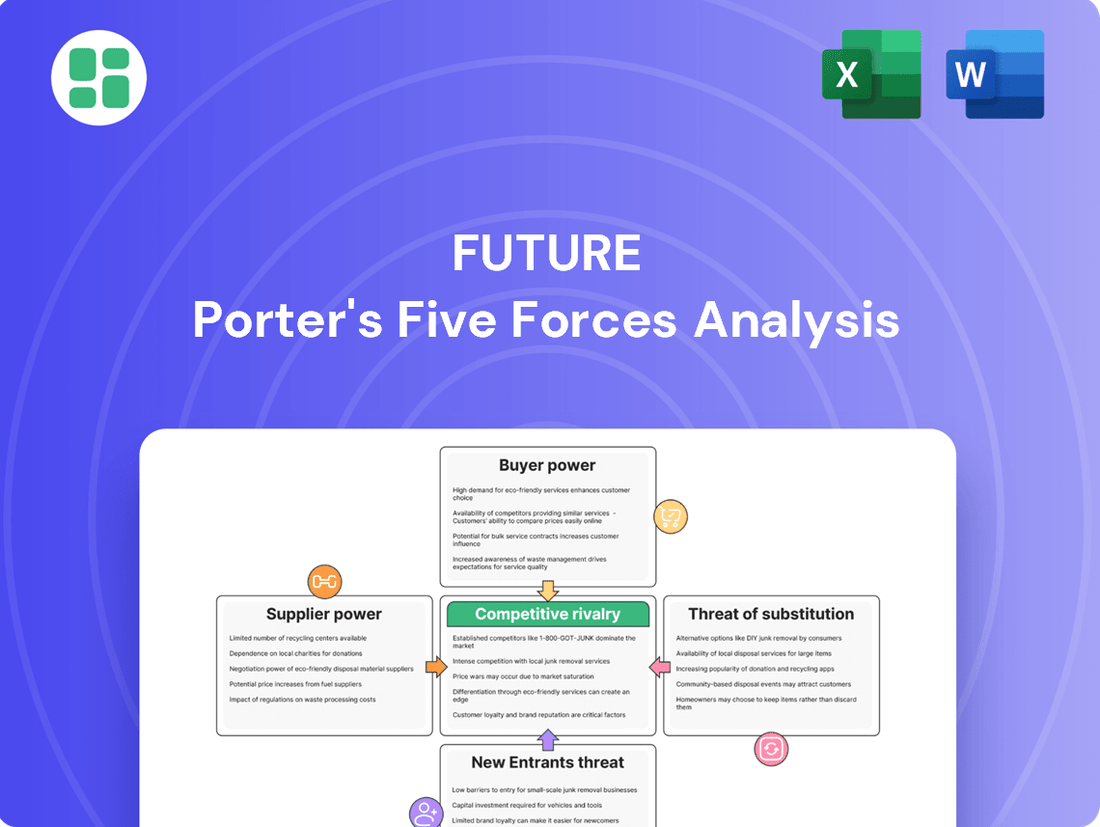

Future Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

This brief overview highlights the core competitive pressures Future faces. Understanding the nuances of supplier power, buyer bargaining, and the threat of substitutes is crucial for navigating its market landscape.

The complete report reveals the real forces shaping Future’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Future PLC's reliance on specialist content creators, such as journalists and videographers, grants these suppliers significant bargaining power. The company's Growth Acceleration Strategy, focused on building engaged audiences through brand leadership and content, directly highlights the critical need for unique, authoritative material in areas like technology and gaming. This demand means skilled creators can command better terms.

Suppliers of proprietary technology and platforms, like those offering advanced content management systems or specialized ad tech, hold significant sway if their offerings are unique and hard to substitute. For companies such as Future PLC, whose digital operations and revenue streams heavily depend on sophisticated platforms for content delivery and monetization, these technology providers are essential partners.

In 2024, the digital media landscape saw continued consolidation and investment in proprietary tech. For instance, major ad tech platforms reported substantial revenue growth, often driven by their unique data capabilities and targeting algorithms, which makes switching suppliers a costly and disruptive endeavor for publishers.

