Games Workshop Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Games Workshop Group Bundle

Games Workshop Group masterfully leverages its unique intellectual property and dedicated community to create a powerful business model. Their strategy focuses on a strong direct-to-consumer approach, supported by a robust retail and distribution network, fostering deep customer engagement through immersive lore and hobby activities.

Unlock the full strategic blueprint behind Games Workshop Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Games Workshop leverages licensing partners to expand its Warhammer universe, notably through video games and screen adaptations. For example, the Warhammer 40,000: Space Marine 2 video game, released in late 2024, demonstrates the considerable financial upside from these strategic alliances.

The company is actively pursuing more substantial licensing agreements, building on its established relationship with Amazon for Warhammer 40,000 film and television projects. This strategy diversifies revenue streams and amplifies brand visibility across multiple entertainment platforms.

Independent retailers and trade accounts represent a significant channel for Games Workshop, acting as vital conduits to customers worldwide. These partnerships are instrumental in extending the company's market presence, particularly in regions where direct retail outlets are not established, thereby fostering local Warhammer hobby communities.

As of the 2024/25 fiscal year, Games Workshop maintained relationships with an impressive 8,100 independent retailers spanning 71 countries. The majority of transactions with these partners are managed efficiently through dedicated telesales teams, highlighting a streamlined approach to supporting this crucial distribution network.

Games Workshop collaborates with hobby and gaming event organizers to stage significant gatherings like the Warhammer Open Series and Grand Narrative events. These partnerships are crucial for cultivating a vibrant community, encouraging competitive gaming, and enriching the overall hobby experience.

These organized events serve as vital touchpoints, allowing players to interact, display their meticulously crafted armies, and immerse themselves in the rich, evolving narratives of the Warhammer universes. For example, the Warhammer 40,000: San Diego Open in 2024 saw hundreds of participants competing, highlighting the scale and importance of these community-driven events.

Material and Component Suppliers

Games Workshop's success as a designer and manufacturer of miniature wargames hinges on its key partnerships with material and component suppliers. These partnerships are crucial for sourcing raw materials, plastics, paints, and various other components essential for producing their high-quality Citadel Miniatures. Maintaining robust relationships ensures consistent quality and uninterrupted production, vital for meeting global demand.

The company's vertical integration strategy means they manage a significant portion of their manufacturing in-house. However, they still depend on external suppliers for specialized inputs, making these relationships strategic. For instance, in 2024, Games Workshop continued to invest in its manufacturing capabilities, which indirectly influences the types and volumes of materials sourced from its partners.

- Plastic Granule Suppliers: Essential for the injection molding of their miniatures, requiring consistent quality and volume.

- Paint and Pigment Manufacturers: Critical for the extensive Citadel paint range, demanding specific color accuracy and durability.

- Packaging Material Providers: Key for ensuring product protection during transit and presentation to consumers.

Logistics and Shipping Providers

Games Workshop relies heavily on its logistics and shipping partners to maintain its global reach. These relationships are crucial for ensuring timely delivery of its diverse product range, from intricate miniatures to hobby tools, to a worldwide customer base. In 2024, the company continued to leverage these partnerships to manage international freight and supply its network of retail stores, independent stockists, and direct-to-consumer online channels efficiently.

The effectiveness of these partnerships directly impacts Games Workshop's ability to meet customer demand and manage inventory across its international operations. By optimizing shipping routes and costs, these providers enable Games Workshop to offer competitive pricing and reliable service, a critical factor in customer satisfaction for hobbyists who often anticipate new releases.

- Global Reach: Partnerships ensure products reach customers in over 100 countries.

- Cost Efficiency: Negotiated rates with logistics providers help manage the cost of international shipping.

- Supply Chain Reliability: Dependable shipping is vital for maintaining stock levels in a growing international market.

Games Workshop's key partnerships are critical for its operational success and brand expansion. These include licensing agreements for digital and screen media, a vast network of independent retailers, event organizers, and essential material suppliers.

The company's strategy with licensing partners, such as the Amazon deal for Warhammer 40,000 film and television, aims to broaden audience reach and generate new revenue streams, exemplified by the successful 2024 video game releases.

Independent retailers, numbering over 8,100 in 71 countries as of 2024/25, form a vital distribution channel, supported by efficient telesales operations.

Collaborations with event organizers enhance community engagement and brand loyalty, with events like the 2024 Warhammer 40,000: San Diego Open drawing hundreds of participants.

What is included in the product

This Business Model Canvas outlines Games Workshop's strategy of engaging a passionate hobbyist customer base through high-quality miniatures, a rich lore, and a strong community focus, leveraging direct-to-consumer sales and a network of independent retailers.

Provides a structured framework to diagnose and alleviate the pain of complex strategic planning, offering clarity on Games Workshop's core value propositions and customer segments.

Activities

Games Workshop's primary focus is the ongoing creation and expansion of its rich Warhammer intellectual property, notably Warhammer: Age of Sigmar and Warhammer 40,000. This involves crafting new narratives, characters, and game mechanics to keep the universes fresh and engaging for fans.

A crucial aspect of their operations is the active protection of these valuable IPs. This includes vigilant monitoring and legal action against unauthorized use or imitation to safeguard brand integrity and their market position.

In 2024, Games Workshop reported significant revenue growth, with their IP development and management being a direct driver of this success. The continued investment in lore and game systems directly fuels product sales and licensing opportunities.

Games Workshop's core activity revolves around the meticulous design and manufacturing of its renowned Citadel Miniatures. This encompasses everything from initial digital sculpting to the final injection molding process, resulting in hundreds of new, high-quality fantasy miniature sculpts each year. This commitment to in-house production ensures a consistent standard of excellence.

The company’s vertical integration is a significant strategic advantage. By controlling both manufacturing and logistics, Games Workshop can optimize its profit margins and maintain stringent quality control across its entire product line. For instance, in the financial year ending May 2023, Games Workshop reported revenue of £490.7 million, with a significant portion directly attributable to the sale of these meticulously crafted miniatures.

