Five9 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five9 Bundle

Five9, a leader in cloud contact center solutions, boasts significant strengths in its robust technology and strong market reputation. However, understanding its competitive landscape, potential threats, and areas for improvement is crucial for strategic decision-making.

Want the full story behind Five9’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Five9 has showcased exceptional financial performance, with full-year 2024 revenue exceeding $1 billion. This milestone highlights the company's sustained growth trajectory.

The company's revenue growth accelerated, with a notable 17% increase in Q4 2024 and subscription revenue climbing by 19%. This demonstrates strong customer adoption and recurring revenue streams.

Continuing this momentum into 2025, Five9 reported a record $283.3 million in revenue for Q2 2025, a 12% year-over-year increase that beat expectations. This consistent financial strength reinforces its competitive advantage.

Five9's leadership in AI and intelligent customer experience (CX) platforms is a significant strength. The company earned the 2024 Aragon Research Innovation Award for AI Contact Centers, underscoring its pioneering work in the field.

Further solidifying this position, Five9 was named a Leader in multiple Aragon Research Globe reports for AI Agent Platforms and Intelligent Contact Centers in 2025. These accolades highlight their consistent innovation and market recognition.

At the core of Five9's offerings is its AI-powered platform, featuring the Genius AI suite. This technology enables advanced capabilities like AI Agents that can autonomously reason, decide, and act, directly improving customer interactions and boosting agent efficiency.

Five9's fully cloud-native contact center platform provides exceptional scalability and flexibility, allowing businesses to easily adjust resources up or down based on demand without significant capital expenditure on hardware. This agility is a key strength, enabling companies to adapt swiftly to market changes and seasonal peaks. For instance, during the busy holiday shopping season of 2024, clients could seamlessly add agents to handle increased call volumes.

Strategic Partnerships and Integrations

Five9 has cultivated significant strategic partnerships, notably with industry giants like Salesforce, ServiceNow, and Microsoft Teams. These deep integrations are not just about connectivity; they create a powerful ecosystem for AI-driven workflows, offering clients truly comprehensive solutions. This collaborative approach bolsters Five9's market standing and opens doors to a wider enterprise customer base, directly impacting its sales pipeline.

These alliances are crucial for extending Five9's reach and enhancing its value proposition. For instance, the integration with Salesforce allows for seamless customer data flow, improving agent efficiency and customer experience. By embedding its capabilities within platforms already critical to businesses, Five9 reduces friction for adoption and strengthens its competitive moat.

- Salesforce Integration: Enhances CRM capabilities for a unified customer view.

- ServiceNow Partnership: Streamlines IT service management and customer support workflows.

- Microsoft Teams Collaboration: Facilitates unified communications and contact center operations.

- Ecosystem Expansion: Broadens market access and strengthens deal flow through trusted technology partners.

Consistent Market Leadership and Recognition

Five9's consistent market leadership is a significant strength, underscored by its repeated designation as a Leader in the Gartner Magic Quadrant for Contact Center as a Service (CCaaS). This prestigious recognition has been achieved for four consecutive years, demonstrating sustained excellence and a clear vision in a dynamic market. Furthermore, Five9 was named a Leader in the IDC MarketScape for CCaaS Applications Software in 2024.

This ongoing validation from industry analysts like Gartner and IDC confirms Five9's robust execution and unwavering commitment to innovation. It positions the company as a reliable and forward-thinking provider in the competitive customer experience sector.

- Gartner Magic Quadrant Leader for CCaaS: Four consecutive years of recognition.

- IDC MarketScape Leader for CCaaS Applications Software: Recognized in 2024.

- Industry Authority: Sustained leadership validates vision and execution.

- Commitment to Innovation: Demonstrates ongoing investment in evolving CX solutions.

Five9's robust financial performance is a key strength, with full-year 2024 revenue surpassing $1 billion and Q2 2025 revenue reaching $283.3 million, a 12% year-over-year increase. The company's leadership in AI and intelligent CX platforms, evidenced by multiple 2024 and 2025 Aragon Research awards, highlights its innovation. Its fully cloud-native platform offers crucial scalability and flexibility, allowing clients to adapt to demand fluctuations efficiently.

