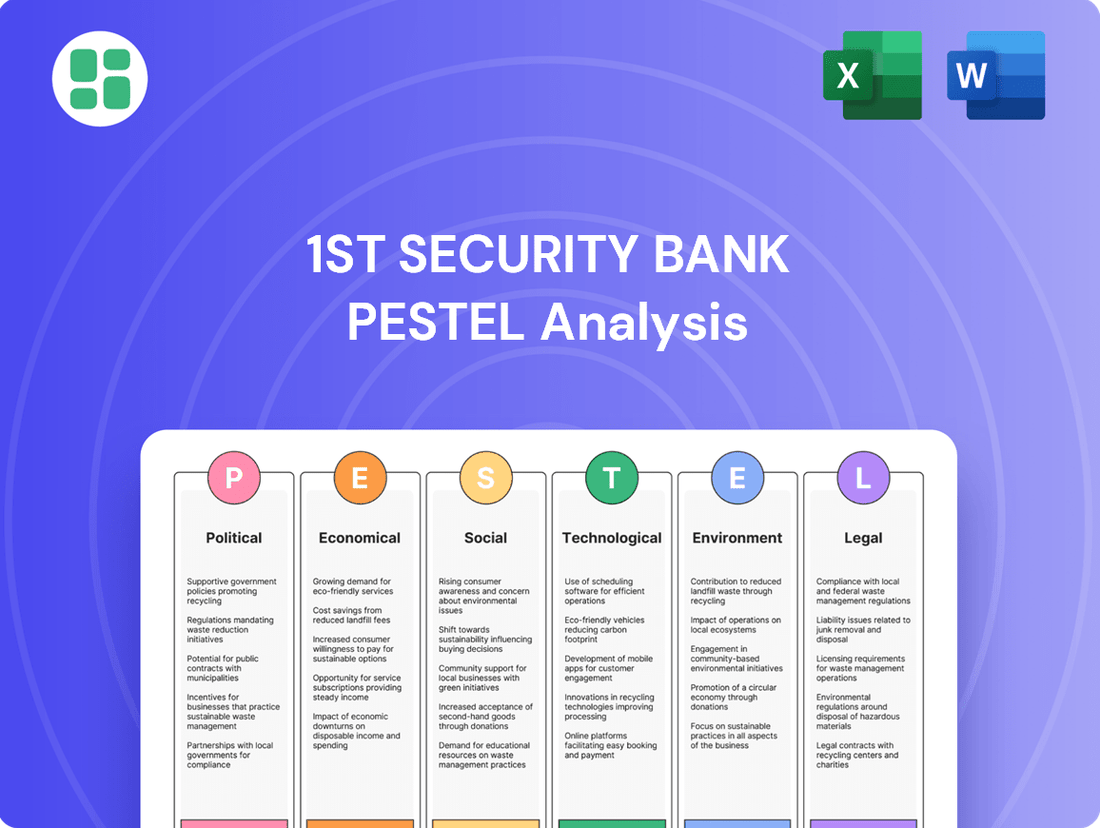

1st Security Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1st Security Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting 1st Security Bank's strategic direction. This comprehensive PESTLE analysis provides actionable insights to anticipate market shifts and identify potential opportunities and threats. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

The U.S. banking sector is navigating a complex regulatory environment, with potential shifts anticipated following the 2024 elections. Expanded legal challenges and Supreme Court decisions could introduce uncertainty, impacting areas like capital requirements and consumer protection. However, core focuses such as artificial intelligence adoption and cybersecurity resilience are expected to remain priorities for regulators, irrespective of political leadership changes.

Government spending and fiscal policies significantly influence the economic landscape, directly affecting sectors like banking. For instance, changes in state-level budgets, such as Washington's projected revenue shortfall, can lead to shifts in local economic activity, impacting consumer spending and business investment, which in turn shapes the operational environment for banks like 1st Security Bank.

Uncertainty surrounding trade policy shifts and potential tariffs, particularly with evolving administrations, can significantly impact business confidence and overall economic expansion. For 1st Security Bank, this translates to a direct influence on borrowing costs and investment strategies for its core clientele.

For instance, the U.S. imposed tariffs on billions of dollars worth of goods from China in 2023 and 2024, creating volatility in supply chains and impacting sectors like manufacturing and agriculture. This uncertainty can lead businesses to defer capital expenditures, thereby reducing demand for commercial loans, a key revenue stream for banks like 1st Security Bank.

