1st Security Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1st Security Bank Bundle

1st Security Bank operates within a dynamic financial landscape, where understanding competitive pressures is paramount. Our initial assessment highlights key factors influencing profitability, from the intensity of rivalry to the bargaining power of customers.

The complete report reveals the real forces shaping 1st Security Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors represent a crucial source of capital for banks, and their influence, particularly for institutions like 1st Security Bank, is substantial. This power stems from their role as the primary suppliers of funds. The competitive landscape for securing these funds remains intense, with deposit costs staying high throughout 2024 and projected into 2025.

The ongoing 'war for deposits' means banks are finding it difficult to lower the interest rates they offer to depositors as quickly as central banks might be cutting their benchmark rates. This dynamic puts pressure on net interest margins, as the cost of funding remains elevated even as asset yields potentially adjust.

Technology and software providers wield considerable bargaining power in the banking sector, largely due to the industry's growing dependence on sophisticated digital solutions. Banks increasingly rely on specialized providers for critical functions like artificial intelligence, robust cybersecurity, and modern core banking systems. This reliance is amplified as banks invest heavily in digital transformation to remain competitive and meet evolving customer expectations.

Skilled employees are the backbone of any bank, and 1st Security Bank is no exception. Expertise in areas like regulatory compliance, cutting-edge technology, and building strong customer relationships directly impacts service quality and operational efficiency. The demand for such talent, especially in competitive regions like the Pacific Northwest, can significantly enhance employees' leverage in negotiating compensation and benefits.

In 2024, the financial services sector continued to face a tight labor market for specialized roles. For instance, the U.S. Bureau of Labor Statistics reported that employment for financial managers, a key segment for banks, was projected to grow 4% from 2022 to 2032, indicating ongoing demand. 1st Security Bank's focus on fostering a positive culture and achieving 'Best Place to Work' accolades underscores its strategic approach to attracting and retaining these vital human resources, which in turn can moderate supplier power.

Regulatory Bodies

Regulatory bodies like the FDIC and SEC act as powerful, albeit non-traditional, suppliers to banks such as 1st Security Bank. They dictate operational rules, compliance standards, and capital adequacy, significantly influencing how banks function. For instance, in 2024, the banking sector continued to see increased scrutiny on capital requirements, impacting strategic planning and investment decisions.

The cost of compliance with these regulations is substantial. Banks must allocate considerable resources to regulatory technology (RegTech) and dedicated compliance personnel to navigate the complex and ever-changing landscape. This ongoing investment effectively raises the operational cost for institutions like 1st Security Bank.

- Regulatory Influence: Agencies such as the FDIC and SEC impose critical operational frameworks and capital mandates on banks.

- Compliance Costs: Significant investments in RegTech and compliance teams are necessary to meet evolving regulatory demands.

- Risk of Non-Compliance: Failure to adhere to regulations can result in severe financial penalties and operational limitations for banks.

Financial Data and Infrastructure Providers

Financial data and infrastructure providers hold significant bargaining power over banks like 1st Security Bank. These entities supply critical services such as real-time market data, payment processing networks, and credit scoring, which are fundamental to a bank's ability to function and manage risk. The integration of these systems into a bank's core operations often results in substantial switching costs, making it difficult and expensive to change providers.

The increasing digitization of business-to-business payments further amplifies this dependence. Banks rely on these providers for secure, efficient, and compliant transaction processing. For instance, in 2024, the global B2B payments market was projected to reach trillions of dollars, underscoring the sheer volume and importance of the underlying infrastructure. Disruptions or changes in these services can directly impact a bank's revenue streams and operational continuity.

- High Switching Costs: Integrating new financial data feeds or payment systems requires extensive IT investment, data migration, and retraining, creating a strong lock-in effect for existing providers.

- Critical Infrastructure: Services like SWIFT for international payments or credit rating agencies are non-negotiable for global banking operations, giving these suppliers leverage.

- Data Dependency: Banks depend on accurate and timely financial data for lending decisions, investment strategies, and regulatory compliance, making reliable providers indispensable.

Depositors are the primary suppliers of capital for banks, and their bargaining power is significant, especially given the competitive environment for deposits in 2024, which saw elevated interest rates. This 'war for deposits' directly impacts a bank's funding costs, influencing net interest margins.

