Gale Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gale Pacific Bundle

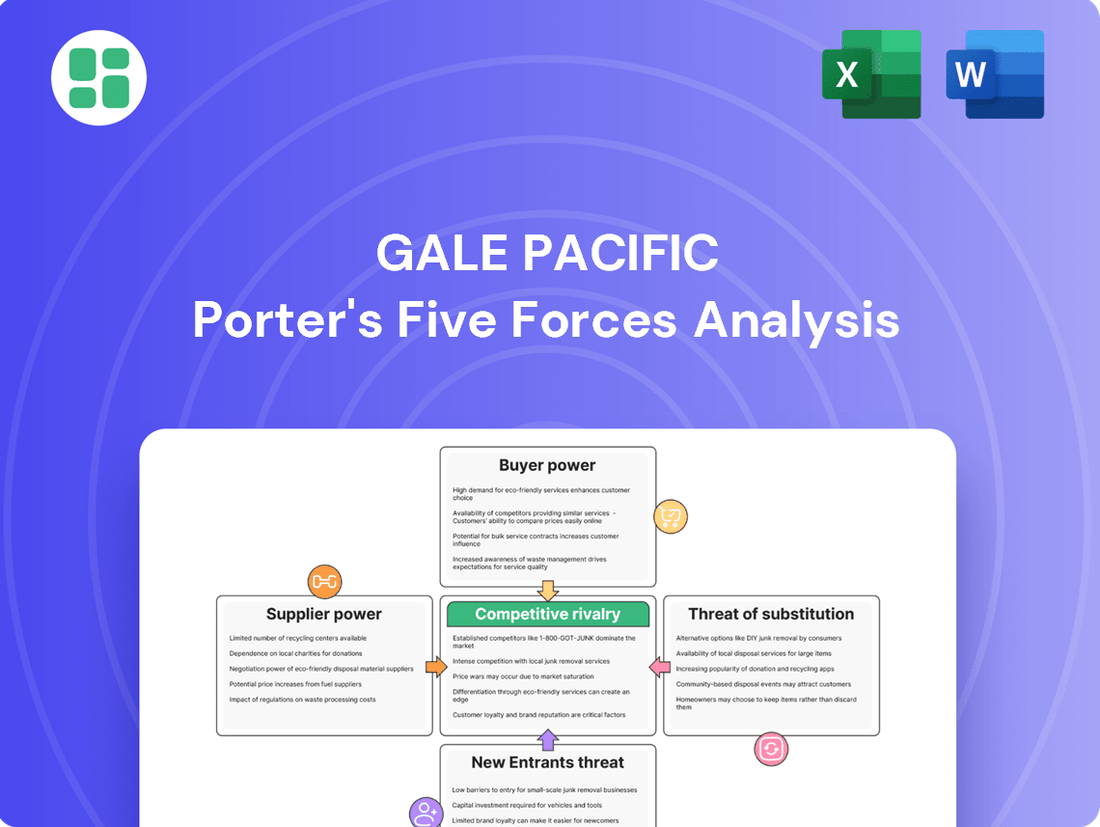

Gale Pacific faces a dynamic competitive landscape, with moderate buyer power and the threat of substitutes influencing its market position. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Gale Pacific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gale Pacific's reliance on specialized polymers and advanced fabrics means its raw material sourcing is concentrated. For instance, in 2024, the global market for high-performance polymers used in advanced textiles saw significant price volatility, with key producers operating in a limited number of regions. This concentration among suppliers of critical inputs grants them considerable bargaining power, potentially driving up costs for Gale Pacific.

Gale Pacific faces challenges due to high switching costs associated with proprietary materials. If suppliers provide specialized fabrics or polymers, changing to a new vendor could mean substantial expenses for Gale Pacific in terms of retooling, rigorous quality testing, and product redesigns. This situation inherently limits Gale Pacific's negotiation leverage with its current suppliers.