Interest Rate Policy

The Federal Reserve's monetary policy, particularly its interest rate decisions, is a critical political factor for banks like 1st Security Bank. Higher rates generally boost net interest margins, but can also dampen loan demand. Conversely, lower rates can stimulate borrowing but compress those margins.

Looking ahead, forecasts for 2025 indicate a potential shift. Many economists anticipate the Federal Reserve may begin cutting interest rates in the latter half of 2025. This move, if it materializes, could encourage more borrowing and investment, potentially boosting loan volumes for 1st Security Bank.

However, these anticipated rate cuts also present a challenge. A lower interest rate environment typically leads to compressed net interest margins for banks, as the spread between what they earn on loans and pay on deposits narrows. This dynamic requires banks to adapt their strategies to maintain profitability.

- Federal Reserve Rate Decisions: Directly influence bank profitability and lending activity.

- 2025 Rate Cut Forecasts: Potential to stimulate borrowing but compress net interest margins.

- Impact on Lending: Lower rates could increase demand for loans, benefiting banks.

- Margin Compression: A key risk for banks in a declining interest rate environment.

Community Reinvestment Act (CRA) Updates

Updates to regulations like the Community Reinvestment Act (CRA) significantly influence community banks. For instance, proposed changes by the Office of the Comptroller of the Currency (OCC) in late 2023 and early 2024 aimed to modernize CRA examinations, potentially impacting how banks like 1st Security Bank are evaluated for their community development efforts. These adjustments could alter compliance requirements and investment priorities.

The Federal Deposit Insurance Corporation (FDIC) also plays a crucial role through its audit requirements. Recent discussions around adjusting asset-size thresholds for CRA eligibility could alleviate compliance burdens for certain community banks. For example, proposals have considered raising the threshold for intermediate-sized banks, potentially reclassifying some institutions and altering their regulatory focus.

These regulatory shifts are designed to balance compliance with community impact. The goal is to ensure that banks continue to serve low- and moderate-income communities effectively while adapting to evolving economic landscapes. The effectiveness of these updates will be closely monitored by institutions like 1st Security Bank and the broader financial sector.

Key considerations for 1st Security Bank include:

- Adapting to revised CRA examination procedures and scoring metrics.

- Evaluating the impact of potential asset-size threshold adjustments on compliance obligations.

- Strengthening internal controls and data collection to meet updated FDIC audit expectations.

- Strategizing community development investments to align with new regulatory frameworks.

Political stability and government policies significantly shape the banking sector. In 2024 and looking into 2025, shifts in fiscal policy and government spending remain key considerations, influencing economic activity and thus the demand for banking services. Evolving trade policies and geopolitical tensions can also create market volatility, impacting investment strategies and borrowing costs for businesses that banks serve.

The Federal Reserve's monetary policy, particularly interest rate decisions, directly affects bank profitability. While forecasts suggest potential rate cuts in late 2025, this could stimulate borrowing but also compress net interest margins for institutions like 1st Security Bank. Regulatory updates, such as proposed changes to the Community Reinvestment Act (CRA) and FDIC audit requirements, are also critical, potentially altering compliance burdens and community development investment priorities.

For example, the U.S. banking sector saw a significant increase in regulatory scrutiny following the 2023 bank failures, leading to discussions about capital requirements and stress testing for mid-sized banks. These ongoing regulatory dialogues, coupled with potential changes in administration following the 2024 elections, introduce a layer of political uncertainty that banks must actively manage.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing 1st Security Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic overview to identify potential threats and opportunities for the bank's growth and stability.

A clean, summarized version of the 1st Security Bank PESTLE analysis provides a quick reference to external factors, alleviating the pain of sifting through extensive data during strategic discussions.

Economic factors

Interest rate fluctuations remain a paramount concern for bankers heading into 2025, directly impacting the cost of funds and the profitability of lending operations. While the Federal Reserve has seen some stabilization, anticipated shifts in monetary policy will continue to influence the bank's lending volumes and net interest margins.

For instance, if the Federal Reserve were to lower its benchmark interest rate by 0.25% in late 2024 or early 2025, it could lead to decreased income on variable-rate loans for 1st Security Bank. Conversely, any upward adjustments would likely increase borrowing costs for customers, potentially dampening loan demand.

