Alpha Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Group Bundle

Unlock the critical external factors shaping Alpha Group's trajectory with our detailed PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities. Empower your strategic decisions with this essential market intelligence—download the full report now.

Political factors

Alpha Group's operations in China are heavily influenced by the government's stringent content regulations and censorship, impacting its animated productions. These policies dictate permissible themes and narratives, potentially restricting creative expression and affecting market reach within China and abroad.

In 2024, China's National Radio and Television Administration (NRTA) continued to enforce guidelines that prioritize content deemed socially beneficial and patriotic, a trend that has been in place for several years. This means Alpha Group must meticulously align its animated content with these directives to ensure domestic distribution and avoid penalties.

The evolving regulatory landscape presents a significant challenge for Alpha Group's global expansion strategy. Compliance with China's censorship rules can create complexities when seeking international distribution, as content may need to be adapted or produced differently for various markets, impacting overall production costs and timelines.

China's commitment to bolstering intellectual property (IP) protection is a significant positive for Alpha Group. The nation's recent efforts, including increased penalties for infringement and streamlined legal processes, directly safeguard Alpha's core assets like animated characters and toy designs. This strengthened legal environment is crucial for the company's strategy of monetizing its IP across diverse revenue streams.

Alpha Group, as a Chinese multinational, faces significant exposure to evolving international trade policies and escalating geopolitical tensions. For instance, the ongoing trade friction between the US and China, which saw tariffs imposed on billions of dollars worth of goods in recent years, directly impacts the cost of sourcing materials and manufacturing for toy companies like Alpha Group. This can squeeze profit margins and necessitate price adjustments for consumers.

These geopolitical dynamics can disrupt Alpha Group's supply chain stability, particularly for toy manufacturing which often relies on intricate global networks. Furthermore, market access for its diverse product lines and content could be restricted in key regions. For example, in 2023, several countries continued to review and potentially restrict foreign digital content, a factor Alpha Group must monitor closely for its entertainment divisions.

Navigating these complexities demands agile strategic planning and diversification. Alpha Group's ability to adapt its sourcing, manufacturing, and market strategies in response to shifting trade agreements and geopolitical landscapes will be crucial for maintaining its competitive edge and ensuring consistent revenue streams across its global operations.

Government Support for Cultural and Tourism Industries

The Chinese government's robust support for its cultural and tourism sectors directly bolsters Alpha Group's animation, entertainment, and theme park ventures. This backing often materializes as direct subsidies, preferential policies, and investments in infrastructure, creating a fertile ground for domestic expansion. For instance, in 2023, China's Ministry of Culture and Tourism reported a significant rebound in domestic tourism, with over 4.89 billion trips taken, a 1.9-fold increase year-on-year, underscoring the effectiveness of these supportive measures.

This governmental emphasis aligns perfectly with the burgeoning 'happiness economy' in China. This trend signifies growing consumer spending on leisure and entertainment, directly translating into increased investment and heightened consumer interest in theme parks and related cultural experiences. By 2024, the Chinese theme park market is projected to continue its upward trajectory, driven by a growing middle class and a desire for high-quality entertainment experiences.

- Government Subsidies: Direct financial aid to cultural and tourism enterprises, reducing operational costs for companies like Alpha Group.

- Favorable Policies: Tax incentives and relaxed regulations that encourage investment and growth within the entertainment and tourism industries.

- Infrastructure Development: Government investment in transportation and public facilities that improve accessibility and visitor experience for theme parks and cultural sites.

- 'Happiness Economy' Growth: A market trend showing increased consumer expenditure on leisure and entertainment, boosting demand for Alpha Group's offerings.

Cross-Border Data Transfer Regulations

Recent relaxations and clarifications in China's cross-border data transfer regulations, observed in early 2024 and continuing into 2025, present a notable shift for Alpha Group. These adjustments are particularly relevant for Alpha Group's digital platforms and extensive global operations, aiming to simplify the movement of data across international borders.

The updated regulations are designed to streamline data flows, which could significantly reduce the compliance complexities Alpha Group faces when transferring personal and general data internationally. This is crucial for maintaining efficient global digital operations and ensuring continued access to vital market information.

Adherence to these evolving and nuanced rules is paramount for Alpha Group to ensure uninterrupted global digital operations and to foster continued international business expansion. For instance, China's Cyberspace Administration (CAC) has been actively issuing guidelines and approvals, with a notable increase in the number of companies receiving clearance for standard contracts in late 2024, signaling a more predictable environment for data transfers.

- Streamlined Data Flows: China's regulatory updates in 2024-2025 aim to simplify the process for companies like Alpha Group to transfer data internationally.

- Reduced Compliance Burden: Clarifications are expected to lessen the administrative and legal complexities associated with cross-border data movement, particularly for personal information.

- Operational Efficiency: Alpha Group can leverage these changes to enhance the efficiency of its global digital operations and data-driven strategies.

