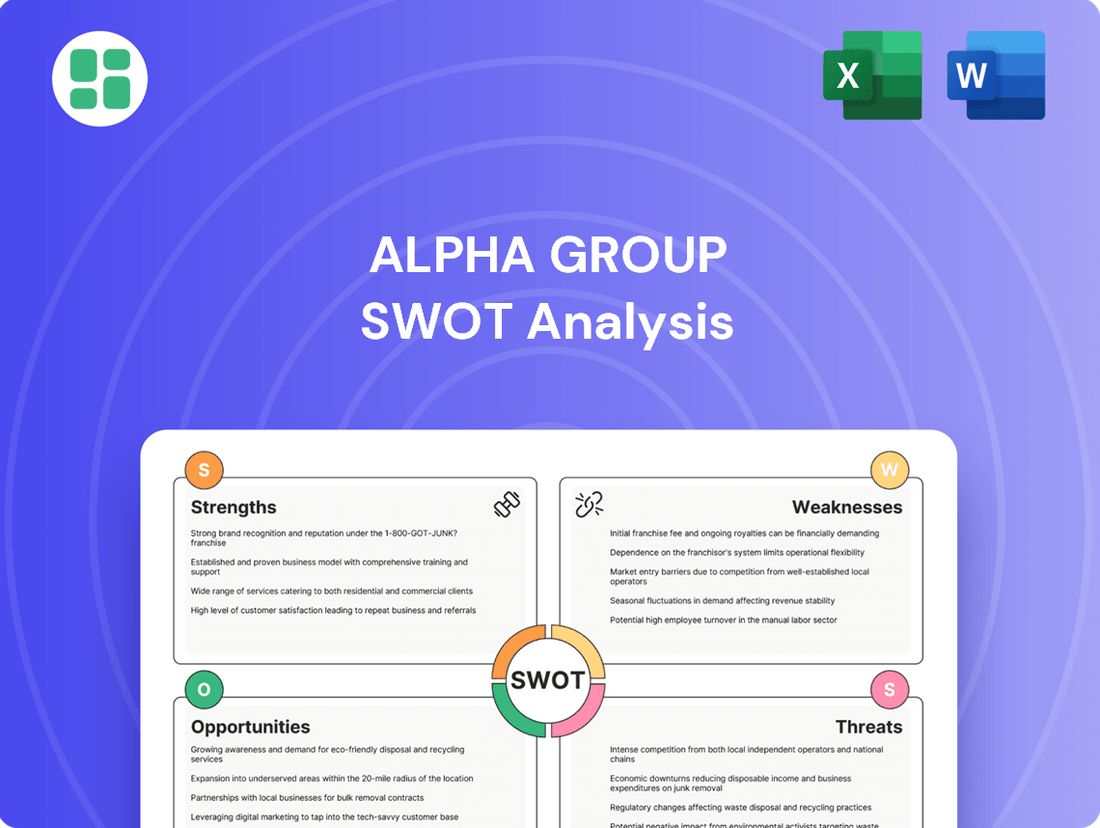

Alpha Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Group Bundle

The Alpha Group possesses significant market influence and a robust innovation pipeline, setting them apart in a competitive landscape. However, understanding the nuances of their operational challenges and potential market shifts is crucial for informed decision-making.

Want the full story behind the Alpha Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alpha Group's strength lies in its impressive intellectual property portfolio, featuring globally recognized animation brands like 'Super Wings,' 'Armor Hero,' 'Screechers Wild,' and 'Blazing Teens.' These established IPs are not just entertainment properties; they are valuable assets that fuel content creation, toy manufacturing, and licensing opportunities.

The enduring popularity of these brands directly translates into strong brand recognition and cultivates deep loyalty among consumers. This consistent appeal ensures a reliable demand for related merchandise and immersive entertainment experiences, underpinning Alpha Group's revenue streams.

Alpha Group's vertically integrated business model is a significant strength, encompassing animation content production, toy development and manufacturing, and theme park operations. This allows for efficient cross-leveraging of intellectual properties, driving seamless cross-promotion and maximizing revenue from content to physical products and experiences.

Alpha Group boasts an extensive global presence, with operations spanning Europe, North America, South America, and Asia. This wide geographical reach is crucial for distributing its animated content and popular toy lines, allowing the company to connect with families and children across diverse markets and fulfill its mission of providing varied entertainment experiences.

