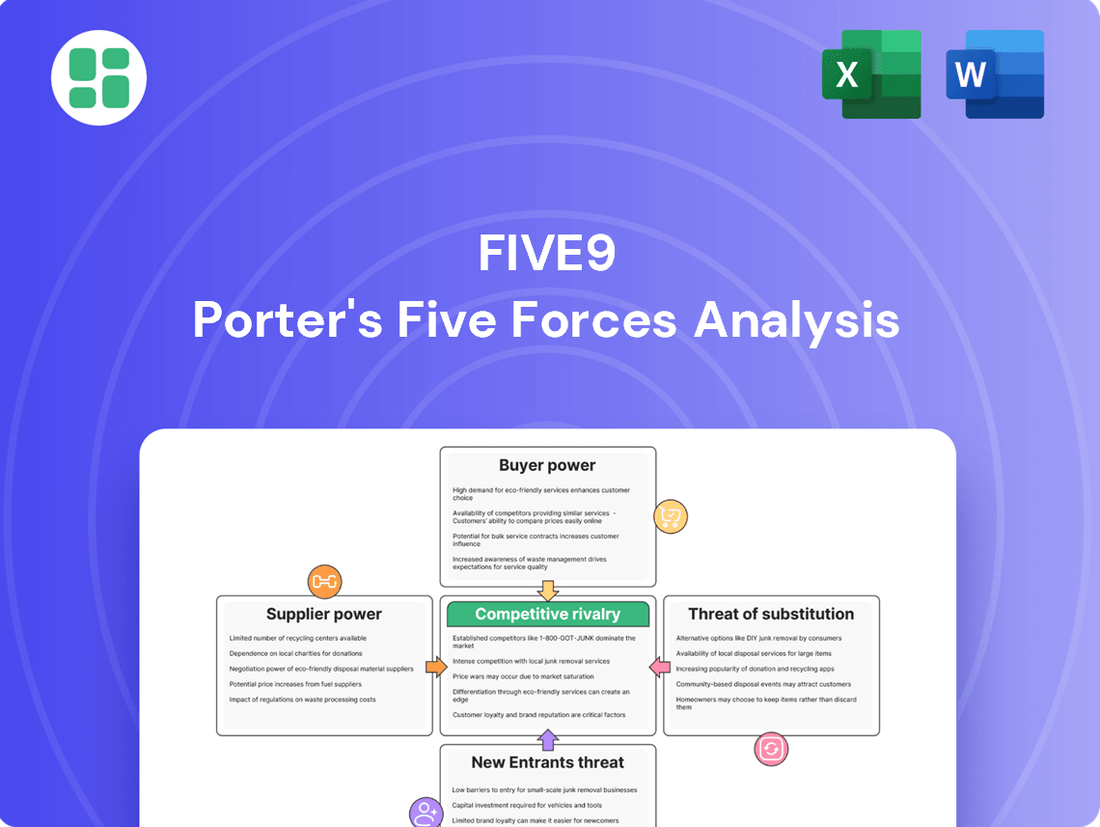

Five9 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five9 Bundle

Five9 operates in a dynamic cloud contact center market, facing intense competition and evolving customer expectations. Understanding the interplay of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Five9’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Five9's reliance on a few major cloud infrastructure providers like AWS, Azure, and Google Cloud significantly amplifies supplier bargaining power. These providers control the essential backbone of Five9's operations, giving them leverage in pricing and service terms.

The concentration in the cloud infrastructure market means Five9 has limited alternatives, increasing the cost and complexity of switching. For instance, in 2023, AWS, Azure, and Google Cloud collectively held over 65% of the global cloud infrastructure market share, underscoring their market dominance and the potential for substantial switching costs for Five9.

The growing reliance on AI and machine learning for advanced contact center features places Five9 in a position of dependence on suppliers for specialized components and algorithms. When these sophisticated technologies are unique or come from a small group of providers, these specialized software vendors gain leverage. For instance, Five9 has seen its Enterprise AI revenue accelerate significantly, highlighting its commitment to AI-driven solutions and thus its reliance on such suppliers.