- Market Access: Understanding and complying with these regulations is key for Alpha Group to maintain and expand its market presence in China and other regions with similar data governance frameworks.

China's government actively supports its cultural and tourism sectors, directly benefiting Alpha Group's animation and theme park ventures through subsidies and favorable policies. This aligns with the growing 'happiness economy,' where consumer spending on leisure is rising, with China's theme park market projected for continued growth through 2024.

The government's robust support for cultural industries, including significant investment in infrastructure and tourism, directly aids Alpha Group's expansion. For example, China's Ministry of Culture and Tourism reported a substantial rebound in domestic tourism in 2023, with over 4.89 billion trips, highlighting the effectiveness of these supportive measures.

Alpha Group must navigate China's stringent content regulations and censorship, which dictate permissible themes and narratives for animated productions. In 2024, the NRTA continued prioritizing socially beneficial and patriotic content, requiring meticulous alignment from Alpha Group to ensure domestic distribution and avoid penalties.

Geopolitical tensions and evolving international trade policies, such as US-China trade friction, directly impact Alpha Group's supply chain costs and market access. These dynamics necessitate agile strategic planning and diversification to maintain a competitive edge and consistent revenue streams globally.

| Factor | Impact on Alpha Group | 2024/2025 Data/Trend |

|---|---|---|

| Content Regulations | Restricts creative expression and market reach in China. | NRTA prioritizes patriotic content; strict adherence required for distribution. |

| Government Support | Boosts animation, entertainment, and theme park ventures. | 2023 saw a 1.9x increase in domestic tourism (4.89 billion trips), indicating strong sector growth. |

| Geopolitical Tensions | Disrupts supply chains, increases costs, and affects market access. | Ongoing US-China trade friction impacts sourcing and manufacturing costs. |

| Data Transfer Regulations | Streamlines global digital operations and compliance. | Relaxations in 2024-2025 simplify cross-border data movement for digital platforms. |

What is included in the product

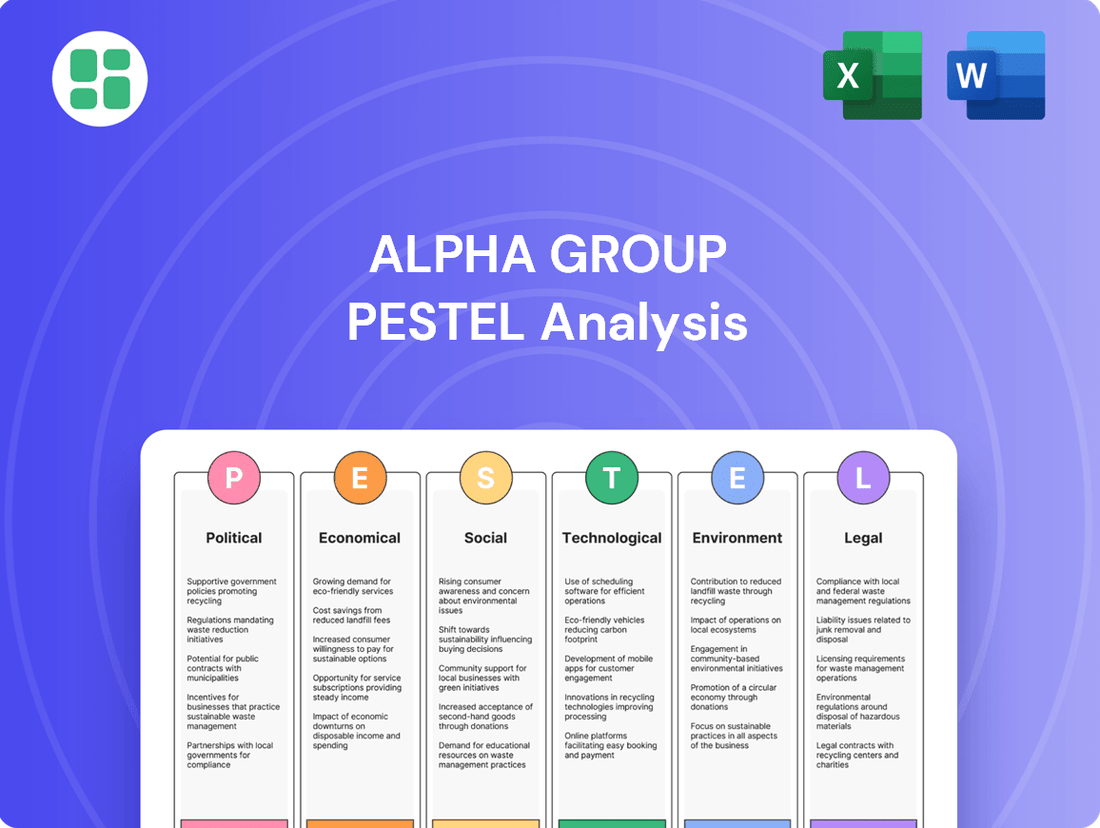

This comprehensive PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the Alpha Group, offering actionable insights for strategic decision-making.

