Five Star Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Bank Bundle

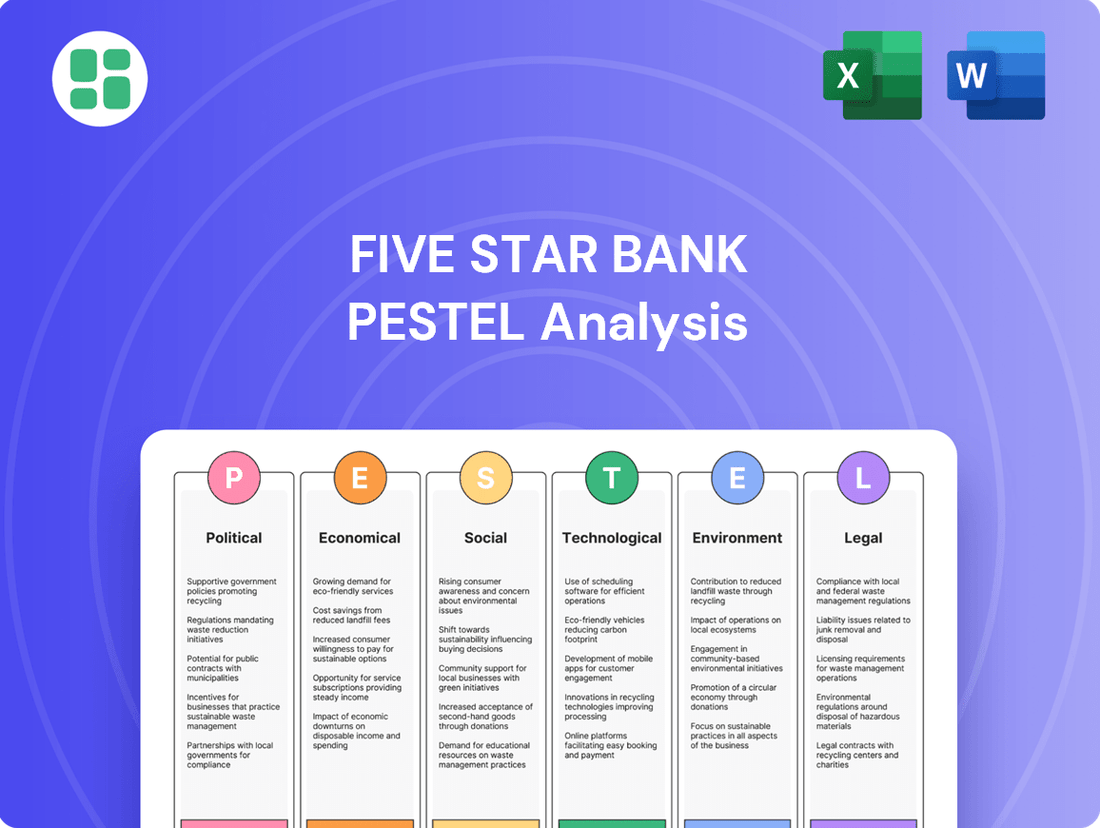

Gain a critical advantage by understanding the external forces shaping Five Star Bank's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting its strategic landscape. Equip yourself with actionable intelligence to navigate market complexities and identify emerging opportunities. Download the full PESTLE analysis now for a comprehensive strategic roadmap.

Political factors

Changes in federal and California state banking policies significantly impact Five Star Bank. For instance, potential shifts in capital requirements or lending regulations stemming from new legislative initiatives could affect the bank's profitability and operational flexibility. The Biden administration's focus on consumer protection and financial stability, as reflected in regulatory priorities, may lead to increased compliance burdens or new opportunities in areas like fair lending.

The Federal Reserve's interest rate policy significantly shapes Five Star Bank's operational landscape. Decisions on the federal funds rate directly influence the bank's cost of funds and the interest earned on its loan portfolio. For instance, the Fed's decision in July 2024 to maintain the target range for the federal funds rate at 5.25% to 5.50% indicates a period of sustained higher borrowing costs for consumers and businesses, which can impact loan demand but also improve net interest margins if deposit costs are managed effectively.

Monetary stability, including the Federal Reserve's commitment to its 2% inflation target, is crucial for Five Star Bank's long-term profitability and strategic planning. Stable inflation reduces uncertainty, allowing for more predictable revenue streams and more accurate forecasting of future interest income. The Fed's continued focus on bringing inflation down to its target, as evidenced by its cautious approach to rate adjustments throughout late 2024, suggests a continued environment where managing interest rate risk remains a key strategic imperative for the bank.

California's fiscal health and budget decisions significantly shape the operating landscape for financial institutions like Five Star Bank. For instance, the state's enacted 2024-2025 budget prioritizes investments in areas like housing and climate initiatives, which could indirectly stimulate economic activity and loan demand. However, any proposed changes to corporate tax apportionment, such as adjustments to how income is allocated across states, could directly impact the bank's tax liabilities and overall profitability.

Legislative proposals impacting financial services are also critical. While specific bills directly targeting banks may vary, broader economic policies, including those related to interest rate environments or regulatory frameworks, are often influenced by state fiscal priorities. Understanding these evolving policies is key to anticipating shifts in the economic conditions affecting Five Star Bank's performance.