If suppliers can easily move into making the final products themselves, they gain a lot of power. For Gale Pacific, this means if a supplier of, say, specialized shade fabrics could start producing the finished screens, they'd become a direct competitor. This possibility means Gale Pacific might have to accept less favorable terms from that supplier.

Impact of Global Supply Chain Disruptions

The ongoing global supply chain disruptions, a persistent issue since 2020, significantly bolster the bargaining power of suppliers. These disruptions have led to shortages of critical raw materials and extended delivery times, forcing companies like Gale Pacific to contend with higher costs and less predictable inventory. For instance, in 2023, many manufacturing sectors experienced an average increase in lead times for key components by over 20% compared to pre-pandemic levels, directly impacting production schedules and increasing reliance on suppliers who can deliver reliably.

Gale Pacific, in particular, has navigated these challenges, reporting in its 2023 annual filings that increased costs of goods sold, partly attributable to supply chain volatility, put pressure on its margins. This situation grants suppliers greater leverage, as they become essential in maintaining production flow. The ability of suppliers to dictate terms, pricing, and delivery schedules becomes more pronounced when alternative sources are scarce or equally affected by global instability.

- Increased Input Costs: Suppliers can command higher prices for raw materials due to scarcity and logistical challenges.

- Extended Lead Times: Delays in material delivery force manufacturers to accept supplier-imposed timelines.

- Reduced Supplier Competition: When many suppliers face similar disruptions, the competitive landscape shifts, empowering those with available stock.

- Impact on Profitability: Higher input costs and production delays directly affect a company's bottom line, giving suppliers more negotiation power.

Differentiated Inputs and Proprietary Technology

Suppliers who provide highly differentiated or patented raw materials and manufacturing technologies possess significant bargaining power. Gale Pacific's reliance on these unique inputs for its innovative product lines, such as its advanced shade fabrics, directly translates into stronger supplier leverage.

Gale Pacific's commitment to innovative and sustainable fabrics means it often requires specialized inputs. This dependence on suppliers who can offer such materials inherently strengthens their position in negotiations.

- Differentiated Inputs: Suppliers offering unique or hard-to-replicate materials can command higher prices or more favorable terms.

- Proprietary Technology: Suppliers with exclusive manufacturing technologies essential for Gale Pacific's product quality and innovation have increased bargaining power.

- Supplier Dependence: Gale Pacific's need for these specialized inputs makes it more vulnerable to supply disruptions or price increases from these key suppliers.

Gale Pacific's bargaining power with suppliers is constrained by its reliance on specialized, proprietary materials. In 2024, the market for high-performance polymers used in advanced textiles experienced notable price fluctuations due to a concentrated supplier base in specific regions. This concentration, coupled with high switching costs for Gale Pacific due to retooling and product redesign, significantly strengthens supplier leverage.

| Factor | Impact on Gale Pacific | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Limited alternative sources for critical polymers | High |

| Switching Costs | Significant expenses for changing suppliers | High |

| Proprietary Materials | Dependence on unique, innovative fabrics | High |

| Global Supply Chain Disruptions (2020-present) | Increased lead times and material costs | High |

What is included in the product

This analysis of Gale Pacific's competitive environment examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly understand competitive pressures with a visual representation of each Porter's Five Forces for Gale Pacific, enabling faster, more informed strategic adjustments.

Customers Bargaining Power

Gale Pacific's customer base is anchored by major retailers such as Bunnings, Walmart, Lowe's, and Home Depot. These industry giants, along with substantial commercial and industrial clients, represent significant purchasing power.

The sheer volume of business these large customers conduct grants them considerable leverage. They can effectively negotiate for lower prices, extended payment terms, and customized product specifications, directly impacting Gale Pacific's profit margins.