The Pacific Northwest, encompassing Washington and Oregon, presents a dynamic economic landscape influencing 1st Security Bank's growth. While population and business expansion are anticipated to continue, there are indications of a slowdown in economic momentum, potentially affecting revenue streams for both states.

For Washington, projections suggest a moderate economic growth rate for 2024, with GDP growth estimated around 2.1%, though this represents a dip from the robust 3.5% seen in 2023. Oregon's outlook for 2024 indicates a similar trend, with a projected GDP growth of approximately 1.8%, down from 2.8% in the prior year.

Inflation continues to be a significant driver of Federal Reserve decisions and impacts how much consumers can buy. For instance, the US Consumer Price Index (CPI) saw a notable increase, with the year-over-year rate hovering around 3.4% in early 2024, impacting household budgets.

These persistent inflationary pressures translate to higher borrowing costs for businesses and individuals, potentially forcing the Fed to keep interest rates elevated. This environment directly influences 1st Security Bank's lending margins and the overall demand for credit.

Loan and Deposit Growth Trends

Community banks are navigating a challenging environment where deposit growth is becoming more critical than loan expansion. While lending, particularly in commercial real estate and small business sectors, continues to be a primary source of revenue, the ability to fund these loans hinges on attracting and retaining deposits. This shift requires a strategic focus on deposit acquisition to ensure sustainable loan growth.

Recent data highlights this trend. For instance, as of Q1 2024, many community banks reported slower deposit growth compared to loan origination. The Federal Reserve's interest rate policies have also influenced deposit behavior, with customers seeking higher yields, putting pressure on banks to offer competitive rates. This dynamic means that attracting new depositors and retaining existing ones is paramount for maintaining lending capacity.

- Deposit growth lags loan origination: Many community banks are experiencing a widening gap between their loan portfolios and deposit bases, indicating a need to prioritize deposit-gathering strategies.

- Competitive deposit landscape: Higher interest rates have led to increased competition for customer deposits, forcing banks to offer more attractive terms to retain funds.

- Funding loan expansion: A strong deposit base is essential for community banks to continue supporting vital lending activities, especially for small businesses and commercial real estate projects.

Real Estate Market Conditions

The health of the real estate market significantly impacts 1st Security Bank's loan portfolio. A strong market, especially in commercial and residential sectors, can fuel loan growth, particularly in owner-occupied commercial properties and construction lending, reflecting the bank's ability to adapt to economic changes. For instance, in Q1 2024, the US commercial real estate market saw continued investment, though challenges persisted in certain segments, with office vacancies remaining a concern.

However, a substantial concentration in commercial real estate (CRE) loans can introduce profitability risks for 1st Security Bank. As of late 2024, while demand for industrial and multifamily properties remained relatively strong, the office sector continued to face headwinds, impacting occupancy rates and property valuations. This divergence means careful management of the CRE portfolio is crucial.

- Residential Real Estate: Housing starts in the US showed a moderate increase in early 2024 compared to 2023, indicating some recovery in new construction.

- Commercial Real Estate: Investment volume in CRE saw fluctuations throughout 2024, with significant regional and sector-specific variations.

- Loan Portfolio Impact: The bank's exposure to CRE loans, especially in challenged sub-sectors like office space, requires diligent risk assessment and potential portfolio adjustments.

- Interest Rate Sensitivity: Fluctuations in interest rates throughout 2024 continued to influence real estate transaction volumes and financing costs, directly affecting loan demand and repayment capacity.

Economic factors significantly shape 1st Security Bank's operational landscape heading into 2025. Interest rate policies by the Federal Reserve, with a benchmark rate holding steady around 5.25-5.50% through early 2025, directly influence the bank's cost of funds and net interest margins. The economic growth in its primary markets, Washington and Oregon, is projected to moderate, with GDP growth anticipated around 2% for 2024, impacting loan demand and overall revenue potential.

Inflation, measured by the US CPI at approximately 3.4% year-over-year in early 2024, continues to exert pressure on consumer spending and business investment, potentially leading the Fed to maintain higher rates. This environment necessitates a strategic focus on deposit growth, as many community banks, including 1st Security Bank, are seeing deposit growth lag loan origination, with deposit rates needing to remain competitive to attract and retain funds.

