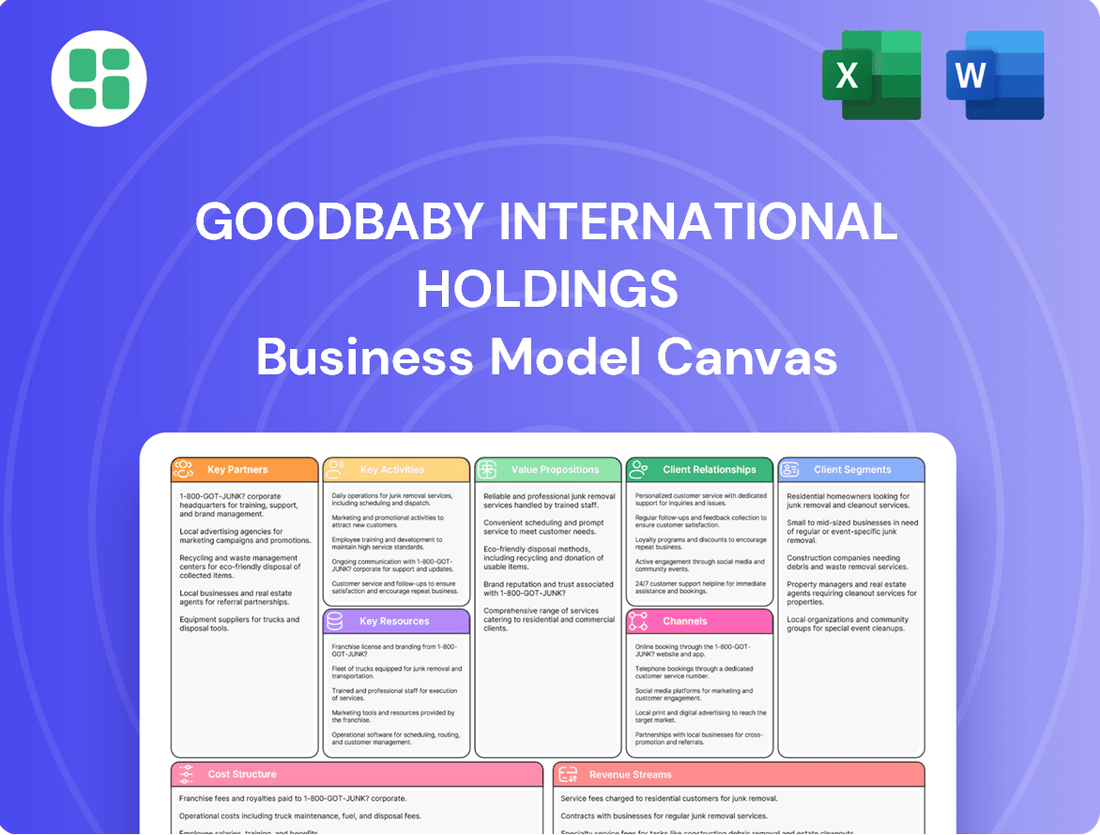

Goodbaby International Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodbaby International Holdings Bundle

Unlock the strategic blueprint behind Goodbaby International Holdings's success with our comprehensive Business Model Canvas. Discover how they connect with key customer segments, deliver innovative value propositions, and build strong partnerships to drive growth in the global baby products market.

This detailed Business Model Canvas for Goodbaby International Holdings offers a clear, actionable view of their operations, from revenue streams to cost structures. It's an invaluable resource for anyone looking to understand competitive strategies in the fast-paced baby care industry.

Ready to gain a competitive edge? Download the full Goodbaby International Holdings Business Model Canvas to explore their core activities, key resources, and channels to market. It's the perfect tool for strategic planning and market analysis.

Partnerships

Goodbaby International Holdings prioritizes strong supplier relationships for essential raw materials and components, ensuring product quality and safety. These partnerships are vital for sourcing fabrics, plastics, and other critical elements used in their extensive product lines, from infant strollers to car seats.

The company's commitment to high standards necessitates reliable suppliers capable of meeting stringent safety and sustainability requirements. For instance, in 2023, Goodbaby continued to focus on ethical sourcing, a trend that gained further momentum across the global supply chain throughout the year.

Goodbaby International Holdings relies heavily on its retail distribution partners, including major global retailers like Walmart and Target, for its worldwide reach. These collaborations span both physical stores and online platforms, ensuring products are accessible to a broad customer base across various regions. For instance, in 2024, Goodbaby continued to leverage these relationships to drive sales of its extensive product lines.

Goodbaby International actively collaborates with technology firms and research institutions to pioneer advancements in juvenile product design, safety, and smart parenting solutions. These alliances are crucial for integrating cutting-edge technologies and materials, ensuring the company remains a leader in the industry. For instance, their global network of R&D centers underscores this commitment to innovation.

Safety Certification Bodies and Regulatory Agencies

Goodbaby International Holdings actively partners with key international safety certification bodies, such as TÜV Rheinland and SGS, to ensure its products meet rigorous global standards. This commitment is crucial for market access and consumer confidence.

Adherence to regulations like the European Union's General Product Safety Directive and the US Consumer Product Safety Improvement Act (CPSIA) is a continuous operational focus. In 2024, Goodbaby continued its proactive engagement with these agencies to maintain compliance across its diverse product lines, from strollers to car seats.

