Goodbaby International Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodbaby International Holdings Bundle

Goodbaby International Holdings navigates a landscape shaped by intense rivalry among existing players and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Goodbaby International Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Goodbaby International Holdings, a major player in juvenile products, relies on a global network for essential materials like plastics, metals, and fabrics, as well as specialized parts such as wheels and safety buckles. The degree of supplier concentration for these inputs is a key factor in their bargaining power.

When few suppliers can provide critical, specialized components, their leverage naturally grows, potentially leading to higher costs for Goodbaby. For instance, if a single manufacturer dominates the production of a unique, high-performance stroller wheel, they hold significant sway. In 2024, the automotive industry, which shares some material and component needs with juvenile products, saw certain specialized electronic component suppliers command price increases due to limited production capacity and high demand, a dynamic that can translate to Goodbaby's supply chain.

Conversely, Goodbaby can mitigate this risk by maintaining a broad and diversified supplier base for more common, commoditized materials. A wide selection of vendors for standard plastics or fabrics allows Goodbaby to switch suppliers more easily if one attempts to exert excessive pricing power, thereby keeping their own costs in check.

The cost and complexity involved in switching suppliers significantly shape the bargaining power of suppliers for Goodbaby International. For specialized components, like those found in their advanced car seats or smart strollers, the investment in new tooling, re-certification processes, and potential loss of established economies of scale can make switching suppliers a costly and time-consuming endeavor. This complexity inherently increases supplier leverage.

Conversely, for more standardized materials or less technologically intensive components, the switching costs for Goodbaby are considerably lower. In these instances, Goodbaby can more readily explore alternative suppliers, which in turn provides them with greater negotiation power. For example, in 2024, Goodbaby's procurement of standard plastics and textiles likely involved numerous suppliers with minimal differentiation, allowing for competitive pricing negotiations.

The uniqueness of inputs significantly impacts supplier bargaining power. For Goodbaby International Holdings, if suppliers provide highly specialized, patented, or technologically advanced materials crucial for product innovation and safety, their leverage increases. This is especially true for brands like CYBEX, which depend on cutting-edge design and safety features.

Threat of Forward Integration by Suppliers

The possibility of suppliers moving into producing finished juvenile products themselves could definitely boost their leverage. While this is not a frequent occurrence for basic material providers, those who supply specialized components and possess strong research and development skills might present this challenge.

Goodbaby International Holdings' own vertically integrated operations, which encompass manufacturing, serve as a key defense against this threat. This integration lessens the company's dependence on outside manufacturing partners.

- Supplier Forward Integration Threat: Suppliers moving into finished product manufacturing increases their power.

- Component Suppliers: Specialized component makers with R&D capabilities are more likely to pose this threat.

- Goodbaby's Defense: Vertical integration, including manufacturing, reduces reliance on external services.

Importance of Goodbaby to Suppliers

Goodbaby International's substantial purchasing volume significantly impacts its suppliers. As a major client, Goodbaby's business often represents a considerable portion of a supplier's revenue, potentially leading to more favorable pricing and terms for Goodbaby. For instance, if a supplier's revenue is heavily reliant on Goodbaby, they may be more amenable to price adjustments to secure continued large orders.

Goodbaby's global reach and consistent demand for high-volume production make it a vital partner for many component manufacturers and raw material providers. This reliance gives Goodbaby leverage in negotiations, as suppliers are motivated to maintain a strong relationship with such a significant customer.

- Significant Customer Dependency: Many suppliers depend on Goodbaby for a substantial percentage of their sales, increasing Goodbaby's leverage.

- Volume Discounts: Goodbaby's large-scale orders enable them to negotiate volume discounts, reducing their cost of goods.

- Supplier Willingness to Negotiate: Suppliers are often more willing to compromise on price and payment terms to retain Goodbaby's consistent business.

The bargaining power of suppliers for Goodbaby International Holdings is influenced by the concentration of suppliers for critical inputs, the cost and complexity of switching suppliers, and the uniqueness of the materials provided.