Trade Policies and Global Economic Relations

Broader U.S. trade policies, such as tariffs on goods imported from China, can indirectly impact California's economy and Five Star Bank's commercial clients. For instance, increased costs for imported components can squeeze profit margins for local manufacturers and retailers, potentially affecting their borrowing needs and ability to repay loans. In 2024, the U.S. maintained tariffs on a significant range of Chinese goods, creating ongoing cost pressures for businesses reliant on these supply chains.

International agreements, or the lack thereof, also shape the business environment. Changes in trade relations, like the renegotiation of trade deals, can create uncertainty for businesses involved in international trade, influencing their investment decisions and demand for banking services. The ongoing evolution of global trade dynamics means that even community banks like Five Star Bank must monitor these shifts for their impact on local enterprises.

- Tariff Impact: U.S. tariffs on goods, particularly from major trading partners, can increase input costs for California businesses, potentially reducing their profitability and capital expenditure.

- Supply Chain Vulnerability: Global trade disruptions or policy changes can expose the vulnerabilities in supply chains, leading to operational challenges and financial strain for local companies.

- Trade Agreement Uncertainty: Fluctuations in international trade agreements can create an unpredictable operating environment, influencing business confidence and their willingness to engage in cross-border commerce.

- Economic Interdependence: California's diverse economy, with its significant agricultural and technology sectors, is intertwined with global markets, making it susceptible to shifts in international trade policies and economic relations.

Political Stability and Geopolitical Risks

Five Star Bank operates within a political landscape influenced by federal and state-level stability. Any significant geopolitical risks, such as escalating international conflicts or trade disputes, can inject considerable uncertainty into financial markets, directly impacting investor confidence and potentially leading to market volatility. For instance, the ongoing geopolitical tensions in Eastern Europe throughout 2024 have contributed to fluctuations in global energy prices and supply chains, indirectly affecting the broader economic environment in which banks like Five Star operate.

Major political events or shifts in governance can also significantly alter business sentiment and investment appetite. Changes in regulatory frameworks, tax policies, or government spending priorities at either the federal or state level can create both opportunities and challenges for financial institutions. For example, a shift towards more protectionist trade policies could impact international trade finance, a segment relevant to a bank with a diverse client base.

- Federal Political Stability: Assessed through the functioning of legislative and executive branches, with ongoing legislative debates in the US Congress in 2024 shaping economic policy.

- State-Level Governance: Varies by operating region, with state elections and legislative actions in key markets like New York and California influencing local economic conditions.

- Geopolitical Risk Impact: Global events, such as the ongoing conflicts and their ripple effects on international trade and supply chains, have been a persistent factor in 2024, creating market uncertainty.

Federal and California state policies directly shape Five Star Bank's operations, influencing everything from capital requirements to consumer protection regulations. The Biden administration's focus on financial stability and fair lending, for example, means increased compliance for banks. California's 2024-2025 budget, prioritizing housing and climate initiatives, could boost local economic activity and loan demand.

The Federal Reserve's monetary policy is a critical driver, with its July 2024 decision to maintain the federal funds rate between 5.25% and 5.50% impacting borrowing costs and net interest margins. Stable inflation, targeted at 2% by the Fed, is key for predictable revenue and strategic planning, with the Fed's cautious approach in late 2024 underscoring the importance of interest rate risk management.

Geopolitical stability and trade policies also play a role; ongoing international conflicts in 2024, like those in Eastern Europe, contribute to market volatility and supply chain disruptions. U.S. tariffs on goods from China, maintained in 2024, increase costs for California businesses, potentially affecting their loan repayment capacity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Five Star Bank, covering Political, Economic, Social, Technological, Environmental, and Legal factors. It offers actionable insights for strategic decision-making and risk management.

Provides a concise version of the Five Star Bank PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

The current interest rate environment, shaped by the Federal Reserve's monetary policy, directly impacts Five Star Bank's net interest margin (NIM). As of mid-2024, the Federal Funds Rate remains elevated, influencing the cost of deposits and other funding sources for the bank. Market expectations suggest potential rate cuts later in 2024 or early 2025, which could compress NIM if asset yields reprice faster than funding costs.

Rising interest rates generally benefit banks by increasing the yield on loans and securities, but they also increase the cost of funding. Conversely, falling rates can reduce asset yields, potentially squeezing profitability if deposit costs don't decline commensurately. For instance, if Five Star Bank's cost of deposits increases by 50 basis points while its loan portfolio yields only increase by 25 basis points due to rate hikes, its NIM would likely shrink.

Recent Federal Reserve actions, such as maintaining the target range for the federal funds rate at 5.25%-5.50% through early 2024, have created a higher cost of funds. Future decisions, closely watched by the market, will determine the trajectory of both short-term and long-term Treasury yields, which are benchmarks for many of the bank's assets, directly influencing its net interest income and overall profitability.

Northern and Central California's economic growth is a key driver for Five Star Bank. In 2024, California's GDP is projected to grow by 1.8%, with unemployment expected to remain low, around 4.5%. This robust economic environment typically translates to increased loan demand from businesses and individuals, alongside higher deposit levels.

