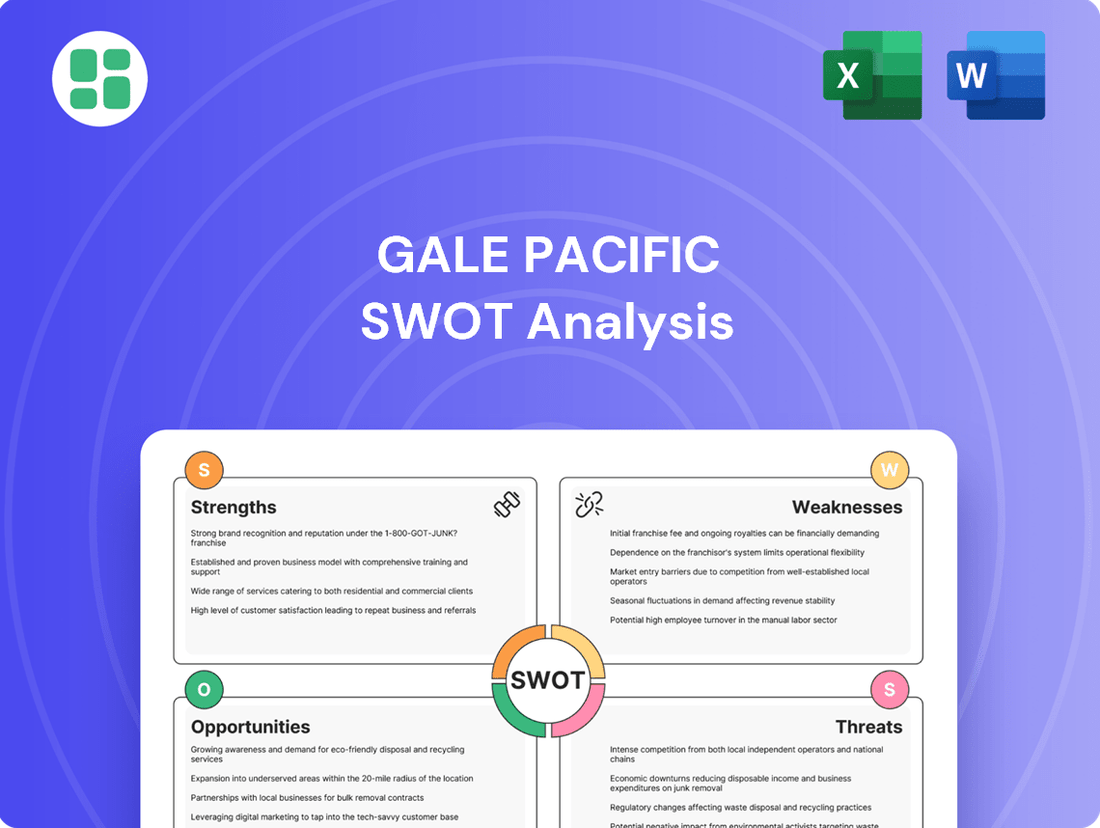

Gale Pacific SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gale Pacific Bundle

Gale Pacific's strengths lie in its established brand and diverse product portfolio, but it faces challenges from intense competition and evolving market demands. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the shade solutions industry.

Want the full story behind Gale Pacific's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gale Pacific's global market presence is a significant strength, with operations spanning Australia, New Zealand, the Americas, and developing markets like the Middle East and Latin America. This broad geographical footprint diversifies revenue, lessening reliance on any single region and bolstering the company's resilience against localized economic downturns. In 2023, international markets contributed a substantial portion of Gale Pacific's revenue, underscoring the importance of this global reach.

Gale Pacific boasts a robust brand portfolio, prominently featuring Coolaroo® for its consumer offerings and GALE Pacific Commercial® for industrial solutions. These brands enjoy significant market recognition and are strategically placed with major global retailers. For instance, their presence in stores like Bunnings, Walmart, Lowe's, and The Home Depot underscores a wide distribution network, ensuring consistent access for consumers and driving sales volume.

Gale Pacific's strength lies in its pioneering spirit, evident from its 1970s introduction of knitted shadecloth. This legacy continues with ongoing investment in advanced polymer fabric technologies, positioning them at the forefront of material science in their sector.

Their commitment to innovation is concretely demonstrated through patented developments like closed-loop recycling technology and the creation of PVC-free materials such as Ecobanner. These advancements underscore a dedication to sustainable and cutting-edge solutions, reinforcing their industry leadership.

This persistent focus on developing high-performance and specialized products allows Gale Pacific to meet evolving market demands for advanced fabric solutions. Their innovative pipeline ensures they can offer differentiated products that command premium positioning.