In 2024, the juvenile products industry, like many others, experienced supply chain pressures. For instance, the cost of key raw materials such as polypropylene, a common plastic in car seats and strollers, saw fluctuations. While specific data for Goodbaby’s direct input costs isn't publicly itemized in this context, broader commodity market trends indicate potential for supplier leverage.

The threat of supplier forward integration, where suppliers might move into producing finished goods, is a factor. However, Goodbaby's own vertical integration, including manufacturing capabilities, acts as a significant countermeasure, reducing its dependence on external manufacturing partners.

Goodbaby’s substantial purchasing volume provides considerable leverage. For a supplier whose revenue is significantly tied to Goodbaby’s orders, maintaining this relationship often translates into more favorable pricing and terms for Goodbaby.

| Factor | Impact on Goodbaby | Example/2024 Context |

| Supplier Concentration | High concentration increases supplier power. | Limited suppliers for specialized stroller wheels can drive up costs. |

| Switching Costs | High costs for specialized components empower suppliers. | Re-tooling and certification for advanced car seat components are costly. |

| Input Uniqueness | Unique or patented materials increase supplier leverage. | Proprietary safety features for premium brands like CYBEX. |

| Goodbaby's Purchasing Volume | Large volume grants Goodbaby negotiation power. | Significant orders for plastics and textiles allow for volume discounts. |

What is included in the product

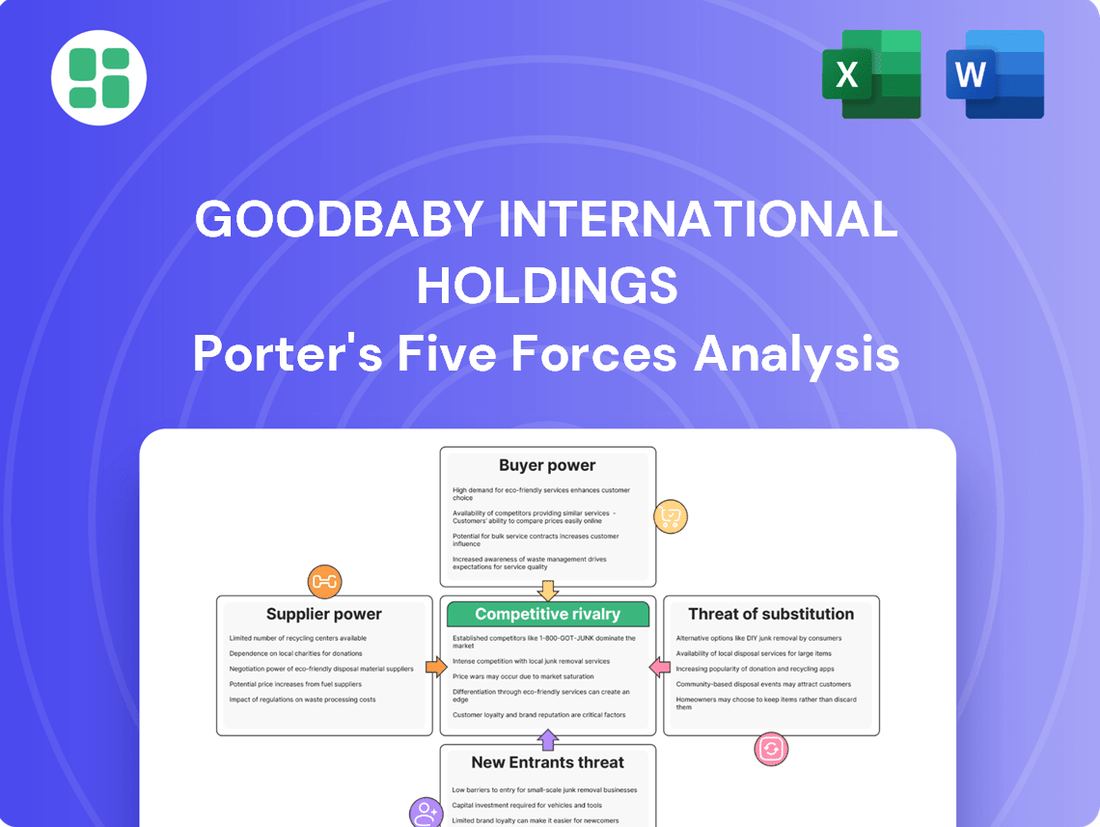

Goodbaby International Holdings' Porter's Five Forces analysis reveals intense rivalry from established and emerging players, moderate buyer power due to brand loyalty, and significant threat from substitutes like second-hand markets.