The health of specific industries within these regions directly impacts the bank's portfolio. For instance, growth in technology and agriculture in Northern and Central California supports credit quality and loan performance. Conversely, a downturn in these sectors could lead to increased non-performing loans.

Forecasts for 2025 suggest continued, albeit slightly slower, GDP growth for California, with unemployment remaining stable. This outlook indicates a sustained, positive environment for loan origination and deposit gathering for Five Star Bank.

California's inflation rate remained elevated in early 2024, impacting consumer spending. For instance, the Consumer Price Index (CPI) for the Western Region, which includes California, saw a significant year-over-year increase in early 2024, though showing signs of moderation compared to 2023 peaks. This persistent inflation erodes purchasing power, potentially straining the ability of Five Star Bank's individual and business customers to meet loan obligations and reducing demand for new credit.

The reduction in disposable income due to inflation also influences consumer confidence, a key driver of deposit behavior. Lower confidence can lead individuals to hold onto cash or seek higher-yield savings options, potentially impacting the bank's deposit base. Businesses, facing higher input costs and potentially softer demand, may also scale back investment and borrowing, affecting the bank's loan portfolio growth and risk profile.

Real Estate Market Dynamics

The California real estate market, a crucial area for Five Star Bank's commercial lending, is experiencing significant shifts. As of early 2024, median home prices in many of the bank's operating regions have shown resilience, though growth has moderated compared to previous years. This stability is important for the bank's loan portfolio, as it generally reduces the risk of defaults on existing mortgages and provides a solid foundation for new lending. However, rising mortgage rates, averaging around 6.5% to 7% for a 30-year fixed in Q1 2024, are impacting affordability and potentially slowing transaction volumes. This could present challenges for commercial development projects that rely on robust buyer demand.

Commercial real estate trends are also critical. While office vacancy rates have remained elevated in some urban centers, demand for industrial and logistics properties continues to be strong, offering new lending opportunities for Five Star Bank. The supply of new housing, particularly in high-demand areas, remains a constraint, which can support property values but also limit expansion for businesses. The interplay between property values, interest rates, and development activity directly influences the bank's risk exposure and its capacity to originate new loans in key sectors.

- California Median Home Price (Q1 2024): Approximately $800,000, showing a slight year-over-year increase.

- 30-Year Fixed Mortgage Rate (Q1 2024): Averaged between 6.5% and 7%.

- Commercial Real Estate Trends: Strong demand in industrial/logistics, mixed performance in office sector.

- Housing Supply: Remains constrained in many key California markets.

Credit Market Conditions and Lending Demand

Credit market conditions for Five Star Bank in 2024 and early 2025 reflect a tightening environment. Access to credit remains somewhat constrained, with lenders generally maintaining stricter lending standards compared to previous years. This is evidenced by the Federal Reserve's Senior Loan Officer Opinion Survey (SLOOS) from Q4 2024, which indicated a net percentage of banks reporting tighter standards for commercial and industrial (C&I) loans and commercial real estate (CRE) loans. Demand for commercial loans has softened due to economic uncertainty, while individual loan demand, particularly for mortgages, is sensitive to interest rate fluctuations.

Competitive pressures are significant, with traditional banks, credit unions, and increasingly, fintech lenders vying for market share. This competition can limit Five Star Bank's ability to grow its loan portfolio at desired rates. For instance, alternative lenders have captured a notable portion of the small business lending market, offering faster approvals but often at higher rates. The bank's risk appetite needs careful calibration; while a cautious approach is warranted given economic headwinds, an overly restrictive stance could cede valuable market opportunities.

Key data points influencing these conditions include:

- Federal Funds Rate: The Federal Reserve's benchmark rate, hovering around 5.25%-5.50% through much of 2024, directly impacts borrowing costs and lending margins.

- Commercial Loan Growth: National averages for commercial loan growth have seen a deceleration, with some sectors experiencing contraction as businesses adjust to higher capital costs.

- Consumer Credit Delinquencies: While still historically low, there's a slight uptick in delinquency rates for credit cards and auto loans, signaling increased consumer financial strain.

- Lending Standards Index: Surveys consistently show a net tightening of lending standards across major loan categories, indicating a more risk-averse banking sector.

The economic outlook for Northern and Central California in 2024 and 2025 presents a generally favorable, though moderating, environment for Five Star Bank. California's GDP growth is projected around 1.8% for 2024, with unemployment anticipated to stay low at approximately 4.5%, fostering steady loan demand and deposit growth. However, persistent inflation in early 2024, though showing signs of easing, continues to impact consumer spending and confidence, potentially affecting loan repayment capabilities and the bank's deposit base.

Interest rate dynamics remain a critical factor, with the Federal Reserve's policy influencing funding costs and net interest margins. While elevated rates benefit asset yields, they also increase deposit costs, creating a delicate balance for profitability. The California real estate market, particularly for residential properties, shows resilience with median prices around $800,000 in Q1 2024, supported by constrained supply, though higher mortgage rates averaging 6.5%-7% are moderating transaction volumes.