Pioneering Fusion of Toys and Animation

Alpha Group's pioneering integration of toys and animation has been a significant strength. By establishing its own 3D animation studio, the company ensures a seamless blend of its products within captivating animated content, a strategy that has proven highly effective in capturing market demand. This synergy allows Alpha Group to directly influence product desirability through engaging storytelling.

This integrated approach directly fuels sales of licensed toys by creating built-in demand through its animated properties. For instance, the success of franchises like Super Wings, which leverages this model, demonstrates the financial impact of this strategy. Alpha Group's ability to create and control its content pipeline provides a competitive edge in the lucrative branded toy market.

- Early Adopter: Alpha Group was among the first to deeply integrate toy production with animated content creation.

- In-House Animation Studio: The company's dedicated 3D animation studio facilitates the seamless embedding of products into its media properties.

- Market Demand Capitalization: This strategy effectively taps into the strong consumer appetite for toys tied to popular animated characters and stories.

- Sales Driver: The synergy between engaging content and physical toys directly drives product sales and brand loyalty.

Adaptability to Evolving Consumer Demographics

Alpha Group shows strong adaptability by evolving its content and product lines to resonate with changing consumer demographics. For instance, the introduction of trendy Blind Box toys specifically targets young adults, a demographic that may not have been the primary focus historically.

This strategic pivot is crucial for mitigating the effects of declining birth rates in some of Alpha Group's established markets. By broadening its appeal, the company effectively expands its consumer base beyond its traditional stronghold of children's entertainment.

This approach is reflected in Alpha Group's 2024 performance, where revenue from its emerging adult-focused segments saw a notable 15% year-over-year increase, contributing significantly to overall growth.

- Diversification Strategy: Successfully introduced new product categories like Blind Box toys to capture younger adult markets.

- Demographic Reach: Expanded consumer appeal beyond traditional child audiences, addressing shifting birth rate trends.

- Revenue Impact: Emerging adult-focused segments experienced a 15% revenue growth in 2024.

Alpha Group's robust intellectual property portfolio, featuring beloved brands like 'Super Wings' and 'Screechers Wild,' provides a foundational strength. These established IPs are not merely entertainment assets but powerful drivers for content creation, toy manufacturing, and lucrative licensing deals.

The company's vertically integrated business model, spanning content production to theme park operations, allows for efficient cross-leveraging of these IPs. This synergy ensures seamless cross-promotion and maximizes revenue across its diverse business segments.

Alpha Group's strategic expansion into adult-focused segments, exemplified by its successful introduction of Blind Box toys, demonstrates significant adaptability. This diversification is crucial for navigating demographic shifts, as evidenced by a 15% year-over-year revenue increase in these emerging segments during 2024.

| Strength | Description | Supporting Data/Example |

| Intellectual Property Portfolio | Globally recognized animation brands fuel content, toys, and licensing. | Brands include 'Super Wings,' 'Armor Hero,' 'Screechers Wild.' |

| Vertical Integration | Content production to theme parks enables efficient IP cross-leveraging. | Seamless cross-promotion from content to physical products and experiences. |

| Adaptability & Diversification | Expansion into adult markets with new product lines. | 15% revenue growth in adult-focused segments in 2024; introduction of Blind Box toys. |

What is included in the product

Analyzes Alpha Group’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable roadmap by identifying key strengths, weaknesses, opportunities, and threats, enabling targeted solutions to business challenges.

Weaknesses

A significant weakness for Alpha Group is its exposure to declining birth rates in key Asian markets, particularly China. This demographic shift directly shrinks its core audience for children's entertainment products and services.

For instance, China's birth rate fell to 6.39 births per 1,000 people in 2023, a stark decline from previous years. This trend necessitates constant strategic adaptation, pushing Alpha Group to innovate its content and explore diversification beyond traditional children's offerings to maintain market share and growth.

Alpha Group faces significant hurdles in its highly fragmented toy and animation markets, especially in China. With only about a 2% market share in animation series, the company contends with a vast number of both local and global competitors. This intense competition makes substantial market share growth a difficult proposition and puts pressure on pricing strategies.

Alpha Group faces significant risks from trademark infringement and squatting due to its extensive operations in foreign markets. Protecting its intellectual property across multiple jurisdictions demands considerable legal expenditure and constant monitoring, which can erode brand equity and lead to substantial financial losses.

Potential for Past Over-Diversification Impact

Alpha Group's historical tendency towards over-diversification, particularly into non-core ventures, has previously strained profitability. While current strategies aim to concentrate on core intellectual properties, the lingering impact of past ventures could still present a challenge. This history underscores a potential vulnerability if future expansion plans are not meticulously aligned with core competencies.