Instantly understand competitive intensity with a clear, visual breakdown of Goodbaby's Porter's Five Forces, highlighting key threats and opportunities.

Customers Bargaining Power

Goodbaby International Holdings caters to a broad range of customers worldwide, from large retail chains and niche baby product stores to e-commerce sites and direct consumers. This wide reach diversifies its revenue streams.

However, the presence of significant 'Blue Chip customers,' as noted in their financial disclosures, means that a few major retail partners can wield considerable bargaining power. Their substantial purchase volumes allow them to negotiate more favorable terms, potentially impacting Goodbaby's profit margins.

Customers of Goodbaby International, including both retailers and end-consumers, face a market brimming with alternative brands and products in the highly competitive juvenile durable goods sector. This abundance of choices directly fuels their bargaining power.

The widespread availability of strollers, car seats, and cribs from a multitude of manufacturers means customers can readily switch to competitors if they find Goodbaby's prices too high or perceive a dip in quality. For instance, in 2024, the global baby care products market was valued at over $100 billion, with numerous players vying for market share, underscoring the intense competitive landscape.

Buyer price sensitivity is a key element in the baby product market, particularly for items where features are similar or for families managing tight budgets. Goodbaby International Holdings navigates this by offering a range of products. For instance, their premium CYBEX brand targets consumers willing to pay more for advanced design and safety features, while the Evenflo brand emphasizes affordability and value for a broader customer base.

Customer Information and Transparency

The expansion of e-commerce and the proliferation of online reviews have dramatically enhanced customer knowledge about product attributes, quality benchmarks, and price points. This heightened transparency directly fuels customer bargaining power.

With readily available information, consumers can effortlessly compare offerings across different brands and retailers, leading to more informed purchase decisions. This ease of comparison significantly amplifies their influence in the market.

- Increased Online Transparency: E-commerce platforms and review sites provide detailed product comparisons and user feedback, empowering consumers with unprecedented information.

- Informed Purchasing Decisions: Customers can now easily research features, quality, and pricing, allowing them to select the best value propositions.

- Price Sensitivity: Greater access to pricing data makes consumers more sensitive to price differences, pushing companies to compete more aggressively on cost.

- Brand Loyalty Shifts: Informed customers are less tethered to specific brands, potentially switching to competitors offering better value or quality based on readily available data.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while theoretically present, is generally low for Goodbaby International Holdings. Large retailers could potentially develop their own private label juvenile products, cutting out manufacturers. However, the significant capital investment needed, coupled with stringent safety regulations and the challenge of building brand trust in a sensitive market, makes this a less likely scenario for durable juvenile goods.

Consider the complexities involved: establishing manufacturing facilities for juvenile products requires substantial upfront costs, often in the hundreds of millions for advanced production lines. Furthermore, navigating the intricate web of international safety standards, such as those mandated by the Consumer Product Safety Improvement Act (CPSIA) in the US or EN standards in Europe, adds considerable operational and compliance overhead. For instance, obtaining certifications for car seats or cribs can be a lengthy and expensive process, often taking over a year and costing tens of thousands of dollars per product line.

- High Capital Investment: Establishing manufacturing capabilities for juvenile products demands significant financial outlay, potentially exceeding $100 million for state-of-the-art facilities.

- Regulatory Hurdles: Strict safety regulations for juvenile products, like those in the EU and North America, create substantial barriers to entry for potential backward integrators.

- Brand Building Challenges: Retailers would need to invest heavily in establishing brand credibility and consumer trust for safety-critical items, a process that typically takes years.

Goodbaby International faces substantial customer bargaining power due to the highly competitive juvenile products market, where numerous alternatives exist. The widespread availability of strollers, car seats, and cribs allows consumers to easily switch brands if pricing or quality is not met. In 2024, the global baby care market exceeded $100 billion, highlighting the intense competition and the leverage customers possess.