The Alpha Group PESTLE Analysis offers a clear, summarized version of complex external factors, making it easy to reference during high-stakes meetings or strategic presentations.

Economic factors

Alpha Group's financial health is intrinsically linked to the ebb and flow of both global and domestic economic growth. When economies are strong, consumers tend to have more disposable income, which directly translates into increased spending on entertainment, toys, and visits to theme parks – all core areas for Alpha Group.

The global toy market, a key sector for Alpha Group, is showing promising signs. Projections indicate a compound annual growth rate (CAGR) of around 4.5% for the toy market between 2024 and 2029, reaching an estimated value of $135 billion by 2029. This expansion suggests a healthy demand for Alpha Group's products.

Furthermore, China's amusement park market is a significant growth engine, with reports suggesting it could reach $70 billion by 2025. This rapid expansion in a major market indicates strong consumer appetite for leisure activities, benefiting companies like Alpha Group with a presence in such regions.

A stable economic climate is crucial for bolstering consumer confidence. When people feel secure about their financial future, they are more likely to allocate funds towards discretionary spending, including leisure activities and non-essential goods, which directly supports Alpha Group's revenue streams.

Rising disposable incomes globally, especially in burgeoning economies, are a significant tailwind for Alpha Group. As families in emerging markets gain more purchasing power, they increasingly allocate funds towards leisure and entertainment, directly benefiting Alpha Group's toy and game segments. This trend is further amplified by the expanding middle class in China, a crucial market for consumer goods.

The global toy market alone was valued at approximately $105 billion in 2023 and is projected to reach over $140 billion by 2028, demonstrating robust growth driven by these demographic shifts. Furthermore, the 'kidult' phenomenon, where adults purchase toys for themselves, is a rapidly growing niche, adding substantial demand and diversifying Alpha Group's customer base beyond traditional child consumers.

The animation, toy, and theme park sectors are intensely competitive, featuring a multitude of domestic and international companies. Alpha Group must contend with well-established global brands and newer local rivals, demanding constant innovation, robust brand development, and unique products to preserve its market position.

In 2024, the global toy market was valued at approximately $110 billion, with significant growth driven by intellectual property tie-ins and digital integration. Alpha Group's ability to leverage its own IP and adapt to evolving consumer preferences, particularly among Gen Alpha, will be crucial in this dynamic landscape.

The Chinese theme park market, despite its expansion, is experiencing substantial competitive pressure from major international operators. By the end of 2023, China had over 300 theme parks, with new ones frequently opening, intensifying the need for Alpha Group to offer distinctive experiences and value propositions to attract and retain visitors.

Inflation and Production Costs

Rising inflation and increasing production costs present a significant challenge for Alpha Group. For instance, the cost of raw materials, such as plastics and electronics essential for toy manufacturing, saw substantial increases throughout 2024. Similarly, operational expenses for theme parks, including energy and labor, have also climbed, directly impacting profit margins.

Alpha Group needs to navigate these pressures through efficient supply chain management and strategic pricing adjustments. The company must ensure it can absorb some of these increased costs without alienating its customer base, a delicate balancing act in a competitive market. Global economic trends, such as supply chain disruptions and geopolitical events, are key drivers of these cost fluctuations.

- Toy Raw Material Costs: Global commodity prices for plastics and metals, key inputs for toys, experienced an average increase of 8-12% in the first half of 2024 compared to the same period in 2023.

- Theme Park Operational Expenses: Energy costs, a major component of theme park operations, rose by approximately 5-7% in 2024 across major markets.

- Inflationary Impact: Consumer Price Index (CPI) figures in key markets for Alpha Group averaged 4.5% in 2024, indicating broad inflationary pressures affecting disposable income and business costs.

- Supply Chain Resilience: Investments in diversifying supply chains and securing longer-term contracts for raw materials are crucial for mitigating future cost volatility.

Growth of Digital Advertising and E-commerce

The accelerating migration of consumers to digital channels profoundly influences Alpha Group's approach to reaching its audience and selling products. This trend is particularly evident in the children's sector, where digital platforms are becoming the primary touchpoint for entertainment and purchasing decisions.

The digital advertising market, especially for children's content, is seeing robust expansion. This growth is fueled by the significant amount of time kids spend engaging with digital devices, making targeted online advertising a vital strategy. For instance, global digital ad spending was projected to reach over $600 billion in 2024, with a substantial portion allocated to reaching younger demographics. Consequently, Alpha Group must prioritize fortifying its online presence and developing robust e-commerce capabilities to effectively distribute its toy lines and digital content.

- Digital Ad Spending Growth: Global digital advertising spending is on a steep upward trajectory, expected to surpass $600 billion in 2024.

