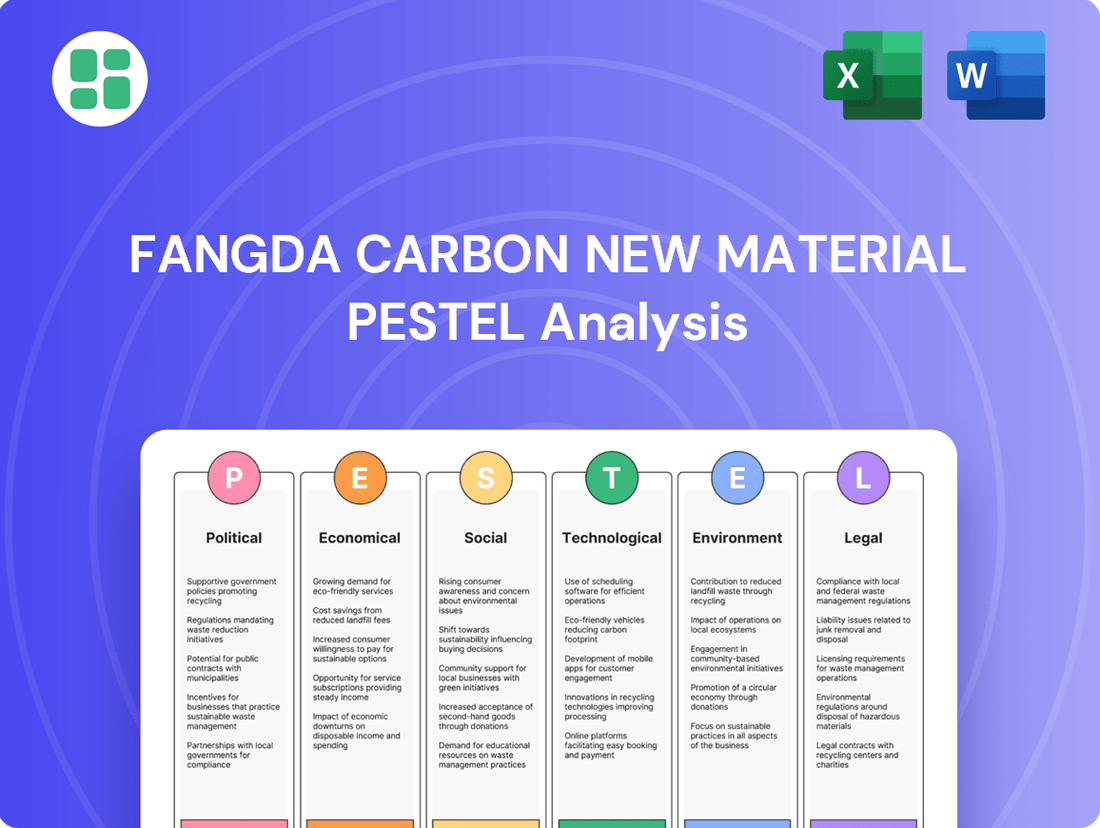

Fangda Carbon New Material PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fangda Carbon New Material Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Fangda Carbon New Material's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to anticipate market shifts and identify strategic opportunities. Download the full report to gain a decisive advantage.

Political factors

China's industrial policies, especially those focusing on upgrading heavy industries and controlling excess capacity, significantly shape Fangda Carbon's operating environment. For instance, the 14th Five-Year Plan (2021-2025) targets a reduction in energy consumption per unit of GDP, directly influencing sectors like steel, a major consumer of Fangda's graphite electrodes.

Policies promoting energy saving and carbon reduction are particularly relevant, as they can spur demand for advanced, lightweight materials where Fangda operates. China's commitment to achieving carbon peak by 2030 and carbon neutrality by 2060, with specific action plans for 2024-2025, will likely intensify these trends, pushing industries to adopt more efficient production methods and materials.

Global trade relations and the potential for tariffs on carbon and graphite products present a significant variable for Fangda Carbon. For instance, the U.S. International Trade Commission reported that in 2023, imports of graphite electrodes, a key product for Fangda, faced scrutiny and potential adjustments in trade policy, impacting export markets.

Geopolitical tensions and evolving trade policies, such as those that might emerge with shifts in U.S. administrations or China's strategic decisions regarding critical minerals like graphite, introduce considerable uncertainty. China, a major producer of graphite, has implemented export controls on certain critical raw materials, as seen in late 2023, which can directly influence supply chain stability and market access for Fangda's graphite-based materials.

China's heightened emphasis on environmental protection, particularly through its expanding national carbon emissions trading scheme (ETS), directly influences Fangda Carbon's operational expenses and strategic investment planning. The ETS, which broadened its scope to encompass steel, cement, and aluminum sectors in 2024-2025, introduces carbon costs for Fangda's clientele and potentially its own manufacturing processes. This regulatory shift is expected to drive market demand for more energy-efficient materials and advanced production techniques.