Technology and skilled employees also represent key supplier groups. Banks' increasing reliance on specialized digital solutions and the tight labor market for financial expertise in 2024 empower these suppliers, driving up costs for essential services and talent acquisition.

Regulatory bodies like the FDIC and SEC act as powerful, non-traditional suppliers, dictating operational standards and capital requirements. The substantial costs associated with compliance, including investments in RegTech, highlight their influence.

Financial data and infrastructure providers, essential for operations like payment processing and credit scoring, possess considerable leverage due to high switching costs and the critical nature of their services. The reliance on these providers is amplified by the increasing digitization of financial transactions.

What is included in the product

Tailored exclusively for 1st Security Bank, this analysis dissects the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute products on its market position and profitability.

Instantly identify and address competitive threats with a clear, actionable breakdown of the banking landscape.

Customers Bargaining Power

Individual retail customers typically have low bargaining power with banks like 1st Security Bank. The financial impact of any single customer's account is quite small relative to the bank's total assets.

However, this power can increase when customers act collectively. The rise of digital banking and attractive competitor offerings mean that a significant portion of consumers are willing to switch. In fact, data from early 2025 suggests that close to 20% of retail banking customers are considering a move to a different institution if a more appealing option becomes available.

1st Security Bank's strategic focus on small businesses and commercial clients places these customer segments in a position of moderate to high bargaining power. These clients often require specialized financial solutions, such as customized loan structures and intricate cash management services, which can be resource-intensive for the bank to provide.

The ability of these commercial clients to shift substantial deposit balances or loan portfolios to competing financial institutions, particularly local banks that might offer more attractive terms or personalized service, significantly amplifies their leverage. This dynamic is particularly relevant in 2024, where the competitive landscape for commercial banking services remains intense, with many institutions vying for these valuable relationships.

Digital natives, particularly Gen Z and Millennials, exert considerable bargaining power over financial institutions like 1st Security Bank. These younger consumers are highly mobile-first, seeking seamless digital experiences, instant payment capabilities, and accessible digital advisory services. Their willingness to switch providers based on superior digital offerings directly pressures banks to innovate.

Data from 2024 indicates a significant trend: a substantial portion of younger customers are open to switching banks if a better digital experience is offered. For instance, a recent survey revealed that over 60% of Gen Z individuals consider a bank's mobile app a primary factor in their choice of financial institution. This preference for convenience and digital integration means banks must continuously invest in user-friendly platforms to avoid losing this crucial demographic.

Access to Alternatives and Low Switching Costs

The banking sector, including institutions like 1st Security Bank, faces significant customer bargaining power due to increased access to alternatives and reduced switching costs. The rise of fintech companies and neobanks offers consumers more choices, making it easier to move funds and services. For example, in 2024, the digital banking adoption rate continued its upward trend, with a significant percentage of consumers expressing openness to switching providers for better digital experiences or lower fees.

While some customers might hesitate due to the perceived hassle or uncertainty of switching, a compelling offer from a competitor can easily overcome these barriers. If a financial institution fails to meet evolving customer needs, such as offering seamless digital platforms or competitive interest rates, customers are increasingly willing to explore new options. This dynamic compels traditional banks to constantly innovate and remain competitive in terms of product features, customer service quality, and pricing structures to retain their client base.

- Increased Competition: The proliferation of fintechs and neobanks provides customers with more choices, lowering the overall switching costs.

- Digital Adoption: Growing comfort with digital financial services encourages customers to explore and switch to providers offering superior online experiences.

- Price Sensitivity: Customers are more likely to switch if they find better rates or lower fees elsewhere, pressuring banks on pricing strategies.

- Demand for Convenience: Banks must offer user-friendly interfaces and efficient services to match the convenience offered by newer, digitally-native competitors.

Information and Transparency

Customers today have unprecedented access to information, making them far more discerning. Online reviews, comparison websites, and social media platforms allow individuals to easily research and compare banking products, interest rates, and service quality. For instance, in 2024, a significant portion of consumers actively sought out customer reviews before choosing a financial institution, with many stating that transparency around fees was a key deciding factor.