The rise of e-commerce and online reviews has significantly increased transparency, empowering customers with detailed product comparisons and pricing information. This heightened awareness makes buyers more price-sensitive and less loyal to specific brands, further amplifying their negotiating strength.

While backward integration by large retailers is a theoretical concern, the high capital investment, stringent safety regulations, and brand-building challenges for juvenile products make it a low probability threat for Goodbaby International.

| Factor | Impact on Goodbaby | Customer Bargaining Power |

| Market Competition | High | High |

| Availability of Substitutes | High | High |

| Customer Price Sensitivity | Moderate to High | High |

| Online Transparency | High | High |

| Threat of Backward Integration | Low | Low |

Full Version Awaits

Goodbaby International Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Goodbaby International Holdings' Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the baby products industry. This comprehensive analysis provides actionable insights into the competitive landscape affecting Goodbaby.

Rivalry Among Competitors

The global market for durable juvenile products is quite crowded, featuring a wide array of companies. Goodbaby International faces competition from major international brands such as Graco, Britax, and Maxi-Cosi, as well as numerous other global and regional manufacturers. This broad competitive landscape fuels a high degree of rivalry.

The durable juvenile products market is experiencing a steady growth trajectory. Projections indicate a compound annual growth rate (CAGR) ranging from 4.12% to 7.4% between 2025 and 2034, depending on the specific product segment. This positive growth environment, while generally favorable, can still foster intense competition as companies vie for market share.

Goodbaby International Holdings actively combats competitive rivalry through a robust multi-brand strategy, featuring names like CYBEX, Evenflo, and gb. This approach allows them to cater to diverse consumer segments and price sensitivities, effectively differentiating their product lines within the market.

The company cultivates strong brand loyalty, especially with premium offerings such as CYBEX, which is highly regarded for its innovative design and stringent safety standards. This loyalty acts as a significant buffer against direct price competition, solidifying their market position and providing a distinct competitive edge.

Switching Costs for Consumers

For consumers, switching costs between different brands of juvenile products are generally low. This is because there are frequently many alternatives that perform similarly, making it easy for parents to change brands. For instance, in 2024, the global baby care market, which includes juvenile products, was valued at over $80 billion, indicating a highly competitive landscape with numerous players vying for market share.

This low switching cost intensifies competition, compelling companies like Goodbaby International Holdings to continuously innovate and offer compelling value propositions to retain customers. Brands must focus on quality, safety, design, and price to differentiate themselves. In 2023, Goodbaby International reported revenue of approximately HKD 6.6 billion, demonstrating the need for effective strategies to maintain and grow this figure in a market where customer loyalty can be fluid.

- Low Switching Costs: Consumers can easily switch between juvenile product brands due to the availability of many functionally similar alternatives.

- Intensified Competition: This ease of switching forces companies to constantly innovate and provide strong value to keep customers.

- Market Value: The global baby care market exceeded $80 billion in 2024, highlighting the competitive nature of the industry.

- Goodbaby Revenue: In 2023, Goodbaby International's revenue was around HKD 6.6 billion, underscoring the challenge of customer retention in this low-switching-cost environment.

Exit Barriers for Competitors

High exit barriers can indeed trap companies in an industry, even when they are not profitable. This often happens when a significant portion of a company's assets are specialized, like dedicated manufacturing plants or research and development facilities, which have little value outside the specific industry. Goodbaby International Holdings has invested heavily in its 'one-dragon vertically integrated platform,' which suggests substantial fixed assets tied to its operations.

These specialized assets, coupled with strong brand recognition that is difficult to divest, create significant hurdles for competitors looking to leave the market. For instance, if a competitor has invested millions in child safety seat manufacturing equipment, selling it off at a loss might be impossible, forcing them to continue operating at a reduced capacity or even at a loss to recoup some investment.

- Specialized Assets: Goodbaby's vertical integration likely means significant capital expenditure in manufacturing and R&D facilities, making it costly for competitors to exit.

