Five Star Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Bank Bundle

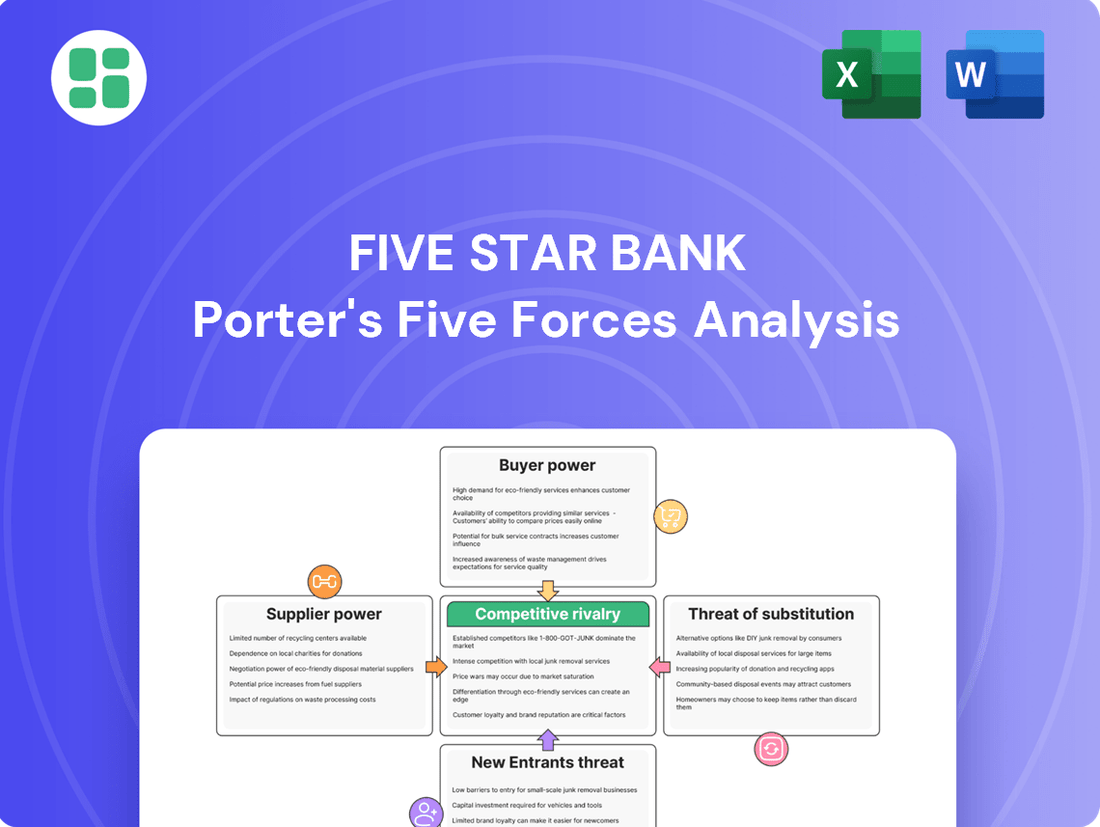

This glimpse into Five Star Bank's competitive landscape highlights the critical interplay of industry forces. Understanding the intensity of rivalry and the power of buyers is crucial for navigating this market effectively.

The complete report reveals the real forces shaping Five Star Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of technology and software providers for Five Star Bank is generally moderate to high, especially concerning essential core banking platforms and specialized financial applications. The significant investment and complexity involved in switching these deeply integrated systems create substantial switching costs for the bank, often running into millions of dollars and requiring extensive downtime.

While these providers hold considerable sway, the evolving landscape of financial technology, including the rise of cloud-based solutions and a growing number of fintech innovators, is gradually introducing more alternatives. This increased vendor competition could potentially temper the suppliers' leverage in the long run, offering Five Star Bank more flexibility in its technology choices.

The bargaining power of human capital and specialized talent is a significant factor for Five Star Bank. Skilled labor, particularly in critical areas like commercial lending, treasury management, cybersecurity, and regulatory compliance, holds considerable sway. The demand for experienced banking professionals in California remains robust, creating a competitive landscape where top talent can command higher compensation and benefits, directly influencing the bank's operational expenses.

Capital market providers, such as Federal Home Loan Banks and other financial institutions offering wholesale funding or interbank lending, can exert moderate bargaining power. This influence is directly tied to the prevailing liquidity conditions in the wider financial markets and Five Star Bank's specific reliance on these external funding channels.