Games Workshop oversees a sophisticated global distribution system, encompassing its owned retail outlets, a robust online platform at Warhammer.com, and collaborations with independent retailers. This intricate operation requires meticulous inventory and logistics management across diverse sales channels to ensure worldwide product accessibility.

In 2024, Games Workshop continued its strategic expansion of its retail presence, particularly in crucial international territories, reinforcing its commitment to reaching a broader customer base.

Community Engagement and Event Management

Games Workshop Group's key activities heavily revolve around fostering an immersive hobby experience for its dedicated customer base. This involves the meticulous organization and support of a wide array of gaming events and tournaments, such as the popular Warhammer Open Series, which directly engages enthusiasts and showcases competitive play.

Maintaining a vibrant online community presence is equally vital. Platforms like Warhammer Community and various social media channels serve as crucial hubs for news, discussions, and community building, directly contributing to customer loyalty and sustained brand enthusiasm.

These community engagement and event management efforts are not just about hosting games; they are strategic drivers of brand advocacy and repeat engagement. For instance, the Warhammer Open Series events are designed to be premium experiences, attracting significant attendance and media attention, thereby reinforcing the brand's premium positioning.

- Event Organization: Hosting and supporting local and international gaming events, including major tournaments like the Warhammer Open Series, which saw significant participation in 2024.

- Online Community Management: Actively managing and engaging with customers through Warhammer Community website and social media channels to foster brand loyalty.

- Content Creation for Engagement: Producing regular content, such as battle reports and hobby tutorials, to keep the community informed and inspired.

- Customer Feedback Integration: Using feedback from community events and online interactions to inform product development and future event planning.

Marketing and Brand Promotion

Games Workshop dedicates resources to marketing that amplify brand presence and foster community interaction, primarily targeting their dedicated hobbyist audience rather than seeking broad, mass-market appeal. This strategy involves highlighting new product launches, producing engaging digital content, and utilizing their online channels to inspire existing fans and draw in newcomers.

In 2024, Games Workshop continued to emphasize community and digital engagement as core marketing pillars. Their approach focuses on building excitement around new releases and fostering a sense of belonging among their player base. This often translates into significant social media activity, including live streams, painting tutorials, and lore-focused content.

- Digital Engagement: Games Workshop heavily leverages platforms like YouTube, Instagram, and their own Warhammer Community website to share news, showcase painted miniatures, and run community events.

- Content Creation: They produce a steady stream of content, from new model reveals and lore articles to painting guides and battle reports, designed to keep hobbyists engaged and informed.

- Community Focus: Marketing efforts are geared towards celebrating and supporting the existing community through events, competitions, and direct interaction, reinforcing brand loyalty.

- Product-Centric Promotion: New product releases are the focal point of much of their promotional activity, with extensive previews and launch campaigns designed to generate significant interest.

Games Workshop's key activities center on the continuous development and expansion of its intellectual property, primarily Warhammer: Age of Sigmar and Warhammer 40,000. This involves creating new lore, characters, and game mechanics to keep its universes engaging.

The company also focuses on the meticulous design and manufacturing of its Citadel Miniatures, controlling the entire process from digital sculpting to injection molding. This vertical integration allows for high-quality control and optimized profit margins.

Furthermore, Games Workshop actively manages its global distribution network, encompassing owned retail stores, its online platform, and independent retailers, ensuring worldwide product accessibility.

Community engagement is another vital activity, with extensive organization of gaming events and tournaments, alongside active management of online communities to foster brand loyalty and enthusiasm.

Marketing efforts are strategically focused on digital engagement and community interaction, highlighting new product launches and creating content that inspires both existing fans and newcomers.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| IP Development | Creating new narratives, characters, and game mechanics for Warhammer universes. | Continued investment fuels product sales and licensing. |

| Miniature Design & Manufacturing | In-house creation of high-quality fantasy miniatures. | Hundreds of new sculpts annually; FY23 revenue £490.7 million from miniatures. |

| Distribution Management | Overseeing global sales channels including retail, online, and independent partners. | Strategic expansion of retail presence in key international territories. |

| Community & Event Engagement | Organizing gaming events and managing online communities. | Significant attendance at Warhammer Open Series events in 2024. |

| Marketing & Digital Engagement | Targeted marketing focusing on community interaction and digital content. | Heavy use of YouTube, Instagram, and Warhammer Community website for engagement. |