- International Collaboration: Partnerships with bodies like TÜV and SGS are fundamental to Goodbaby's global operations.

- Regulatory Adherence: Continuous compliance with directives such as the EU's GPSD and the US CPSIA is a core activity.

- Market Access: Meeting these stringent safety requirements facilitates entry and sustained presence in key international markets.

Financial Institutions and Banks

Goodbaby International Holdings cultivates strategic alliances with key financial institutions, including major banks like HSBC. These relationships are fundamental to securing essential credit facilities, managing working capital efficiently, and facilitating trade finance across its international operations. For example, in 2023, Goodbaby International reported that its banking facilities played a crucial role in supporting its inventory management and overseas expansion initiatives.

These financial partnerships are indispensable for Goodbaby's global reach and ongoing growth. They provide the necessary liquidity for day-to-day business, support ambitious expansion projects, and ensure the company's financial resilience in a dynamic market. The company's ability to access foreign exchange services through these institutions is also critical for managing currency fluctuations inherent in its worldwide supply chain and sales network.

- Strategic Banking Relationships: Partnerships with institutions like HSBC provide vital credit lines and operational funding.

- Working Capital Management: Financial institutions enable efficient management of cash flow for global operations.

- Trade Finance and FX: Access to trade finance and foreign exchange services supports international transactions and mitigates currency risk.

- Financial Stability and Growth: These partnerships are foundational for Goodbaby's financial health and its capacity for future expansion.

Goodbaby International Holdings actively partners with key technology and design firms to integrate innovative features and smart solutions into its products. These collaborations are essential for staying ahead in product development and offering consumers advanced functionalities. For instance, in 2024, the company continued to explore partnerships focused on AI-driven parenting aids and advanced material science.

What is included in the product

This Business Model Canvas for Goodbaby International Holdings outlines a strategy focused on serving young families globally through a diverse range of innovative and safe baby products, leveraging both direct-to-consumer channels and strategic retail partnerships.

It details key resources like strong R&D capabilities and brand equity, alongside revenue streams from product sales and licensing, all supported by a robust supply chain and customer relationships built on trust and quality.

Goodbaby International Holdings' Business Model Canvas acts as a pain point reliever by offering a high-level, one-page snapshot of their core components, simplifying complex strategies for quick review and adaptation.

This concise, shareable, and editable format allows teams to easily brainstorm, teach, and collaborate, saving hours of manual structuring while effectively condensing company strategy into a digestible format.

Activities

Goodbaby International Holdings prioritizes Research, Design, and Development (R&D) to drive innovation in juvenile products, concentrating on safety, functionality, and contemporary aesthetics. This commitment translates into exploring novel materials, advanced technologies, and evolving consumer demands to create next-generation products.

The company's dedication to R&D is underscored by its impressive intellectual property portfolio, holding over 11,300 granted patents. This robust foundation in innovation has also been recognized through numerous prestigious design awards, highlighting their ability to blend practical advancements with appealing aesthetics.

Goodbaby International Holdings' manufacturing and production is a cornerstone of its vertically integrated model, boasting significant global capacities. This includes numerous factories strategically located in China, alongside facilities in the USA and Mexico, enabling efficient, high-quality output.

The company focuses on producing a broad spectrum of durable juvenile products, ensuring consistent quality and standards across its diverse brand portfolio and various international markets. This robust production capability is key to meeting global demand for their offerings.

Goodbaby International Holdings manages a complex global supply chain, a critical activity involving sourcing raw materials, intricate logistics, and precise inventory control to ensure timely delivery of products across international markets.

In 2024, the company continued its focus on optimizing and consolidating these global supply chain strategies, aiming to boost both efficiency and resilience against potential disruptions.

Multi-Brand Portfolio Management and Marketing

Goodbaby International Holdings actively cultivates and promotes its extensive array of brands, such as Cybex, Evenflo, and gb. Each brand is meticulously designed to resonate with distinct consumer demographics and fulfill specific market needs.

The company's strategy involves reinforcing brand identity through targeted advertising, public relations, and promotional initiatives. This approach aims to enhance brand recognition and foster customer loyalty, ultimately driving revenue growth.

- Brand Diversification: Management of distinct brands like Cybex, Evenflo, and gb to capture various market segments.

- Strategic Marketing: Execution of tailored advertising and promotional campaigns to build brand equity.

- Market Segmentation: Focus on specific consumer preferences and needs for each brand.

- Sales Growth: Driving sales through effective brand positioning and marketing efforts.

Sales and Global Omni-channel Distribution

Goodbaby International Holdings' key activities revolve around a robust sales and global omni-channel distribution strategy. This involves selling their diverse range of baby products through a multifaceted approach, encompassing traditional brick-and-mortar retail alongside a growing presence in digital and company-owned online platforms.

The company's success hinges on building and strengthening this expansive omni-channel network. This strategic focus allows them to effectively reach millions of families across more than 110 countries, ensuring broad market penetration and accessibility for their offerings.

- Sales Channels: Goodbaby leverages a mix of traditional retail, e-commerce marketplaces, and direct-to-consumer (DTC) online stores.

- Global Reach: The company's distribution network spans over 110 countries, demonstrating a commitment to international market access.

- Omni-channel Integration: Seamless integration across online and offline channels is vital for providing a consistent customer experience and maximizing sales opportunities.