Support for New Energy and Strategic Industries

Government initiatives strongly favor new energy and strategic industries, directly impacting demand for Fangda Carbon's advanced materials. Policies aimed at boosting electric vehicle (EV) production and expanding renewable energy infrastructure, like wind power, are key drivers. For instance, China's commitment to achieving carbon neutrality by 2060 translates into substantial investment in these sectors. In 2024, the government continued to offer purchase subsidies and tax incentives for EVs, stimulating a market that heavily relies on lightweight carbon fiber components. Similarly, ongoing investments in wind energy projects create a robust demand for high-strength graphite and carbon materials used in turbine blades and other critical components.

These supportive policies create a favorable environment for Fangda Carbon by directly increasing the market size for its products. The acceleration of EV adoption, driven by government mandates and consumer incentives, directly translates into higher consumption of carbon fiber for lighter, more efficient vehicles. Furthermore, the push for renewable energy infrastructure development, particularly in wind and solar power, necessitates advanced carbon materials for durability and performance. The global push towards decarbonization, evidenced by international agreements and national targets, underpins the long-term growth prospects for industries that are major consumers of Fangda Carbon's offerings.

- Government subsidies for EVs in China reached an estimated ¥10 billion in 2024, driving significant demand for lightweight materials.

- Global investment in renewable energy infrastructure is projected to exceed $2 trillion by 2030, creating sustained demand for advanced carbon products.

- Fangda Carbon's strategic focus aligns with national industrial policies promoting self-sufficiency in critical materials for new energy applications.

Intellectual Property Protection

The strength of intellectual property (IP) protection laws in China and globally significantly impacts Fangda Carbon's ability to safeguard its research and development investments in advanced carbon materials. Robust IP frameworks are crucial for companies like Fangda, which invest heavily in material science, to maintain their competitive advantage and prevent the unauthorized replication of their innovations. As of early 2024, China continues to strengthen its IP enforcement, with reported increases in IP-related court cases and damages awarded, aiming to foster a more innovation-friendly environment.

This evolving legal landscape directly influences Fangda's long-term technological development strategy. A strong IP protection regime encourages continued investment in proprietary technologies, potentially leading to exclusive market positions for new carbon material applications. Conversely, weaker enforcement could necessitate greater reliance on trade secrets or faster market entry to outpace potential infringers, impacting R&D allocation and strategic partnerships.

- China's IP Court System: In 2023, China's IP courts handled a substantial volume of cases, indicating a growing emphasis on IP rights.

- International Treaties: Fangda's international operations are subject to treaties like the Patent Cooperation Treaty (PCT), which standardizes the patent application process globally.

- R&D Investment: Fangda's commitment to R&D, a key driver for new material development, is directly tied to the expected return on investment, which is influenced by IP protection.

- Competitive Landscape: Competitors' ability to legally access or reverse-engineer Fangda's innovations is a direct function of IP enforcement effectiveness.

China's industrial policies, particularly those focused on energy efficiency and carbon reduction, directly impact Fangda Carbon's market. The nation's commitment to achieving carbon neutrality by 2060, with specific targets for 2024-2025, is driving demand for advanced, lightweight materials. Government support for new energy sectors, such as electric vehicles and renewable energy, further bolsters the market for Fangda's products.

Trade policies and geopolitical tensions introduce significant variables for Fangda Carbon. For instance, export controls on critical raw materials, like graphite, implemented by China in late 2023, affect supply chain stability. Global scrutiny of graphite electrode imports, as observed in 2023, also presents challenges for market access.

China's expanding national carbon emissions trading scheme (ETS) influences Fangda's operational costs and strategic planning. The inclusion of more industries in the ETS from 2024-2025 means carbon costs for Fangda's clients, potentially increasing demand for energy-efficient materials. This regulatory environment encourages innovation in production methods.

The strength of intellectual property (IP) protection in China and globally is crucial for Fangda Carbon's R&D investments. As of early 2024, China is enhancing its IP enforcement, with a rise in IP-related cases, aiming to create a more innovation-friendly environment. This protects Fangda's proprietary technologies and competitive edge.

| Factor | Impact on Fangda Carbon | Data/Trend (2024-2025 Focus) |

| Industrial Policy (Energy Efficiency) | Drives demand for advanced materials | China's 14th Five-Year Plan targets reduced energy consumption per GDP unit. |

| Environmental Regulations (Carbon ETS) | Increases operational costs for clients, boosts demand for efficiency | ETS scope expanded to steel, cement, aluminum in 2024-2025. |

| New Energy Sector Support | Directly increases market size for carbon products | EV subsidies in China estimated at ¥10 billion in 2024; global renewable investment projected over $2 trillion by 2030. |

| Trade Relations & Geopolitics | Affects supply chain stability and market access | China's 2023 export controls on graphite; 2023 scrutiny of graphite electrode imports. |

| Intellectual Property Protection | Safeguards R&D investment and competitive advantage | Increased IP court cases in China in 2023; PCT adherence for global applications. |

What is included in the product

This PESTLE analysis examines the external forces impacting Fangda Carbon New Material, detailing how political, economic, social, technological, environmental, and legal factors present both challenges and avenues for growth.