This heightened transparency directly impacts a bank's bargaining power. When customers can readily see competitor offerings and pricing, they are less likely to accept unfavorable terms. Banks that are not upfront about their fee structures or fail to meet service expectations are vulnerable to losing business to more transparent and responsive competitors. In 2023, data showed a direct correlation between negative online sentiment regarding hidden fees and customer attrition for several regional banks.

- Informed Consumers: Increased access to online reviews and comparison tools empowers customers to make well-researched decisions.

- Price Sensitivity: Transparency in pricing and fees makes customers more sensitive to competitive offers.

- Service Expectations: Banks must meet or exceed service standards, as dissatisfied customers can easily switch providers.

- Reputation Management: Online reputation significantly influences customer acquisition and retention in the banking sector.

The bargaining power of customers for 1st Security Bank is shaped by several factors, including the increasing availability of digital alternatives and heightened price sensitivity. While individual retail customers generally hold limited sway, their collective willingness to switch, driven by better digital experiences or lower fees, exerts pressure. For instance, data from early 2025 indicated that around 20% of retail banking customers were considering switching institutions for more appealing options.

Commercial clients and digital-native consumers, such as Gen Z and Millennials, possess more significant bargaining power. Commercial clients often require tailored services, making them valuable but also more mobile if competitor terms are superior. In 2024, over 60% of Gen Z individuals cited a bank's mobile app as a primary decision factor, underscoring the leverage this demographic holds.

The ease with which customers can compare offerings online and the reduced costs associated with switching banks amplify customer leverage. Transparency regarding fees and service quality is crucial, as customers are readily informed and can easily move their business. A 2023 analysis showed a correlation between negative online sentiment about hidden fees and customer attrition in regional banks.

| Customer Segment | Bargaining Power Factor | 2024/2025 Data Point |

|---|---|---|

| Retail Customers | Low individually, but collective switching power | ~20% willing to switch for better options (early 2025) |

| Commercial Clients | Moderate to High due to specialized needs | Intense competition for these relationships in 2024 |

| Digital Natives (Gen Z/Millennials) | High due to demand for digital experience | >60% consider mobile app primary factor (2024) |

| All Customers | Increased due to digital alternatives & transparency | Growing digital adoption and price sensitivity |