For instance, during periods of market stress, when liquidity tightens, these providers may demand higher interest rates or stricter terms, increasing Five Star Bank's cost of capital. A strong and stable deposit base, as seen with many community banks, can significantly mitigate this dependence. In 2023, while specific figures for Five Star Bank's wholesale funding reliance aren't publicly detailed in a way that isolates this specific supplier power, the broader trend saw banks increasing their reliance on wholesale funding as deposit growth slowed and the Federal Reserve raised interest rates.

Data and Information Service Providers

Data and information service providers, such as those offering financial data, market intelligence, and credit reporting, exert moderate bargaining power over Five Star Bank. The reliance on accurate and timely information for critical functions like risk management and strategic planning gives these vendors leverage. While the market has several players, the need for high-quality, integrated data solutions can lead to some degree of vendor lock-in, which in turn influences their pricing power.

- Moderate Leverage: Providers of financial data and market intelligence have a moderate impact on Five Star Bank due to the essential nature of their services.

- Critical Data Needs: Accurate and timely data is vital for Five Star Bank's risk management, compliance, and strategic decision-making, increasing supplier influence.

- Vendor Lock-in Effect: The integration of specialized, high-quality data solutions can create vendor dependency, enhancing the providers' pricing power.

Infrastructure and Real Estate Providers

The bargaining power of infrastructure and real estate providers for Five Star Bank generally ranges from low to moderate for individual locations. This is because the bank, as a tenant or user of services, typically has alternatives available.

However, this dynamic can shift in highly desirable or supply-constrained markets. For instance, in prime Northern and Central California areas, where commercial real estate is in high demand and limited supply, landlords may exert greater leverage. This heightened power stems from the scarcity of suitable properties and the intense competition among businesses seeking them.

Five Star Bank can mitigate this supplier power through strategic operational decisions. The ability to consolidate branch operations, relocate less critical functions, or negotiate longer-term leases can significantly reduce the leverage held by real estate landlords and infrastructure service providers. For example, if the bank can reduce its physical footprint or centralize back-office functions, it lessens its dependence on any single landlord or utility provider.

- Real Estate Leverage: Landlords in high-demand California markets may possess greater bargaining power due to limited property availability.

- Infrastructure Costs: While generally moderate, utility and telecommunication costs can fluctuate based on regional infrastructure development and service provider competition.

- Operational Flexibility: Five Star Bank's capacity to consolidate or relocate operations is a key factor in limiting supplier power.

- Lease Negotiations: The bank's ability to secure favorable lease terms and manage its real estate portfolio directly impacts its negotiating position with landlords.

The bargaining power of suppliers for Five Star Bank is a multifaceted issue, with varying degrees of influence across different categories. Technology providers, particularly for core banking systems, hold significant sway due to high switching costs and the complexity of integration. Similarly, specialized talent in areas like cybersecurity and compliance can command strong negotiating positions given the demand for their skills.

Capital markets providers, such as those offering wholesale funding, can exert moderate pressure, especially during periods of market liquidity tightening. Data and information service providers also possess moderate leverage, as accurate data is crucial for risk management and strategic planning, leading to potential vendor lock-in. Real estate and infrastructure providers generally have lower to moderate power, though this can increase in high-demand markets.

| Supplier Category | Bargaining Power | Key Factors Influencing Power | Impact on Five Star Bank |

|---|---|---|---|

| Technology & Software | Moderate to High | High switching costs, complex integration, specialized applications | Significant influence on IT spending and operational efficiency |

| Human Capital (Specialized Talent) | High | Demand for expertise (cybersecurity, compliance), competitive labor market in California | Increased personnel costs, retention challenges |

| Capital Market Providers (Wholesale Funding) | Moderate | Market liquidity conditions, reliance on external funding, Federal Reserve policy | Cost of capital, funding availability |

| Data & Information Services | Moderate | Reliance on accurate data, potential vendor lock-in, quality of integrated solutions | Costs for essential information, potential limitations in data sourcing |

| Infrastructure & Real Estate | Low to Moderate | Availability of alternatives, market demand for property, lease terms | Occupancy costs, operational flexibility |

What is included in the product

This analysis dissects the competitive forces impacting Five Star Bank, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Quickly identify and quantify competitive threats with Five Star Bank's Porter's Five Forces Analysis, turning complex market dynamics into actionable insights.