- Brand Value: Established brands in the baby products sector, like Goodbaby's, are difficult to divest, acting as a retention factor for struggling players.

- Price Competition: The presence of companies unable to exit profitably can lead to prolonged price wars as they attempt to maintain market share or cover fixed costs.

The competitive rivalry within the durable juvenile products market is substantial, driven by a crowded global landscape featuring major brands and numerous regional players. Goodbaby International leverages a multi-brand strategy, including CYBEX and Evenflo, to differentiate its offerings and capture diverse market segments.

Low switching costs for consumers, coupled with the market's overall value exceeding $80 billion in 2024, mean companies must continuously innovate and provide strong value propositions. Goodbaby International’s 2023 revenue of approximately HKD 6.6 billion highlights the ongoing challenge of customer retention amidst this intense competition.

High exit barriers, stemming from specialized assets like Goodbaby's vertically integrated platform, can prolong price competition. Companies unable to exit profitably may continue operations, potentially leading to price wars as they try to cover fixed costs.

| Key Factor | Description | Impact on Goodbaby International |

| Market Crowding | Numerous global and regional competitors | Intensifies rivalry, requiring strong differentiation |

| Brand Strategy | Multi-brand approach (CYBEX, Evenflo) | Caters to diverse segments, mitigating direct competition |

| Switching Costs | Low for consumers | Demands continuous innovation and value to retain customers |

| Market Size | Global baby care market >$80 billion (2024) | Indicates significant opportunity but also intense competition for share |

| Exit Barriers | High due to specialized assets | Can lead to prolonged price competition from struggling players |

SSubstitutes Threaten

The threat of substitutes for durable juvenile products like strollers and car seats is relatively low but present. The core need is child mobility and safety, and while direct product substitutes are limited for safety-critical items, alternative methods of transport or care can emerge. For instance, parents might increasingly opt for baby carriers, slings, or even utilize public transport without specialized gear, especially in urban environments or for shorter distances.

Lower-cost alternatives like borrowing, renting, or buying second-hand products pose a significant threat, especially for items with limited use, such as baby gear. This trend is amplified by growing environmental consciousness and the embrace of circular economy principles, which encourage reuse over new purchases. For instance, the second-hand baby clothing market in the UK alone was valued at an estimated £200 million in 2023, indicating a substantial shift in consumer behavior.

The performance and convenience of substitutes significantly impact the threat they pose to Goodbaby International Holdings. For instance, while a basic baby carrier can replace a stroller for brief outings, it lacks the comfort, storage capacity, and long-distance functionality of a stroller, limiting its effectiveness as a direct substitute for many parents.

In the crucial realm of child safety during travel, the threat of substitutes for car seats is exceptionally low. Stringent regulatory requirements and paramount safety concerns mean that functional alternatives for transporting infants and young children in vehicles are virtually non-existent, reinforcing Goodbaby's market position in this segment.

Changing Parental Lifestyles and Preferences

Evolving parental lifestyles, such as a growing preference for urban living and minimalist aesthetics, can significantly impact the demand for baby products. This shift may lead parents to favor multi-functional items that save space and offer greater utility, potentially reducing the perceived need for numerous single-purpose baby gear. For instance, a 2024 survey indicated that over 60% of new parents in major metropolitan areas prioritize compact and convertible baby products.

Goodbaby International Holdings actively addresses these changing consumer preferences by focusing on the development of innovative, smart, and versatile products. Their product lines often feature integrated functionalities, such as strollers that convert into travel systems or cribs that adapt as the child grows. This strategy aims to align with the modern parent's desire for efficiency and adaptability in their purchases.

- Urbanization Trends: Increasing urban populations worldwide, with cities like Shanghai and Beijing seeing significant growth, necessitate space-saving solutions for young families.

- Minimalist Movement: A growing segment of parents are embracing minimalist living, seeking fewer, higher-quality, and multi-purpose items for their children.

- Technological Integration: Smart baby products that offer enhanced safety, convenience, or monitoring capabilities are increasingly sought after by tech-savvy parents.

- Sustainability Concerns: Parents are showing a greater interest in eco-friendly and durable products that can be reused or passed down, impacting the perceived value of single-use or less adaptable items.