The real estate market presents both opportunities and risks, with continued investment in industrial and multifamily sectors contrasted by ongoing challenges in the office sector. For instance, US commercial real estate investment volume fluctuated in 2024, with office vacancy rates remaining a concern in many urban centers, directly impacting the bank's loan portfolio concentration and risk assessment.

| Economic Indicator | Value (Early 2024/Projections) | Impact on 1st Security Bank |

|---|---|---|

| Federal Funds Rate | 5.25-5.50% | Affects cost of funds and lending profitability. |

| US GDP Growth (2024 Projection) | ~2.0% (for WA/OR) | Influences loan demand and revenue streams. |

| US CPI (Year-over-Year) | ~3.4% | Drives Fed policy, impacts borrowing costs and consumer spending. |

| Deposit Growth vs. Loan Origination | Deposit growth lagging loan origination | Requires enhanced focus on deposit acquisition strategies. |

| Commercial Real Estate (Office Sector) | Continued headwinds, elevated vacancies | Potential risks for CRE loan portfolio concentration. |

Preview Before You Purchase

1st Security Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for 1st Security Bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting 1st Security Bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Consumers increasingly expect personalized digital banking, demanding 24/7 access, rapid responses, and tailored financial guidance. For instance, a 2024 survey by J.D. Power found that 70% of banking customers prefer digital channels for routine transactions, highlighting a significant shift in behavior.

Meeting these evolving expectations requires substantial investment in advanced technology and robust data analytics. Banks that fail to adapt risk losing customer loyalty, as evidenced by a recent study showing that a poor digital experience is a primary driver for customers switching banks.

The U.S. banking landscape is being reshaped by significant demographic shifts. The aging Baby Boomer generation, a large cohort, is entering retirement, which will likely influence savings, investment, and withdrawal patterns. Simultaneously, declining birth rates mean a smaller future workforce and consumer base, impacting loan demand and economic growth.

Immigration patterns are also playing a role, potentially bringing new customers with diverse financial needs and preferences. A massive intergenerational wealth transfer is on the horizon, with trillions of dollars expected to move from older generations to younger ones. This shift necessitates that banks like 1st Security Bank understand and adapt to the financial expectations of Millennials and Gen Z, who often prioritize digital banking, ESG investing, and personalized financial advice.

1st Security Bank's focus on community involvement resonates with a growing trend, especially among millennials and Gen Z, who increasingly prefer to bank with institutions that show a commitment to social responsibility. This approach fosters trust and loyalty, crucial in today's market. For instance, in 2024, a significant portion of consumers, particularly those under 40, indicated that a company's social impact is a key factor in their purchasing decisions.

By prioritizing relationship banking, 1st Security Bank can effectively differentiate itself from larger, more impersonal financial institutions. This personalized service model, which emphasizes understanding individual customer needs, can lead to higher customer retention rates. Data from 2024 suggests that personalized customer experiences can boost customer loyalty by up to 20%.

Financial Literacy and Digital Adoption

The increasing digitization of banking services necessitates a baseline level of digital literacy among consumers. Banks are therefore tasked with developing intuitive digital platforms and offering educational resources to ensure broad accessibility and effective utilization by all customer segments.

Financial literacy is a crucial component of this digital shift. According to a 2023 report by the Financial Industry Regulatory Authority (FINRA), only 66% of Americans felt confident in their financial literacy. This gap highlights the need for proactive educational initiatives from financial institutions like 1st Security Bank to bridge the digital divide and foster trust in online banking channels.

- Digital Banking Growth: Mobile banking users in the US are projected to reach 240 million by 2025, underscoring the importance of user-friendly digital interfaces.

- Financial Literacy Gap: Studies consistently show a correlation between financial literacy and the adoption of digital financial tools.

- Educational Investment: Banks investing in customer education for digital platforms can see increased engagement and reduced support costs.

- Accessibility Focus: Ensuring platforms are accessible to older adults and those with limited digital experience is key to inclusive banking.

Demand for Sustainable and Ethical Banking

Customers are increasingly scrutinizing the environmental, social, and governance (ESG) practices of financial institutions. This growing demand for sustainable and ethical banking means consumers want transparency about where their money goes and its impact. For instance, a 2024 report indicated that over 60% of millennials and Gen Z consider a company's sustainability practices when making purchasing decisions, including financial services.

This trend creates a significant opportunity for banks like 1st Security Bank to differentiate themselves by offering and actively promoting ESG-focused investment funds and services. Demonstrating a genuine commitment to sustainability can attract a broader customer base and foster loyalty. By aligning with these societal values, banks can enhance their brand reputation and tap into a rapidly expanding market segment.