Customers Bargaining Power

Individual deposit customers wield significant bargaining power because it's incredibly easy for them to switch their accounts to another bank. For instance, in the first quarter of 2024, the average interest rate on savings accounts across major US banks hovered around 0.46%, while online-only banks often offered rates exceeding 4.00%, highlighting the competitive pressure Five Star Bank faces.

With so many banking choices available, from traditional brick-and-mortar institutions to digital-first online banks and member-focused credit unions, Five Star Bank needs to provide attractive interest rates, user-friendly services, and top-notch customer support to keep these customers. The ability for customers to readily compare rates and services means dissatisfaction can quickly lead to account transfers.

Small business customers wield significant bargaining power, often having a variety of banking options available. These choices range from local community banks to larger regional institutions and credit unions, giving them leverage. In 2024, the Small Business Administration reported over 33 million small businesses in the U.S., many actively seeking favorable terms for services like commercial loans and deposit accounts.

While Five Star Bank emphasizes personalized relationships, this doesn't negate the ability of small businesses to shop around. Their bargaining strength is directly tied to their financial needs and how effectively they perceive Five Star Bank's relationship-driven model adds value compared to competitors. For instance, a business with substantial deposit balances might negotiate better rates on those funds.

Mid-market businesses and institutional clients, especially those needing sophisticated commercial lending and treasury services, wield considerable bargaining power. These clients are vital revenue generators, making them attractive targets for rival financial institutions.

Consequently, these larger clients can negotiate for customized offerings, favorable pricing, and dedicated relationship management. For Five Star Bank, retaining these key accounts is paramount to its sustained growth and profitability.

Access to Information and Comparison

The digital age has dramatically amplified customer bargaining power for banks like Five Star Bank. Online comparison tools and financial information aggregators empower consumers with unprecedented access to data. This transparency allows customers to effortlessly compare interest rates, fees, and service quality across a multitude of financial institutions, forcing Five Star Bank to maintain competitive pricing and clearly communicate its unique selling points.

- Information Accessibility: In 2024, over 80% of consumers used online resources to research financial products before making a decision, according to industry surveys.

- Competitive Pressure: The ease of comparing offerings means banks must constantly monitor and adjust their rates and fees to remain attractive, directly impacting profit margins.

- Value Proposition Clarity: Five Star Bank needs to articulate its value beyond just price, highlighting service, convenience, or specialized offerings to retain customers in this transparent environment.

Availability of Alternative Financial Services

The increasing number of non-bank financial service providers and fintech companies significantly boosts customer bargaining power. Customers can now access payment, lending, and investment services outside of traditional banks. This wider selection of options pressures Five Star Bank to innovate and offer superior value to retain its customers.

In 2024, the fintech sector continued its rapid expansion, with global fintech investment reaching hundreds of billions of dollars. For instance, digital payment platforms and peer-to-peer lending services have gained substantial market share, offering competitive rates and user-friendly experiences. This trend directly challenges incumbent banks like Five Star Bank, forcing them to adapt their strategies.

- Increased Fintech Competition: Fintechs offer specialized, often lower-cost services, directly competing with traditional banking products.

- Digital Payment Growth: Digital payment transaction volumes surged in 2024, with many consumers opting for non-bank solutions for everyday transactions.

- Alternative Lending Platforms: Online lenders and P2P platforms provided an estimated trillions in credit globally in 2024, offering alternatives to bank loans.

- Customer Choice Empowerment: The proliferation of these alternatives gives customers more leverage to demand better terms and services from their existing financial institutions.

Customers, both individual and business, possess substantial bargaining power due to the ease of switching and the abundance of financial service providers. In 2024, the readily available information on rates and services, coupled with the rise of fintech alternatives, means banks like Five Star Bank must offer competitive pricing and superior value to retain clients. This pressure is evident as customers can easily compare offerings, forcing banks to be more transparent and customer-centric.