Strategic partnerships with industry leaders like Salesforce, ServiceNow, and Microsoft Teams are vital, creating an AI-driven ecosystem that enhances Five9's value proposition and market reach. This is further solidified by its consistent recognition as a Leader in Gartner's Magic Quadrant for CCaaS for four consecutive years and its 2024 IDC MarketScape leadership. These accolades underscore Five9's sustained market authority and commitment to advancing CX solutions.

| Metric | 2024 (Full Year) | Q2 2025 |

|---|---|---|

| Revenue | >$1 Billion | $283.3 Million |

| Year-over-Year Revenue Growth (Q2 2025) | N/A | 12% |

| Key Awards | Aragon Research Innovation Award (AI Contact Centers) | Aragon Research Globe Leader (AI Agent Platforms, Intelligent Contact Centers) |

| Gartner Recognition | Leader (CCaaS Magic Quadrant) | Leader (CCaaS Magic Quadrant) |

| IDC Recognition | N/A | MarketScape Leader (CCaaS Applications Software) |

What is included in the product

This SWOT analysis provides a strategic overview of Five9's internal strengths and weaknesses, alongside external opportunities and threats within the contact center as a service (CCaaS) market.

Offers a clear, actionable framework to identify and address critical customer service challenges.

Helps pinpoint areas for improvement in customer engagement and operational efficiency.

Weaknesses

Five9's financial performance, while showing positive trends in non-GAAP metrics, continues to grapple with GAAP net losses. For instance, the company reported GAAP net losses in both the fourth quarter of 2024 and the first quarter of 2025. This suggests that despite healthy revenue expansion and non-GAAP profitability, Five9 isn't yet consistently profitable according to generally accepted accounting principles.

These persistent GAAP net losses contribute to a negative trailing price-to-earnings (P/E) ratio, which can be a red flag for value-focused investors. Compounding this, Five9 carries a notable debt-to-equity ratio, potentially raising concerns about its financial leverage and overall risk profile for certain market participants.

Five9 has implemented significant workforce reductions, including a 7% cut in August 2024 and an additional 4% reduction in April 2025, affecting around 120 employees. These actions, while framed as strategic realignments and profitability enhancements, may indicate underlying operational inefficiencies or intense pressure to manage costs within the highly competitive cloud contact center market.

Five9 faces formidable competition in the Contact Center as a Service (CCaaS) market. Established rivals like Genesys, NICE CXone, and Talkdesk command significant market share and brand recognition. This intense rivalry necessitates continuous innovation and aggressive market strategies to maintain and grow Five9's position.

The growing influence of hyperscalers such as Amazon Web Services (AWS), Microsoft, and Google presents another substantial challenge. These tech giants are increasingly embedding contact center capabilities into their cloud offerings, often leveraging advanced, proprietary AI. Their ability to offer integrated solutions and potentially lower price points due to their vast infrastructure could disrupt the market and pressure Five9's margins.

Lengthening Sales Cycles for Large Enterprise Deals

Five9 has observed that sales cycles for substantial enterprise deals are extending. This trend directly affects the predictability of revenue streams and can dampen growth momentum. Securing these significant contracts demands more time and a greater allocation of resources, potentially decelerating the onboarding of new, high-value enterprise clients.

The lengthening of these cycles is a notable weakness, as it implies a more arduous path to closing large accounts. This can create a drag on the company's ability to rapidly expand its market share within the lucrative enterprise segment. For instance, while specific deal cycle lengths aren't publicly broken out, industry-wide data from 2024 and early 2025 indicates an average enterprise software sales cycle can now range from 6 to 18 months, a notable increase from previous years.

- Extended Enterprise Sales Cycles: Difficulty in closing large, high-value deals within anticipated timeframes.

- Impact on Revenue Predictability: The extended duration of these sales cycles makes forecasting revenue more challenging.

- Resource Intensiveness: Large enterprise deals require significant investment in sales and support resources, increasing costs.

- Slower Growth Momentum: A longer sales cycle can hinder the pace of new customer acquisition, particularly in the enterprise market.

Sensitivity to Macroeconomic and Geopolitical Factors

Five9's reliance on customer spending makes it vulnerable to economic downturns. For instance, in 2024, the company cited customer budget constraints as a reason for downward revisions in its revenue outlook, demonstrating how broader economic shifts directly impact its financial performance.

Geopolitical instability can also hinder Five9's growth, particularly in international markets. Delays in adoption due to these global concerns represent a significant weakness, as they limit the company's ability to capitalize on diverse revenue streams.

- Economic Sensitivity: Customer budget constraints, evident in 2024 revenue guidance revisions, highlight Five9's vulnerability to macroeconomic slowdowns.