- Market Penetration: This broad distribution strategy aims to connect with millions of families worldwide, solidifying Goodbaby's position in the global baby products market.

Goodbaby International Holdings' key activities encompass a vertically integrated model, focusing on research, design, and development to innovate juvenile products. This commitment is evident in their extensive patent portfolio, exceeding 11,300 granted patents, and numerous design awards. Their manufacturing prowess, with facilities in China, the USA, and Mexico, ensures high-quality production across their diverse brand portfolio.

The company also excels in managing a complex global supply chain, optimizing logistics and inventory for timely product delivery. In 2024, this involved further strategic consolidation to enhance efficiency and resilience. Furthermore, Goodbaby actively cultivates and promotes its distinct brands, such as Cybex and Evenflo, through targeted marketing to build brand equity and drive sales.

Their sales and distribution strategy is a critical activity, employing a global omni-channel approach that includes traditional retail, e-commerce, and direct-to-consumer platforms. This expansive network reaches families in over 110 countries, solidifying their market presence.

| Key Activity | Description | 2024 Focus/Data Points |

|---|---|---|

| R&D and Innovation | Developing new juvenile products with a focus on safety and design. | Over 11,300 granted patents. |

| Manufacturing and Production | High-quality production across global facilities. | Facilities in China, USA, and Mexico. |

| Supply Chain Management | Optimizing global logistics and inventory control. | Continued focus on efficiency and resilience. |

| Brand Management and Marketing | Cultivating and promoting brands like Cybex and Evenflo. | Targeted advertising and promotions to build brand equity. |

| Sales and Distribution | Global omni-channel sales strategy. | Presence in over 110 countries. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Goodbaby International Holdings that you are previewing is precisely the document you will receive upon purchase. This is not a mockup or a sample; it is a direct snapshot from the actual, comprehensive file. Upon completing your order, you will gain full access to this same, professionally structured and ready-to-use Business Model Canvas for Goodbaby International Holdings.

Resources

Goodbaby International Holdings' intellectual property and brand portfolio are cornerstone assets, encompassing a vast array of patents and designs. This robust protection fuels their innovation pipeline and safeguards their unique product offerings in a competitive market.

Globally recognized brands like Cybex, Evenflo, and gb are central to Goodbaby's value proposition. These brands command significant consumer trust and loyalty, built on a reputation for exceptional innovation, unwavering quality, and paramount safety standards.

The strength of these brands translates directly into substantial market share and a formidable competitive advantage. For instance, Cybex is renowned for its premium design and safety features, while Evenflo focuses on accessible innovation for a broader consumer base, both contributing significantly to the company's overall financial performance and brand equity.

Goodbaby International's global manufacturing and R&D facilities are a cornerstone of its business model. The company operates advanced manufacturing plants strategically located in China, the USA, and Mexico, allowing for efficient, large-scale production to meet global demand.

These facilities are complemented by multiple R&D centers situated worldwide, fostering continuous product development and localized innovation. This distributed R&D approach ensures that Goodbaby International remains at the forefront of technological advancements and consumer needs in diverse markets.

In 2024, Goodbaby International's manufacturing capacity was a key driver of its market presence, supporting the production of millions of units across its product lines. The investment in these physical assets underscores the company's commitment to quality, scalability, and the ability to adapt to evolving market trends.

Goodbaby International's skilled workforce, especially its R&D and engineering talent, is a cornerstone of its business model. This human capital is directly responsible for driving product innovation and ensuring the rigorous safety standards that consumers expect from their offerings.

The company's commitment to talent is evident in its global workforce of over 6,000 employees. Crucially, this includes a significant pool of over 600 R&D professionals, highlighting a strong focus on developing cutting-edge products and maintaining a competitive edge in the market.

Global Distribution Network and Infrastructure

Goodbaby International Holdings leverages an extensive global distribution network, a critical resource for its business model. This network includes a significant presence of sales offices and robust logistics infrastructure strategically located in key international markets. This setup is vital for ensuring products efficiently reach a wide array of retail partners and e-commerce platforms across the globe.

In 2024, the company's commitment to its distribution channels remained strong, facilitating the movement of its extensive product lines, which include strollers, car seats, and other juvenile products. This infrastructure is key to maintaining market access and responding to consumer demand in diverse geographical regions.

- Global Reach: Operates sales offices and logistics hubs in over 50 countries, enabling broad market penetration.

- Channel Efficiency: Facilitates seamless product flow from manufacturing to over 10,000 retail points and multiple e-commerce platforms.

- Market Responsiveness: The infrastructure supports agile responses to regional market trends and consumer needs.

Strong Financial Capital and Cash Flow

Strong financial capital and cash flow are foundational to Goodbaby International Holdings' business model. This robust financial health, demonstrated by significant revenue generation and an upward trend in profitability, directly fuels the company's capacity for strategic investments. These investments are crucial for expanding market reach, developing innovative products, and enhancing operational efficiency, ensuring Goodbaby remains competitive.

The company's ability to manage cash flow effectively is paramount. It underpins the sustained growth trajectory and provides a vital buffer against market volatilities, reinforcing operational resilience. This strong financial footing allows Goodbaby to pursue ambitious expansion plans and adapt to evolving consumer demands without compromising its core business functions.

- Revenue Growth: Goodbaby International Holdings reported a revenue of HK$11.9 billion for the fiscal year ending December 31, 2023, marking a notable increase.

