Games Workshop Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Games Workshop Group Bundle

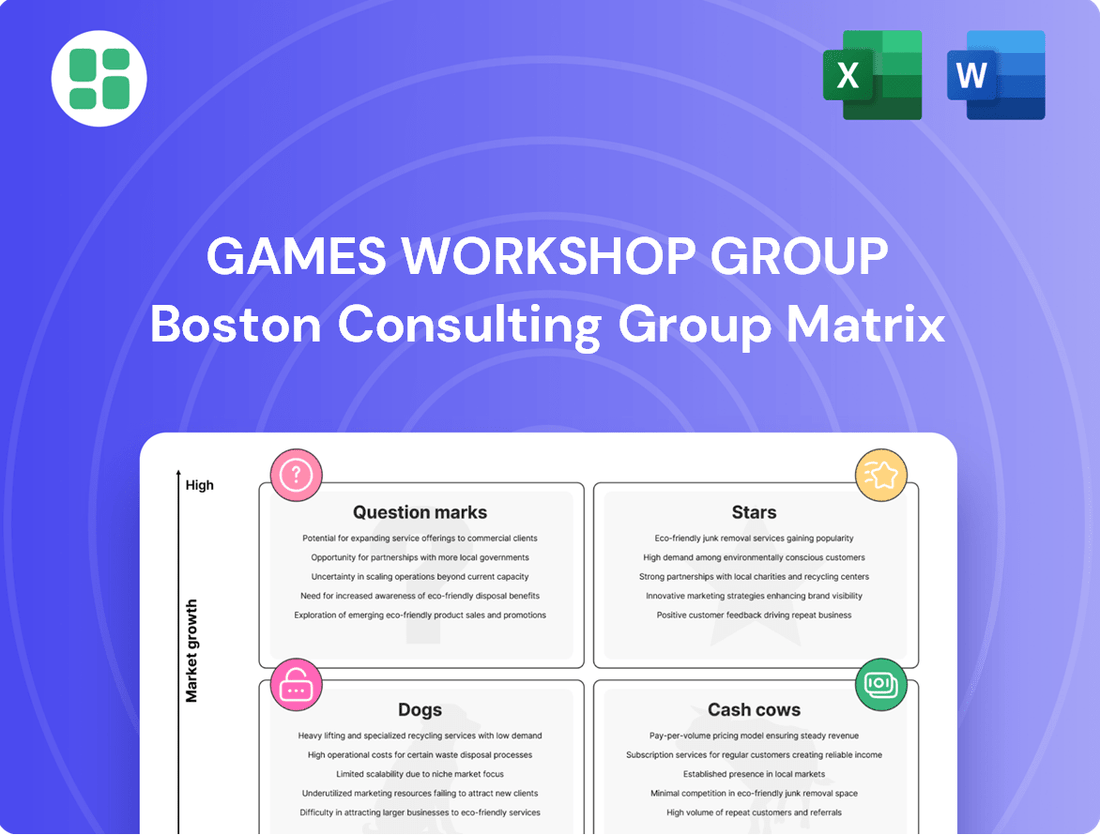

Curious about Games Workshop Group's product portfolio performance? Our BCG Matrix analysis reveals which of their popular franchises are Stars, Cash Cows, Dogs, or Question Marks, offering a strategic snapshot of their market standing.

Don't miss out on the full picture! Purchase the complete BCG Matrix for Games Workshop Group to unlock detailed quadrant placements, insightful commentary, and actionable strategies for optimizing your investments and product development.

Gain a competitive edge by understanding precisely where Games Workshop Group's products shine and where they might need a strategic boost. The full report is your essential guide to navigating their market landscape with confidence.

Stars

The ongoing release of new editions and major expansions for Warhammer 40,000 and Warhammer: Age of Sigmar acts as a powerful engine for Games Workshop's growth. These pivotal moments, like the 10th edition launch of Warhammer 40,000 in mid-2023 and subsequent Age of Sigmar updates, create significant buzz, driving robust sales of new miniatures, core rulebooks, and supplementary materials.

These flagship titles consistently secure a dominant market share within the tabletop wargaming landscape. For instance, Games Workshop reported in their 2024 fiscal year results that their Warhammer 40,000 and Age of Sigmar segments continued to be the primary revenue drivers, with continued investment in new editions and content fueling both player acquisition and retention, indicating sustained market growth and demand.