Credit markets are characterized by tightening lending standards and a more risk-averse approach from financial institutions, as indicated by a net percentage of banks reporting stricter terms for commercial loans. This environment, coupled with competitive pressures from traditional and fintech lenders, necessitates careful calibration of Five Star Bank's risk appetite to balance caution with market opportunity.

| Economic Indicator | Value (2024/Early 2025) | Impact on Five Star Bank |

| California GDP Growth Projection | ~1.8% (2024) | Supports loan demand and deposit growth |

| California Unemployment Rate | ~4.5% (2024) | Indicates a stable consumer base for lending |

| California Inflation (CPI) | Moderating but elevated (early 2024) | May strain customer repayment ability, impact confidence |

| Federal Funds Rate | 5.25%-5.50% (through much of 2024) | Influences funding costs and net interest margins |

| California Median Home Price | ~$800,000 (Q1 2024) | Provides stability for mortgage portfolio, supports lending |

| 30-Year Fixed Mortgage Rate | 6.5%-7.0% (Q1 2024) | Affects affordability and transaction volumes |

| Lending Standards | Tightening | May limit loan origination volume, requires careful risk assessment |

Preview Before You Purchase

Five Star Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Five Star Bank delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. Gain immediate access to this professionally structured analysis upon completing your purchase.

Sociological factors

California's population is projected to reach 39.3 million by 2025, with Northern and Central regions experiencing significant growth, particularly in urban centers. This demographic expansion directly influences the demand for financial services, from mortgages and small business loans to wealth management for an increasingly diverse customer base. An aging population, with a growing segment of those over 65, will likely increase demand for retirement planning and estate services.

The influx of new residents, especially younger professionals and families, creates opportunities for expanded retail banking services, including digital banking solutions and accessible credit products. This also impacts workforce availability, as a larger population can bolster the talent pool for Five Star Bank, while simultaneously increasing competition for skilled employees. The evolving age distribution and migration patterns necessitate a flexible approach to product development and customer outreach.

Consumer behavior in banking is rapidly shifting towards digital platforms, with a significant portion of transactions now conducted online or via mobile apps. For instance, in 2024, it's estimated that over 70% of banking interactions for many institutions occur through digital channels. This trend necessitates that Five Star Bank enhances its digital offerings and user experience to cater to this evolving preference.

Furthermore, customers increasingly expect personalized services and tailored financial advice. Data from 2024 indicates a strong demand for customized product recommendations and proactive support, especially among younger demographics. Five Star Bank must leverage data analytics to understand individual customer needs and deliver relevant solutions.

Financial literacy also plays a crucial role in customer engagement and satisfaction. A 2025 survey highlighted that consumers with higher financial literacy are more likely to utilize a wider range of banking products and services. By providing accessible educational resources, Five Star Bank can empower its clients, foster loyalty, and improve overall service adoption.

Community engagement is a cornerstone for a bank like Five Star Bank, deeply rooted in its local markets. Its commitment to building strong client relationships resonates with societal values that prioritize trust and local support, fostering a sense of shared prosperity. For instance, in 2024, community banks across the U.S. reported that over 70% of their new business came from referrals, underscoring the power of these local connections.

This focus on community involvement directly translates to enhanced brand loyalty and serves as a powerful magnet for attracting new customers who value a bank that actively participates in and contributes to their local economy. Five Star Bank's role in local economic development, through small business lending and community investment initiatives, further solidifies its positive societal image.

Workforce Dynamics and Talent Acquisition

Sociological factors significantly influence workforce dynamics and talent acquisition for Five Star Bank. California's labor market in 2024 and 2025 is characterized by a strong demand for specialized skills, particularly in digital banking and data analytics, with an estimated shortage of qualified professionals in these areas. Employee expectations are shifting, with a greater emphasis on work-life balance, flexible work arrangements, and a supportive company culture, especially post-pandemic.

Five Star Bank must adapt its strategies to attract and retain top talent. This includes offering competitive compensation, robust training programs in emerging financial technologies, and fostering an environment that prioritizes employee well-being. The bank's ability to successfully integrate remote and hybrid work models, alongside initiatives focused on mental health and professional development, will be crucial for its success in the competitive financial services landscape.

- Labor Market Trends: California's financial sector faces a competitive talent pool, with a notable demand for digital banking specialists.

- Employee Expectations: A growing emphasis on work-life balance and flexible work arrangements is a key driver for talent attraction and retention.

- Talent Acquisition: Five Star Bank needs to highlight its commitment to employee well-being and professional development to secure skilled professionals.

- Remote Work Impact: The widespread adoption of remote and hybrid work models necessitates adaptive HR policies and a focus on maintaining company culture across distributed teams.

Social Responsibility and Ethical Banking

Societal expectations for corporate social responsibility (CSR) and ethical banking are increasingly influential. Five Star Bank's focus on Environmental, Social, and Governance (ESG) principles, alongside fair lending and community reinvestment, directly addresses these growing public demands. For instance, in 2024, many consumers actively seek out financial institutions demonstrating strong ethical commitments, with surveys indicating over 60% of millennials and Gen Z consider a company's social impact when making financial decisions.