Preview Before You Purchase

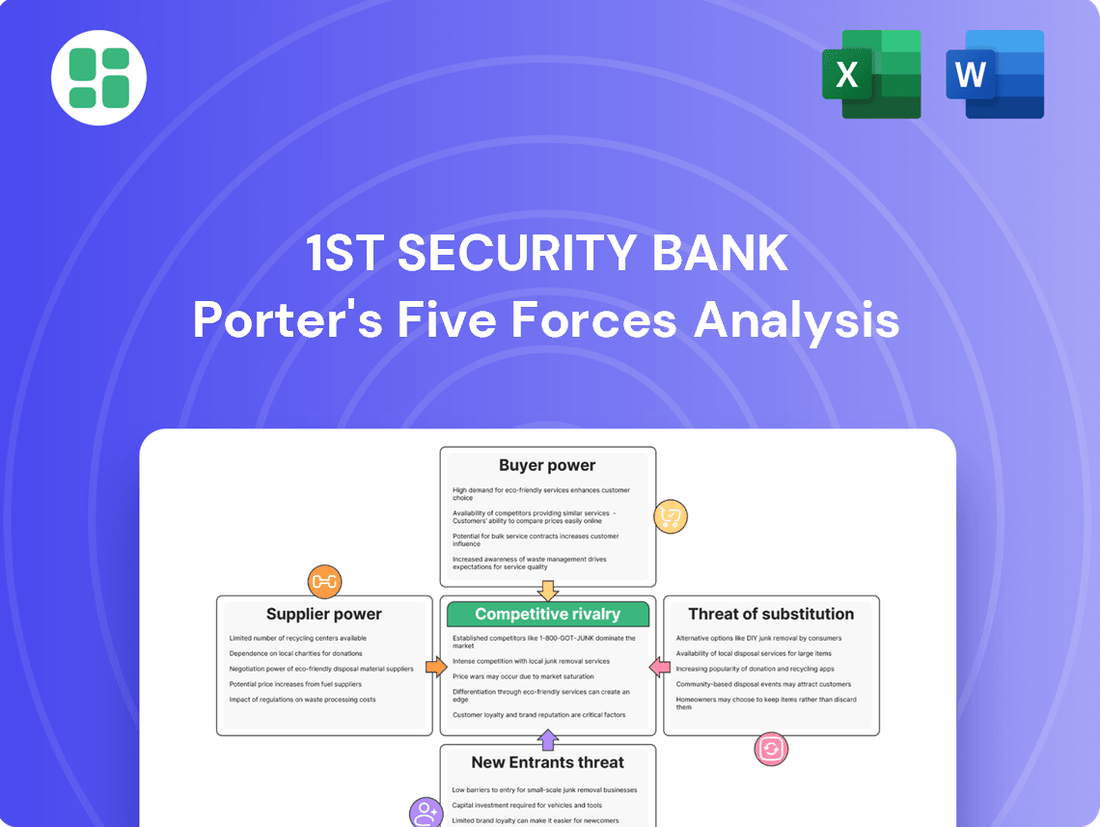

1st Security Bank Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for 1st Security Bank, offering a detailed examination of industry competition. The document you see is precisely the same professionally formatted analysis you will receive immediately after purchase, providing actionable insights into the bank's strategic landscape. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact file, ready for your immediate review and utilization.

Rivalry Among Competitors

The Pacific Northwest banking landscape is highly fragmented, featuring a blend of national giants, super-regional players, and a multitude of smaller community banks. This creates a fiercely competitive environment for 1st Security Bank, which operates 27 branches across Washington and Oregon, vying for market share in deposits, loans, and wealth management services.

Large, diversified banks present a formidable competitive force for institutions like 1st Security Bank. Their established brand recognition and vast operational scale allow them to invest heavily in cutting-edge technology and offer a wider spectrum of financial products. For instance, in 2024, major banks continued to leverage their resources to enhance digital banking platforms, a key area of competition.

The financial services landscape is experiencing a significant shake-up due to fintech and neobanks. These digital-first players, often operating with lower overheads, are rapidly gaining market share by offering streamlined, user-friendly services and competitive pricing. For instance, by the end of 2023, the global fintech market was valued at over $11 trillion, demonstrating its substantial impact.

This intense competition forces established institutions like 1st Security Bank to constantly innovate and enhance their digital offerings. Neobanks, in particular, are challenging traditional banks by focusing on specific niches, such as small business banking or international money transfers, and providing a seamless digital experience that many customers now expect. This pressure compels incumbents to accelerate their digital transformation strategies to remain competitive.

Deposit Competition and Margin Pressure

The competition for deposits remains intense, a critical battleground for banks like 1st Security Bank. This ongoing struggle for core funding directly impacts their ability to lend and invest, influencing overall financial health.

While the focus has evolved from solely aggressive rate increases to more relationship-driven approaches, the fundamental need to attract and retain deposits continues to exert pressure on net interest margins. Banks must balance offering competitive rates with the cost of acquiring and maintaining these crucial funds.

- Deposit Growth: In 2023, community banks saw an average deposit growth of 3.5%, a notable slowdown compared to prior years, indicating increased competition for customer funds.

- Net Interest Margin (NIM) Impact: Rising funding costs directly compress NIMs. For instance, if a bank’s cost of funds increases by 50 basis points, and its average earning assets remain constant, its NIM will decrease accordingly.

- Relationship Banking Value: Banks are increasingly leveraging broader product offerings and personalized service to retain deposits, recognizing that customer loyalty can offset marginal rate differences.

- Regulatory Scrutiny: Deposit stability is a key focus for regulators, especially following recent banking sector stresses, adding another layer of consideration for banks managing their deposit strategies.

Relationship-Based vs. Digital Service

1st Security Bank's competitive rivalry is shaped by the ongoing tension between its relationship-based, community-focused approach and the digital-first strategies of larger competitors. While 1st Security Bank actively engages in local events and fosters personal connections, many larger institutions are heavily investing in digital platforms to attract and retain customers. This creates a dynamic where the bank must balance its established strengths with the need to enhance digital offerings to remain competitive in a rapidly evolving financial landscape.