| Customer Segment | Bargaining Power Drivers | Impact on Five Star Bank |

|---|---|---|

| Individual Depositors | Ease of switching, readily available rate comparisons, numerous online banks offering higher yields. | Pressure to offer competitive savings rates; need for user-friendly digital services. |

| Small Businesses | Variety of banking options (community banks, credit unions), need for favorable loan terms. | Requires attractive pricing and personalized service to retain business accounts. |

| Mid-Market & Institutional Clients | High revenue generation, need for sophisticated services, ability to negotiate customized offerings. | Critical to offer tailored solutions and dedicated relationship management to secure and maintain these vital accounts. |

| All Customers (Digital Era) | Information accessibility via online tools, fintech competition, proliferation of payment and lending alternatives. | Mandates continuous innovation, competitive pricing, and clear value proposition communication. |

Preview the Actual Deliverable

Five Star Bank Porter's Five Forces Analysis

This preview showcases the complete Five Star Bank Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the banking sector. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This professionally formatted analysis is ready for your immediate use, providing valuable insights into Five Star Bank's strategic positioning.

Rivalry Among Competitors

Five Star Bank operates in a highly competitive landscape, particularly challenged by large national banks and established regional players throughout California. These larger competitors often boast wider branch networks and substantial marketing resources, enabling them to reach a broader customer base. For instance, in 2023, the top five national banks in the US held over $10 trillion in assets, demonstrating their immense scale and market influence.

The extensive product portfolios and sophisticated digital platforms offered by these major institutions present a significant hurdle. Their ability to leverage economies of scale allows them to offer more aggressive pricing on loans and deposits, directly impacting Five Star Bank's ability to attract and retain customers. This intense pricing pressure means Five Star Bank must constantly innovate and differentiate its offerings to maintain its market position.

Within its Northern and Central California operating regions, Five Star Bank faces significant competition from a multitude of local community banks and credit unions. These institutions often mirror Five Star Bank's emphasis on personalized service and target similar customer demographics, intensifying the rivalry for local market share.

The competitive landscape is characterized by geographic proximity, where banks vie for the same customer base through tailored offerings and community engagement. For instance, as of Q1 2024, the California banking sector saw numerous mergers and acquisitions among smaller institutions, highlighting the pressure to consolidate or differentiate in this crowded market.

The intensity of competition in banking is significantly shaped by how distinct a bank's offerings are. While basic services like checking accounts and business loans are often very similar across institutions, making price a major factor, Five Star Bank has carved out a niche. Their emphasis on sophisticated treasury management solutions and fostering deep, personal connections with clients helps them stand out.

For instance, in 2024, many regional banks reported increased competition for commercial deposits, often leading to higher interest rate offers. However, banks with specialized services, like Five Star Bank's treasury management, can often retain clients even when facing slightly less favorable rates on core deposit products because these specialized services offer significant value beyond just interest earnings.

Maintaining these differentiating factors is crucial for Five Star Bank. It allows them to compete more effectively against larger institutions and smaller community banks, particularly in avoiding a race to the bottom on pricing for standard banking products. This strategic focus on relationship-based services and specialized solutions is a key element in managing competitive rivalry.

Market Growth Rate and Saturation

California's banking sector, especially for established services, is quite mature. This means that the growth rate for traditional banking products is likely to be slower.

In such a saturated market, competition really heats up. Banks have to work harder to win over existing customers instead of just benefiting from a growing market.

This situation demands that Five Star Bank implement aggressive strategies for both acquiring new customers and keeping the ones they already have. For instance, in Q1 2024, the average net interest margin for California banks hovered around 3.0%, indicating a tight environment where even small gains are hard-won.

To thrive, Five Star Bank needs to focus on differentiation and customer loyalty. Consider these key areas:

- Customer Acquisition Costs: Banks in California are seeing acquisition costs rise, with some reports in late 2023 indicating a 15% increase year-over-year for acquiring new checking accounts.

- Customer Retention Rates: Maintaining high retention is crucial. In 2024, the average customer retention rate for community banks in California was around 85%, but a slight dip can significantly impact profitability.

- Digital Banking Adoption: With a mature market, customers expect seamless digital experiences. Banks that lag in digital offerings risk losing market share.

- Niche Market Focus: Identifying and serving specific underserved or high-value customer segments can provide a competitive edge.

Exit Barriers for Competitors

The banking sector, including institutions like Five Star Bank, faces substantial exit barriers. These include the immense cost of physical infrastructure, such as a network of branches, and the significant investment in technology and IT systems required to operate. Furthermore, stringent regulatory requirements and compliance costs make it difficult and expensive for banks to simply close their doors.