Preview Before You Purchase

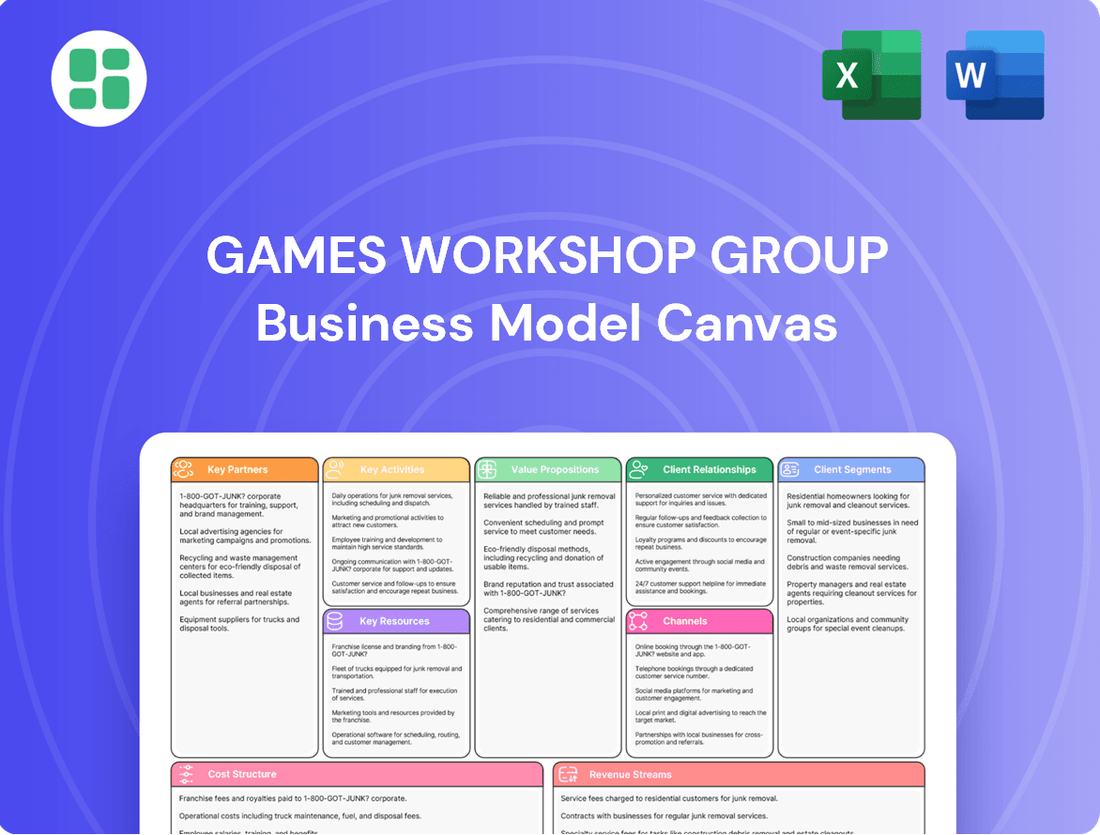

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, professionally formatted file. Upon completing your order, you will gain full access to this same comprehensive Business Model Canvas, ready for your strategic analysis.

Resources

Games Workshop's most valuable asset is its extensive intellectual property, particularly the Warhammer 40,000 and Age of Sigmar universes. This IP encompasses a rich tapestry of characters, lore, artwork, and intricate game systems, all meticulously protected and leveraged through licensing agreements with external partners.

The sheer strength and depth of this brand are fundamental to Games Workshop's dominant market position. In 2024, the company continued to see significant revenue generated from its core tabletop games, with the Warhammer universes forming the bedrock of this success.

Games Workshop's commitment to its in-house design and manufacturing is a cornerstone of its business model. The company operates its own design studios and manufacturing plants, which include advanced plastic injection molding facilities and a dedicated paint factory. This vertical integration allows for meticulous control over every aspect of product creation, from the initial concept to the final painted miniature.

This direct oversight ensures exceptional product quality and fosters production efficiency. It also fuels innovation, enabling Games Workshop to push the boundaries of miniature design and manufacturing techniques. In 2024, the company continued its strategic investment in tooling and expanding its factory capacity, demonstrating a clear focus on strengthening these core operational assets.

Games Workshop's core strength lies in its highly skilled workforce, particularly within its dedicated Warhammer Studio. This team comprises expert designers, sculptors, artists, writers, and game developers who are the engine of the company's creativity.

These specialists are directly responsible for the creation of new miniatures, compelling artwork, intricate game rules, and engaging lore. This continuous output of fresh content is absolutely vital for keeping the Warhammer universes alive and exciting for fans, driving the innovation that underpins Games Workshop's product pipeline.

The company's investment in this creative talent is evident. For the fiscal year ending June 2, 2024, Games Workshop reported revenue of £490.5 million, a significant portion of which is attributable to the consistent delivery of high-quality, original content generated by its internal creative teams.

Global Retail Store Network

Games Workshop's extensive global retail store network, exceeding 500 locations across 24 countries, is a cornerstone of its business model. These stores are not just points of sale but also crucial community hubs that foster customer engagement and brand loyalty. They provide a tangible, in-person experience of the hobby, which is vital for attracting new enthusiasts and retaining existing ones.

This direct-to-consumer channel allows Games Workshop to control the customer experience, offer expert advice, and host events, thereby strengthening its relationship with its fanbase. By the end of the 2023 financial year, Games Workshop reported a significant increase in its retail presence, underscoring the strategic importance of these physical touchpoints in its overall growth strategy.

- Global Reach: Over 500 stores in 24 countries.

- Direct Sales Channel: Facilitates direct revenue generation and margin control.

- Community Hubs: Foster customer engagement, events, and hobby immersion.

- Customer Recruitment: Essential for introducing new individuals to the hobby.

Robust Digital Platforms and Online Presence

Games Workshop's digital backbone is its robust online presence, primarily centered around Warhammer.com and the Warhammer Community website. These platforms are crucial for direct sales, allowing customers to purchase miniatures, paints, and accessories directly, bypassing traditional retail channels. This direct-to-consumer approach is a cornerstone of their strategy.

These digital hubs also serve as vital marketing and community engagement tools. They host a wealth of content, including game rules, extensive lore, and hobby tutorials, fostering a highly engaged fanbase. Social media channels further amplify this reach, connecting with enthusiasts worldwide and driving brand loyalty.

In 2024, Games Workshop continued to invest heavily in its digital infrastructure. For instance, the company reported that online sales represented a significant portion of its revenue, underscoring the importance of Warhammer.com. The Warhammer Community site saw millions of unique visitors monthly, demonstrating its effectiveness in building and maintaining a passionate player base.

- Warhammer.com: Direct-to-consumer sales channel for miniatures, paints, and accessories.

- Warhammer Community: Hub for rules, lore, hobby tutorials, and community engagement.

- Social Media: Amplifies marketing efforts and connects with a global fanbase.

- Digital Content Distribution: Essential for sharing rules, lore, and hobby guidance.

Games Workshop's key resources are its deeply ingrained intellectual property, particularly the Warhammer 40,000 and Age of Sigmar universes, which are meticulously guarded and expanded upon. This IP forms the foundation of their product lines and licensing opportunities.

The company's in-house design and manufacturing capabilities are critical, allowing for strict quality control and innovation in miniature production. This vertical integration extends to their highly skilled creative teams, who consistently generate new content that fuels fan engagement.