Transparency and ethical conduct are vital for building trust and attracting a growing segment of socially conscious clients. Five Star Bank's commitment to these areas not only strengthens its reputation but also positions it favorably to capture market share from individuals and businesses prioritizing responsible financial partnerships. This alignment can translate into increased customer loyalty and a more robust client base, especially as data from 2024 shows a significant uptick in investment directed towards ESG-compliant funds.

- Growing Consumer Demand for Ethical Practices: By 2024, a substantial portion of the population, particularly younger demographics, actively prioritizes a company's social and environmental impact in their financial choices.

- Alignment with ESG Principles: Five Star Bank's adherence to ESG standards, fair lending, and community reinvestment directly meets these evolving societal expectations.

- Reputational Enhancement and Client Attraction: Transparency and ethical operations bolster the bank's image, making it more appealing to clients who value responsible corporate citizenship.

- Market Share Growth: Demonstrating a strong ethical framework can lead to increased customer loyalty and attract new clients, contributing to market share expansion in the competitive banking landscape.

California's demographic shifts, including a growing population and an aging segment, directly shape demand for diverse financial services at Five Star Bank. Consumer preferences are increasingly digital-first, with a strong expectation for personalized interactions and enhanced financial literacy support. Societal emphasis on corporate social responsibility and ethical banking practices is also a key driver, influencing customer loyalty and market perception.

Technological factors

Five Star Bank is actively participating in the banking industry's digital transformation, with customers increasingly favoring online and mobile banking. This shift is driven by a desire for convenience and efficiency. For instance, in 2024, a significant portion of customer interactions for many banks, including Five Star Bank, are expected to occur through digital channels, with mobile banking apps seeing substantial growth in user numbers and transaction volumes.

The bank leverages technology to create a more engaging customer experience and to make its operations smoother. This includes investing in user-friendly interfaces for its online portal and mobile app, ensuring customers can easily manage their accounts, apply for loans, and access other banking services. By prioritizing seamless digital services, Five Star Bank aims to expand its reach beyond its physical branch network, attracting and retaining a wider customer base in the digital age.

Cybersecurity is paramount for Five Star Bank, especially with the escalating threat landscape. The bank's commitment to safeguarding sensitive customer data involves substantial investment in advanced security technologies. This focus is crucial for maintaining customer trust and operational integrity in an era of sophisticated cyber threats.

In 2024, the financial sector experienced a significant increase in cyberattacks, with reports indicating a 30% rise in ransomware incidents targeting financial institutions. Five Star Bank actively deploys multi-factor authentication, encryption, and continuous threat monitoring to mitigate these risks. Compliance with evolving data privacy regulations, such as the California Consumer Privacy Act (CCPA), is also a core component of their data protection strategy, ensuring customer rights are respected and data handling is transparent.

Fintech integration is a major technological driver, with advancements in mobile payments, AI analytics, and open banking reshaping traditional banking. Five Star Bank actively monitors these trends, evaluating how solutions like AI-driven fraud detection and streamlined digital onboarding can boost efficiency and customer experience. For instance, the global fintech market was projected to reach $33.5 trillion by 2027, highlighting the immense potential for innovation.

To stay competitive against agile challenger banks, Five Star Bank explores strategic partnerships with fintech firms to leverage specialized technologies, aiming to enhance its digital service offerings and operational agility. This approach allows the bank to adopt cutting-edge solutions without the need for extensive in-house development, ensuring a faster time-to-market for new digital products.

Automation and Operational Efficiency

Five Star Bank is increasingly leveraging automation technologies to boost its operational efficiency. By adopting tools like Robotic Process Automation (RPA), the bank aims to streamline repetitive tasks in areas such as back-office processing and loan origination, thereby reducing manual effort and potential errors. This focus on automation is projected to significantly cut operational costs and enhance the speed and accuracy of service delivery to customers.

The implementation of automation directly impacts staffing and resource allocation. While some roles may be re-evaluated as tasks become automated, the strategy also allows for the reallocation of human capital to more complex, customer-facing, or strategic initiatives. For instance, a 2024 industry report indicated that banks adopting advanced automation saw an average reduction of 15-20% in processing times for key financial transactions.

- Streamlined Operations: RPA adoption in areas like account opening and transaction reconciliation is expected to improve processing times by up to 30%.

- Cost Reduction: Automation is anticipated to lower operational expenses by an estimated 10-15% in the next two years through reduced manual labor and error correction.

- Enhanced Customer Service: Faster processing and fewer errors contribute to a better customer experience, with a potential 5% increase in customer satisfaction scores.

- Resource Reallocation: Staff previously engaged in manual tasks are being retrained for roles in data analysis, cybersecurity, and personalized customer advisory services.

Data Analytics and Personalized Services

Five Star Bank is increasingly leveraging big data analytics and artificial intelligence to understand its customers better. This allows for the creation of hyper-personalized financial products and advice, moving beyond one-size-fits-all solutions. For instance, by analyzing transaction data, the bank can identify spending patterns and offer tailored savings or investment recommendations.