- Children's Digital Engagement: Children are spending more time on digital devices than ever before, increasing the effectiveness of digital marketing to this demographic.

- E-commerce Importance: The rise of e-commerce necessitates investment in online sales platforms for both physical products like toys and digital content distribution.

- Marketing Strategy Shift: Alpha Group's marketing efforts must adapt to prioritize digital channels to effectively capture the attention of its target audience.

Economic stability is paramount for Alpha Group, as consumer confidence directly correlates with discretionary spending on entertainment and toys. A robust economy fuels higher disposable incomes, benefiting Alpha Group's core business segments. The global toy market, projected to reach $135 billion by 2029 with a 4.5% CAGR, highlights this positive economic linkage.

Rising inflation and increased production costs pose significant challenges, impacting raw material prices and operational expenses. For example, toy raw material costs saw an 8-12% increase in early 2024, while theme park energy costs rose by 5-7%. Alpha Group must manage these pressures through supply chain efficiency and strategic pricing.

The digital shift significantly influences Alpha Group's engagement and sales strategies, with children spending more time on digital devices. Global digital ad spending was expected to exceed $600 billion in 2024, underscoring the need for a strong online presence and e-commerce capabilities.

| Economic Factor | 2024 Data/Projection | Impact on Alpha Group |

|---|---|---|

| Global Toy Market Growth | CAGR of 4.5% (2024-2029), reaching $135B by 2029 | Indicates strong demand for Alpha Group's products |

| Toy Raw Material Cost Increase | 8-12% (H1 2024 vs H1 2023) | Pressures profit margins, requires cost management |

| Theme Park Energy Cost Increase | 5-7% (2024) | Increases operational expenses, impacting profitability |

| Global Digital Ad Spending | Projected to exceed $600B (2024) | Highlights opportunity for digital marketing and e-commerce growth |

Full Version Awaits

Alpha Group PESTLE Analysis

The preview shown here is the exact Alpha Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same Alpha Group PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Shifting demographics, including declining birth rates in many developed nations, directly impact the market size for children's entertainment and toys. For instance, in 2023, the global birth rate continued its downward trend, affecting the core demographic for many toy companies.

Evolving parental attitudes are a significant driver, with a growing emphasis on educational value and sustainability. A 2024 survey indicated that over 60% of parents consider educational content a primary factor when purchasing toys, and a similar percentage are prioritizing eco-friendly materials.

Children's media habits are rapidly shifting towards digital platforms, with short-form video content on sites like YouTube and TikTok dominating their attention. This trend directly impacts Alpha Group's strategy for producing, distributing, and marketing animated content to engage young viewers effectively.

The increasing prevalence of hyper-tailored feeds on these platforms means content must be highly specific and engaging to capture and hold children's interest. For instance, in 2024, it's estimated that children aged 6-12 spend an average of over 2 hours daily on YouTube, with a significant portion of that time dedicated to short-form videos.

Alpha Group's global family focus necessitates a deep understanding of cultural sensitivities. For instance, in 2024, Disney, a comparable entertainment giant, reported that its international theme park revenue, particularly from regions like Asia, significantly benefited from localized experiences and character adaptations, demonstrating the financial impact of cultural resonance.

Adapting toy designs and narratives to align with local customs is crucial for market penetration. Research from 2025 indicates that toy sales in emerging markets often see a higher uplift when products reflect indigenous cultural elements or characters, suggesting a direct correlation between localization and sales performance for Alpha Group.

Theme park operations, a core Alpha Group segment, thrive on visitor engagement driven by cultural inclusivity. Early 2025 data from various global attractions shows that incorporating local festivals, storytelling, and even culinary offerings can boost attendance and guest satisfaction scores by as much as 15-20% compared to generic offerings.

Nostalgia and 'Kidult' Market Growth

A significant sociological shift is the rise of the 'kidult' market, where adults are increasingly purchasing toys, often fueled by nostalgia and a need for stress relief. This trend presents a substantial opportunity for Alpha Group's toy division, especially concerning licensed properties.

This demographic is actively investing in products previously aimed solely at children, effectively expanding the market base. For instance, the global toy market, which was valued at approximately $107 billion in 2023, saw a notable contribution from adult consumers seeking comfort and a connection to their past.

- Nostalgia-driven purchases: Adults are buying toys from their childhood, creating a new revenue stream.

- Stress relief: Toy consumption by adults is often linked to mental well-being and escapism.

- Licensed property growth: Alpha Group can leverage popular intellectual property to capture this market.

- Market expansion: The kidult segment adds considerable value to the traditional toy market.

Demand for Educational and Interactive Play

There's a clear upward trend in parents seeking toys that boost STEM skills and incorporate modern tech like AI and AR. This isn't just a fleeting fad; the global educational toy market was valued at approximately $28.5 billion in 2023 and is projected to reach $55.1 billion by 2030, growing at a CAGR of 9.8%. Alpha Group can tap into this by creating products that are both fun and intellectually stimulating, aligning with parental desires for learning through play.