Their global network of over 500 retail stores acts as both a sales channel and a community hub, fostering direct customer relationships and brand loyalty. This physical presence is complemented by a strong digital infrastructure, including Warhammer.com and the Warhammer Community website, which drive online sales and engagement.

| Key Resource | Description | 2024 Relevance |

| Intellectual Property (Warhammer 40,000, Age of Sigmar) | Rich lore, characters, artwork, game systems. | Core revenue driver, basis for licensing and new product development. |

| In-house Design & Manufacturing | Plastic injection molding, paint factory, design studios. | Ensures product quality, efficiency, and innovation; capacity expansion in 2024. |

| Creative Talent (Warhammer Studio) | Designers, sculptors, artists, writers, game developers. | Generates new content, essential for maintaining fan interest and driving product pipeline. |

| Global Retail Store Network | Over 500 stores in 24 countries. | Direct sales, community building, customer engagement, and hobby immersion. |

| Digital Presence (Warhammer.com, Warhammer Community) | Online sales, content hub, community engagement. | Significant revenue contributor, vital for marketing and maintaining fan base. |

Value Propositions

Games Workshop provides an unparalleled hobby experience, allowing enthusiasts to collect, build, paint, and engage in strategic battles with intricately detailed miniatures. This deep engagement is rooted in its expansive fantasy and sci-fi lore, fostering a strong sense of community and long-term customer loyalty.

The company's commitment to this immersive experience is reflected in its consistent financial performance. For the fiscal year ending May 26, 2024, Games Workshop reported revenue of £490.7 million, a significant increase from previous years, demonstrating the strong demand for its hobby products.

Games Workshop Group is celebrated for its Citadel Miniatures, widely considered the finest in the fantasy genre. This reputation for superior quality and intricate detail is a cornerstone of their value proposition, fostering strong customer loyalty.

The company's commitment to exceptional design and craftsmanship is a significant differentiator in the market. This focus ensures that each miniature offers a premium experience for hobbyists and collectors alike.

In 2024, Games Workshop continued to emphasize this high-quality output, a strategy that has historically driven their premium pricing and market position. Their dedication to detailed, well-designed miniatures remains a primary draw for their dedicated fanbase.

Games Workshop’s commitment to continuous new product innovation is a cornerstone of its business model. Throughout 2024, the company continued its relentless release schedule of new miniatures, updated rule sets for its popular games like Warhammer 40,000 and Age of Sigmar, and expanded lore through novels and codexes. This steady stream of fresh content ensures hobbyists always have something new to collect, paint, and play with, fostering deep engagement.

This strategy directly fuels customer retention and acquisition. For instance, the release of new army codexes and accompanying model ranges in 2024, such as the highly anticipated updates for factions like the Orks and Tyranids, generated significant buzz and sales. These releases not only cater to existing players but also attract new hobbyists eager to dive into the rich, evolving universes.

Strong Community and Social Connection

The Warhammer hobby cultivates a strong global community, offering numerous avenues for social engagement. Customers connect through organized events, competitive tournaments, and active online forums, all centered around their shared passion.

This strong sense of belonging and the opportunity for shared experiences represent a core value proposition for Games Workshop customers. It transforms a solitary pastime into a social and interactive pursuit.

As of fiscal year 2024, Games Workshop reported revenue of £490.7 million, with a significant portion driven by the enduring appeal and community engagement surrounding its products. The company actively supports this through various initiatives:

- Organized Play: Facilitating local store events and larger international tournaments that foster competition and community bonding.

- Online Platforms: Maintaining active forums, social media channels, and content creation that allow hobbyists to connect and share their work globally.

- Community Events: Hosting events like Warhammer Fest, which draws thousands of attendees, further strengthening the social fabric of the hobby.

Proprietary and Expansive Universes

Games Workshop's proprietary universes, like Warhammer: Age of Sigmar and Warhammer 40,000, are central to their business model. These expansive and continuously developing fantasy and sci-fi worlds provide a deep well of content that customers can engage with across multiple formats.

This rich narrative tapestry, meticulously built over decades, offers customers a unique and immersive experience. The depth of lore and world-building allows for endless exploration and creative engagement, fostering a dedicated and passionate community.

- Deep Lore and World-Building: Customers invest in the rich, interconnected narratives of Warhammer: Age of Sigmar and Warhammer 40,000.

- Multi-Platform Engagement: Access to these universes extends beyond miniatures to books, video games, and other media, broadening customer touchpoints.

- Community and Creativity: The expansive universes foster a strong community, encouraging fan creativity and ongoing participation.

- Brand Loyalty: The unique and evolving nature of these proprietary worlds cultivates significant brand loyalty and repeat engagement.

Games Workshop offers a unique hobby experience through its high-quality, intricately detailed miniatures, fostering deep customer engagement. This commitment to craftsmanship, evident in its Citadel Miniatures, drives premium pricing and market standing. The company's continuous product innovation, including new model releases and updated game rules, ensures ongoing customer interest and acquisition.

The company's proprietary universes, such as Warhammer: Age of Sigmar and Warhammer 40,000, provide a rich narrative foundation for its products. This deep lore encourages multi-platform engagement and fuels significant brand loyalty. The strong global community, cultivated through organized play and online platforms, is a key element of the value proposition, transforming a hobby into a social experience.

| Value Proposition Element | Description | 2024 Impact/Data |

|---|---|---|

| Unparalleled Hobby Experience | Collect, build, paint, and battle with detailed miniatures; deep lore fosters community and loyalty. | Revenue of £490.7 million reported for FY ending May 26, 2024, reflecting strong demand. |

| Superior Miniature Quality | Citadel Miniatures are considered the finest in the fantasy genre, driving customer loyalty. | Focus on detailed, well-designed miniatures remains a primary draw for its dedicated fanbase. |

| Continuous Product Innovation | Relentless release schedule of new miniatures, updated rules, and expanded lore. | New army codexes and model ranges in 2024 generated significant buzz and sales. |

| Strong Global Community | Social engagement through events, tournaments, and online platforms. | Warhammer Fest draws thousands, strengthening the hobby's social fabric. |

| Proprietary Universes | Expansive and evolving fantasy/sci-fi worlds (Warhammer 40k, Age of Sigmar) offering multi-platform engagement. | Rich narrative tapestry fosters endless exploration and creative engagement. |

Customer Relationships

Games Workshop cultivates deep customer loyalty through its community-centric engagement strategy. This involves organizing a wide array of events, from local store meetups to large-scale international tournaments, fostering a vibrant ecosystem for hobbyists. For instance, in the fiscal year ending May 2024, Games Workshop reported revenue of £490.7 million, a significant portion of which is driven by this engaged community.