Five9's ability to deliver its cloud-based contact center solutions is fundamentally dependent on access to reliable telecommunications infrastructure. This includes the network backbone, data transmission capabilities, and voice services provided by a range of telecom carriers.

While the telecommunications sector is generally competitive, the essential nature of high-quality, low-latency connectivity for real-time voice and data in contact centers can grant significant bargaining power to these infrastructure suppliers. For instance, in 2024, the global telecommunications market generated over $1.5 trillion in revenue, highlighting the scale and importance of these providers.

The critical dependence on these services means that Five9, and similar companies, must ensure robust partnerships with providers who can guarantee uptime and performance. Any disruption or significant price increase from these suppliers could directly impact Five9's service delivery and operational costs.

Proprietary Technology and Licensing

The bargaining power of suppliers for Five9 is significantly influenced by their proprietary technology and licensing terms. Suppliers offering unique components like advanced speech analytics or specialized natural language processing (NLP) can command higher prices or more favorable terms due to Five9's integration needs.

Five9’s reliance on third-party software for core functionalities, such as workforce optimization (WFO) modules, creates a dependency. This dependency can empower suppliers, especially if their technology is difficult to replicate or replace, as seen in the competitive landscape of cloud contact center solutions where specialized AI capabilities are highly valued.

- Proprietary Technology: Suppliers of unique AI-driven speech analytics or NLP engines hold considerable sway.

- Licensing Agreements: The terms of these licenses can directly impact Five9's operational costs and platform flexibility.

- Integration Dependency: Five9's need to integrate specialized third-party tools can lead to supplier leverage.

- Market Value: In 2024, the demand for advanced contact center AI solutions means suppliers of such technologies are in a strong position.

Talent and Expertise in Niche Areas

The demand for highly skilled professionals in areas like cloud architecture, AI development, and cybersecurity grants specialized talent significant bargaining power. Five9's reliance on these experts to innovate and maintain its platform means that attracting and retaining them can drive up labor costs, impacting profitability. For instance, in 2024, the average salary for a senior cloud architect in the US was reported to be around $170,000 annually, a figure that can escalate with specialized certifications and experience.

This scarcity of niche expertise creates a competitive landscape for talent, potentially leading to challenges in acquisition and retention for companies like Five9. The ability of these specialized workers to command higher compensation or choose between multiple offers directly influences Five9's operational expenses and its capacity to scale its innovative offerings. In 2023, the tech industry saw a notable increase in demand for AI specialists, with some roles experiencing salary growth exceeding 15% year-over-year.

- Niche Skill Demand: High demand for cloud architects, AI developers, and cybersecurity experts.

- Talent Retention Costs: Increased labor costs and potential challenges in acquiring top talent for Five9.

- Competitive Labor Market: Specialized professionals can leverage their skills for better compensation and opportunities.

- Impact on Innovation: Five9's ability to innovate is directly tied to its success in attracting and retaining these critical skill sets.

Five9's bargaining power with its suppliers is significantly influenced by the concentration within key supply markets, particularly for cloud infrastructure and specialized AI components. When a few providers dominate, like AWS, Azure, and Google Cloud which held over 65% of the global cloud market in 2023, they gain substantial leverage over pricing and service terms. This concentration, coupled with the high switching costs for integrating new systems, empowers these suppliers.

Furthermore, the reliance on suppliers for proprietary technologies, such as advanced NLP or speech analytics, strengthens their position. The 2024 demand for AI-driven contact center solutions means suppliers of these niche capabilities are well-positioned to dictate terms. This dependency can lead to increased operational costs for Five9 if suppliers exploit their market advantage through pricing or licensing agreements.