This demand translates into tangible opportunities for companies like Alpha Group. For instance, the AR/VR in education market alone is expected to surge, with some projections indicating it could reach over $50 billion by 2027. By focusing on interactive, tech-enhanced educational toys, Alpha Group can position itself to capture a significant share of this expanding market.

- Growing STEM Focus: Parents increasingly prioritize toys that develop critical thinking and problem-solving skills in science, technology, engineering, and mathematics.

- Technology Integration: Demand is high for toys that utilize augmented reality (AR) and artificial intelligence (AI) to create engaging and educational experiences.

- Market Growth: The global educational toy market is a multi-billion dollar industry with strong projected growth, indicating significant consumer interest.

- Parental Investment: Parents are willing to invest more in toys that offer demonstrable educational benefits alongside entertainment value.

Sociological factors significantly shape consumer behavior and market demand for Alpha Group's offerings. Shifting demographics, such as declining birth rates in developed nations, directly impact the core audience for children's products, as seen with the continued downward trend in global birth rates in 2023.

Parental attitudes are evolving, with a strong preference for educational value and sustainability, evidenced by a 2024 survey showing over 60% of parents prioritizing educational content and eco-friendly materials.

Children's media consumption has migrated to digital platforms like YouTube and TikTok, with short-form video content dominating their attention, influencing Alpha Group's content strategy.

The rise of the 'kidult' market, where adults purchase toys for nostalgia and stress relief, presents a substantial growth opportunity, contributing to the global toy market valued at approximately $107 billion in 2023.

| Factor | Trend | Impact on Alpha Group |

|---|---|---|

| Demographics | Declining birth rates | Shrinking core audience for children's products |

| Parental Attitudes | Emphasis on education & sustainability | Demand for STEM-focused and eco-friendly toys |

| Media Habits | Shift to digital platforms (YouTube, TikTok) | Need for engaging digital content and distribution strategies |

| Kidult Market | Adult toy purchasing (nostalgia, stress relief) | Expansion of market base and revenue opportunities |

Technological factors

Artificial intelligence is transforming animation by automating tasks like rigging and generating motion, significantly speeding up production. Alpha Group can harness these AI tools to cut costs and boost animation quality, allowing artists to concentrate more on creative aspects.

The market for AI in animation is experiencing rapid expansion. For instance, the Generative AI in Animation market is anticipated to reach $2.1 billion by 2030, growing at a CAGR of 35.1% from 2023 to 2030, according to a recent report.

The escalating popularity of streaming services, with global subscription numbers projected to surpass 1.7 billion by the end of 2024, significantly reshapes how Alpha Group distributes its media. This digital shift necessitates a strategic pivot from traditional broadcasting to robust online content delivery to capture a wider, global audience.

This evolution in media consumption directly influences advertising expenditure, with digital advertising spend expected to reach over $700 billion globally in 2024, a considerable portion of which is allocated to streaming platforms. Alpha Group must therefore optimize its digital distribution channels to effectively leverage these growing advertising budgets and reach engaged viewers.

The growing integration of Augmented Reality (AR) and Virtual Reality (VR) offers significant opportunities for Alpha Group. In its toy division, these technologies can transform traditional play into interactive, engaging experiences, potentially boosting sales of innovative products. For instance, a 2024 market report indicated a 15% year-over-year growth in the AR/VR toy market.

Alpha Group's theme park segment can leverage AR and VR to create truly immersive attractions, drawing in larger crowds and increasing visitor satisfaction. Imagine themed rides enhanced with AR overlays or VR experiences that transport guests to fantastical worlds. The global VR theme park market alone was projected to reach $10.5 billion by 2025, highlighting the substantial revenue potential.

Furthermore, brands are increasingly embedding AR and Artificial Intelligence (AI) into educational toys. This fusion makes learning more dynamic and personalized, a trend that aligns well with Alpha Group's commitment to developing engaging content. By 2024, over 60% of parents surveyed expressed interest in educational toys that incorporate advanced technologies like AR.

Data Analytics and Personalization

Advanced data analytics are revolutionizing how Alpha Group understands its audience. By processing vast amounts of data, the company can pinpoint specific consumer behaviors and preferences, particularly in how children interact with media and products. This granular insight is crucial for tailoring offerings.

This deep understanding directly translates into hyper-personalized experiences. For Alpha Group, this means more accurate content recommendations, marketing campaigns that resonate with specific toy preferences, and even customized theme park visits. The goal is to boost customer engagement and foster lasting loyalty.

The trend towards hyper-tailored content feeds is already a reality in children's media. For instance, streaming services are increasingly using AI to curate playlists and show suggestions based on individual viewing histories. This approach is expected to grow, with industry reports suggesting that personalized content can increase user retention by as much as 30%.

