Gear4Music Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gear4Music Bundle

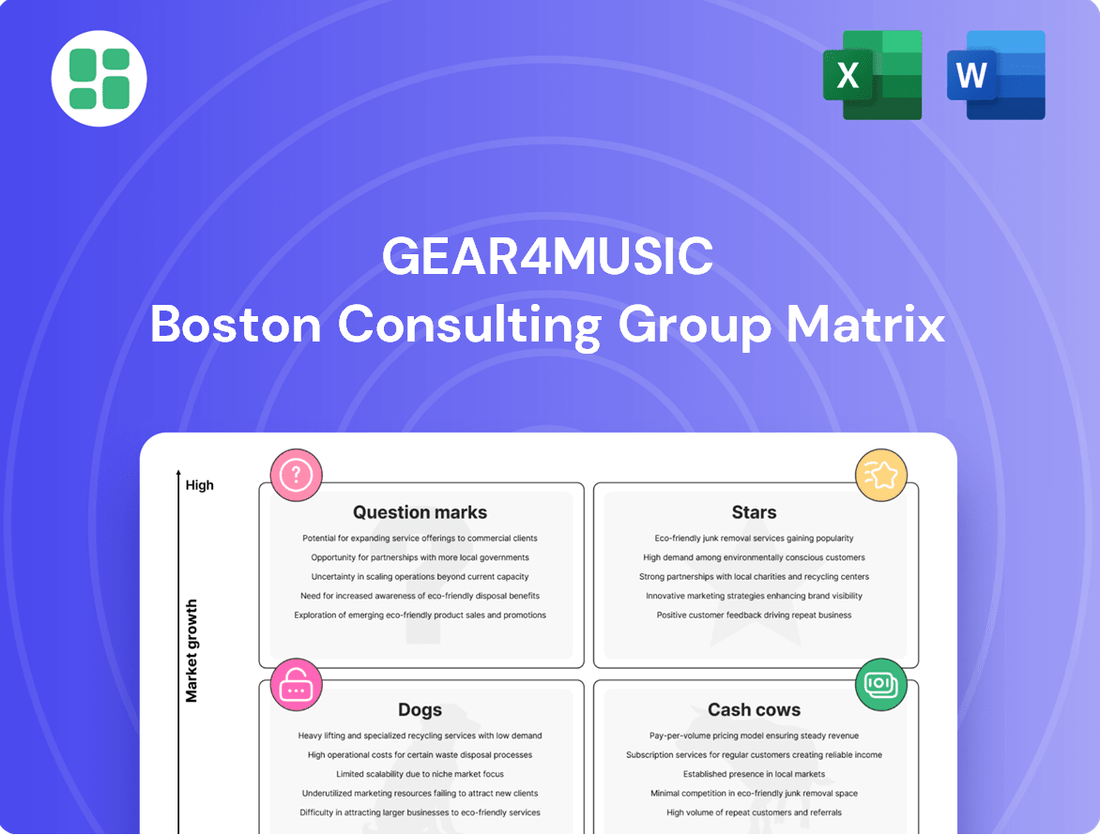

Curious about Gear4Music's product portfolio performance? Our BCG Matrix preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture; purchase the full BCG Matrix to unlock detailed quadrant analysis and actionable strategies for optimizing their product mix and driving future growth.

Stars

The market for digital and hybrid instruments is booming, with hybrid/smart instruments specifically anticipated to see a compound annual growth rate of 12.4% from 2025 to 2030. Gear4music, a prominent online retailer, is strategically positioned to capitalize on this upward trend. Their robust e-commerce infrastructure facilitates extensive market reach and streamlined distribution of these innovative, tech-forward products to a worldwide audience.

The home audio equipment market is experiencing significant expansion, with a projected compound annual growth rate (CAGR) of 10.8% between 2024 and 2025. This upward trend is expected to continue, reaching a 12.5% CAGR by 2029.

Gear4music's strategic entry into the Audio-Visual (AV) equipment sector in 2021 has proven fruitful, as evidenced by reported growth in this category during FY24. By focusing on modern wireless and smart home integrated devices, the company is well-positioned to capitalize on this high-growth market.