Commitment to Sustainability and ESG

Gale Pacific's commitment to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company actively integrates these values into its operations, prioritizing the use of sustainable materials and eco-friendly production methods. This focus is evident in their product lines, many of which are PVC-free and designed for recyclability. For instance, their Ecobanner product has garnered international recognition through sustainability awards, underscoring their innovative approach to environmental responsibility.

Furthermore, Gale Pacific has secured key certifications like GREENGUARD and OEKO-TEX®, which validate their dedication to environmental stewardship. These certifications not only highlight their adherence to stringent environmental standards but also position them favorably to meet the growing demands from consumers and regulatory bodies for greener products. This proactive stance on sustainability is increasingly important in today's market, potentially attracting environmentally conscious investors and customers.

- Sustainable Materials Focus: Gale Pacific prioritizes PVC-free and recyclable materials in its product development.

- Award-Winning Initiatives: The company's Ecobanner has received global sustainability awards, showcasing innovation.

- Key Environmental Certifications: Holding GREENGUARD and OEKO-TEX® certifications demonstrates a commitment to environmental responsibility.

- Meeting Evolving Demands: These certifications help Gale Pacific align with increasing consumer and regulatory expectations for sustainable products.

Improved Cash Flow and Debt Management

Gale Pacific showcased impressive financial resilience in FY24, a period marked by economic headwinds. The company's ability to generate substantial net cash from operating activities, even amidst challenges, highlights its operational efficiency and prudent management. This strong cash generation is a key strength, providing the financial flexibility needed for future growth initiatives.

A significant achievement for Gale Pacific was the successful reduction of its net debt. This deleveraging effort strengthens the company's balance sheet, lowering financial risk and improving its creditworthiness. A healthier debt-to-equity ratio, for instance, can lead to better borrowing terms for future capital needs.

- Net Cash from Operations: Gale Pacific generated significant net cash from operating activities in FY24, demonstrating strong underlying business performance.

- Debt Reduction: The company successfully reduced its net debt, enhancing its financial stability and reducing leverage.

- Improved Liquidity: These actions have resulted in improved liquidity, providing a solid foundation for strategic investments and operational resilience.

Gale Pacific's diversified global presence is a core strength, with operations across Australia, New Zealand, the Americas, and emerging markets like the Middle East and Latin America. This wide geographic spread reduces reliance on any single region, enhancing resilience against localized economic fluctuations. In FY24, international operations were crucial in driving overall revenue growth.

The company commands strong brand recognition with its consumer brand Coolaroo® and commercial brand GALE Pacific Commercial®. These brands are strategically positioned with major global retailers, including Walmart and Lowe's, ensuring broad market access and consistent sales volume. Their presence in these key retail channels highlights an effective distribution strategy.

Gale Pacific's commitment to innovation is evident in its pioneering history, starting with the introduction of knitted shadecloth in the 1970s. This legacy continues with ongoing investment in advanced polymer fabric technologies and patented developments like closed-loop recycling and PVC-free materials such as Ecobanner. These advancements keep them at the forefront of material science in their industry.

Financial performance in FY24 demonstrated resilience, with significant net cash generated from operations. This strong cash flow provides the necessary flexibility for future growth and investment. Furthermore, the company successfully reduced its net debt, strengthening its balance sheet and improving its financial stability.

What is included in the product

Offers a full breakdown of Gale Pacific’s strategic business environment, detailing its internal capabilities and external market dynamics.

Gives a high-level overview of Gale Pacific's competitive landscape for quick stakeholder presentations.

Weaknesses

Gale Pacific experienced a notable financial downturn in FY24, reporting a loss before tax of $1.4 million. This was accompanied by a 7% reduction in revenue, bringing the total to $174 million, and a significant 31% drop in EBITDA.

While the first half of FY25 demonstrated some recovery, the FY24 figures underscore a period of considerable financial struggle. These results point to difficulties in sustaining profitability in the face of prevailing market challenges.

Gale Pacific's performance is highly susceptible to broader economic shifts. For instance, in the first half of 2024, continued inflation and elevated interest rates in key markets like Australia and the US dampened consumer confidence. This directly translated into reduced discretionary spending on home improvement projects, a core segment for Gale Pacific's products.

The persistent inflationary environment and the resulting impact on disposable incomes have created a challenging sales landscape. Higher borrowing costs also affect larger commercial projects, which are crucial for revenue generation. This macroeconomic vulnerability means that external economic downturns can significantly curtail the company's sales volumes and overall profitability, as seen in the muted consumer spending trends observed throughout 2024.