The core of this rivalry lies in how banks cater to diverse customer preferences. For instance, in 2024, while digital banking adoption continued to surge, with a significant portion of transactions occurring online, a substantial segment of the population still values in-person interactions and personalized advice. 1st Security Bank's strategy leans into this latter group, leveraging its community presence as a differentiator.

- Community Focus: 1st Security Bank's emphasis on local engagement and personalized service contrasts with the scalable digital models of national banks.

- Digital Investment: The need to invest in robust digital capabilities to meet evolving customer expectations creates a strategic challenge against digitally native competitors.

- Customer Preference: While digital banking grew, a segment of customers still prefers in-person interactions, a preference 1st Security Bank aims to capitalize on.

The competitive rivalry for 1st Security Bank is intense, stemming from a diverse mix of national banks, regional players, and agile fintech companies. This fragmented market forces the bank to continually adapt its strategies to capture and retain customers. The ongoing competition for deposits, a vital source of funding, directly impacts the bank's ability to lend and its overall profitability.

| Competitor Type | Key Strengths | Impact on 1st Security Bank |

|---|---|---|

| National Banks | Brand recognition, scale, digital investment | Pressure on pricing, need for digital parity |

| Regional Banks | Local market knowledge, established relationships | Direct competition for similar customer segments |

| Fintech/Neobanks | Agility, lower overhead, niche focus, user experience | Disruption of traditional services, customer acquisition challenges |

SSubstitutes Threaten

Fintech payment and lending solutions present a significant threat to traditional banks like 1st Security Bank. Companies offering streamlined payment processing, peer-to-peer lending, and niche credit products often appeal to consumers with their speed, convenience, and lower fees. For instance, the digital lending market saw substantial growth, with fintech lenders originating billions in loans in 2023, directly competing for customer segments that banks traditionally served.

The rise of embedded finance, where financial services are seamlessly integrated into non-financial platforms, poses a significant threat of substitution for traditional banks like 1st Security Bank. For instance, e-commerce giants offering point-of-sale financing directly to consumers bypass traditional banking channels. This trend is accelerating, with projections indicating the embedded finance market could reach $7 trillion globally by 2030, according to some industry analyses, directly impacting bank revenue streams.

Credit unions present a significant threat of substitution for 1st Security Bank, especially for individuals prioritizing personalized service and potentially more favorable fee structures. In 2023, credit unions saw a substantial increase in membership, reaching over 137 million members in the U.S., and their member-centric approach can directly appeal to customers who might otherwise bank with a community-focused institution like 1st Security Bank.

Community Development Financial Institutions (CDFIs) also pose a threat, particularly by serving niche markets and offering tailored financial solutions. These institutions are designed to support underserved communities, and as 1st Security Bank emphasizes its community role, CDFIs offer a direct alternative for customers within those specific demographics seeking specialized lending and financial empowerment programs.

Digital Wallets and Cryptocurrency

Digital wallets and the growing use of cryptocurrencies present a significant threat of substitutes for traditional banking services. These technologies allow for transactions and value storage outside of conventional financial institutions, particularly appealing to younger, tech-oriented demographics. For instance, global digital payment transactions were projected to reach over $10.5 trillion in 2024, highlighting the scale of this shift away from traditional methods.

While cryptocurrencies are still maturing, their potential to disrupt traditional deposit and payment systems is considerable. This evolving landscape means that banks like 1st Security Bank must consider how these digital alternatives might erode market share for their core offerings.

- Digital Wallets: Offer convenient, often mobile-first payment solutions, directly competing with debit and credit card services.

- Cryptocurrencies: Provide an alternative store of value and medium of exchange, potentially bypassing bank accounts for certain transactions.

- Consumer Adoption: Increasing comfort with digital platforms fuels the adoption of these substitute technologies, especially among younger generations.

- Market Disruption: These substitutes threaten traditional banking revenue streams from transaction fees and deposit interest.

Direct Investment Platforms and Robo-Advisors

Direct investment platforms and robo-advisors present a significant threat to traditional wealth management services offered by banks like 1st Security Bank. These digital alternatives provide a more cost-effective and user-friendly way for individuals to manage their investments, bypassing the need for full-service bank advisory.