Future PLC's magazine division relies heavily on printing companies and distribution networks. For instance, in 2024, the cost of paper and ink saw fluctuations, impacting the overall production expenses for print publications. Any significant increase in these input costs, or a lack of readily available alternative suppliers, could empower these traditional media suppliers, potentially squeezing Future's profit margins.

Data and analytics providers.

Data and analytics providers hold considerable sway over media companies like Future PLC, especially when their insights are proprietary or offer a distinct advantage. For Future PLC, which thrives on audience engagement and generating revenue, having access to high-quality data and analytics is non-negotiable. This is crucial for refining advertising placements and e-commerce initiatives.

The bargaining power of these suppliers intensifies if their data is indispensable for understanding audience behavior and market trends, enabling Future PLC to tailor content and monetization strategies effectively. In 2023, the digital advertising market saw significant growth, with programmatic advertising, heavily reliant on data analytics, accounting for a substantial portion of ad spend, underscoring the value of these providers.

- Essential for audience segmentation and targeted advertising.

- Unique data sets can provide a significant competitive edge.

- Reliance on specialized analytics tools increases supplier power.

- Market trends show increasing dependence on data-driven insights for media monetization.

Limited pool of niche experts.

The bargaining power of suppliers can be significantly influenced by the availability of specialized knowledge. For companies like Future PLC, which rely heavily on in-depth content within niche sectors, a limited pool of truly expert contributors can amplify supplier leverage. These individuals, possessing unique insights into areas such as vintage electronics or cutting-edge astrophotography, are not easily replaced.

This scarcity of specialized talent means these experts can often negotiate more favorable compensation or contractual terms. For instance, a freelance writer with a proven track record of generating highly engaging content on obscure historical periods might command a premium rate. In 2024, industry reports indicated that specialized freelance content creators in high-demand technical fields saw their average hourly rates increase by 8-12% compared to the previous year, reflecting this dynamic.

- Limited Expertise: Future PLC's business model depends on specialized content, meaning a small number of individuals possess the deep knowledge required.

- High Demand for Niche Skills: Experts in areas like vintage computing or advanced drone piloting are sought after, increasing their value.

- Negotiating Power: Due to their irreplaceable knowledge and reputation, these experts can dictate higher fees or better working conditions.

- Impact on Costs: This supplier power can directly affect content creation costs for Future PLC, potentially impacting profit margins if not managed effectively.

The bargaining power of suppliers for Future PLC is substantial, particularly for those providing specialized content and proprietary technology. The company's strategy hinges on high-quality, unique content, making skilled creators and advanced tech providers indispensable. This reliance allows these suppliers to negotiate favorable terms, directly impacting Future PLC's operational costs and competitive positioning.

In 2024, the digital media sector continued to see significant demand for specialized content creators, with reports indicating that rates for niche freelance writers and videographers in tech and gaming saw an average increase of 8-12%. Similarly, the ad tech market in 2023 saw major platforms reporting revenue growth driven by unique data capabilities, making switching suppliers a costly proposition for publishers like Future PLC.

| Supplier Type | Key Dependence | Impact on Future PLC | 2024/2023 Data Point |

| Specialist Content Creators | Unique, authoritative material for audience engagement | Higher content creation costs, potential for premium rates | 8-12% average rate increase for niche freelance creators |

| Proprietary Technology Providers | Advanced content management, ad tech, data capabilities | Increased reliance on specific platforms, high switching costs | Ad tech platforms revenue growth driven by unique data |

| Data & Analytics Providers | Audience behavior insights, market trends for monetization | Essential for targeted advertising and e-commerce initiatives | Programmatic advertising growth underscoring data value |

| Printing & Distribution Networks | Physical magazine production and delivery | Vulnerability to input cost fluctuations (paper, ink) | Paper and ink cost fluctuations impacting production expenses |

What is included in the product

This analysis will dissect the competitive forces impacting Future, revealing the intensity of rivalry, the power of buyers and suppliers, and the threats from new entrants and substitutes.