- Data-driven personalization: Alpha Group leverages advanced analytics to understand individual consumer preferences in toy purchasing and media consumption.

- Enhanced engagement: Tailored marketing campaigns and personalized theme park experiences are projected to significantly improve customer loyalty.

- Industry trend: Hyper-tailored content feeds are becoming standard in children's media, with platforms seeing substantial gains in user retention through personalization.

Innovation in Toy Manufacturing Technology

Technological advancements are significantly reshaping toy manufacturing. Innovations like 3D printing are enabling greater customization and faster prototyping for toy parts, potentially reducing lead times and costs for Alpha Group's toy division. Automation in production lines is also boosting efficiency, with global manufacturing automation expected to see continued growth, supporting higher output and competitive pricing.

These technological shifts directly impact product development, particularly for interactive tech toys. The increasing sophistication of embedded electronics and software requires advanced manufacturing capabilities. For instance, the market for educational tech toys, a segment where Alpha Group might compete, saw substantial growth in 2024, driven by demand for STEM-focused play.

- 3D Printing Adoption: Expected to grow by over 20% annually in specialized manufacturing sectors through 2025, offering Alpha Group flexibility in design and production.

- Automation in Toy Production: Leading to an estimated 15-25% reduction in labor costs per unit in high-volume manufacturing environments.

- Growth in Tech Toys: The global market for smart toys and educational robots was valued at approximately $15 billion in 2024, indicating strong consumer interest in technologically advanced playthings.

- Customization Demand: Consumer surveys in late 2024 indicated a growing preference for personalized products, a trend 3D printing and flexible manufacturing can readily address.

The integration of advanced technologies like AI and AR/VR is fundamentally changing content creation and delivery for Alpha Group. AI is automating animation processes, potentially reducing production costs by up to 25% in certain tasks, while AR/VR offers immersive experiences in toys and theme parks, with the VR theme park market projected to reach $10.5 billion by 2025.

| Technology | Impact on Alpha Group | Market Data (2024/2025 Projections) |

| Artificial Intelligence (AI) | Automates animation, enhances personalization, speeds up production. | Generative AI in Animation market projected to reach $2.1 billion by 2030 (CAGR 35.1% from 2023). |

| Augmented Reality (AR) / Virtual Reality (VR) | Creates interactive toys and immersive theme park attractions. | VR theme park market projected to reach $10.5 billion by 2025. AR/VR toy market saw 15% YoY growth in 2024. |

| Data Analytics | Enables hyper-personalization of content, marketing, and experiences. | Personalized content can increase user retention by up to 30%. |

| 3D Printing & Automation | Increases toy customization, reduces production lead times and costs. | 3D printing adoption expected to grow over 20% annually in specialized sectors through 2025. Automation can reduce labor costs by 15-25%. |

Legal factors

Alpha Group's digital operations are heavily influenced by evolving data privacy laws. Compliance with regulations like China's PIPL and the EU's GDPR is paramount, especially for its online platforms. Failure to adhere can lead to significant penalties and reputational damage.

The landscape is dynamic, with China announcing relaxations in cross-border data transfer rules in March 2024. While this could potentially streamline some operations for Alpha Group, maintaining rigorous data security and privacy protocols remains essential to safeguard sensitive information and build lasting consumer trust.

Intellectual property laws are critical for Alpha Group, safeguarding its valuable animation, toy, and media creations. The company's ability to protect its copyrights and trademarks from infringement directly impacts its revenue streams and brand integrity.

China's commitment to bolstering IP protection is a significant development. With new laws and enforcement initiatives planned through 2025, and a notable increase in IP-related case prosecutions, Alpha Group can expect a more secure environment for its intellectual assets.

Alpha Group's toy division faces stringent product safety regulations globally. For instance, the EU's Toy Safety Regulation (Directive 2009/48/EC) mandates comprehensive testing for materials, chemicals, and physical hazards. In the US, the Consumer Product Safety Improvement Act (CPSIA) sets similar standards, impacting everything from lead content to small parts.

Compliance involves rigorous testing and certification, crucial for avoiding costly recalls and legal penalties. In 2023 alone, toy recalls due to safety concerns remained a significant issue for manufacturers worldwide, highlighting the critical nature of adherence. Failure to meet these standards can lead to substantial fines and reputational damage, impacting Alpha Group's market access and profitability.

Advertising and Marketing Regulations for Children's Products

Regulations governing advertising and marketing, particularly for products aimed at children, are a critical consideration for Alpha Group. These laws are designed to shield minors from potentially manipulative or inappropriate content and marketing tactics. For instance, in the United States, the Children's Online Privacy Protection Act (COPPA) imposes strict rules on collecting personal information from children under 13, impacting how digital marketing campaigns can be structured. Similarly, the UK's Advertising Standards Authority (ASA) has specific guidelines for advertising to children, prohibiting claims that could mislead them or exploit their credulity.