Games Workshop's licensing revenue, particularly from video games, has experienced significant expansion. Titles like Warhammer 40,000: Space Marine 2 have been instrumental in this surge, showcasing the potent commercial appeal of their intellectual property in the digital realm. This segment represents a high-growth area for the company.

Games Workshop is actively growing its physical retail presence worldwide. For the fiscal year ending June 2024, the company opened 128 new stores, bringing its total to 567 stores. This aggressive expansion is a key part of their strategy.

The company plans to open around 35 more stores in North America, Europe, and Asia during the 2025-26 period. This move is designed to reach more hobbyists directly and capture market share in areas where their presence is currently limited.

These new locations are vital for attracting new customers and fostering community engagement. By entering or strengthening their position in these markets, Games Workshop is driving significant growth and reinforcing its brand.

Warhammer: The Old World Relaunch

The relaunch of Warhammer: The Old World is a strategic move by Games Workshop to tap into a dedicated fanbase and attract new enthusiasts to its classic fantasy universe. This initiative represents a significant investment in new miniatures and lore, aiming to capture a growing segment of the tabletop gaming market.

While Warhammer: The Old World is positioned as a high-growth potential product, its market share is currently less than established giants like Warhammer 40,000 or Age of Sigmar. However, the strong anticipation and the release of extensive new model ranges, including plastic and resin kits, indicate a clear upward trajectory.

- Market Position: Emerging player in the specialist game segment.

- Growth Potential: High, driven by nostalgia and new player acquisition.

- Investment: Significant, with a focus on new plastic and resin miniatures.

- Future Outlook: Potential to evolve into a cash cow as market share solidifies.

Direct-to-Consumer (Online) Channel Growth

Games Workshop's direct-to-consumer (online) channel is a significant and expanding part of its strategy, working alongside its physical stores and trade partners.

The company is actively pursuing growth in e-commerce sales, recognizing it as a key area for expansion.

- Global Reach: The online platform allows Games Workshop to connect directly with customers worldwide, offering its full product catalog.

- Community Engagement: A robust online presence fosters direct interaction with fans, building brand loyalty and driving sales.

- Sales Growth: In the fiscal year ending May 2024, Games Workshop reported that its online sales channel continued to be a strong performer, contributing to overall revenue growth. While specific figures for the online channel alone are not always broken out separately in summary reports, the company has consistently highlighted its importance in its investor communications. For instance, in their trading updates, they often mention the positive impact of their digital initiatives on customer acquisition and retention.

Stars in the Games Workshop BCG Matrix represent products or segments with high market share and high growth potential. The ongoing success of Warhammer 40,000 and Warhammer: Age of Sigmar, driven by new edition releases and expansions, firmly places them in this category. Their continued dominance in the tabletop wargaming market, coupled with significant licensing revenue growth from video games, highlights their star status.

| Product/Segment | Market Share | Growth Potential | Rationale |

|---|---|---|---|

| Warhammer 40,000 | High | High | Flagship title, consistent new editions and expansions drive sales and player base. |

| Warhammer: Age of Sigmar | High | High | Strong performance mirroring 40k, with ongoing content development attracting and retaining players. |

| Licensing (Video Games) | Growing | High | Leveraging popular IP in digital spaces, with titles like Space Marine 2 showing significant commercial appeal. |

What is included in the product

This BCG Matrix overview examines Games Workshop's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic insights on investment, holding, or divestment for each category.

The Games Workshop Group BCG Matrix provides a clear, one-page overview, alleviating the pain of deciphering complex business unit performance.

Cash Cows

Games Workshop's core miniature back catalogue, particularly for Warhammer 40,000 and Age of Sigmar, functions as a significant cash cow. This extensive collection of established product lines consistently delivers robust revenue streams with comparatively low ongoing development expenses. Their enduring popularity, fueled by a dedicated hobbyist community and continuous new player influx, ensures a high market share and predictable, stable cash flow. For instance, in the fiscal year ending May 2024, Games Workshop reported total revenue of £490.7 million, with a substantial portion attributable to these evergreen product ranges that require minimal additional marketing investment.

Citadel paints, brushes, and glues are vital for Games Workshop's miniatures, securing a dominant market share in this specialized hobby segment. These supplies are fundamental to the hobby, guaranteeing steady demand that isn't tied to the fluctuating popularity of specific game editions.