This segment, therefore, represents a strong Star product line for Gear4music, offering substantial potential for increased market share and revenue growth as consumer demand for sophisticated home entertainment solutions escalates.

Gear4music has strategically bolstered its own-brand product lines, aiming for enhanced profitability. This focus is evident in a substantial 67% expansion of own-brand stock-keeping units (SKUs) since 2020.

These higher-margin items now represent a significant 23.6% of total product sales in the first half of fiscal year 2025, underscoring their growing commercial importance.

As these own-brand products gain momentum in expanding market niches, they are poised to ascend to leadership positions within their respective categories.

Second-Hand Sales Platform

Gear4music's second-hand sales platform, launched in 2023, is a rapidly expanding segment of their business. During the first half of fiscal year 2025, this platform experienced an impressive sales increase of 286%. This substantial growth highlights the increasing consumer demand for pre-owned musical instruments and Gear4music's successful entry into this high-potential market.

The company is actively working to boost consumer awareness and broaden the accessibility of this platform. By tapping into the growing trend of sustainable consumption and the appeal of more affordable musical equipment, Gear4music is strategically positioning itself for continued success.

- Rapid Growth: Sales on the second-hand platform surged by 286% in H1 FY25.

- Market Trend: Capitalizes on the increasing demand for refurbished and used musical equipment.

- Strategic Expansion: Focus on increasing consumer awareness and channel availability.

- Market Position: Establishing a strong foothold in a burgeoning market segment.

UK Online Musical Instrument Sales

Gear4music, the leading UK online musical instrument retailer, is well-positioned within a rapidly expanding market. The online channel for musical instruments is projected to grow at a substantial 10.3% compound annual growth rate (CAGR) through 2030. This robust growth trajectory highlights the increasing consumer preference for online purchasing in the musical instrument sector.

Despite economic headwinds affecting consumer spending in fiscal year 2025, Gear4music achieved a notable 9% increase in UK revenues. This performance underscores the company's resilience and its ability to capture market share even in challenging conditions. The musical instrument market in the UK has seen some consolidation due to competitor difficulties, further strengthening Gear4music's position.

- Market Dominance: Gear4music is the largest UK online musical instrument retailer.

- Sector Growth: The online musical instrument retail sector is forecast to expand at a 10.3% CAGR until 2030.

- Resilient Revenue: UK revenues for Gear4music grew by 9% in FY25, defying challenging consumer environments.

- Market Consolidation: Competitor failures have led to market consolidation, benefiting Gear4music's market share.

Gear4music's own-brand products are performing exceptionally well, showing strong growth in expanding market niches. With a 67% increase in own-brand SKUs since 2020, these higher-margin items constituted 23.6% of total sales in H1 FY25. This segment is poised to become a market leader due to increasing consumer demand and strategic focus.

| Category | Market Growth | Gear4music Performance | Star Potential |

|---|---|---|---|

| Own-Brand Products | Expanding Niches | 23.6% of H1 FY25 Sales (up from previous periods) | High - Strong growth and increasing market share |

| Second-Hand Sales | Rapidly Growing | 286% sales increase in H1 FY25 | High - Capitalizing on sustainability and affordability trends |

| Audio-Visual Equipment | High Growth (10.8% CAGR 2024-2025) | Reported growth in FY24 | High - Focus on wireless and smart home devices |

What is included in the product

The Gear4Music BCG Matrix analyzes its product portfolio, categorizing items as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides strategic decisions on investment, divestment, and resource allocation for each product category.

A clear BCG Matrix visual, easily exportable to PowerPoint, helps focus strategic discussions on resource allocation.

Cash Cows

Established core musical instrument categories like guitars and keyboards are Gear4music's cash cows. String instruments, including guitars, held a significant 28% market share in 2024, demonstrating their enduring popularity and substantial revenue generation. These foundational product lines, while mature, offer stable and predictable cash flow, forming the bedrock of the company's financial stability.

Gear4music's mature UK e-commerce operations are a clear cash cow. As the largest online retailer of musical instruments and equipment in the UK, this segment commands a significant market share.

In the financial year ending March 2025 (FY25), UK revenues saw a healthy 9% increase. This growth demonstrates the stability and profitability of this established business, even amidst broader market headwinds.