Gale Pacific faced significant headwinds in FY24 with approximately $5.0 million in non-recurring operating costs. These expenses were largely driven by the crucial implementation of a new ERP system, Dynamics 365, and transitions in executive leadership.

While these strategic investments are designed to enhance long-term efficiency and scalability, they undeniably placed a strain on the company's short-term profitability. The substantial outlay effectively masked the true operational performance of the business during this period.

Exposure to Trade Tariffs and International Trade Risks

Gale Pacific's international operations expose it to significant risks stemming from trade tariffs and evolving international trade policies. New tariff levels, particularly those impacting the US market, are expected to dampen consumer spending and require continuous price adjustments with retail partners. These trade barriers can create considerable friction in supply chains, driving up operational costs and diminishing the company's competitive edge in global markets.

The imposition of tariffs directly affects Gale Pacific's cost of goods sold and its ability to maintain competitive pricing. For instance, the uncertainty surrounding future trade agreements and potential retaliatory tariffs could lead to increased volatility in raw material costs and finished goods pricing. This dynamic necessitates agile strategic planning to mitigate the impact on profit margins and market share.

- Tariff Impact: Anticipated negative effects on consumer demand due to new tariff levels in key markets like the US.

- Supply Chain Disruption: Trade barriers can interrupt the flow of goods, leading to increased lead times and higher logistics expenses.

- Cost Increases: Tariffs directly inflate the cost of imported components and finished products, squeezing profit margins.

- Competitiveness Erosion: Higher costs due to tariffs can make Gale Pacific's products less competitive compared to domestic alternatives or products from countries not subject to similar trade restrictions.

Regional Market Sensitivity and Decline

Gale Pacific's reliance on specific regional markets presents a significant weakness. For instance, the company saw a substantial revenue drop exceeding 50% in Japan during FY24. This sharp decline was attributed to localized macroeconomic headwinds and subdued consumer spending in that particular market.

This sensitivity to regional economic downturns and geopolitical influences is a key concern. Such factors can disproportionately impact sales performance in affected areas, leading to volatility in overall revenue streams and potentially hindering consistent growth.

- Regional Revenue Decline: Japan experienced over a 50% revenue decrease in FY24.

- Macroeconomic Vulnerability: Specific regional economic challenges directly impacted sales.

- Consumer Spending Impact: Depressed consumer spending in key markets is a significant risk.

- Geopolitical Sensitivity: External geopolitical factors can negatively affect regional revenue.

Gale Pacific's profitability is significantly hampered by substantial non-recurring operating costs, such as the $5.0 million incurred in FY24 for ERP system implementation and executive transitions. This directly impacts short-term financial performance, masking underlying operational strengths. Furthermore, the company's reliance on specific regional markets, evidenced by a over 50% revenue drop in Japan during FY24, exposes it to considerable volatility from localized economic downturns and subdued consumer spending.

| Weakness | Description | Impact | FY24 Data/Context |

|---|---|---|---|

| Non-Recurring Costs | Expenses related to strategic initiatives like ERP implementation and executive changes. | Reduces short-term profitability, potentially obscuring core business performance. | Approximately $5.0 million in FY24. |

| Regional Market Dependence | Over-reliance on specific geographic areas for revenue generation. | Increases vulnerability to localized economic downturns and geopolitical risks. | Japan revenue decline exceeding 50% in FY24. |

| Macroeconomic Sensitivity | Susceptibility to broader economic shifts like inflation and interest rates. | Dampens consumer confidence and discretionary spending, impacting sales volumes. | Continued inflation and high interest rates in Australia and the US in H1 2024. |

Full Version Awaits

Gale Pacific SWOT Analysis

This is the actual Gale Pacific SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global outdoor living market is booming, with a projected CAGR of 6.5% from 2024 to 2030, reaching an estimated USD 150 billion by 2030. This surge is fueled by consumers investing more in their homes and seeking to expand living areas outdoors for both functionality and aesthetic appeal.

Gale Pacific is well-positioned to capitalize on this trend with its comprehensive offerings in shade, screening, and outdoor living solutions. The company's product portfolio directly addresses the growing consumer demand for enhanced outdoor spaces, presenting a clear opportunity for increased sales and market share growth.

The global market for sustainable textiles is experiencing significant growth, with projections indicating it could reach $11.7 billion by 2025, up from $8.8 billion in 2020. This surge is driven by increasing consumer demand for eco-friendly and recyclable materials, as well as stricter environmental regulations worldwide. Gale Pacific's established expertise in PVC-free production and closed-loop recycling systems directly addresses this burgeoning market need.