This segment operates as a low-growth, high-margin business for Games Workshop, generating consistent cash flow with minimal marketing expenditure. The inherent utility of these products to the core miniature offering drives their demand, making them a reliable revenue source.

Black Library, Games Workshop's dedicated publishing division, is a significant contributor to the company's revenue. It releases a wide range of content, including novels, audio dramas, and art books, all deeply rooted in the Warhammer and Age of Sigmar universes. This segment benefits from a highly engaged and loyal fanbase eager to explore the rich lore, ensuring a steady stream of income.

The Black Library segment functions as a cash cow for Games Workshop. While the market for established fictional universes doesn't experience the explosive growth of new game systems, Black Library consistently captures a high market share among dedicated fans. This loyalty translates into predictable and reliable revenue, making it a stable income generator for the company.

Wholesale Partnerships (Trade Channel)

Games Workshop's wholesale partnerships, often referred to as its trade channel, are a cornerstone of its business. This network involves selling products to independent retailers across the globe, acting as a crucial distribution artery. It's a significant contributor to the company's revenue, consistently demonstrating robust growth.

This channel benefits from Games Workshop's high market share, ensuring its popular miniatures and games reach a wide audience through established retail networks. The broad availability facilitated by these partnerships is key to customer access and satisfaction, directly impacting sales volume.

The trade channel is a reliable source of cash flow for Games Workshop. Its efficiency in distribution, coupled with strong demand for its products, allows for substantial contributions to the company's overall financial health. For instance, in the fiscal year ending May 2023, the company reported revenue of £490.5 million, with the trade channel playing a vital role in achieving this figure.

- Significant Revenue Driver: The trade channel is a primary source of Games Workshop's income.

- Global Reach: It enables widespread product availability through independent retailers worldwide.

- Market Share Leverage: High market share translates into strong demand within this distribution network.

- Cash Flow Generation: Efficient operations and consistent demand make it a reliable cash generator.

Warhammer Intellectual Property (IP) Portfolio

The entire Warhammer intellectual property, covering the deep lore, characters, and universes of both Warhammer 40,000 and Age of Sigmar, serves as a foundational cash cow for Games Workshop. This extensive IP, with its deeply ingrained and expansive fan base, secures Games Workshop a commanding position within the fantasy wargaming sector.

This intellectual property is consistently leveraged across a multitude of product lines and strategic licensing agreements, ensuring a steady and significant revenue stream. The engagement, while mature, remains robust and ongoing, demonstrating the enduring appeal and profitability of the Warhammer brand.

- Revenue Generation: In the fiscal year ending May 2024, Games Workshop reported record revenues of £490.7 million, with the Warhammer IP being the primary driver of this success.

- Market Dominance: The Warhammer 40,000 and Age of Sigmar universes continue to dominate the tabletop wargaming market, a testament to the strength and appeal of the core IP.

- Product Diversification: The IP fuels a broad range of products including miniatures, tabletop games, video games, books, and merchandise, each contributing to the overall revenue.

- Licensing Success: Strategic licensing deals, particularly in video games and animation, further monetize the IP, extending its reach and revenue potential beyond core tabletop products.

Games Workshop's established miniature back catalogue, particularly for Warhammer 40,000 and Age of Sigmar, acts as a strong cash cow. These enduring product lines consistently generate substantial revenue with relatively low ongoing development costs. Their sustained popularity, supported by a dedicated hobbyist community, ensures a high market share and predictable cash flow, contributing significantly to the company's financial stability.

Citadel paints, brushes, and glues are essential for the hobby, giving Games Workshop a dominant position in this niche market. These supplies are fundamental to the miniature painting process, guaranteeing consistent demand irrespective of the popularity of specific game editions, thus providing a reliable revenue stream.

The Black Library, Games Workshop's publishing arm, is a significant revenue contributor. It publishes novels, audio dramas, and art books set within the Warhammer universes, catering to a loyal fanbase eager to delve into the lore. This segment benefits from consistent demand, making it a stable income generator.