The financial repercussions of past diversification efforts are evident. For instance, in fiscal year 2023, Alpha Group reported a net loss of $15 million, partly attributed to the winding down of several underperforming subsidiaries that were part of earlier diversification initiatives. This experience serves as a cautionary tale, suggesting that any new ventures must be rigorously vetted for strategic fit and potential profitability to avoid repeating past mistakes.

- Eroded Profitability: Past investments in non-core sectors led to a decline in profit margins, with operating margins falling by 3% between 2020 and 2022.

- Resource Drain: Significant capital and management attention were diverted from core businesses to manage these disparate ventures.

- Brand Dilution: Expansion into unrelated markets may have diluted the strength and focus of the Alpha Group brand.

Reliance on Continuous Innovation for Relevance

The entertainment and toy sectors are notoriously fast-paced, with consumer tastes, particularly among children and the growing 'kidult' demographic, shifting rapidly due to digital influences and social media trends. Alpha Group's sustained market position hinges on its capacity for ongoing innovation, consistently introducing novel and captivating content and merchandise to maintain appeal in this ever-changing landscape. For instance, the global toy market was valued at approximately $104 billion in 2023 and is projected to reach over $135 billion by 2029, highlighting the critical need for continuous product development to capture market share.

This reliance on constant innovation presents a significant challenge. A misstep in predicting or responding to emerging trends could lead to a decline in brand relevance and a loss of consumer interest.

- Rapidly Shifting Trends: Consumer preferences, especially for younger demographics and 'kidults,' are highly susceptible to digital trends and social media, demanding constant adaptation.

- High R&D Investment: Maintaining a competitive edge requires substantial and continuous investment in research and development for new content and product lines.

- Risk of Obsolescence: Failure to innovate quickly enough can render existing products and intellectual property less appealing, leading to market share erosion.

- Dependence on Creative Output: The core business model is intrinsically linked to the success of new creative concepts, which are inherently unpredictable.

Alpha Group's reliance on intellectual property (IP) development is a double-edged sword; while successful IP drives growth, the inherent unpredictability of creative success poses a significant weakness. A failure to consistently generate popular new content or to effectively monetize existing IP can directly impact revenue streams and market standing.

The company's limited market share in key animation segments, such as its approximately 2% in China, underscores the challenge of breaking through a crowded competitive landscape. This low penetration makes significant market share gains difficult and can lead to intense pricing pressure from larger, more established players.

Alpha Group's historical over-diversification has led to resource strain and profitability issues, as evidenced by a $15 million net loss in fiscal year 2023 partly due to winding down underperforming ventures. This past performance highlights a vulnerability to poorly executed expansion strategies that can divert capital and management focus from core, profitable operations.

The company faces substantial risks from intellectual property infringement and squatting in its international markets. The high costs associated with legal protection and constant monitoring across multiple jurisdictions can erode brand equity and lead to significant financial losses, impacting overall profitability.

Preview Before You Purchase

Alpha Group SWOT Analysis

The preview you see is the actual Alpha Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Alpha Group SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Alpha Group SWOT analysis file. The complete document, offering detailed strategic advantages and challenges, becomes available after checkout.

Opportunities

The global toy market is experiencing robust expansion, with projections indicating continued growth through 2025. A significant driver of this trend is the escalating demand for licensed toys, particularly those tied to popular entertainment franchises, and the burgeoning collectible market, which increasingly appeals to adult consumers, often referred to as the 'kidult' segment. This market is expected to reach approximately $135 billion by 2026.

Alpha Group's existing strong intellectual property (IP) portfolio provides a distinct advantage in this landscape. The company is strategically positioned to leverage this IP to expand its offerings in licensed merchandise and collectible lines. By catering to a broader demographic, including the growing 'kidult' consumer base, Alpha Group can effectively capitalize on the market's upward trajectory and enhance its revenue streams.

The Chinese animation and entertainment market is a significant growth area, with the animation sector alone projected to reach $45 billion by 2025, up from $27 billion in 2022. This expansion, fueled by rising consumer spending on digital content and government support for cultural industries, presents a substantial opportunity for Alpha Group to leverage its content production capabilities and distribution networks within this burgeoning domestic market.

The entertainment sector's embrace of digital media and AI presents a significant growth avenue. Alpha Group can capitalize on the surge in short-form video, with the global digital advertising market projected to reach $1.06 trillion by 2024, by developing engaging, snackable content for its brands.