| Supplier Category | Market Concentration & Leverage Factors | Impact on Five9 | 2023/2024 Data Point |

|---|---|---|---|

| Cloud Infrastructure | Dominated by a few major players (AWS, Azure, Google Cloud) | High switching costs, price leverage for suppliers | AWS, Azure, Google Cloud held >65% cloud market share (2023) |

| Specialized AI/NLP Software | Proprietary technology, high integration dependency | Potential for premium pricing, favorable licensing terms | High demand for AI in contact centers (2024) |

| Telecommunications | Essential for service delivery, critical for uptime | Leverage for providers of high-quality, low-latency connectivity | Global telecom market revenue >$1.5 trillion (2024) |

| Specialized Talent | Scarcity of niche skills (AI, Cloud Architecture) | Increased labor costs, retention challenges for Five9 | Senior Cloud Architect salaries ~$170,000 (US, 2024) |

What is included in the product

This analysis dissects the competitive landscape for Five9 by examining the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products or services.

Instantly understand competitive pressures with a dynamic, interactive model that highlights where Five9 can best leverage its strengths.

Customers Bargaining Power

For large enterprises, the decision to switch Contact Center as a Service (CCaaS) platforms like Five9 is a complex and costly undertaking. The process demands substantial investment in migrating vast amounts of customer data, retraining hundreds or even thousands of agents on new workflows and interfaces, and ensuring seamless integration with existing Customer Relationship Management (CRM) systems and other critical business applications. These substantial upfront and ongoing costs significantly diminish a customer's leverage to negotiate better terms once they've committed to Five9's platform.

The financial implications of such a migration are considerable. For instance, a large enterprise might spend upwards of $1 million to $5 million on a CCaaS platform transition, factoring in software, implementation services, and internal resource allocation. This investment creates a strong incentive for these businesses to remain with their chosen provider, thereby lowering their bargaining power with Five9.

The cloud contact center market is incredibly crowded, presenting a significant advantage to customers. With many players like Genesys, NICE, Talkdesk, Cisco, and Amazon Connect vying for business, companies have a wealth of options. This abundance of choice directly translates to increased bargaining power for customers.

Businesses can readily shop around, comparing not just features and pricing but also the quality of service offered by various CCaaS providers. For instance, as of early 2024, the CCaaS market size was estimated to be around $20 billion, with projections indicating substantial growth. This competitive landscape means providers like Five9 must offer compelling value to retain and attract clients.

The bargaining power of customers is a key factor in Five9's competitive landscape. If Five9 had a few very large customers that accounted for a significant portion of its revenue, these customers could exert considerable bargaining power, potentially demanding lower prices or more favorable terms.

However, Five9 serves a diverse customer base of over 2,500 clients globally. This broad distribution of its customer base, as of early 2024, significantly mitigates the risk of high customer concentration for any single client, thereby reducing the overall bargaining power of individual customers.

Demand for Omnichannel and AI-Driven Solutions

Customers are increasingly looking for seamless experiences across all channels, from web chat to phone calls, and they expect businesses to use AI to personalize their interactions. This growing demand for sophisticated omnichannel and AI-powered solutions directly impacts the bargaining power of customers. If a company can't deliver these advanced capabilities, customers have more leverage to seek out competitors who can.

Five9's Intelligent CX Platform, featuring Five9 Genius AI, is designed to address these evolving customer expectations. The platform's ability to offer integrated omnichannel engagement and leverage AI for tasks like predictive routing and agent assistance is crucial for retaining customers. For instance, in 2023, businesses reported that 70% of customers expect agents to have context from previous interactions across channels, highlighting the importance of Five9's integrated approach.

- Customer Demand for AI: A significant percentage of consumers, often exceeding 60%, express a willingness to engage with AI-powered customer service tools for faster resolutions.

- Omnichannel Expectations: Over 75% of customers expect a consistent experience when switching between different communication channels with a brand.

- Impact on Retention: Companies failing to meet these omnichannel and AI demands risk losing customers, with reports indicating that poor customer service is a primary driver for switching brands for up to 50% of consumers.

Price Sensitivity and Subscription Models

Customers in the Contact Center as a Service (CCaaS) market, including those considering Five9, demonstrate significant price sensitivity. The scalability and cost efficiencies inherent in CCaaS solutions are weighed against the overall expenditure, especially when numerous providers are vying for market share. In 2024, the competitive landscape intensified, placing further pressure on pricing strategies.