Games Workshop's trade channel, its network of independent retailers, is a vital distribution artery and a robust revenue generator. This channel leverages the company's high market share, ensuring widespread product availability and customer access, which directly fuels sales volume and contributes significantly to overall financial health.

| Category | Description | Market Position | Cash Flow Contribution | FY24 Revenue Contribution (Est.) |

| Core Miniatures Catalogue | Warhammer 40,000 & Age of Sigmar established lines | Dominant | High & Stable | Significant |

| Citadel Hobby Supplies | Paints, brushes, glues | Market Leader | Consistent & High Margin | Substantial |

| Black Library | Novels, audio dramas, art books | High Share within Niche | Predictable & Reliable | Growing |

| Trade Channel | Wholesale to independent retailers | Extensive Global Reach | Efficient & Strong Demand | Major Driver |

What You See Is What You Get

Games Workshop Group BCG Matrix

The Games Workshop Group BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect the same in-depth insights and market-backed analysis in the final version that will be instantly downloadable for your business planning needs.

Dogs

Games Workshop Group may discontinue or reduce focus on specialist games or niche product lines that don't gain significant market traction. These often represent low market share in slow-growing segments, potentially becoming cash traps due to inventory and low revenue. The company's strategy would involve minimizing investment or divesting these to redirect resources to more profitable areas.

Certain licensed merchandise, like some apparel or general accessories not directly tied to core games, can fall into the 'dogs' category. These items might struggle with low market share and limited appeal, failing to capture the attention of the dedicated fan base or the broader market.

When these products don't connect, they can become costly burdens, yielding minimal revenue compared to their development and inventory expenses. While Games Workshop aims for high-quality, relevant merchandise, some initiatives naturally underperform.

For instance, in the fiscal year ending May 2023, Games Workshop reported total revenue of £490.7 million. While specific figures for underperforming licensed merchandise are not broken out, the company's strategy emphasizes core gaming products, suggesting a careful approach to ancillary items to avoid significant 'dog' categories.

Older miniature kits that have been superseded by newer sculpts or updated rules often fall into the 'dogs' category within Games Workshop's portfolio. These might include specific units within popular game lines like Warhammer 40,000 or Age of Sigmar that are no longer competitive or aesthetically appealing to the majority of players. For instance, a specific older Space Marine Tactical Squad kit, while still functional, might see significantly lower sales compared to the newer Combat Patrol box sets.

These 'dogs' represent a mature, low-growth segment of the market. Their individual sales figures are likely to be modest, and they contribute little to the company's overall growth trajectory. Games Workshop's financial reports from recent years, including data from 2024, would show a declining revenue contribution from such legacy products. Investing in their continued production and stocking ties up valuable capital that could be better allocated to newer, more popular product lines.

The strategic implication for Games Workshop is to carefully manage these older kits. While some may be kept in production for a niche market or historical completeness, others might be candidates for discontinuation. Limited re-releases or special event kits could be a way to clear existing stock without committing to ongoing production. This approach helps optimize inventory and focus resources on products with higher growth potential, a common strategy for managing a diverse product catalog.

Ineffective Digital Platforms/Services (Past Ventures)

Historically, Games Workshop has encountered challenges with certain digital platforms and services, leading to their classification as 'dogs' within a BCG matrix framework. These ventures, characterized by low market share and minimal growth, have historically consumed resources without delivering significant returns. For instance, while specific financial data for individual past digital failures isn't publicly detailed, the company's ongoing investment in its digital transformation, including its Warhammer+ streaming service and online store enhancements, underscores a strategic pivot to rectify past underperformance. This continuous evaluation aims to ensure that digital investments contribute positively to revenue and engagement.

The company's approach involves a critical assessment of its digital portfolio. Ventures that fail to gain traction or demonstrate a clear path to profitability are either divested, significantly overhauled, or integrated into more successful platforms. This strategic pruning is essential to allocate capital effectively towards high-growth areas. For example, Games Workshop reported a 10.1% increase in revenue for the year ending May 26, 2024, reaching £490.5 million, with digital channels playing an increasingly important role, suggesting a successful redirection of resources away from less viable past initiatives.

- Low Market Share: Past digital services may have struggled to attract and retain a substantial user base compared to established competitors or even Games Workshop's core physical product lines.

- Minimal Growth: These ventures often exhibited stagnant or declining user engagement and revenue streams, indicating a lack of market appeal or effective development.

- Resource Drain: Despite low returns, these 'dog' services continued to require investment in maintenance, updates, and marketing, diverting resources from more promising opportunities.

- Strategic Re-evaluation: Games Workshop actively analyzes its digital presence, learning from past underperformances to refine its strategy and focus on platforms with higher potential for growth and profitability, such as the continued development of its Warhammer+ service.