This operation is a substantial cash generator. The significant cash flow produced can be strategically deployed to fuel investments in more dynamic growth areas within the company or to effectively manage overall operational expenses.

Standard professional audio equipment, encompassing recording gear and PA systems, forms a significant segment within Gear4music's offerings. This category typically exhibits a high market share due to consistent demand from musicians and audio professionals.

The market for audio equipment, while experiencing growth, sees established, standard professional-grade products as reliable revenue generators. These items often require minimal marketing spend to maintain their steady sales, contributing predictably to overall profitability.

Showroom and Distribution Network

Gear4music's showroom and distribution network, while not a primary growth engine, functions as a crucial Cash Cow. These physical assets, spread across the UK and Europe, underpin the company's dominant online market share by ensuring logistical efficiency and offering tangible customer interaction points. In 2024, Gear4music continued to leverage this infrastructure to maintain high customer satisfaction and operational scale, contributing to a stable revenue stream.

The network's value lies in its ability to support Gear4music's established position in the market. It facilitates efficient order fulfillment, a key differentiator in the competitive online retail space. This operational strength allows the company to generate consistent cash flow, reinvested into other areas of the business or returned to shareholders.

- Logistical Backbone: The distribution centers are vital for timely and cost-effective delivery, supporting Gear4music's large online sales volume.

- Customer Touchpoints: Showrooms provide brand visibility and a physical presence, enhancing customer trust and engagement.

- Operational Efficiency: The established network minimizes delivery times and costs, a critical factor in maintaining profitability.

- Brand Credibility: Physical showrooms and a robust distribution system reinforce Gear4music's image as a reliable and established retailer.

Basic Musical Accessories and Consumables

Basic musical accessories and consumables, like strings, drumsticks, and cables, are the bedrock of a musician's toolkit. These are the items that get used up and need replacing regularly, ensuring a constant flow of sales for retailers. For a company like Gear4music, these products represent a stable, reliable income source.

The demand for these essentials is generally consistent, as they are fundamental to playing and maintaining instruments. This steady repurchase cycle means they contribute to a predictable revenue stream, even if the individual product growth isn't explosive. In 2023, the global musical instrument accessories market was valued at approximately $5.5 billion, with consumables forming a significant portion of this.

- High Volume Sales: Products like guitar strings and drumsticks are purchased frequently by a broad base of musicians.

- Predictable Revenue: Consistent demand for consumables creates a steady and reliable income for retailers.

- Low Growth, High Share: While not a high-growth category, these items often represent a substantial market share for established retailers.

- Essential Replenishment: Musicians constantly need to replace worn-out or broken accessories, driving repeat business.

Gear4music's established e-commerce platform in the UK is a prime example of a cash cow. As the dominant online retailer in the musical instrument sector, it consistently generates substantial revenue. This segment's maturity means it requires less investment for growth but yields significant, stable profits, underpinning the company's financial health.

The company's core instrument categories, such as guitars and keyboards, are also strong cash cows. These mature product lines, which held a significant market share in 2024, provide a predictable and substantial cash flow. Their stability allows Gear4music to fund investments in other business areas.

Basic musical accessories and consumables, like strings and drumsticks, represent another key cash cow. Their consistent demand and high repurchase rate ensure a steady revenue stream. The global market for these items was valued at approximately $5.5 billion in 2023, highlighting their importance.

Professional audio equipment, particularly standard recording gear and PA systems, contributes to Gear4music's cash cow portfolio. These items benefit from consistent demand from musicians and audio professionals, offering reliable sales with minimal marketing expenditure.

| Business Segment | BCG Category | Key Characteristics | 2024 Market Share (Est.) | Revenue Contribution |

|---|---|---|---|---|

| UK E-commerce | Cash Cow | Dominant market position, mature, stable revenue | High (Largest online retailer) | Substantial and predictable |

| Guitars & Keyboards | Cash Cow | Established core products, consistent demand | 28% (String instruments) | Significant revenue generator |

| Accessories & Consumables | Cash Cow | High repurchase rate, essential for musicians | High (Within $5.5B market) | Steady and reliable income |

| Professional Audio Equipment | Cash Cow | Consistent demand, minimal marketing needed | High (Established products) | Predictable profitability |

Full Transparency, Always

Gear4Music BCG Matrix

The Gear4Music BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no limitations – just the complete, professionally formatted strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix document you are currently exploring is the exact same file that will be delivered to you upon completing your purchase. It's a comprehensive, actionable tool designed to provide clear insights into Gear4Music's product portfolio, ready for integration into your strategic planning.