Five9's subscription-based model, a standard in the industry, is subject to customer scrutiny. Buyers actively compare pricing structures, seeking the most cost-effective solutions that can clearly demonstrate a return on investment (ROI). This focus on value means that providers must not only offer advanced features but also transparent and competitive pricing to attract and retain clients.

- Price Sensitivity: Customers evaluate CCaaS providers based on overall cost, not just features.

- Competitive Pressure: A crowded market in 2024 amplified customer focus on pricing.

- Subscription Scrutiny: Five9's pricing models are analyzed for cost-effectiveness and clear ROI.

- Value Proposition: Providers must balance advanced features with competitive and transparent pricing.

The bargaining power of customers in the CCaaS market is shaped by switching costs, market competition, and evolving customer demands for AI and omnichannel experiences. While high migration costs can anchor customers, a crowded market with numerous providers like Genesys, NICE, and Talkdesk, estimated to be worth around $20 billion in early 2024, empowers customers with choices. This competitive pressure forces providers like Five9 to offer compelling value and transparent pricing to retain their diverse client base, which exceeded 2,500 globally by early 2024.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (as of early 2024) |

|---|---|---|

| Switching Costs | Lowers bargaining power due to high migration and retraining expenses. | Enterprise migrations can cost $1M-$5M, involving data, training, and integration. |

| Market Competition | Increases bargaining power due to a wide array of provider options. | CCaaS market estimated at ~$20B, with many competitors like Genesys, NICE, Talkdesk. |

| Customer Demands (AI/Omnichannel) | Increases bargaining power if providers fail to meet expectations. | 70% of businesses report customers expect cross-channel context; 60%+ willing to use AI for faster service. |

| Customer Concentration | Lowers bargaining power for individual customers. | Five9 serves over 2,500 clients, distributing revenue and reducing reliance on any single large customer. |

Full Version Awaits

Five9 Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Five9, detailing the competitive landscape and strategic implications. The document you see here is precisely what you will receive instantly after purchase, offering a professionally formatted and ready-to-use resource for your business strategy. You can be confident that no placeholders or mockups are present; this is the actual, comprehensive analysis you will obtain to inform your decision-making.

Rivalry Among Competitors

The cloud contact center market is a hotbed of competition, fueled by its rapid expansion. Projections indicate the global cloud contact center market will surge, with some estimates placing it at over $50 billion by 2025, and continuing its upward trajectory. This substantial growth naturally attracts a multitude of players, intensifying the rivalry.

Five9 navigates a landscape crowded with formidable competitors. Established giants such as Genesys, NICE, and Cisco have a strong presence, offering comprehensive solutions. Additionally, tech behemoths like Amazon Web Services (AWS) and Microsoft are increasingly making their mark, leveraging their extensive cloud infrastructure and broad customer bases to offer compelling contact center services.

The competitive rivalry within the contact center as a service (CCaaS) market is intensely fueled by the relentless pace of technological innovation, especially in artificial intelligence (AI) and automation. Vendors are in a perpetual race to integrate cutting-edge AI-driven features, such as sophisticated intelligent routing, real-time sentiment analysis, and increasingly capable virtual agents. This forces players like Five9 to continuously invest in and enhance their AI capabilities to avoid falling behind and to maintain a competitive edge in an evolving market.

In 2024, the CCaaS sector saw significant AI integration, with many providers showcasing advancements in generative AI for customer service. For instance, companies are leveraging AI to automate a larger portion of customer interactions, aiming to reduce agent workload and improve first-contact resolution rates. Five9, in response, has been actively developing its AI offerings, including its own AI-powered virtual agent solutions, to compete with rivals who are also heavily investing in this area. The market's growth, projected to reach over $30 billion globally by 2025, underscores the importance of technological differentiation through AI.

Competitors actively differentiate themselves through unique feature sets, robust integrations, and tailored solutions for specific industries. This means companies are constantly innovating to offer something distinct in the market.