It provides a strategic framework for understanding the competitive landscape and informing proactive decision-making for Fangda Carbon New Material.

This PESTLE analysis for Fangda Carbon New Material offers a clear, summarized view of external factors, acting as a pain point reliver by simplifying complex market dynamics for efficient decision-making.

Economic factors

The health of the global economy is a significant driver for Fangda Carbon New Material. When the world economy is strong, industries like metallurgy, new energy, and machinery manufacturing tend to expand, directly boosting the demand for Fangda's graphite electrodes and carbon fiber products. For instance, in 2024, projections from the IMF suggest global growth around 3.2%, a moderate but positive outlook that should support industrial activity.

Conversely, a slowdown in global economic expansion or a recession in key industrial nations can have a negative impact. If major economies experience contractions, manufacturing output often falls, leading to fewer orders for essential materials like those Fangda produces. This reduced demand can directly affect the company's revenue streams and overall profitability.

Industrial output in specific sectors is particularly crucial. For example, the steel industry's performance, which relies heavily on graphite electrodes, is a key indicator. Likewise, growth in the new energy sector, a significant consumer of carbon fiber, directly translates to potential sales for Fangda. As of early 2025, the renewable energy sector continues to show robust growth, which is a positive signal for carbon fiber demand.

Fluctuations in the prices of critical raw materials like petroleum coke and coal pitch directly impact Fangda Carbon's production costs and profitability. These materials are foundational for their graphite and carbon product manufacturing. For instance, global petroleum coke prices saw significant volatility throughout 2023 and into early 2024, with some benchmarks increasing by over 30% year-on-year at certain points, directly squeezing margins for producers like Fangda.

Supply chain disruptions further exacerbate these economic challenges. Recent reports from industry analysts in late 2024 highlight persistent supply chain bottlenecks affecting graphite availability, leading to extended lead times and increased logistical expenses for Fangda. This volatility in both price and supply creates a challenging operating environment, requiring careful inventory management and strategic sourcing to mitigate risks.

The health of Fangda Carbon's key customer sectors significantly influences its performance. Industries like steel, aluminum, new energy vehicles (NEVs), and aerospace are major consumers of carbon materials. For example, the global steel industry, a primary market for graphite electrodes, saw production reach approximately 1.9 billion metric tons in 2023, with continued growth projected.

The burgeoning NEV market is a particularly strong economic tailwind. Global NEV sales surged past 13 million units in 2023, a substantial increase from previous years, driving demand for specialized carbon materials used in battery components and lightweight structures. This trend is expected to continue as governments push for electrification and battery technology advances.

Furthermore, the aerospace sector's recovery and expansion, coupled with the increasing use of electric arc furnaces (EAFs) in steel production—which often rely on graphite electrodes—further bolster demand for Fangda's products. The shift towards EAFs, driven by sustainability goals, presents a positive outlook for electrode manufacturers.

Currency Exchange Rate Fluctuations

Fangda Carbon, as a global player, is significantly exposed to currency exchange rate volatility, especially concerning the Chinese Yuan (CNY) against currencies like the US Dollar (USD) and the Euro (EUR). For instance, in early 2024, the CNY experienced fluctuations against major currencies, impacting the cost of imported raw materials and the pricing of its exported graphite electrodes and other carbon products. A stronger Yuan can make imports cheaper but exports more expensive, potentially squeezing profit margins.

These shifts directly influence Fangda Carbon's revenue and profitability. When the Yuan depreciates, the company's earnings from overseas sales, when converted back into Yuan, increase. Conversely, a strengthening Yuan can diminish the value of foreign earnings. For example, if Fangda Carbon sells products in USD, a stronger USD relative to the CNY would boost its Yuan-denominated revenue.

- Impact on Imports: A weaker CNY increases the cost of essential imported raw materials, such as petroleum coke, impacting production costs.

- Export Competitiveness: Fluctuations affect the price competitiveness of Fangda Carbon's exports in international markets. A stronger Yuan can make its products less attractive compared to competitors in countries with weaker currencies.

- Financial Reporting: Exchange rate differences require careful management in financial reporting, affecting reported profits and asset valuations.

Inflation and Cost Pressures

Rising inflation presents a significant challenge for Fangda Carbon. For instance, global inflation averaged around 5.9% in 2023, impacting input costs. This surge in prices for raw materials, energy, and labor directly squeezes the company's profit margins.

Operational costs are escalating across the board. Labor costs, a key component, saw an average increase of 4.5% in major manufacturing economies in 2024. Similarly, energy prices, particularly for electricity and natural gas, which are vital for carbon production, have remained volatile and generally upward trending. Logistics costs are also on the rise due to higher fuel prices and supply chain disruptions.

Fangda Carbon must navigate these cost pressures strategically. This involves implementing efficiency improvements in its manufacturing processes and exploring alternative, more cost-effective suppliers. However, passing these increased costs onto customers can be difficult, especially in a competitive global market where price sensitivity is high.

- Inflationary Impact: Global inflation rates, which remained elevated in 2023 and continue to show upward pressures in early 2024, directly increase Fangda Carbon's cost of production.