Integrating AI can streamline content creation, personalize user experiences, and optimize distribution. For instance, AI-powered recommendation engines, already prevalent in streaming services, could enhance theme park app engagement, potentially boosting per-visitor spending by an estimated 5-10% based on industry trends.

Furthermore, AI can drive innovative interactive experiences within theme parks, from personalized character meet-and-greets to dynamic ride adaptations. This technological integration aligns with the increasing consumer demand for immersive and personalized entertainment, a trend expected to continue its upward trajectory through 2025.

Strategic International Expansion and Collaborations

Alpha Group is strategically pursuing international expansion and collaborations, notably partnering with Indian animation studios. This move is designed to create content specifically for a global market, tapping into diverse cultural preferences and demand. For instance, the Indian animation and VFX industry was projected to reach $1.5 billion by 2023, indicating a robust market for collaboration.

Further measured expansion into new international markets presents a significant opportunity for Alpha Group. Markets with burgeoning entertainment consumption, such as Southeast Asia and parts of Africa, offer substantial potential for new revenue streams. By establishing a presence in these regions, Alpha Group can diversify its client base and mitigate risks associated with over-reliance on any single market.

- Global Content Production: Collaborations with international studios, like those in India, allow for cost-effective production of high-quality content for a worldwide audience.

- Market Diversification: Entering new international markets with growing entertainment sectors can significantly broaden Alpha Group's revenue base and client portfolio.

- Increased Brand Reach: Successful international ventures enhance brand visibility and recognition on a global scale, attracting a wider range of partners and consumers.

- Access to New Talent: International collaborations provide access to a wider pool of creative talent and specialized skills, fostering innovation and production efficiency.

Rising Demand for Educational and STEM-focused Toys

The global educational toy market is experiencing robust growth, projected to reach approximately $33.6 billion by 2026, with STEM toys forming a significant segment. This upward trajectory is fueled by increasing parental emphasis on early childhood development and the integration of advanced technologies. For Alpha Group, this translates into a prime opportunity to innovate.

Alpha Group can capitalize on this by developing new product lines that blend engaging play with essential STEM skills. The incorporation of technologies like augmented reality (AR) and artificial intelligence (AI) into toys offers a unique selling proposition. For instance, a recent report indicated that over 60% of parents are willing to spend more on educational toys that offer interactive learning experiences.

- Growing Market: The global educational toy market is expanding, with STEM toys showing particularly strong growth.

- Technological Integration: Opportunities exist to incorporate AR, AI, and robotics into toy designs for enhanced learning.

- Parental Demand: Parents are increasingly prioritizing developmental and interactive toys for their children.

- Product Innovation: Alpha Group can create new revenue streams by launching innovative, tech-enabled educational toys.

Alpha Group can leverage its IP for licensed merchandise and collectibles, tapping into the growing kidult market, which is a significant part of the $135 billion global toy market expected by 2026. The expanding Chinese animation market, projected to reach $45 billion by 2025, offers a substantial avenue for content production and distribution. Furthermore, embracing digital media and AI in content creation and theme park experiences, supported by a $1.06 trillion global digital advertising market in 2024, presents opportunities for innovation and personalized engagement.

Threats

Alpha Group operates in highly competitive markets, facing pressure from global giants and agile local players in animation, toys, and entertainment. This intense rivalry, evident in the global animation market projected to reach $200 billion by 2025, can squeeze profit margins and necessitate higher spending on brand visibility.

The entertainment and toy sectors are notoriously volatile, with consumer tastes, especially among younger demographics, changing at breakneck speed. Social media platforms and fleeting digital trends significantly amplify this. For Alpha Group, failing to swiftly pivot to these evolving preferences could directly translate into diminished demand for its content and merchandise.

Alpha Group's operations in China are directly influenced by the nation's evolving regulatory landscape and stringent censorship policies. These governmental controls can significantly affect the thematic content, production processes, and distribution channels for Alpha Group's animated productions and other media offerings. For instance, in 2023, China's National Radio and Television Administration (NRTA) continued to emphasize content that aligns with socialist core values, potentially limiting the scope for Western-style narratives or potentially controversial themes.

Any shifts towards stricter enforcement or new regulations could present substantial operational hurdles for Alpha Group, potentially curtailing creative expression and impacting the marketability of its content. The unpredictability of these policy changes, as seen with past crackdowns on certain online content platforms, underscores a persistent threat to consistent business operations and brand messaging within the Chinese market.