Dynamic scenario planning allows you to stress-test competitive pressures and anticipate future market shifts before they impact your business.

Customers Bargaining Power

Future PLC's diverse revenue streams significantly dilute customer power. The company generates income from advertising, e-commerce through affiliate marketing, and various subscription models, creating a broad customer base.

This multi-channel approach means that the company is not overly reliant on any single customer segment. For instance, if advertising revenue experiences a dip, the growth in e-commerce or subscriptions can help stabilize overall performance. In 2023, Future reported a 10% growth in its e-commerce segment, showcasing the resilience provided by this diversification.

Audience fragmentation and the sheer volume of choices available online significantly dilute the bargaining power of individual customers. For a company like Future PLC, while their strategy of focusing on niche content aims to cultivate dedicated audiences, the vast landscape of free and paid online information, coupled with diverse entertainment options, means a single reader or consumer has minimal leverage. For instance, the digital publishing market in 2024 is characterized by an abundance of platforms, from social media to specialized blogs, offering alternatives that make it difficult for any single publisher to command significant individual customer influence.

Advertising clients' leverage is somewhat limited by Future PLC's niche audience strategy. While large advertisers and media agencies buying significant ad space across multiple Future brands do hold some sway, Future's strength lies in its ability to connect advertisers with highly engaged, specialist audiences. This targeted reach across diverse verticals allows Future to maintain strong pricing power for its premium advertising slots.

E-commerce partners' influence.

Future PLC's reliance on e-commerce partners for affiliate marketing means these partners hold some sway. However, Future PLC's established brand authority and loyal readership, which translates into significant traffic and conversion rates for its partners, significantly mitigates this power. This strong audience engagement allows Future PLC to negotiate favorable commission structures, as its content is a key driver of partner sales.

In 2023, Future PLC reported that its affiliate marketing segment contributed substantially to its revenue. For instance, the company's focus on high-intent audiences actively seeking product recommendations through its content, such as in the technology and home sectors, means that retailers are eager to participate in these affiliate programs. This symbiotic relationship, where Future PLC provides valuable traffic and conversion opportunities, strengthens its bargaining position.

- E-commerce Partners' Leverage: Retailers and service providers involved in Future PLC's affiliate marketing programs have the potential to influence commission rates.

- Future PLC's Counterbalance: The company's substantial content reach and audience trust are critical assets, driving significant traffic and conversions for its partners.

- Negotiating Strength: Future PLC's ability to deliver high-quality leads to its partners provides a strong foundation for negotiating favorable commission rates.

- Audience as a Driver: The trust and engagement of Future PLC's audience are key factors in its partners' willingness to accept negotiated terms, as demonstrated by the consistent performance of its affiliate channels.

Subscriber churn sensitivity.

For subscription services like those offered by Future PLC, customer bargaining power is significantly amplified by churn sensitivity. If subscribers don't see ongoing value or find the pricing unfavorable, they can readily cancel their subscriptions. This necessitates a constant focus on delivering high-quality, exclusive content to maintain subscriber loyalty.

In the competitive digital media space, Future PLC must actively manage this power. For instance, in 2023, the digital publishing sector saw varying success in subscriber retention, with some companies reporting churn rates as high as 15-20% for certain digital-only offerings if value propositions weaken. Future PLC's strategy must therefore prioritize innovation and unique content offerings to mitigate this risk.

- Subscriber Churn Impact: High churn rates directly impact recurring revenue, a critical metric for subscription businesses.

- Content Value Proposition: Future PLC must consistently demonstrate superior content value to justify subscription costs.

- Competitive Landscape: The ease with which customers can switch to competitors with similar or lower prices intensifies this bargaining power.

- Retention Strategies: Investing in exclusive content, personalized experiences, and community building are key to reducing churn sensitivity.

The bargaining power of customers for Future PLC is generally low due to its diverse revenue streams and niche audience strategy. While individual consumers have many choices, Future's ability to offer specialized content and targeted advertising limits their individual leverage.