These platforms, including online forums and social media groups, allow fans to share their passion, showcase their creations, and connect with like-minded individuals. This sense of belonging and shared experience directly translates into enhanced customer retention and repeat purchases, as hobbyists invest more time and money into their shared passion.

Games Workshop fosters direct customer relationships through its 535 owned retail stores. These locations offer more than just products; they are hubs for hobbyists, providing personalized advice, in-store demonstrations, and a welcoming environment for learning and community engagement. This direct interaction is crucial for attracting new enthusiasts and nurturing loyalty among existing fans.

Games Workshop actively engages its community through Warhammer Community and various social media platforms. Their approach is friendly and informative, offering daily news, guides for building and painting miniatures, and other engaging content. This consistent digital presence is key to building a strong connection with hobbyists.

The company leverages these digital channels to inspire creativity and provide ongoing support for its customers. By sharing tutorials and hobby insights, Games Workshop fosters a sense of belonging and encourages continued participation in the hobby. This digital strategy is crucial for maintaining customer loyalty and driving repeat engagement with their products.

In 2024, Games Workshop continued to see strong performance, with their digital content playing a significant role. While specific figures for digital engagement aren't always broken out, the company's overall revenue growth, which reached £490.5 million in the year ending May 2024, reflects the success of their customer-centric strategies, including their robust online presence.

Customer Service and Support

Games Workshop offers customer service primarily to handle inquiries, resolve order discrepancies, and provide product assistance. The company acknowledges online feedback but prioritizes direct communication channels for efficient problem-solving and enhancing the customer's online journey.

- Customer Support Channels: Games Workshop utilizes direct channels for customer service, focusing on resolving specific issues rather than broad online engagement.

- Feedback Integration: While online feedback is noted, the emphasis is on using direct interactions to improve customer experiences and address problems.

- Operational Focus: The company's customer service strategy is geared towards efficient resolution of queries and support needs, ensuring a smooth experience for hobbyists.

Long-Term Hobbyist Retention

Games Workshop excels at long-term hobbyist retention by consistently refreshing its product lines and intellectual property. This strategy fuels a continuous cycle of engagement for its dedicated fanbase. For example, the company launched numerous new miniatures and rulebooks throughout 2024, keeping hobbyists invested in expanding their collections and armies.

The company's commitment to a 'forever' hobby ethos means a steady stream of new content, from narrative expansions to painting guides. This ensures that even long-time customers always have something new to explore and invest in, fostering deep loyalty.

- Consistent New Product Releases: Games Workshop regularly introduces new miniatures, codexes, and accessories, maintaining excitement and encouraging repeat purchases.

- Intellectual Property Development: Ongoing investment in the lore and narrative of its core universes, such as Warhammer 40,000 and Age of Sigmar, keeps the stories fresh and engaging.

- Hobby Experiences: The company supports and promotes hobby activities like painting and gaming through events and online resources, deepening customer connection.

- Community Building: Fostering a sense of community among players and hobbyists through social media, forums, and official events further solidifies long-term relationships.

Games Workshop's customer relationships are built on a foundation of community, direct engagement, and continuous product innovation. Their strategy fosters deep loyalty by creating shared experiences and providing ongoing value to hobbyists. This approach is reflected in their consistent revenue growth, with the fiscal year ending May 2024 showing revenues of £490.5 million.

| Key Customer Relationship Aspect | Description | Impact/Data Point (FY24) |

|---|---|---|

| Community Engagement | Organizing events, online forums, social media groups | Drives repeat purchases and customer retention. |

| Direct Retail Presence | 535 owned stores offering advice and community hubs | Facilitates new customer acquisition and loyalty. |

| Digital Content & Support | Warhammer Community, tutorials, painting guides | Maintains customer connection and inspires creativity. |

| Product Refresh & IP Development | Consistent new releases, lore expansion | Ensures long-term hobbyist investment and engagement. |

Channels

Games Workshop's own-brand retail stores are crucial for direct customer engagement, offering an exclusive environment for purchasing their unique products. These locations act as vital community hubs, fostering hobbyist participation and attracting new enthusiasts to the Games Workshop universe.

As of the first half of fiscal year 2024, Games Workshop reported a significant number of these retail stores operating globally, with 2024 seeing continued expansion. These stores are key to the company's strategy of controlling the customer experience and brand presentation.

Warhammer.com serves as Games Workshop's primary direct-to-consumer channel, offering a comprehensive global sales platform. This allows them to reach customers worldwide with their entire product catalog, including exclusive items and early releases.

In the fiscal year ending May 2024, Games Workshop reported group revenue of £491.5 million, with a significant portion of this driven by their direct sales channels, including Warhammer.com. This online store is crucial for building brand loyalty and providing access to digital content and community forums.

Games Workshop relies heavily on its independent retailers and wholesale partners to get its products into the hands of hobbyists globally. These partnerships are vital for market penetration, especially in regions without a direct Games Workshop store presence. In the fiscal year ending May 2024, Games Workshop reported that its retail segment, which includes its own stores and online sales, accounted for £227.4 million of its total revenue. The trade segment, encompassing these wholesale partners, brought in an impressive £251.9 million, demonstrating the significant contribution of these external channels to the company's overall success and reach.