Five9's strategy centers on its Intelligent CX Platform, emphasizing AI-driven customer experiences as a core differentiator. However, rivals are not standing still; they also offer strong platforms, often excelling in areas like unified communications or specialized CRM integrations, creating a dynamic competitive landscape.

Acquisitions and Strategic Partnerships

Competitive rivalry in the cloud contact center market is intense, with frequent acquisitions and strategic partnerships shaping the landscape. Companies actively pursue these avenues to broaden their service portfolios and extend their market presence. For instance, Five9 has forged strategic alliances with key players like Salesforce and Verint, aiming to bolster its own solutions and solidify its competitive standing against rivals who are similarly building collaborative networks.

These alliances are crucial for staying ahead. In 2024, the cloud communications sector continued to see significant M&A activity. Companies are consolidating to offer more integrated solutions, often combining AI, analytics, and customer engagement platforms. This consolidation trend means that even established players like Five9 must continually adapt and partner to maintain their edge.

- Strategic Alliances: Five9 partners with Salesforce and Verint to enhance its cloud contact center offerings.

- Market Consolidation: The industry experiences frequent acquisitions as companies seek to expand capabilities and market reach.

- Competitive Response: Rivals also form alliances, intensifying the need for strategic partnerships to maintain market position.

- 2024 Trends: Continued M&A activity in cloud communications, with a focus on integrated AI and analytics solutions.

Customer Switching Costs and Retention Strategies

While Five9's cloud-based contact center solutions can involve significant integration and training, making switching costs relatively high for businesses, the competitive landscape is fierce. Competitors are aggressively pursuing Five9's clientele by offering aggressive pricing, enhanced functionalities, and more tailored solutions. For instance, in 2024, the unified communications and collaboration market, which overlaps with contact center solutions, saw continued innovation and competitive pressure from players like Zoom, Microsoft Teams, and Cisco, all vying for market share.

To counter this, Five9's retention strategy hinges on delivering exceptional customer satisfaction, proactive support, and ongoing product innovation. Maintaining high service levels and demonstrating clear ROI are crucial. The company's focus on AI-powered features and agent experience aims to deepen customer loyalty and reduce churn. In 2023, Five9 reported a customer retention rate of over 90%, underscoring the effectiveness of their strategies in a challenging market.

- High Integration Costs: Businesses invest heavily in integrating Five9's platform with existing CRM and other business systems, creating a barrier to switching.

- Competitor Incentives: Rival providers frequently offer discounted pricing, bundled services, or advanced features to attract dissatisfied or price-sensitive Five9 customers.

- Customer Satisfaction Focus: Five9 prioritizes customer success through dedicated support teams and continuous training to ensure clients maximize the platform's value.

- Product Innovation: Regular updates and the introduction of new AI-driven capabilities, such as advanced analytics and intelligent routing, are key to retaining clients by offering a continuously improving solution.

The competitive rivalry within the cloud contact center market is exceptionally fierce, driven by rapid technological advancements, particularly in AI and automation. Vendors like Five9 face intense pressure from established players such as Genesys and NICE, alongside tech giants like AWS and Microsoft, all vying for market share. This dynamic environment necessitates continuous innovation and strategic differentiation to maintain a competitive edge.

In 2024, the sector witnessed a significant push in AI integration, with companies like Five9 actively developing AI-powered virtual agents to enhance customer interactions and reduce agent workload. The market's projected growth, exceeding $30 billion by 2025, fuels this intense competition, making technological differentiation a critical success factor. Competitors are also actively differentiating through unique feature sets and industry-specific solutions.

Strategic alliances and market consolidation are key trends shaping this rivalry. Five9's partnerships with Salesforce and Verint exemplify this strategy, aiming to bolster its offerings. The continued M&A activity in 2024, with a focus on integrated AI and analytics, means that even established players must adapt and collaborate to stay ahead.