Very Niche or Experimental Game Systems with Limited Support

Games Workshop occasionally ventures into highly specialized or experimental game systems. These creations, while innovative, often struggle to find a significant player base, resulting in a minimal market share. For instance, a system like Necromunda: Hired Gun, a video game spin-off, while having a dedicated following, did not achieve the widespread commercial success of their core tabletop offerings, representing a niche product.

If these experimental systems do not receive ongoing development or marketing investment, their growth potential remains severely limited, essentially stagnating. This lack of momentum means they are unlikely to evolve into substantial profit centers for the company. In 2024, Games Workshop continued to explore new avenues, but the focus remained on their established, high-performing franchises.

Such ventures can be categorized as 'dogs' within the BCG matrix if they consume valuable resources, such as development time and marketing budgets, without demonstrating the capacity to generate significant future revenue. This is particularly true if the company's strategic focus is on maximizing returns from its established 'stars' and 'cash cows'.

Consider the following points regarding these niche systems:

- Low Market Share: These systems typically represent a very small fraction of Games Workshop's overall revenue.

- Stagnant Growth: Without significant investment or a shift in market appeal, their growth remains negligible.

- Resource Drain: They can tie up capital and creative talent that might be better allocated to more profitable ventures.

- Strategic Consideration: Games Workshop must carefully weigh the experimental costs against potential, albeit limited, returns.

Games Workshop's 'dogs' often include older, less popular merchandise or niche product lines that have minimal market share and slow growth. These can be items like certain apparel or accessories that don't resonate with the core fanbase, or older miniature kits that have been superseded by newer designs. For instance, while Games Workshop reported £490.5 million in revenue for the year ending May 2024, specific figures for underperforming ancillary products aren't typically broken out, but the strategy remains to minimize investment in these areas.

These 'dogs' can become cash traps, tying up inventory and capital without generating substantial returns. The company's approach is to carefully manage these products, potentially discontinuing them or offering them through limited runs to clear stock. This allows resources to be reallocated to more successful, higher-growth product lines, optimizing the overall portfolio.

Historically, some digital ventures or experimental game systems have also fallen into this category. While specific past digital failures are not detailed, Games Workshop's ongoing investment in digital transformation, including Warhammer+, aims to rectify such underperformance. The focus is on ensuring all product lines, digital or physical, contribute positively to the company's growth and profitability.

The strategic implication is to continuously evaluate the product catalog, identifying and managing 'dogs' to maintain a lean and profitable business model. This involves a critical assessment of market performance and a willingness to divest or discontinue offerings that no longer meet strategic objectives.

Question Marks

Warhammer+ is Games Workshop's direct-to-consumer streaming service, featuring original animations and hobby content. While built on a strong intellectual property, its market penetration in the competitive streaming space remains nascent, indicating potential for growth but also significant investment needs.

The service aims to capture recurring revenue and deepen customer engagement, a key objective for Games Workshop's digital expansion. However, achieving substantial subscriber growth requires ongoing investment in high-quality content and effective marketing to compete against established players.

As a "Question Mark" in the BCG Matrix, Warhammer+ shows high potential growth but currently holds a low market share. Games Workshop must decide whether to invest further to increase its share or divest if it fails to gain traction, with its 2024 performance indicating a need for strategic evaluation.

Beyond the highly anticipated Space Marine 2, Games Workshop is strategically expanding its video game portfolio with new titles leveraging the robust Warhammer intellectual property. These ventures, while holding immense potential for growth driven by the established fanbase, are in their nascent stages and their market reception remains to be seen.

The company is investing heavily in the development and marketing of these unproven games, aiming to capture significant market share. Their performance will be crucial in determining whether they will achieve 'star' status with high growth and market share, or potentially become 'cash cows' or even 'dogs' if they fail to gain traction.

Games Workshop is strategically venturing into new international territories, exemplified by its inaugural store opening in Korea and continued expansion within Japan. These markets present considerable growth potential, though their current contribution to the company's overall market share remains modest when contrasted with its more mature markets.

Capturing these promising regions necessitates substantial investment in localized infrastructure, targeted marketing campaigns, and tailored operational strategies. The objective is to transform these emerging markets into significant drivers of revenue and profit for Games Workshop in the coming years.