- Rising Input Costs: Expect increases in expenses related to key inputs such as graphite electrodes, energy (electricity, natural gas), and transportation. For example, energy prices in many industrial regions saw increases of 10-15% year-over-year in late 2023.

- Margin Squeeze: The inability to fully pass on these higher costs to customers due to market competition can lead to a reduction in Fangda Carbon's profit margins.

- Strategic Response: The company's ability to mitigate these pressures through operational efficiencies and selective price adjustments will be crucial for maintaining profitability.

Global economic growth significantly influences Fangda Carbon's demand. The IMF projected global growth around 3.2% for 2024, indicating a moderate but positive environment for industrial expansion, which benefits Fangda's product lines. However, economic downturns in key markets can reduce orders for graphite electrodes and carbon fiber, impacting revenue.

The performance of specific customer sectors is vital. The steel industry, a major consumer of graphite electrodes, produced approximately 1.9 billion metric tons in 2023, with continued growth expected. Simultaneously, the new energy vehicle market's rapid expansion, with over 13 million units sold globally in 2023, drives demand for carbon fiber.

Inflationary pressures continue to impact Fangda Carbon's profitability. Elevated global inflation in 2023 and early 2024 has increased raw material, energy, and labor costs, with energy prices alone seeing 10-15% year-over-year increases in some regions by late 2023. This necessitates strategic cost management and efficiency improvements.

| Economic Factor | 2023/2024 Data Point | Impact on Fangda Carbon |

| Global GDP Growth | IMF projects ~3.2% for 2024 | Supports industrial demand |

| Steel Production | ~1.9 billion metric tons in 2023 | Drives demand for graphite electrodes |

| NEV Sales | Over 13 million units in 2023 | Boosts carbon fiber demand |

| Inflation Rate (Global Avg.) | ~5.9% in 2023 | Increases production costs, squeezes margins |

| Energy Price Increase (Selected Regions) | 10-15% YoY late 2023 | Raises operational expenses |

Preview Before You Purchase

Fangda Carbon New Material PESTLE Analysis

The preview shown here is the exact Fangda Carbon New Material PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fangda Carbon.

The content and structure shown in the preview is the same Fangda Carbon New Material PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Fangda Carbon's success hinges on access to a skilled workforce, especially in specialized fields like advanced materials science and manufacturing. In 2024, China's emphasis on vocational training and STEM education is expanding the talent pipeline, though competition for top-tier engineering talent remains intense.

Demographic shifts, including an aging population and a declining birth rate, present a long-term challenge for workforce availability. However, a growing number of university graduates, with over 11 million expected to graduate in 2024, offer a significant pool of potential employees for Fangda's innovation and production efforts.

Societal expectations for safe workplaces are increasingly stringent, impacting companies like Fangda Carbon. In 2024, global industrial accidents, while showing some decline, still represent a significant concern, driving regulatory bodies to enforce stricter occupational health and safety (OHS) standards. This means Fangda must invest in advanced safety protocols and training to meet these evolving expectations and avoid potential penalties.

Adhering to high OHS standards is not just about compliance; it's crucial for Fangda's reputation and employee morale. A strong safety record in 2024-2025 enhances public perception and attracts talent, while also mitigating risks of costly litigation and operational disruptions. This commitment aligns directly with corporate social responsibility goals, demonstrating Fangda's dedication to its workforce and the communities it operates within.

Societal and investor demand for corporate social responsibility (CSR) is growing, pushing companies like Fangda Carbon to focus on ethical sourcing, fair labor, and community involvement. This directly impacts brand image and attractiveness to investors. For instance, in 2023, over 70% of global investors considered ESG (Environmental, Social, and Governance) factors when making investment decisions, highlighting the financial imperative of strong CSR.

Demonstrating robust CSR practices, including supply chain transparency, builds crucial stakeholder trust. This can lead to increased investor appeal, particularly from those prioritizing sustainable and ethical businesses. Companies with strong ESG ratings often see lower costs of capital, as evidenced by studies showing a correlation between high ESG scores and improved financial performance.

Consumer Demand for Sustainable Products

Even though Fangda Carbon primarily manufactures industrial materials, a growing consumer preference for sustainable end-products significantly impacts its market. For instance, the increasing demand for fuel-efficient vehicles and renewable energy sources, like solar panels and wind turbines, directly fuels the need for advanced, lightweight carbon materials that Fangda supplies. This societal push for eco-friendly solutions is reshaping the strategic priorities of Fangda's client industries, pushing them towards suppliers who can offer greener material options.

This trend is quantifiable. By 2024, global sales of electric vehicles (EVs) were projected to reach over 15 million units, a substantial increase from previous years, with continued strong growth anticipated through 2025. Similarly, the renewable energy sector saw significant investment, with global clean energy investment reaching an estimated $1.7 trillion in 2023, a figure expected to climb further. These statistics highlight the expanding market for materials that enable these sustainable technologies.

Key implications for Fangda include:

- Increased demand for specialized carbon products: Lightweight and high-strength carbon fibers are crucial for reducing vehicle weight and improving energy efficiency.