Regulatory Environment and Safety Standards

The stringent regulatory environment for juvenile products, especially car seats, significantly curtails the appeal of substitutes that don't meet established safety benchmarks. For instance, in 2024, compliance with standards like ECE R129 (i-Size) in Europe or FMVSS 213 in the United States requires extensive testing and certification, making it difficult for uncertified alternatives to gain traction.

These rigorous safety regulations function as a formidable barrier, ensuring that only products meeting specific certification criteria can effectively compete. This dynamic substantially diminishes the threat posed by informal or non-compliant substitutes, as consumers prioritize safety and legal adherence. Goodbaby International Holdings, by adhering to these global standards, reinforces its market position against less regulated offerings.

- High Certification Costs: Meeting global safety standards involves substantial investment in research, development, and testing, deterring low-cost, non-compliant competitors.

- Consumer Trust: Certified products build consumer confidence, making them the preferred choice over potentially unsafe alternatives.

- Market Access Restrictions: Many jurisdictions restrict the sale of juvenile products that do not meet their specific safety regulations.

The threat of substitutes for Goodbaby International Holdings' products, particularly safety-critical items like car seats, remains low due to stringent safety regulations and high consumer trust in certified brands. However, for less critical juvenile products like strollers, the threat is more pronounced from lower-cost alternatives such as second-hand markets and rental services, a trend bolstered by growing environmental awareness.

For instance, the second-hand baby gear market is expanding, with platforms reporting significant growth in 2023 and 2024. While a baby carrier might substitute a stroller for short trips, it doesn't offer the same convenience or capacity, limiting its direct impact. Furthermore, evolving consumer preferences towards minimalism and multi-functional items, as indicated by a 2024 survey showing over 60% of new parents in metro areas prioritizing compact products, also influence substitute choices.

The high cost and complexity of meeting global safety standards, such as ECE R129 or FMVSS 213, act as a significant barrier against uncertified substitutes, reinforcing Goodbaby's market position. This regulatory landscape ensures that only compliant products can effectively compete, making it difficult for less regulated alternatives to gain traction in the juvenile product sector.

| Product Category | Primary Substitute Threat | Impact Level | Key Factors |

|---|---|---|---|

| Car Seats | Minimal (due to safety regulations) | Low | Stringent safety standards (e.g., ECE R129, FMVSS 213), high consumer trust in certified brands, legal compliance requirements. |

| Strollers | Moderate (second-hand, rental, baby carriers) | Medium | Cost sensitivity, environmental consciousness, growing circular economy adoption, urban living trends favoring multi-functional or compact solutions. |

| Other Juvenile Gear (e.g., cribs, high chairs) | Moderate (second-hand, borrowing, multi-functional alternatives) | Medium | Limited product lifespan for some items, desire for space-saving solutions, influence of minimalist lifestyle trends. |

Entrants Threaten

Entering the durable juvenile products market, particularly for manufacturing and global distribution, demands significant capital. Goodbaby International Holdings, as of its latest reports, operates with substantial investments in research and development, advanced manufacturing facilities, and a complex global supply chain. This high barrier to entry, estimated in the hundreds of millions of dollars for establishing comparable operations, deters many potential new players.

Goodbaby's established 'one-dragon vertically integrated platform' allows it to achieve considerable economies of scale. This integration, covering everything from product design to sales, enables cost efficiencies that are difficult for new entrants to replicate. For instance, in 2024, the company's optimized production processes contributed to a competitive cost structure, making it challenging for smaller, less integrated businesses to match its pricing and profitability.

Goodbaby International Holdings benefits significantly from its strong brand recognition, cultivated over years of operation, and its well-established global distribution networks. This allows them to reach consumers effectively across various markets.

New companies entering the market face a substantial hurdle in replicating this brand trust and securing access to the extensive retail and online distribution channels that Goodbaby already commands. This process is both time-consuming and capital-intensive, creating a significant barrier.