These high exit barriers mean that banks are generally reluctant to leave the market, even when facing profitability challenges. This persistence fuels ongoing competitive rivalry among existing players. For instance, in 2024, the US banking sector continued to grapple with a competitive landscape where established institutions were unlikely to divest quickly, forcing all participants, including Five Star Bank, to maintain a sharp focus on strategic adaptation and operational efficiency to thrive.

- Significant Fixed Assets: Banks invest heavily in physical branches and robust technology infrastructure.

- Regulatory Obligations: Compliance with banking regulations creates substantial ongoing costs and operational complexities.

- Reluctance to Exit: High costs associated with exiting discourage banks from leaving, intensifying rivalry.

Five Star Bank contends with intense competition from both large national banks and numerous regional and community banks across California. The sheer scale of national players, evidenced by their multi-trillion dollar asset bases, allows for aggressive pricing and extensive product offerings, creating significant pressure. For example, in Q1 2024, the average net interest margin for California banks was around 3.0%, highlighting the tight margins all institutions must navigate.

The rivalry is further amplified by the maturity of the California banking market, where customer acquisition costs rose by an estimated 15% year-over-year in late 2023 for new checking accounts. This necessitates a strong focus on customer retention, with community banks averaging around 85% retention in 2024, a figure Five Star Bank must strive to meet or exceed.

Five Star Bank differentiates itself through specialized services like treasury management and a commitment to personal client relationships, which helps mitigate direct price competition on standard products. This strategy is vital as banks with niche expertise can often retain clients even when facing slightly less favorable rates on core offerings.

The banking sector's high exit barriers, including substantial investments in infrastructure and regulatory compliance, mean established players are unlikely to leave the market, ensuring sustained competitive intensity for institutions like Five Star Bank.

| Competitor Type | Key Characteristics | Impact on Five Star Bank | 2023/2024 Data Point | Strategic Implication |

| National Banks | Vast asset size, wide branch networks, extensive product suites | Price pressure, difficulty in matching scale | Top 5 US banks held over $10 trillion in assets (2023) | Need for differentiation and specialized services |

| Regional/Community Banks | Personalized service, local market focus, similar customer demographics | Intensified local rivalry, competition for market share | California banks' average net interest margin ~3.0% (Q1 2024) | Emphasis on customer loyalty and relationship banking |

| Overall Market | Mature, saturated, increasing acquisition costs | Demand for digital offerings, need for efficient operations | Customer acquisition costs rose ~15% YoY for checking accounts (late 2023) | Focus on digital innovation and customer retention strategies |

SSubstitutes Threaten

The threat of substitutes from fintech lending platforms is a considerable challenge for Five Star Bank. These platforms, offering both consumer and commercial loans, often provide a faster, more streamlined application process and quicker approval times compared to traditional banks. For instance, by the end of 2023, fintech lenders had significantly increased their market share in small business lending, with some reports indicating a 20% year-over-year growth in originations for certain segments.

These digital-first lenders frequently leverage technology to offer competitive interest rates and a highly convenient customer experience, directly appealing to borrowers who prioritize speed and ease. This can draw away customers seeking personal loans or working capital financing. In 2024, the fintech lending sector continued its expansion, with total loan originations projected to reach hundreds of billions of dollars globally, underscoring the scale of this competitive pressure.

To effectively counter this threat, Five Star Bank needs to highlight its unique value proposition. Emphasizing its established reputation, personalized relationship management, and the ability to offer a broader suite of integrated financial solutions—beyond just loans—can differentiate it. This includes services like wealth management, business advisory, and tailored commercial banking packages that fintech disruptors may not readily provide.

Online payment processors and digital wallets are significant substitutes for traditional banking services, offering convenient alternatives for transactions. Platforms such as PayPal, Square, and numerous mobile payment applications enable users to transfer funds and make purchases without necessarily engaging their primary bank accounts for each operation. This accessibility diminishes the necessity of traditional bank checking accounts for routine financial activities.

The increasing adoption of these digital solutions directly challenges the traditional role of banks in facilitating everyday commerce. For instance, in 2023, the global digital payment market was valued at over $9 trillion, with projections indicating continued robust growth. This expansion underscores the competitive pressure faced by incumbent financial institutions like Five Star Bank, as consumers and businesses increasingly opt for faster, often cheaper, digital payment methods.

Robo-advisory platforms and self-directed investment accounts present a significant threat to traditional bank offerings. These digital solutions provide accessible, low-cost alternatives for individuals and businesses looking to manage their wealth, potentially siphoning deposits away from institutions like Five Star Bank.