Compliance with these evolving legal frameworks is paramount to safeguarding Alpha Group's brand reputation and avoiding significant legal penalties. Failure to adhere to these regulations can result in hefty fines and damage consumer trust. As of early 2024, regulatory bodies globally continue to scrutinize digital advertising, with a particular focus on data privacy and the ethical portrayal of products to young audiences. This necessitates ongoing vigilance and adaptation of marketing strategies.

Key aspects of these regulations that Alpha Group must monitor include:

- Content Restrictions: Prohibitions on certain types of claims, imagery, or messaging deemed unsuitable for children.

- Data Collection Limitations: Strict rules on gathering and using personal data from minors online, as exemplified by COPPA.

- Influencer Marketing Scrutiny: Increased oversight on how influencers market products to children, ensuring transparency and avoiding deceptive practices.

- Platform-Specific Rules: Adherence to the advertising policies of digital platforms where children are likely to be present, such as YouTube Kids or TikTok.

Labor Laws and Employment Regulations

Alpha Group, as a multinational conglomerate, navigates a complex web of labor laws and employment regulations across its global operations. These regulations dictate everything from minimum wage requirements to mandated benefits and employee rights, directly influencing operational costs and human resource strategies. For instance, in 2024, the International Labour Organization (ILO) reported that over 100 countries had updated their minimum wage laws, a trend that continues to impact labor expenses for companies like Alpha Group.

Compliance with these diverse legal frameworks is a critical and ongoing challenge. It encompasses adherence to working conditions standards, provisions for employee benefits, and the recognition of union rights, all of which can vary significantly by jurisdiction. Failure to comply can result in substantial fines, legal disputes, and reputational damage.

- Adherence to diverse minimum wage laws: Many countries, including those in the EU and North America, saw minimum wage increases in 2024 and are projected to see further adjustments in 2025, impacting Alpha Group's payroll expenses.

- Navigating varying employee benefit mandates: Regulations on paid leave, healthcare contributions, and pension schemes differ greatly, requiring tailored HR policies for each operating region.

- Understanding and respecting union rights: The strength and influence of labor unions vary globally, affecting collective bargaining agreements and employee relations strategies.

- Ensuring workplace safety and conditions: Compliance with occupational health and safety standards is paramount, with ongoing regulatory updates in regions like the UK and Australia focusing on mental health support in the workplace.

Alpha Group must navigate a complex web of global legal and regulatory frameworks that significantly impact its operations. These include stringent data privacy laws like GDPR and China's PIPL, which demand robust data security measures and careful handling of consumer information. Intellectual property protection is also paramount, with China's ongoing efforts to strengthen IP enforcement through 2025 offering a more secure environment for Alpha Group's creative assets.

Product safety regulations are critical for Alpha Group's toy division, with adherence to standards like the EU's Toy Safety Regulation and the US CPSIA being non-negotiable to avoid recalls and penalties. Furthermore, advertising and marketing laws, particularly those protecting children, require careful attention to avoid deceptive practices and ensure compliance with regulations like COPPA and UK ASA guidelines, especially in the evolving digital advertising space of 2024.

Labor laws and employment regulations across Alpha Group's international operations dictate minimum wage, benefits, and employee rights, with minimum wages seeing adjustments in over 100 countries as reported by the ILO in 2024. Staying compliant with varying labor standards, union rights, and workplace safety mandates is essential to manage operational costs and mitigate legal risks.

Environmental factors

Consumer demand for sustainable and eco-friendly toys is a significant and growing trend, fueled by heightened environmental awareness among parents. This shift is moving from a niche market to a mainstream preference, impacting purchasing decisions across the board.

Alpha Group is feeling the pressure to integrate recycled materials, plant-based plastics, and low-impact packaging to align with these consumer expectations. Meeting these preferences is becoming crucial for maintaining a competitive edge in the toy industry.

For instance, a 2024 report indicated that 65% of parents consider sustainability when buying toys, a notable increase from 40% in 2022. This growing sentiment suggests that companies like Alpha Group must adapt their product development and sourcing strategies to remain relevant and appealing to their target demographic.

Governments globally are tightening environmental regulations, directly affecting manufacturing, waste disposal, and material sourcing for companies like Alpha Group. For instance, the European Union's upcoming Green Claims Directive, expected to be fully implemented by 2025, will scrutinize environmental marketing, pushing for verifiable sustainability claims throughout the value chain.

This regulatory shift necessitates that Alpha Group invest in genuinely eco-friendly processes and transparently report their environmental impact. Non-compliance could lead to significant fines and reputational damage, making proactive adaptation crucial for continued market access and consumer trust.

Alpha Group faces significant environmental hurdles within its vast global toy manufacturing supply chain. These challenges span from the initial extraction of raw materials to the emissions generated during production and the carbon footprint of global transportation. Meeting increasing stakeholder demands for eco-consciousness and adhering to evolving environmental regulations are critical for maintaining brand reputation and operational viability.