However, for subscription services, customer power increases due to churn sensitivity. Future PLC must continuously provide value to retain subscribers, as seen in the digital publishing sector where high churn rates can impact revenue significantly if content offerings falter.

E-commerce partners, while having some influence on commission rates, are often willing to accept Future PLC's terms due to the company's strong audience engagement and ability to drive sales, as indicated by substantial revenue contributions from affiliate marketing.

| Factor | Impact on Future PLC | Mitigation Strategy |

|---|---|---|

| Audience Fragmentation | Low individual customer power | Niche content, targeted advertising |

| Subscription Churn | Increased customer power | Focus on exclusive content, value proposition |

| E-commerce Partnerships | Moderate partner leverage | Strong audience reach, high conversion rates |

Preview the Actual Deliverable

Future Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This preview showcases the comprehensive Porter's Five Forces analysis, providing actionable insights into the competitive landscape of your chosen industry. You'll receive this exact, professionally formatted document instantly upon purchase, ensuring you have all the strategic information you need without delay.

Rivalry Among Competitors

Future PLC faces intense rivalry from a crowded digital publishing market. Competitors range from established digital-native publishers to traditional media outlets aggressively expanding their online presence, and a vast array of niche websites catering to specific interests. This dynamic environment means Future must constantly innovate in content creation and revenue generation strategies to maintain its market position.

The digital landscape has seen a surge of independent content creators, from bloggers to YouTubers and social media influencers, who now directly vie for audience attention and advertising revenue. This trend significantly lowers the barrier to entry for content creation, presenting a substantial challenge for established players like Future PLC.

Future PLC must actively work to preserve its authority and keep its audience engaged amidst this influx of agile, often niche, competitors. For instance, in 2024, the creator economy continued its robust growth, with platforms like YouTube reporting over 2 billion logged-in monthly users, many of whom are individual creators generating substantial viewership.

Changes in search engine algorithms, particularly the integration of AI features like Google's AI Overviews, present a significant challenge for Future PLC. These shifts can drastically alter organic traffic, a crucial component of their business model. For instance, in early 2024, Google began rolling out AI Overviews, which summarize search results, potentially reducing the need for users to click through to individual websites.

Future PLC must therefore adapt its content strategy to ensure continued discoverability and proper attribution in this evolving digital landscape. The increasing prevalence of AI-generated content necessitates a focus on unique, high-quality, and authoritative content that stands out. This adaptation is critical to maintaining their visibility and engagement with their target audience.

Diversification of revenue strategies.

Competitors are increasingly moving beyond traditional advertising, exploring revenue streams like subscriptions, e-commerce, and events. This shift intensifies rivalry as companies vie for consumer spend across multiple channels.

Future PLC's own growth strategy mirrors this diversification, aiming to capture new monetization opportunities. This direct competition on revenue diversification tactics means companies must innovate rapidly to secure market share.

- Diversified Revenue Streams: Competitors are expanding into subscriptions, e-commerce, events, and branded content, moving away from sole reliance on advertising.

- Intensified Competition: Future PLC's focus on similar diversification strategies directly competes with rivals for emerging revenue streams.

- Consumer Spend Capture: The battleground shifts to capturing consumer spending across various platforms, not just ad impressions.

Fragmented audience attention.

The media consumption habits of audiences are incredibly fragmented, making it a constant battle for attention. Future PLC, like many in its industry, faces this challenge head-on, competing not only with traditional publishing rivals but also with a vast array of digital entertainment options. This means the company is vying for eyeballs against everything from social media feeds to streaming giants.

This fragmentation means that capturing and retaining audience attention is a significant hurdle. In 2024, the average consumer spends over 7 hours per day online, a substantial portion of which is dedicated to non-publishing content. Future PLC must therefore continuously innovate its content strategy to stand out in this crowded digital landscape.

- Fragmented Media Consumption: Audiences are spread across numerous platforms, from social media to streaming services, diluting attention for any single content provider.

- Intense Competition for Attention: Future PLC competes with a wide array of digital entertainment, not just direct publishing competitors, for limited consumer time.