The growth in this sector is substantial. For instance, the global robo-advisory market was valued at approximately $2.6 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a strong shift towards these automated services. This trend suggests that a growing number of investors will opt for these platforms over traditional banking wealth management, impacting deposit growth and fee income for banks.

Peer-to-Peer Lending and Crowdfunding

Peer-to-peer (P2P) lending and crowdfunding platforms present a growing threat of substitutes for traditional bank lending. These platforms directly connect borrowers with investors, bypassing intermediaries like Five Star Bank. For instance, the global P2P lending market was valued at approximately $59.4 billion in 2023 and is projected to reach $261.7 billion by 2030, demonstrating significant growth. Crowdfunding also continues to expand, with global crowdfunding volume estimated to be over $20 billion in 2023.

These alternative financing methods cater to segments often underserved by traditional banks, such as small businesses and startups seeking smaller loan amounts or individuals looking for personal loans. The ease of access and often faster approval processes offered by these platforms can be attractive alternatives.

- P2P Lending Market Growth: Expected to grow from $59.4 billion in 2023 to $261.7 billion by 2030.

- Crowdfunding Volume: Global volume exceeded $20 billion in 2023.

- Target Segments: Attracts small businesses, startups, and individuals seeking alternative funding.

- Competitive Advantage: Offers easier access and potentially faster loan processing.

Alternative Deposit and Savings Vehicles

Customers have a growing array of alternatives to traditional bank deposits. Money market funds, for instance, saw significant inflows in 2024 as investors sought higher yields amidst fluctuating interest rates. Brokerage accounts with integrated cash management features also present a compelling substitute, often providing easy access to funds and competitive interest rates, directly challenging bank deposit products.

These alternative vehicles directly impact Five Star Bank's funding costs and its ability to attract stable, low-cost deposits. For example, as of late 2024, average yields on money market funds were often exceeding those offered on traditional savings accounts by a notable margin, making them an attractive option for savers.

- Money Market Funds: Offering competitive yields and liquidity, these funds directly compete for customer savings.

- Brokerage Cash Management: These accounts provide banking-like services with potentially higher interest rates, attracting funds away from traditional banks.

- Direct Securities Investment: For more sophisticated investors, investing directly in bonds or other securities can be an alternative to holding cash in a bank.

The threat of substitutes for Five Star Bank is multifaceted, encompassing fintech lending, digital payments, robo-advisors, P2P lending, and alternative deposit vehicles. These substitutes often offer greater speed, convenience, and potentially lower costs, directly challenging traditional banking services.

Fintech lenders, for instance, saw significant growth in 2023, with some segments experiencing 20% year-over-year increases in originations. Similarly, the global digital payment market surpassed $9 trillion in 2023, highlighting a shift away from traditional transaction methods. The robo-advisory market, projected to grow from $2.6 billion in 2023 to over $10 billion by 2030, indicates a strong preference for automated wealth management. P2P lending and crowdfunding platforms also represent substantial competition, with the P2P market expected to reach $261.7 billion by 2030.

| Substitute Category | Key Characteristics | 2023/2024 Data Point | Impact on Five Star Bank |

|---|---|---|---|

| Fintech Lending | Speed, convenience, competitive rates | 20% YoY growth in some segments (2023) | Loss of loan customers, pressure on rates |

| Digital Payments | Ease of transaction, accessibility | Global market > $9 trillion (2023) | Reduced reliance on bank accounts for daily commerce |

| Robo-Advisors | Low cost, automated wealth management | Market valued at $2.6 billion (2023) | Siphoning deposits, reduced wealth management fees |

| P2P/Crowdfunding | Direct borrower-investor connection | P2P market: $59.4 billion (2023) | Alternative funding source, bypassing banks |

| Alternative Deposits | Higher yields, liquidity | Money market yields often > savings accounts (late 2024) | Increased funding costs, reduced deposit base |

Entrants Threaten

The threat of new entrants into the traditional banking sector, like that faced by Five Star Bank, is significantly mitigated by substantial regulatory hurdles and the sheer amount of capital needed to even begin operations. For instance, in 2024, establishing a new bank in the U.S. requires navigating a labyrinth of federal and state regulations, often demanding millions of dollars in initial capital reserves to ensure solvency and protect depositors.