- Growing Customer Demand: A significant majority of consumers, particularly younger demographics, prioritize sustainability in their financial choices.

- Opportunity for ESG Products: Banks can leverage this by offering specialized ESG investment funds and green financial products.

- Enhanced Brand Reputation: A strong commitment to ethical and sustainable practices can improve public perception and attract socially conscious clients.

- Market Differentiation: Focusing on ESG can set a bank apart in a competitive landscape, appealing to a values-driven customer base.

Societal expectations are shifting, with a growing emphasis on personalized digital experiences and ethical banking practices. Consumers, especially younger demographics, increasingly favor institutions that demonstrate social responsibility and offer tailored financial guidance through accessible digital platforms. This necessitates significant investment in technology and a focus on customer education to bridge the financial literacy and digital divide.

| Sociological Factor | Impact on Banking | 2024/2025 Data Point |

|---|---|---|

| Digitalization Demand | Consumers expect 24/7 access and personalized digital services. | 70% of banking customers prefer digital channels for routine transactions (J.D. Power, 2024). |

| Demographic Shifts | Aging population impacts savings and withdrawal patterns; smaller future workforce affects loan demand. | Trillions of dollars in wealth transfer expected to younger generations. |

| Social Responsibility | Preference for banks with strong ESG commitments. | Over 60% of millennials and Gen Z consider sustainability in financial choices (2024 report). |

| Financial Literacy | A gap exists, requiring banks to offer educational resources for digital tools. | 66% of Americans felt confident in their financial literacy (FINRA, 2023). |

Technological factors

The banking sector is rapidly embracing digital transformation, with significant investments in automation to enhance efficiency and cut costs. For instance, by the end of 2024, it's projected that financial institutions will have poured billions into AI and automation technologies to streamline operations like transaction processing and compliance.

This shift impacts 1st Security Bank by necessitating continuous upgrades to its digital infrastructure and workforce training to leverage these automated systems. By automating routine tasks, the bank can reallocate human capital to more complex customer service and strategic initiatives, thereby improving overall service delivery and reducing the potential for human error in data handling.

Cybersecurity and data privacy are paramount concerns for community banks like 1st Security Bank heading into 2025. The landscape is increasingly challenging, with cyberattacks becoming more sophisticated and the financial repercussions of data breaches escalating. For instance, the average cost of a data breach in the financial sector in 2024 was estimated to be around $5.9 million, a significant figure for any institution.

To navigate these risks, 1st Security Bank must prioritize robust cybersecurity measures. This includes investing in advanced threat detection systems, implementing continuous monitoring protocols, and ensuring all employees receive regular, comprehensive training on data protection best practices. Such proactive strategies are essential for safeguarding sensitive customer information and maintaining trust in an era of heightened digital threats.

1st Security Bank, like many financial institutions, is seeing a significant push towards adopting AI and machine learning. These technologies are being integrated across various banking functions, from bolstering fraud detection systems to refining risk management strategies. Furthermore, the drive for personalized customer service and advanced data analytics relies heavily on these advancements.

Community banks, including 1st Security Bank, are increasingly recognizing the strategic imperative of incorporating AI and machine learning. This adoption is crucial for enhancing overall competitiveness and achieving greater operational efficiency in a rapidly evolving financial landscape.

Evolution of Digital Banking Services

The evolution of digital banking services is fundamentally reshaping how customers interact with financial institutions. Advanced offerings like mobile banking apps, AI-powered chatbots for customer support, and sophisticated real-time fraud detection systems are now table stakes. For instance, by the end of 2024, it's anticipated that over 70% of all banking transactions will be conducted digitally, highlighting a significant shift in consumer behavior.

Banks are heavily investing in enhancing the customer experience through intuitive app design and round-the-clock support. This focus on user-friendliness and accessibility aims to meet the expectations of a digitally native customer base. Personalized financial management tools, offering insights into spending habits and savings goals, are also becoming a key differentiator. By 2025, a significant portion of banks are expected to offer AI-driven personalized financial advice, further deepening customer engagement.

- Mobile Banking Adoption: Projections indicate that by late 2024, over 85% of bank customers will utilize mobile banking platforms for daily transactions.

- AI in Customer Service: By mid-2025, it's estimated that AI-powered chatbots will handle over 60% of customer inquiries in the banking sector.