Customers in both residential and commercial markets often exhibit significant price sensitivity. This is amplified by the wide array of shade, screening, and outdoor living products available from various competitors, giving buyers ample choice. For instance, in 2024, consumer spending on home improvement, a key driver for residential sales, saw a moderate slowdown compared to previous years due to persistent inflation and higher interest rates, making price a more critical factor in purchasing decisions.

Economic pressures, such as rising inflation and cost of living concerns, directly translate into increased price sensitivity for both individual homeowners and businesses. This heightened sensitivity can force companies like Gale Pacific to absorb higher input costs or risk losing market share. In 2023, the average inflation rate in key markets for Gale Pacific remained elevated, impacting disposable income and business investment budgets, thereby intensifying pressure on product pricing and potentially squeezing profit margins.

Customers seeking outdoor shade and privacy solutions, like those offered by Gale Pacific, benefit from a vast marketplace filled with alternative products and brands. This means consumers can readily compare options from numerous manufacturers of shade sails, outdoor blinds, and architectural fabrics, ensuring they find a solution that fits their specific needs and budget.

The sheer volume of choices empowers customers, as they can easily switch to a competitor if Gale Pacific's pricing, quality, or product features aren't perceived as competitive. For instance, in 2024, the global outdoor furniture market, which includes shade solutions, was valued at approximately USD 28.5 billion, indicating a highly competitive landscape where customer choice is paramount.

Low Switching Costs for Customers

For many of Gale Pacific's consumer-facing products, such as shade sails and outdoor blinds, customers face minimal costs when switching to a competitor. This ease of transition significantly amplifies their bargaining power.

When brand loyalty is not a dominant factor and product differentiation is limited, consumers can readily opt for alternatives. This flexibility means Gale Pacific must remain competitive on price and quality to retain its customer base.

- Low Switching Costs: Customers can easily switch between brands for products like shade sails and outdoor blinds.

- Price Sensitivity: Without strong brand attachment, customers are more likely to choose based on price.

- Competitive Landscape: Gale Pacific operates in markets where alternatives are readily available, increasing customer leverage.

Customer's Potential for Backward Integration (Large Scale)

While typically a significant hurdle, exceptionally large commercial clients or major retailers might explore backward integration. This could involve developing their own private label product lines or even establishing in-house manufacturing capabilities, particularly for more commoditized offerings. For instance, a large hardware chain might consider producing its own branded shade cloth if the economics were compelling enough, reducing reliance on suppliers like Gale Pacific.

The sheer scale of such potential customers means that even the *threat* of backward integration can act as a powerful bargaining chip. This leverage allows them to negotiate more favorable terms, pricing, and conditions from their suppliers. In 2024, the trend towards private label expansion across retail sectors, driven by margin pressures, makes this a relevant consideration for manufacturers in competitive markets.

- High Capital Investment: Establishing manufacturing facilities requires substantial upfront capital, making it a deterrent for most customers.

- Expertise and Operational Complexity: Customers would need to acquire significant expertise in manufacturing processes, quality control, and supply chain management.

- Focus on Core Competencies: Most large customers prefer to concentrate on their core business, such as retail or distribution, rather than manufacturing.

- Market Dynamics: The feasibility of backward integration is heavily influenced by the specific product's complexity and the competitive landscape.

Gale Pacific's customers, particularly large retailers like Bunnings and Walmart, wield significant bargaining power due to their substantial purchasing volumes. This leverage allows them to negotiate favorable pricing and terms, directly impacting Gale Pacific's profitability. The market's price sensitivity, exacerbated by economic factors like the 2023 elevated inflation rates, further empowers buyers who have numerous alternative suppliers offering similar outdoor living products.