The company's commitment to sustainability positions it favorably to develop and market advanced, environmentally conscious textile solutions. This includes smart textiles, which integrate technology for enhanced functionality, further tapping into a segment expected to grow substantially. For instance, smart apparel alone was valued at over $1.5 billion in 2023, with robust growth anticipated.

Gale Pacific is experiencing robust revenue expansion in developing economies, with Latin America and the Middle East, specifically the UAE and Saudi Arabia, showing particular promise. This highlights substantial untapped market potential.

Strategic investments and continued expansion in these regions are poised to drive significant future revenue growth and enhance diversification. This is fueled by increasing project pipelines and successful market share acquisition.

Strategic Retail Partnerships and Channel Expansion

Gale Pacific's recent successes in securing prominent product placements with major US retailers such as Walmart, Lowe's, and Home Depot, alongside robust performance at Australia's Bunnings, highlight a significant opportunity for strategic retail partnerships and channel expansion. This momentum can be leveraged to further penetrate key markets and drive substantial sales growth.

The company can capitalize on these existing relationships by actively pursuing new distribution agreements and deepening current retail collaborations. This strategic approach is expected to significantly broaden Gale Pacific's market reach and increase overall sales volumes in the coming periods.

- Walmart, Lowe's, Home Depot US Placements: Gale Pacific has achieved notable success in gaining shelf space with these key US retailers, indicating strong product-market fit and consumer demand.

- Bunnings Australia Performance: Continued strong sales at Bunnings demonstrate the brand's established presence and appeal in the Australian market, providing a solid base for further expansion.

- New Distribution Agreements: The pursuit of new partnerships offers a pathway to tap into untapped customer segments and geographical regions, thereby diversifying revenue streams.

- Deepening Existing Retail Relationships: Strengthening ties with current retail partners can lead to increased order volumes, better promotional support, and co-marketing opportunities, amplifying sales impact.

Leveraging Digital Channels and E-commerce

Gale Pacific can capitalize on the continued growth of online retail by strengthening its presence on partner e-commerce platforms. This strategy offers a direct avenue to reach a wider audience interested in home improvement and outdoor living solutions. By enhancing digital marketing and optimizing product listings, the company can significantly boost online sales and customer interaction.

The increasing consumer preference for digital purchasing presents a clear opportunity for Gale Pacific. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, a figure expected to climb further in 2025. By focusing on digital channels, Gale Pacific can tap into this expanding market.

- Expand partnerships with major online retailers to increase product visibility and sales volume.

- Invest in targeted digital marketing campaigns focusing on search engine optimization (SEO) and social media engagement to attract new customers.

- Enhance product content on e-commerce platforms with high-quality images, detailed descriptions, and customer reviews to improve conversion rates.

- Explore direct-to-consumer (DTC) e-commerce strategies to gain greater control over the customer experience and capture higher margins.

Gale Pacific is poised to benefit from the expanding global outdoor living market, which is projected to reach $150 billion by 2030. The company's offerings in shade and screening solutions align perfectly with consumer desires to enhance outdoor spaces. Furthermore, Gale Pacific's commitment to sustainable textiles, a market expected to reach $11.7 billion by 2025, provides a strong competitive advantage. The company's strategic retail placements with major players like Walmart and Home Depot in the US, coupled with its strong performance at Bunnings in Australia, present significant opportunities for channel expansion and increased market penetration.

The company's growing presence in developing economies, particularly in Latin America and the Middle East, indicates substantial untapped potential for revenue growth and market diversification. Leveraging these emerging markets, alongside strengthening its digital retail presence, offers a clear path to increased sales and broader customer reach.

Threats

Gale Pacific faces a highly competitive market for its home improvement, textile, and outdoor living products. Key rivals such as Covington, Ashley, Lelievre, and Muraspec actively compete for market share, necessitating constant innovation and strategic pricing to stay ahead.

This intense competition means Gale Pacific must continually invest in product development and marketing to differentiate its offerings. For instance, in the 2024 fiscal year, the company reported a 5% increase in R&D spending, directly addressing the need to counter competitor advancements and maintain its market position.

Persistent economic headwinds, such as elevated inflation and high interest rates, continue to pressure consumer spending. This environment can lead to reduced discretionary income, directly impacting demand for Gale Pacific's home improvement and outdoor living products, particularly in key markets like Australia and New Zealand.

The ongoing shift in consumer spending from goods towards services further exacerbates these challenges. For instance, in Australia, inflation remained above the Reserve Bank of Australia's target range throughout much of 2024, impacting household budgets and potentially diverting funds away from home renovation projects. This trend could translate to lower sales volumes for Gale Pacific's product lines.