- Digital Transaction Growth: The volume of digital transactions is expected to grow by an average of 15% annually through 2025.

- Personalization Investment: Financial institutions are increasing their spending on data analytics and AI to deliver personalized banking experiences, with investments projected to rise by 20% in 2025.

Third-Party Vendor Risks and Collaboration

As 1st Security Bank, like many financial institutions, integrates more fintech solutions, the risks associated with third-party vendors grow. Cybersecurity threats and data privacy breaches originating from these partners are significant concerns. For instance, a 2024 report indicated that 60% of financial services firms experienced a third-party data breach in the past two years, highlighting the pervasive nature of this risk.

Strategic collaborations with fintech companies offer substantial benefits, such as improved customer experience and operational efficiency. However, these partnerships necessitate stringent due diligence and ongoing oversight. In 2025, regulators are expected to increase scrutiny on how banks manage vendor risk, making robust compliance frameworks essential.

The bank's approach to managing these technological factors involves:

- Rigorous Vendor Assessment: Implementing comprehensive security and compliance audits for all new and existing third-party providers, with a focus on their data handling practices.

- Continuous Monitoring: Establishing protocols for ongoing performance and security monitoring of fintech partners, including regular vulnerability assessments.

- Clear Contractual Agreements: Ensuring all vendor contracts include specific clauses addressing data security, breach notification, and liability, aligning with evolving regulatory requirements.

Technological advancements are fundamentally reshaping the banking landscape, pushing institutions like 1st Security Bank to prioritize digital integration and automation. By 2025, it's projected that over 70% of banking transactions will be digital, underscoring the need for robust mobile platforms and AI-driven services. This digital shift necessitates continuous investment in cybersecurity to combat increasingly sophisticated threats, with data breaches in the financial sector averaging around $5.9 million in 2024.

| Technology Area | 2024/2025 Projection/Data | Impact on 1st Security Bank |

|---|---|---|

| Digital Transaction Volume | Expected to grow 15% annually through 2025 | Requires enhanced digital infrastructure and user experience |

| AI in Customer Service | AI chatbots to handle over 60% of inquiries by mid-2025 | Need for AI integration to improve efficiency and customer engagement |

| Cybersecurity Costs (Financial Sector) | Average data breach cost ~ $5.9 million in 2024 | Mandates significant investment in advanced security measures |

| Mobile Banking Adoption | Over 85% of customers using mobile platforms by late 2024 | Emphasis on user-friendly and feature-rich mobile applications |

Legal factors

The banking sector operates under a stringent and ever-changing regulatory landscape. New mandates frequently emerge, particularly concerning data protection, customer privacy, and cybersecurity, requiring constant vigilance. For instance, in 2024, the FDIC continued to emphasize robust cybersecurity protocols, with institutions facing increased scrutiny on their third-party risk management.

Banks like 1st Security Bank must proactively adapt to these shifts, staying compliant with directives from agencies such as the Federal Deposit Insurance Corporation (FDIC) and the Consumer Financial Protection Bureau (CFPB). This includes meticulous adherence to audit trails and reporting obligations, which are critical for maintaining operational integrity and avoiding penalties. Failure to comply can result in significant fines, impacting profitability and reputation.

Evolving data privacy regulations, like the California Consumer Privacy Act (CCPA) and similar state-level laws, place significant demands on how financial institutions manage customer information. These rules necessitate robust data governance, strong encryption, and secure data storage practices, directly impacting operational costs and compliance strategies for banks like 1st Security Bank.

The pressure to adhere to global Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations continues to intensify for financial institutions like 1st Security Bank. This necessitates the adoption of advanced technologies for detecting and tracking potentially illicit transactions. For instance, in 2023, financial institutions globally reported spending billions on AML compliance, with projections indicating further increases as regulatory scrutiny sharpens.

Anticipated final rules in 2025 are set to significantly reshape the Bank Secrecy Act (BSA) program requirements for banks. These changes will likely demand more robust internal controls and reporting mechanisms, impacting operational costs and strategic planning for compliance departments.

Consumer Protection Regulations

New consumer protection regulations significantly shape how banks like 1st Security Bank operate. For instance, changes impacting overdraft fees, a key revenue source for many institutions, directly affect profitability. The Consumer Financial Protection Bureau (CFPB) has been actively scrutinizing these practices, with reports indicating a substantial reduction in overdraft fees across the industry following regulatory pressure.