The ease with which customers can switch to competitors, due to low switching costs and limited product differentiation, reinforces their bargaining strength. While backward integration is a theoretical threat for major clients, the high capital investment and operational complexity involved generally limit its practical application, thus moderating this specific aspect of customer power.

| Factor | Impact on Gale Pacific | Supporting Data (2023/2024) |

|---|---|---|

| Purchasing Volume of Key Retailers | High Leverage for Price Negotiation | Major retailers represent a substantial portion of sales, enabling strong negotiation. |

| Price Sensitivity of Customers | Pressure on Margins | Elevated inflation in 2023 increased customer focus on price. |

| Availability of Alternatives | Weakened Brand Loyalty | Global outdoor furniture market valued at approx. USD 28.5 billion in 2024, indicating intense competition. |

| Switching Costs | Facilitates Customer Mobility | Minimal costs to switch between brands for shade and screening products. |

| Threat of Backward Integration | Potential for Reduced Reliance on Suppliers | Trend towards private label expansion in 2024 makes this a consideration, though capital intensive. |

Full Version Awaits

Gale Pacific Porter's Five Forces Analysis

This preview displays the comprehensive Gale Pacific Porter's Five Forces analysis, detailing the competitive landscape, including threats from new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The market for advanced fabrics, screening, shade, and outdoor living products is indeed quite fragmented. Gale Pacific faces competition from a broad spectrum of players, ranging from large global manufacturers to smaller, specialized niche companies. This diversity means Gale Pacific must contend with various competitive strategies and market approaches.

Gale Pacific's competitive set includes well-known names across different segments. For instance, in fabrics, companies like Covington and Lelievre represent established brands. In other areas, players such as Ashley and Muraspec also contribute to the competitive intensity, illustrating the wide-ranging nature of Gale Pacific's competitive rivalry.

Gale Pacific actively differentiates its products through a strong focus on innovation, durability, and sustainability. This strategy aims to set its offerings apart in a competitive market.

The intensity of rivalry is directly impacted by how effectively competitors can introduce unique features, such as enhanced UV protection, superior weather resistance, integrated smart controls, or the use of eco-friendly materials. For instance, in the shade solutions market, companies are increasingly investing in research and development to bring advanced materials and designs to consumers, as seen in the growing demand for energy-efficient and aesthetically pleasing outdoor living products.

The industry faces significant pressure from macroeconomic conditions. Rising household costs, elevated interest rates, and a struggling housing market directly dampen consumer spending, particularly on discretionary items like home improvement products. This economic squeeze intensifies competition as companies vie for a smaller pool of available sales.

Gale Pacific's performance in FY24 clearly illustrates this vulnerability. The company reported that these challenging external economic factors led to reduced sell-through rates across various retail channels, indicating a direct correlation between economic headwinds and decreased consumer demand for their products.

High Fixed Costs in Manufacturing

Manufacturing advanced fabrics and finished products, like those produced by Gale Pacific, demands substantial capital for specialized machinery and production facilities. This inherently creates high fixed costs for all players in the industry.

These elevated fixed costs create a strong incentive for companies to run their operations at maximum capacity to spread the overhead. When demand falters, this pressure to utilize capacity can trigger aggressive pricing strategies, intensifying competition among manufacturers.

- High Capital Investment: Setting up advanced fabric manufacturing lines requires millions in specialized equipment, contributing to significant fixed costs.

- Capacity Utilization Pressure: Companies must maintain high production volumes to cover fixed costs, leading to price wars when demand is low.

- Intensified Rivalry: The drive to cover fixed expenses can make companies less willing to exit the market, even during downturns, thereby sustaining competitive rivalry.

- 2024 Industry Data: In 2024, the global textile machinery market, a key indicator for fabric manufacturing investment, was valued at approximately $16.5 billion, highlighting the substantial upfront capital required.

Global Presence and Regional Market Dynamics

Gale Pacific navigates a complex competitive landscape, with its global operations spanning Australia/New Zealand, the Americas, and developing markets. While the company has achieved notable share gains in the United States, its presence in other regions, like the Middle East, is characterized by robust growth alongside intense competition.