- Geopolitical Impact: Adverse geopolitical events can slow international customer adoption, affecting Five9's global expansion strategy.

- Revenue Guidance Revisions: The need to adjust revenue forecasts due to economic factors underscores the company's susceptibility to external market conditions.

Five9's ongoing GAAP net losses, despite non-GAAP profitability, present a significant weakness. For example, the company reported GAAP net losses in Q4 2024 and Q1 2025, impacting its ability to demonstrate consistent bottom-line profitability under standard accounting principles. This can make it less attractive to investors prioritizing GAAP earnings. Furthermore, a negative trailing P/E ratio and a notable debt-to-equity ratio suggest potential financial leverage concerns for some market participants.

Preview the Actual Deliverable

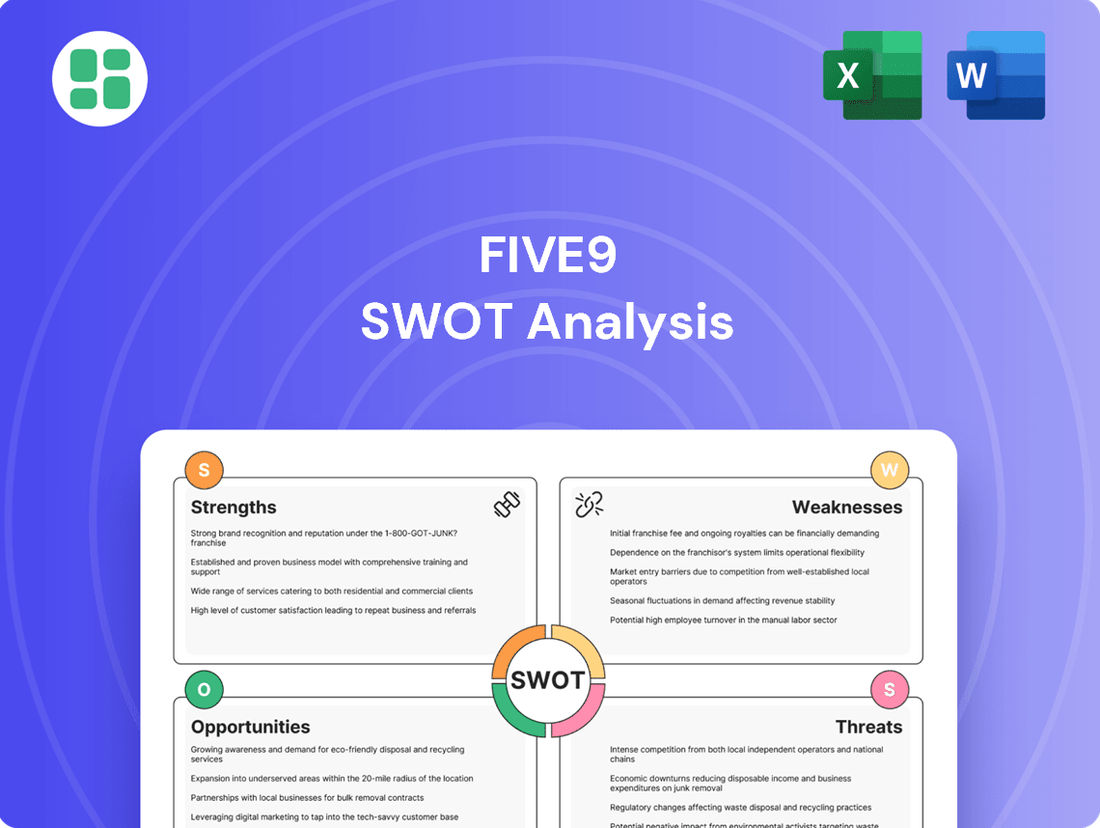

Five9 SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Five9's Strengths, Weaknesses, Opportunities, and Threats, providing valuable insights for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Five9's competitive landscape and internal capabilities.

Opportunities

The global contact center market presents a substantial growth runway, with less than 30% of agents having migrated to cloud solutions by 2024. This underpenetration signifies a vast opportunity for cloud-native providers like Five9 to capture market share.

The demand for AI and automation within contact centers is accelerating, pushing businesses away from outdated on-premises systems. Legacy providers are also scaling back investments, further fueling the shift towards cloud-based solutions and creating a fertile ground for Five9's expansion.

The market is witnessing a significant surge in demand for AI and automation within customer experience, presenting a prime opportunity for Five9. The company's AI bookings more than tripled year-over-year in Q2 2025, underscoring this powerful market trend.