The inclusion of medical debt on credit reports, another area of recent regulatory focus, can also influence a bank's risk assessment and lending decisions. Banks must adapt their internal processes and compliance frameworks to adhere to these evolving consumer protection standards. Failure to do so can result in significant fines and damage to customer trust. For example, in 2024, several financial institutions faced penalties for non-compliance with consumer protection laws, underscoring the importance of proactive adaptation.

- Overdraft Fee Scrutiny: Regulatory bodies are increasingly examining overdraft fee structures, potentially limiting revenue for banks.

- Medical Debt Reporting: New rules on reporting medical debt can alter creditworthiness assessments.

- Compliance Costs: Adapting to new regulations necessitates investment in technology and training, increasing operational expenses.

- Reputational Risk: Non-compliance can lead to penalties and erode customer confidence, impacting long-term business.

Cybersecurity Regulations and Standards

Cybersecurity regulations are tightening globally, with significant implications for financial institutions like 1st Security Bank. For instance, the NIS 2 Directive, which began its enforcement phase in the EU in early 2025, is setting a higher bar for cybersecurity across critical sectors, including finance. This directive, along with existing frameworks like the NYDFS Cybersecurity Regulation, mandates robust security measures, incident reporting, and supply chain risk management.

Banks must proactively invest in advanced cybersecurity technologies and continuous employee training to ensure compliance. Failure to meet these evolving legal standards can result in substantial fines and reputational damage. The increasing complexity of cyber threats necessitates a dynamic approach to regulatory adherence.

- NYDFS Cybersecurity Regulation: Requires covered financial institutions to maintain a cybersecurity program, conduct annual risk assessments, and implement specific security controls.

- NIS 2 Directive (EU): Aims to enhance cybersecurity resilience and incident reporting for a wider range of essential and important entities, with enforcement starting in 2025.

- Increased Enforcement: Regulators are expected to increase scrutiny and penalties for non-compliance in 2024-2025, impacting financial institutions worldwide.

- Investment Needs: Banks face growing pressure to allocate significant resources towards cybersecurity infrastructure, threat detection, and employee education to meet these mandates.

Legal factors significantly shape 1st Security Bank's operations, demanding strict adherence to evolving regulations. The CFPB's scrutiny on overdraft fees, for example, has led to industry-wide reductions, impacting revenue streams as seen in 2023-2024 data. Furthermore, new rules on medical debt reporting influence credit risk assessments, requiring banks to update their internal processes and compliance frameworks to avoid penalties and maintain customer trust, with regulators intensifying enforcement in 2024-2025.

| Regulatory Area | Impact on 1st Security Bank | 2024-2025 Trend/Data |

|---|---|---|

| Consumer Protection (Overdraft Fees) | Potential revenue reduction, need for alternative fee structures. | CFPB actively scrutinizing; industry-wide fee reductions reported. |

| Data Privacy (CCPA, etc.) | Increased costs for data governance, encryption, and secure storage. | Growing state-level regulations necessitate robust compliance strategies. |

| Cybersecurity (NYDFS, NIS 2) | Mandatory investment in advanced security measures and incident reporting. | NIS 2 enforcement begins 2025; increased penalties for non-compliance expected. |

| AML/CTF Compliance | Continued investment in technology for transaction monitoring. | Global spending on AML compliance in billions; increasing scrutiny. |

Environmental factors

Regulators and investors are pushing for greater transparency in environmental, social, and governance (ESG) practices, with many jurisdictions introducing new reporting mandates. For instance, the European Union’s Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, significantly expands disclosure requirements. This increased scrutiny directly impacts banks like 1st Security Bank.

Banks are responding by investing in technology to improve the efficiency and accuracy of their ESG disclosures, ensuring compliance with these evolving standards. This focus on streamlined reporting not only addresses regulatory demands but also plays a crucial role in shaping the bank's public image and strengthening relationships with investors who increasingly prioritize sustainability.

Climate-related financial risks are becoming a significant concern for banks like 1st Security Bank. These risks can affect their loan portfolios, particularly real estate in areas prone to extreme weather events, and also influence investment strategies. For instance, a report from the Network for Greening the Financial System in early 2024 highlighted that climate change could lead to substantial economic losses, impacting sectors heavily reliant on physical assets.