Licensed Digital Platforms (Video Games, Streaming)

Games Workshop's strategy includes licensing its intellectual property (IP) for video games and streaming content, significantly broadening its market reach. This approach allows the Warhammer universe to connect with a wider audience beyond traditional tabletop gaming enthusiasts.

These licensing deals are a crucial revenue stream, generating income from third-party developers and platforms. For instance, the company has ongoing partnerships for video game development, and in 2023, Games Workshop announced a significant multi-year deal with Amazon Studios to develop new Warhammer 40,000 television series and films, aiming to expand the brand's presence in the premium entertainment sector.

- Expanded Reach: Licensing digital platforms like video games and streaming services introduces the Warhammer IP to new demographics and global audiences.

- Revenue Generation: These agreements provide a substantial and growing revenue stream through licensing fees and royalties from digital content.

- Brand Amplification: Successful digital adaptations enhance brand visibility and engagement, potentially driving interest back to core tabletop products.

- Strategic Partnerships: Collaborations with major entertainment companies, such as the Amazon Studios deal, underscore the value and potential of the Warhammer IP in the digital and media landscape.

Hobby Events and Tournaments

Games Workshop's physical events, such as the Warhammer Open series and Grand Narratives, are crucial channels. These gatherings directly expose customers to their products, drive sales, and foster community interaction. Attendees get to experience the hobby hands-on, play games, and buy merchandise.

These events are not just about sales; they are vital for community building and brand loyalty. For instance, the Warhammer Open events in 2024 saw significant attendance, with thousands of hobbyists gathering to compete and socialize. This direct engagement reinforces the immersive nature of the Games Workshop hobby.

- Product Showcase: Events provide a prime opportunity to display new releases and existing product lines, allowing potential customers to see and interact with them.

- Direct Sales: On-site sales at these events contribute directly to revenue, often featuring exclusive event merchandise or early releases.

- Community Engagement: Tournaments and narrative events build strong community bonds, encouraging repeat participation and brand advocacy.

- Hobby Immersion: These physical spaces allow new and existing customers to fully immerse themselves in the hobby, experiencing the games and the social aspect firsthand.

Games Workshop's channels are multifaceted, encompassing direct retail, online sales, independent retailers, and strategic licensing. The company's own-brand stores and Warhammer.com are vital for direct customer engagement and global product reach. In the fiscal year ending May 2024, Games Workshop reported group revenue of £491.5 million, with direct sales playing a significant role.

Independent retailers and wholesale partners are crucial for market penetration, contributing £251.9 million to the trade segment revenue in the fiscal year ending May 2024. Licensing agreements, such as the Amazon Studios deal for Warhammer 40,000 series, expand brand reach and generate substantial revenue through royalties and fees.

Physical events like Warhammer Open series are key for community building and direct sales, fostering hobby immersion and brand loyalty. These events allow for direct customer interaction and product showcasing, driving engagement and sales.

| Channel | Description | FY24 Revenue Contribution (Approx.) |

|---|---|---|

| Own-Brand Retail Stores | Direct customer engagement, community hubs, exclusive product sales. | Part of £227.4 million retail segment revenue. |

| Warhammer.com | Global direct-to-consumer platform, exclusive items, digital content. | Part of £227.4 million retail segment revenue. |

| Independent Retailers/Wholesale | Market penetration, global product distribution. | £251.9 million (Trade Segment Revenue). |

| Licensing (Digital & Media) | IP expansion, revenue from video games, TV, film. | Significant and growing revenue stream, exact figures not separately disclosed but contributes to overall growth. |

| Physical Events | Product showcase, direct sales, community building. | Drives sales and engagement, contributing to overall revenue. |

Customer Segments

Dedicated miniature wargamers and hobbyists form the bedrock of Games Workshop's customer base. These individuals are passionate about collecting, assembling, painting, and playing with the detailed miniatures, demonstrating a deep commitment to the Warhammer universe. Their engagement is fueled by the rich lore, intricate game mechanics, and the artistic expression inherent in the hobby.

In 2024, Games Workshop continued to see strong performance driven by this core segment. Their sales in the fiscal year ending May 2024 reached £490.7 million, a testament to the enduring appeal and consistent spending of these enthusiasts. This segment represents a significant portion of the company's revenue, highlighting their vital role in the business model.

This segment comprises individuals who are drawn to Games Workshop's miniatures primarily for their artistic merit and the challenge of painting them. They see the miniatures as collectibles, appreciating the intricate details and the opportunity for creative expression through painting. For these customers, the gaming aspect is often secondary to the hobby of collecting and painting.

In 2024, Games Workshop continued to see strong engagement from its dedicated painting community. The company offers a wide array of paints, brushes, and tools specifically designed to support this segment, contributing to their robust sales in hobby supplies. Many collectors and painters actively participate in online forums and social media, showcasing their painted miniatures, which in turn inspires others and drives further interest in the hobby.

Casual gamers and newcomers are a crucial segment for Games Workshop, often drawn in by the rich lore of Warhammer 40,000 or Warhammer Age of Sigmar, or simply the desire to play with friends. These individuals represent the future customer base, and Games Workshop actively cultivates them through accessible products like starter sets. In 2024, the company's focus on expanding its digital presence and creating engaging narrative content continued to be a key strategy for attracting and retaining these less experienced players.

Digital Entertainment Consumers

This segment encompasses individuals drawn to the Warhammer universe through digital channels, such as video games, novels, and forthcoming film and television projects. These consumers represent a significant gateway into the broader Games Workshop ecosystem, potentially leading them to the core miniature wargaming hobby.

The robust performance of licensed titles, exemplified by the anticipation surrounding Space Marine 2, underscores the expanding reach and appeal of this customer base. Games Workshop's strategic focus on these digital touchpoints aims to broaden its audience and foster deeper engagement with its intellectual property.

