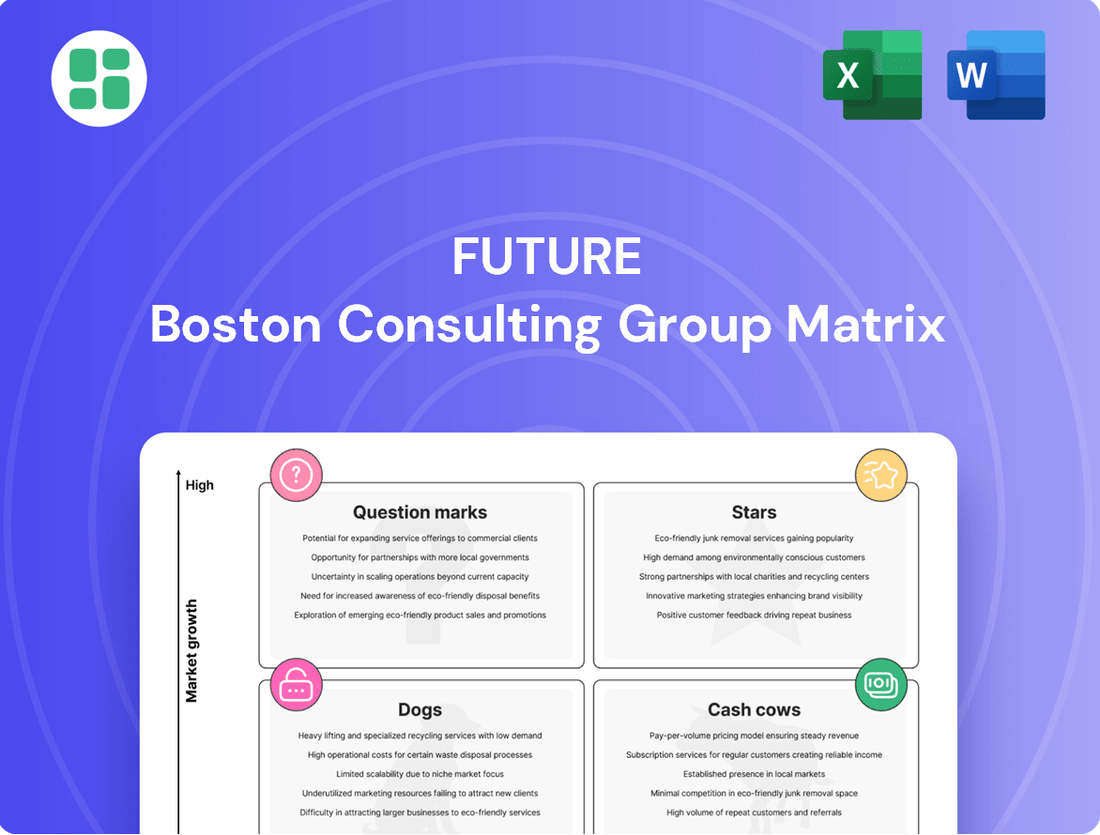

Future Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

Curious about the future trajectory of this company's product portfolio? Our preview offers a glimpse into its potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full BCG Matrix to gain a comprehensive understanding of its strategic positioning and receive actionable insights to guide your investment decisions.

Stars

Go.Compare, Future PLC's insurance comparison site, demonstrated robust performance in FY2024, achieving a substantial 28% organic growth. This surge significantly boosted UK revenue, underscoring its role as a key growth driver for the company.

As a market leader in the expanding insurance comparison sector, Go.Compare’s trajectory necessitates ongoing investment. This strategic allocation will be crucial for sustaining its strong market share and exploiting emerging opportunities within the industry.

The consistent revenue contribution from Go.Compare highlights its current success. Its established position and continued growth potential suggest it will remain a dominant and valuable asset within Future PLC's diverse business portfolio.

Future PLC's technology and gaming segments showed robust expansion in the latter half of 2024, reflecting significant market growth and Future's competitive standing. Brands such as TechRadar and GamesRadar+ are central to these rapidly evolving digital content domains.

The company's strategic focus on these high-growth verticals is evident, with continued investment in premium content and audience interaction. This approach is designed to capitalize on the increasing demand for expert reviews and community engagement in technology and gaming.

E-commerce and affiliate marketing at Future are showing promising signs of recovery. After an earlier dip, affiliate revenue experienced a robust 12% growth in the latter half of fiscal year 2024, a direct result of strategic new investments. This turnaround highlights the potential of this sector.