- Digital Engagement Statistics: In 2024, the average individual dedicates over 7 hours daily to online activities, underscoring the challenge of capturing a significant share of this time.

- Strategic Imperative: Continuous innovation in content creation and distribution is essential for Future PLC to effectively engage and retain its target audience amidst this fragmented attention economy.

The competitive rivalry within the digital publishing space remains a dominant force for Future PLC. Established digital-native publishers and traditional media houses aggressively expanding online present significant challenges. Furthermore, the proliferation of niche websites and the burgeoning creator economy, exemplified by platforms like YouTube boasting over 2 billion monthly users in 2024, intensify this rivalry by lowering entry barriers and fragmenting audience attention.

| Competitor Type | Key Characteristics | Impact on Future PLC |

|---|---|---|

| Digital-Native Publishers | Agile, often niche focus, strong SEO strategies. | Direct competition for audience and advertising revenue. |

| Traditional Media Outlets (Online) | Established brands, significant resources, broad reach. | Compete for premium advertising and subscriber growth. |

| Creator Economy (Influencers, Bloggers) | High engagement, authentic connection, diverse monetization. | Fragment audience attention, offer alternative content sources. |

| AI-Powered Content Platforms | Rapid content generation, potential for scale. | Challenges discoverability and requires focus on unique, authoritative content. |

SSubstitutes Threaten

The proliferation of free user-generated content (UGC) across platforms like YouTube, TikTok, and numerous blogs presents a substantial threat of substitution for Future PLC. This readily available content can fulfill many of the informational and entertainment needs that Future’s publications aim to address.

While UGC may not always possess the same editorial rigor or depth as professionally produced content, its sheer volume and accessibility make it a powerful alternative. For instance, in 2024, the creator economy continued its explosive growth, with millions of individuals generating and distributing content daily, often for free to the end-user.

This free alternative directly competes for audience attention and, consequently, advertising revenue. Brands may opt to allocate their marketing budgets to these high-traffic UGC platforms, diverting potential income streams that would otherwise support Future PLC’s business model.

The rise of direct-to-consumer (DTC) brand publishing presents a significant threat to companies like Future PLC. Many brands are now bypassing traditional media by creating their own content and publishing platforms. This allows them to engage directly with their audience, reducing reliance on external advertisers for reach.

This DTC trend means brands can offer highly specialized information directly from the source, potentially offering a more tailored and authoritative experience than generalist publishers. For instance, in 2024, the global content marketing market was valued at over $400 billion, with a significant portion driven by brands investing in their own owned media channels.

Social media platforms like TikTok and Instagram are rapidly becoming major news and entertainment sources, especially for younger demographics. For instance, a 2024 Pew Research Center study found that 62% of U.S. adults get news from social media at least sometimes. This trend directly threatens traditional media outlets, including Future PLC, by offering an alternative, often more engaging, way for consumers to access content.

This shift means users may bypass dedicated news websites or apps, opting instead for curated feeds and short-form video content. Future PLC needs to strategically use these platforms for content distribution and audience interaction, ensuring they don't solely rely on them and maintain a direct relationship with their core readership.

Alternative entertainment forms.

The threat of substitutes for Future PLC is significant, as consumers have a wide array of alternative entertainment options vying for their leisure time and attention. Beyond traditional media, services like Netflix, Disney+, and Amazon Prime Video offer vast libraries of on-demand content, directly competing for viewing hours. Similarly, the booming online gaming industry, with titles like Fortnite and Call of Duty, provides highly engaging and interactive experiences that can easily capture consumer engagement.

Interactive digital experiences, including social media platforms and virtual reality applications, further dilute the market share for content providers like Future PLC. For instance, in 2024, global spending on video games was projected to reach over $200 billion, highlighting the immense draw of these digital alternatives. Future PLC must continuously innovate to remain relevant in this crowded landscape where consumer attention is a finite and fiercely contested resource.

- Video Streaming Services: Platforms like Netflix, Disney+, and Amazon Prime Video offer extensive on-demand content, directly competing for viewing time.

- Online Gaming: The global gaming market, projected to exceed $200 billion in 2024, presents highly interactive and engaging alternatives.