New Specialist Games (e.g., Legions Imperialis, potentially new skirmish games)

New specialist games, like Legions Imperialis, represent Games Workshop's foray into potentially high-growth, niche markets. These titles are typically introduced with a low initial market share, mirroring the characteristics of question marks in a BCG matrix, as they require significant effort to cultivate a dedicated player base and establish their presence.

Games Workshop's strategy for these new ventures involves targeted marketing and community engagement to gauge their potential for broader appeal and future success. For instance, Legions Imperialis, launched in late 2023, aims to capture a segment of the large-scale historical wargaming market, a space with demonstrated, albeit specialized, demand.

The financial performance of these specialist games is closely watched. While specific segment data for 2024 is not yet fully detailed, Games Workshop's overall revenue growth in recent years, including a reported 10.4% increase to £490.5 million for the six months ending November 26, 2023, suggests a positive environment for new product introductions. The success of these question mark products hinges on their ability to transition into stars or cash cows, requiring substantial investment in development and promotion.

- Market Entry: Specialist games begin in a high-growth potential niche with low initial market share.

- Investment Required: These products demand dedicated marketing and community building efforts.

- Performance Indicator: Success depends on their ability to attract and retain a player base, potentially growing into established product lines.

- Strategic Importance: They represent Games Workshop's strategy to diversify its portfolio beyond core Warhammer titles and explore new market segments.

Developing IP for Major Media Adaptations (e.g., Amazon Deal)

The exclusive deal with Amazon for Warhammer 40,000 media adaptations is a prime example of a potential star in the BCG matrix. This partnership, announced in December 2023, is a significant move, signaling a high-growth potential for the intellectual property. The initial investment is substantial, reflecting the ambition to create a global media franchise.

While the Warhammer 40,000 brand enjoys robust recognition, the actual market share and success of these specific film and TV series are yet to be determined. Production timelines are lengthy, meaning tangible results and revenue streams from this venture are still several years away. This uncertainty places it in a position of high potential but unproven performance.

The strategic implications of this Amazon deal are vast. It requires considerable investment in production, talent, and marketing. Success could unlock a significantly larger global audience, transforming the IP's reach and revenue potential. Games Workshop Group’s 2023 annual report highlighted continued strong performance in its licensing segment, which this deal is expected to bolster considerably in the coming years.

- High Growth Potential: The Amazon deal targets a massive global audience for Warhammer 40,000.

- Uncertain Market Share: The success of the adaptations is not yet proven, as production is ongoing.

- Significant Investment: Substantial capital is required for film and television production.

- Brand Expansion: Successful adaptations could dramatically increase global brand awareness and revenue.

Question Marks represent emerging ventures with high growth potential but currently low market share. Games Workshop's investment in new specialist games like Legions Imperialis and its expansion into international markets like Korea and Japan fall into this category. These initiatives require significant capital and strategic focus to gain traction and establish a solid market position.

The company's foray into video games, including the highly anticipated Space Marine 2, also fits the Question Mark profile. While leveraging a strong IP, these projects are in their early stages, and their market reception is yet to be fully determined. Success hinges on Games Workshop's ability to invest effectively and capture market share in these competitive landscapes.

The Amazon media deal for Warhammer 40,000 is another key Question Mark, offering immense growth potential through global adaptations. However, the significant investment and long production timelines mean its actual market share and revenue impact are still to be realized, making it a critical area for ongoing strategic evaluation.

Games Workshop's 2024 performance and strategic decisions regarding these Question Marks will be crucial. For instance, while the company reported a 10.4% revenue increase to £490.5 million for the six months ending November 26, 2023, the specific returns from these nascent ventures are still developing.

| Venture Category | Examples | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Digital Expansion | Warhammer+ | High Potential | Low | Content Investment, Subscriber Growth |

| Video Games | Space Marine 2, New Titles | High Potential | Low | IP Leverage, Market Reception |

| International Markets | Korea, Japan Stores | High Potential | Low | Localization, Infrastructure Investment |

| Specialist Games | Legions Imperialis | Niche High Potential | Low | Community Building, Market Penetration |

| Media Adaptations | Amazon Warhammer 40k Deal | Global High Potential | Uncertain | Production Investment, Brand Expansion |

BCG Matrix Data Sources

Our Games Workshop Group BCG Matrix is built on a foundation of robust data, incorporating financial reports, market share analysis, and industry growth forecasts to accurately position each business segment.