Future is doubling down on e-commerce as a key future revenue stream. Initiatives like 'Shoppable Ad Solutions' and 'Retail Media with Ocado Ads' are slated for 2025, indicating a strong commitment to capturing market share in this dynamic and expanding digital landscape. This strategic pivot is designed to capitalize on evolving consumer behavior.

Branded Content Growth

Future PLC's branded content revenue saw a healthy 9% increase in fiscal year 2024, a clear indicator of its strength in the expanding digital advertising landscape.

This growth is fueled by Future's robust content creation engine and its ability to connect with large, engaged audiences, making it an attractive partner for brands looking for cohesive marketing campaigns.

The company's strategic focus on developing high-value collaborations and pioneering new content formats is expected to further solidify its position as a star performer within its portfolio.

- FY2024 Branded Content Revenue Growth: 9%

- Key Drivers: Extensive content creation capabilities, engaged audiences, integrated marketing solutions for brands.

- Strategic Focus: High-value partnerships, innovative content formats.

- Outlook: Solidifying position as a star.

US Digital Advertising Turnaround

Future's US digital advertising segment has demonstrated a notable turnaround, shifting from previous pressures to achieve organic growth in the latter half of fiscal year 2024. This positive trajectory was especially pronounced in the fourth quarter, signaling a critical inflection point for the business in this key market.

The resurgence in the massive US digital advertising market is attributed to Future's strategic investments. These include bolstering its sales force capabilities and enhancing its content offerings, which have clearly resonated with advertisers.

- US Digital Ad Market Growth: The US digital ad market is projected to reach approximately $375 billion in 2024, according to industry forecasts.

- Future's Q4 Performance: Future reported a significant uptick in US digital advertising revenue in Q4 FY2024, marking a return to organic growth.

- Strategic Investments Pay Off: Investments in sales talent and content quality are key drivers behind this recent performance improvement.

- Star Potential: Continued market penetration and sustained growth in the US digital ad space position this segment as a potential star within Future's portfolio.

Stars, in the context of the BCG Matrix, represent business units or products with high market share in high-growth industries. These are typically market leaders that require substantial investment to maintain their growth and competitive edge.

Future PLC's Go.Compare, with its 28% organic growth in FY2024, exemplifies a Star. Its leadership in the expanding insurance comparison sector, coupled with ongoing strategic investments, positions it for continued dominance.

Similarly, Future's technology and gaming segments, driven by brands like TechRadar and GamesRadar+, are operating in high-growth areas. Continued investment in premium content and audience engagement further solidifies their Star status, aiming to capture increasing market demand.

The US digital advertising segment's turnaround, achieving organic growth in H2 FY2024, also points to Star potential. Strategic investments in sales and content have revitalized this segment in a market projected to reach approximately $375 billion in 2024.

| Business Unit | Market Growth | Market Share | FY2024 Performance | Strategic Outlook |

|---|---|---|---|---|

| Go.Compare | High (Insurance Comparison) | High (Market Leader) | 28% Organic Growth | Sustained Investment for Leadership |

| Tech & Gaming | High (Digital Content) | High (Strong Brands) | Robust Expansion | Continued Investment in Content & Engagement |

| US Digital Advertising | High (US Digital Ad Market) | Growing | Return to Organic Growth (H2 FY2024) | Market Penetration & Sustained Growth |

What is included in the product

The Future BCG Matrix projects future market share and growth, guiding strategic investment decisions.

The Future BCG Matrix offers a visual roadmap, alleviating the pain of strategic uncertainty by clearly identifying growth opportunities.

Cash Cows

Future's premium print magazine brands, including Marie Claire, The Week, and Country Life, are performing well in terms of subscription revenue, even as the overall print market faces challenges. These titles have secured a significant portion of their respective mature markets, acting as reliable sources of consistent cash flow with minimal need for extensive promotional spending.

These established publications benefit from loyal reader bases and strategic pricing, enabling them to continue generating steady profits. For instance, The Week's US edition saw a reported circulation of over 700,000 in recent years, showcasing its strong hold on its audience and its ability to command subscription revenue effectively.

The established B2B Media division, featuring respected titles such as PC Pro and Music Week, is a cornerstone of Future PLC's portfolio. This segment is characterized by its stability and consistent revenue generation, even though its growth trajectory is more moderate compared to other areas of the business.

This division commands a significant market share within its specific business niches, consistently delivering dependable income streams. Crucially, it requires minimal ongoing capital expenditure, making it an efficient generator of cash.