The intensity of rivalry varies significantly by region, influenced by local market structures, consumer preferences, and the presence of established domestic and international players. For instance, in the US, Gale Pacific competes with a mix of large, diversified companies and specialized regional manufacturers, each vying for market share in a mature yet dynamic sector.

- Australia/New Zealand: Gale Pacific holds a strong position, but faces competition from both local manufacturers and imported goods.

- Americas: The US market, a key growth area, sees Gale Pacific competing with established players and new entrants, particularly in the DIY and professional segments.

- Developing Markets: Competition is often fragmented, with a mix of local producers and international brands adapting to diverse economic conditions and consumer needs.

The competitive rivalry within Gale Pacific's markets is substantial due to a fragmented industry structure featuring numerous global and niche players. This intense competition is further fueled by the need for high capital investment in manufacturing, leading to pressure for capacity utilization and aggressive pricing, especially when demand softens.

Gale Pacific's FY24 performance, with reduced sell-through rates attributed to macroeconomic pressures like rising household costs and interest rates, highlights how economic downturns amplify competitive rivalry as companies fight for diminished consumer spending. The global textile machinery market, valued around $16.5 billion in 2024, underscores the significant capital barriers that contribute to this sustained rivalry.

| Region | Gale Pacific's Position | Key Competitive Factors |

|---|---|---|

| Australia/New Zealand | Strong | Local manufacturers, imported goods |

| Americas (especially US) | Gaining share, competitive | Established players, new entrants, DIY vs. Professional segments |

| Developing Markets | Growing, fragmented | Local producers, international brands adapting to local conditions |

SSubstitutes Threaten

Traditional construction methods like solid roofs and patios offer a more permanent and robust form of sun protection, acting as direct substitutes for Gale Pacific's shade solutions. In 2024, the global construction market was valued at approximately $13.5 trillion, indicating a significant investment in permanent structures that inherently provide shade.

Natural elements such as mature trees and landscaping also present a substitute, offering aesthetic appeal and shade without the direct purchase of specialized fabric products. The landscaping services industry, a proxy for such natural solutions, saw continued growth in 2024, reflecting consumer interest in integrating natural shade into their outdoor spaces.

Consumers seeking privacy and screening solutions have a wide array of non-fabric alternatives readily available. These include traditional options like solid wooden or brick fences, concrete walls, and even more modern solutions such as metal panels or composite materials. The existence of these substitutes directly impacts the demand for specialized privacy fabrics.

For instance, in the residential sector, the cost-effectiveness and durability of a solid timber fence can make it a more attractive option than a high-quality privacy screen fabric, especially for long-term boundary solutions. In 2024, the global market for fencing and gate systems was valued at approximately USD 45 billion, indicating a substantial consumer preference for these non-fabric alternatives.

Businesses also have access to various non-fabric screening methods, from architectural features like louvers and screens integrated into building design to readily available modular panel systems. The perceived longevity and structural integrity of these alternatives can diminish the perceived value of fabric-based privacy solutions, especially in commercial applications where permanence is often prioritized.

The market for outdoor living and screening solutions presents a notable threat from DIY options and cheaper alternatives. These substitutes, often less durable but significantly more affordable, can attract consumers prioritizing cost savings over longevity or brand reputation. This segment of the market, particularly appealing to budget-conscious buyers, could siphon demand away from Gale Pacific's more established and premium product lines.

Technological Advancements in Competing Solutions

Technological advancements in competing solutions present a significant threat. Innovations like smart glass, which can electronically alter its tint, offer a high-tech alternative for sun control and privacy, potentially bypassing traditional fabric-based systems. Similarly, dynamic architectural elements that can shift or reconfigure themselves could also serve as substitutes.

While these technologies are still developing, their potential to offer integrated, sophisticated solutions could disrupt the market for fabric awnings and shade systems. For instance, the global smart glass market was projected to reach around $7.5 billion in 2024, indicating growing investment and consumer interest in such alternatives.