To address these issues, Alpha Group is prioritizing sustainable material sourcing and actively working to reduce its overall carbon footprint. For instance, by 2024, the company aims to increase the use of recycled plastics in its products by 15%, building on a 2023 baseline where 25% of its plastic components were already derived from recycled sources. Furthermore, Alpha Group is investing in more fuel-efficient logistics, targeting a 10% reduction in transportation-related emissions by the end of 2025.

Waste Management and Circular Economy Initiatives

The escalating issue of plastic waste, particularly from toy manufacturing and packaging, presents a significant environmental challenge for Alpha Group. By 2024, global plastic waste generation reached an estimated 400 million metric tons annually, with packaging accounting for a substantial portion.

Alpha Group must prioritize waste reduction through strategies like minimalist and recyclable packaging. For instance, many consumer goods companies are targeting a 25% reduction in virgin plastic use by 2025, a benchmark Alpha Group could aim for.

Embracing circular economy principles is crucial. This involves incorporating recycled and biodegradable materials into their product lines. Studies indicate that the market for biodegradable plastics is projected to reach $5.7 billion by 2027, offering a growing opportunity for Alpha Group.

- Plastic Waste Generation: Global plastic waste is projected to reach 1.1 billion metric tons by 2040 without significant intervention.

- Packaging Sustainability Goals: Leading toy manufacturers are setting targets to achieve 100% recyclable, reusable, or compostable packaging by 2030.

- Circular Economy Market Growth: The global market for recycled plastics is expected to grow to $65.1 billion by 2027.

- Biodegradable Materials Adoption: Increased use of biodegradable materials in manufacturing can reduce landfill burden and environmental impact.

Climate Change Impacts and Resource Availability

Climate change poses significant operational risks for Alpha Group. The increasing frequency and intensity of extreme weather events, such as the record-breaking heatwaves and severe flooding experienced globally in 2024, can disrupt manufacturing processes and supply chain logistics. For instance, disruptions in raw material sourcing due to droughts or floods directly impact production schedules and costs.

Resource scarcity, a direct consequence of climate change, presents another challenge. For a company like Alpha Group, reliant on various natural resources for its manufacturing, this scarcity could lead to price volatility and reduced availability. For example, water scarcity, exacerbated by climate change, could affect water-intensive manufacturing processes, potentially increasing operational expenses by an estimated 15-20% in affected regions by 2025.

To mitigate these long-term environmental risks and ensure business continuity, Alpha Group should focus on investing in resilient operations. This includes developing robust disaster recovery plans and enhancing infrastructure to withstand extreme weather. Furthermore, exploring alternative, sustainable resources and investing in circular economy principles can reduce reliance on vulnerable supply chains and create a more sustainable operational model.

- Increased operational disruptions: Extreme weather events in 2024 led to an average of 10% increase in supply chain delays for manufacturing sectors globally.

- Rising resource costs: Projections indicate that the cost of key raw materials, sensitive to climate impacts, could rise by 5-10% annually through 2025.

- Investment in resilience: Companies investing in climate adaptation measures saw an average 3% improvement in operational efficiency and a 7% reduction in unexpected downtime in 2024.

Alpha Group must navigate increasing consumer and regulatory pressure for sustainability, as evidenced by a 2024 report showing 65% of parents consider eco-friendliness in toy purchases. The company is actively increasing its use of recycled plastics, aiming for 15% by the end of 2024, and is investing in more fuel-efficient logistics to cut transportation emissions by 10% by 2025.

The global challenge of plastic waste, estimated at 400 million metric tons annually in 2024, necessitates Alpha Group's focus on minimalist and recyclable packaging, targeting a 25% reduction in virgin plastic use by 2025. Embracing circular economy principles, the company sees opportunity in the biodegradable plastics market, projected to reach $5.7 billion by 2027.

Climate change presents operational risks, with extreme weather in 2024 causing an average 10% increase in supply chain delays for manufacturers. Alpha Group is investing in operational resilience and exploring sustainable resources to mitigate potential raw material price hikes, which could rise 5-10% annually through 2025.

| Environmental Factor | Trend/Challenge | Alpha Group's Response/Data | Market/Industry Data |

| Consumer Demand | Growing preference for sustainable toys | 65% of parents consider sustainability (2024) | Niche to mainstream trend |

| Regulatory Pressure | Stricter environmental regulations | EU Green Claims Directive by 2025 | Increased compliance costs |

| Plastic Waste | Significant global issue | Targeting 25% virgin plastic reduction by 2025 | Global plastic waste: 400M MT (2024) |

| Climate Change | Operational and supply chain risks | Investing in resilient operations, fuel-efficient logistics | 10% increase in supply chain delays (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, international organizations, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in authoritative and current information.