- Interactive Digital Experiences: Social media, VR, and other digital platforms capture significant user attention, diverting it from traditional content consumption.

AI-powered content aggregation and synthesis.

AI-powered content aggregation and synthesis presents a significant threat of substitutes. Advanced AI models can now aggregate, summarize, and even generate content across numerous topics, potentially diminishing the reliance on multiple specialist publications. This capability means users might find comprehensive information without needing to visit various sources, directly impacting traditional content providers.

Future PLC's strategic partnership with OpenAI in 2024 underscores the company's recognition of this evolving landscape. This collaboration is a proactive measure to integrate AI capabilities, aiming to adapt and leverage these new technologies rather than be supplanted by them. By working with OpenAI, Future PLC seeks to enhance its own content offerings and user experience in the face of these disruptive AI tools.

- AI's Content Synthesis Capability: AI can consolidate information from diverse sources, offering users a singular, synthesized output.

- Reduced Need for Multiple Sources: This synthesis can decrease user engagement with individual specialist publications.

- Future PLC's Adaptation Strategy: The company's 2024 partnership with OpenAI signals an effort to embrace AI for content enhancement.

- Industry Impact: The rise of AI aggregators challenges traditional media models, necessitating strategic adaptation.

The threat of substitutes for Future PLC is amplified by the increasing accessibility of free, user-generated content (UGC) and the rise of direct-to-consumer (DTC) brand publishing. In 2024, the creator economy's continued expansion meant millions generated content daily, often free, directly competing for audience attention and advertising revenue.

Brands increasingly bypass traditional media, investing in their own content platforms. The global content marketing market, exceeding $400 billion in 2024, saw significant growth in these owned media channels, offering specialized information directly to consumers.

Furthermore, social media platforms are becoming primary news sources, especially for younger demographics, with 62% of U.S. adults getting news from social media at least sometimes in 2024, according to Pew Research. This diverts audience engagement from dedicated publications.

The entertainment landscape also presents strong substitutes, with video streaming services and online gaming capturing significant leisure time. Global video game spending was projected to surpass $200 billion in 2024, illustrating the powerful draw of these interactive alternatives.

AI-powered content aggregation and synthesis further challenge traditional media by offering synthesized information, potentially reducing the need for multiple specialist sources. Future PLC's 2024 partnership with OpenAI reflects an effort to integrate and leverage these AI capabilities.

| Substitute Category | Key Competitors/Examples | 2024 Market Data/Trend | Impact on Future PLC |

|---|---|---|---|

| User-Generated Content (UGC) | YouTube, TikTok, Blogs | Creator economy growth, millions of daily content creators | Competition for audience attention and advertising revenue |

| Direct-to-Consumer (DTC) Publishing | Brand-owned websites/platforms | Content marketing market > $400 billion | Brands bypass traditional media, offer specialized content |

| Social Media News Consumption | TikTok, Instagram | 62% of US adults get news from social media (Pew Research) | Diverts audience from dedicated news sources |

| Video Streaming | Netflix, Disney+, Amazon Prime | High engagement for on-demand content | Competes for leisure time and viewing hours |

| Online Gaming | Fortnite, Call of Duty | Global spending projected > $200 billion | Highly interactive and engaging alternative |

| AI Content Aggregation | AI summarization tools, AI news generators | AI partnership by Future PLC (2024) | Potential reduction in need for multiple specialist publications |

Entrants Threaten

The ease of creating and distributing digital content significantly lowers the barrier to entry for new players. Unlike traditional media requiring substantial investment in printing presses or broadcast infrastructure, digital platforms allow individuals and small teams to launch with minimal capital. For instance, in 2024, the global creator economy was estimated to be worth over $250 billion, highlighting the sheer volume of new entrants leveraging these low barriers.

New entrants can carve out success by focusing on highly specific, underserved niches within Future PLC's core markets. By building passionate, engaged communities around these specialized content areas, they can directly challenge Future's established specialist positions. For instance, a new platform dedicated solely to vintage gaming restoration, with a strong community forum and user-generated content, could attract a dedicated audience that might otherwise engage with Future's broader gaming publications.