- Smart Glass: Offers electronic control over tint for sun management and privacy, a direct competitor to fabric shade solutions.

- Dynamic Architectural Elements: Advanced building components that can adapt to environmental conditions, providing an alternative to passive shading.

- Market Growth: The increasing investment in smart building technologies signals a growing potential for these substitutes to gain traction.

Shifting Consumer Preferences for Outdoor Spaces

Consumer preferences are a dynamic force, and the desire for enhanced outdoor living spaces is a prime example. As people invest more in their homes, they're looking for seamless transitions between indoor and outdoor areas, often opting for more permanent and elaborate constructions like pergolas or covered patios.

This shift presents a potential threat of substitution for companies like Gale Pacific, which specializes in shade solutions. If consumers increasingly favor these fixed, architectural elements over more flexible shade products, it could impact demand for their offerings.

For instance, in 2024, the global market for outdoor living products saw significant growth, with a notable increase in spending on permanent structures. Data suggests that while shade sails and awnings remain popular, the demand for built-in solutions is accelerating, indicating a potential challenge for flexible shade providers.

- Evolving Consumer Needs: A growing preference for integrated indoor-outdoor living is driving demand for permanent outdoor structures.

- Substitution Risk: Fixed structures like pergolas and covered patios can directly replace the need for flexible shade solutions.

- Market Trends: In 2024, the outdoor living sector experienced robust growth, with a notable uptick in investments towards permanent installations.

The threat of substitutes for Gale Pacific's shade solutions is multifaceted, encompassing traditional construction, natural elements, and technological advancements. Consumers often opt for more permanent structures like solid roofs and patios, as evidenced by the global construction market's approximate $13.5 trillion valuation in 2024, which inherently provides shade.

Natural landscaping, such as mature trees, also offers shade and aesthetic appeal, with the landscaping services industry showing continued growth in 2024. Furthermore, non-fabric alternatives like wooden fences, valued at USD 45 billion globally in 2024 for fencing and gate systems, present a cost-effective and durable substitute for privacy screening.

Emerging technologies like smart glass, with a projected market of around $7.5 billion in 2024, offer dynamic sun control and privacy, potentially disrupting the market for fabric-based systems. These substitutes, ranging from permanent architectural features to high-tech solutions, directly challenge Gale Pacific's offerings by providing alternative means of achieving shade and privacy.

| Substitute Category | Examples | Market Data/Relevance (2024) |

|---|---|---|

| Permanent Construction | Solid roofs, Patios, Pergolas | Global Construction Market: ~$13.5 trillion |

| Natural Elements | Mature Trees, Landscaping | Landscaping Services Industry: Continued Growth |

| Non-Fabric Screening | Wooden Fences, Brick Walls, Metal Panels | Global Fencing & Gate Systems Market: ~USD 45 billion |

| Technological Solutions | Smart Glass, Dynamic Architectural Elements | Global Smart Glass Market: ~$7.5 billion (projected) |

Entrants Threaten

The advanced fabrics and finished products manufacturing sector demands significant upfront capital. Think millions for specialized machinery, ongoing R&D, and setting up production lines.

For instance, a new entrant would need to invest heavily just to match the technological capabilities of established firms. This high barrier to entry deters many potential competitors.

Furthermore, achieving economies of scale is crucial for cost competitiveness. Gale Pacific, with its extensive 70+ year operational history, likely benefits from substantial purchasing power and optimized production processes, making it difficult for newcomers to match their per-unit costs.

Gale Pacific enjoys a significant advantage due to its deeply entrenched relationships with major global retailers, providing unparalleled access to key markets. Furthermore, the strong brand recognition associated with its Coolaroo and GALE Pacific Commercial lines creates a substantial barrier for any newcomers attempting to penetrate the market.