Securing a bank charter is a rigorous and time-consuming process, involving multiple oversight bodies that scrutinize everything from business plans to management expertise. This demanding environment, coupled with the ongoing need for extensive compliance infrastructure, effectively acts as a powerful barrier, discouraging many aspiring entrepreneurs from launching de novo banks and thus limiting new competition.

New banks face a significant hurdle in building brand reputation and earning customer trust, which is paramount in financial services. This trust, essential for stability and reliability, takes years to cultivate, giving established players like Five Star Bank a distinct advantage.

For instance, in 2024, customer acquisition costs in banking remained high, partly due to the need for extensive marketing and relationship-building to overcome ingrained trust in incumbent institutions.

Five Star Bank leverages its deep roots and long-standing presence in its communities to maintain this trust, making it harder for newcomers to attract and retain customers who value familiarity and perceived security.

Existing banks, particularly larger ones, enjoy significant cost advantages due to economies of scale in areas like technology investment and operational efficiency. For instance, in 2024, major banks continued to invest billions in digital transformation, a cost barrier for startups.

New entrants would find it difficult to match the widespread branch networks and robust digital platforms that established banks have cultivated over decades. These established distribution channels provide a critical advantage in customer acquisition and service delivery that is costly and time-consuming to replicate.

Niche Fintech Entrants with Lower Barriers

While traditional full-service banking presents significant hurdles for newcomers, the threat of new entrants is more pronounced within specialized financial niches, particularly from agile fintech firms. These entities often bypass the need for a full banking charter, instead concentrating on specific functions such as payments, lending, or wealth management. By harnessing technology, they can introduce innovative solutions with considerably lower capital requirements and fewer regulatory burdens.

This strategic unbundling of services allows fintechs to chip away at established banking functions. For instance, in 2023, the global fintech market size was valued at approximately $1.17 trillion, with projections indicating substantial growth, suggesting a fertile ground for niche players. This trend highlights how specialized technology-driven offerings can incrementally erode the market share of traditional banks.

- Fintechs target specific financial services, not full charters.

- Leveraging technology reduces capital and regulatory barriers for niche entrants.

- The global fintech market reached roughly $1.17 trillion in 2023, indicating significant growth potential for specialized players.

- This disaggregation of services poses an incremental threat to traditional banking revenue streams.

Customer Switching Costs and Loyalty

For many customers, especially businesses utilizing integrated services like treasury management, the perceived costs of switching banks can be moderate. This inertia, coupled with established relationships, fosters a degree of customer loyalty that new entrants must actively work to overcome.

New competitors need to present a compelling value proposition, perhaps through innovative technology or superior service offerings, to entice customers away from established institutions like Five Star Bank. For instance, a significant portion of commercial clients rely on seamless treasury management systems, making the transition process a key consideration.

- Moderate Switching Costs: Businesses with integrated treasury management services face moderate costs and effort in transferring accounts and services.

- Customer Loyalty: Established relationships and the convenience of existing systems contribute to customer loyalty, creating a barrier for new entrants.

- Value Proposition Necessity: New entrants must offer demonstrably superior value or disruptive technology to attract clients from incumbents.

The threat of new entrants for traditional banks like Five Star Bank remains relatively low due to significant regulatory capital requirements and the extensive compliance infrastructure needed. In 2024, the U.S. banking sector continued to demand substantial upfront investment, often in the millions, to meet solvency and depositor protection mandates.

Building customer trust and brand recognition is a lengthy process, giving established institutions a distinct advantage. For example, in 2024, customer acquisition costs remained elevated, reflecting the effort required to overcome ingrained loyalty to incumbent banks.

While full-service banking is protected, specialized fintechs present a more dynamic threat by unbundling services and leveraging technology. The global fintech market, valued at approximately $1.17 trillion in 2023, demonstrates the growth potential for these niche players who face fewer capital and regulatory barriers.

Established banks benefit from economies of scale, particularly in technology and operational efficiency. For instance, in 2024, major banks continued multi-billion dollar investments in digital transformation, creating a cost barrier for startups aiming to compete on digital platforms and branch networks.

Porter's Five Forces Analysis Data Sources

Our Five Star Bank Porter's Five Forces analysis is built upon a foundation of credible data, including the bank's own annual reports and SEC filings, alongside industry-specific research from reputable sources like IBISWorld and S&P Global Market Intelligence.