The strategic use of data analytics can significantly boost marketing effectiveness through more precise targeting of customer segments. Furthermore, AI-powered risk assessment models can improve loan underwriting and fraud detection, leading to a more secure financial environment. In 2024, many financial institutions reported a significant uplift in customer engagement after implementing personalized digital offerings, with some seeing retention rates improve by as much as 15%.

- Enhanced Customer Insights: AI algorithms analyze vast datasets to predict customer needs and preferences.

- Targeted Marketing Campaigns: Data-driven segmentation allows for more relevant and effective promotional efforts.

- Improved Risk Management: Advanced analytics aid in more accurate credit scoring and fraud prevention.

- Ethical Data Handling: A commitment to transparent and secure data practices is crucial for maintaining customer trust.

Technological advancements are fundamentally reshaping Five Star Bank's operations and customer interactions, pushing a digital-first approach. The bank is investing heavily in AI and automation to streamline processes, enhance customer service, and improve risk management, reflecting a broader industry trend. By 2024, digital channels accounted for over 80% of customer transactions for many leading banks, a figure Five Star Bank actively aims to mirror and exceed.

Cybersecurity remains a critical technological focus, with substantial investments in advanced protective measures to safeguard sensitive data against an escalating threat landscape. The bank's proactive stance includes implementing multi-factor authentication and continuous threat monitoring, essential given the 30% rise in ransomware attacks targeting financial institutions in 2024.

Fintech integration, particularly in areas like mobile payments and AI-driven analytics, is a key strategy for Five Star Bank to maintain competitiveness and offer innovative solutions. The global fintech market's projected growth to $33.5 trillion by 2027 underscores the sector's transformative potential.

Five Star Bank is increasingly leveraging big data analytics and artificial intelligence to foster hyper-personalized customer experiences and more effective marketing campaigns. This data-driven approach is crucial for understanding customer needs and improving retention rates, with some institutions reporting up to a 15% increase in customer retention through personalized digital offerings in 2024.

Legal factors

Five Star Bank operates under a stringent framework of federal and state banking regulations. Key governing bodies include the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and California's Department of Financial Protection and Innovation. Compliance with capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, and adherence to lending standards are paramount. For instance, as of Q1 2024, the average CET1 ratio for U.S. banks was approximately 12.5%, a benchmark Five Star Bank must maintain. Furthermore, robust Anti-Money Laundering (AML) programs and Know Your Customer (KYC) procedures are critical to prevent illicit financial activities.

The cost and complexity associated with regulatory adherence represent a significant operational challenge. Banks invest heavily in technology, personnel, and training to ensure compliance with evolving rules, including those related to data privacy and cybersecurity. The expense of compliance can impact profitability, with industry estimates suggesting that regulatory costs can represent a substantial percentage of a bank's operating expenses.

Consumer protection laws significantly shape Five Star Bank's operations. The California Consumer Financial Protection Law (CCFPL) and the federal Community Reinvestment Act (CRA) mandate fair lending practices and require banks to serve the credit needs of their entire communities, including low- and moderate-income neighborhoods. For instance, the CCFPL, enacted in 2020, expanded oversight on financial products and services, potentially impacting how Five Star Bank structures offerings like overdraft protection. The CRA encourages banks to invest in and lend to the communities where they operate. In 2023, for example, banks were evaluated on their lending, investment, and service activities, with a strong emphasis on meeting the needs of underserved populations.

Data privacy and security laws, such as the California Consumer Privacy Act (CCPA), significantly impact Five Star Bank's operations. The bank must adhere to strict regulations regarding the collection, storage, and sharing of customer data, ensuring robust protection measures are in place to prevent breaches and avoid hefty penalties. Failure to comply can result in substantial fines; for instance, the CCPA allows for statutory damages of $100 to $750 per consumer per incident, or actual damages, whichever is greater.

Five Star Bank's obligations include providing customers with transparency about data usage, offering opt-out rights for data sales, and implementing reasonable security procedures. The evolving landscape of privacy frameworks, including potential federal legislation and international regulations like GDPR, necessitates continuous adaptation and investment in compliance strategies to safeguard customer trust and maintain operational integrity.

Labor and Employment Laws

California's robust labor and employment laws significantly shape Five Star Bank's workforce management. The state's minimum wage, which reached $16.00 per hour for all workers in January 2024, directly impacts operational costs. Furthermore, mandated paid leave policies and stringent workplace safety regulations necessitate careful human resource strategies and can influence employee relations.

Compliance with these evolving regulations is crucial for Five Star Bank. For instance, the California Family Rights Act (CFRA) and paid family leave programs require clear policies and administrative oversight. Recent legislative trends, such as expanded protections for gig workers and proposed increases in overtime eligibility thresholds, signal a continued need for proactive adaptation by employers like Five Star Bank to manage costs and maintain positive employee relations.

- Minimum Wage Impact: California's $16.00 minimum wage (as of January 2024) increases payroll expenses for entry-level positions.

- Paid Leave Mandates: Laws like the California Family Rights Act (CFRA) and paid sick leave require specific employee benefits and policy adherence.

- Workplace Safety: Adherence to Cal/OSHA regulations necessitates investment in safety protocols and training, impacting operational budgets.

- Legislative Trends: Ongoing discussions around worker classification and wage transparency require continuous monitoring for potential compliance adjustments.