The growing adoption of these platforms directly impacts a bank's fee income from wealth management. For instance, by mid-2024, assets under management on major robo-advisor platforms had surpassed hundreds of billions of dollars, demonstrating a clear shift in consumer preference towards lower-cost digital solutions.

This trend is further amplified by the increasing financial literacy and comfort with technology among younger investors. As more individuals opt for self-directed investing or automated portfolio management, the demand for traditional, higher-fee bank-managed portfolios is likely to diminish.

- Lower Fees: Robo-advisors typically charge annual management fees in the range of 0.25% to 0.50%, significantly lower than the 1% or more often charged by human advisors.

- Accessibility: Many platforms allow individuals to start investing with very low minimums, some as low as $1, making wealth management accessible to a broader audience.

- Convenience: Direct investment platforms and robo-advisors offer 24/7 access to investment accounts and automated rebalancing, appealing to tech-savvy investors.

The threat of substitutes for 1st Security Bank is substantial, encompassing a range of fintech innovations, alternative financial institutions, and evolving payment technologies. These substitutes often offer greater convenience, lower costs, or specialized services that can draw customers away from traditional banking. The market is dynamic, with new digital solutions constantly emerging and gaining traction, particularly among younger, tech-savvy demographics.

Fintech payment solutions and digital wallets are directly challenging traditional transaction services, while robo-advisors and direct investment platforms are eroding market share in wealth management. Even credit unions and CDFIs, while offering different models, provide viable alternatives for specific customer segments. The increasing adoption of these substitutes underscores the need for banks like 1st Security Bank to adapt and innovate to remain competitive.

The growth in digital payments and alternative investment platforms highlights a clear shift in consumer behavior. For instance, global digital payment transactions were projected to exceed $10.5 trillion in 2024, indicating a significant move away from traditional banking channels for everyday transactions. Similarly, assets under management on robo-advisor platforms have reached hundreds of billions of dollars by mid-2024, demonstrating the appeal of lower-cost, accessible investment solutions.

| Substitute Type | Key Features | Impact on Banks | 2024 Market Data/Projections |

| Fintech Payment Solutions | Speed, convenience, lower fees | Reduced transaction revenue | Billions in digital lending originations (2023) |

| Digital Wallets/Cryptocurrencies | Alternative payment/store of value | Erosion of deposit base, transaction fees | Global digital payment transactions > $10.5 trillion (projected 2024) |

| Robo-Advisors/Direct Investment | Lower fees, accessibility, automation | Loss of wealth management fees | Hundreds of billions in AUM on robo-advisor platforms (mid-2024) |

| Credit Unions | Personalized service, member focus | Competition for retail deposits and loans | Over 137 million members in U.S. (2023) |

Entrants Threaten

The banking sector presents formidable barriers to entry, primarily driven by substantial capital requirements and rigorous regulatory oversight. For instance, in 2024, establishing a new national bank in the United States often necessitates a minimum of $10 million in capital, with many requiring significantly more to ensure solvency and operational stability.

Navigating the complex web of licensing procedures, including approvals from federal and state authorities, adds another layer of difficulty. New entrants must also demonstrate robust risk management frameworks and build public trust, which takes considerable time and investment, making direct competition as a full-service bank a daunting prospect for many potential newcomers.

While traditional banking faces high entry barriers, the financial technology (fintech) and neobank sector presents a distinct threat. These digital-first institutions can sidestep many legacy costs and regulatory hurdles by focusing on niche services or operating with lighter compliance frameworks. For instance, neobanks often boast significantly lower operational costs compared to traditional banks, with some reporting overheads up to 70% lower, allowing them to offer more competitive pricing and attract customers.

Big tech firms and other non-traditional players are increasingly entering financial services by leveraging their vast customer bases and data. This is often done through embedded finance, where financial services are integrated into non-financial platforms. For instance, in 2024, companies like Apple and Google continued to expand their financial offerings, such as payment services and credit products, directly within their existing ecosystems.