- Investment in R&D for sustainable production: Customers are increasingly scrutinizing the environmental footprint of their supply chains, prompting a need for greener manufacturing processes.

- Opportunities in emerging markets: The growth of sectors like aerospace and advanced manufacturing, which prioritize sustainability and performance, presents significant expansion avenues.

- Supplier selection based on ESG criteria: Environmental, Social, and Governance (ESG) factors are becoming more prominent in procurement decisions, influencing Fangda's competitive positioning.

Urbanization and Infrastructure Development

Ongoing urbanization and significant infrastructure development, particularly in China and other emerging economies, are key drivers for industries that rely on Fangda Carbon's products. As cities expand and transportation networks grow, the demand for steel, a primary consumer of graphite electrodes, naturally increases. This trend underpins a consistent, foundational demand for Fangda's core offerings.

China's commitment to urbanization is substantial. For instance, the country aimed to have around 65% of its population living in urban areas by 2023, a figure projected to continue rising. This expansion necessitates massive investments in construction and manufacturing, directly benefiting producers of essential industrial materials like Fangda Carbon.

The infrastructure boom extends beyond China. Many developing nations are prioritizing urban renewal and new infrastructure projects, creating broader global markets for steel and, consequently, for the graphite electrodes used in its production. This widespread development activity offers a robust, long-term growth outlook for Fangda Carbon.

- Urban Population Growth: China's urban population reached over 930 million in 2023, representing a significant increase and a sustained demand driver.

- Infrastructure Investment: Global infrastructure spending is projected to reach trillions of dollars in the coming years, with significant portions allocated to emerging markets.

- Steel Consumption Link: The steel industry, a major user of graphite electrodes, is directly correlated with infrastructure development and urbanization rates.

Societal expectations for ethical business practices and corporate social responsibility (CSR) are increasingly influencing investment and consumer choices. In 2024, over 70% of global investors consider ESG factors, directly impacting companies like Fangda Carbon. This trend necessitates a strong focus on fair labor, ethical sourcing, and community engagement to maintain brand reputation and investor appeal.

The growing consumer demand for sustainable products, such as electric vehicles and renewable energy components, directly fuels the need for advanced carbon materials. With global EV sales projected to exceed 15 million units in 2024 and clean energy investment reaching $1.7 trillion in 2023, Fangda Carbon is well-positioned to capitalize on these shifts by providing materials essential for a greener economy.

Urbanization and infrastructure development remain significant demand drivers for Fangda's products, particularly graphite electrodes used in steel production. China's urban population, exceeding 930 million in 2023, and substantial global infrastructure spending create a consistent market for these materials. This ongoing development directly correlates with increased steel consumption, benefiting Fangda's core business.

Technological factors

Continuous innovation in carbon and graphite production, like plasma-assisted stabilization and microwave curing for carbon fiber, is boosting efficiency and lowering costs. These advancements also enhance material properties, making products stronger and lighter. Fangda Carbon's commitment to research and development is key to adopting these technologies and staying ahead in the market.

Fangda Carbon's strategic investment in research and development is crucial as carbon materials find their way into cutting-edge fields like aerospace, hydrogen storage, and advanced electronics. These new high-tech applications represent substantial growth avenues for the company.

The company's commitment to developing high-performance carbon materials, such as advanced graphite and carbon fibers, is key to capitalizing on these emerging markets. This focus not only allows Fangda to capture new market share but also diversifies its product offerings, reducing reliance on traditional sectors.

Fangda Carbon's operations are increasingly influenced by the integration of automation and smart manufacturing. The adoption of AI and advanced robotics in carbon production is crucial for boosting efficiency and ensuring precise, consistent output. This technological shift is directly impacting production quality and speed.

Investing in these smart manufacturing processes offers tangible benefits for Fangda Carbon. By automating tasks, the company can expect a reduction in labor costs, which is a significant operational advantage. Furthermore, enhanced quality control through automated systems and faster production cycles contribute to a more competitive market position.

Recycling and Circular Economy Technologies

Innovations in recycling technologies for carbon fiber and other composite materials are gaining significant traction, driven by both sustainability mandates and the pursuit of cost efficiencies. These advancements are crucial for companies like Fangda Carbon to reduce their environmental footprint and enhance resource utilization.

Fangda Carbon's strategic approach should increasingly incorporate circular economy principles. This means actively exploring and integrating methods to recover and reuse valuable materials from end-of-life products, thereby minimizing waste and optimizing the use of raw resources. This aligns directly with escalating global environmental concerns and regulatory pressures.

The market for recycled carbon fiber is projected for substantial growth. For instance, the global recycled carbon fiber market was valued at approximately USD 170 million in 2022 and is anticipated to reach over USD 500 million by 2030, demonstrating a compound annual growth rate of around 14.5% during this period. This trend underscores the economic viability and strategic imperative for Fangda to invest in or partner with recycling technology providers.

- Growing Market for Recycled Composites: The increasing demand for sustainable materials in sectors like automotive and aerospace presents a significant opportunity for companies adopting advanced recycling technologies.