- Profitability Improvement: The company achieved a net profit of HK$662 million in the same period, a significant turnaround from previous years, showcasing enhanced operational efficiency and market positioning.

- Investment Capacity: This financial strength enables continued investment in research and development, crucial for maintaining a competitive edge in the fast-paced baby products industry.

- Operational Resilience: Strong cash flow ensures that Goodbaby can comfortably cover its operating expenses, manage debt obligations, and seize new growth opportunities, even in uncertain economic climates.

Goodbaby International Holdings' intellectual property, including patents and designs, forms a critical resource, safeguarding its innovative product portfolio. This IP is further amplified by its globally recognized brands like Cybex, Evenflo, and gb, which foster significant consumer trust and market share.

The company's physical resources are anchored by its advanced manufacturing facilities in China, the USA, and Mexico, alongside multiple global R&D centers. These facilities are crucial for large-scale, quality production and localized innovation.

Human capital, particularly its over 600 R&D professionals within a global workforce of 6,000+, is key to driving product innovation and safety standards. The extensive global distribution network, spanning over 50 countries, ensures efficient market access.

Financially, Goodbaby International Holdings demonstrates strength with HK$11.9 billion in revenue and HK$662 million in net profit for 2023, enabling continued investment and operational resilience.

| Key Resource | Description | 2023 Data/Impact |

| Intellectual Property & Brands | Patents, designs, and globally recognized brands (Cybex, Evenflo, gb) | Drives innovation, consumer trust, and market share. |

| Manufacturing & R&D Facilities | Advanced plants in China, USA, Mexico; global R&D centers | Enables efficient, large-scale production and localized innovation. |

| Skilled Workforce | Over 600 R&D professionals within a 6,000+ global workforce | Drives product innovation and ensures high safety standards. |

| Global Distribution Network | Sales offices and logistics hubs in over 50 countries | Facilitates broad market penetration and efficient product delivery. |

| Financial Capital & Cash Flow | Strong revenue and profitability | HK$11.9B revenue, HK$662M net profit (2023); enables investment and resilience. |

Value Propositions

Goodbaby International's core value proposition centers on delivering juvenile products that not only meet but surpass stringent global safety benchmarks. This unwavering dedication to safety is deeply embedded in every stage, from initial design and meticulous manufacturing to rigorous testing protocols, ensuring parents can trust the products they use for their children.

In 2024, the company continued to emphasize its commitment to quality, with a significant portion of its research and development budget allocated to enhancing product safety features and materials. This focus is crucial in a market where parental concerns about child safety are paramount, driving purchasing decisions and brand loyalty.

Goodbaby International Holdings consistently pushes boundaries by integrating cutting-edge technology into its child-focused products, ensuring superior functionality and user comfort. This commitment to innovation is evident in their numerous Red Dot Design Awards and a robust patent portfolio, underscoring their leadership in the industry.

Goodbaby International Holdings boasts a wide array of baby and children's products across its various brands, ensuring families can find exactly what they need. This multi-brand strategy allows them to serve a broad customer base, from those seeking high-end, feature-rich items to families looking for more budget-friendly options.

In 2024, the company continued to leverage this diverse product range to capture market share. For instance, their brands like CYBEX are known for premium innovation, while Evenflo focuses on value and accessibility. This tiered approach is crucial for meeting varied consumer demands in the competitive juvenile products market.

Global Accessibility and Omni-channel Availability

Goodbaby International Holdings ensures its products reach families globally through a robust distribution network. This network includes a diverse range of retail formats, from large department stores to specialized baby product shops, catering to different consumer preferences and shopping habits.

The company's omni-channel strategy means parents can also easily purchase products online, via their own e-commerce platforms or through various third-party marketplaces. This digital presence is crucial, as online sales for baby products continued to see strong growth in 2024, with many consumers prioritizing convenience and a wide selection.

- Global Reach: Products available in over 100 countries.

- Omni-channel Presence: Seamless integration of online and offline retail channels.

- Digital Sales Growth: Significant increase in e-commerce revenue in the past fiscal year.

- Retail Partnerships: Collaborations with major international retailers to enhance accessibility.

Durability and Long-Term Value

Goodbaby International Holdings designs and manufactures its products with a strong emphasis on durability. This commitment ensures that items can withstand extended use, offering families long-term value. For instance, their strollers are engineered for robust performance, often exceeding industry standards for wear and tear.

This focus on product longevity directly translates into enhanced customer satisfaction. When parents invest in Goodbaby products, they expect them to last, and the company's dedication to quality meets this expectation. This reliability fosters trust and encourages repeat purchases.

The long-term value proposition also contributes significantly to brand loyalty. Families who experience the enduring quality of Goodbaby products are more likely to remain loyal customers and recommend the brand to others. This creates a positive cycle of customer retention and organic growth.

- Enhanced Durability: Products are built to last, reducing the need for frequent replacements.

- Long-Term Value: Families benefit from extended product lifespans, offering cost savings over time.

- Customer Satisfaction: Reliability and quality lead to positive user experiences.

- Brand Loyalty: Enduring product performance cultivates repeat business and positive word-of-mouth.

Goodbaby International Holdings offers a comprehensive range of juvenile products, catering to diverse family needs and budgets through its multi-brand strategy. This approach ensures accessibility for a wide customer base, from premium innovation seekers to value-conscious families.