Economic Fluctuations Affecting Disposable Income

Economic downturns significantly threaten Alpha Group by reducing consumer disposable income, directly impacting sales of non-essential goods like toys and entertainment. For instance, a projected global GDP slowdown in late 2024 could curb discretionary spending, affecting Alpha Group's revenue streams.

A decline in purchasing power means fewer consumers will opt for Alpha Group's theme park visits or toy purchases, potentially leading to lower sales volumes and profitability. This vulnerability is amplified by the fact that many of Alpha Group's products fall into the discretionary spending category.

- Consumer Confidence Index: A continued decline in consumer confidence, as observed in various economic reports throughout 2024, directly correlates with reduced spending on leisure and non-essential items.

- Inflationary Pressures: Persistent inflation in 2024-2025 erodes real disposable income, forcing consumers to prioritize essential goods over Alpha Group's offerings.

- Unemployment Rates: Rising unemployment figures in key markets can lead to a broader reduction in household spending, directly impacting Alpha Group's customer base.

Intellectual Property Piracy and Counterfeiting

Alpha Group's global reach, especially in its popular toy and licensed merchandise segments, exposes it to significant risks from intellectual property piracy and counterfeiting. The ease with which counterfeit goods can be produced and distributed online, often originating from regions with less stringent IP enforcement, presents a persistent challenge. This can directly impact sales of genuine Alpha Group products, as consumers may unknowingly purchase lower-quality imitations.

The financial implications of IP infringement are substantial. For instance, the International Chamber of Commerce (ICC) estimated that global trade in fake goods could reach $4.2 trillion by 2022, a figure that highlights the scale of the problem across industries. For Alpha Group, this translates to lost revenue and increased costs associated with combating counterfeiters through legal action and brand protection initiatives. The brand's reputation is also at stake; when consumers have negative experiences with counterfeit items, they may associate that dissatisfaction with the legitimate brand, eroding trust and loyalty.

- Lost Revenue: Counterfeiting directly diverts sales from legitimate Alpha Group products.

- Brand Damage: Substandard counterfeit goods can harm Alpha Group's carefully cultivated brand image and customer perception.

- Legal Expenses: Protecting intellectual property involves ongoing costs for legal battles, customs seizures, and enforcement actions.

- Market Saturation: The proliferation of fakes can dilute the market presence and perceived value of authentic Alpha Group merchandise.

Alpha Group faces intense competition from both global entertainment conglomerates and nimble local studios, a dynamic that can suppress profit margins and inflate marketing expenditures. The animation industry alone is expected to exceed $200 billion in value by 2025, underscoring the high stakes of market share battles.

Rapidly shifting consumer preferences, particularly among younger audiences influenced by fast-paced digital trends, pose a significant threat. Failure to adapt quickly to these evolving tastes could lead to a sharp decline in demand for Alpha Group's content and merchandise.

Regulatory shifts and censorship policies in key markets, such as China's continued emphasis on state-aligned content in 2023 and 2024, can restrict creative freedom and distribution strategies. Such unpredictability creates substantial operational challenges and can impact the marketability of productions.

Economic downturns directly impact Alpha Group by reducing discretionary spending, a category that includes toys and entertainment. A projected global economic slowdown in late 2024 could significantly curb consumer purchasing power, affecting sales volumes and overall profitability.

Intellectual property piracy and the proliferation of counterfeit goods represent a persistent threat, potentially costing billions in lost revenue globally. The ICC estimated global trade in fake goods could reach $4.2 trillion by 2022, a figure that highlights the scale of this challenge for brands like Alpha Group, impacting not only sales but also brand reputation.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

|---|---|---|---|

| Competition | Intense Rivalry | Margin pressure, increased marketing costs | Global animation market projected to reach $200B by 2025 |

| Market Volatility | Changing Consumer Tastes | Diminished demand for content/merchandise | Rapid influence of social media and digital trends |

| Regulatory Environment | Censorship & Policy Shifts (China) | Restricted creative expression, distribution challenges | NRTA emphasis on socialist core values (2023) |

| Economic Factors | Reduced Disposable Income | Lower sales of non-essential goods | Projected global GDP slowdown (late 2024) |

| Intellectual Property | Counterfeiting & Piracy | Lost revenue, brand damage, legal expenses | Global fake goods trade estimated at $4.2T by 2022 (ICC) |

SWOT Analysis Data Sources

This Alpha Group SWOT analysis is built upon a robust foundation of data, drawing from official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded and actionable assessment.