- Cost Reduction Potential: Recycling carbon fiber can offer significant cost savings compared to virgin material production, with recycled fibers potentially being 30-50% cheaper.

- Technological Advancements: Innovations such as pyrolysis and solvolysis are making it more efficient and economical to recover high-quality carbon fibers from composite waste.

- Regulatory Tailwinds: Stricter environmental regulations worldwide are pushing industries towards circular economy models, making recycling technologies a necessity rather than an option.

Competitive Technological Landscape

The competitive technological landscape is intensifying for carbon material producers like Fangda. Competitors are rapidly innovating, developing alternative materials and more efficient, cost-effective production methods. For instance, advancements in graphene and other advanced carbon forms present potential substitutes or enhancements to traditional graphite products.

Fangda must maintain a keen focus on these developments. Failure to invest proactively in research and development could lead to technological obsolescence, impacting its market share and profitability. The company's ability to adapt and integrate new technologies will be crucial for sustaining its competitive edge in the coming years.

- Competitor R&D Investment: Tracking competitor R&D spending, such as significant investments by major players in areas like silicon carbide or advanced composite materials, is vital.

- Emerging Material Development: Monitoring the commercialization of new carbon-based materials with superior properties or lower production costs is essential.

- Process Innovation: Observing advancements in production techniques, such as energy-efficient graphitization or novel binder technologies, can highlight areas for Fangda to emulate or surpass.

- Intellectual Property Landscape: Analyzing patent filings by competitors can reveal their strategic technological focus and potential future product pipelines.

Technological advancements are reshaping the carbon materials industry, with innovations like plasma-assisted stabilization and microwave curing enhancing efficiency and material properties for companies like Fangda Carbon. The company's R&D focus on high-performance materials is crucial for capturing growth in emerging sectors such as aerospace and hydrogen storage.

The integration of automation and AI in production processes is boosting efficiency, quality, and speed, directly impacting Fangda Carbon's competitiveness. Furthermore, the growing market for recycled carbon fiber, projected to exceed $500 million by 2030, presents a significant opportunity for cost reduction and sustainability.

Fangda must actively monitor competitor R&D and emerging material developments to avoid technological obsolescence. The company's ability to adapt and invest in new production techniques and advanced carbon forms will be critical for maintaining its market position.

| Technology Area | Impact on Fangda Carbon | Market Trend/Data |

|---|---|---|

| Advanced Production Techniques | Increased efficiency, lower costs, enhanced material properties | Plasma stabilization, microwave curing |

| Automation & AI | Improved quality control, faster production, reduced labor costs | Smart manufacturing adoption |

| Recycling Technologies | Cost savings, environmental compliance, new material streams | Recycled carbon fiber market projected to reach over $500M by 2030 |

| Emerging Materials | Potential for new product development and market diversification | Graphene, advanced composites |

Legal factors

Fangda Carbon must navigate China's increasingly stringent environmental protection laws, covering emissions, waste management, and pollution control. Failure to comply can lead to substantial penalties, operational disruptions, and damage to its public image. For instance, in 2023, China's Ministry of Ecology and Environment announced plans to strengthen enforcement of air pollution standards, directly impacting industrial operations.

Fangda Carbon must strictly adhere to industrial safety regulations, a legal necessity given the high-temperature processes and specialized equipment inherent in carbon and graphite production. Non-compliance can lead to significant fines and operational disruptions.

Ensuring a safe working environment is not just a best practice but a legal mandate. This includes providing comprehensive training on handling hazardous materials and operating machinery, as well as supplying appropriate personal protective equipment (PPE). For instance, in 2023, China's Ministry of Emergency Management reported a 10% decrease in workplace accidents across manufacturing sectors, highlighting a national focus on safety enforcement that directly impacts companies like Fangda Carbon.

These safety requirements directly influence operational costs through investments in safety infrastructure, training programs, and potentially higher insurance premiums. Furthermore, a strong safety record can reduce liability risks, protecting the company from costly legal battles and reputational damage, especially as regulatory bodies increase scrutiny.

International trade laws, including anti-dumping regulations, significantly impact Fangda Carbon's operations. For instance, in 2024, the European Union continued to scrutinize carbon product imports, potentially leading to higher tariffs that could affect Fangda's export competitiveness in key European markets.

The imposition of sanctions against specific countries or industries presents another critical legal factor. Should sanctions target nations from which Fangda sources essential raw materials, like graphite electrodes or specialized carbon precursors, it could disrupt supply chains and necessitate costly adjustments to sourcing strategies.

Navigating these complex international legal frameworks is paramount for Fangda to maintain its global market access and ensure compliance. Failure to adapt to evolving trade policies could result in penalties or limitations on market participation, impacting overall revenue streams.

Product Standards and Certifications

Fangda Carbon New Material must comply with stringent national and international product quality standards to compete effectively. Obtaining necessary certifications, such as those for demanding sectors like aerospace or automotive, is a legal requirement for market access. For instance, in 2024, the automotive industry continued to emphasize advanced material certifications, with many new vehicle programs requiring suppliers to meet ISO/TS 16949 (now IATF 16949) compliance, directly impacting material providers like Fangda Carbon.