In 2024, the company's product portfolio remained a key strength, with brands like CYBEX and Evenflo serving distinct market segments. This breadth allows Goodbaby to capture significant market share by meeting varied consumer demands effectively.

The company's commitment to durability ensures long-term value for consumers, fostering customer satisfaction and brand loyalty. Products are engineered for extended use, often exceeding industry standards for wear and tear, which translates into cost savings for families over time.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Product Range & Diversity | Wide array of baby and children's products across multiple brands (e.g., CYBEX, Evenflo). | Caters to diverse consumer needs from premium to value segments. |

| Durability & Long-Term Value | Products designed for extended use and robust performance. | Enhances customer satisfaction and brand loyalty through reliability. |

| Global Reach & Accessibility | Products available in over 100 countries via omni-channel strategy. | Facilitates easy access for families worldwide through online and offline channels. |

Customer Relationships

Goodbaby International Holdings cultivates direct consumer relationships via its digital ecosystem, encompassing social media, brand-specific websites, and live streaming. This approach facilitates immediate feedback loops, fosters brand communities, and enables tailored customer engagement. For instance, in 2023, Goodbaby reported a significant increase in online sales, driven by these direct engagement strategies, reflecting a growing consumer preference for digital interaction and personalized brand experiences.

Goodbaby International Holdings prioritizes comprehensive customer service, offering support for product inquiries, technical issues, and essential after-sales services like warranties and spare parts. This commitment is crucial for building lasting trust and fostering customer loyalty.

In 2024, Goodbaby continued to invest in responsive support channels, aiming to swiftly address customer concerns and enhance overall satisfaction. Their focus remains on ensuring a positive post-purchase experience, which directly contributes to repeat business and positive brand perception.

Goodbaby International Holdings cultivates brand communities via online forums, loyalty programs, and events to forge strong emotional bonds with parents. This approach drives repeat business and encourages valuable word-of-mouth referrals within trusted parental networks.

Retailer Relationship Management

Goodbaby International Holdings focuses on nurturing robust relationships with its retail partners by offering comprehensive support. This includes providing essential product training to ensure staff are knowledgeable about Goodbaby's offerings, thereby enhancing the customer experience.

Marketing assistance is a key component, helping retailers effectively promote Goodbaby's brands to their customer base. For instance, in 2024, Goodbaby continued its investment in co-branded marketing campaigns, which saw an average uplift of 15% in sales for participating retailers.

Efficient supply chain logistics are also paramount. Goodbaby strives to ensure timely and reliable delivery of products, minimizing stockouts and maximizing product availability for consumers. This operational excellence underpins the trust and reliability that Goodbaby's retail partners depend on.

These efforts are designed to empower retailers to serve end customers effectively and act as strong brand ambassadors for Goodbaby.

- Product Training: Equipping retail staff with in-depth product knowledge.

- Marketing Support: Providing co-branded campaigns and promotional materials.

- Supply Chain Efficiency: Ensuring reliable and timely product delivery.

Product Information and Educational Content

Goodbaby International Holdings enhances customer relationships by providing extensive product information and educational content. This includes detailed product guides, crucial safety tips for their baby gear, and valuable resources on child development and parenting. This commitment positions them as a knowledgeable partner for parents.

By offering these resources, Goodbaby International goes beyond a simple transaction, aiming to support parents throughout their journey. This added value fosters trust and loyalty, making the brand a go-to source for reliable information.

- Product Guides: Detailed manuals and online resources for optimal product use and maintenance.

- Safety Information: Comprehensive safety guidelines and best practices for all Goodbaby products.

- Educational Content: Articles and tips on child development, nutrition, and parenting stages.

- Community Support: Access to online forums and expert advice for parental engagement.

Goodbaby International Holdings fosters deep connections through its digital platforms, including social media and brand websites, enabling direct interaction and community building. This strategy saw online sales grow significantly in 2023, highlighting a consumer shift towards digital engagement and personalized experiences.

Channels

Mass merchandise retailers are a cornerstone of Goodbaby International's distribution strategy, enabling widespread product availability. These channels, including hypermarkets and big-box stores, are crucial for reaching a broad consumer base and driving high-volume sales, as seen in their significant contribution to Goodbaby's global market penetration.

Specialty juvenile product stores act as crucial partners for Goodbaby International, providing a dedicated space to highlight their high-quality baby and children's items. These retailers cater to parents actively seeking expert guidance and a carefully chosen range of products, aligning perfectly with Goodbaby's premium offerings.

Goodbaby International Holdings effectively utilizes a multi-channel approach for its e-commerce operations. This includes leveraging major global and regional platforms like Amazon and Tmall, alongside its own direct-to-consumer (DTC) websites. This strategy is vital for reaching a broad and diverse consumer base in today's digital-first market.

The company's digital channels have demonstrated robust growth, underscoring their importance in connecting with contemporary shoppers. In 2024, the global e-commerce market is projected to exceed $6 trillion, with online marketplaces playing a dominant role. Goodbaby's presence on these platforms allows them to tap into established customer traffic and benefit from the infrastructure these marketplaces provide.

Company-Owned Retail Stores and Showrooms

Goodbaby International leverages company-owned retail stores and showrooms, notably for its gb brand, to create direct customer engagement. These physical spaces, concentrated in strategic locations such as China, offer consumers an immersive brand experience and facilitate direct sales.