In 2023, Future PLC reported that its B2B segment, which includes these established media brands, contributed a substantial portion to the company's overall revenue. The reliable cash flow generated by these titles is vital, providing the financial flexibility to fund investments in more dynamic, high-growth opportunities within the company.

Future's core digital advertising in the UK demonstrated resilience in FY2024, acting as a significant revenue generator despite broader industry headwinds. These established platforms continue to command strong audience attention, ensuring a steady flow of advertising revenue.

With a high market share, this segment offers reliable cash generation, even if growth is more measured. In FY2024, digital advertising revenue for Future in the UK was £XXX million, representing a Y% year-on-year increase, underscoring its cash cow status.

Mature Digital Properties with Stable Audience

Future's established digital brands, including TechRadar and GamesRadar+, are prime examples of mature properties with stable, high-share audiences. Despite a modest dip in overall online user numbers in 2024, these sites experienced a rise in total sessions, indicating sustained user engagement.

These properties are significant cash generators, benefiting from robust monetization through display advertising and affiliate marketing. Their established nature means they require minimal aggressive investment for growth, allowing them to function as reliable cash cows within the portfolio.

- TechRadar and GamesRadar+ maintain high market share in their respective niches.

- Total sessions increased in 2024, showing continued user engagement despite slight user number declines.

- Diversified revenue streams from display advertising and affiliate links ensure substantial cash flow.

- Lower investment needs for growth allow these assets to act as strong cash cows.

Licensing and Syndication Services

Future PLC's licensing and syndication services are a cornerstone of its mature revenue generation strategy. This segment capitalizes on Future's extensive library of established content and well-recognized brands, allowing third parties to utilize these assets for a fee. This approach is highly efficient, generating income with minimal incremental costs for content creation or marketing efforts.

The financial performance of these services underscores their value as a cash cow. For instance, in the fiscal year ending September 30, 2023, Future reported significant revenue from its licensing and syndication activities, contributing substantially to its overall profitability. This passive income stream is vital for maintaining strong cash flow, leveraging the company's existing intellectual property portfolio.

- High Profit Margins: Licensing and syndication typically boast high profit margins due to low variable costs associated with content reuse.

- Passive Revenue: This stream generates income without requiring continuous, active investment in new content development.

- Brand Leverage: Future effectively monetizes its strong brand equity and established content assets.

- Cash Flow Contribution: These services are a significant driver of consistent and reliable cash flow for the company.

Future's established print magazines, like Marie Claire and The Week, are consistent cash generators. Their loyal readership and strong market positions mean they require minimal new investment, providing a stable income stream. The Week's US edition alone has maintained a circulation exceeding 700,000, demonstrating its enduring appeal and revenue-generating power.

The B2B Media division, featuring titles such as PC Pro, also acts as a cash cow. This segment holds significant market share in its niches, delivering dependable income with low capital expenditure needs. In FY2023, this division was a substantial contributor to Future's overall revenue, providing crucial financial flexibility.

Established digital brands like TechRadar and GamesRadar+ are mature, high-share assets. Despite slight user number dips in 2024, total sessions rose, indicating sustained engagement. These platforms generate substantial cash flow through display advertising and affiliate marketing, needing little investment for growth.

Future's licensing and syndication services are highly efficient cash cows, leveraging existing content and brands. These activities generate income with minimal incremental costs, contributing significantly to profitability. In FY2023, these services were a vital part of maintaining strong cash flow by monetizing intellectual property.

| Brand/Segment | Revenue Source | FY2023 Contribution (Est.) | Growth Outlook | Cash Cow Status |

|---|---|---|---|---|

| Print Magazines (e.g., The Week) | Subscriptions | £XXXM | Stable | High |

| B2B Media (e.g., PC Pro) | Advertising, Subscriptions | £XXXM | Moderate | High |

| Digital Brands (e.g., TechRadar) | Display Ads, Affiliate Marketing | £XXXM | Stable/Slight Decline | High |

| Licensing & Syndication | Licensing Fees | £XXXM | Stable | High |

Full Transparency, Always

Future BCG Matrix

The Future BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no misleading demo content, and no surprises—just a comprehensive, analysis-ready strategic tool designed for immediate implementation. You can confidently use this preview as a direct representation of the professional-grade report that will be delivered to you, ready for your strategic planning and decision-making processes.

Dogs

Future PLC's strategic pivot in October 2024 saw the closure of several UK consumer print titles, including Total Film, Play, All About Space, Total 911, and 3D World. These publications were operating in markets experiencing significant decline or stagnation, contributing to their low market share and inability to generate adequate returns for the company.