What you see here is not a sample, but the actual Gear4Music BCG Matrix report that will be yours to download and utilize after purchase. This ensures you receive a complete, ready-to-deploy analysis that accurately reflects the strategic positioning of Gear4Music's offerings.

Dogs

Gear4music's European regional sales are currently in the Dogs quadrant of the BCG Matrix. In FY25, European revenues saw an 8% drop, reflecting intense competition and subdued consumer spending across several key markets.

This underperformance is particularly noticeable in specific European regions where the company has found it challenging to establish a strong market presence or achieve consistent profitability. These areas represent a drain on resources, consuming capital and management attention without generating commensurate returns, suggesting a need for a strategic re-evaluation.

Certain niche acoustic instruments, while perhaps holding sentimental value or catering to a dedicated but small customer base, might represent a challenge within Gear4music's product portfolio. For instance, instruments like the hurdy-gurdy or the less common types of lutes, despite their historical significance, often see limited sales volumes.

These items can tie up valuable inventory space and capital. If Gear4music has substantial stock of such slow-moving products with poor sales prospects, they could be categorized as Dogs in the BCG matrix. This means they are not generating significant revenue and might even incur holding costs without a clear path to increased demand, especially as digital alternatives gain traction.

Certain basic, highly commoditized accessories with numerous competitors and razor-thin margins might fall into this category. For instance, basic instrument cables or guitar picks, where Gear4music faces intense competition from both large retailers and smaller specialized suppliers, could be examples.

While essential to a musician's setup, if Gear4music's market share in these specific sub-segments is low and competition is fierce, these products may only break even or incur losses after operational costs are factored in. For example, a report from Statista in early 2024 indicated that the global market for musical instrument accessories, while growing, is highly fragmented with many small players vying for market share in basic categories.

These products offer little strategic advantage or growth potential for Gear4music, primarily serving as add-ons rather than significant profit drivers. Their inclusion in the portfolio is more about offering a complete solution to customers than generating substantial revenue.

Specific Unsuccessful Marketing Initiatives

Gear4music's venture into an AI-powered marketing system during the first half of fiscal year 2025 presented a significant hurdle. This initiative, intended to optimize campaigns, initially led to a temporary surge in marketing expenditures, which in turn affected the sales mix. The company reported that these AI system implementation costs contributed to a 5% increase in overall marketing spend for that period.

When specific marketing campaigns or technological investments, like the AI system, consistently underperform relative to their cost, they can become problematic. These initiatives might fail to generate the anticipated returns, thereby draining financial resources without fostering growth or expanding market share. Such underperforming assets are often categorized as cash traps, necessitating a thorough review of their viability and strategic direction.

- AI Marketing System Rollout: Initial H1 FY25 costs increased marketing spend by 5% without immediate positive ROI.

- Underperforming Campaigns: Initiatives failing to meet growth or market share targets represent potential cash traps.

- Resource Drain: Continued investment in unsuccessful strategies diverts capital from more promising areas.

- Strategic Re-evaluation: These "dogs" require critical assessment to determine if they can be revitalized or should be divested.

Excess or Obsolete Inventory

Excess or obsolete inventory represents a classic 'Dog' in the BCG Matrix for Gear4music. This includes any significant accumulation of old stock or products that have been superseded by newer models or technologies. For instance, in 2024, a retailer like Gear4music might find itself with a substantial amount of older model digital pianos or synthesizers that are no longer in high demand due to the release of advanced, feature-rich replacements.

These items inherently possess low growth prospects and low market share, as per the definition of a Dog. They tie up valuable working capital that could be deployed elsewhere, and can also incur ongoing storage costs, diminishing profitability. Efficient inventory management is therefore paramount to avoid these cash traps.

- Low Market Share: Products that are no longer in vogue or have been technologically surpassed typically see a sharp decline in customer interest, leading to a minimal share of the current market.