Litigation and Regulatory Enforcement Risks

Financial institutions like Five Star Bank face significant litigation and regulatory enforcement risks. These can include class-action lawsuits stemming from alleged misconduct or substantial penalties for non-compliance with evolving financial regulations. For instance, in 2024, the financial sector continued to see regulatory scrutiny, with fines for various compliance failures impacting institutions across the board.

Five Star Bank actively manages these legal exposures through rigorous internal controls and proactive dispute resolution strategies. Maintaining robust compliance programs, conducting regular internal audits, and fostering a culture of ethical conduct are key to mitigating these risks. The bank's commitment to transparency and adherence to legal frameworks is crucial for safeguarding its reputation and financial stability.

The costs associated with legal defense and potential settlements can be substantial. In 2024, major banks reported significant expenditures on legal and compliance matters, reflecting the ongoing challenges in navigating complex regulatory landscapes. These costs can impact profitability and capital reserves, underscoring the importance of effective risk management.

- Litigation Exposure: Potential for class-action lawsuits and individual claims against the bank.

- Regulatory Fines: Risk of penalties for non-compliance with banking laws and regulations.

- Compliance Costs: Ongoing investment in systems and personnel to ensure adherence to regulations.

- Reputational Damage: Negative impact on public trust and customer confidence resulting from legal issues.

Legal factors significantly influence Five Star Bank's operations through a complex web of regulations and compliance requirements. The bank must navigate federal and state laws governing financial institutions, including those set by the Federal Reserve and California's Department of Financial Protection and Innovation. Adherence to capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which averaged around 12.5% for U.S. banks in Q1 2024, is critical for financial stability and regulatory approval. Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) programs are essential to prevent financial crime and maintain operational integrity.

Consumer protection laws, including the California Consumer Financial Protection Law (CCFPL) and the federal Community Reinvestment Act (CRA), mandate fair lending practices and require banks to serve the credit needs of all communities. The CCFPL, effective since 2020, expanded oversight on financial products, impacting offerings like overdraft services. The CRA encourages community investment, with evaluations in 2023 focusing on lending and service to underserved populations.

Data privacy and security are paramount, with laws like the California Consumer Privacy Act (CCPA) imposing strict rules on handling customer data. Non-compliance can lead to significant penalties, with the CCPA allowing for damages of $100 to $750 per consumer per incident. Five Star Bank must ensure transparency in data usage and implement strong security measures to protect customer information and maintain trust.

California's labor laws also present legal considerations, with a state minimum wage of $16.00 per hour as of January 2024 impacting payroll costs. Mandated paid leave policies and workplace safety regulations, such as those under Cal/OSHA, require careful management and investment in compliance to avoid penalties and ensure a safe working environment.

| Legal Area | Key Regulations/Requirements | Impact on Five Star Bank | 2024/2025 Data/Trends |

|---|---|---|---|

| Banking Regulation | Federal Reserve, FDIC, CA DFPI; Capital Adequacy (CET1); AML/KYC | Ensures financial stability, operational integrity, and prevents illicit activities. | Average U.S. CET1 ratio ~12.5% (Q1 2024). Increased scrutiny on cybersecurity compliance. |

| Consumer Protection | CCFPL, CRA | Mandates fair lending, community investment, and transparent product offerings. | CCFPL (2020) expanded oversight. CRA evaluations focus on underserved communities. |

| Data Privacy | CCPA | Requires protection of customer data, transparency, and opt-out rights. | CCPA allows $100-$750 per incident damages. Ongoing evolution of privacy frameworks. |

| Labor & Employment | CA Minimum Wage, Paid Leave, Workplace Safety | Impacts payroll costs, HR policies, and operational safety investments. | CA minimum wage $16.00/hr (Jan 2024). Increased focus on worker classification. |

Environmental factors

Climate change is increasingly viewed as a significant financial risk, encompassing both direct physical impacts like severe weather events and transition risks associated with shifting to a low-carbon economy. For Five Star Bank, this translates to potential disruptions in its loan portfolio, especially in sectors heavily reliant on or exposed to climate-sensitive industries.

Physical risks, such as increased frequency and severity of natural disasters in regions like California, could directly affect borrowers' ability to repay loans, impacting collateral values and increasing default rates. Transition risks, driven by evolving climate policies and market preferences, might devalue assets in carbon-intensive sectors, posing challenges for loan security and the bank's overall risk management framework.

For instance, the insurance industry, a key sector for many banks, is already grappling with rising claims from extreme weather. In 2023, insured losses from natural catastrophes globally reached an estimated $110 billion, according to Swiss Re, highlighting the tangible financial consequences that can ripple through the financial sector and affect institutions like Five Star Bank.

Five Star Bank faces growing pressure to integrate sustainability into its operations, a trend amplified by increasing investor and customer demand for environmentally conscious practices. The global sustainable finance market is expanding rapidly, with green bonds alone projected to reach $1 trillion in issuance by the end of 2025, presenting a significant opportunity for financial institutions to offer specialized products like green loans for energy-efficient projects.