Gale Pacific's significant investment in proprietary technology and manufacturing expertise acts as a substantial barrier to new entrants. Their long-standing focus on developing innovative, sustainable fabrics, like those used in their Shade and Water divisions, requires considerable R&D and specialized knowledge that is not easily replicated. For instance, achieving the specific UV protection ratings and durability standards in their shade fabrics involves complex material science and manufacturing processes honed over years.

Regulatory and Certification Requirements

The production and marketing of fabrics for commercial, architectural, and industrial uses necessitate strict adherence to various safety, environmental, and performance standards. Obtaining necessary certifications can be a significant barrier for newcomers, requiring substantial investment in compliance and testing.

For instance, in 2024, the global textile market saw increased scrutiny on sustainability certifications like OEKO-TEX and Bluesign. New entrants must invest not only in production capabilities but also in the rigorous processes and documentation required to meet these benchmarks, adding considerable cost and time to market entry.

- Complex Compliance: New companies face intricate regulatory landscapes for specialized fabrics.

- Certification Costs: Obtaining industry-recognized certifications like OEKO-TEX or Bluesign can be expensive.

- Market Access Barriers: Non-compliance with standards can restrict access to key commercial and industrial markets.

Access to Raw Materials and Supply Chain Relationships

New entrants face significant hurdles in securing consistent and affordable access to the specialized raw materials essential for high-performance fabric manufacturing. For instance, the global textile industry's reliance on specific synthetic fibers or advanced natural blends can create supply chain bottlenecks for newcomers. Gale Pacific, as a seasoned player, likely benefits from established, long-term contracts with key material suppliers, ensuring preferential pricing and guaranteed availability, a critical advantage that is difficult for new competitors to replicate quickly.

Established relationships are paramount. In 2024, the textile industry continued to see supply chain disruptions, making these supplier relationships even more valuable. Companies with strong, multi-year agreements often secure better terms and priority allocation of critical inputs. This can translate to a direct cost advantage for incumbent firms like Gale Pacific, making it harder for new entrants to compete on price or even secure necessary inventory.

- Supplier Loyalty Programs: Many raw material providers offer tiered benefits or loyalty discounts to their long-term partners, which new entrants are unlikely to qualify for initially.

- Volume Commitments: Incumbents often have the volume commitments in place to negotiate lower per-unit costs for raw materials, a feat difficult for smaller, new operations.

- Quality Assurance: Established relationships also often mean a higher degree of trust and consistent quality from suppliers, reducing the risk of production issues for established firms.

- Geopolitical Risk Mitigation: Long-standing supplier networks can also be more resilient to geopolitical disruptions, offering a more stable supply chain for established companies.

The threat of new entrants for Gale Pacific is moderate to low, primarily due to the substantial capital requirements and established brand loyalty. Significant investments are needed for specialized machinery, research and development, and production line setup, creating a high barrier. For instance, in 2024, the global advanced textiles market continued to demand cutting-edge material science and manufacturing processes, making it challenging for newcomers to match existing technological sophistication.

Gale Pacific's long-standing supplier relationships, cultivated over its 70+ year history, also present a formidable entry barrier. These established contracts often secure preferential pricing and guaranteed availability of critical raw materials, a significant advantage that new competitors struggle to replicate quickly. In 2024, supply chain volatility underscored the value of these deep-rooted partnerships, providing incumbents with cost and availability advantages.

| Barrier Type | Impact on New Entrants | Gale Pacific Advantage |

|---|---|---|

| Capital Requirements | High (machinery, R&D) | Established infrastructure |

| Brand Recognition & Loyalty | Challenging to build | Strong market presence (Coolaroo) |

| Supplier Relationships | Difficult to establish | Preferential pricing, guaranteed supply |

| Proprietary Technology | Requires significant investment | Honed expertise in fabric science |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gale Pacific is built on a foundation of publicly available company filings, including annual reports and investor presentations. We supplement this with industry-specific market research reports and data from reputable financial information providers to capture a comprehensive view of the competitive landscape.