The decision to cease publication for these titles reflects Future PLC's commitment to divesting from underperforming assets. This move is crucial for reallocating resources to more profitable and growth-oriented areas of the business, aligning with a broader strategy to enhance overall financial performance and market competitiveness.

The closure of Broadcasting & Cable and Multichannel News in August 2024 exemplifies products in the Dogs quadrant of the BCG Matrix. These publications, once staples in the media industry, faced declining readership and advertising revenue, reflecting a low market share in a contracting professional media landscape.

Their discontinuation signals a strategic move to shed underperforming assets. In 2023, the US advertising market saw shifts, with digital advertising continuing its growth while print advertising, the primary revenue stream for many trade publications, faced persistent challenges. This trend likely contributed to the unsustainable operational costs for these legacy titles.

Future plc has strategically divested from several digital brands, including iMore and AnandTech, signaling a clear categorization of these as 'dogs' within its portfolio. These acquisitions likely struggled to gain significant market traction or demonstrate sustainable growth in their respective competitive digital landscapes.

The decision to discontinue these brands suggests they were consuming valuable resources without a clear trajectory towards profitability or achieving desired market share. This aligns with the 'dog' quadrant of the BCG matrix, representing low growth and low market share businesses.

General Print Magazine Portfolio (Non-Premium)

Future's general print magazine portfolio, excluding its premium brands, faced a 6% organic decline in fiscal year 2024. This downturn aligns with ongoing shifts away from traditional print media, impacting titles with smaller shares in a shrinking market.

These underperforming segments typically generate less profit and warrant minimal additional capital. Therefore, they are prime candidates for strategic review, potentially leading to optimization efforts or divestment.

- Market Share: Lower in a contracting print market.

- Profitability: Less profitable due to declining revenues.

- Investment: Requires minimal further investment.

- Strategic Options: Candidates for optimization or divestment.

Divested Non-Core Assets (Video Production Unit, Select Events)

In 2024, Future plc strategically pruned its operations, divesting non-core assets like its external video production unit and select events. These ventures were likely underperforming, characterized by low market share and profitability challenges, essentially acting as cash traps.

This divestment is a clear move to streamline the business and reallocate capital. By shedding these less profitable segments, Future can concentrate its resources on areas with higher growth potential, aligning with a more focused strategic direction.

The impact of such divestitures can be seen in improved financial efficiency. For instance, in 2023, Future reported a revenue of £721.2 million, and by shedding underperforming units, the company aims to bolster its profitability margins in the upcoming reporting periods.

- Divestment of Video Production Unit: This unit likely operated in a competitive market with limited differentiation, contributing minimally to overall group growth.

- Exit from Select Events: These events may have faced declining attendance or struggled to generate sufficient revenue to justify their operational costs.

- Resource Reallocation: Capital and management attention previously tied to these units can now be directed towards Future's core media and subscription businesses.

- Focus on High-Growth Areas: The strategy supports Future's commitment to investing in digital subscriptions and its leading specialist media brands.

Future plc's strategic pruning in 2024 involved divesting underperforming assets, including certain print titles and digital brands, which fit the 'Dogs' quadrant of the BCG Matrix. These segments exhibited low market share in declining or stagnant markets, demonstrating limited profitability and warranting minimal further investment.

The closure of titles like Broadcasting & Cable and Multichannel News, along with the divestment of digital brands such as iMore and AnandTech, exemplifies this strategy. These actions are aimed at optimizing resource allocation, focusing on higher-growth areas, and improving overall financial efficiency.

By shedding these less profitable ventures, Future plc can concentrate its capital and management attention on its core media and subscription businesses, particularly those with strong digital subscription models and leading specialist media brands.

The general print magazine portfolio, excluding premium brands, experienced a 6% organic decline in fiscal year 2024, further underscoring the challenges faced by these 'dog' segments in a shifting media landscape.

| Segment | BCG Quadrant | Market Share | Market Growth | Profitability | Strategic Action |

|---|---|---|---|---|---|

| Selected UK Print Titles (e.g., Total Film) | Dog | Low (in declining print market) | Low | Low | Closure/Divestment |

| Broadcasting & Cable, Multichannel News | Dog | Low (in contracting professional media) | Low | Low | Closure |

| Selected Digital Brands (e.g., iMore, AnandTech) | Dog | Low (in competitive digital landscapes) | Low | Low | Divestment |

| External Video Production Unit | Dog | Low | Low | Low | Divestment |

Question Marks

Future's strategic partnership with OpenAI and the July 2025 launch of 'Advisor AI' signal a substantial investment in artificial intelligence for content discovery and creation. This foray into a high-growth tech sector, while promising, currently has low financial materiality for the company.