These entrants may not seek full banking licenses but can still siphon off profitable segments of the financial value chain, like payments, lending, or wealth management. This strategy allows them to operate with a lighter regulatory touch compared to incumbent banks. By 2024, the embedded finance market was projected to reach hundreds of billions of dollars globally, demonstrating the significant revenue potential for these new entrants.

Digital-First Operating Models

New competitors can leverage digital-first operating models to bypass the costs and complexities of traditional brick-and-mortar banking. This allows them to offer more competitive pricing and a streamlined digital customer experience. For instance, neobanks, often built on modern cloud infrastructure, can operate with significantly lower overheads compared to established institutions. In 2023, the global digital banking market was valued at over $100 billion, indicating substantial growth and attractiveness for new entrants focused on digital innovation.

These digital-native players can achieve greater agility and scalability, rapidly adapting to market changes and customer preferences. Their lean structures enable faster product development and deployment. For example, some fintechs have been able to launch new payment solutions or lending platforms in a matter of months, a pace often challenging for legacy banks. This agility directly translates into a competitive advantage in attracting and retaining customers.

- Digital-First Advantage: New entrants can build operations from scratch, avoiding legacy system costs and limitations.

- Cost Efficiency: Digital models often lead to lower operational expenses, enabling more competitive pricing.

- Agility and Scalability: The ability to adapt quickly and scale digitally allows for rapid market penetration.

- Enhanced Customer Experience: Focus on digital channels can deliver a superior and more convenient customer journey.

Niche Market Focus

New entrants often bypass broad market competition by concentrating on specific, underserved niches. This strategy allows them to develop specialized offerings that cater precisely to these segments, building a loyal customer base. For instance, fintech startups in 2024 have increasingly focused on micro-investing or specialized lending platforms, attracting users with tailored digital experiences.

This niche focus can pose a significant threat to community-focused banks like 1st Security Bank. By excelling in a particular area, these new players can capture market share and build brand loyalty. Consider the rise of digital-only banks that offer specialized savings accounts with higher interest rates, directly competing for deposit customers.

- Niche Specialization: New entrants target specific customer needs, offering tailored products or services.

- Market Traction: This focused approach helps new players gain initial customers and build a reputation.

- Competitive Threat: Specialized offerings can erode market share from broader-service providers.

- Example: Fintechs focusing on micro-investing or specialized lending in 2024 demonstrate this trend.

The threat of new entrants for traditional banks like 1st Security Bank is moderate but evolving, primarily due to the rise of fintech and digital-first competitors. While significant capital and regulatory hurdles still deter many from launching full-service banks, these new players often bypass traditional barriers by focusing on specific financial services or leveraging technology. For instance, in 2024, the global fintech market continued its rapid expansion, with transaction volumes in digital payments alone projected to exceed $10 trillion, showcasing lucrative segments accessible to new entrants.

These digital challengers can operate with substantially lower overheads, enabling them to offer more competitive rates and user-friendly experiences, directly impacting customer acquisition for incumbent institutions. The agility of these new players allows them to innovate and adapt quickly, posing a continuous challenge to established banks. By 2024, neobanks were estimated to hold over 15% of the retail banking market share in several developed economies, highlighting their growing influence.

The threat is amplified by big tech companies entering financial services through embedded finance, integrating banking functionalities into their existing platforms. This strategy allows them to reach vast customer bases with minimal direct competition in traditional banking terms. For example, in 2023, the value of embedded finance transactions globally was estimated to be over $500 billion, indicating the significant revenue streams being captured by non-traditional players.

| Type of Entrant | Key Advantages | 2024 Market Impact/Projection | Threat Level to Traditional Banks |

|---|---|---|---|

| Fintech Startups | Agility, niche focus, lower overheads | Rapid growth in specialized lending and payments; Global fintech market valued at over $1.5 trillion in 2023. | Moderate to High |

| Neobanks | Digital-first, cost efficiency, enhanced CX | Gaining significant retail market share; Over 200 million neobank customers globally by early 2024. | Moderate to High |

| Big Tech (Embedded Finance) | Vast customer base, data analytics, seamless integration | Expanding financial services within existing ecosystems; Embedded finance projected to reach $7 trillion by 2030. | High (indirect) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for 1st Security Bank is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate data from regulatory filings and economic indicators to provide a comprehensive view of the competitive landscape.