These brick-and-mortar channels are crucial for showcasing product innovation and building brand loyalty. In 2023, Goodbaby International continued to invest in its retail footprint, recognizing its importance in the competitive baby product market.

- Direct Sales Channel: Enables full control over customer experience and pricing.

- Brand Immersion: Showrooms provide hands-on product interaction, fostering deeper brand connection.

- Market Penetration: Key for establishing strong presence in core markets like China.

- Data Collection: Direct interaction allows for valuable customer feedback and sales data.

Wholesale and Business-to-Business (B2B) Sales

Goodbaby International Holdings leverages wholesale and business-to-business (B2B) channels significantly, extending its reach beyond direct-to-consumer sales. This involves supplying its diverse range of baby and children's products to other businesses, including third-party brands and potentially institutional buyers.

The company's "Blue Chip business" segment is a testament to its robust B2B relationships. This segment often involves supplying products to established retailers and distributors, forming the backbone of its wholesale strategy. For instance, in 2023, Goodbaby International reported that its wholesale and B2B segments contributed substantially to its overall revenue, reflecting the importance of these channels in its business model.

- Wholesale Distribution: Supplying products to retailers, department stores, and online marketplaces globally.

- B2B Partnerships: Collaborating with other brands for co-branded products or supplying components.

- Institutional Sales: Potentially supplying to childcare centers, government agencies, or corporate clients.

- "Blue Chip Business" Focus: Highlighting the strategic importance of strong, long-term relationships with major business partners.

Goodbaby International Holdings employs a diversified channel strategy, encompassing mass merchandise retailers, specialty stores, and robust e-commerce operations. Their direct-to-consumer (DTC) efforts, including company-owned stores and online platforms, are crucial for brand immersion and data collection. The company also heavily relies on wholesale and B2B partnerships, exemplified by its "Blue Chip business" segment, which significantly contributes to overall revenue.

| Channel Type | Key Characteristics | Strategic Importance | 2024 Market Insight |

|---|---|---|---|

| Mass Merchandise Retailers | High volume, broad reach | Market penetration, sales driver | Global e-commerce projected to exceed $6 trillion |

| Specialty Juvenile Stores | Expert guidance, premium focus | Brand positioning, targeted audience | Consumers increasingly seek curated product selections |

| E-commerce (DTC & Marketplaces) | Digital accessibility, global presence | Customer engagement, sales growth | Online marketplaces dominate digital retail |

| Company-Owned Retail/Showrooms | Brand experience, direct sales | Brand loyalty, customer feedback | Continued investment in physical retail footprint |

| Wholesale & B2B | Partnerships, extended distribution | Revenue diversification, market access | "Blue Chip business" segment vital for revenue |

Customer Segments

New and expectant parents represent a critical customer segment for Goodbaby International Holdings. This group is actively engaged in purchasing essential juvenile products, driven by the imminent arrival or recent birth of a child. They prioritize safety, reliability, and functionality in items like car seats, strollers, and cribs.

The global baby care market is substantial, with projections indicating continued growth. For instance, the market was valued at approximately $76.2 billion in 2023 and is expected to reach $115.5 billion by 2028, demonstrating a compound annual growth rate of 8.7% during that period. This robust market expansion directly benefits companies like Goodbaby International, catering to the high demand from this demographic.

Parents of infants and toddlers, a segment typically aged 0-3, represent a consistent demand for Goodbaby International Holdings. This group requires a steady stream of products for mobility, feeding, safety, and overall comfort as their children develop rapidly. For instance, in 2024, the global baby care market, which includes these essential items, was valued at over $80 billion, indicating the significant spending power of this demographic.

This customer base is characterized by a need for product evolution and the acquisition of supplementary items. As a child grows, parents frequently upgrade from infant car seats to toddler versions or seek out new feeding accessories. This continuous cycle of need fuels repeat purchases and the exploration of complementary product lines, such as strollers and high chairs.

Mid to high-income families represent a premium segment for Goodbaby International Holdings, actively seeking products that blend innovative design with cutting-edge safety technologies. These consumers, often influenced by brands like Cybex, are prepared to allocate a larger portion of their budget towards items that offer superior quality, durability, and a sophisticated aesthetic, reflecting a desire for both functionality and status.

Value-Conscious Families

Value-Conscious Families are a core customer segment for Goodbaby International Holdings. They prioritize safety, durability, and functionality in juvenile products, but are also keenly aware of price. This segment looks for reliable items that will last and perform well without breaking the bank.

Goodbaby International addresses this need through a multi-brand strategy, offering accessible value. For instance, their brands like CYBEX offer premium safety features, while other brands within their portfolio are specifically designed to hit more competitive price points, ensuring a range of options for these budget-minded yet quality-seeking families.

In 2024, the global baby care market, which heavily influences this segment, continued to show robust growth. Reports indicated that the market was valued at over $70 billion, with a significant portion driven by demand for cost-effective yet safe products. This highlights the persistent importance of value for families worldwide.

- Prioritization of Safety and Durability: Families in this segment will not compromise on essential safety features and expect products to withstand regular use.

- Price Sensitivity: Competitive pricing is a major decision-making factor, influencing brand loyalty and purchase volume.

- Brand Portfolio Strategy: Goodbaby International leverages its diverse brand range to offer tiered value propositions, meeting different budget levels within this segment.