New entrants can disrupt established players like Future PLC by leveraging cutting-edge technologies. For instance, AI-powered content creation and hyper-personalization can offer tailored user experiences that traditional methods struggle to match. In 2024, the global AI market was valued at over $200 billion, showcasing its rapid growth and potential for new business models.

Web3 technologies, with their emphasis on decentralization and direct monetization, present another avenue for disruption. Entrants can build platforms that empower creators and users directly, potentially bypassing the centralized structures that companies like Future PLC currently operate within. This shift could enable novel revenue streams and community engagement strategies, challenging existing market dynamics.

Access to capital for digital startups.

The threat of new entrants is significantly influenced by access to capital, particularly for digital startups. Unlike traditional media, which often demands substantial upfront investment in physical infrastructure, digital ventures can leverage venture capital and angel investment more readily. This ease of access to funding allows new digital players to scale quickly and mount a serious challenge to established businesses. For instance, in 2024, global venture capital funding for technology startups, a broad category that includes digital media, remained robust, with significant allocations towards companies demonstrating rapid growth potential and innovative business models.

This influx of capital directly fuels innovation and enables aggressive market entry strategies for digital startups. They can invest heavily in technology, marketing, and talent, quickly disrupting existing market dynamics. Consider the growth of short-form video platforms; many emerged with substantial backing, allowing them to acquire users and content creators at an unprecedented pace, directly impacting established social media and entertainment companies. The availability of funding means that even smaller, agile teams can potentially challenge market leaders if they possess a compelling digital-first proposition.

- Venture Capital Funding Trends: In the first half of 2024, venture capital firms continued to deploy capital into promising tech startups, with digital media and entertainment sectors seeing notable interest.

- Angel Investor Activity: Angel investors remain a crucial source of early-stage capital, providing seed funding that allows digital startups to develop minimum viable products and gain initial traction.

- Impact on Incumbents: The ability of digital startups to secure rapid funding allows them to outspend or out-innovate traditional media companies, forcing incumbents to adapt or risk obsolescence.

- Scalability through Funding: Access to capital enables digital startups to achieve rapid scalability, a key factor in their ability to challenge established players and capture market share quickly.

Disruptive business models.

Disruptive business models pose a significant threat. New entrants might introduce hyper-personalized content feeds, bypassing traditional advertising. For instance, platforms facilitating direct creator monetization, where audiences pay creators directly, could siphon revenue from Future PLC's established advertising and e-commerce models. Community-owned media ventures also present a challenge, potentially fragmenting Future's audience and subscription base.

The threat of new entrants remains substantial due to the significantly lowered barriers to entry in the digital media landscape. Minimal capital investment is required to launch digital content platforms, contrasting sharply with the substantial infrastructure costs of traditional media. For example, the global creator economy's estimated value exceeding $250 billion in 2024 underscores the accessibility for new players.

New entrants can effectively challenge established entities like Future PLC by targeting niche markets and fostering strong community engagement. Leveraging advanced technologies such as AI for personalized content delivery and Web3 for decentralized platforms offers further disruptive potential. The robust venture capital funding available to tech startups in 2024, particularly in digital sectors, empowers these new entrants to scale rapidly and innovate aggressively.

| Factor | Impact on New Entrants | Example/Data (2024) |

|---|---|---|

| Digitalization | Lowers capital requirements for content creation and distribution | Creator economy valued over $250 billion |

| Niche Targeting | Allows focused community building and direct competition | Emergence of highly specialized online communities |

| Technological Advancements | Enables personalized experiences and new business models | Global AI market valued over $200 billion |

| Access to Capital | Facilitates rapid scaling and market penetration | Robust VC funding for digital startups |

Porter's Five Forces Analysis Data Sources

Our Future Porter's Five Forces analysis is built upon a robust foundation of data, integrating current market intelligence from leading industry research firms, financial data from reputable business intelligence platforms, and forward-looking projections from economic forecasting agencies to anticipate future competitive landscapes.