- Low Growth Prospects: The demand for these items is unlikely to increase, and often continues to decrease as newer alternatives become more prevalent.

- Capital Tie-up: Obsolete stock represents capital that is not generating returns, instead consuming resources for storage and potential write-downs.

- Storage Costs: Holding onto excess or obsolete inventory incurs warehousing, insurance, and potential obsolescence costs, further eroding profit margins.

Gear4music's European operations, particularly in certain regions, are currently positioned as Dogs in the BCG matrix. This is evidenced by an 8% revenue drop in FY25, a direct consequence of intense market competition and weakened consumer spending across key European territories.

The company's European sales performance reflects a struggle to gain traction and profitability in specific areas. These underperforming segments consume significant resources, including capital and management focus, without yielding proportionate returns, signaling a need for strategic redirection.

Examples of these "Dogs" could include niche acoustic instruments with limited appeal or basic, commoditized accessories where Gear4music holds a small market share amidst fierce competition. For instance, a Statista report in early 2024 highlighted the fragmented nature of the musical instrument accessories market, with many small players competing in basic categories.

The rollout of an AI-powered marketing system in H1 FY25, which increased marketing spend by 5% without immediate positive ROI, also represents a potential Dog. Such initiatives, if they consistently fail to deliver anticipated growth or market share, become cash traps, diverting funds from more productive ventures.

| BCG Category | Market Share | Market Growth | Gear4music Example | Financial Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Underperforming European Regions, Niche Instruments, Basic Accessories, Unsuccessful AI Marketing Initiatives | Resource drain, low profitability, potential cash trap |

Question Marks

Gear4music's acquisition of stock and digital assets from collapsed UK competitors, such as GAK.co.uk and S&T Audio Limited in 2025, places these entities within the question marks category of the BCG Matrix. These moves are designed to bolster Gear4music's market share by absorbing struggling rivals.

While these acquisitions represent an opportunity to expand market presence, they also carry inherent risks. The integration process for these acquired assets, including their digital platforms and inventory, will demand substantial capital investment and meticulous strategic planning to convert them into profitable, high-market share segments.

The ultimate success of these newly acquired assets remains uncertain, classifying them as question marks. Their future performance hinges on Gear4music's ability to effectively manage the integration, leverage the acquired digital capabilities, and capitalize on the existing customer bases without incurring excessive costs or diluting brand focus.

Expanding into emerging global markets presents a classic "Question Mark" scenario for Gear4music. While the company already ships to 190 countries, focusing on high-growth regions like the Middle East, which is projected to see a 7.8% CAGR for musical instruments through 2030, offers significant untapped potential. This represents a high-growth market where Gear4music currently holds a low market share.

These expansion efforts, however, demand considerable upfront investment. Gear4music would need to allocate resources towards tailoring its offerings to local preferences (localization), establishing robust distribution networks (logistics), and implementing targeted marketing campaigns. The risk lies in the uncertainty of immediate returns on these substantial investments, a hallmark of Question Mark strategic moves.

High-end niche professional audio-visual solutions represent a potential Star or Question Mark for Gear4music. This segment offers high-value opportunities, with the professional AV market projected to grow significantly, reaching an estimated USD 159.7 billion globally by 2028, according to a 2024 report by Grand View Research. However, Gear4music's current market penetration in these specialized areas is likely minimal, necessitating substantial investment in technical expertise, tailored sales strategies, and dedicated customer support to compete effectively against established players.

Sustainable and Eco-Friendly Musical Instruments

Gear4music's 'Sustainable Sound Scheme,' launched in 2025, taps into a burgeoning consumer demand for eco-friendly musical instruments. This initiative aligns with a significant growth trend, as evidenced by market reports indicating a projected 15% compound annual growth rate for sustainable consumer goods through 2028. While this niche is expanding rapidly, Gear4music's current market penetration is likely in its early stages, suggesting a nascent position within this segment. Substantial investment will be crucial to establish a strong brand presence and scale production, aiming to capture a more significant market share in the coming years.

The sustainable musical instrument market, while promising, requires strategic development to yield substantial returns. Gear4music's commitment to this area addresses a clear market opportunity, but the initial investment in sourcing sustainable materials and ethical manufacturing processes will be considerable. For instance, the global market for sustainable products reached an estimated $150 billion in 2024, with a notable portion attributed to lifestyle and hobby sectors.