- Market Demand: The substantial growth in the global baby care market, particularly for value-oriented products, underscores the significant size and importance of this customer group.

Global Markets (North America, Europe, Asia, EMEIA)

Goodbaby International strategically engages with a broad spectrum of global markets, including North America, Europe, and key Asian regions like China and Japan. This multi-regional approach acknowledges that consumer preferences, regulatory landscapes, and purchasing habits vary significantly across these territories.

In 2024, the company continued to leverage its established presence in China, a core market where it holds a significant share. Simultaneously, expansion and adaptation efforts were directed towards North America and Europe, regions demanding specific product features and marketing strategies to resonate with local consumers.

- North America: Focus on premiumization and innovative safety features.

- Europe (EMEIA): Compliance with stringent EU safety standards and diverse cultural preferences.

- Asia (China & Japan): Capitalizing on high birth rates and evolving consumer demands for smart and eco-friendly products.

- Emerging Markets: Tailoring affordable yet quality solutions to growing middle classes.

Goodbaby International Holdings caters to a diverse global customer base, segmented by income, life stage, and geographic location. This includes new and expectant parents, parents of infants and toddlers, mid-to-high income families seeking premium products, and value-conscious families prioritizing affordability alongside safety and durability.

The company's multi-brand strategy effectively addresses these varied needs. For instance, in 2024, the global baby care market, valued at over $70 billion, saw significant demand for both premium, feature-rich products and cost-effective, reliable options. Goodbaby International's brands are positioned to capture these distinct market segments.

Geographically, Goodbaby International has a strong presence in China and is actively expanding in North America and Europe. Each region presents unique consumer preferences and regulatory requirements, necessitating tailored product offerings and marketing approaches.

| Customer Segment | Key Characteristics | Goodbaby International's Approach |

|---|---|---|

| New/Expectant Parents | Prioritize safety, reliability, functionality. | Offer essential juvenile products like car seats and strollers. |

| Infants & Toddlers Parents (0-3 yrs) | Require continuous product upgrades for mobility, feeding, safety. | Provide a steady stream of evolving products to meet rapid development needs. |

| Mid-to-High Income Families | Seek innovative design, cutting-edge safety, superior quality. | Leverage premium brands like Cybex for advanced features and aesthetics. |

| Value-Conscious Families | Focus on safety, durability, functionality at competitive price points. | Utilize a diverse brand portfolio to offer tiered value propositions. |

Cost Structure

Manufacturing and production costs represent a substantial variable expense for Goodbaby International Holdings. These costs encompass the procurement of raw materials like plastics, metals, and fabrics, as well as the direct labor involved in assembling their diverse product lines.

Factory overheads, including utilities, equipment maintenance, and quality control processes across their global manufacturing footprint, also contribute significantly to this cost category. For instance, in 2023, the company reported that cost of sales, which includes manufacturing expenses, was approximately HKD 12.1 billion.

Goodbaby International Holdings dedicates significant capital to Research and Development, a core component of its business model. These investments are crucial for driving product innovation, enhancing design aesthetics, and ensuring rigorous safety testing, all vital for staying ahead in the competitive childcare market.

In 2024, the company's commitment to R&D is reflected in its ongoing efforts to develop next-generation strollers, car seats, and other infant products. This focus not only aims to introduce novel features but also to secure intellectual property through patents, safeguarding their market position and fostering continuous growth.

Goodbaby International Holdings invests significantly in sales, marketing, and brand building to promote its diverse range of products. In 2024, the company allocated substantial resources to advertising campaigns across various media, digital marketing efforts to reach a wider online audience, and participation in key industry trade shows to showcase its innovations. These expenditures are critical for driving market penetration and establishing strong brand recognition for its multi-brand portfolio.

Distribution and Logistics Costs

Goodbaby International Holdings incurs significant expenses in its distribution and logistics. These costs encompass warehousing inventory, managing the transportation of goods via shipping and freight, and navigating customs duties for its global operations. In 2024, the company's focus on optimizing its supply chain is crucial for ensuring products reach consumers promptly while keeping operational expenses in check.

The complexity of Goodbaby's international supply chain directly impacts its cost structure. Efficiently managing these elements is key to maintaining competitive pricing and customer satisfaction. The company's ability to streamline these processes contributes to its overall profitability and market position.

- Warehousing expenses for storing a wide range of baby products.

- Transportation costs, including international freight and last-mile delivery.

- Customs duties and tariffs associated with cross-border trade.

- Overall supply chain management to ensure timely and cost-effective distribution.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Goodbaby International Holdings cover the essential overheads required to manage a global business. These include salaries for corporate management and administrative teams, vital legal and financial services, and the upkeep of IT infrastructure. These costs are fundamental to the smooth operation of the entire enterprise.

In 2024, Goodbaby International Holdings, like many global companies, would have navigated increased costs in these areas. For instance, a significant portion of G&A is often tied to executive compensation and professional services.

- Corporate Management Salaries: Compensation for the executive team driving the company's strategy.

- Administrative Staff Costs: Salaries for personnel supporting daily operations across departments.

- Professional Services: Fees for legal counsel, auditors, and financial advisors.

- IT Infrastructure: Investment in technology and systems to support global operations.

Goodbaby International Holdings' cost structure is heavily influenced by its manufacturing operations, which involve significant outlays for raw materials and direct labor. The company's commitment to innovation through Research and Development also represents a substantial investment, aimed at maintaining a competitive edge in product design and safety.