This robust growth allows Five9 to further capitalize on its advanced AI-driven solutions, including its AI Agents and GenAI Studio. By expanding these offerings, Five9 can effectively address the evolving needs of customers and drive enhanced operational efficiency for its clients.

Five9 is actively expanding its AI-driven solutions, notably with its 'agentic CX' offerings. These solutions feature AI Agents capable of independent reasoning, decision-making, and action, directly addressing the growing demand for more autonomous customer service.

The introduction of GenAI Studio further solidifies Five9's position by enabling businesses to create and customize their own AI-powered engagement strategies. This empowers clients to leverage advanced AI for enhanced customer interactions, a critical differentiator in the competitive contact center market.

This strategic focus on advanced AI and customization is expected to drive significant market share growth for Five9. As businesses increasingly prioritize intelligent and automated customer service, Five9's innovative approach positions it to capitalize on this expanding market opportunity.

Leveraging Existing Partnerships for Broader Market Reach

Five9's strategic alliances with major technology players such as Salesforce, ServiceNow, and Microsoft are pivotal for expanding its market presence. These relationships facilitate deeper integration of Five9's contact center solutions into existing enterprise systems, making them more attractive to a larger customer base.

These collaborations enable the development of more robust, end-to-end customer experience platforms. By offering bundled solutions, Five9 can enhance its value proposition, potentially increasing average revenue per user and capturing a greater share of the enterprise market.

- Expanded Distribution Channels: Partnerships provide access to new customer segments through the sales and marketing networks of alliance partners.

- Enhanced Solution Offerings: Deeper integrations with platforms like Salesforce Service Cloud allow for more seamless data flow and unified customer views.

- Increased Customer Stickiness: Bundled solutions and integrated workflows make it harder for customers to switch providers.

- Market Validation: Association with reputable partners lends credibility and can accelerate adoption rates.

Untapped International Market Expansion

Despite geopolitical headwinds impacting global markets, Five9 has a substantial opportunity in expanding its reach internationally, especially within Europe and Asia. This expansion offers a clear path to diversifying revenue and lessening dependence on the U.S. market.

In 2023, the global cloud contact center market was valued at approximately $12.4 billion, with projections indicating significant growth in international segments. For instance, the European market is expected to see a compound annual growth rate (CAGR) of over 15% through 2027, presenting a fertile ground for Five9's solutions.

- Europe: Strong demand for cloud-based customer service solutions, driven by digital transformation initiatives.

- Asia-Pacific: Rapidly growing economies with increasing adoption of advanced communication technologies.

- Market Adaptation: Tailoring product features and pricing to meet the specific needs of diverse international customer bases.

- Revenue Diversification: Reducing concentration risk by tapping into new customer segments and geographical markets.

The ongoing migration from on-premises to cloud contact center solutions represents a significant opportunity for Five9. With less than 30% of agents having transitioned to the cloud by 2024, the market is ripe for further penetration by cloud-native providers.

Five9's investment in AI and automation, particularly its AI Agents and GenAI Studio, directly addresses the accelerating demand for these capabilities. The company's AI bookings more than tripling year-over-year in Q2 2025 highlights the strong market pull for these advanced solutions.

Strategic partnerships with tech giants like Salesforce, ServiceNow, and Microsoft offer Five9 expanded distribution channels and deeper integration possibilities, enhancing its value proposition and customer stickiness.

International expansion, especially in Europe and Asia, presents a substantial growth avenue. The European cloud contact center market, projected to grow at a CAGR exceeding 15% through 2027, offers significant potential for revenue diversification.

| Opportunity Area | Market Data | Five9's Position |

|---|---|---|

| Cloud Migration | <10% of agents on cloud by 2024 | Cloud-native leader |

| AI & Automation Demand | AI bookings > 3x YoY (Q2 2025) | Advanced AI solutions (AI Agents, GenAI Studio) |

| Strategic Alliances | Integration with Salesforce, ServiceNow, Microsoft | Enhanced enterprise adoption |

| International Expansion | Europe CCaaS CAGR > 15% (to 2027) | Untapped European and Asian markets |

Threats

The cloud contact center market is a crowded space, with many established companies and new entrants all trying to capture a piece of the pie. This intense competition can force Five9 to lower prices, spend more on marketing, and work harder to attract skilled employees, all of which can affect how much money they make and how quickly they can grow.