Despite high integration costs for clients, which create switching barriers, competitors aggressively target Five9's customer base with attractive pricing and enhanced functionalities. For instance, in 2024, players like Zoom and Microsoft Teams intensified competition in the overlapping unified communications space. Five9 counters by prioritizing customer satisfaction, proactive support, and ongoing product innovation, maintaining a customer retention rate above 90% in 2023.

| Competitor | Key Differentiators | 2024 Focus Areas |

|---|---|---|

| Genesys | Comprehensive CCaaS platform, strong enterprise presence | AI-driven analytics, omnichannel capabilities |

| NICE | Workforce optimization, AI-powered analytics | Generative AI for agent assistance, cloud migration |

| Cisco | Unified communications integration, broad IT infrastructure | Contact center AI, hybrid cloud solutions |

| AWS | Cloud infrastructure, broad ecosystem integration | Contact center AI services (Amazon Connect), scalability |

| Microsoft | Teams integration, Azure cloud services | AI-powered customer service solutions, hybrid work integration |

SSubstitutes Threaten

Traditional on-premise contact center systems represent a significant threat of substitutes for cloud-native providers like Five9. While the market is clearly shifting to the cloud, large enterprises with substantial existing investments in hardware and software, or those facing stringent data residency and regulatory demands, may find it difficult to migrate. These legacy systems can offer a comparable core functionality, albeit often with higher upfront costs and less flexibility.

For extremely small businesses or those with very limited customer contact, basic phone systems, email, and common messaging applications might seem like alternatives. However, these options fall short of the sophisticated features like advanced call routing, in-depth analytics, and workforce management that Five9 provides.

Large enterprises with significant IT budgets, like a major bank or a global tech firm, might explore building their own contact center infrastructure. This in-house development can be a viable substitute for commercial CCaaS solutions, especially if the company foresees unique operational needs or potential long-term cost efficiencies. For instance, a company might invest millions in custom software to integrate deeply with its legacy systems, a move that could be cheaper than adapting a third-party platform over many years.

Unified Communications as a Service (UCaaS) Platforms

Some Unified Communications as a Service (UCaaS) providers are broadening their services to incorporate fundamental contact center capabilities. This expansion positions them as potential substitutes for businesses that need unified communications and integrated customer service, rather than a dedicated contact center solution. For instance, companies like 8x8 and RingCentral are actively marketing combined UCaaS and Contact Center as a Service (CCaaS) packages.

This trend means that businesses looking for basic customer interaction management alongside their internal communication tools might opt for these integrated UCaaS offerings instead of a standalone CCaaS platform. The market for UCaaS is substantial and growing, with reports indicating the global UCaaS market was valued at approximately $34.4 billion in 2023 and is projected to reach over $70 billion by 2028, demonstrating the scale of this potential substitution.

- Integrated Offerings: UCaaS providers like 8x8 and RingCentral are merging UC and CC capabilities, creating a single platform.

- Market Penetration: The significant and expanding UCaaS market size suggests a broad base of potential customers for these combined solutions.

- Cost-Effectiveness: For businesses with less complex contact center needs, a bundled UCaaS/CCaaS solution can be more cost-effective than separate systems.

- Strategic Shift: This represents a strategic move by UCaaS players to capture a larger share of the customer interaction market.

Manual Processes and Traditional Customer Service Methods

Manual processes and traditional customer service methods represent a significant threat of substitutes for cloud-based contact center solutions like Five9. Businesses might still rely on direct email, basic phone systems without advanced features, or even in-person interactions to handle customer inquiries. These low-tech alternatives can be perceived as cheaper upfront, especially for smaller operations or those with very limited customer interaction volumes.

For instance, a small local business might find it sufficient to manage customer queries through a single business phone line and a general inquiry email address. This approach avoids the recurring subscription costs associated with sophisticated software. In 2024, while digital transformation is widespread, a segment of businesses, particularly SMBs, may still opt for these simpler, less integrated methods to manage customer service, especially if their customer base is geographically concentrated or their service needs are basic.

- Manual Email Support: Businesses can use generic email addresses, requiring staff to manually sort, respond, and track customer issues without specialized software.

- Basic Phone Lines: Traditional landlines or simple mobile phones can be used for customer calls, lacking features like intelligent call routing, IVR, or call recording.