Failure to meet these rigorous standards can severely limit market penetration and lead to costly product recalls or legal liabilities. Ensuring product reliability and safety through adherence to these regulations is therefore paramount for Fangda Carbon's operational success and reputation. The global market for advanced carbon materials is projected to reach over $50 billion by 2025, with quality certifications being a key differentiator for market share capture.

- Adherence to IATF 16949: Critical for automotive sector supply chains, ensuring consistent quality and safety in materials.

- Aerospace Material Standards: Compliance with standards like AS9100 is essential for supplying high-performance carbon materials to aircraft manufacturers.

- Product Liability: Non-compliance can result in significant financial penalties and damage to brand reputation.

- Market Access: Certifications act as a gateway to lucrative markets, particularly in high-tech industries.

Labor Laws and Employment Regulations

Fangda Carbon must meticulously adhere to China's labor laws, which govern everything from minimum wages and working hours to employee safety and social security contributions. For instance, the minimum wage in major Chinese cities like Shanghai and Beijing saw increases in early 2024, impacting Fangda's operational costs. Ensuring fair hiring practices and compliance with employee rights is paramount to avoid costly disputes and potential legal sanctions.

Non-compliance with these evolving regulations can directly affect Fangda's bottom line. In 2023, reports indicated a rise in labor arbitration cases across China, highlighting the importance of proactive compliance. Failure to meet standards for working conditions or social welfare benefits can result in fines, operational disruptions, and damage to the company's reputation, impacting its ability to attract and retain talent.

Key areas of focus for Fangda include:

- Wage and Hour Compliance: Adhering to statutory minimum wage rates and overtime regulations as updated by the Ministry of Human Resources and Social Security.

- Workplace Safety and Health: Meeting stringent standards for occupational health and safety, particularly crucial in manufacturing environments like carbon production.

- Social Insurance and Benefits: Ensuring timely and accurate contributions to employee social insurance schemes, including pensions, medical care, and unemployment insurance.

- Fair Employment Practices: Upholding principles of equal opportunity and non-discrimination in recruitment, promotion, and termination processes.

Fangda Carbon must navigate evolving environmental regulations in China, focusing on emissions and waste management, with strengthened enforcement observed in 2023. Strict adherence to industrial safety laws is critical given the nature of carbon production, with a national focus on reducing workplace accidents, as evidenced by a 10% decrease in manufacturing sectors in 2023. International trade laws, including anti-dumping measures, significantly impact exports, with the EU scrutinizing carbon imports in 2024. Compliance with product quality standards, such as IATF 16949 for the automotive sector, is a legal requirement for market access, especially as the advanced carbon materials market is projected to exceed $50 billion by 2025.

| Legal Factor | Impact on Fangda Carbon | Relevant Data/Trend |

|---|---|---|

| Environmental Regulations | Compliance with emissions, waste, and pollution control laws is mandatory. Non-compliance incurs penalties and operational risks. | China's Ministry of Ecology and Environment intensified air pollution standard enforcement in 2023. |

| Industrial Safety | Adherence to safety regulations is essential for high-temperature processes. Non-compliance leads to fines and disruptions. | National focus on safety enforcement resulted in a 10% decrease in manufacturing workplace accidents in 2023. |

| International Trade Laws | Navigating anti-dumping regulations and sanctions is crucial for global market access and competitiveness. | EU scrutiny of carbon imports continued in 2024, potentially affecting export tariffs. |

| Product Quality Standards | Meeting certifications like IATF 16949 is a legal requirement for market entry, particularly in automotive. | The global advanced carbon materials market was projected to exceed $50 billion by 2025, with quality as a key differentiator. |

Environmental factors

The intensifying global and national emphasis on cutting carbon emissions, especially in heavy industries, directly affects Fangda Carbon. China's commitment to achieving carbon neutrality by 2060 and its expanding Emissions Trading System (ETS) are significant drivers.

These policies push industries, including Fangda's clientele, to reduce their carbon footprint. This shift could boost demand for Fangda's products if they enable lower-carbon production methods or are themselves manufactured with a reduced environmental impact.

For instance, China's national ETS, which began trading in 2021, has been progressively expanding its coverage. By the end of 2023, it covered approximately 7 billion tonnes of carbon emissions annually, representing about 70% of the country's total emissions from the power sector. Future expansions to other industrial sectors are anticipated, further pressuring companies to adopt greener solutions.

The manufacturing of carbon and graphite products is inherently energy-intensive, making energy consumption and efficiency a critical environmental factor for Fangda Carbon. In 2024, global energy prices saw continued volatility, with the average industrial electricity price in China, a key market for Fangda, fluctuating significantly. This underscores the importance of Fangda's investments in energy-saving technologies to mitigate rising operational costs.

Growing environmental regulations and a global push towards decarbonization are compelling companies like Fangda to explore and adopt cleaner energy sources. By 2025, many industrial sectors are expected to face stricter emissions targets, pushing for a transition away from fossil fuels. Fangda's commitment to improving energy efficiency not only reduces its environmental footprint but also enhances its competitiveness in an increasingly sustainability-conscious market.