- Digital Engagement Growth: Games Workshop reported that its licensed entertainment segment, including video games and books, continues to be a key growth driver.

- Video Game Impact: The successful launch and ongoing popularity of titles like Warhammer 40,000: Space Marine 2 are crucial in attracting new fans to the Warhammer IP.

- Cross-Platform Appeal: This segment is vital for introducing new audiences to the Warhammer lore, who may then explore physical products like miniatures.

- Future IP Expansion: Upcoming film and TV adaptations are expected to further bolster this customer segment by offering diverse entry points into the Warhammer universe.

Retail and Trade Partners

Games Workshop's retail and trade partners, primarily independent hobby stores and specialist retailers, represent a vital customer segment. These businesses act as intermediaries, purchasing Games Workshop products in bulk to make them accessible to the end consumer. Strong relationships and consistent support are paramount for these partners, as their success directly impacts Games Workshop's reach and sales volume.

For the fiscal year ending May 2024, Games Workshop reported that its trade partners continued to be a significant contributor to revenue. The company actively supports these partners through various initiatives, including product allocation, marketing materials, and in-store event support. This collaborative approach ensures that the hobby is well-represented at the local level.

- Wholesale Operations: Independent retailers and distributors are key to Games Workshop's wholesale strategy, buying products in volume for resale.

- Business Relationships: Maintaining robust business relationships with these partners is essential for consistent product distribution and market penetration.

- Support Systems: Games Workshop provides crucial support, including marketing collateral and event assistance, to empower its trade partners.

- Revenue Contribution: These partners are a fundamental part of Games Workshop's revenue generation, facilitating access to their product range for hobbyists worldwide.

The core customer segment for Games Workshop consists of dedicated miniature wargamers and hobbyists who are deeply invested in collecting, building, painting, and playing with their detailed miniatures. These enthusiasts are drawn to the rich lore and intricate gameplay of the Warhammer universes, representing the bedrock of the company's loyal customer base and a significant driver of its revenue.

In the fiscal year ending May 2024, Games Workshop reported total revenue of £490.7 million, with a substantial portion attributed to this core hobbyist segment. Their continued engagement fuels consistent sales of miniatures, paints, tools, and accessories, underscoring their critical role in the business model.

Another key segment includes individuals who appreciate the artistic and collectible aspects of the miniatures, focusing on the painting and display of these detailed models. For this group, the creative expression through painting is often as important, if not more so, than the gaming aspect itself, contributing significantly to sales of hobby supplies.

Games Workshop also actively cultivates casual gamers and newcomers, often introduced to the Warhammer universe through accessible starter sets and engaging narrative content. The company's strategic expansion into digital platforms, including video games and upcoming film and television projects, is crucial for broadening its audience and attracting new fans who may then transition into the core hobby.

Cost Structure

Games Workshop's manufacturing and production costs are substantial, primarily driven by the intricate design, tooling, and high-volume production of its plastic miniatures. Raw materials like specialized plastics, coupled with the ongoing maintenance of sophisticated machinery and factory labor, represent significant expenditures. For instance, in the fiscal year ending May 2024, Games Workshop reported cost of sales at £225.2 million, reflecting these intensive production outlays.

The company consistently allocates capital towards enhancing its tooling and expanding production capacity. This strategic investment is crucial to effectively meet the robust global demand for its diverse product lines. Such investments ensure that Games Workshop can maintain its output quality and volume, supporting its market position.

Staff wages and salaries represent a significant outlay for Games Workshop, covering a broad spectrum of roles from creative talent in the Warhammer Studio to the teams involved in manufacturing, retail operations, and corporate functions. This investment in human capital is crucial for maintaining the quality and innovation that defines their products.

In 2024, Games Workshop continued its commitment to competitive compensation, which is essential for attracting and retaining skilled employees in a specialized industry. The company also reinforces employee loyalty and motivation through its group profit share scheme, directly linking staff performance to the company's overall success.

Sales, Marketing, and Distribution Expenses are significant for Games Workshop. These costs encompass running their extensive global retail store network, including rent, utilities, and staffing. Managing their online store operations and the complex logistics of worldwide shipping also fall under this category.

Marketing is a key investment, strategically deployed to boost brand visibility and engage their passionate community. For the fiscal year ending May 28, 2023, Games Workshop reported £211.3 million in selling, marketing, and distribution costs, reflecting the substantial investment required to maintain their global reach and product promotion.

Research and Development (R&D) and IP Development

Games Workshop Group invests heavily in R&D to create new intellectual property, game systems, and innovative products. This commitment drives significant costs, encompassing salaries for their talented creative teams, sophisticated software for design, and specialized tooling for crafting new miniature designs. For the fiscal year ending May 26, 2024, Games Workshop reported a notable increase in their investment in product development and intellectual property, reflecting their ongoing strategy to expand their universes and gameplay experiences.

- Investment in New IP: Continuous creation of new lore, characters, and settings to expand existing franchises like Warhammer 40,000 and Age of Sigmar.

- Game System Development: Resources allocated to designing, playtesting, and refining rulesets for both new and existing tabletop games.

- Product Innovation: Funding for the design and engineering of new miniature sculpts, associated accessories, and digital tools to enhance the gaming experience.

- Creative Staffing: Significant expenditure on salaries and benefits for writers, artists, sculptors, game designers, and software developers.

IT Systems and Infrastructure Investment

Games Workshop is undertaking a significant IT systems and infrastructure upgrade, a crucial cost driver for enhancing operational efficiency. This investment focuses on modernizing systems across sales, manufacturing, and distribution. In 2024, the company continued to allocate substantial capital towards this ongoing project, recognizing its importance for future growth and streamlined operations.

The replacement of older IT systems is a key expenditure, designed to improve how Games Workshop manages its sales, production, and logistics. This strategic investment is expected to yield long-term benefits by creating a more integrated and responsive business model. The company views this as a necessary capital expenditure to maintain its competitive edge.