The juvenile products sector, especially for critical items like car seats and cribs, faces substantial regulatory scrutiny. Globally, these products must meet rigorous safety standards and undergo complex certification processes. For instance, in the US, the Consumer Product Safety Commission (CPSC) sets standards, and in Europe, EN standards are paramount. These requirements can significantly slow down and increase the cost for any new company looking to enter the market, acting as a formidable barrier.

Access to Raw Materials and Supply Chains

Securing consistent and affordable access to essential raw materials, like plastics and textiles, and establishing robust global supply chains presents a significant hurdle for potential new entrants in the baby product industry. Goodbaby International Holdings has cultivated long-standing, strong relationships with its key suppliers, ensuring preferential pricing and reliable material flow. For instance, in 2023, the company reported that its procurement strategies helped mitigate the impact of fluctuating commodity prices, a testament to its established supplier network.

These established partnerships and the intricate, optimized global supply chain infrastructure that Goodbaby has developed over years of operation are not easily or quickly replicated by newcomers. Building a comparable network, negotiating favorable terms, and achieving the same level of logistical efficiency would require substantial investment and time, creating a considerable barrier to entry. The company's 2024 projections anticipate further supply chain enhancements, aiming to reduce lead times by an additional 5-7%, a target that would be exceptionally challenging for an emerging competitor to match.

- Supplier Relationships: Goodbaby's deep-rooted partnerships provide preferential access and pricing for critical raw materials.

- Supply Chain Efficiency: Years of optimization have resulted in a global supply chain that is difficult for new entrants to replicate.

- Cost Advantage: Established supply chain management contributes to a cost structure that new players would struggle to achieve initially.

- Market Responsiveness: An efficient supply chain allows Goodbaby to respond more quickly to market demand and product innovation.

Intellectual Property and Innovation

Goodbaby International Holdings significantly invests in research and development, evidenced by its substantial patent portfolio, especially in innovative and award-winning product categories. This robust intellectual property acts as a formidable barrier to entry, safeguarding unique product designs, advanced safety mechanisms, and proprietary manufacturing techniques. For instance, in 2023, the company reported R&D expenses of HKD 398 million, underscoring its commitment to innovation.

The extensive patent protection makes it difficult for new competitors to introduce comparable products without risking infringement. This forces potential entrants to either invest heavily in developing entirely novel solutions or face legal challenges, thereby increasing the cost and risk associated with market entry.

- R&D Investment: Goodbaby International's commitment to innovation is reflected in its consistent R&D spending, aiming to create differentiated products.

- Patent Portfolio: A significant number of patents protect Goodbaby's unique product designs, safety features, and manufacturing processes.

- Barrier to Entry: Intellectual property rights deter new entrants by requiring substantial investment in original innovation or risking patent infringement.

The threat of new entrants for Goodbaby International Holdings is moderate, primarily due to significant capital requirements for manufacturing and global distribution, which can run into hundreds of millions of dollars. Established brand recognition and extensive distribution networks also pose a substantial hurdle, requiring considerable time and investment for newcomers to replicate. Furthermore, stringent regulatory standards and complex certification processes for juvenile products add another layer of difficulty and cost, acting as a formidable barrier.

The company's integrated supply chain and strong supplier relationships provide a cost advantage that is difficult for new players to match. Goodbaby's commitment to R&D, evidenced by its substantial patent portfolio, further deters new entrants by requiring significant investment in original innovation or risking patent infringement.

| Factor | Impact on New Entrants | Goodbaby's Advantage |

|---|---|---|

| Capital Requirements | High (hundreds of millions USD) | Established infrastructure and scale |

| Brand Recognition & Distribution | Difficult and costly to build | Years of market presence and network development |

| Regulatory Hurdles | Significant cost and time for compliance | Expertise in navigating global standards |

| Supplier Relationships & Supply Chain | Challenging to secure favorable terms and efficiency | Preferential pricing, optimized logistics, and cost efficiencies |

| Intellectual Property | Risk of infringement, need for substantial R&D | Robust patent portfolio protecting unique designs and processes |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Goodbaby International Holdings is built upon a foundation of diverse and credible data sources. This includes detailed company financial reports, investor presentations, and annual filings from regulatory bodies, alongside comprehensive industry research reports from reputable market analysis firms.