favorable terms. | Partnerships with over 1,000 manufacturers, including Fender and Yamaha. |

| Economies of Scale | Lower per-unit costs in purchasing, marketing, and logistics. | Inability to match competitive pricing and reach. | Bulk discounts on inventory and optimized distribution networks. |

| Proprietary E-commerce Platform | Sophisticated, multilingual, and data-driven online infrastructure. | Requires substantial technological investment and expertise. | AI-driven recommendation engine enhancement for personalized customer journeys. |

Porter's Five Forces Analysis Data Sources

Our Gear4Music Porter's Five Forces analysis is built upon a foundation of publicly available company filings, including annual reports and investor presentations. We supplement this with insights from reputable industry analysis firms and market research reports to capture a comprehensive view of the competitive landscape.