The rise of hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) entering the Contact Center as a Service (CCaaS) market presents a substantial challenge for Five9. These tech giants possess immense financial backing and extensive existing customer relationships, allowing them to offer integrated CCaaS solutions that bundle with their broader cloud services.

For instance, Microsoft's integration of Azure AI capabilities into Dynamics 365 Customer Service, and AWS's expanding suite of contact center solutions like Amazon Connect, directly compete with Five9's offerings. This competitive pressure is amplified by their ability to leverage advanced AI and machine learning technologies, which are core to their existing businesses, potentially offering more sophisticated and cost-effective solutions to a wide range of enterprises.

The Contact Center as a Service (CCaaS) market is rapidly maturing, and as more vendors offer comparable AI-driven functionalities, the risk of commoditization intensifies. This trend inevitably leads to greater pricing pressures across the industry.

Competitors, particularly large hyperscalers with broader market reach, may adopt aggressive pricing strategies, accepting lower profit margins to capture significant market share. This competitive landscape could compel Five9 to re-evaluate its own pricing models, potentially impacting its overall profitability and revenue growth.

For instance, in the competitive cloud communications sector, average selling prices for core services have seen a downward trend as feature sets converge. Analysts noted in early 2024 that while Five9 has a strong product offering, maintaining premium pricing becomes challenging when competitors bundle similar capabilities at lower price points.

Macroeconomic Headwinds and Customer Budget Constraints

Ongoing macroeconomic uncertainties, such as persistent inflation and the specter of economic slowdowns, are creating significant headwinds for businesses. This environment often translates into tighter customer budgets, leading to delayed purchasing decisions for new software solutions like those offered by Five9. For instance, the IMF projected global growth to slow to 2.9% in 2024, a slight decrease from earlier forecasts, indicating a cautious economic outlook that can impact enterprise spending.

These conditions can directly affect Five9's performance by lengthening sales cycles, reducing the average deal size, and generally dampening demand for cloud contact center solutions. A more conservative spending environment means potential clients may scrutinize investments more heavily, prioritizing essential operational needs over new technology acquisitions. This cautious approach can put pressure on Five9's revenue forecasts and overall growth trajectory.

- Inflationary Pressures: Elevated inflation rates can erode consumer and business purchasing power, leading to reduced discretionary spending on software.

- Economic Slowdown Concerns: Fears of recession or slower economic growth prompt companies to cut costs, potentially impacting IT budgets and new software investments.

- Extended Sales Cycles: Increased budget scrutiny and the need for multiple approvals can significantly lengthen the time it takes to close deals, impacting revenue recognition.

- Reduced Deal Sizes: Customers may opt for smaller deployments or phased rollouts to manage costs, leading to lower average contract values for Five9.

Potential Impact of Securities Fraud Lawsuit

Five9 is currently navigating a securities fraud lawsuit filed by investors. This legal challenge, irrespective of the final judgment, is projected to incur substantial legal expenses. Furthermore, it demands significant attention from the company's leadership, potentially diverting focus from core business operations and strategic growth initiatives.

The ongoing litigation can also negatively affect investor sentiment and the company's stock performance. Such legal entanglements can erode market confidence, impacting Five9's valuation and its ability to secure future funding. This situation underscores the financial and operational risks associated with such claims.

Moreover, the lawsuit poses a threat to Five9's corporate image. A tarnished reputation can hinder its capacity to attract new clientele and retain its existing customer base. This reputational damage can have long-term consequences on market share and competitive positioning.

- Legal Costs: Anticipated to be significant, impacting profitability.

- Management Distraction: Diverts crucial attention from strategic objectives.

- Investor Confidence: Potential erosion of market trust and stock valuation.

- Reputational Damage: Affects customer acquisition and retention efforts.

Intense competition from hyperscalers like AWS and Microsoft, who leverage their vast resources and AI capabilities, poses a significant threat by potentially commoditizing the CCaaS market and driving down prices. Economic uncertainties, including projected slower global growth in 2024 according to the IMF, can lead to tighter customer budgets and extended sales cycles. Furthermore, the ongoing securities fraud lawsuit against Five9 presents substantial legal costs, management distraction, and potential reputational damage, impacting investor confidence and customer retention.

SWOT Analysis Data Sources

This Five9 SWOT analysis is informed by a robust combination of proprietary market intelligence, customer feedback platforms, and publicly available financial filings. These sources provide a comprehensive view of Five9's competitive landscape and operational performance.