- In-Person Service: For brick-and-mortar businesses, face-to-face interactions can serve as a substitute for remote or digital customer service channels.

- Cost Perception: These manual methods often appear more cost-effective in the short term compared to investing in advanced contact center technology.

While cloud-native CCaaS solutions like Five9 offer advanced features, traditional on-premise contact center systems remain a viable substitute for some organizations. Companies with substantial existing investments in hardware and software, or those with strict data residency requirements, might find migrating to the cloud challenging. These legacy systems can provide core functionality, though often at a higher upfront cost and with less adaptability.

For businesses with very basic customer interaction needs, simple phone systems, email, and common messaging apps can serve as alternatives. However, these options lack the sophisticated call routing, analytics, and workforce management capabilities offered by specialized CCaaS platforms. For instance, a small retail shop might manage customer inquiries through a single business phone line and a general email address, avoiding the recurring subscription fees of advanced software. In 2024, a notable segment of SMBs, particularly those with geographically concentrated customer bases or straightforward service requirements, may continue to favor these less integrated, manual methods.

| Substitute Type | Description | Key Characteristics | Potential User Segment |

|---|---|---|---|

| On-Premise Systems | Traditional, self-hosted contact center infrastructure. | High upfront cost, significant IT investment, less flexibility, strong data control. | Large enterprises with existing infrastructure, strict regulatory needs. |

| Basic Communication Tools | Standard phone lines, email, messaging apps. | Low upfront cost, minimal features, manual operation, limited scalability. | Very small businesses, micro-businesses, low-volume customer interactions. |

| In-House Development | Building custom contact center solutions internally. | High development cost, tailored functionality, long-term maintenance, potential for unique integration. | Large enterprises with unique operational needs, significant IT budgets. |

| UCaaS with CCaaS Integration | Unified Communications platforms incorporating basic contact center features. | Bundled services, cost-effective for combined needs, less specialized than dedicated CCaaS. | Businesses seeking unified communications and basic customer service integration. |

Entrants Threaten

Establishing a sophisticated cloud contact center platform, akin to Five9's, demands a considerable financial outlay. This includes substantial investments in resilient cloud infrastructure, geographically dispersed data centers for redundancy, and the continuous development of cutting-edge software. For instance, building out comparable cloud capabilities can easily run into tens or even hundreds of millions of dollars in upfront capital.

The need for specialized expertise presents a substantial barrier for new entrants in the Contact Center as a Service (CCaaS) market. Developing and maintaining a sophisticated platform requires deep knowledge in AI, machine learning, natural language processing, data analytics, and cybersecurity. For instance, in 2024, the global demand for cybersecurity professionals alone was projected to exceed 4 million unfilled positions, highlighting the scarcity and cost of acquiring such talent.

New entrants face a significant hurdle due to Five9's strong brand recognition and established customer relationships, cultivated over years of reliable service delivery. This brand loyalty translates into a competitive advantage, making it difficult for newcomers to gain traction. For instance, in 2023, Five9 reported a customer retention rate of over 90%, demonstrating the strength of these existing bonds.

Regulatory Compliance and Data Security Standards

The contact center industry faces significant barriers to entry due to stringent regulatory compliance and data security standards. New players must invest heavily to meet requirements like GDPR, HIPAA, and PCI-DSS, which are critical for handling sensitive customer information.

These compliance demands create a substantial financial and operational hurdle. For instance, the cost of implementing and maintaining robust data security infrastructure can run into millions of dollars, a significant outlay for any new entrant aiming to compete with established players like Five9.

- High Compliance Costs: Adhering to regulations like GDPR and HIPAA necessitates significant investment in secure infrastructure and ongoing audits.

- Data Security Investments: Protecting customer data against breaches requires advanced cybersecurity measures, a substantial upfront and recurring expense.

- Navigating Complex Regulations: Understanding and implementing the nuances of various industry-specific compliance frameworks is a considerable challenge for newcomers.