- IT System Modernization: Ongoing investment in replacing legacy systems for improved operational flow.

- Capital Expenditure: Significant budget allocated in 2024 to support these infrastructure upgrades.

- Efficiency Gains: Aimed at enhancing performance across sales, manufacturing, and distribution channels.

- Long-Term Strategy: Viewed as a foundational investment for sustained business improvement.

Games Workshop's cost structure is heavily weighted towards manufacturing and royalties, reflecting the intricate nature of its products and intellectual property. The company's commitment to quality and innovation necessitates significant investment in raw materials, skilled labor, and advanced production techniques. For the fiscal year ending May 26, 2024, Games Workshop reported cost of sales at £263.1 million, a notable increase from the previous year, underscoring these production-related expenses.

Royalties are a crucial component, particularly as Games Workshop expands its intellectual property through licensing agreements for animation, video games, and other media. These agreements ensure that the company benefits from its rich lore and characters across various platforms. While specific royalty figures are not always itemized separately in their public reporting, the strategic importance of these partnerships contributes to the overall cost and revenue streams.

Additional significant costs include selling, marketing, and distribution expenses, which were £245.2 million in the fiscal year ending May 26, 2024. This covers the operation of their global retail presence, online sales, and the logistics of reaching their worldwide customer base. Investment in research and development, including new product design and intellectual property creation, also represents a substantial ongoing expenditure necessary for maintaining their market leadership and expanding their universes.

| Cost Category | FY 2024 (£ million) | FY 2023 (£ million) |

| Cost of Sales | 263.1 | 225.2 |

| Selling, Marketing, and Distribution | 245.2 | 211.3 |

Revenue Streams

Games Workshop's core product sales, encompassing their popular fantasy miniatures, essential hobby supplies like paints and tools, and Black Library publications, form the bedrock of their revenue. This segment is the company's primary money-maker, driven by a direct-to-consumer approach through their own retail outlets and a robust online presence, alongside sales to independent retailers.

For the year ended May 26, 2024, Games Workshop reported a significant portion of its revenue stemming from these core product sales. Their retail channel, which includes their physical stores and online sales, generated a substantial amount, demonstrating the effectiveness of their direct engagement with the hobbyist community.

Licensing royalties represent a significant and expanding revenue avenue for Games Workshop. This stream is fueled by granting third-party developers the rights to create video games, mobile titles, and media adaptations, including films and TV series, based on their popular intellectual property.

The recent success of games like Warhammer 40,000: Space Marine 2 has demonstrably bolstered this revenue stream, highlighting the growing commercial appeal of their established universes. This strategy allows Games Workshop to leverage its brand across multiple platforms, reaching a broader audience.

Digital sales, exemplified by Warhammer+ subscriptions, represent a growing revenue stream for Games Workshop, diversifying income beyond its traditional physical product sales. This digital platform offers a wealth of content, including exclusive animations, in-depth battle reports, and unique lore, attracting a dedicated fanbase and fostering deeper engagement.

For the fiscal year ending May 26, 2024, Games Workshop reported a significant increase in its digital segment. While specific figures for Warhammer+ are often bundled, the company's overall revenue reached £490.5 million, with the digital offerings playing an increasingly vital role in this growth, demonstrating a successful expansion into the digital entertainment space.

Event Ticket Sales and Merchandise

Games Workshop Group generates significant revenue through ticket sales for its official events, such as the Warhammer Open series and Grand Narratives. These gatherings are crucial for community engagement and provide a direct income stream.

Beyond event entry, sales of related merchandise, both at these events and through online channels, further boost this revenue segment. This includes exclusive items, apparel, and accessories tied to the Warhammer universe.

- Event Ticket Sales: Income from attendees at Warhammer Open days, Warhammer Fest, and various regional tournaments.

- Merchandise Sales at Events: Revenue from exclusive or limited-edition products sold directly to attendees.

- Online Merchandise Sales: Continued sales of event-related merchandise through Games Workshop's official webstore.

- Tournament Entry Fees: Specific fees for participation in competitive gaming events, often including prizes.

Sales of Exclusive and Limited Edition Products

Games Workshop frequently introduces exclusive and limited-edition miniatures and merchandise. These special releases often command higher prices because of their desirability and collectibility, appealing directly to their most passionate fans and collectors.

This strategy drives significant revenue by creating scarcity and urgency. For instance, during the 2023 fiscal year, Games Workshop reported total revenue of £490.7 million, with a notable portion attributed to these high-demand, special releases that capitalize on the collector market.

- Premium Pricing: Limited editions are sold at a markup, enhancing profit margins.

- Collector Demand: These products tap into the strong desire of dedicated fans to acquire unique items.

- Brand Loyalty: Exclusive releases foster a sense of community and reward loyal customers.

- Sales Boost: They generate spikes in sales and create buzz around new product launches.

Games Workshop's revenue streams are diverse, primarily driven by the sale of their core hobby products like miniatures and paints. Licensing intellectual property for video games and media further diversifies their income. Additionally, digital subscriptions and event-related sales contribute significantly to their overall financial performance.

| Revenue Stream | Description | Fiscal Year 2024 (ended May 26, 2024) Contribution |

| Core Product Sales | Miniatures, paints, tools, books | Primary revenue driver; total group revenue £490.5 million |

| Licensing Royalties | Third-party games, media adaptations | Growing segment, boosted by titles like Warhammer 40,000: Space Marine 2 |

| Digital Subscriptions | Warhammer+ content | Increasingly vital, contributing to overall revenue growth |

| Events and Merchandise | Ticket sales, event-exclusive items | Community engagement and direct sales |

| Limited Editions | Special, high-demand collectibles | Capitalizes on collector market, driving premium sales |

Business Model Canvas Data Sources

The Games Workshop Group Business Model Canvas is built upon a foundation of financial disclosures, market research reports, and internal operational data. These sources ensure each block accurately reflects the company's current strategy and market position.