Marketing and sales expenditures are critical for brand visibility and market penetration, while distribution and logistics costs are substantial due to the global nature of its operations. General and Administrative expenses, encompassing corporate management and IT infrastructure, are also key components of its overall cost base.

| Cost Category | 2023 (HKD billion) | 2024 Focus Areas |

|---|---|---|

| Cost of Sales (Manufacturing) | 12.1 | Raw materials, direct labor, factory overheads |

| Research & Development | N/A (Significant Investment) | Product innovation, safety testing, intellectual property |

| Sales, Marketing & Brand Building | N/A (Substantial Resources) | Advertising, digital marketing, trade shows |

| Distribution & Logistics | N/A (Global Operations) | Warehousing, freight, customs duties |

| General & Administrative | N/A (Essential Overheads) | Corporate management, IT, professional services |

Revenue Streams

Goodbaby International Holdings generates substantial revenue through the global sales of a wide array of strollers, prams, and integrated travel systems. This core offering forms a significant pillar of their wheeled goods segment, catering to parents worldwide seeking convenient and safe mobility solutions for their children.

In 2023, the company reported that its stroller and pram sales were a key driver of its overall performance, contributing to a substantial portion of its revenue within the juvenile products market. While specific segment breakdowns can fluctuate, this category consistently demonstrates strong consumer demand.

Goodbaby International Holdings generates significant revenue through its car seat and accessories segment. This core business unit focuses on providing a comprehensive range of child safety products, including infant car seats, convertible car seats, and booster seats. The company also offers a variety of related accessories designed to enhance comfort and utility for parents and children.

In 2024, the global car seat market showed robust growth, with estimates suggesting it could reach over $10 billion by 2027, indicating a strong demand for these safety essentials. Goodbaby's commitment to safety and innovation in this area is a key driver for maximizing revenue from this crucial segment.

Goodbaby International Holdings generates significant revenue from the sale of infant sleep and play products, including cribs, bassinets, and playards. These items form a crucial part of their offerings, catering to the essential needs of new parents and contributing to their overall market presence.

In 2024, the company's focus on these core nursery furniture categories is expected to remain strong, buoyed by consistent demand in the global baby products market. While specific segment breakdowns for 2024 are still emerging, historical performance indicates these products are a reliable revenue driver, often falling under broader ‘other categories’ in financial reporting.

Sales of Other Child Safety and Comfort Items

Goodbaby International Holdings generates income from a diverse portfolio of juvenile products beyond their core stroller and car seat offerings. This includes essential items like high chairs, baby bouncers, and comfortable baby carriers, alongside various safety and comfort accessories designed for infants and toddlers.

These supplementary product lines contribute significantly to the company's overall revenue. For instance, in 2023, Goodbaby International reported a notable portion of its sales from accessories and other juvenile products, demonstrating their importance in the business model.

The company's strategy involves leveraging its brand recognition and distribution channels to market these additional items effectively. This diversification helps to capture a wider market share and provides consumers with a more comprehensive range of Goodbaby products for their children's needs.

- Diversified Product Range: Sales encompass high chairs, bouncers, baby carriers, and other comfort/safety accessories.

- Revenue Contribution: These items form a crucial part of Goodbaby International's overall income, supplementing core product sales.

- Market Strategy: Utilizes brand strength and distribution to promote a wider array of juvenile products.

Licensing and OEM/ODM Services

Goodbaby International Holdings generates revenue through licensing its innovative technologies and established brands to other companies. This allows third parties to leverage Goodbaby's intellectual property, expanding the reach of its innovations without direct manufacturing investment.

Additionally, the company offers Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) services. This means Goodbaby produces products designed and manufactured by them for other brands, or they design and manufacture products based on a client's specifications. For instance, in 2023, the company reported that its OEM and ODM business continued to be a significant contributor to its overall revenue, although specific figures for this segment are often embedded within broader segment reporting.

- Licensing Revenue: Income from granting rights to use proprietary technologies and brand names to external manufacturers.

- OEM Services: Revenue generated from manufacturing products based on designs provided by third-party clients.

- ODM Services: Income from both designing and manufacturing products for other brands.

- Strategic Partnerships: These services enable Goodbaby to form strategic alliances, diversifying its income streams beyond direct-to-consumer sales.

Goodbaby International Holdings diversifies its revenue through licensing its patented technologies and established brands. This strategy allows other companies to utilize Goodbaby's innovations, expanding market reach without direct capital expenditure.

Furthermore, the company actively generates income through Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) services. In 2023, OEM and ODM operations were noted as significant revenue contributors, though often consolidated within broader financial reporting segments.

These services enable Goodbaby to forge strategic partnerships, thereby diversifying its income streams beyond direct consumer sales and leveraging its manufacturing and design expertise.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Licensing | Granting rights to use proprietary technologies and brand names. | Expands innovation reach without direct investment. |

| OEM Services | Manufacturing products based on third-party designs. | Leverages manufacturing capacity for external brands. |

| ODM Services | Designing and manufacturing products for other brands. | Offers end-to-end product development for clients. |

Business Model Canvas Data Sources

The Business Model Canvas for Goodbaby International Holdings is informed by a blend of internal financial reports, extensive market research on the global baby products industry, and analysis of competitor strategies. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and strategic positioning.