- Reputational Risk: Non-compliance can lead to severe penalties and damage a new entrant's reputation, making market entry particularly risky.

Network Effects and Integration Ecosystems

Five9 benefits significantly from strong network effects within its robust partner ecosystem, which boasts over 1,400 partners. This extensive network, coupled with deep integrations into leading CRM platforms such as Salesforce, Zendesk, and Microsoft Dynamics, creates a powerful advantage. New entrants face a substantial barrier in replicating this comprehensive integration landscape, a process that demands considerable time and substantial investment to build comparable reach and functionality.

The challenge for new entrants is amplified by the need to establish similar breadth and depth in their integration ecosystems to effectively compete. This requires not only technical development but also the cultivation of relationships with a vast array of technology providers and channel partners. For instance, Five9's established presence in the market means its integrations are often pre-built and readily available to customers, offering immediate value that new entrants struggle to match.

Consider the competitive landscape in 2024: many cloud-based contact center solutions are vying for market share. However, those with established, seamless integrations into widely adopted business software, like Five9's connections to major CRMs, present a more compelling offering. This integration depth acts as a significant deterrent, as new companies must invest heavily in development and partnership building to even approach the existing connectivity that established players offer.

- Network Effects: Five9 leverages its extensive partner ecosystem (1,400+ partners) and integrations with major CRMs like Salesforce and Microsoft Dynamics.

- Integration Ecosystem Barrier: New entrants must invest significant time and resources to build comparable integration capabilities.

- Customer Adoption: Pre-built integrations offer immediate value, making it difficult for new entrants to attract customers.

- 2024 Landscape: Established integration depth is a key differentiator in the competitive cloud contact center market.

The threat of new entrants into the cloud contact center market, like the one Five9 operates in, is significantly mitigated by substantial capital requirements. Building a robust, scalable platform demands extensive investment in cloud infrastructure, data centers, and ongoing software development, easily reaching tens to hundreds of millions of dollars. This high initial cost acts as a strong deterrent for potential newcomers.

Specialized talent is another major barrier. Developing advanced AI, machine learning, and cybersecurity features requires deep expertise, a scarce and expensive resource. In 2024, the global shortage of cybersecurity professionals alone was projected to be over 4 million, underscoring the difficulty and cost of acquiring necessary talent.

Existing customer loyalty and strong brand recognition, exemplified by Five9's over 90% customer retention rate in 2023, make market entry challenging. New entrants must overcome established trust and reliable service delivery, a feat that requires considerable time and proven performance.

Stringent regulatory compliance, including GDPR, HIPAA, and PCI-DSS, imposes significant financial and operational burdens. New entrants must invest heavily in secure infrastructure and navigate complex legal frameworks, with compliance costs potentially running into millions of dollars annually, a substantial hurdle compared to established players.

Five9's extensive partner ecosystem, comprising over 1,400 partners and deep integrations with major CRMs like Salesforce and Microsoft Dynamics, creates a powerful network effect. Replicating this comprehensive integration landscape requires substantial time and investment, making it difficult for new entrants to offer comparable immediate value and connectivity.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment in cloud infrastructure and software development. | Up to hundreds of millions of dollars for comparable cloud capabilities. |

| Specialized Expertise | Need for deep knowledge in AI, ML, NLP, and cybersecurity. | Global cybersecurity talent shortage projected over 4 million in 2024. |

| Brand Loyalty & Customer Relationships | Established trust and reliable service delivery. | Five9's customer retention rate exceeded 90% in 2023. |

| Regulatory Compliance | Adherence to data security and privacy standards (GDPR, HIPAA). | Millions of dollars in investment for robust data security infrastructure. |

| Integration Ecosystem | Extensive partner network and CRM integrations. | Five9's 1,400+ partners and integrations with Salesforce, Zendesk, Microsoft Dynamics. |

Porter's Five Forces Analysis Data Sources

Our Five9 Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from Five9's annual reports, investor presentations, and SEC filings. We also leverage industry-specific market research reports and analyses from leading technology publications to provide a comprehensive view of the competitive landscape.