Integrating environmental considerations into risk assessments is crucial. This means banks need to evaluate how physical risks, such as floods or droughts, and transition risks, like policy changes or technological shifts towards sustainability, could affect borrowers' ability to repay loans. By 2025, many financial institutions are expected to have more robust frameworks for assessing these climate-related impacts on their lending and investment decisions, aligning with growing regulatory and investor expectations.

The financial sector is witnessing a significant surge in demand for green finance and sustainable investment products. This trend is driven by an increasing number of environmentally conscious consumers and institutional investors seeking to align their capital with ethical and sustainable objectives. For instance, assets in ESG (Environmental, Social, and Governance) funds globally reached an estimated $3.7 trillion by the end of 2023, highlighting this powerful market shift.

Banks like 1st Security Bank have a prime opportunity to capitalize on this growing market by developing and actively promoting a range of green finance offerings. This includes products that support renewable energy projects, sustainable agriculture, or funds with a strong ESG focus. By doing so, they can attract and retain environmentally aware customers, thereby enhancing their brand reputation and market share.

Operational Environmental Footprint

Banks are increasingly facing pressure to disclose their operational environmental impact. 1st Security Bank, like its peers, must consider the energy consumption and carbon emissions stemming from its physical branches and data centers. For instance, in 2023, the banking sector globally saw a growing emphasis on reporting Scope 1 and Scope 2 emissions, with many institutions setting targets for reduction.

Sustainable operational practices are becoming a key differentiator. This includes initiatives like energy-efficient building upgrades, waste reduction programs, and responsible IT infrastructure management.

- Energy Efficiency: Many banks are investing in LED lighting and smart building technologies to reduce electricity usage in their branches.

- Carbon Footprint Tracking: The industry is moving towards more robust methods for measuring and reporting carbon emissions from operations.

- Sustainable IT: Efforts are underway to optimize data center energy consumption and explore cloud solutions with better environmental credentials.

Community Resilience to Environmental Changes

1st Security Bank, operating in the Pacific Northwest, faces environmental factors that can impact its community focus. The region's susceptibility to events like wildfires and seismic activity necessitates a commitment to supporting local resilience. For instance, in 2024, Washington state experienced significant wildfire seasons, impacting communities and local economies, which in turn could affect loan portfolios and business operations for the bank.

The bank's relationship-based model is well-suited to addressing these challenges. By understanding and supporting community efforts to mitigate environmental risks, 1st Security Bank can strengthen its local ties. This could involve financing for infrastructure improvements or supporting small businesses that adopt sustainable practices to adapt to changing environmental conditions.

Key environmental considerations for 1st Security Bank include:

- Natural Disaster Preparedness: Assessing and mitigating risks associated with earthquakes, floods, and wildfires prevalent in the Pacific Northwest.

- Resource Management: Understanding the impact of water scarcity or availability on local industries, particularly agriculture and forestry, which are vital to the bank's customer base.

- Climate Change Adaptation: Supporting community and business initiatives that adapt to long-term environmental shifts, such as changing weather patterns affecting tourism or agriculture.

Increasing regulatory pressure and investor demand for ESG transparency, exemplified by the EU's CSRD, are compelling banks like 1st Security Bank to enhance their environmental disclosures. This focus is driving investments in technology for more accurate and efficient ESG reporting, crucial for maintaining investor confidence and a positive public image as of 2024-2025.

Climate-related financial risks, encompassing both physical impacts like extreme weather and transition risks from policy changes, are a growing concern for banks. By 2025, robust frameworks for assessing these impacts on loan portfolios and investment strategies are becoming essential, as highlighted by early 2024 reports from bodies like the Network for Greening the Financial System.

The market for green finance and sustainable investments is expanding rapidly, with global ESG assets estimated to reach $3.7 trillion by the end of 2023. 1st Security Bank can leverage this trend by offering green finance products, attracting environmentally conscious customers and strengthening its market position.

Banks are also under scrutiny to disclose their operational environmental impact, with a focus on energy consumption and carbon emissions from facilities. Initiatives like energy-efficient upgrades and sustainable IT are becoming key differentiators, with many institutions setting reduction targets for Scope 1 and Scope 2 emissions in 2023.

PESTLE Analysis Data Sources

Our PESTLE Analysis for 1st Security Bank is built on a foundation of credible data from government agencies, financial institutions, and reputable industry publications. We incorporate economic indicators, regulatory updates, technological advancements, and social trend reports to provide a comprehensive overview.