- Market Growth: The demand for eco-friendly products, including musical instruments, is experiencing robust growth, projected to continue at a significant pace.

- Nascent Market Share: Gear4music's presence in the sustainable instrument niche is likely small, presenting an opportunity for expansion.

- Investment Requirement: Capturing a larger share necessitates significant investment in R&D, sustainable sourcing, and marketing to differentiate offerings.

- Competitive Landscape: While the market is growing, the competitive intensity within the sustainable instrument segment is expected to increase as more players enter.

Advanced Music Production Software and Digital Services

The music production software and digital services sector represents a high-growth area, driven by the increasing adoption of software-only tools and subscription-based remote learning platforms. This trend is fundamentally reshaping how music is created and learned. For Gear4music, this signifies a substantial opportunity to diversify beyond its traditional hardware focus.

Expanding into this digital realm would position Gear4music in a dynamic and evolving market where its current market share is minimal. This strategic pivot necessitates significant investment in both proprietary software development and strategic alliances with existing digital service providers.

- Market Growth: The global digital music market was valued at over $20 billion in 2023 and is projected to grow significantly, fueled by streaming and digital content creation.

- Software Dominance: A substantial portion of music production now relies on digital audio workstations (DAWs) and virtual instruments, with many users preferring software over physical instruments for certain tasks.

- Subscription Models: The rise of subscription services for both software access and online music education indicates a strong consumer preference for flexible, recurring payment models.

- Investment Needs: Entering this competitive digital landscape requires considerable capital for R&D, user acquisition, and building robust digital infrastructure.

Gear4music's strategic acquisitions of struggling UK music retailers in 2025, like GAK.co.uk and S&T Audio Limited, place these entities squarely in the Question Mark quadrant of the BCG Matrix. These moves are aimed at consolidating market share by absorbing competitors, but they come with significant integration risks and require substantial capital to transform into profitable ventures.

The success of these acquired assets is currently uncertain, making them prime examples of Question Marks. Gear4music must navigate the complexities of integrating digital platforms and inventory, while carefully managing costs and brand focus to realize their potential.

Expanding into new, high-growth international markets, such as the Middle East with its projected 7.8% CAGR for musical instruments through 2030, presents Gear4music with classic Question Mark opportunities. Despite shipping to 190 countries, these emerging regions represent high-growth potential where the company currently holds a low market share, necessitating significant investment in localization and logistics.

The high-end professional audio-visual solutions market, projected to reach USD 159.7 billion globally by 2028, also falls into the Question Mark category for Gear4music. While offering high-value opportunities, the company's minimal penetration in this specialized segment demands considerable investment in technical expertise and tailored sales strategies to compete effectively.

Gear4music's 'Sustainable Sound Scheme,' launched in 2025, targets a rapidly expanding niche. With the sustainable consumer goods market growing at a projected 15% CAGR through 2028, this initiative represents a high-growth area where Gear4music's market share is likely nascent, requiring substantial investment to build brand presence and scale production.

The music production software and digital services sector is another high-growth area for Gear4music, with the global digital music market valued at over $20 billion in 2023. This segment, dominated by DAWs and subscription models, requires significant capital for R&D and infrastructure to compete effectively.

| Category | Description | Market Growth | Current Market Share | Investment Need |

|---|---|---|---|---|

| Acquired Competitors (2025) | Integration of GAK.co.uk, S&T Audio Limited assets | N/A (internal consolidation) | Low (newly acquired) | High (integration, rebranding) |

| Emerging Markets (e.g., Middle East) | Expansion into new geographic regions | High (7.8% CAGR for musical instruments) | Low | High (localization, logistics) |

| High-End AV Solutions | Specialized professional audio-visual equipment | High (USD 159.7 billion by 2028) | Low | High (technical expertise, sales) |

| Sustainable Instruments | Eco-friendly musical instruments | High (15% CAGR for sustainable goods) | Low (nascent) | High (R&D, sourcing) |

| Digital Music Services | Software, online learning platforms | High ($20 billion+ in 2023) | Low | High (software development) |

BCG Matrix Data Sources

Our Gear4Music BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.