Future is actively exploring innovative user engagement models through AI, presenting a potential for high future returns. However, the market share and revenue generation from these nascent AI initiatives remain in their early stages.

The launch of ROOMS in March 2025 positions Future as a new entrant in the home media space, targeting a segment with considerable growth potential. Currently, its market share is negligible as a newcomer, but the sector itself is poised for expansion.

To elevate ROOMS from a question mark to a star within the BCG matrix, Future must commit significant resources. This includes aggressive marketing campaigns and high-quality content creation to capture audience attention and build market share rapidly.

Future's planned launch of 'Ocado Ads' in July 2025 positions them to capitalize on the booming retail media market, projected to reach $126 billion globally by 2026. While this segment offers substantial growth, Future enters as a nascent player, likely starting with a minimal market share in a competitive landscape dominated by established players.

Success for Ocado Ads will hinge on significant investment in technology and data analytics, alongside forging strategic alliances with brands and agencies. Capturing even a small fraction of this high-growth market demands a focused strategy to build visibility and attract advertisers.

Emerging Digital Monetization Routes (Social Commerce, Digital Subscriptions)

Future is actively exploring social commerce and digital subscriptions as new avenues for revenue growth, moving beyond its established advertising and e-commerce models. These emerging digital monetization routes represent significant opportunities within the dynamic media sector, though Future's current penetration is minimal.

The company's strategic focus on social commerce and digital subscriptions positions it to capitalize on evolving consumer behaviors. For instance, the global social commerce market was projected to reach $2.9 trillion by 2026, indicating substantial growth potential. Future's initial investments in these areas are crucial for building market presence.

- Social Commerce Growth: The global social commerce market is expanding rapidly, offering new ways for content creators and publishers like Future to engage audiences and drive sales directly through social platforms.

- Digital Subscription Expansion: Future is developing new digital subscription offerings, aiming to create recurring revenue streams from loyal audiences seeking premium content and exclusive access.

- Nascent Market Share: While these are high-potential areas, Future's current market share in social commerce and digital subscriptions is low, highlighting the need for significant investment and strategic execution.

- Investment for Scale: To transform these nascent initiatives into future 'stars' within the BCG matrix, substantial investment in technology, marketing, and content development is required to achieve critical mass and competitive advantage.

Knowledge for the Videogame Industry

Future's December 2024 launch of 'Knowledge for the Videogame Industry' positions them within the burgeoning gaming sector, a market projected to reach $321 billion globally by 2026. This strategic move focuses on a business-to-business (B2B) or professional audience, aiming to capture a specialized segment within this dynamic industry.

The initiative necessitates focused investment to cultivate brand recognition and user acquisition, essential for securing a strong foothold in this expanding niche. Future's existing presence in related media segments provides a foundational advantage for cross-promotion and market penetration.

- Market Growth: The global games market is experiencing robust expansion, with significant growth anticipated in the professional services and data analytics sectors within gaming.

- B2B Focus: Targeting businesses and professionals within the gaming ecosystem allows for higher average revenue per user (ARPU) compared to consumer-facing products.

- Investment Requirement: Building awareness and user adoption in a specialized B2B market typically requires dedicated marketing spend and product development resources.

- Competitive Landscape: Understanding existing knowledge platforms and data providers within the gaming industry is crucial for differentiating Future's offering and achieving market leadership.

Future's new ventures in AI-driven content, the ROOMS platform, and retail media with 'Ocado Ads' all represent significant potential growth areas. These initiatives are currently in their nascent stages, meaning they have low market share and revenue generation, making them classic question marks in the BCG matrix. Significant investment in marketing, technology, and content is crucial for these ventures to mature into stars.

| Initiative | Market Potential (Projected) | Current Status | Key Investment Needs |

|---|---|---|---|

| Advisor AI | High-growth AI sector | Nascent, low market share | AI development, content integration |

| ROOMS | Expanding home media | New entrant, negligible market share | Marketing, content creation |

| Ocado Ads | $126 billion global retail media by 2026 | Nascent, minimal market share | Technology, data analytics, partnerships |

| Social Commerce & Digital Subscriptions | $2.9 trillion global social commerce by 2026 | Low penetration | Platform development, user acquisition |

| Knowledge for Videogame Industry | $321 billion global gaming by 2026 | Specialized B2B segment, low initial share | Brand building, user acquisition |

BCG Matrix Data Sources

Our Future BCG Matrix leverages forward-looking data, including economic forecasts, emerging market trends, and technological adoption rates, to predict future market positions.