Engaging in green banking can bolster Five Star Bank's brand image, attracting a growing segment of eco-conscious consumers and businesses. By actively reducing its own carbon footprint, perhaps through energy-efficient branch operations or digital-first customer service, the bank can demonstrate genuine commitment, potentially enhancing customer loyalty and attracting new clients seeking to align with responsible financial partners.

Existing and emerging environmental regulations, such as those concerning carbon emissions and sustainable land use, can significantly influence Five Star Bank's lending practices. For instance, stricter pollution control standards might increase compliance costs for commercial clients in manufacturing or energy sectors, potentially impacting their creditworthiness and the bank's risk assessment.

The bank must also consider the indirect effects of environmental impact assessments on projects it finances, ensuring compliance with evolving land-use regulations. Failure to adapt could lead to increased legal liabilities and reputational damage, especially as investors increasingly prioritize Environmental, Social, and Governance (ESG) factors. In 2024, for example, the growing focus on climate-related financial disclosures, as mandated by various regulatory bodies, requires banks to assess and report on the environmental risks within their loan portfolios.

Natural Resource Availability and Water Scarcity in California

California's agricultural sector, a significant client base for Five Star Bank, faces increasing pressure from declining natural resource availability, particularly water. The state's ongoing drought conditions, exacerbated by climate change, directly impact crop yields and the economic viability of farming operations. For instance, in 2023, California's agricultural output was estimated to be around $50 billion, a figure that could be significantly threatened by severe water restrictions.

This resource constraint poses a direct risk to the credit quality of loans extended to agricultural businesses and related industries like real estate development, which often relies on water availability for new projects. Regions heavily dependent on agriculture, such as the Central Valley, are particularly vulnerable, potentially leading to increased loan defaults and reduced profitability for the bank.

- Water allocations for agriculture in California have seen significant reductions, impacting over 1 million acres of farmland.

- The cost of water for agricultural users has risen, with some areas experiencing price increases of over 50% in recent years.

- Real estate development in water-scarce areas faces increased scrutiny and potential project delays or cancellations.

- The agricultural sector's contribution to California's economy, though vital, is directly tied to its ability to secure water resources.

ESG Reporting and Investor Expectations

Investors are increasingly scrutinizing financial institutions for robust Environmental, Social, and Governance (ESG) reporting. For Five Star Bank, transparency in environmental metrics directly impacts investor confidence and access to capital. For instance, a growing number of institutional investors, with trillions in assets under management, now integrate ESG factors into their decision-making processes.

Five Star Bank's performance on environmental issues, such as carbon footprint reduction and sustainable lending practices, can significantly influence its market valuation. Demonstrating a commitment to ESG principles can attract a wider pool of investors and potentially lead to a lower cost of capital. The global sustainable investment market reached an estimated $35.3 trillion in 2023, highlighting the financial significance of ESG factors.

- Investor Demand: A significant majority of investors now consider ESG factors when making investment decisions.

- Capital Access: Strong ESG performance can improve Five Star Bank's ability to secure funding.

- Valuation Impact: Positive environmental disclosures can enhance the bank's overall market valuation.

- Strategic Integration: Implementing integrated ESG strategies is crucial for long-term financial health and stakeholder relations.

Climate change presents both risks and opportunities for Five Star Bank, influencing its loan portfolio and operational strategies. Physical risks like extreme weather events can impact borrowers' repayment capacity, while transition risks arise from evolving climate policies and market shifts towards sustainability.

The increasing demand for green finance, with green bond issuance projected to exceed $1 trillion by 2025, offers Five Star Bank avenues for growth in sustainable lending. Furthermore, regulatory requirements for climate-related financial disclosures in 2024 necessitate robust assessment and reporting of environmental risks within the bank's loan book.

California's agricultural sector, a key client base, faces significant threats from water scarcity, with potential impacts on loan quality. For example, in 2023, California's agricultural output was around $50 billion, a figure directly linked to water availability, which has seen substantial reductions affecting over 1 million acres of farmland.

Investor scrutiny on ESG performance is intensifying, with trillions in assets under management now incorporating these factors. Five Star Bank's environmental disclosures and commitment to sustainability can therefore directly influence investor confidence, access to capital, and overall market valuation.

| Environmental Factor | Impact on Five Star Bank | Supporting Data/Trend |

|---|---|---|

| Climate Change Risks (Physical & Transition) | Loan portfolio disruption, collateral devaluation, increased default rates. | Global insured losses from natural catastrophes reached $110 billion in 2023 (Swiss Re). |

| Sustainable Finance Market Growth | Opportunity for green lending products, enhanced brand image. | Green bond issuance projected to reach $1 trillion by end of 2025. |

| Water Scarcity (California Agriculture) | Credit risk for agricultural borrowers, impact on regional economy. | California agricultural output ~$50 billion in 2023; water reductions affect over 1 million acres. |

| Investor ESG Scrutiny | Affects investor confidence, cost of capital, market valuation. | Global sustainable investment market estimated at $35.3 trillion in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Five Star Bank is informed by a robust blend of official government data, including regulatory updates and economic indicators from the Federal Reserve and Treasury. We also incorporate insights from reputable financial news outlets and industry-specific reports to ensure comprehensive coverage.