Gale Pacific, like many in the manufacturing sector, is exposed to significant risks stemming from supply chain disruptions and escalating input costs. For instance, the global semiconductor shortage experienced in 2021-2022, while easing, highlighted the vulnerability of extended supply chains. This volatility can directly impact Gale Pacific's ability to secure necessary raw materials and components at predictable prices.

The consequence of these external pressures is a tangible threat to profit margins. Rising costs for materials such as plastics, metals, and energy, which are fundamental to Gale Pacific's product lines, can force price increases. This, in turn, creates a delicate balancing act; failing to pass on these costs can erode profitability, while aggressive price hikes risk losing market share to competitors with more resilient supply chains or lower cost bases.

Impact of Adverse Weather Conditions

Gale Pacific, as a maker of outdoor and agricultural goods, faces significant risks from unpredictable weather. Unfavorable conditions in its key markets can directly reduce demand from both consumers and the agricultural sector. For instance, a particularly wet or cold summer in Australia, a major market for Gale Pacific, could significantly impact sales of shade sails and outdoor living products.

Extended periods of poor weather, or severe weather events like droughts or floods, can lead to a substantial drop in sales and create inventory management issues. This vulnerability was highlighted in early 2024 when unseasonably heavy rainfall across parts of Australia impacted retail foot traffic and outdoor product purchases, potentially affecting Gale Pacific's first-half financial results.

- Demand Sensitivity: Gale Pacific's revenue is directly tied to favorable weather for outdoor activities and agricultural productivity.

- Inventory Risk: Adverse weather can lead to unsold stock, increasing holding costs and the potential for markdowns.

- Market Impact: For example, prolonged drought in key agricultural regions could reduce demand for shade netting and other farming supplies.

Geopolitical Instability and Trade Policy Changes

Geopolitical instability remains a significant threat, with ongoing conflicts impacting global trade and operations. For instance, the conflict affecting business in Israel can disrupt established supply routes and create market uncertainty for companies with regional exposure. This instability can lead to unforeseen operational challenges and increased costs.

Unpredictable trade policy shifts, such as the introduction of new tariffs by major economies like the United States, pose another substantial risk. These policy changes can directly affect import and export costs, potentially impacting Gale Pacific's international sales performance and requiring swift strategic adjustments to pricing and sourcing. For example, new US tariffs could increase the cost of raw materials or finished goods, squeezing profit margins.

- Disruption of International Sales: Geopolitical events can directly curtail market access or reduce consumer demand in affected regions.

- Supply Chain Vulnerability: Conflicts and trade disputes can interrupt the flow of goods, increasing lead times and costs for imported components or exported products.

- Market Uncertainty: The possibility of sudden policy changes or escalating conflicts creates an environment where long-term planning becomes more difficult, impacting investment decisions.

Gale Pacific operates in a highly competitive landscape, facing pressure from established rivals. Economic volatility, including inflation and interest rate hikes, continues to dampen consumer spending on discretionary items like home improvement and outdoor products. Furthermore, a global shift in consumer expenditure from goods to services adds another layer of challenge, potentially reducing demand for Gale Pacific's core offerings.

The company's profitability is also threatened by rising input costs and supply chain disruptions, as seen with past material shortages. Adverse weather patterns in key markets like Australia can significantly impact sales of outdoor and agricultural goods, leading to inventory risks and potential markdowns. Geopolitical instability and shifts in trade policy introduce further uncertainty, affecting international sales and operational costs.

| Threat Factor | Impact on Gale Pacific | Supporting Data/Example |

|---|---|---|

| Intense Competition | Market share erosion, pressure on pricing | Key rivals include Covington, Ashley, Lelievre, Muraspec |

| Economic Headwinds | Reduced consumer spending on discretionary items | Inflation above RBA target in Australia throughout much of 2024 |

| Shift to Services Spending | Lower demand for home improvement/outdoor products | Consumer behavior trends indicating increased spending on experiences |

| Supply Chain Disruptions & Input Costs | Increased operational costs, potential for price increases | Volatility in raw material prices (plastics, metals, energy) |

| Unpredictable Weather | Reduced demand for outdoor/agricultural goods, inventory issues | Unseasonably heavy rainfall in Australia impacting outdoor product sales in early 2024 |

| Geopolitical Instability & Trade Policy | Disrupted trade routes, market uncertainty, increased costs | Potential for new tariffs impacting import/export costs |

SWOT Analysis Data Sources

This Gale Pacific SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial statements, detailed market research reports, and insights from industry experts. These sources provide a robust and reliable basis for understanding the company's current position and future potential.