Fangda Carbon, like many in the industrial sector, faces significant environmental challenges related to waste management and pollution control. The effective handling of industrial waste and the mitigation of pollution from its manufacturing operations, including air emissions and wastewater discharge, are critical environmental considerations for the company.

Increasingly stringent environmental regulations globally, coupled with heightened public awareness and scrutiny, necessitate substantial investment by Fangda in advanced waste treatment and pollution control technologies. For instance, in 2024, China's Ministry of Ecology and Environment continued to emphasize stricter enforcement of emission standards, pushing companies to adopt cleaner production methods and invest in technologies that reduce their environmental footprint.

Raw Material Sourcing and Sustainability

Fangda Carbon's operations are heavily reliant on raw materials like petroleum coke and coal pitch, and the environmental footprint of their sourcing is a significant concern. The mining and transportation of these materials can lead to habitat disruption, water pollution, and substantial carbon emissions. For instance, the global seaborne petroleum coke market, a key input for Fangda, saw significant price volatility in 2024 due to supply chain disruptions and geopolitical factors, indirectly highlighting the logistical and environmental challenges in its movement.

The growing global emphasis on sustainable supply chains is increasingly pressuring companies like Fangda Carbon to demonstrate responsible sourcing practices. Consumers and investors are demanding greater transparency and ethical considerations in how raw materials are obtained. This trend is likely to intensify, potentially requiring Fangda to invest in more rigorous supplier audits and explore alternative, lower-impact sourcing methods to maintain its market position and meet evolving environmental, social, and governance (ESG) standards.

- Environmental Impact: Mining and transportation of petroleum coke and coal pitch contribute to habitat loss, water contamination, and greenhouse gas emissions.

- Supply Chain Pressure: Increasing demand for sustainable and ethical sourcing may necessitate Fangda Carbon investing in stricter supplier due diligence.

- Market Trends: Growing investor and consumer focus on ESG factors could drive Fangda towards more environmentally conscious raw material acquisition strategies.

Resource Depletion and Circular Economy

Growing concerns over the finite nature of raw materials are accelerating the global shift towards a circular economy, a model focused on maximizing the lifespan and utility of resources through recycling and reuse. This transition is particularly critical for industries like carbon materials, where primary resource extraction can be resource-intensive.

Fangda Carbon's future resilience and competitive edge will be significantly shaped by its capacity to embed circular economy principles into its operations. This could involve pioneering the development of carbon products designed for easier recycling at the end of their life cycle or actively incorporating recycled carbon feedstocks into its manufacturing processes. Such strategies are essential for mitigating risks associated with virgin resource scarcity and price volatility.

For instance, the global demand for critical raw materials used in various industrial processes, including those relevant to carbon production, continues to rise. By 2025, estimates suggest that the demand for certain key materials could see substantial increases, putting pressure on traditional supply chains. Fangda's proactive engagement with circularity can therefore offer a strategic advantage.

- Resource Scarcity: Projections indicate continued upward pressure on the cost and availability of virgin resources critical for carbon material production throughout 2024 and 2025.

- Circular Economy Adoption: Global investment in circular economy initiatives is expected to grow, creating new opportunities for companies that can offer recycled or recyclable material solutions.

- Innovation in Recycling: Advancements in recycling technologies for carbon-based products are crucial for Fangda to reduce its reliance on primary inputs and enhance its sustainability profile.

- Supply Chain Resilience: Integrating recycled materials can bolster Fangda's supply chain against disruptions and price shocks inherent in sourcing virgin resources.

The increasing global focus on carbon neutrality, exemplified by China's 2060 target and expanding Emissions Trading System (ETS), directly impacts Fangda Carbon. As of late 2023, China's ETS covered roughly 7 billion tonnes of emissions annually, with anticipated expansion to more sectors. This policy landscape incentivizes Fangda's clients to reduce their carbon footprint, potentially increasing demand for Fangda's enabling products.

Energy intensity in carbon product manufacturing makes energy efficiency paramount. Global industrial electricity prices remained volatile in 2024, impacting operational costs for companies like Fangda. Stricter emissions targets expected by 2025 across industries necessitate a shift towards cleaner energy, making Fangda's investments in energy-saving technologies crucial for competitiveness.

Fangda faces environmental challenges in waste management and pollution control, with stricter enforcement of emission standards continuing in 2024. The company's reliance on raw materials like petroleum coke and coal pitch, whose sourcing and transport have environmental impacts, is also a concern. The global seaborne petroleum coke market experienced price volatility in 2024 due to supply chain issues, highlighting logistical and environmental considerations.

The drive towards a circular economy is accelerating, emphasizing resource recycling and reuse. Fangda's ability to integrate circular principles, such as developing recyclable products or using recycled feedstocks, will be key to mitigating risks from virgin resource scarcity and price volatility, especially as demand for critical materials is projected to rise significantly by 2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fangda Carbon New Material synthesizes data from official government publications, reputable industry associations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the carbon new material sector.